Summary

Table of Content

Wireless Charging Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wireless Charging Market Size

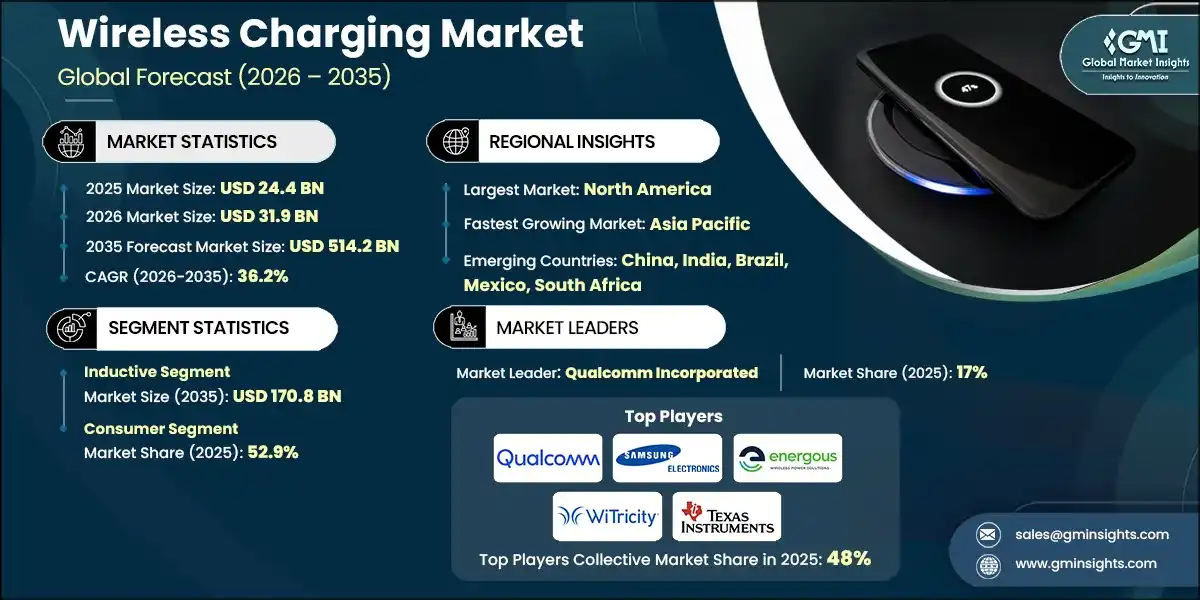

The global wireless charging market was valued at USD 24.4 billion in 2025. The market is expected to grow from USD 31.9 billion in 2026 to USD 514.2 billion in 2035, at a CAGR of 36.2% during the forecast period according to the latest report published by Global Market Insights Inc. The market for wireless charging is expanding, owing to growing consumer electronics adoption, technological innovation, increasing use within the electric vehicle industry, and government policies and regulations that encourage the establishment of charging infrastructure.

To get key market trends

As electric vehicle (EV) adoption continues to rise, the need for convenient and efficient charging solutions is growing. Wireless charging technology is being incorporated into several EV models, which makes the process easier by eliminating the need for physical connectors. Recent innovations, such as wireless charging pads and dynamic charging systems, are helping make charging more seamless and accessible. For example, according to IEA, in 2023, global EV sales reached almost 14 million, reflecting a jump of 35% from the previous year. This growth propelled the total amount of electric cars on the roadways to nearly 40 million, with EVs accounting for approximately 18% of all new car sales globally, up from 14% in 2022.

Recent advancements in wireless charging technology focus on enhancing speed, efficiency, and convenience. These enhancements also consist of resonant and radio frequency charging, allowing for longer power delivery and more flexible placement of charging devices. Innovations are reducing charging durations and broadening the applications of wireless charging technology from smartphones to laptops and wearables. This progress addresses older limitations and drives more widespread commercialization within the consumer electronics and automotive sectors. For example, STMicroelectronics, in May 2024, presented a 50-watt, Qi-compatible transmitter and receiver combination that allows for faster development and wider wireless charging adoption in high-power applications like medical and industrial equipment, home appliances, and computer peripherals. This combination uses ST's proprietary STSC - ST Super Charge protocol, enabling faster charging rates as compared to standard Qi protocols used with smartphones.

The wireless charging market encompasses the technologies and solutions designed to allow devices in consumer electronics, automotive, industrial, and healthcare economies to wirelessly transfer power without the use of a wired charging system via inductive, resonant, or RF methods.

Wireless Charging Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 24.4 Billion |

| Market Size in 2026 | USD 31.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 36.2% |

| Market Size in 2035 | USD 514.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increased adoption in consumer electronics | Drives higher demand for wireless charging solutions, expanding the market across smartphones, wearables, and accessories. |

| Advancements in wireless charging technology | Improves efficiency, range, and user convenience, accelerating adoption across industries. |

| Growth of electric vehicles (EVs) | Creates significant opportunities for wireless charging infrastructure in residential, commercial, and public spaces. |

| Government initiatives and regulations | Support infrastructure development and standardization, promoting widespread market growth and adoption. |

| Pitfalls & Challenges | Impact |

| Higher cost of wireless charging systems | Restricts adoption among price-sensitive consumers and limits large-scale deployment. |

| Limited charging range | Reduces convenience and flexibility, affecting user experience and slowing market penetration. |

| Opportunities: | Impact |

| Innovation in long-range and dynamic charging technologies | Expands applications for electric vehicles and industrial uses, enhancing market potential. |

| Opportunities for managed wireless charging services in commercial spaces | Enables new revenue streams and supports large-scale adoption of wireless charging solutions. |

| Market Leaders (2025) | |

| Market Leaders |

17% market share. |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Wireless Charging Market Trends

- A major trend influencing the wireless charging industry is the ongoing integration of wireless power technology into electric vehicles, fueled by OEM efforts to simplify the automation of home and public charging.

- In September of 2025, Porsche began offering a wireless charging option for the new Electric Cayenne, which features an 11-kW home charging inductive charger that allows for cable-free charging by simply parking over a charging plate that is mounted in the floor. This initial offering marks a pivot in the market toward inductive EV charging systems as automakers focus their charging system investments on efficiency and alignment control for differentiated electric vehicles.

- Customer electronics manufacturers are integrating high-efficiency wireless charging systems, multi coil systems, and long-range technology into smart phones, wearables, and accessories, prioritizing seamless charging experiences.

- Advancements pertaining to the Qi2 Standardization is assisting in increasing efficiency in interoperability, power delivery systems, and the compatibility of devices, expediting adoption in the consumer, automotive, and industrial sectors.

- The incorporation of wireless charging amenities into locations such as airports, retail stores, workplaces, and hotels, is expediting the implementation of wireless charging as companies aim to improve customer satisfaction and mitigate the impact of heavy device usage.

Wireless Charging Market Analysis

Learn more about the key segments shaping this market

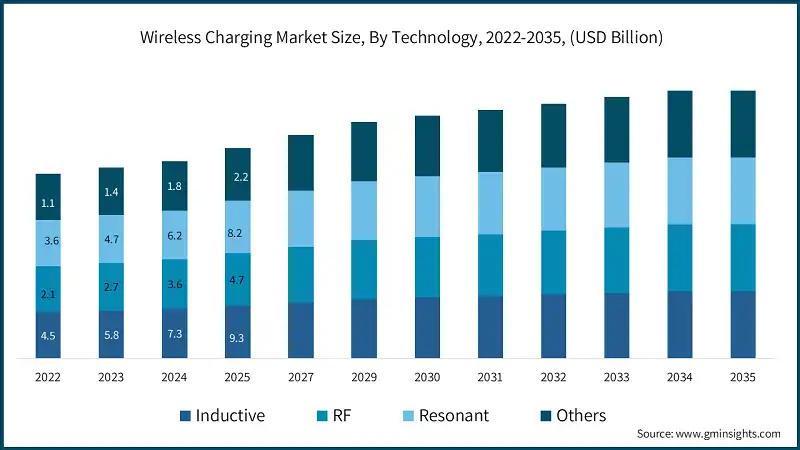

On the basis of technology, the market is segmented into inductive, RF, resonant, and others.

- The inductive segment is anticipated to reach USD 170.8 billion by 2035. Inductive wireless charging continues to gain traction in consumer electronics, particularly smartphones, wearables, and small accessories, due to its reliability, safety, and cost-effectiveness. Manufacturers are enhancing coil alignment and efficiency to reduce charging times and improve user convenience.

- The segment is witnessing significant adoption in electric vehicle home charging pads and commercial charging stations, supported by standardized protocols like Qi and Qi2, which ensure interoperability across a wide range of devices.

- The resonant segment was valued at USD 8.2 billion in 2025 and is anticipated to grow at a CAGR of 38.8% over the forecast years. Resonant wireless charging is increasingly favored for mid-range applications, allowing flexible device placement without precise alignment. This technology is being integrated into automotive applications, including dynamic in-road charging and parking-based EV solutions, enabling more convenient and efficient energy transfer.

- Advances in resonant charging are also enabling multi-device charging on a single platform, driving innovation in public spaces, commercial facilities, and smart homes. Collaborations between automakers, technology providers, and infrastructure developers are accelerating its commercialization and adoption.

Learn more about the key segments shaping this market

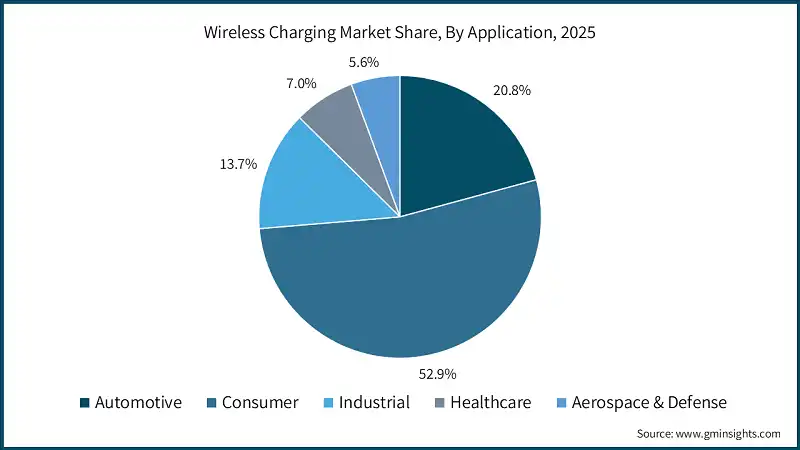

On the basis of application, the wireless charging market is divided into automotive, consumer, industrial, healthcare, and aerospace & defense.

- The consumer segment held a market share of 52.9% in 2025. The consumer segment is experiencing rapid adoption of wireless charging across smartphones, wearables, earbuds, and other portable electronics. Advances in multi-coil and high-efficiency charging solutions are improving convenience, reducing charging times, and enabling seamless integration into home, office, and public environments.

- Growing standardization efforts, such as Qi2, and increasing awareness among end-users are driving broader acceptance, while manufacturers continue to innovate with aesthetically integrated charging pads and furniture-embedded solutions.

- The automotive segment is anticipated to grow at a CAGR of 39.1% during the forecast period 2026 - 2035. The automotive segment is witnessing strong growth due to the rising adoption of electric vehicles and the need for convenient, cable-free charging solutions. Innovations in dynamic in-road charging and high-power inductive systems are enabling faster and more flexible EV charging.

- Collaborations between automakers, technology providers, and infrastructure developers are accelerating the deployment of wireless charging solutions in residential, commercial, and public spaces, while government incentives and regulations further support market expansion.

Looking for region specific data?

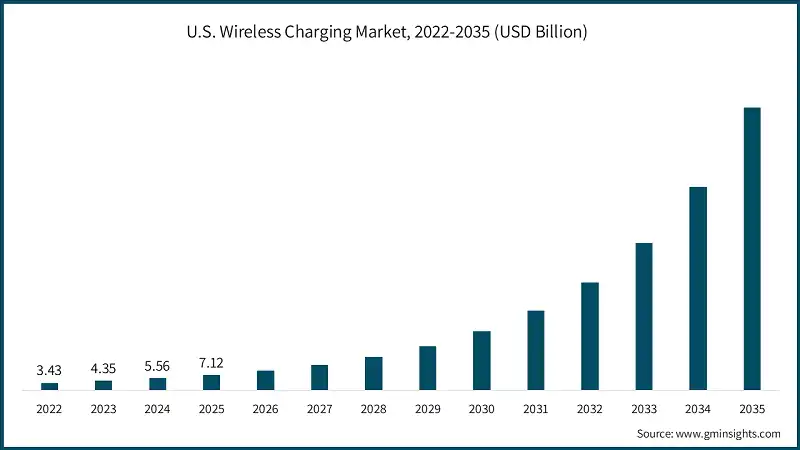

North America Wireless Charging Market The North America market dominated the global wireless charging industry with a market share of 34% in 2025. The U.S. wireless charging market was valued at USD 3.4 billion and USD 4.3 billion in 2022 and 2023, respectively. The market size reached USD 7.1 billion in 2025, growing from USD 5.5 billion in 2024. Europe market accounted for USD 7.7 billion in 2025 and is anticipated to show lucrative growth over the forecast period. Germany dominates the Europe wireless charging market, showcasing strong growth potential. The Asia Pacific market is anticipated to grow at the highest CAGR of 38.8% during the analysis timeframe. China wireless charging market is estimated to grow with a significant CAGR, in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. South Africa wireless charging industry to experience substantial growth in the Middle East and Africa market in 2025. The competitive landscape of the wireless charging industry is defined by rapid technological innovation and strategic collaborations among leading electronics manufacturers, automotive OEMs, and specialized technology providers. Top players such as Qualcomm Incorporated, Samsung Electronics Co. Ltd., Energous Corporation, WiTricity Corporation, and Texas Instruments Inc. hold a combined market share of approximately 48% in the global wireless charging market. These companies are heavily investing in research and development to improve charging efficiency, extend range, and integrate wireless power solutions into consumer electronics and electric vehicles. The market is also witnessing partnerships, joint ventures, and acquisitions aimed at accelerating product commercialization and expanding regional presence. Additionally, smaller startups and niche technology firms are contributing by developing advanced inductive, resonant, and long-range wireless charging solutions, fostering innovation and differentiation. This dynamic ecosystem is driving rapid technological progress and supporting the overall growth and diversification of the market. Prominent players operating in the wireless charging industry are as mentioned below: Qualcomm Incorporated is a key player in the wireless charging market with a leading market share of ~17%. The company is recognized for its extensive patent portfolio and leadership in developing advanced wireless power standards, which enhance interoperability and enable seamless integration of wireless charging solutions across consumer electronics and electric vehicles. Samsung Electronics Co. Ltd. holds a significant market share of ~14% in the market. The company leverages its broad consumer electronics ecosystem to rapidly integrate wireless charging technologies across smartphones, wearables, and other devices, driving adoption and fostering innovation.Europe Wireless Charging Market

Asia Pacific Wireless Charging Market

Latin American Wireless Charging Market

Middle East and Africa Wireless Charging Market

Wireless Charging Market Share

Wireless Charging Market Companies

Energous Corporation commands a market share of ~9% in the market. The company specializes in RF-based over-the-air charging technology, offering flexible and efficient wireless power solutions that extend beyond traditional inductive systems, supporting both consumer and industrial applications.Wireless Charging Industry News

The wireless charging market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Technology

- Inductive

- RF

- Resonant

- Others

Market, By Application

- Automotive

- Consumer

- Industrial

- Healthcare

- Aerospace & Defense

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the wireless charging market?

North America led the global market with 34% share in 2025, driven by strong consumer electronics demand, advancing EV infrastructure, and accelerated deployment of inductive charging technologies across public and commercial spaces.

Who are the key players in the wireless charging market?

Major players include Qualcomm, Samsung Electronics, Energous Corporation, WiTricity Corporation, and Texas Instruments, supported by innovations in inductive, resonant, and RF-based wireless power technologies.

What are the upcoming trends in the wireless charging industry?

Key trends include long-range and RF-based wireless power delivery, Qi2 standardization, EV dynamic charging systems, multi-device charging platforms, and widespread integration of wireless charging in smart homes, offices, airports, and public infrastructure.

What is the growth outlook for the automotive segment from 2026 to 2035?

The automotive segment is projected to grow at a CAGR of 39.1% through 2035, supported by rising EV penetration and growing demand for cable-free, high-power, and dynamic in-road charging systems.

What was the valuation of the consumer application segment in 2025?

The consumer segment held 52.9% market share in 2025, driven by extensive adoption of wireless charging in smartphones, wearables, earbuds, and home electronics.

How much revenue did the inductive technology segment generate in 2035?

The inductive technology segment is anticipated to reach USD 170.8 billion by 2035, supported by its widespread use in smartphones, wearables, and EV home-charging pads.

What is the wireless charging market size in 2025?

The wireless charging industry was valued at USD 24.4 billion in 2025, driven by rising adoption across consumer electronics, electric vehicles, and smart devices.

What is the market size of the wireless charging industry in 2026?

The market size for wireless charging reached USD 31.9 billion in 2026, marking strong expansion supported by rapid integration of inductive and resonant charging technologies.

What is the projected value of the wireless charging market by 2035?

The market size for wireless charging is expected to reach USD 514.2 billion by 2035, growing at a CAGR of 36.2%. This surge is fueled by EV charging innovation, long-range wireless power development, and expanding consumer electronics ecosystems.

Wireless Charging Market Scope

Related Reports