Summary

Table of Content

Wire and Cable Polymer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wire & Cable Polymer Market Size

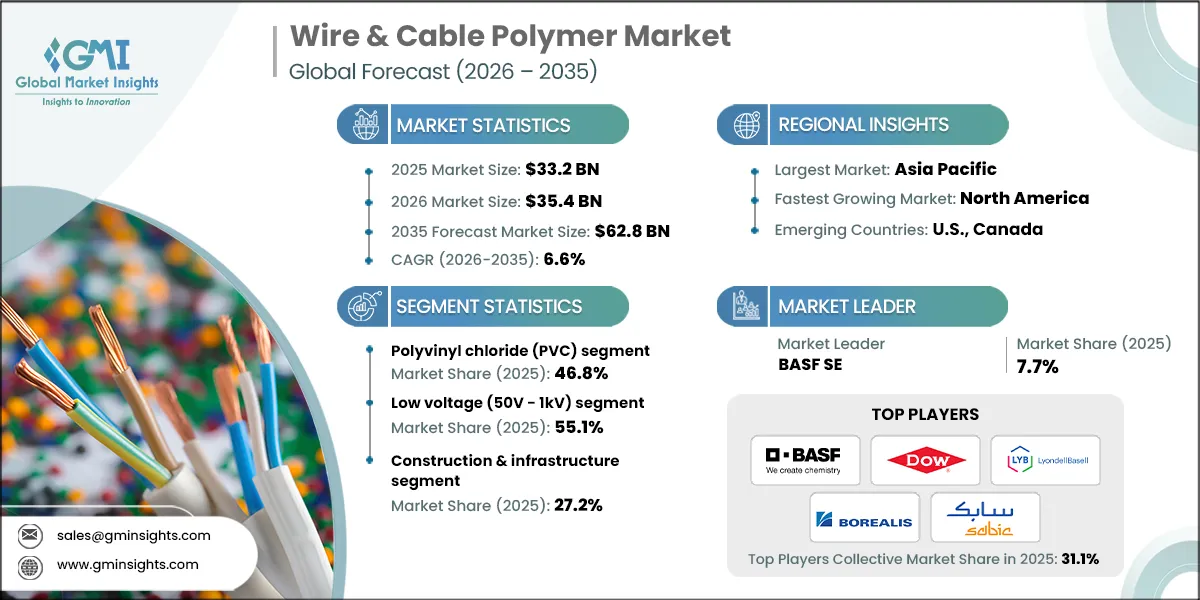

The global wire & cable polymer market was valued at USD 33.2 billion in 2025. The market is expected to grow from USD 35.4 billion in 2026 to USD 62.8 billion in 2035, at a CAGR of 6.6% according to latest report published by Global Market Insights Inc.

To get key market trends

- The wire and cable polymer market is growing tremendously because of rampant demand from various sectors such as construction, automotive, telecommunications, and energy. One trend that seems to be prevalent in the market is the drift from conventional polymers to the modern advanced and high-performance polymers, whereby cross-linked polyethylene (XLPE) and thermoplastic elastomers (TPE) and flame-retardant plastics are considered to provide better durability, flexibility, and safety parameters. These polymers are now preferred over traditional materials because of their superior electrical insulation properties and resistance to environmental stressors.

- Polymer materials are needed to ensure that electrical signals and power are transmitted safely and to avoid any short circuiting or electrical failure. The application of polymers is vast, in construction, they are used in power cables and wiring systems, in the automotive industry for wiring harnesses and electronic systems; in telecommunications for fiber optic cables and for renewable energy systems such as solar and wind power cables.

- Among the advantages that polymers offer in wire and cable applications, excellent electrical insulation, chemical resistance, lightweight nature, and ease of processing are prominent. These characteristics lend to a longer useful life, safety, and cost-effective solutions to users. The development of eco-friendly and recyclable polymers responds to the global sustainability drive, therefore bolstering market growth.

Wire and Cable Polymer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 33.2 Billion |

| Market Size in 2026 | USD 35.4 Billion |

| Forecast Period 2026-2035 CAGR | 6.6% |

| Market Size in 2035 | USD 62.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising infrastructure development | Increasing investments in power transmission, smart cities, and urban infrastructure boost demand for durable and high-performance cables. |

| Automotive electrification | Growing adoption of electric vehicles (EVs) and connected cars requires advanced wiring systems with reliable, lightweight, and heat-resistant polymers. |

| Technological advancements | Innovations in polymer materials, such as flame-retardant and eco-friendly options, enhance safety standards and environmental compliance, driving market growth. |

| Pitfalls & Challenges | Impact |

| Environmental regulations | Stringent regulations on the use of certain chemicals in polymers may limit material choices and increase compliance costs. |

| Volatility in raw material prices | Fluctuations in the prices of petrochemical feedstocks can impact the cost of producing polymers, affecting overall profitability. |

| Opportunities: | Impact |

| High-performance polymer development | Ongoing research to create polymers with enhanced electrical, thermal, and mechanical properties. |

| Shift towards eco-friendly polymers | Increasing focus on recyclable and bio-based polymers to reduce environmental impact. |

| Market Leaders (2025) | |

| Market Leader |

7.7% |

| Top Players |

Collective Market Share of 31.1% in 2025 |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | U.S., Canada |

| Future outlook |

|

| Companies covered: | 12 |

| Tables, Charts & Figures: | 205 |

| Countries covered: | 18 |

| No of Pages: | 190 |

What are the growth opportunities in this market?

Wire & Cable Polymer Market Trends

- Dynamic growth transformed by technological trends as well as an evolving regulatory and constant stream of product innovation characterizes the wire and cable polymer market. High-performance, lightweight, and durable polymers, which benefit electrical insulation as well as their mechanical properties, are becoming the norm. Both innovations, such as cross-linked polyethylene (XLPE), thermoplastic elastomers, and bio-based polymers, are well on their way to becoming mainstream performance standards owing to the increased safety and environmentally friendly profiles.

- The advancement of technology is significant in the growth of smart polymers and nanocomposite materials. Revolutionary polymers portray flame retardancy, thermal stability, and electrical performance, displaying promising benefits for applications in renewable energies, electric vehicles, and 5G infrastructure, among others.

- With stricter regulations becoming effective regarding safety, environmental impact, and recyclability, the panel created by the governments and regulatory bodies increases the flame retardancy, decreases the smoke emissions, and pushes up the use of materials friendly to the environment. These further advantages the shift towards bio-based and recyclable polymers, in line with global sustainability initiatives.

- Product innovation is driven by this demand for even greener, safer, and more efficient materials which include flame-retardant, halogen-free, and low-smoke polymers as well as multifunctional materials that combine insulation, shielding, and fire resistance among others. The application of nanotechnology brings forth novel and advanced polymer composites characterized with superior electrical and thermal properties.

Wire & Cable Polymer Market Analysis

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

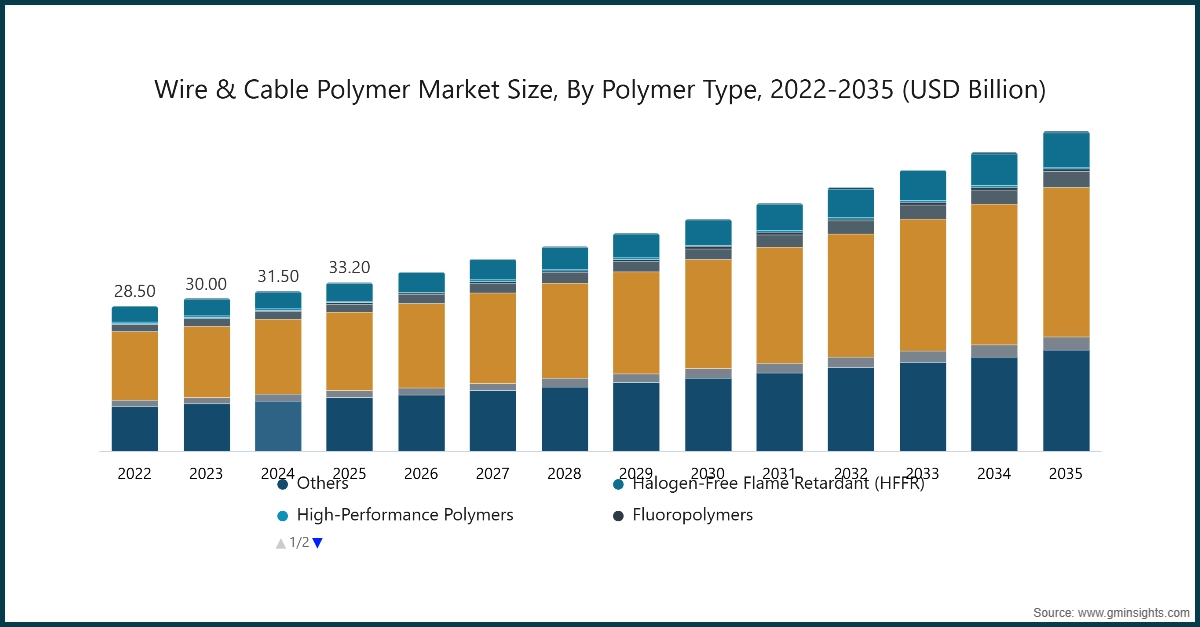

Based on polymer type, the market is segmented into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), elastomers, fluoropolymers, high-performance polymers, halogen-free flame retardant (HFFR), others. Polyvinyl chloride (PVC) dominated the market with an approximate market share of 46.8% in 2025 and is expected to grow with a CAGR of 6.6% by 2035.

- The segment of wire and cable polymers consisting of polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC) continues to grow apace because of their utility in electrical insulation and jacketing. The excellent electrical insulation quality, chemical inertness, and cost-effectiveness delivered by PE and PVC, making them mass-accepted in constructions, automotive, telecommunications, and other such industries. The population growth demands advanced wiring systems in infrastructure projects and consumer electronics, further fueling the growth of these polymers in the market.

- Elastomers and fluoropolymers have begun to be favored compared to other types of polymers, as their flexibility is unmatched compared to others, along with being resistant to high temperatures and performing well with electricity as well. Elastomers are generally used in applications which require high flexibility and resilience, such as in connectors and flexible cables. Fluoropolymers are then used in demanding environments, aerospace, military, and chemical processing industries where their unique chemical inertness and thermal stability prove to be an asset.

High-performance polymers and halogen-free flame retardant (HFFR) materials are thus some of the newest and key segments in the wire and cable market. As a result, it also enhances the safety aspect of these materials in terms of flame retardancy, lower smoke emissions, and environmentally friendly attributes to meet evolving regulated standards across the globe. Eco-friendly and fire-safe solutions installed in buildings are propelling innovations in such segments, with expenditure pouring in research and development with integrated focus on the next generation of polymers that are high-performance but also sustainable.

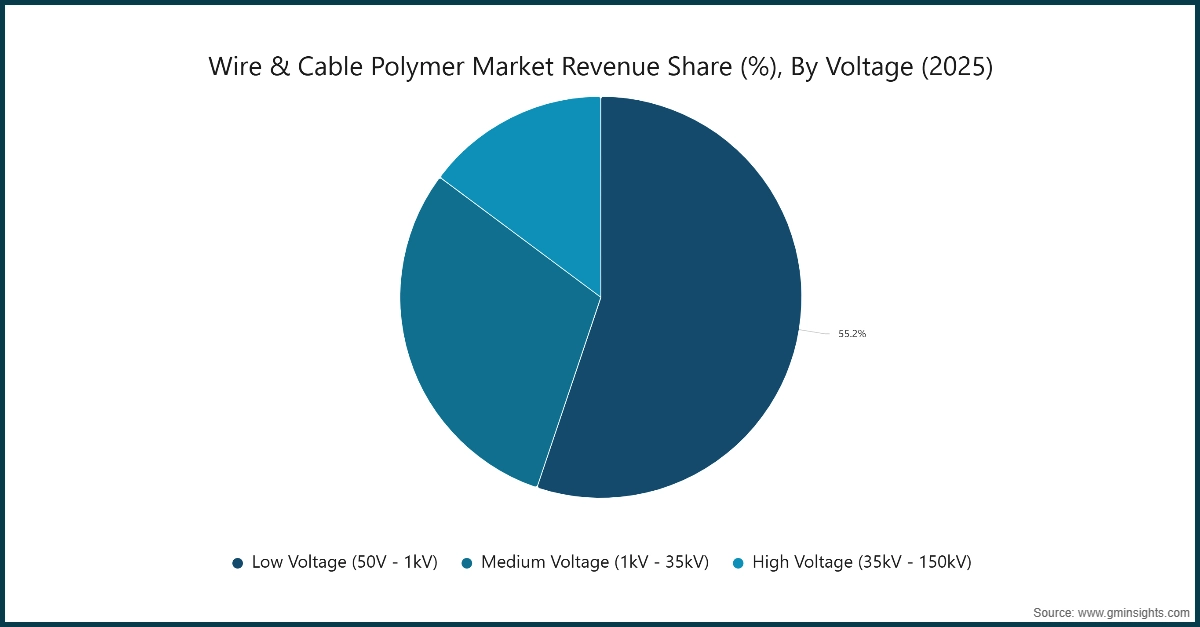

Learn more about the key segments shaping this market

Based on voltage, the wire & cable polymer market is segmented into low voltage (50V - 1kV), medium voltage (1kV - 35kV), and high voltage (35kV - 150kV). Low voltage (50V - 1kV) held the largest market share of 55.1% in 2025 and is expected to grow at a CAGR of 6.8% during 2026-2035.

- The low voltage segment (50V - 1kV), predominantly used in household and commercial applications, has witnessed a continued progression steered by urbanization, smart building projects, and an increase in energy-efficient wiring solutions. Investment by governments and private sector entities into smart grid initiatives and renewal energy integration has further propelled demand for durable high-performance polymers in low voltage cables while stressing safety and sustainability in the environment.

- The medium (1kV-35kV) and high voltage (35kV-150kV) segments are experiencing accelerated growth driven by large power transmission projects and the general trend toward renewable energy sources such as wind and solar energy farms. Such segments need advanced polymer materials with superior electrical insulation, thermal stability, and flame retardancy to enable safe and reliable power transmission. Upgrading old grid infrastructure around the world and expanding renewable generation capacity are expected to further boost demand for polymer-based specialty cables in these voltage ranges.

Based on end-user industry, the market is segmented into power generation, telecommunications, automotive & transportation, construction & infrastructure, industrial manufacturing, oil & gas, mining & resources, renewable energy, data centers & it, aerospace & defense, and healthcare. Construction & infrastructure segments dominated the market with an approximate market share of 27.2% in 2025 and is expected to grow with a CAGR of 6.9% by 2035.

- The dynamics of wire and cable polymer markets across end-user industries are continuously driven by technological demands and infrastructure developments. One of these very significant contributors is the construction and infrastructure market, because of urbanization, smart city projects, and infrastructure developments that require solid and reliable wiring systems over time.

- In the area of power generation, through increasingly tangible use of renewable sources of energy like wind energy and solar energy, the demand for specialized polymer cables with higher insulation, thermal stability, and high durability capacities to resist extreme environment conditions increase. The development of smart grid initiatives enhances this trend as more reliable high-performance wiring solutions is required, creating a corresponding upward growth trend in this segment.

- Data centers experience the rapid escalation of data and spreading high-speed internet networking infrastructure as the economy demands advanced cables with electrical properties giving much more room for improvement in terms of fire safety features. In parallel, with the increasing involvement of lightweight and fire-retardant as well as flexible polymers in wiring systems, the standards for safety and performance are heightened in the automobiles and transportations.

- Industrial manufacturing, oil & gas, mining, and resources industries are pressing demands on high-performance polymers that could resist extreme temperatures, chemicals, and mechanical stresses. The renewable energy industry, in specific, is getting bigger and thus is calling for the durability of polymer cable for windmills and solar farms.

Looking for region specific data?

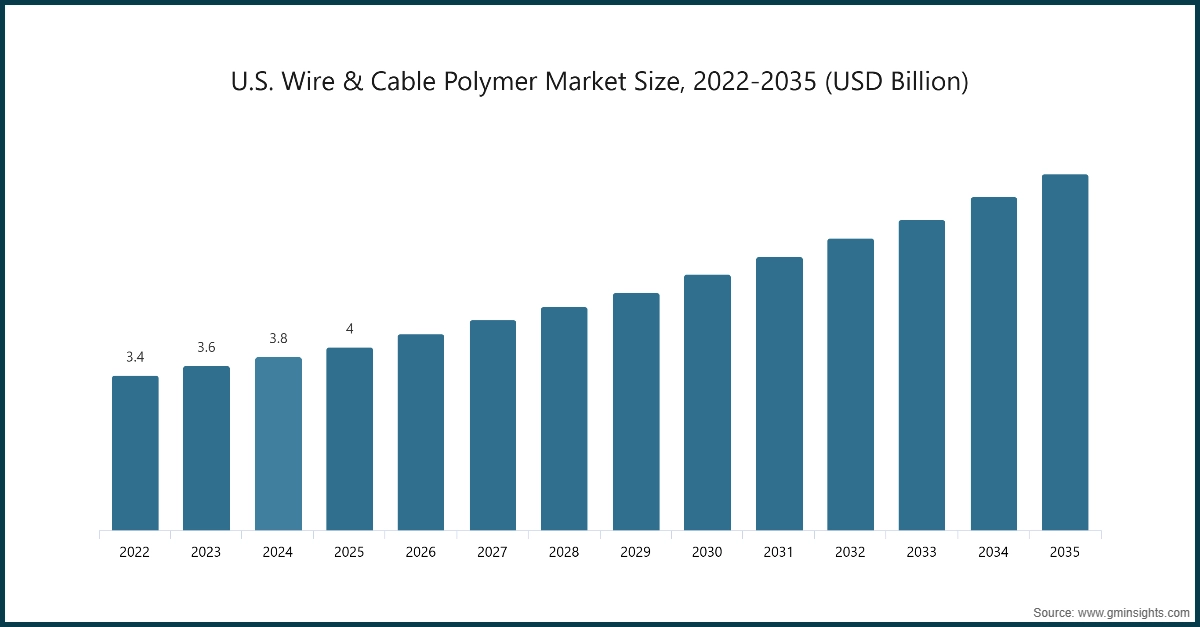

The North America wire & cable polymer marke is growing rapidly on the global level with a market share of 15.1% in 2025.

- With infrastructural modernization investment in renewable energy and the expansion of telecommunications, the wire and cable polymer market is witnessing steady growth in North America. The demands for tough yet high-performance polymers that combine excellent insulation, fire resistance and flexibility are mounting with the region's focus on smart grid projects and electric vehicle adoption. Stringent safety and environmental norms, therefore, compel the manufacturers to work towards eco-friendly polymer cables with flame-resistant properties. The U.S. and Canada boast a very mature market with continued technological growth and infrastructure modernization, and with an eye on sustainability and safety.

Europe wire & cable polymer market leads the industry with revenue of USD 5.6 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- European wire and cable polymer markets are driven primarily by sustainability, regulations, and technology innovations. The existing strict environmental and safety standards are accelerating the implementation of eco-friendly, halogen-free, and fire-retardant polymers. The region's renewable energy projects smart city initiatives, and infrastructure upgrades foster the demand for durable and high-quality cables. Demand from the automotive sector for electric vehicles and smart transportation systems is also contributing to market growth. The emerging landscape of 5G networks and data center construction further pushes the demand for advanced polymers with great electrical & thermal properties. Especially Germany, France, and the UK are at the forefront of activities in the market, emphasizing the need for innovative and sustainable polymer solutions that will cater to the ever-changing industry standards.

The Asia Pacific wire & cable polymer market is anticipated to grow at a CAGR of 6.7% during the analysis timeframe.

- Asia Pacific is turning up to be a dominant market for wire and cable polymers due to rapid urbanization, industrial development, and extending energy infrastructure development. It is countries like China, India and Japan, investing heavily in renewable energy, smart city projects and electric vehicle adoption, which are adding weight to the demand for specific polymer cables. Cost competitiveness along with technological advancements is acting as a stimulus to innovate in polymer materials, flame retardant and high-temperature resistant ones included. The expanding telecommunications sector, driven particularly through 4G and 5G deployment, offers the market even more opportunities.

Latin America wire & cable polymer market accounted for 3.7% market share in 2025 and is anticipated to show steady growth over the forecast period.

- The Latin American wire and cable polymer market is slowly gaining traction on infrastructural development, renewable energy projects, and urbanization. Brazil, Mexico & Argentina are key markets investing in energy transmission, smart grid initiatives and transportation infrastructure, ultimately requiring polymer cables with reliability and durability. The region's commitment to renewables, especially solar and wind projects is poised to foster opportunities for high-performance polymer insulation materials. However, the growth rates may be affected by the economic cycle and the regulatory environment.

Middle East & Africa wire & cable polymer market accounted for 5.9% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

The MEA region is moderately growing in the wire and cable polymer market, mostly supported by infrastructural projects, oil & gas activities, and investments in renewable energy. With the heightened emphasis on power transmission network expansion and smart city development in the Middle East, especially in the UAE, Saudi Arabia, and South Africa, the demand for high-quality polymer cables with enhanced insulation and fire resistance is fostered. Africa's growing energy and telecommunications sectors further grab some opportunities for the market with rising demand for durable and cost-effective polymer solutions.

Wire & Cable Polymer Market Share

The top 5 companies in Wire & cable polymer industry include BASF SE, Dow Inc., LyondellBasell, Borealis AG, and SABIC. These are prominent companies operating in their respective regions covering approximately 31.1% of the market share in 2025. These companies hold strong positions due to their extensive experience in wire & cable polymer market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

BASF SE is a leader in the chemical industry globally and has an extensive innovative, high-performance polymer and specialty material portfolio which also has a stronghold on the wire and cable polymer market. The company commits to sustainability by offering eco-friendly polymer & flame-retardant solutions that comply strictly with various regulations worldwide.

Dow Inc. is one of the well-known companies in advanced polymers for wire and cable. Advances in products such as high-performance polyethylene, PVC, and specialty compounds, comprehensively evaluated, promise to deliver excellent electrical insulation, flame retardance, and weatherability. Dow became recognized for developing lightweight, flexible, and durable polymers, an evolution-dependent institution on the automotive, telecommunications, and renewable energy sectors.

LyondellBasell, regarded for its well-diversified catalog of polyolefins and advanced polymer materials for wire and cable applications. Its product lines include high-density polyethylene (HDPE) and polypropylene (PP), providing exceptional properties in electrical insulation, chemical resistance and mechanical strength. Most importantly, a competitive advantage comes with relatively cheap manufacturing processes and the ability to develop, produce and scale innovative, high-quality materials.

Borealis is another strong player, in polyolefins and innovative solutions for the wire and cable market. Strong in R&D prowess, coupled with a collaborative approach with customers, help the companies tailor solutions alongside specific regional needs and industry standards. Strategic investments made by Borealis into advanced manufacturing and sustainable product lines will ensure its position as a leading innovator in cable polymers.

SABIC is a global chemical company, and it is augmented into the wire and cable polymer segment. The product range encompasses engineering plastics, flame-retardant compounds, and specialty polymers that are specially designed for high-performance electrical and electronic applications. Innovation capability, customization, and a solid global supply chain stand as the pillars on which SABIC manages to sustain excellence in competition. The company aims at developing materials that render excellent electrical properties, flexible, and environmentally compliant with the ever-increasing demand for sustainable and fire-safe cables.

Wire & Cable Polymer Market Companies

Major players operating in the Wire & cable polymer industry include:

Arkema SA

- BASF SE

- Borealis AG

- Dow Inc.

- Eastman Chemical Company

- ExxonMobil Corporation

- LG Chem Ltd

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- SABIC

- Solvay SA

- Sumitomo Chemical Co., Ltd.

Wire & Cable Polymer Industry News

- In January 2025, Sumitomo Electric displayed its Thunderbolt 5 cables at Integrated Systems Europe (ISE) 2025. The company plans to underscore the benefits of these cables which increase the effectiveness of high-speed data transfer in cutting-edge audio-visual and IT technologies. Thunderbolt 5 cables offer enhanced connectivity and performance, enabling users to maximize the capabilities of next-gen technologies in the rapidly evolving industry.

- In October 2024, Alfanar has secured contracts worth USD 5.3 billion with the Saudi Electricity Company (SEC) to enhance Saudi Arabia’s power infrastructure. The agreements cover substations, transmission lines, and smart grid solutions to support the country’s energy transition. Alfanar’s expertise in power and automation strengthens its role in Saudi Arabia’s electricity sector development.

This wire & cable polymer market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2026 to 2035, for the following segments:

Market, By Polymer Type

- Polyethylene

- Low Density Polyethylene (LDPE)

- High Density Polyethylene (HDPE)

- Linear Low Density Polyethylene (LLDPE)

- Polypropylene

- Polyvinyl Chloride (PVC)

- Flexible PVC

- Rigid PVC

- Elastomers

- Ethylene Propylene Rubber (EPR)

- Ethylene Propylene Diene Monomer (EPDM)

- Silicone Rubber

- Thermoplastic Elastomers (TPE)

- Thermoplastic Polyurethane (TPU)

- Fluoropolymers

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Perfluoroalkoxy (PFA)

- Ethylene Tetrafluoroethylene (ETFE)

- High-Performance Polymers

- Polyether Ether Ketone (PEEK)

- Polyetherimide (PEI)

- Polyphenylene Sulfide (PPS)

- Halogen-Free Flame Retardant (HFFR) Compounds

- Others

Market, By Voltage

- Low voltage (50V - 1kV)

- Medium voltage (1kV - 35kV)

- High voltage (35kV - 150kV)

Market, By End-User Industry

- Power Generation

- Telecommunications

- Automotive & transportation

- Construction & infrastructure

- Industrial manufacturing

- Oil & gas

- Mining & resources

- Renewable energy

- Data Centers & IT

- Aerospace & defense

- Healthcare

The above information is provided for the following regions and countries:

· North America

- U.S.

- Canada

· Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

· Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

· Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

· Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the projected size of the wire & cable polymer market in 2026?

The market is anticipated to grow to USD 35.4 billion in 2026.

Which polymer type dominated the market in 2025?

Polyvinyl chloride (PVC) led the market with an approximate share of 46.8% in 2025 and is expected to grow at a CAGR of 6.6% through 2035.

What was the market share of the low voltage segment in 2025?

The low voltage segment (50V - 1kV) held the largest market share of 55.1% in 2025 and is projected to grow at a CAGR of 6.8% during 2026-2035.

Which end-user industry dominated the wire & cable polymer market in 2025?

The construction & infrastructure segment dominated the market with an approximate share of 27.2% in 2025 and is expected to grow at a CAGR of 6.9% by 2035.

Who are the major players in the wire & cable polymer market?

Key players include Arkema SA, BASF SE, Borealis AG, Dow Inc., Eastman Chemical Company, ExxonMobil Corporation, and LG Chem Ltd.

What are the key trends in the wire & cable polymer market?

Key trends include the adoption of high-performance, lightweight, and durable polymers, advancements in smart polymers and nanocomposites, and increasing applications in renewable energy, electric vehicles, and 5G infrastructure.

Which region is experiencing rapid growth in the wire & cable polymer market?

North America is witnessing rapid growth, holding a 15.1% market share in 2025, driven by advancements in infrastructure and increasing demand for high-performance polymers.

What was the market size of the wire & cable polymer market in 2025?

The market size was valued at USD 33.2 billion in 2025, with a CAGR of 6.6% projected through 2035, driven by technological advancements, regulatory evolution, and product innovations.

What is the projected value of the wire & cable polymer market by 2035?

The market is expected to reach USD 62.8 billion by 2035, fueled by the adoption of high-performance polymers, smart materials, and increasing demand from renewable energy and 5G infrastructure sectors.

Wire and Cable Polymer Market Scope

Related Reports