Summary

Table of Content

Water Soluble Polymer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Water Soluble Polymer Market Size

Water Soluble Polymer Market Size was valued over USD 24 billion in 2016, and the industry will grow at a CAGR of up to 5.6% through 2024. The industry is increasing due to the rising potable water demand in across all nations. It is further triggering the wastewater treatment demand across industrial, and municipal processes, which would require more products such as water-soluble polymers.

The tightening environmental regulations in developing economies regarding effluent discharge from manufacturing companies and drinking water purity are further accelerating the demand for these products and will enhance the global water soluble polymer market over the forecast period.

To get key market trends

To get key market trends

Companies involved in production of pharmaceuticals, nutraceuticals, mineral processing, oil & gas, and paper generate high volumes of effluents. Besides, the wastewater generated from oil & gas companies are carcinogenic, and sometimes toxic. This enormous generation is restricted with strict regulations on their disposal, will further demand more waste treatment products, giving a significant boost to the water soluble polymer market growth.

Oil & gas sector acts as one of the prominent consumers of these commodities. The hydrates formation in the oil & gas pipelines has become a major challenge in oil & gas operations. These are highly employed in pipelines in order to reduce hydrate formation. The rising crude oil production in the world will further trigger the global water soluble polymers market share by 2024.

Product consumption will grow over the coming years due to their growing demand in the developing nations. These countries are completely focusing on employing eco-friendly products, as they help in restricting the pollution levels. Favorable government regulations in these economies will further assist in increasing water soluble polymer market demand.

Water Soluble Polymer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 24 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 5.6% |

| Market Size in 2024 | 38 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Water soluble polymer market could face restraints due to the adverse environmental, and health impact of synthetic polymers. These products may affect the environment in various direct or indirect ways. This market may be further affected due to instability in raw material prices of synthetically derived products from the past few years. Over the coming years, the raw material prices are expected to oscillate highly, which in turn may show a negative impact on its growth.

Water Soluble Polymer Market Analysis

The polyacrylamide & copolymers segment accounted for a revenue of over USD 5 billion in 2016 and the segment is likely to exhibit promising gains over the forecast timeframe due to prevalence of stringent government regulations to reduce the release of harmful agents into the environment. This has been extensively used as an effective coagulant and flocculant, owing to its properties such as good thermal stability, high miscibility, solubility, and nontoxic nature, and so forth for separating all kinds of suspended solid particles present in industrial liquid effluents.

Learn more about the key segments shaping this market

Water treatment segment lead the application base in 2016 and accounted for approximately 25% of the total business share. Increasing demand for effluent treatment is majorly driving the growth of this segment. Rising effluent generation from the manufacturing companies is creating a huge demand for water treatment processes, which in turn is accelerating the water soluble polymer market segment. Over the future years, the demand for potable water is going to rise and drive towards growth over the forecast period.

Asia Pacific held a major share of 30% in 2016. Increasing industrialization, coupled with the favorable industrial regulations in developing economies of this region are creating an enormous growth avenue for manufacturing companies, which is leading to massive wastewater generation. The stringent regulations regarding industrial effluents disposal are creating a high demand for wastewater treatment processes, thereby driving the water soluble polymer market size by 2024.

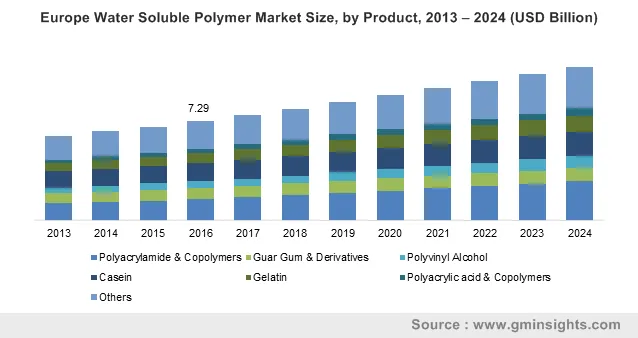

North America will witness a sluggish growth, owing to a highly matured market in this region. In 2016. Europe will also witness a moderate CAGR close to 5%. However, tightening regulations regarding wastewater treatment plays a vital role in driving the water soluble polymer market.

Water Soluble Polymer Market Share

Prominent players operating in this water soluble polymer industry include

- BASF SE

- SNF SAS

- Ashland Inc

- Arkema S.A.

- Kemira OYJ

- Kuraray Group

- E. I. du Pont de Nemours and Company

- The Dow Chemical Company

- Nitta Gelatin Inc.

- LG Chem Ltd

These companies have their unique product applications in various verticals such as water treatment, petroleum, detergents & household products, paper making, and oil & gas.

Industry Background

Water soluble polymers are derivatives of both natural and synthetic raw materials. The global market is determined to be highly attractive, as this polymer product has extensive applications in various applications such as oil & gas, wastewater treatment, pharmaceutical, paper production, etc. Extensive research activities will further implement product demand across niche applications such as drug delivery systems and food.

Water soluble polymer market report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in kilo tons and revenue in USD billion from 2013 to 2024, for the following segments:

By Product

- Polyacrylamide & copolymers

- Guar gum & derivatives

- Polyvinyl alcohol

- Casein

- Gelatin

- Polyacrylic acid & copolymers

- Others

By Application

- Water treatment

- Detergents & household products

- Paper making

- Petroleum

- Others (Food, etc.)

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Australia

- India

- Japan

- Indonesia

- Latin America

- Argentina

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- UAE

- Kuwait

- South Africa

Frequently Asked Question(FAQ) :

How much growth will global water soluble polymer industry share attain during the forecast spell?

The overall water soluble polymer market might register a crcr of 5.6% over the anticipated period.

How much remuneration is the water soluble polymer market projected to register in 2024?

Overall water soluble polymer market would be pegged at a valuation of 38 Billion (USD)in 2024.

How is the APAC water soluble polymers industry slated to fare over the upcoming timeframe?

Owing to rising industrialization and the introduction of favorable regulatory framework across developing countries in the region, the industry of water soluble polymers in APAC is likely to register significant growth.

What water soluble polymer products are expected to witness remunerative gains over the coming years?

Polyacrylamide & copolymers product segment is likely to register tremendous growth owing to extensive use as a highly effective flocculant and coagulant.

Which challenges are likely to impede adoption of water soluble polymers?

The adverse health, as well as environmental impact of synthetic water soluble polymers is expected to hamper the revenue growth opportunities for the industry in coming years.

What trends are fueling water soluble polymer market growth?

Growing demand for potable water across countries, and increasingly tightening environmental regulations regarding drinking water purity and effluent discharge from production plants is fueling revenue growth of the industry.

Water Soluble Polymer Market Scope

Related Reports