Cosmetic Contact Lenses Market size to exceed USD 1.3 Bn by 2024

Published Date: September 2024

Cosmetic Contact Lenses Market size is set to exceed USD 1.3 billion by 2024; according to a new research report by Global Market Insights Inc.

Growing usage in entertainment sector is expected to boost cosmetic contact lens market size. These lenses are primarily utilized in the entertainment industry owing to the need for more dramatic makeup. Increasing customer inclination towards colored contact lenses will further drive the segment demand. Growing disposable incomes encourages consumer purchasing power on lifestyle products, thus supporting the contact lenses demand.

Surging penetration through online medium coupled with the relaxation in regulatory approval is expected to boost cosmetic contact lens market size. The FDA characterizes these products under the medical devices category and mandated prescription for purchase A noteworthy upturn in light of swelling demand for altering the aesthetic appearance and growing disposable income are the supporting factors driving the market growth.

Get more details on this report - Request Free Sample PDF

The increasing acceptance of corrective LASIK surgery is expected to negatively affect the market size. Additionally, an increase in the overall geriatric population along with occurrences of visual inaccuracies will further hinder the industry growth.

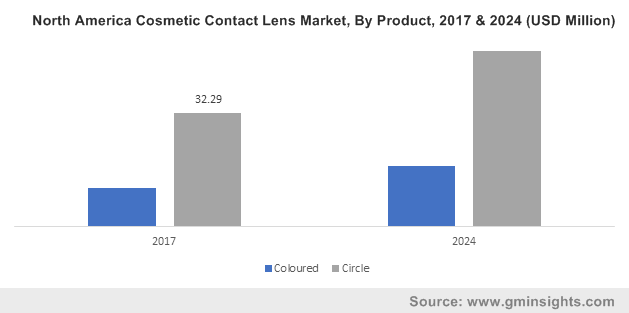

Circle product segment accounted for over 70% revenue share in 2017 owing to the availability of diverse designs coupled with its ability to blend in naturally with the usual appearance of eyes. This segment has gained tremendous popularity over the last few years among the teens and young adults’ population.

RGP segment will witness significant gains at approximately 6% over the forecast period. This can be attributed to associated benefits such as high oxygen permeability, sharp vision, durability, and cost-effectiveness. Other noticeable factors include moving capacity, smooth surface, and ability to maintain shape are fueling the business growth.

Browse key industry insights spread across 546 pages with 1121 market data tables & 25 figures & charts from the report, “Cosmetic Contact Lenses Market Size By Product (Coloured, Circle), By Type (RGP, Soft Contact, Hybrid Contact), By Material (Hydrogel, Polymers), By Distribution Channel (Optical Stores, Independent Brand Showrooms, Online Stores, Retail Stores), By Design (Spherical, Toric, Bifocal & Multifocal), By Usage (Daily Disposable, Weekly Disposable, Monthly Disposable, Annual) Industry Analysis Report, Regional Outlook (U.S, Canada, Germany, UK, France, Spain, Italy, Switzerland, Nordic Countries, Belgium, Luxembourg, Ireland, Poland, Russia, China, India, Japan, South Korea, Thailand, Indonesia, Malaysia, Vietnam, Taiwan, Singapore, Brazil, Mexico, Argentina, Saudi Arabia, South Africa, UAE, Egypt, Tunisia), Application Potential, Competitive Market Share & Forecast, 2018 - 2024” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/cosmetic-contact-lens-market

Hydrogel material accounts for over USD 600 million in 2017. Rising demand for soft and comfortable cosmetic lens influences the material growth. Hydrogel has captured a strong focus over the last few years owing to its advantages as compared to other counterparts. Some of the benefits are low risk of eye infection and comfort for consumers.

Online stores distribution channel segment is expected to account for over 20% revenue share by 2024. These stores provide products at lower prices along with on-time delivery which will foster new opportunities for the industry growth.

Spherical design segment will grow at over 6.5% from 2018 to 2024 owing to factors such as enhanced clarity in vision and correction of conditions such as nearsightedness & farsightedness. These product designs offer high level of comfort and customization which further support the business growth.

Daily disposable lens is expected to hold revenue of approximately USD 500 million by 2024. These cosmetic lenses have gained a strong attention from young owing to ease of utilization thereby, propelling segment demand.

Asia Pacific cosmetic contact lenses market accounted for over 70% of revenue share in 2017, owing to growing acceptance by the image-conscious population to cope up with the current fashion trends. Major countries including China, Japan, and Taiwan are contributing primarily towards the regional industry expansion.

Global cosmetic contact lens market share is moderately consolidated with top four players accounting for 57% of the industry share in 2017. Johnson & Johnson, Novartis, Cooper Vision, Bausch & Lomb (Valeant Pharmaceuticals), Ciba Vision are among the major industry players with significant market shares. The global market also consists of several regional players mainly including Asian manufacturers contributing to fragmented share.

Other notable players include Grand Vision, Lagado Corporation, InnoVision, Qualimed and Metro Optics. Mergers & acquisitions, production capacity expansions, innovations, joint ventures and supply agreements are among the strategies adopted by industry participants. For instance, in December 2017, Cooper Vision acquired Paragon Vision Sciences an U.S. based specialty contact lens company to strengthen its foothold in the industry.

Cosmetic Contact Lenses Market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in million units and revenue in USD million from 2013 to 2024, for the following segments:

Cosmetic Contact Lenses Market By Product

- Coloured

- Circle

Cosmetic Contact Lenses Market By Type

- RGP

- Soft Contact

- Hybrid Contact

Cosmetic Contact Lenses Market By Material

- Hydrogel

- Polymer

Cosmetic Contact Lenses Market By Distribution Channel

- Optical stores

- Independent Brand Showrooms

- Online Stores

- Retail Stores

- Others

Cosmetic Contact Lenses Market By Design

- Spherical

- Toric

- Bifocal and Multifocal

- Others

Cosmetic Contact Lenses Market By Usage

- Daily Disposable

- Weekly Disposable

- Monthly Disposable

- Annual

The above information is provided for the following region and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Switzerland

- Nordic Countries

- Belgium

- Luxembourg

- Ireland

- Poland

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Taiwan

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

- Tunisia

Preeti Wadhwani,