APAC Material Handling Equipment Market size worth $80bn by 2025

Published Date: February 2019

Asia Pacific Material Handling Equipment Market size is set to exceed USD 80 billion by 2025; according to a new research report by Global Market Insights Inc. The shipments are expected to grow at a CAGR of around 7% from 2019 to 2025.

APAC material handling equipment market is experiencing high growth with the strong presence of companies offering robotic technologies for warehouse automation. The growing demand for these automated solutions for supporting several warehouse operations such as packaging, transportation, storage, and retrieval will accelerate the demand in the Asia Pacific material handling equipment market. Moreover, the increasing labor costs are forcing industries to shift their focus toward robotic technologies. Increased operational efficiencies and productivity with the applications of these systems in the warehouses are helping companies to improve their sales and productivity.

The aftermarket demand for equipment parts, accessories, and services is witnessing high growth in the APAC material handling equipment market. The industrial sectors are engaged in performing regular maintenance and repairs of their industrial machinery to minimize the system downtime and failure. These maintenance tasks involve the replacement and installation of new parts or components for enhancing the system efficiency and operability. Such factors are predicted to accelerate market growth. Moreover, several small-scale industries are installing used machinery to minimize the additional expenses of purchasing new equipment. These machines require the replacement of parts and components at regular intervals. Such factors are anticipated to provide an impetus to the industry growth.

Get more details on this report - Request Free Sample PDF

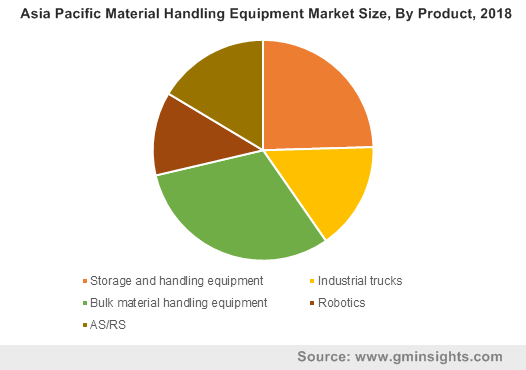

In 2018, the bulk equipment accounted for around 35% of the APAC material handling equipment market share. Products such as machine parts and components that are bulky require effective technologies that can handle and transport the components safely without any damage. The growing adoption of conveyor belts to transport industrial products from one production unit to the other will drive the market demand. The manufacturers are engaged in incorporating innovative technologies into these products to enhance business operations and production rates. For instance, smart motors and controllers are being integrated into a single module that offers control communications and work with the specific system.

Browse key industry insights spread across 390 pages with 430 market data tables & 22 figures & charts from the report, “Asia Pacific Material Handling Equipment Market Size By Demand (New, Aftermarket), By Product (Storage & Handling Equipment [Racks, Stacking Frames, Shelves, Bins & Drawers, Mezzanines], Industrial Trucks [Automated Guided Vehicles (AGVs), Hand, Platform & Pallet Trucks, Order Pickers, Pallet Jacks, Side-Loaders, Walkie Stackers], Bulk Material Handling Equipment [Conveyor Belts, Stackers, Reclaimers, Elevators], Robotics, Automated Storage & Retrieval System (AS/RS) [Unit-Load AS/RS, Mini-Load AS/RS]), By Application (3PL, E-Commerce, Durable Manufacturing, Food & Beverage, General Merchandise, Food Retail), By Sales Channel (Independent Dealers/Distributors, Direct Sales To Customers, Rental Companies, Online Channel), Industry Analysis Report, Regional Outlook, Application Potential, Price Trend, Competitive Market Share & Forecast, 2019 – 2025” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/asia-pacific-material-handling-equipment-market

In the APAC material handling equipment market, aftermarket players are providing their products through different sales channels such as distributors, online channels, and rental companies. Online channels are expected to witness a high demand for these products due to the increased dependency of end users to order the component needed by selecting the required parts from several online retail sites. These retail channels allow manufacturers to compare the prices, specifications, brands, and other parameters before the purchase of products without visiting physical stores. Moreover, online retail channels also offer several discounts or offers to these manufacturers, which is also a major factor propelling the adoption of online sales channels in the APAC material handling equipment market.

Regulatory authorities in the region are developing several initiatives that are generating a high demand for automated technologies. In 2018, China accounted for around 40% of the Asia Pacific material handling equipment market share. The Made in China 2025 initiative by the Government of China is accelerating the production rate of the country. It is encouraging global and domestic companies to establish their manufacturing facilities within the country to support this initiative. These manufacturing facilities will require automated technologies for enhancing and improving production capabilities and operations, boosting the APAC material handling equipment market demand. Furthermore, the manufacturers are also helping small-scale companies to purchase these automated machines by flexible loan and financing options. This is aiding companies to install modern equipment in their facilities within the budget range.

Key players in the APAC material handling equipment market include Columbus McKinnon, Beumer Group GmbH & Co. KG, JBT Corporation, KUKA AG, Liebherr, Kion Group AG, Murata Machinery, Ltd., TGW Logistics Group GmbH, Kardex AG, and System Logistics, among others. These companies are engaged in developing intelligent solutions that will allow industries to monitor the business processes remotely. The manufacturers are partnering with different technology providers to incorporate smart technologies into their product offerings. For instance, in November 2018, Mantsinen Group collaborated with Remion Ltd. for the supply of remote monitoring technologies, which are being integrated into the company’s material handling machines. The technology providers are also engaged in developing intelligent hardware and software tools, accelerating technological advancements and innovations. In April 2017, TotalTrax, Inc. launched software-driven equipment monitoring technology for enhancing the labor productivity, safety, and management of product handling machines.

The APAC material handling equipment market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue in USD & shipments in Unit from 2015 to 2025, for the following segments:

Asia Pacific Material Handling Equipment Market, By Demand

- New demand

- Aftermarket

APAC Material Handling Equipment Market, By Product

- Storage & Handling Equipment

- Racks

- Stacking Frames

- Shelves, Bins & Drawers

- Mezzanines

- Industrial Trucks

- Automated Guided Vehicles (AGVs)

- Hand, Platform & Pallet Trucks

- Order Pickers

- Pallet Jacks

- Side-Loaders

- Walkie Stackers

- Bulk Material Handling Equipment

- Conveyor belts

- Stackers

- Reclaimers

- Elevators

- Others

- Robotics

- Automated Storage & Retrieval System (AS/RS)

- Unit-Load AS/RS

- Mini-Load AS/RS

APAC Material Handling Equipment Market, By Sales Channel

- Independent dealers/distributors

- Direct sales to customers

- Rental companies

- Online channel

APAC Material Handling Equipment Market, By Application

- 3PL

- E-Commerce

- Durable Manufacturing

- Food & Beverage

- General Merchandise

- Food Retail

APAC Material Handling Equipment Aftermarket, By Product

- Storage & Handling Equipment

- Racks

- Stacking Frames

- Shelves, Bins & Drawers

- Mezzanines

- Industrial Trucks

- Automated Guided Vehicles (AGVs)

- Hand, Platform & Pallet Trucks

- Order Pickers

- Pallet Jacks

- Side-Loaders

- Walkie Stackers

- Bulk Material Handling Equipment

- Conveyor belts

- Stackers

- Reclaimers

- Elevators

- Others

- Robotics

- Automated Storage & Retrieval System (AS/RS)

- Unit-Load AS/RS

- Mini-Load AS/RS

APAC Material Handling Equipment Aftermarket, By Sales Channel

- Independent dealers/distributors

- Direct sales to customers

- Rental companies

- Online channel

The above information is provided for the following regions and countries:

- China

- Hong Kong

- Oceania

- Australia

- New Zealand

- Rest of Asia

- India

- South Korea

- Japan

- ASEAN

- Indonesia

- Malaysia

- Thailand

- Taiwan

- Singapore

- Philippines

- Vietnam

- Myanmar

Preeti Wadhwani, Saloni Gankar