Bucket Trucks Market worth over $1.5 billion by 2026

Published Date: July 2020

Bucket Trucks Market size is set to be over USD 1.5 billion by 2026, according to a new research report by Global Market Insights Inc.

The increasing government and private sector investments in the construction industry are primarily driving the market growth. Increasing government investments in developing advanced power grids to cater to the rising electricity demand will create a huge demand for bucket trucks across the globe. These trucks are integrated with an insulated bucket that offers enhanced safety by protecting operators from electrocution in case the boom comes in contact with a live wire.

The major factor challenging bucket trucks market growth is the high cost associated with the equipment. Manufacturers use high-quality basic components for the construction of bucket trucks, increasing the overall cost of the machine. Furthermore, the emergence of automated and battery-operated construction machinery will also increase equipment cost, hampering business growth.

Get more details on this report - Request Free Sample PDF

The recent outbreak of COVID-19 pandemic is further challenging industry growth. Government authorities across the globe have implemented stringent lockdowns and restricted movement to prevent virus spread. Furthermore, bucket truck manufacturers have temporarily shut down their manufacturing plants owing to the unavailability of raw materials and labors.

Analyst view: “The growing demand for electric lifting platform owing to its enhanced fuel efficiency and high productivity is driving bucket trucks market growth.”

Increasing market demand for efficient bucket trucks to enhance efficiency and productivity

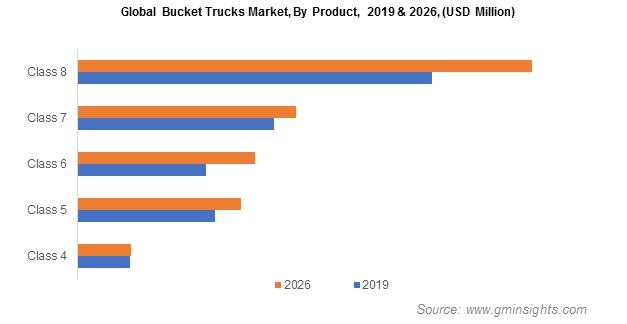

The class 4 trucks segment is projected to cross USD 75 million by 2026, growing at a CAGR of about 1.5% from 2020 to 2026. The increasing industry demand can be attributed to the rising adoption of bucket trucks for maintenance & repair activities. Class 4 includes van-mounted trucks that are primarily used in the telecommunication industry for electric pole maintenance. These trucks are available with additional spaces, allowing operators to carry extra tools or spare payload, driving the market.

Browse key industry insights spread across 258 pages with 426 market data tables & 23 figures & charts from the report, “Bucket Trucks Market Size, By Product (Class 4, Class 5, Class 6, Class 7, Class 8), By Type (Insulated, Non-insulated), By Application (Construction, Utility [Electric, Water], Telecommunication, Forestry), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Landscape & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/bucket-trucks-market

Growing adoption of non-insulated trucks for billboard installation and window cleaning activities

The non-insulated bucket trucks market was valued at over USD 1 billion in 2019, with a share of approximately 80%. Increasing investments in installing billboards and large hoardings to attract consumer attention will propel the market size. Non-insulated trucks are majorly used in installing boards or hoarding owing to their large space availability and enhanced efficiency. Furthermore, these trucks are also gaining popularity in window cleaning and building painting activities due to their ability to safely reach elevated heights, supporting the market size expansion.

Increasing investments in the construction industry across the globe

The demand for these trucks is primarily increasing in the construction industry owing to their maximum safety, efficiency, and productivity at elevated heights. Government organizations across the globe are implementing stringent regulations on worker safety, creating a huge demand for efficient & safer lifting solutions, driving the market demand.

Increasing demand for rental construction machinery in Asia Pacific

Asia Pacific bucket trucks market share is anticipated to reach over USD 240 million by 2026, growing at a CAGR of over 3% from 2020 to 2026. The increasing demand for rental construction machinery to save huge costs associated with new machines is driving industry growth in Asia Pacific. Rental service providers are offering a wide range of fleets with multiple boom length options that cater to varied consumer demands. Furthermore, the presence of construction equipment rental service providers in China, India, and Japan is providing a positive market outlook in Asia Pacific.

Leading market players are adopting various strategies including partnerships & collaborations, mergers & acquisitions, and new product launches to expand their geographical presence and market shares. Additionally, companies are also investing in R&D activities to introduce fuel-efficient & cost-effective lifting solutions in the market.

Key players in the bucket trucks industry include Altec, Inc., Aichi Corporation, Axion Lift, CTE Group SPA, Dur-A-Lift, Inc., Bronto Skylift, Elliott Equipment Company, Manitex International, Inc., Terex Corporation, Palfinger AG, Tadano Ltd., and Versalift.

Preeti Wadhwani, Prasenjit Saha