Summary

Table of Content

Wood Adhesives And Binders Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wood Adhesives And Binders Market Size

Wood Adhesives and Binders Market size generated more than $14 billion in 2015 and is forecast to witness over 4% CAGR through 2024. Robust growth in the construction industry is analyzed to be the key factor propelling the global market over the projected timeframe.

To get key market trends

The product is largely used in the wood products across construction industry for flooring, plywood, cabinets, windows, doors and other structural panels. The global construction industry was valued roughly at over USD 7 trillion in 2013 and is projected to exceed USD 13 trillion by 2024. This trend along with rising demand in order to enhance aesthetic appearance will subsequently propel the wood adhesives and binders market share, particularly for structural bonding applications.

Raw materials required in the wood adhesives and binder market are generally petrochemical feedstock. The product is primarily synthesized from petroleum-based feedstock such as phenols, vinyl acetate, isocyanates, urea, acrylates, polyolefins, styrene butadiene and polyurethanes. These petrochemical and downstream products are dependent on the supply and prices of crude oil.

Oscillating crude oil prices along with the civil unrest in the Middle East have resulted in bottleneck crude oil supply, which also affects the petrochemicals price. This may hamper wood adhesives and binders market price trends over the forecast timeframe. For instance, crude oil price in Dubai was approximately USD 35 per barrel in January 2009 and was close to USD 90 per barrel in July 2014.

Wood Adhesives And Binders Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 14 Billion (USD) |

| Forecast Period 2016 - 2024 CAGR | 4% |

| Market Size in 2024 | 21 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

VOC (volatile organic compounds) emissions during commercial and industrial product applications have associated environmental and health hazards. Prevalence of stringent environmental legislations for VOC emissions may obstruct industry growth by 2024, specially for solvent-based products. For instance, in the U.S., the ARB (Air Resources Board) issued a document for determining RACT (Reasonably Available Control Technology) to keep a check on the pollution caused by adhesive application. These environmental regulations restrict the global wood adhesives and binders market growth, as violation of such government-defined regulations can lead to heavy penalties and losses.

However, emergence of bio-based product has created new growth prospects for the industry participants. For example, polyols, which are bio-derived from soybeans, can be effectively used in polyurethane adhesives formulation. Increasing bio-based product acceptance in the industry owing to its similar characteristics along with environmental and cost benefits will significantly boost the global wood adhesives and binders market by 2024.

Wood Adhesives And Binders Market Analysis

Urea-formaldede segment was approximately USD 3 billion in 2015. Urea-formaldehyde demand is growing owing to its high bond strength and comparatively low prices. These are widely utilized in structural and non-structural applications including flooring & plywood, furniture, windows & doors and cabinets.

Phenol-formaldehyde wood adhesives and binders market segment is projected to expand at over 4% CAGR over the projected timeframe. Phenol-formaldehyde resins adhesives offer advantages that includes better performance at moist conditions, low surface energy and resistance from chemicals. These can be formulated with other additives such as soy for improved bond strength. It also has lower emissions compared to urea-formaldehyde and are widely used for manufacturing particle board and medium density fiberboards.

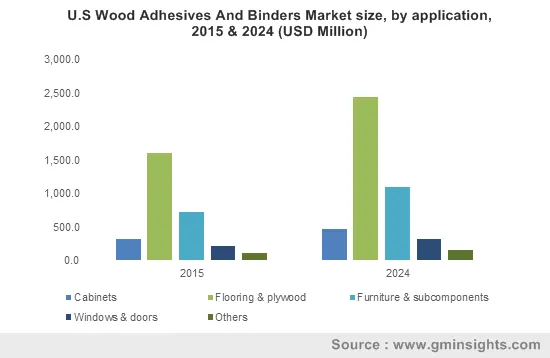

Flooring & plywood applications segment shall witness gains at over 5% CAGR in terms of volume. Flooring & plywood applications include hardwood and softwood plywood applications and oriented strand board (OSB) particle board. Strong growth in the flooring business along with escalating product demand will boost the wood adhesives and binders market revenue by 2024.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Furniture & subcomponents applications generated revenue more than USD 4 billion in 2015. Increasing per capita disposable income of customers across the globe has elevated furniture demand substantially owing to propel the wood adhesives and binders market growth. Furthermore, increasing number of non-residential projects is expected to influence the furniture demand, as large number of desks and other furniture would be required.

North America led mainly by the U.S. shall experience gains more than 4.5% CAGR over the estimated period. Increasing interior remodeling activities in the U.S. due to lavish consumer lifestyles will drive the wood adhesives and binders market. In addition, elevating overall construction industry, residential and commercial, post 2008 economic turmoil will further complement business growth. However, strict government regulations in the region towards solvent-based products may hinder growth.

Asia Pacific, mainly by China, India and Japan, was valued at over USD 3.5 billion in 2015. Rapidly growing construction industry in the region is the prime factor contributing the regional wood adhesives and binders market value. For instance, Asia Pacific accounts roughly around half the global construction spending. Furthermore, rising customer spending power has increased wood demand flooring and furniture applications. This is analyzed to fuel regional industry growth by 2024.

Europe is likely to see moderate growth, with Latin America and the Middle East emerging as potential opportunities for wood adhesives and binders market growth over the coming decade.

Wood Adhesives And Binders Market Share

The global wood adhesives and binders industry share is fairly consolidated with major five industry players accounting for 40% of the global industry share in 2015.

- 3M Company

- Ashland Inc.

- H.B Fuller Company

- Henkel AG & Co. KGaA

- BASF SE

- Huntsman Corporation

- Avery Dennison Corporation

- Dow Chemical Company

are some of the prominent industry participants.

Major chemical companies such as

- Dow

- BASF

- Bostik

enjoy the benefit of backward integration as they can produce raw materials required for product manufacturing. Companies solely manufacturing the product including

- Henkel

- 3M Company

- H.B. Fuller

procure raw materials from chemical industries and manufacture a wide variety of product.

Industry Background

Increasing population across the globe is estimated to boost the construction projects which in turn will fuel wood adhesives and binders market size by 2024. The product offers benefits such as easy usage, time efficiency, lightweight, low prices, and aesthetics which makes it desirable for a wide application spectrum in the constriction construction such as flooring and furniture.

However, stringent regulations associated with volatile organic compounds (VOC) along with volatile petroleum feedstock prices are projected to hamper the product growth during the forecast timeframe. However, drifting focus towards minimizing reliance on synthetic (petroleum-derived) products has created new growth avenue for market players.

Wood Adhesives and Binders Market report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in kilo tons and revenue in USD million from 2013 to 2024, for the following segments:

By Product

- Urea-formaldede (UF)

- Melamine-urea-formaldehyde (MUF)

- Phenol-formaldehyde (PF)

- Isocyanates (MDI, TDI, HDI)

- Soy-based

- Others

By Application

- Cabinets

- Flooring & plywood

- Furniture & subcomponents

- Windows & doors

- Others

The above information has been provided for the following regions and countries:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- South Africa

- GCC

Frequently Asked Question(FAQ) :

Why is the demand for urea-formaldehyde growing across the wood adhesives & binders industry?

Due to it comparatively low prices, high bond strength, and widescale use across structural as well as non-structural applications, the demand for urea-formaldehyde is expected to grow rapidly.

What factors are likely to adversely affect adoption of wood adhesives & binders?

Volatile crude oil prices and the supply bottleneck that has been created across the Middle East due to civil unrest are expected to impede industry price trends over the coming years.

What drivers are impelling growth of the wood adhesives & binders market?

Increasing product demand from the construction sector, owing to its use in flooring, doors, windows, cabinets, plywood, as well as other structural panels, is expected to drive the adoption of wood adhesives & binders.

How much growth will the Wood Adhesives And Binders Market register through the projected timeframe?

The forecast worth of Wood Adhesives And Binders Market is predicted to exceed USD 240 million by 2022.

How much is the Wood Adhesives And Binders industry expected to be worth by the end of the year 2015

In 2015

How is the APAC industry landscape forecast to perform over the coming years?

Owing to the region

Wood Adhesives And Binders Market Scope

Related Reports