Summary

Table of Content

Wedding Gown Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Wedding Gown Market Size

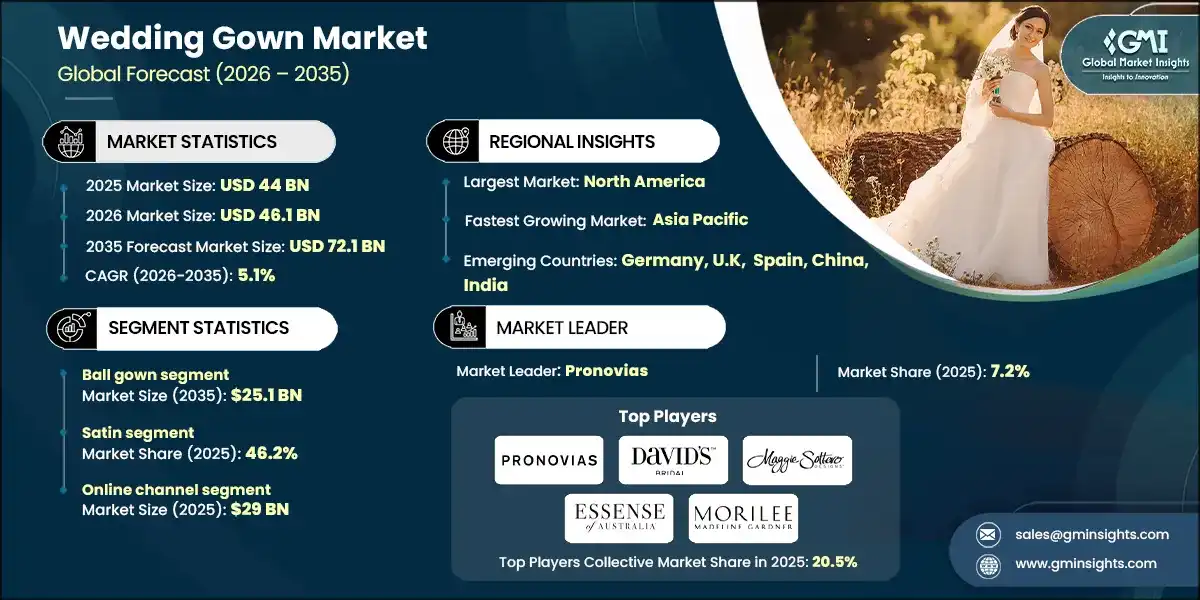

The global wedding gown market was valued at USD 44 billion in 2025. The market is expected to grow from USD 46.1 billion in 2026 to USD 72.1 billion in 2035, at a CAGR of 5.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

According to the National Bureau of Economic Research, the market of wedding dresses is expected to continue growing due to the influence of social media and celebrity culture. Platforms such as Instagram allow for visual experiences when planning a wedding by providing examples of styles and trends to a variety of audiences, many of whom are brides-to-be.

Additionally, brides look to celebrity weddings as the standard of luxury and fashion when selecting their own wedding dresses. The U.S. Census Bureau estimates that 73% of adults within America are using social media by the year 2025; this statistic indicates that individuals of younger generations, including those who will be getting married, are the most frequent users of social media.

Brides look to destination weddings as a determining factor when determining their choice of wedding dress. More and more brides desire dresses that can be easily packed and are suitable for differing climates and locations. For example, lightweight materials are preferred for tropical, beach weddings while wedding ceremonies that take place in a more formal setting require heavier, more intricate designs. The National Travel and Tourism Office have estimated an increase of 32% in flight bookings within the United States for international destinations in the year 2024 compared to 2023, which will continue to drive demand for versatile wedding dresses.

The wedding gown industry continues to be seasonal in nature. In other words, specific months throughout the year have larger quantities of wedding dresses purchased than any other month; therefore, retailers must carefully watch their inventory and cash flow. Even with this seasonality, weddings are a significant part of our culture as evidenced by the U.S. Census Bureau's estimate of 2.1 million marriages in the year 2024.

Economic conditions influence consumer spending on wedding gowns. During periods of economic stability, couples are more likely to invest in high-end gowns. However, even during downturns, weddings are prioritized, with brides opting for budget-friendly yet elegant options to maintain the significance of the occasion.

Wedding Gown Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 44 Billion |

| Market Size in 2026 | USD 46.1 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.1% |

| Market Size in 2035 | USD 72.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Cultural and social traditions | These traditions reinforce the emotional and symbolic importance of wedding gowns, sustaining consistent baseline demand. They also influence regional preferences, prompting designers to offer culturally aligned silhouettes, fabrics, and embellishments. |

| Fashion trends and design innovation | Rapid trend cycles push brides toward contemporary silhouettes and premium craftsmanship, increasing demand for new collections each season. Innovation in fabrics, cuts, and customization options helps brands differentiate and capture trend driven buyers. |

| Celebrity and influencer impact | High-visibility weddings and viral bridal content shape aspirational purchasing, driving demand for designer-inspired looks. Influencers accelerate trend adoption, making certain styles sell out quickly after high-profile appearances. |

| Pitfalls & Challenges | Impact |

| Seasonal and event driven demand | Sales heavily concentrate around peak wedding seasons, causing uneven revenue patterns. Economic slowdowns, travel restrictions, or unexpected postponements can further disrupt sales cycles. |

| High customization costs and lead times | Brides increasingly seek personalized designs, which raises production complexity, requires skilled labor, and lengthens delivery timelines. Any delay or mismatch in final fittings can affect customer satisfaction and brand reputation. |

| Opportunities: | Impact |

| Rising demand for sustainable and ethical gowns | Eco friendly fabrics, recycled textiles, and ethical manufacturing practices are gaining traction. Brands adopting transparent, sustainable production can attract environmentally conscious brides and command premium pricing. |

| Growth of digital bridal commerce | Virtual try on tools, 3D fitting platforms, and online consultations are creating new sales channels. E commerce adoption is accelerating particularly among millennial and Gen Z brides who prefer digital discovery and comparison shopping. |

| Market Leaders (2025) | |

| Market Leaders |

7.2% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Germany, U.K, Spain, China, India |

| Future outlook |

|

What are the growth opportunities in this market?

Wedding Gown Market Trends

Changing innovation and technology transformation are important for the growth of the market.

- As more designers create wedding gowns using eco-friendly fabrics such as organic cotton, linen, bamboo, and recycled textiles, the focus on sustainability continues to grow in the industry. This is largely due to the growing number of brides who are considering the environment when choosing their wedding gown. With approximately 17 million tons of textile waste generated in the United States alone each year, it is easy to see why a sustainable approach is vital in the wedding gown market.

- Designers are expanding their offerings in the market by offering wedding gowns in every body shape, race, and ethnicity, ushering in a new era of inclusivity in wedding gown design. According to the CDC, the average American woman has a body mass index (BMI) around 29.6, this means that the demand for wedding gown sizes that fit a more representative size range is growing.

- Due to the bride's preference for minimalist and timeless styles of bridal fashion, there is a marked increase in brides selecting clean lines, simple silhouettes, and elegant detailing as their preferred style choices. Brides who choose this style will not only benefit from the longevity and durability of the gown itself but encourages investments in versatile gowns that can be reused or repurposed.

- With the Census Bureau in the U.S. noting that American brides spend on average USD 28,000 on their wedding, brides are willing to invest in a gown that will provide them the most return on their investment. Versatility is a key trend, with detachable elements like skirts, capes, and sleeves gaining popularity. These features allow brides to easily transform their look during events. The U.S. Department of Commerce projects growth in the bridal wear market, driven by demand for multifunctional and sustainable designs.

Wedding Gown Market Analysis

Learn more about the key segments shaping this market

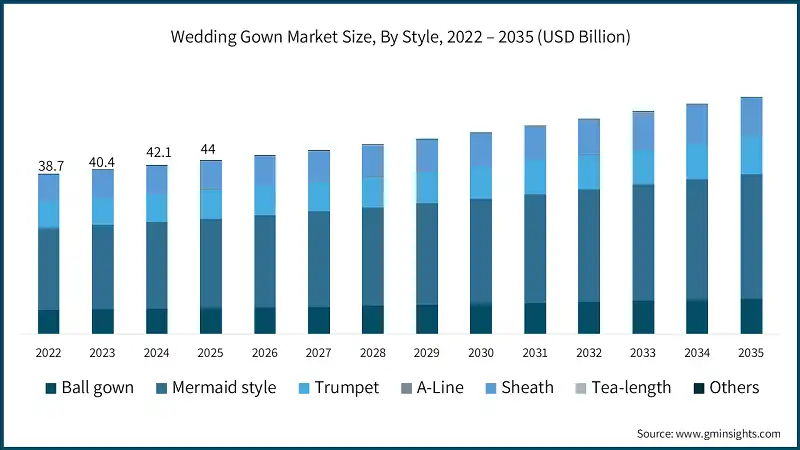

Based on style, the wedding gown industry is segmented into ball gown, mermaid style, trumpet, A-line, sheath, tea-length, others. The ball gown segment accounts for revenue of around USD 15.4 billion in the year 2025 and is expected to reach USD 25.1 billion by 2035.

- The popularity of ball gowns remains high among brides who wish to have a fairy tale wedding atmosphere. Attractive characteristics of a ball gown include its full skirt, embroidered dress, and elaborate embroidery. as a result, ball gowns are ideal for a formal, elaborate wedding.

- Government projection indicate that the wedding industry will continue to grow in the next five years due to increases in the disposable income of the average consumer and their willingness to spend more on luxury wedding attire. For example, the expenses associated with bridal gown in the United States have increased 11% annually over the last 5 years and demonstrate the strong support ball gowns among those consumers purchasing bridal garments.

- Timeless ball gown designs are an excellent choice for brides who want to make a statement and will create an exciting, unique and beautiful appearance at their wedding ceremony. Additionally, the availability of customized ball gowns allows brides to have a gown that is completely unique to them.

- Government reports also indicate that the increasing trend towards sustainable and innovative wedding gown designs will continue to be part of this segment of the bridal clothing industry. Many manufacturers are providing eco-friendly materials in their wedding gown designs and offering brides options for individualized customization to meet the changing needs of consumers.

- The continued focus on traditions, innovations and sustainability within the wedding industry will contribute to the sustained growth of ball gowns and keep them relevant throughout the forecasted period.

Learn more about the key segments shaping this market

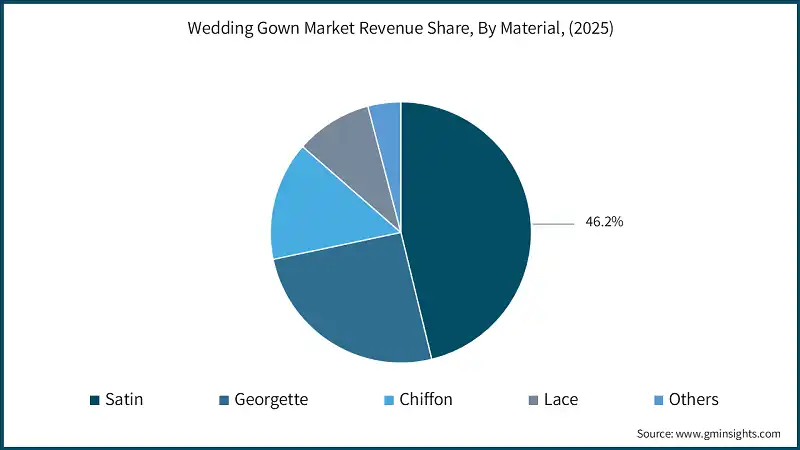

Based on the material, the wedding gown market is bifurcated into satin, georgette, chiffon, lace, others. The satin segments held the largest share, accounting for 46.2% of the global market in 2025.

- The wedding gown fabric industry has seen tremendous growth over the past few years. Satin has been the most popular fabric chosen by brides because of its luxurious appearance. Satin's smooth feel and lovely drape lend themselves to creating wedding gowns that are both sophisticated and traditional.

- There are several factors influencing the rising popularity of satin wedding gowns, including their association with formal and traditional weddings. Brides often choose to wear satin gowns to create the look of classical luxury, which corresponds with the grandeur of many wedding ceremonies. The way that satin enhances the complexity of detailed designs and embellishments is also contributing to the rising popularity of satin.

- The government data indicates that the number of weddings is increasing worldwide, therefore this will lead to an increase in the number of brides purchasing wedding gowns. The U.S. reported more than 2.5 million weddings per year in 2023 and is expected to see consistent yearly increase leading to 2026. The increased demand for wedding gowns will have a favourable effect on the sale of premium materials like satin in the wedding gown market.

- Furthermore, versatility in use contributes significantly toward the growth of the satin fabric in their respective markets. The ability to use satin in styles ranging from ball gowns or a more form-fitted style is what allows the satin fabric to appeal to most brides. Due to this versatility and ability to cross market many related styles of bridal gowns, satin fabric remains a pillar in bridal attire today.

- Satin has established itself as a premier textile within the wedding dress segment, as it continues to improve upon its position in the bridal segment with the growing trend of luxurious fabrics like satin and the need for luxe fabric to support heavier detail-oriented gowns.

Based on distribution channels, the wedding gown market is segmented into online and offline channels. The online channel segment held the largest share, generating a revenue of USD 29 billion of the global market in 2025.

- E-commerce has rapidly grown due to the ease of access & vast amount of styles that are offered online, as well as competitive pricing & ease of use for customers all over the world. Online shopping has also benefited from the rapid advancement in technologies. There are many online storefronts that now utilize augmented reality tools to help brides try on dresses virtually prior to the purchase of the dress.

- Government initiatives to improve digital infrastructure have been a driving force behind this trend. In 2025, global internet penetration reached 65%, up from 60% in 2023, and the primary reason being an increased government funded programmes for the provision of improved internet connectivity and improved digital literacy. As more people gain access to digital technology, more people can shop online including for wedding dresses, which continues to fuel growth within the wedding dress market.

- Even with the amount of growth with online platforms, there is still a large segment of the market that is maintained by offline stores. Many customers desire the physical experience of trying on wedding gowns and are willing to make an appointment to meet with a sales associate to do so. Nonetheless, as the cost-effectiveness, breadth of selections, and convenience of shopping online continues to grow, more consumers will be shifting their purchasing power towards online platforms.

- The balance between online and offline channels continues to evolve with the wedding dress industry. Government support and advances in technology are pushing a transition in how consumers purchase their wedding gowns online through these digital platforms.

Looking for region specific data?

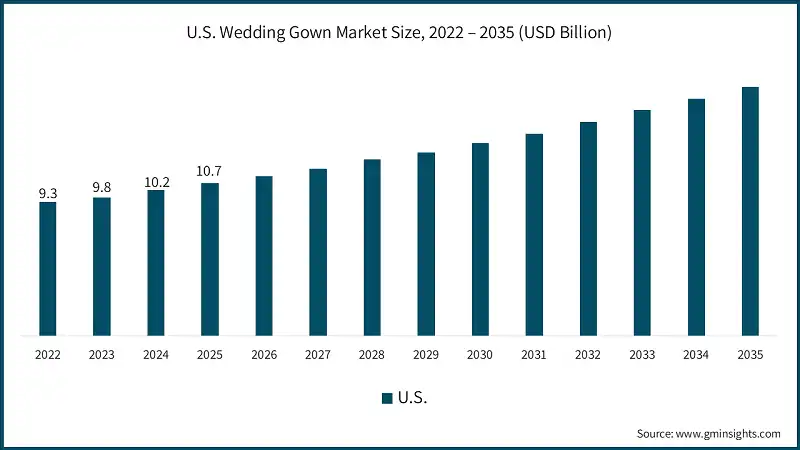

North America Wedding Gown Market

In 2025, the U.S. dominated the market growth in North America, accounting for 74.2% of the share in the region.

- The U.S. wedding gown market benefits from a large and steady marriage base: in 2024, 31.2 women married per 1,000 unmarried women according to the American Community Survey, showing continued high matrimonial activity. These high marriage volumes directly support sustained gown purchases.

- Government statistics from the CDC have indicated that between 3.7 and 24.6 marriages have occurred across U.S. states for the year 2025, with states such as Nevada serving as high volume sources of wedding activity. This diversity of geographic and demographic wedding activity has a stabilizing influence on the bridal retail market.

Asia Pacific Wedding Gown Market

Asia Pacific market is expected to grow at 5.5% during the forecast period.

- Growth in Asia Pacific is supported by rising disposable incomes, strong cultural emphasis on elaborate wedding traditions, and increasing demand for personalized bridal fashion. Modern couples are also embracing global trends, designer labels, and destination-style celebrations, which fuels higher spending on wedding gowns.

Europe Wedding Gown Market

Europe market is expected to grow at 5.3% during the forecast period.

- In Europe, growth is driven by the region’s strong destination-wedding appeal, cultural diversity, and preference for unique, themed, and high-aesthetic ceremonies. The rise of boutique designers, digital wedding planning, and sustainability-focused bridal fashion also contributes to expanding demand.

Middle East and Africa Wedding Gown Market

Middle East and Africa market is expected to grow at 4.8% during the forecast period.

- The growth in the region is fueled by luxury-focused wedding culture, greater spending power among young couples, and strong demand for premium, bespoke bridal wear. The popularity of high-end venues, cultural multi-day celebrations, and rising interest in destination weddings also supports market expansion.

Wedding Gown Market Shares

The top companies in the market include Pronovias, David's Bridal, Maggie Sottero Designs, Essense of Australia and Morilee and collectively hold a share of 20.5% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

- Pronovias manufactures gowns through a global atelier-driven model, with its haute couture Atelier Pronovias pieces hand-crafted in Barcelona and additional production supported by international logistics hubs in Spain, Hong Kong, Brazil, and the U.S. This structure ensures high-precision craftsmanship while enabling large-scale global distribution.

- David’s Bridal functions as a mass-scale bridal producer, sourcing and manufacturing gowns for broad accessibility across its nationwide chain; while detailed factory locations are not publicly disclosed, its scale allows it to supply 25–30% of all U.S. wedding dresses, reflecting a highly streamlined, high-volume production model.

- Maggie Sottero designs its collections in Salt Lake City and Sydney, while manufacturing occurs through a global network—primarily in China and Vietnam—where skilled artisans execute the intricate lacework, corsetry, and detailed construction the brand is known for. Strict quality controls preserve the brand’s signature craftsmanship across all facilities.

Wedding Gown Market Companies Major players operating in the wedding gown industry are: Essense of Australia operates as an international design and manufacturing house producing award winning gowns across multiple labels, supported by global offices in Kansas, Australia, the U.K., Switzerland, the Netherlands, and Canada. Its manufacturing emphasizes structured fits, couture-inspired detailing, and consistent quality for 1,200–1,500 retail partners worldwide. Morilee manufactures its bridal and special occasion gowns through a long established global production network supporting distribution in 3,000+ specialty stores. The brand emphasizes artisan craftsmanship—hand-applied beading, lacework, and form-fitting silhouettes—executed by seasoned dressmakers who uphold its 70 year heritage of meticulous gown construction.Wedding Gown Industry News

The wedding gown market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Style

- Ball gown

- Mermaid style

- Trumpet

- A-Line

- Sheath

- Tea-length

- Others (fit and flare, colmn)

Market, By Materials

- Satin

- Georgette

- Chiffon

- Lace

- Others (tulle, organza)

Market, By Length

- Mini

- Midi

- Maxi

Market, By Sleeve Type

- Short sleeve

- Long sleeve

- Sleeveless

Market, By End Use

- Individuals

- Commercial

- Clothing rental services

- Wedding consultant

- Photographic studio

- Others (religious institutions, social institutions, etc.)

Market, By Distribution Channel

- Online channels

- E-commerce

- Company websites

- Offline channels

- Specialty stores

- Mega retails stores

- Others (individual stores, departmental stores)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What was the market share of the satin material segment?

The satin segment held the largest share, accounting for 46.2% of the global market in 2025.

Which region leads the wedding gown market?

The United States dominated the North American market, accounting for 74.2% of the regional share in 2025.

What are the upcoming trends in the wedding gown industry?

Key trends include the adoption of eco-friendly fabrics, a focus on sustainability, and the expansion of inclusive designs catering to diverse body shapes, races, and ethnicities.

Who are the key players in the wedding gown market?

Key players include Allure Bridals, Amsale, David's Bridal, Essense of Australia, Hayley Paige, Jenny Packham, Justin Alexander, Le Spose di Gio, Maggie Sottero Designs, and Monique Lhuillier.

How much revenue did the ball gown segment generate?

The ball gown segment generated USD 15.4 billion in 2025 and is projected to reach USD 25.1 billion by 2035.

What was the market size of the wedding gown market in 2025?

The market size was valued at USD 44 billion in 2025, with a CAGR of 5.1% expected through 2035, driven by sustainability trends and inclusivity in designs.

What is the projected size of the wedding gown market in 2026?

The market is expected to reach USD 46.1 billion in 2026.

What is the projected value of the wedding gown market by 2035?

The market is expected to reach USD 72.1 billion by 2035, fueled by increasing demand for eco-friendly fabrics and diverse size ranges.

Wedding Gown Market Scope

Related Reports