Summary

Table of Content

Wet Vacuum Pumps Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wet Vacuum Pumps Market Size

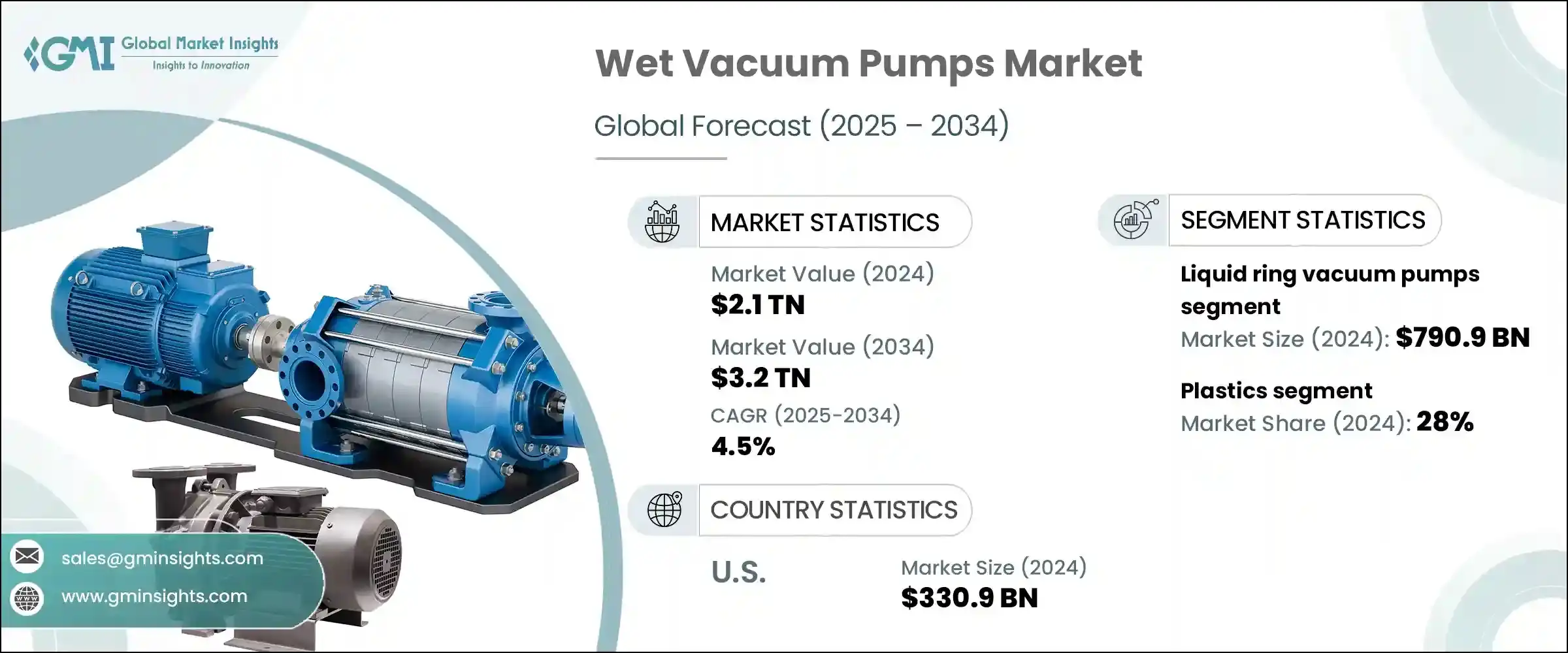

The global wet vacuum pumps market size was valued at USD 2.1 trillion in 2024 and is expected to reach USD 3.2 trillion by 2034, growing at a CAGR of 4.5% from 2025 - 2034.

Wet vacuum pumps are essential for drying and packaging in industrial operations such as chemical processing, food processing, pharmaceuticals, plastics, and power. The demand for wet vacuum pumps is also increasing as there is a rapid growth in all these industries.

To get key market trends

Wet vacuum pumps help chemical, food processing, and pharmaceuticals industries in dealing with strict environmental regulations by managing the gases which are harmful to the environment. Manufacturers are investing in R&D to create more robust, energy-efficient models that meet strict environmental regulations.

Furthermore, the growing electronics and semiconductor industry is also contributing to the wet vacuum pumps market growth. Wet vacuum pumps are known for their ability to keep the surroundings clean, especially in the electronics industry. Thus, with the rising demand for consumer electronics, there is a growing need for wet vacuum pumps for effective production.

Wet Vacuum Pumps Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 2.1 Trillion |

| Forecast Period 2025 - 2034 CAGR | 4.5% |

| Market Size in 2034 | USD 3.2 Trillion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

A significant challenge is the high cost of advanced technology associated with these pumps. The initial investment for wet vacuum pumps is high. Additionally, the wet vacuum pumps market is highly competitive due to numerous manufacturers in the market. This leads to low profit margins, price wars, and low product differentiation. The manufacturers must invest in R&D to come up with pumps updated with new technology to remain competitive in the market. As product demand is directly connected with various industries, such as pharmaceuticals, food processing, and plastics, manufacturers should cater to the different needs and demands of these industries.

Wet Vacuum Pumps Market Trends

- Emerging markets exhibit growing demand for innovation and energy saving vacuum pumps. This is the direct outcome of environmental policies set forth by governments. All producers now shift their focus to formulating pumps which have the capability of saving energy, hence decreasing the expenditure incurred in operation.

- An example of this change is the variable speed drive technology adoption by Busch Vacuum Solutions. It is a controller that allows a motor's rotational speed to be altered. Production level can be set at a certain point, and thus savings are achieved.

Trump Administration Tariffs

- The imposition of tariffs on industrial goods and machinery parts, particularly from China, raised the cost of key components in wet vacuum pumps such as motors, seals, and metal castings. This inflation in costs led to increased production costs for manufacturers and sellers in the United States.

- These tariffs resulted in a review of supply chains that was often accompanied by a relocation of sourcing to non-tariff affected countries. This movement caused delays and short-term disruption in the efficient workflow of the supply chain which affected the delivery of wet vacuum pump systems to the end users.

- The United States must cope with shrinking demand in the market because the prevailing manufacturing costs become detrimental to global competition. Wet vacuum pump exporters have faced increasing competition from overseas manufacturers who do not bear the same burden of tariffs which means that American exports are likely to decline.

Wet Vacuum Pumps Market Analysis

Learn more about the key segments shaping this market

- Based on type, the liquid ring vacuum pumps segment has established itself as the dominant force, generating a revenue of USD 790.9 billion in 2024 and is projected to grow at a CAGR of 4.4% during 2025 to 2034.

- The primary reason for the dominance of liquid ring vacuum pumps is their versatility in managing the gases that are produced during the process. Moreover, their strong performance coupled with low maintenance, and their ability to withstand extreme conditions make them highly sought after in the chemical, food processing, plastics and pharmaceutical industry.

- Based on capacity, the market is bifurcated into low capacity (Up to 100 m3/h), medium capacity (100-1,000 m3/h), and high capacity (above 1,000 m3/h), with the medium capacity segment dominating the market in 2024, holding a total market share of 47%. The segment has the highest market volume due to the adaptability of their medium capacity pumps to different volume demands in the chemical, pharmaceutical and food processing industries.

- It is anticipated that the market will grow at a CAGR of 4.9% during the forecast period from 2025-2034 due to rising requirement of advanced vacuum pumps, enhanced industry performance and competitiveness, and constant need for reliable vacuum pumps.

Learn more about the key segments shaping this market

- Based on application, In 2024, the plastics segment dominated the market with a market share of 28%. Wet vacuum pumps play an important role in many processes in the plastics industry including molding and shaping.

- For plastic products, devices that remove moisture become increasingly appealing as they drive down production costs. In the plastics industry, harmful gases are also emitted. Wet vacuum pumps assist in managing these emissions, which lessens a company's environmental harm which makes them compliant with stringent environmental regulations.

Looking for region specific data?

- The U.S. is dominating the North America wet vacuum pumps market, generating a revenue of around USD 330.9 billion in 2024. The presence of industries and their corresponding types, including chemicals, food processing, and pharmaceuticals that require dependable solutions for their operations, is, foremost, the reason for this dominance. Furthermore, such devices due to wet vacuum pumps emission and pollutant management economics, drive environmental installations in the country.

- Germany is dominating the Europe wet vacuum pumps industry with a revenue of around USD 96.7 billion in 2024. Germany holds the greatest share in the Europe wet vacuum pumps market due to their innovation, industrial development, and strong environmental policies. As one of the key manufacturing regions in Europe, there is a greater need for vacuum pumps in the Pharmaceuticals, Plastic, and Chemical Processing industries. German companies also Focus on Precision Engineering, setting high production standards and boosting the need for wet vacuum pumps that provide unrivaled energy efficiency and performance. In addition, the country’s severe belts on the environment require switching to cleaner technologies, which increases the need for wet vacuum pumps that have reduced emissions and energy use.

- China is leading with an overall market share of around 32.2% in the Asia Pacific wet vacuum pumps market. These developments are driven by the expansion of the chemical, power, pharmaceutical, and plastic industries, which has created a high demand for wet vacuum pumps across these sectors. The growing population in these regions and targeted global fostering of growth means there is an urgent need to apply investment in wet vacuum pumps for operational efficiency. Moreover, the manufacturing and supply-chain infrastructure in China means the country can produce wet vacuum pumps at lower costs. Policies set by the Chinese government on boosting efficiency and sustainability only strengthens this industrial sector through the adoption of vacuum pumps that are cleaner and greener for the environment.

Wet Vacuum Pumps Market Share

- In 2024, market players such as Atlas Copco AB, Gardner Denver Holdings, Inc, Busch Vacuum Solutions, Pfeiffer Vacuum GmbH, Edwards Vacuum, and ULVAC, Inc. collectively holds ~18-20% market share.

- These companies focus on establishing new collaborations and SNCR Wet Vacuum Pumps to expand their market share. They invest a massive amount of funds to develop pumps with new technology that will help them achieve the maximum return on investment.

Wet Vacuum Pumps Market Companies

Major players operating in the wet vacuum pumps industry include:

- Atlas Copco AB

- Gardner Denver Holdings, Inc.

- Busch Vacuum Solutions

- Pfeiffer Vacuum GmbH

- Edwards Vacuum

- ULVAC, Inc.

- Leybold GmbH

- Ebara Corporation

- Becker Pumps Corporation

- Dekker Vacuum Technologies, Inc.

- Tuthill Corporation

- Hokaido Co., Ltd.

- Pfeiffer Vacuum Technology AG

- Graham Corporation

- Flowserve Corporation

Wet Vacuum Pumps Industry News

- In April 2024, Becker Pumps Corp. acquired Air Vac Systems. This acquisition helped increase the efficiency, expand its reach, and boost customer satisfaction.

- In November 2023, Graham Corporation acquired P3 Technologies to expand its technological solutions

- In March 2023, Flowserve Corporation launched a new series of dry running vacuum pump. The series was designed to reduce the cycle times for batch processes.

The wet vacuum pumps market research report includes in-depth coverage of the industry, with estimates & forecast in terms of volume (Thousand Units) and revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Type

- Liquid ring vacuum pumps

- Rotary vane vacuum pumps

- Rotary piston vacuum pumps

- Others

Market, By Capacity

- Low capacity (Up to 100 m3/h)

- Medium capacity (100-1,000 m3/h)

- High capacity (Above 1,000 m3/h)

Market, By Application

- Chemical processing

- Pharmaceutical

- Plastics

- Power

- Metallurgy

- Food processing

- Others

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Indonesia

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

How big is the wet vacuum pumps market?

The wet vacuum pumps market was valued at USD 2.1 trillion in 2024 and is expected to reach around USD 3.2 trillion by 2034, growing at 4.5% CAGR through 2034.

Who are the key players in wet vacuum pumps market?

Some of the major players in the wet vacuum pumps industry include Atlas Copco AB, Gardner Denver Holdings, Busch Vacuum Solutions, Pfeiffer Vacuum GmbH, Edwards Vacuum , ULVAC, Leybold GmbH , Ebara Corporation, Becker Pumps Corporation, Dekker Vacuum Technologies, Tuthill Corporation, Hokaido, Pfeiffer Vacuum Technology AG, Graham Corporation, Flowserve Corporation.

What is the size of liquid ring vacuum pumps segment in the wet vacuum pumps industry?

The liquid ring vacuum pumps segment generated over USD 790.9 billion in 2024.

How much is the U.S. wet vacuum pumps market worth in 2024?

The U.S. wet vacuum pumps market was worth over USD 330.9 billion in 2024.

Wet Vacuum Pumps Market Scope

Related Reports