Summary

Table of Content

Washing Machine Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Washing Machine Market Size

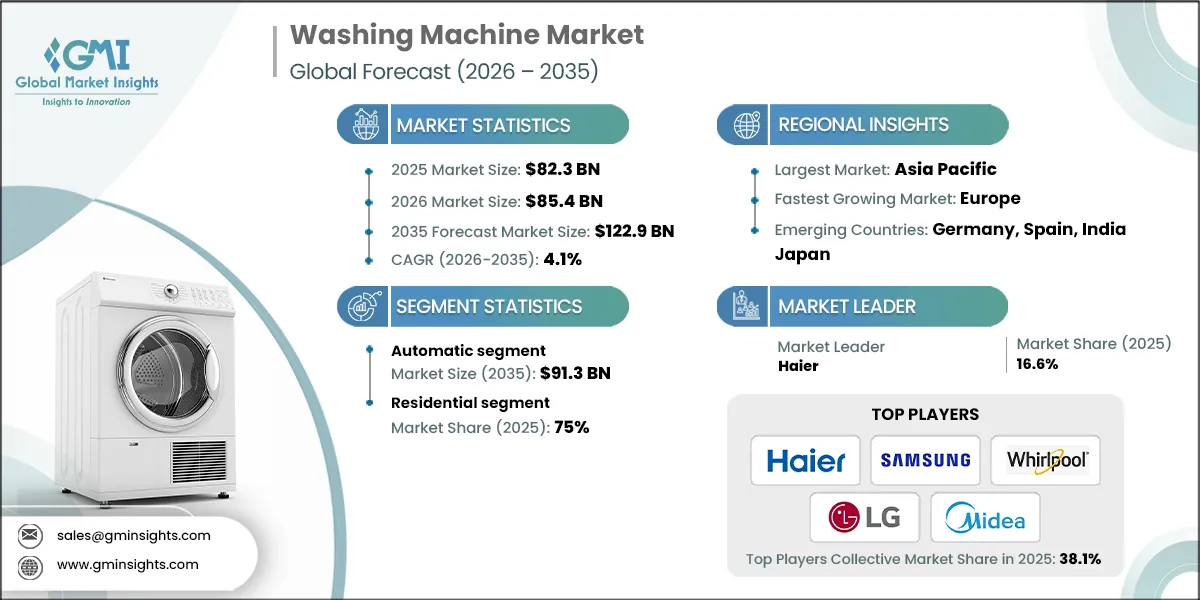

The washing machine market was valued at USD 82.3 billion in 2025. The market is expected to grow from USD 85.4 billion in 2026 to USD 122.9 billion in 2035, at a CAGR of 4.1%, according to latest report published by Global Market Insights Inc.

To get key market trends

Rapid growth in the washing machine industry has been driven by the effects of urbanization and the growth of a new class of potential customers. Increased disposable income, changes to lifestyle choices with increased convenience requirements also lead customers to embrace use of technology in their homes; therefore, demand for compact automated and energy-efficient washers to meet these needs has risen significantly due to more and more people now living in significantly smaller homes and/or multi-family buildings.

The World Bank data helps to generalize this growth, with projections that by the year 2030, approximately 5.3 billion people will be classified as members of the "global middle class," with most of that growth taking place in these locations. Households with higher incomes are allowing them to have access to washing machines. An example would be LG Electronics; they have provided low-cost energy-efficient machines for sale in India and Southeast Asia so that they can continue to provide customers with affordable options in response to an increase in demand.

In addition, government-related projects, such as those related to electricity service in India -"Saubhagya Scheme" or in Africa and Southeast have created an increased amount of access to both electricity and water—the two most essential utilities necessary for the operation and use of a washing machine- which have enabled the growth of this market. Moreover, due to the increasing number of retail outlets, easier funding methods and the availability of many online ecommerce stores selling washing machines, a washing machine is now cheaper and easier for fairly wealthy people to acquire than before.

Samsung has produced low-cost models with smart characteristics aimed at providing value for money for budget-conscious consumers; this is an illustration of how technology is becoming more integrated into home appliances as the trend continues, hence the washing machine industry is expected to grow at a relatively consistent rate during the period

Further the driving force behind the continued growth being urbanization, an expanding middle class and the increasing desire of consumers for energy efficient, compact and technologically sophisticated washers. All of these elements, along with continued support from government regulations and progressive product introductions from major brands, will be the foundation of the washing machine industry for years to come.

Washing Machine Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 82.3 Billion |

| Market Size in 2026 | USD 85.4 Billion |

| Forecast Period 2026-2035 CAGR | 4.1% |

| Market Size in 2035 | USD 122.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Technological advancements | Higher household income enables consumers to allocate more funds toward renovations, upgrades, and premium materials. This drives demand for both DIY and DIFM projects across all home improvement categories. |

| Rising disposable income | Smart home devices, energy-efficient systems, and digital design tools are transforming renovation projects. These innovations enhance convenience, sustainability, and customization, attracting tech-savvy homeowners. |

| Urbanization and the growing middle class | A large portion of housing stock in developed markets is over 30 years old, creating a need for structural repairs and modernization. This trend fuels spending on kitchens, bathrooms, and system upgrades. |

| Pitfalls & Challenges | Impact |

| High competition and price wars | Rapid shifts toward sustainability and smart solutions require constant product innovation. Companies face pressure to adapt quickly or risk losing relevance in a competitive market. |

| Environmental regulations | Major renovations and smart upgrades involve significant upfront costs, limiting adoption among price-sensitive consumers. Economic uncertainty and high interest rates further constrain spending. |

| Opportunities: | Impact |

| Energy-efficient & eco-friendly models | Rising environmental awareness and government incentives create strong demand for green products. Brands offering low-VOC paints, recycled materials, and water-saving fixtures gain a competitive edge. |

| Expansion of smart and functional washing machines | IoT-enabled devices and modular designs are reshaping home improvement into a tech-driven segment. This opens new revenue streams for manufacturers and retailers through connected solutions. |

| Market Leaders (2025) | |

| Market Leader |

|

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Europe |

| Emerging countries | Germany, Spain, India, Japan |

| Future outlook |

|

What are the growth opportunities in this market?

Washing Machine Market Trends

Changing innovation and technology transformation are important for the growth of the washing machine market.

- The washing machine industry is continually changing and growing at a fast pace due to ongoing technological developments that are creating greater efficiency, convenience, and environmentally friendly solutions for users. The introduction of smart technology, such as the ability to control a washing machine's cycle using a smart phone, has greatly simplified product operation for consumers , thus allowing lower operating costs, and ultimately create more product adoption.

- Eco-friendly technologies such as inverter motors, heat pumps, and water filtration/recycling systems are increasingly popular due to the emphasis placed on saving energy and protecting the environment. The U.S. Department of Energy estimates that a washing machine that is classified as being energy efficient can reduce energy consumption by as much as 25% when compared to a conventional washing machine and can reduce water consumption by 33% compared to a conventional washing machine.

- The washing machine industry is continually changing and growing at a fast pace due to ongoing technological developments that are creating greater efficiency, convenience, and environmentally friendly solutions for users. The introduction of smart technology, such as the ability to control a washing machine's cycle using a smart phone, has greatly simplified product operation for consumers.

- The market trends for energy-efficient appliances have also been affected by government policies designed to encourage the development of energy-efficient appliances. An example of this would be the United States Environmental Protection Agency (EPA)'s ENERGY STAR program, which encourages consumers to purchase energy-efficient appliances.

- Consumers are willing to invest in high-tech, robust washing machines with a promise of convenience and energy savings for the future. This has caused a shift in the way the market functions as manufacturers are developing washing machines that offer technological innovations to keep pace with changing consumer trends such as enhanced connectivity, environmental sustainability, and design space optimization.

Washing Machine Market Analysis

Learn more about the key segments shaping this market

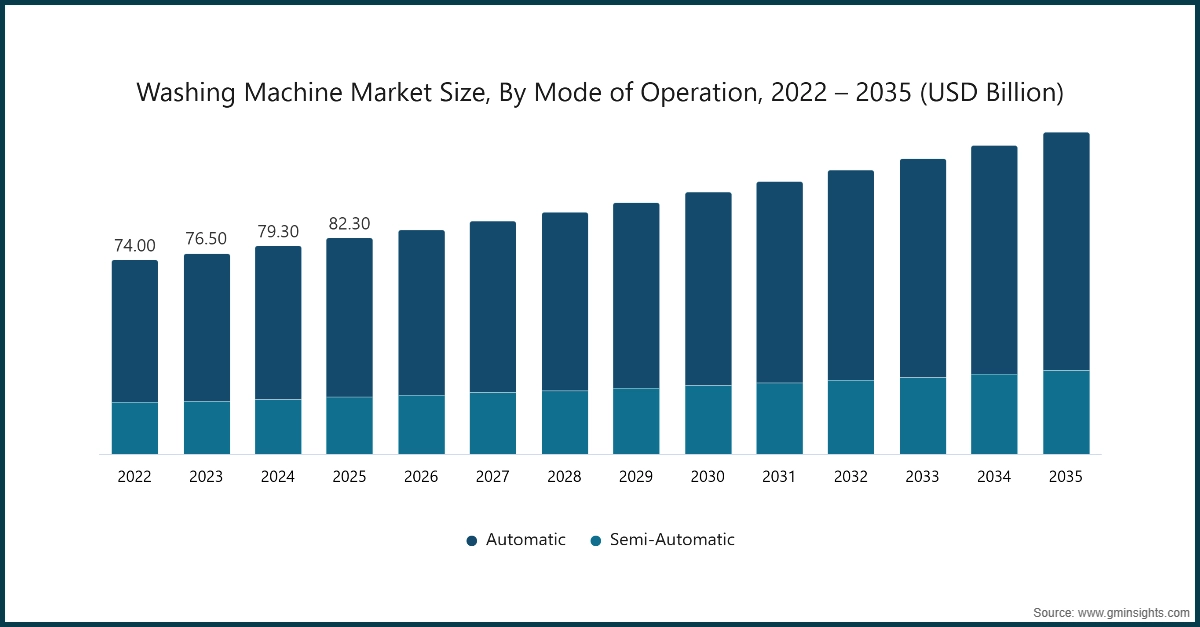

Based on mode of operation, the washing machine industry is segmented into semi-automatic and automatic. The automatic segment accounts for revenue of around USD 60.7 billion in the year 2025 and is expected to reach USD 91.3 billion by 2035.

- Automatic washing machines are leading because they are simple to operate, have advanced technology, and are considered very efficient when compared to other types of washing machines. There are fully automatic washing machine models that are top-loading or front-loading. Fully automatic washing machine models are also the most preferred of consumers because of the simplicity of operation when compared to semi-automatic washing machines.

- The increase in disposable income has caused a drastic shift in many households from using semi-automatic washing machines to using fully automatic washing machines, especially in urban areas. Consumers are increasingly purchasing these washing machine models due to their advanced features, including AI washing cycles, Internet of Things (IoT) connectivity, and their ability to conserve water. A report issued by the U.S. Department of Energy states that households using energy-efficient appliances can save up to 25% on their energy bill compared to traditional appliances.

- Manufacturing companies are responding to the demands of the marketplace for energy-efficient products by producing washing machines that use less water and less power. Many companies, such as LG and Samsung, have introduced washing machine models that use AI technology to automatically select the most efficient washing cycle for different types of fabrics. Additionally, the grow in demand for home automation has also driven the desire for connected appliances.

- Automatic washing machines will see a surge in growth during the next few years due to urbanization and consumers increasingly buying smart devices for their homes. As per the UN, nearly 56.2% of the world’s population reside in an urban society, and this is projected to grow continuously over time. This combination will propel the automatic washing machine sector's exponential growth during the predicted period.

- Further- urbanization trend, governments and organizations are equally responsible for contributing to the development of automatic washing machine demand. In India, for example, the Production-Linked Incentive (PLI) Programme regarding White Goods emphasized the boosting of domestic manufacturing capabilities, including energy-efficient washing machines.

Learn more about the key segments shaping this market

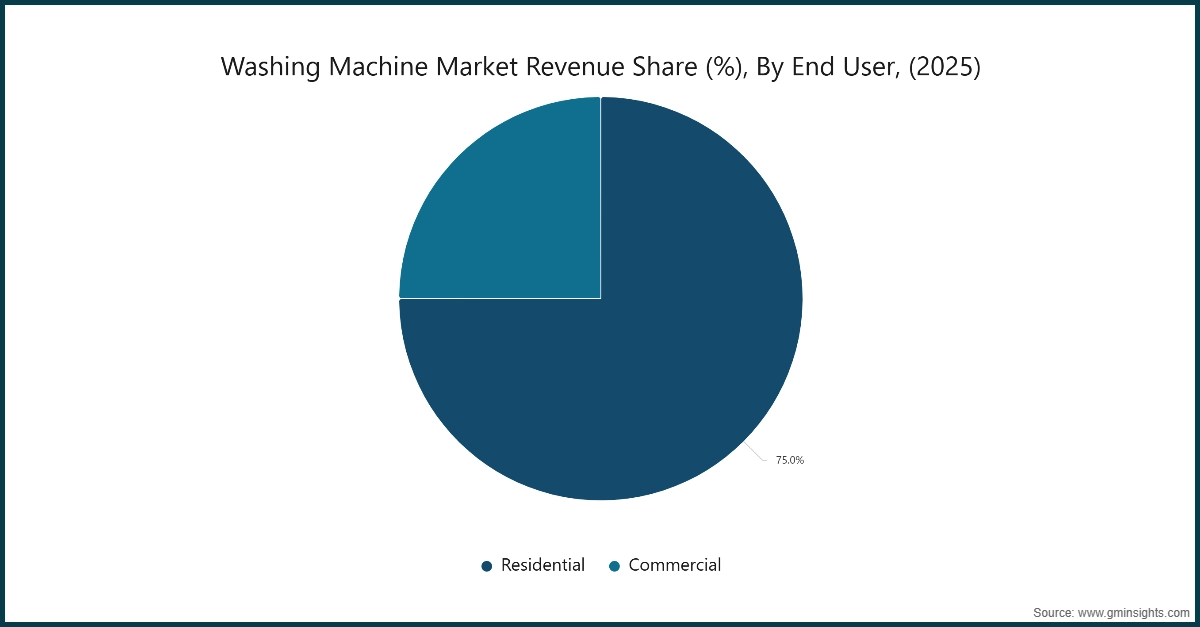

Based on the end user, the washing machine market is bifurcated into residential and commercial. The residential segments held the largest share, accounting for 75% of the global washing machine market in 2025.

- The offline segment dominance is primarily due to the trust and convenience associated with physical retail stores, where consumers can directly inspect products before purchasing. Retailers often provide personalized assistance, demonstrations, and after-sales services, which enhance the customer experience. Additionally, offline stores frequently offer attractive discounts and financing options, making them a preferred choice for buyers.

- Rising disposable incomes and urbanization have further bolstered offline sales, as consumers increasingly seek premium washing machines with advanced features. According to the U.S. Census Bureau, urban areas now house over 83% of the U.S. population, driving demand for household appliances. Governments are also encouraging energy-efficient appliances; for example, India’s Bureau of Energy Efficiency (BEE) introduced star ratings for washing machines, while the European Union implemented stricter energy labeling regulations to promote eco-friendly products.

- Leading manufacturers are leveraging offline channels to expand their market presence. Companies like Whirlpool and Bosch have established exclusive brand outlets and partnerships with multi-brand retailers to showcase their latest models. For instance, Bosch’s retail stores offer live demonstrations of their energy-efficient washing machines, helping consumers make informed decisions.

- Despite the growth of e-commerce, offline channels remain crucial due to their ability to cater to diverse consumer preferences. Many buyers, especially in developing regions, prefer offline stores for their reliability and immediate product availability. According to a report by the Indian Brand Equity Foundation (IBEF), the Indian retail market is expected to reach USD 1.8 trillion by 2030, with offline retail continuing to dominate the appliance segment.

- Government initiatives and consumer demand for sustainable appliances are further shaping the offline washing machine market. For example, India’s Production Linked Incentive (PLI) scheme for white goods aims to boost domestic manufacturing and retail of energy-efficient appliances. Similarly, the European Union’s Green Deal emphasizes sustainable technologies, encouraging manufacturers to focus on eco-friendly washing machines.

Looking for region specific data?

North America Washing Machine Market

In 2025, the U.S. dominated the washing machine market growth in North America, accounting for 75.6% of the share in the region.

- The U.S. dominates the North American washing machine market due to high household penetration and strong demand for premium, smart appliances. According to the U.S. Census Bureau, over 90% of households own a washing machine, driven by high disposable income and preference for convenience. Advanced features like IoT connectivity and energy efficiency further boost adoption.

- Government initiatives such as the ENERGY STAR program by the U.S. Environmental Protection Agency (EPA) encourage consumers to purchase energy-efficient washers, offering rebates and tax incentives. This policy push, combined with rising smart home adoption, strengthens the U.S. leadership in the regional market.

Asia Pacific Washing Machine Market

Asia Pacific washing machine market is expected to grow at 4.5% during the forecast period.

- Asia Pacific’s growth is fueled by urbanization and rising middle-class income, especially in China and India. Government programs like India’s “Make in India” and China’s smart appliance subsidies promote local manufacturing and adoption of advanced washing machines. Increasing e-commerce penetration also accelerates sales in emerging economies.

Europe Washing Machine Market

Europe washing machine market is expected to grow at 4.1% during the forecast period.

- Europe’s market expansion is supported by stringent energy efficiency regulations under the EU Ecodesign Directive and high consumer preference for sustainable appliances. Countries like Germany and France lead in premium front-load washers, while smart connectivity and water-saving technologies drive innovation.

Middle East and Africa Washing Machine Market

Middle East and Africa washing machine market is expected to grow at 3.7% during the forecast period.

- Growth in this region is driven by rising urbanization and electrification projects, particularly in Gulf countries and parts of Africa. Government infrastructure investments and increasing disposable income enable households to shift from manual washing to automatic machines. Demand for compact and affordable models is strong in emerging markets.

Washing Machine Market Share

The top companies in the washing machine market Haier, Samsung, Whirlpool, LG and Midea and collectively hold a share of 38.2% of the market in 2025. These prominent players are proactively involved in strategic endeavors, such as mergers & acquisitions, facility expansions & collaborations, to expand their product portfolios, extend their reach to a broad customer base, and strengthen their market position.

Haier is a global company in home appliances, offering a wide range of washing machines including top load, front-load, and smart models. The brand focuses on IoT-enabled solutions and energy-efficient designs, catering to both premium and budget segments. Haier emphasizes user-friendly features like quick wash cycles and antibacterial technology.

Samsung dominates the premium washing machine segment with advanced technologies such as EcoBubble, AI-powered laundry optimization, and smart connectivity. Its product line includes front-load, top-load, and washer-dryer combos. Samsung leverages innovation and sleek design to attract tech-savvy consumers globally.

Whirlpool offers a broad portfolio of washing machines designed for durability and performance, including semi-automatic and fully automatic models. The company focuses on energy efficiency and stain-removal technologies, appealing to both residential and commercial users. Whirlpool’s strong distribution network supports its global reach.

Washing Machine Market Companies

Major players operating in the washing machine market are:

- Bosch

- Electrolux

- GE Appliances

- Godrej & Boyce

- Haier

- Hisense

- Hitachi

- LG

- Midea

- Panasonic

- Samsung

- Sharp

- TCL

- Toshiba

- Whirlpool

LG is known for its high-end washing machines featuring TurboWash, Steam technology, and AI Direct Drive for fabric care. The brand emphasizes smart home integration and sustainability, offering models that reduce water and energy consumption. LG’s innovation-driven approach positions it as a leader in premium laundry solutions.

Midea targets value-conscious consumers with affordable washing machines that combine reliability and essential features. Its range includes semi-automatic and fully automatic models, with growing investment in smart and eco-friendly technologies. Midea’s competitive pricing and strong presence in emerging markets drive its growth.

Washing Machine Industry News

- In October 2025, Whirlpool announced a large-scale USD 300 million investment to expand production capacity at its Ohio manufacturing plants. This effort aims to support the next generation of residential washers and dryers while creating 400–600 jobs- underscoring their commitment to domestic appliance manufacturing.

- In August 2025, at IFA 2025, LG introduced an AI-driven, energy-efficient laundry lineup for Europe including its HeatPump WasherDryer (WashCombo), achieving Energy Class A. It features AI DD for fabric-adaptive cleaning and a Microplastic Care cycle that captures up to 60% of microfibers released during washing.

- In April 2025, The Electrolux 700 Series front-load washer-dryer pair received recognition from Green Builder Media for its cold-water optimized cleaning using SmartBoost and its Wear It Again refresh cycle. Certified ENERGY STAR Most Efficient 2025 and assembled in a zero-waste-to-landfill facility, this innovation emphasizes sustainability and fabric care.

- In April 2025 Samsung launched its first Bespoke AI Top-Load Washer, featuring AI Wash, AI Energy Mode, and AI VRT+ to optimize water, detergent, and vibration settings. For the first time in its top-load line, the washer integrates Ecobubble technology and smart connectivity through the SmartThings app.

- In June 2024, Bosch introduced new compact 500 and 800 Series washers and dryers supporting full-size innovation in small spaces. Models feature iDOS automatic detergent dosing, Home Connect smart controls, and “Steam Restore” for wrinkle reduction. These products cater to consumers seeking high-tech appliances in apartments and small homes.

The washing machine market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) (from 2022 to 2035), for the following segments:

Market, By Type

- Top-Load

- Front-Load

Market, By Mode of Operation

- Semi-automatic

- Automatic

Market, By Capacity

- Below 6 kg

- 6 kg – 9 kg

- Above 9 kg

Market, By Price

- Low

- Medium

- High

Market, By End-user

- Residential

- Commercial

Market, By Distribution Channel

- Online

- E-Commerce

- Company website

- Offline

- Supermarkets/Hypermarkets

- Specialty Stores

- Others (Individual stores, Departmental stores, etc.)

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the washing machine industry?

Key trends include the integration of smart technologies, eco-friendly features like inverter motors and water recycling systems, and increased adoption of energy-efficient appliances. Government policies promoting sustainability and advancements in AI and IoT connectivity are shaping the market.

Who are the key players in the washing machine market?

Major players include Bosch, Electrolux, GE Appliances, Godrej & Boyce, Haier, Hisense, Hitachi, LG, Midea, Panasonic, Samsung, Sharp, TCL, Toshiba, and Whirlpool. These companies focus on innovation, energy efficiency, and smart home integration to maintain competitive advantages.

What is the washing machine market size in 2025?

The market size for washing machine was valued at USD 82.3 billion in 2025. Urbanization, rising disposable incomes, and demand for energy-efficient appliances have driven market growth.

What is the market size of the washing machine industry in 2026?

The market is expected to reach USD 85.4 billion in 2026, reflecting steady growth driven by technological advancements and increased adoption of automated washers.

What is the projected value of the washing machine market by 2035?

The market size for washing machine is projected to reach USD 122.9 billion by 2035, growing at a CAGR of 4.1%. This growth is supported by urbanization, rising middle-class incomes, and demand for compact, energy-efficient models.

How much revenue did the automatic washing machine segment generate in 2025?

The automatic washing machine segment accounted for approximately USD 60.7 billion in revenue in 2025, driven by consumer preference for advanced features like AI washing cycles and IoT connectivity.

What was the valuation of the residential segment in 2025?

The residential segment held the largest share of the washing machine market in 2025, accounting for 75% of the global market. This dominance is attributed to rising urbanization and increased adoption of smart home appliances.

Which region leads the washing machine market?

The U.S. dominated the North American market in 2025, accounting for 75.6% of the regional share. High household penetration, strong demand for premium appliances, and government incentives like the ENERGY STAR program drive its leadership.

Washing Machine Market Scope

Related Reports