Summary

Table of Content

Wireless Charging IC Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wireless Charging IC Market Size

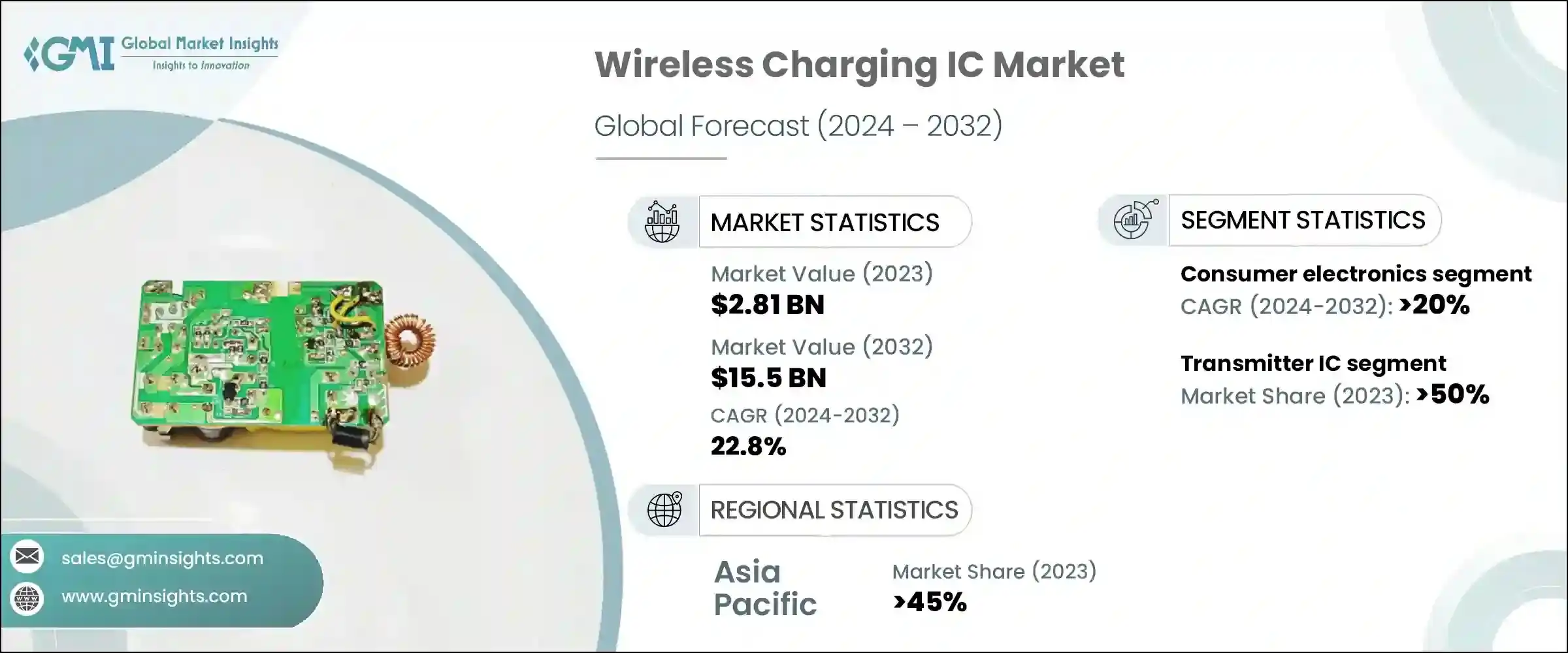

Wireless Charging IC Market was valued at USD 2.81 billion in 2023, and it is anticipated to register a CAGR of over 22.8% between 2024 and 2032. The market is experiencing significant growth, driven by the increasing adoption of wireless charging technology in consumer electronics, electric vehicles, and healthcare devices.

To get key market trends

Technological advancements and the widespread use of the Industrial Internet of Things (IIoT) are key factors propelling the market. The Industrial Internet of Things (IIoT) helps industries change the traditional ways of product manufacturing and delivery processes, making them cost-effective, efficient, reliable, and safe for human operators. IIoT provides wireless connectivity through networked sensors and intelligent devices. Collective data is analyzed by Artificial Intelligence (AI) without the interference of humans. Various factors are boosting the adoption of IIoT technology across all developing countries.

Governments of developing countries, such as Indonesia, Argentina, Brazil, and India, are taking initiatives to develop Industry 4.0 technology for manufacturing processes. For instance, China introduced the Made in China 2025 plan, a 10-year target for digital industrialization. The U.S. established the United Nations Industrial Development Organization (UNIDO). This organization aims to implement Industry 4.0 in developing countries and provide support through a foreign direct investment fund.

Wireless Charging IC Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 2.81 Billion |

| Forecast Period 2024 - 2032 CAGR | 22.8% |

| Market Size in 2032 | USD 15.5 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The growing investments in supporting industrial automation will fuel the market demand for wireless charging ICs in the coming years. As industries worldwide increasingly adopt automation technologies to enhance efficiency, reduce operational costs, and improve productivity, the need for reliable and efficient power solutions becomes paramount. Wireless charging ICs offer a convenient and effective means of powering various automated systems, from industrial robots and automated guided vehicles (AGVs) to sensor networks and IoT devices.

As companies invest more in automation technologies to stay competitive and meet evolving market demands, the adoption of wireless charging ICs is expected to rise. For instance, in July 2024, Fanuc America, a leading manufacturer of industrial robots and automation equipment, opened a new USD 110 million robotics and automation campus in Michigan. The new 650,000 square foot West Campus facility is part of the company's expansion plans to meet growing demand for its products and services.

The growing adoption of wireless charging technologies in industries, such as automotive, consumer electronics, industrial, and telecommunications, is creating opportunities for wireless charging ICs. However, each industry has its standards for compatibility or design challenges, which are impeding the growth of the market. Electromagnetic Compatibility (EMC) is a strict standard that applies to automotive applications. EMC, or the unintentional generation, transmission, and reception of electromagnetic energy, can have negative consequences for a vehicle's electrical system such as Electromagnetic Interference (EMI). Wireless charging's electromagnetic fields can have a negative impact on system performance.

Wireless Charging IC Market Trends

The integration of wireless charging ICs with the Internet of Things (IoT) and smart devices is a significant trend driving the market forward. As the adoption of IoT continues to expand across various industries, the demand for seamless and efficient power solutions for connected devices increases. Wireless charging ICs provide a convenient and efficient way to power a wide range of IoT devices, including sensors, wearables, smart home devices, and industrial IoT applications.

In smart homes, wireless charging pads and surfaces are becoming more common, enabling users to charge multiple devices simultaneously without the need for numerous cables. In industrial settings, IoT sensors and devices that monitor and optimize processes benefit from wireless charging solutions, reducing maintenance and downtime associated with wired connections. This trend is expected to continue as the IoT ecosystem grows, driving the demand for advanced wireless charging ICs that offer higher efficiency, faster charging speeds, and compatibility with various device form factors.

For instance, in August 2022, The South Korean research team at Sejong University has developed a wireless charging system that can safely transfer high levels of power over distances of up to 30 meters. This wireless charging technology was developed to eliminate the need for power cords and cables, enabling wireless power transfer for a variety of applications such as IoT devices, sensors, and even mobile devices with further development.

Radio Frequency (RF)-based wireless charging technologies have seen significant advancements, paving the way for innovative and flexible power solutions across various applications. One of the primary advancements in RF-based wireless charging technology is the extended charging range. Traditional inductive charging methods require close proximity and precise alignment between the charger and the device. In contrast, RF-based charging allows devices to be charged from a distance, providing greater flexibility and convenience. This technology can deliver power over several meters, making it suitable for powering a wide range of devices within a specific area, such as wearables, IoT sensors, and smart home devices.

For example, in January 2023, The AirFuel Alliance has announced the release of a new global standard for RF (radio frequency) wireless power transfer called AirFuel RF. This standard enables wireless charging of multiple devices simultaneously at a distance of up to a few meters, providing true freedom of movement without the need for precise device placement or wired connections.

Wireless Charging IC Market Analysis

Learn more about the key segments shaping this market

Based on type, the market is segmented into receiver IC and transmitter IC. In 2023, the transmitter IC segment accounted for the largest market share with over 50% of the revenue.

- Transmitter ICs play a pivotal role in enabling wireless power transfer by converting electrical energy into electromagnetic waves or fields that can be transmitted wirelessly to receiver devices. As demand grows for wireless charging solutions across various sectors such as consumer electronics, automotive, healthcare, and industrial automation, transmitter ICs are essential components that facilitate efficient and reliable power transmission over short to medium distances. Their ability to deliver adequate power while maintaining high efficiency has positioned transmitter ICs as the preferred choice for manufacturers integrating wireless charging capabilities into their products.

- Technological advancements in transmitter ICs have significantly enhanced their performance and versatility, further bolstering their market share. Modern transmitter ICs feature improved power management capabilities, advanced control algorithms, and enhanced thermal management systems, ensuring optimal charging efficiency and reliability. These advancements not only address the demand for faster charging speeds but also contribute to reducing energy loss during transmission, thereby improving overall energy efficiency.

Learn more about the key segments shaping this market

Based on application, the wireless charging IC market is divided into consumer electronics, automotive, industrial, medical, telecom, aerospace, and others. In 2023, the consumer electronics was the fastest growing segment, growing at a CAGR of over 20%. The market value of the VR/AR segment is expected to reach over USD 6.5 billion by 2032 due to this significant growth rate.

- This growth can be attributed to several key factors driving consumer demand for wireless charging solutions across various electronic devices. In the space of smartphones and wearable technology, consumers increasingly prioritize convenience and ease of use. Wireless charging eliminates the need for cumbersome cables, offering a seamless charging experience at home, in the office, and in public spaces. This convenience factor has fueled the adoption of wireless charging technology among leading smartphone manufacturers and wearable device makers, thereby driving significant growth in the consumer electronics segment.

- Moreover, the proliferation of wireless charging pads and surfaces in homes and public places has further boosted the adoption of wireless charging in consumer electronics. As the infrastructure supporting wireless charging expands, consumers are more inclined to choose devices equipped with this technology, contributing to its rapid market growth.

Looking for region specific data?

In 2023, the Asia Pacific market held the largest share of over 45%, and it is predicted that it will hold its dominant position throughout the forecast period. Asia Pacific region is home to some of the world's largest electronics manufacturers and technology hubs, including China, Japan, South Korea, and Taiwan. These countries are leaders in consumer electronics production, with a strong emphasis on integrating advanced technologies like wireless charging into their product offerings. The presence of major smartphone, tablet, and wearable device manufacturers in Asia Pacific has significantly boosted the demand for wireless charging ICs, particularly in consumer electronics.

Additionally, rapid urbanization, increasing disposable incomes, and a growing tech-savvy population across Asia Pacific have driven the adoption of smartphones and other electronic devices equipped with wireless charging capabilities. Consumers in the region value convenience and innovative technology, leading to a robust market demand for wireless charging solutions in both residential and commercial settings.

China remains a powerhouse in the global wireless charging IC market, driven by its robust manufacturing capabilities and rapid adoption of consumer electronics. The country's extensive production of smartphones, tablets, and wearable devices has propelled demand for wireless charging ICs. In recent years, Chinese companies have intensified their focus on integrating wireless charging technology into flagship smartphone models. According to reports, China is one of the largest markets for wireless charging-enabled smartphones, with significant investments in infrastructure to support wireless charging in public spaces and commercial establishments. This strong consumer demand and manufacturing prowess position China as a key player shaping the future growth of the global market.

Japan continues to be a leading innovator in technology and electronics, playing a pivotal role in the development and adoption of wireless charging ICs. Japanese electronics giants are at the forefront of advancing wireless charging technology, with a focus on enhancing efficiency, safety, and compatibility across various applications. Japanese consumers are known for their early adoption of new technologies, and wireless charging has gained popularity in smartphones, electric vehicles, and smart home devices. Recent industry reports highlight Japan's contributions to the evolution of wireless charging standards and its investments in research and development to maintain a competitive edge in the global market.

Germany stands out in the wireless charging IC industry with its expertise in automotive technology and industrial automation. German manufacturers and research institutions are actively involved in advancing wireless charging solutions for electric vehicles (EVs) and industrial applications. The country's automotive sector, including prominent brands like BMW, Mercedes-Benz, and Volkswagen, has been integrating wireless charging capabilities into electric vehicle models to enhance user convenience and efficiency. Germany's commitment to sustainable mobility and smart manufacturing initiatives further drives the adoption of wireless charging ICs in industrial automation, contributing to the country's strong presence in the global market.

South Korea is a key player in the global wireless charging IC market, leveraging its technological innovation and leadership in consumer electronics. Korean electronics giants such as Samsung and LG have been instrumental in popularizing wireless charging technology in smartphones, wearables, and home appliances. The country boasts a high smartphone penetration rate with a significant portion of devices equipped with wireless charging capabilities. South Korea's focus on advancing wireless power transmission efficiency and expanding infrastructure for wireless charging stations in public places underscores its commitment to shaping the future of wireless charging ICs globally.

Wireless Charging IC Market Share

Samsung and Qualcomm Incorporated hold a significant share of over 30% in the market. Samsung Electronics, a global leader in consumer electronics, has integrated wireless charging technology into a wide range of its flagship smartphones and wearable devices. The company's innovative approach to wireless charging has helped drive adoption among consumers worldwide, contributing significantly to its market share. Samsung's commitment to advancing wireless charging standards and improving charging efficiency has solidified its position as a key player in shaping the evolution of wireless charging ICs.

Qualcomm Incorporated, renowned for its expertise in semiconductor and wireless technology, plays a pivotal role in developing and supplying wireless charging ICs to manufacturers across various sectors. Qualcomm's Snapdragon platforms often integrate advanced wireless charging capabilities, supporting fast charging protocols and ensuring compatibility with multiple wireless charging standards. The company's continuous innovation in wireless power technology and strategic partnerships with leading device manufacturers further strengthen its market presence and influence.

Wireless Charging IC Market Companies

Major players operating in the wireless charging IC industry are:

- Samsung

- Qualcomm Incorporated

- STMicroelectroncis

- Infineon Technologies AG

- Texas Instruments Incorporated

- MediaTek Inc.

- ConvenientPower HK Limited

Wireless Charging IC Industry News

- In May 2024, STMicroelectronics introduced a 50W, Qi-compatible wireless charging transmitter and receiver combination to accelerate the development of high-power wireless charging solutions. This combination uses STMicroelectronics' proprietary STSC (ST Super Charge) protocol, which can provide up to 50W of output power.

- In May 2023, Infineon Technologies released a new wireless charging transmitter IC called the WLC1150, which supports wireless power transfer up to 50W. The WLC1150 is designed to simplify the design of wireless charging systems by offering an integrated solution.

The wireless charging IC market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) from 2021 to 2032, for the following segments:

Market, By Type

- Receiver IC

- Transmitter IC

Market, By Power Range

- Low Range - <15W

- Mid Range- 16-50W

- High Range - >51 W

Market, By Charging Method

- Electromagnetic Induction

- Electrolytic Coupling

- Microwave

- <1GHz

- <5GHz

- <10GHz

- <50GHz

- <100GHz

- <300GHz

- Others

Market, By Application

- Consumer Electronics

- Automotive

- Industrial

- Medical

- Telecom

- Aerospace

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Which major companies are operating in the wireless charging IC market?

Key players operating in the wireless charging IC industry are Samsung, Qualcomm Incorporated, STMicroelectroncis, Infineon Technologies AG, Texas Instruments Incorporated, MediaTek Inc., and ConvenientPower HK Limited, among others.

What is the size of the APAC wireless charging IC industry?

Asia Pacific industry registered 45% share in 2023, owing to the robust electronics manufacturing base, high smartphone penetration, and rapid adoption of electric vehicles.

Why is the demand for transmitter ICs rising?

Wireless charging IC market from the transmitter IC segment captured 50% share in 2023, propelled by its critical role in transmitting power efficiently to charging devices.

How big is the wireless charging IC market?

Industry size for wireless charging IC was worth USD 2.81 billion in 2023 and will grow at 22.8% CAGR between 2024 and 2032, fueled by the increasing adoption of smartphones, wearables, and electric vehicles equipped with wireless charging capabilities.

Wireless Charging IC Market Scope

Related Reports