Summary

Table of Content

White Cement Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

White Cement Market Size

The global white cement market size was estimated at USD 10.5 billion in 2024 and is estimated to grow at 6.8% CAGR from 2025 to 2034. Market growth is driven by increasing infrastructure development, eco-friendly construction material demand, and growth in residential and commercial construction are pushing business growth worldwide.

To get key market trends

Global infrastructure projects are the leading demand for white cement. The governments are heavily investing in the transportation network, the energy facilities, and the urban development projects. For instance, the U.S. has set aside USD 1.2 trillion by 2025 towards infrastructure development, with USD 550 billion coming from the Infrastructure Investment and Jobs Act. Equally, the infrastructure deficit in Asia-Pacific is estimated to rise above USD 1.7 trillion by 2030, which means that construction materials such as white cement will continue to be in demand.

White Cement Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 10.5 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.8% |

| Market Size in 2034 | USD 20.2 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The construction industry is currently paying more attention to sustainability, which is why the demand for eco-friendly materials is growing. White cement’s high reflective characteristics help to minimize the urban heat island phenomenon with energy efficiency of buildings. Also, when it comes to carbon capture technologies, inventions in the production of white cement are making it more of an eco-friendly venture. For instance, companies such as CarbonCure can inject CO₂ into fresh concrete at the point of mixing, resulting in a cut in emissions by 3% to 5% per use.

Growth in the residential and commercial construction industries, especially in the emerging economies, is driving the white cement market. In the UK, for example, the output of residential housing was the best since March 2022, supported by expectations of increased property market demand on account of interest rate cuts. In September, the S&P Global construction purchasing managers’ index spurted to 57.2, reflecting strong expansion.

White Cement Market Trends

- The white cement industry is becoming more and more digitalized, particularly introducing digital technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) to improve production process. These technologies allow real-time monitoring, predictive maintenance, and the improvement of quality control, which would provide better operational efficiency and downtime. To give an example, AI-based predictive maintenance can predict the failures of the equipment, making it possible to act in time and reduce the disruptions of the production.

- To address concerns regarding the environment and resource famine, manufacturers are seeking to embrace alternative raw materials for the manufacture of white cement including fly ash, slag, and recycled aggregates. This approach helps cut dependence on conventional raw materials and ameliorate waste, which helps make manufacturing less wasteful. Addition of these materials can also improve some of the properties of white cement in terms of durability and resistance to chemical attacks.

- To counter supply chain dissolutions and cut down on transport-related emissions, industry is shifting towards erecting smaller, regional production plants. These decentralized plants are also positioned near the demand centres, therefore shortening delivery times, logistics costs and carbon footprints. This trend also enables manufacturers to meet the region’s market demands and desires.

Tariffs Impact

The tariffs imposed on the U.S. white cement market through the Trump administration in 2025 are 25% on cement imports from Canada and Mexico and up to 46% on Vietnamese cement. These countries supplied a combined approximate 27% of American cement imports and also contributed close to 7% of the overall consumption.

The tariffs have caused an increase in the price of imported white cement, impacting regions in the U.S., such as Texas and the Northeast, which mainly rely on the imports from Canada and Mexico. This has strained construction budgets likely delaying infrastructure projects and worsening the housing affordability crisis.

Such domestic producers as Holcim have not been impacted as they have built an entire company around local production and sourcing strategies, enabling them to reap the benefits of increased demand. Exploring the effects of tariffs by Turkish cement exporters on the higher tariff rates is, therefore, important because these exporters have lower tariff rates than those of others.

Prices have increased, and supplies have become less available, particularly for the regions dependent on imports. Those domestic producers are to profit in the short run, but the broader construction industry will be hamstrung by cost escalations and project delays.

White Cement Market Analysis

Learn more about the key segments shaping this market

The white cement industry is segmented by product type into white Portland cement, white masonry cement, white Portland limestone cement (plc), others. White Portland cement accounted for 59.5% of the market share in 2024.

- The most popular segment of the white Portland cement is the most used, being high in strength, superior finish and aesthetic value. It is mostly used in architectural and decorative purposes such as on walls, flooring and sculptures where homogeneity of color and brightness is important. The drivers of the demand for this segment include the increased development of premium construction projects and increased use of structures that appear attractive in residential and commercial spaces.

- White Masonry Cement is popular due to variety and uncomplicated utilizations in mortar, plaster and stucco for building. It has high workability, adhesion, and weathering characteristics; therefore, it is suitable in load-bearing and non-load-bearing structures. This segment is benefiting from the growth in the residential construction segment, and the rise in demand for decorative masonry in contemporary architecture.

- White Portland Limestone Cement (PLC) and Others such as White Calcium Aluminate Cement are picked up as eco-friendly ones and for specific applications. Specifically, PLC provides low carbon emissions and better environmental performance, which correlates with the global trend to a greener model of construction practices. This segment is likely to expand as the builders and contractors are looking for sustainable alternatives to traditional cement.

White cement market is segmented by grades into type 52.5, type 42.5, type 32.5, and others. Type 52.5 accounted for 39.5% of the market share in 2024.

- Type 52.5 is becoming more popular in high strength settings such as in high-rise structures and major construction works whereby longevity and durability are important. In the meantime, Type 42.5 is preferable for its versatility as it is applied for residential, commercial, and common construction for its characteristics of balanced performance. Type 32.5, which is the most economical of all, is widely used for less demanding applications, such as plastering and finishing work. The demand for urban development and infrastructure activities has grown and escalated the demand for higher-grade white cement.

- The Others segment that incorporates custom-tailored grades such as the white calcium aluminate cement is also on the rise as construction procedures require more bespoke materials. These types are applied to a particular use such as refractory linings and industrial flooring. When special properties are required (resistance to extreme conditions, etc.). With the increasing concern on sustainability and environment in the industry, the demand for white cement grades that possess unique properties will increase.

White cement market is segmented by application residential construction, commercial construction, infrastructure development, and decorative applications. The residential construction segment accounted for over 29.5% of the market share in 2024.

- In residential constructions, white cement is highly sought after due to its excellent finishing, attractive looks and long-term endurance, and this makes it a commodity of choice in interior and exterior walls, flooring and ornaments. The increasing demand for housing resulting from the increased rate of urbanization and the growth of the population is providing growth to this sector, as homeowners tend to use premium building materials for aesthetics and durability of their homes.

- Commercial construction also has a critical role to play in the growth of market since office complexes, retail space, hotels, and public buildings more and more use white cement, for its clean, bright look and to achieve its high strength. This segment is being propelled by the demand of up-to-date, architecturally pleasing buildings in commercial real estate; in this regard, white cement is a preferred option in facades, cladding, and flooring.

Learn more about the key segments shaping this market

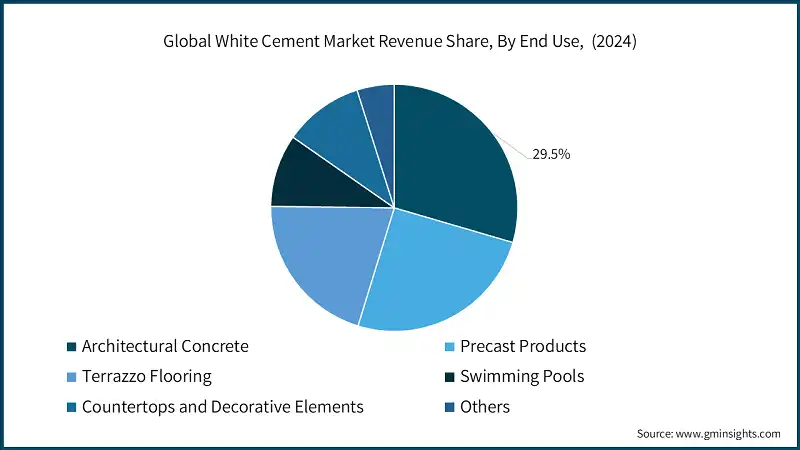

The white cement market is segmented by end use into architectural concrete, precast products, terrazzo flooring, swimming pools, countertops and decorative elements, and others. The architectural concrete segment accounted for over 29.5% of the market share in 2024.

- The largest usage of concrete is in architecture where the aesthetic value and flexibility of white cement play a crucial role. It provides architects and builders with the ability to produce visually dramatic facades, columns, and decorative elements with a smooth and bright finish. This category is thriving off the increasing demand for stylish and innovative building designs in residential and commercial enterprises.

- Precast products such as panels, cladding systems, and decorative elements are another major end use segment because pre-cast products provide faster construction, lower labor cost, and better-quality control. White cement is a good option for the products given their strength, durability and aesthetics. Equally, there is a growing popularity on terrazzo flooring and counter-tops for their distinctive smooth finish and durability resulting in demand in high-end residential, commercial and hospitality projects.

Looking for region specific data?

With over 85% market share, U.S. is leading the white cement market and is valued at USD 2.3 million in 2024.

- The U.S. is poised to witness rapid expansion in terms of white cement consumption, which is mainly attributed to intensive building activities coupled with advancement in technology and a firm stance on sustainable building practices. Availing itself of the high demand for beautiful and long-lasting building materials spread across a huge booming infrastructural development in the country, it is further propelling consumption of white cement.

- North America holds a higher share in the global white cement market on account of having developed construction systems and high demand for good-quality building materials. The region enjoys steady economic viability, well-groomed manufacturing facilities, and building regulations related to high-quality construction. Besides energy efficiency, the mounting focus on sustainable construction practices accelerates the utilization of white cement in several fields like precast concrete, decorative-type products, or structures.

White Cement Market Share

The competitive landscape white cement industry dominated by few players owing to the strength of product innovation, penetrative distribution channels and strategic investments. They also maintain high-quality standards and optimize processes to penetrate the global market competitively. The investment is concentrated on research and development into high-performance product development, sustainable solutions, and customized specialty white cement grades according to diversified customer needs. In continuous improvement and innovation, these companies create industry benchmarks and acquire substantial market share.

Furthermore, such market leaders enjoy brand power and customer loyalty in their supply chain networks for competitive advantage. They are also very actively into strategic mergers, acquisitions, and joint ventures to expand their production capacity and geographical graph. Their efforts towards sustainability and reduction in carbon emissions add more weight to their current positioning in the market, because there is an increased requirement for green building materials. Such a strategic method has, by now, maintained them at the top level, particularly when it comes to the white cement industry globally.

White Cement Market Companies

Under its Birla White brand, UltraTech Cement, a company of the Aditya Birla Group, ranks among the leading white cement producers across the globe. The high quality of its products is coupled with the best manufacturing processes and distribution networks. The company focuses on innovation and sustainability, providing a range of white cement products used for architectural and artistic applications. Birla White is a leader in the Indian market and is steadily gaining international presence.

Aalborg Portland ranks among those giant manufacturers of white cement with a noticeable concern for high-performance products as well as sustainable manufacturing. The Company has production plants in Europe, the Middle East, and the U.S., supplying white cement to over 70 countries. Aalborg is famous for its high-purity white cement, which has a wider array of architectural and decorative applications, and its unfair reputation for quality and creativity.

Cemex is one of the major players in the building materials industry. It has a broad product range that includes white cement, which is extensively used. It has its network of manufacturing and distribution facilities all over the world to produce and distribute good quality white cement for structural and decorative use. Sustainability and innovation, which are key in the business, are other credentials to creating solutions that reduce carbon emissions and enhance the performance of construction materials.

As one of the foremost manufacturers of white cement, J.K. Cement boasts of a premium brand image and a good presence through its products. The company's white cement finds extensive application in decorative and architectural purposes by end use, including flooring, wall finishes, and precast products. J.K. Cement, with its strong distribution, covers both domestic and overseas markets, increases its production to meet an increasing demand.

Çimsa is a recognized white cement producer in Turkey that innovatively manufactures and boasts an excellent export capacity. The white cement products offered by the company are widely variable to be used for architectural, decorative, and industrial purposes in application. Çimsa has strong international export capabilities to over 80 countries and believes in sustainability and production standards.

White Cement Industry News:

- In May 2025, Birla Corporation, with its subsidiary RCCPL, announced cement capacity expansions. This investment comprises the installation of three new grinding units and the expansion of one integrated unit to meet rising demand in central and eastern India.

- UltraTech Cement, an Aditya Birla Group company, acquired Wonder Cement's white cement business in April 2025. The acquisition will thereby increase UltraTech's putty production capacity while maximizing the potential of Wonder Cement's strategically located plant in Rajasthan.

- In December 2024, Quikrete Holdings declared its acquisition of Summit Materials, thus combining two of the largest construction materials producers in the U.S. This merger is tipped to create an even larger construction materials giant that will benefit from increased government spending on infrastructure.

- In August 2024, Çimsa Çimento, a Turkish company, signed an agreement to acquire 95% of Mannok Holdings, an Ireland-based company that would help Çimsa in its strategy for expanding opportunities in the EU market.

This white cement market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (kilo tons) from 2021 - 2034 for the following segments:

Market, By Product Type

- White Portland Cement

- White Masonry Cement

- White Portland Limestone Cement (PLC)

- Others (White Calcium Aluminate Cement, etc.)

Market, By Grade

- Type 52.5

- Type 42.5

- Type 32.5

- Others

Market, By Application

- Residential Construction

- Commercial Construction

- Infrastructure Development

- Decorative Applications

Market, By End Use

- Architectural Concrete

- Precast Products

- Terrazzo Flooring

- Swimming Pools

- Countertops and Decorative Elements

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in white cement market?

Some of the major players in the white cement industry include Aalborg Portland A/S, Adana Çimento Sanayii T.A.Ş., Aditya Birla Group (UltraTech Cement Ltd. - Birla White), Cementir Holding N.V., Cemex S.A.B. de C.V., Çimsa Çimento Sanayi ve Ticaret A.Ş., Federal White Cement Ltd., Holcim Group, J.K. Cement Ltd.

How much is the U.S. white cement market worth in 2024?

The U.S. white cement market was worth over USD 2.3 million in 2024.

How big is the white cement market?

The white cement market was valued at USD 10.5 billion in 2024 and is expected to reach around USD 20.2 billion by 2034, growing at 6.8% CAGR through 2034.

How much white cement market share captured by residential construction segment in 2024?

The North America white cement market residential construction segment held around 29.5% share in 2024.

White Cement Market Scope

Related Reports