APAC E-commerce Automotive Aftermarket size to hit $34.46 Bn by 2026

Published Date: November 2020

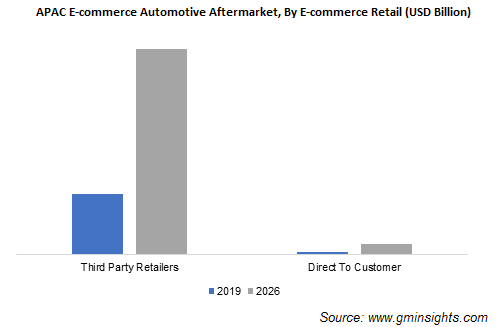

Asia Pacific E-commerce Automotive Aftermarket size is likely to cross USD 34.46 billion by 2026; according to a new research report by Global Market Insights Inc.

Continuous expansion of automotive assembly will result in increased aftermarket sales

Rapid technological evolution and faster replacement rates will promote e-commerce automotive aftermarket industry. The growing customer demand for self-service ordering alternatives will enhance aftermarket sales. Increasing trend for DIY and DIFM in the region will support industry growth. Price availability of the product on the website along with comparison options will enhance the product visibility and help cater to micro services. This will result in competitiveness in the industry. Product offerings via online platforms help eliminate the need for intermediaries, thereby improving the profit margin of manufacturers.

The automobile component suppliers are focusing on increasing online sales to repair shops, retailers, corporate fleets, and other customers. Fast moving or easy-to-install auto components, such as spark plug, brake pad, tires, and lighting, are preferred by online shoppers. Online tech support for installing a product in the vehicle is driving customer loyalty toward virtual shopping. The availability of such services for auto parts will enhance the e-commerce automotive aftermarket industry size.

Shifting trend toward digital service-based business models owing to variations in product buying behavior will escalate e-commerce aftermarket growth. E-commerce channels are also strengthening the automotive aftermarket parts supply chain. Manufacturers are opting for data accuracy, 3D visualization, advanced configuration, guided buying, and automated order renewals especially for B2B buyers. Digital revolution represents huge opportunities for auto manufacturers in Asia Pacific; however, there are a few challenges in the integrated online sales platforms. It includes complex order processing, frequent errors in payment or shipping, and difficulty to promote relevant products to customers.

Get more details on this report - Request Free Sample PDF

The APAC e-commerce automotive aftermarket witnessed an upsurge in online transactions during the pandemic. People have opted for online channels for the repair & maintenance of their vehicles owing to restricted availability of offline channels. The shipments were delayed in the initial phase of the pandemic owing to restrictions on international trades and mobility, but they are recovering at a great pace over the last few months owing to the relaxation of imposed restrictions.

Browse key industry insights spread across 250 pages with 313 market data tables & 17 figures & charts from the report, “Asia Pacific E-commerce Automotive Aftermarket Size By E-commerce Retail (Third Party Retailers, Direct To Customer), By Product (Parts [Braking {Brake Pads, Hydraulics & Hardware, Rotor & Drum}, Steering & Suspension {Control Arms, Ball Joints, Tie Rods, Sway Bar Links, Bushings, Bearings/Seals, Coil Springs}, Hub Assemblies, Universal Joints, Gaskets, Wipers, Filters, Lighting, Spark Plug, Tires], Accessories [Interiors, Exteriors]), By Consumer (B2C, B to Big B, B to Small B), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Market Share & Forecast, 2020 – 2026” in detail along with the table of contents: https://www.gminsights.com/industry-analysis/apac-e-commerce-automotive-aftermarket

The Direct to Customer retail channel to accommodate stable growth

Direct to Customer segment is likely to hold revenue of over USD 1.65 billion by 2026. The direct-to-consumer platform creates an opportunity for companies to build long-term brand value recognition among consumers. Moreover, it facilitates customized product requirements that can be fulfilled directly by manufacturers. The assurance of authentic products along with direct communication with the manufacturing company has influenced the industry growth. Additional benefits to the companies including the understanding of consumer-buying behavior and preference to design further products have positively influenced companies to move toward online shops.

Automotive accessories segment will foresee high acceptance in near future

Automotive interior accessories are predicted to reach more than USD 4.69 billion by 2026. Rising inclination toward enhanced driving experience, vehicle customization, and growing focus on enhanced aesthetic appeal & convenience will escalate the APAC E-commerce automotive aftermarket growth. Readily available automotive interior accessories on e-commerce platforms include floor carpet, headliner, door trim, door opening trim, assist trim, seat fabric, luggage trim, rear shelf, etc.

B to Big B will generate promising revenue growth

The B to Big B consumer segment captured around 10% in the APAC e-commerce automotive aftermarket share and will grow at a decent growth rate of 16% through 2026. The B to Big B distribution network comprises enterprises supplying aftermarket parts such as equipment/systems to tier-1 dealers. The B to Big B channel of distribution generally involves standardized & fast-moving automotive equipment. The commercialization of delivery services along with operational efficiencies and competitive pricing is the prime factor driving the market demand.

APAC will witness significant growth due to the established automobile industry

Japan is expected to constitute above 18% of the overall APAC market share in 2026. The development of omnichannel, customer relationship management systems, and discounts offered on multiple buying are key trends fueling the market growth. The proliferating vehicle fleet size, particularly in China, India, South Korea, and Thailand, will further drive the industry revenue. The development of feasible business models, such as brick-and-click model, along with tie-ups with various overseas industry players will fuel the market demand.

Strategic partnership and supply chain management are key strategies adopted by industry players

The competitive landscape of the APAC E-commerce automotive aftermarket is moderately consolidated. Market players are expanding their geographical reach to cater to specific consumer needs. In December 2017, eBay Inc. announced a partnership with Openbay for the expansion of its sales of automotive aftermarket parts. This partnership helped the company to enhance its foothold in the aftermarket e-tailing.