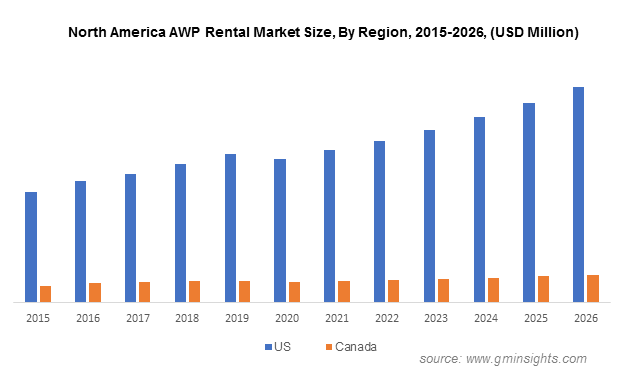

AWP Rental Market size worth over $25bn by 2026

Published Date: May 2020

AWP Rental Market size is set to surpass USD 25 billion by 2026; according to a new research report by Global Market Insights Inc.

The rapidly developing construction industry across the globe will propel the aerial work platform rental market growth. The increasing focus of governments toward the development of the manufacturing sector is providing market opportunities for the adoption of these machines. Access platforms are used to work at elevated heights and perform various repair & maintenance activities. These platforms are also used across various industry verticals to gain operational efficiency and speed over conventional ladders and scaffold.

The rapidly growing mining and construction equipment rental industry, particularly in India, China, and the U.S. is further expected to contribute to the AWP rental industry growth. Moreover, mobile elevating work platforms (MEWPs) are also gaining popularity in the telecom industry for the installation & maintenance of telecom poles, transformers, overhead lines, power cables, streetlights, and other associated infrastructure. Telecommunication contractors are adopting access platform rental solutions due to their low-cost and flexible plans, attributing to market growth.

Get more details on this report - Request Free Sample PDF

The major industry challenge is the lack of trained personnel to operate the equipment. Market leaders are offering safety training and support systems to address the challenge, reducing the number of injuries & fatalities associated with AWPs. Moreover, the lack of product awareness in several African and Asia Pacific countries will restrict regional AWP rental market size. AWP rental companies across the globe are focusing on deploying a number of machines to cater to the increasing customer for rental services, supporting market size in 2019.

Analyst view: The proliferating global construction industry will create a huge demand for AWP rental market over the forecast timeline, owing to its several advantages such as low-cost, and no associated maintenance & repair costs

The impact of COVID-19 has led construction & mining contractors to prevent their product procurement decisions, which will hamper the AWP market in 2020. Moreover, the production and sales of the equipment manufacturing companies have also been significantly impacted due to the COVID-19 outbreak. Companies such as JLG and Genie have temporarily halted their production plants at several locations across the globe, which is anticipated to hamper the AWP rental market growth.

Browse key industry insights spread across 219 pages with 113 market data tables and 41 figures & charts from the report, “(AWP) Aerial Work Platform Rental Market Size By Product (Boom Lift, Scissor Lift, Vertical Mast Lift, Personnel Portable Lift), By Application (Construction, Telecommunication, Transportation & Logistics, Government), Industry Analysis Report, Regional Outlook, Growth Potential, Price Trends, Competitive Landscape & Forecast, 2020 – 2026” in detail along with the table of contents:

https://www.gminsights.com/industry-analysis/aerial-work-platform-awp-rental-market

Ease of use and enhanced flexibility offered by scissor lifts are supporting product adoption

According to the report, scissor AWP rental services accounted for over 50% of the market share in 2019, due to their compact size, simplicity of transfer, and enhanced flexibility. Scissor lift access platforms can be moved easily and safely from one place to another without hassle, reducing all physical efforts and fatigue of operators.

The market is witnessing a trend of renting electric scissor lifts over diesel-powered platforms. Electric lifts are increasingly used for indoor maintenance applications, while diesel-powered lifts are being increasingly used for outdoor operations due to their high power and ability to work in rough terrains. Players operating in this market are offering scissor lifts in a variety of different sizes and types, making them ideal for a wide range of projects. Several leading AWP rental service providers including United Rentals, Aichi Corporation, and Mtandt Rentals are also focusing on increasing their fleet size and offering scissor lifts with multiple power options to gain the AWP rental market share.

The increasing demand for AWP rental services in the transportation & logistics sector to gain efficiency

The increasing use of AWPs in the transportation & logistics industry for lifting heavy cargos from ground to elevated floors to improve working efficiency is providing a positive outlook to the market. Additionally, the innovation of electric access platforms is further expected to support industry growth. Electric-powered MEWPs offer a quieter working environment and produce low emission compared to engine-powered lifts, contributing to the AWP industry growth in 2019.

Personal portable lifts are gaining popularity in the logistics industry due to their compact size, easy operability, and enhanced safety. Furthermore, the growing e-commerce industry in Asia Pacific and North America is expected to support the AWP rental market demand over the forecast timeline. Companies are offering AWP rental options for both manually as well as battery-operated personal lifts, enhancing the flexibility at warehouses & distribution centers.

The developing infrastructure industry and increasing worker safety concerns in Asia Pacific

Asia Pacific AWP rental market is anticipated to reach at USD 3.5 billion by 2026. The growth can be attributed to the rapidly developing construction industry in the region. The construction sector is witnessing high growth due to rising urbanization and increasing government initiatives to support the regional infrastructure industry expansion. These platforms offer efficient performance, high productivity, and enhanced flexibility for performing operations at elevated sites. Increasing worker accidents due to older machines are leading contractors to deploy advanced access platforms to prevent life & property loss. Moreover, the emergence of various AWP rental companies in Asia Pacific contributed to the market size in 2018.

The players operating in the market are focusing on offering new products & services to improve the overall efficiency and reliability of the equipment, providing a positive market outlook. Players are expanding their fleet size with advanced machines to gain maximum market shares. Furthermore, AWP rental companies are also adopting several business expansion strategies, such as partnerships & collaborations with equipment manufacturers, to expand their geographical reach and market share.

Some of the key players of the AWP rental market share are Haulotte Group, United Rentals, Herc Holdings Inc., AFI Uplift Ltd., Riwal, Ashtead Group, Aktio Corporation, Loxam, Kilotou, Nesco Rentals, and Sunstate Equipment Company.

Preeti Wadhwani, Prasenjit Saha