Summary

Table of Content

Virtual Extensible LAN (VXLAN) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Virtual Extensible LAN Market Size

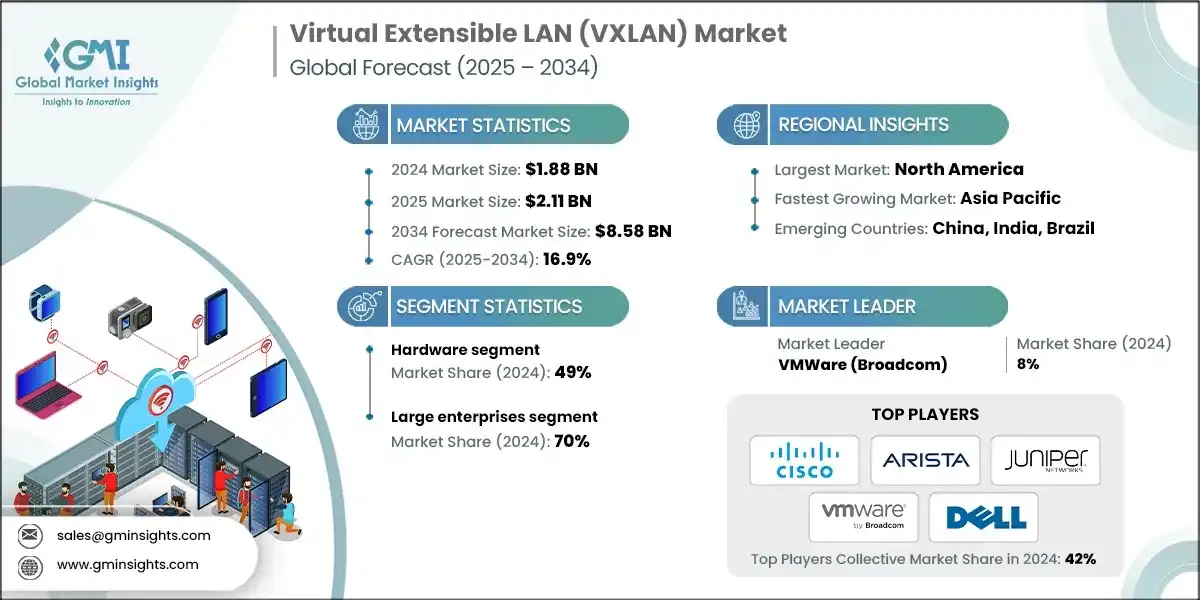

The global virtual extensible LAN market was valued at USD 1.88 billion in 2024. The market is expected to grow from USD 2.11 billion in 2025 to USD 8.58 billion in 2034 at a CAGR of 16.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

Virtual extensible LAN (VXLAN) technology is changing networking for enterprises and data centers by facilitating scalable, flexible, and efficient networking and network virtualization across Layer 2 and Layer 3 boundaries. VXLAN allows the agility to extend Layer 2 services across Layer 3 infrastructure to support current workloads and distributed cloud environments with better mobility and multi-tenancy.

As organizations are moving workloads towards cloud, the need for virtualized overlay networks offering flexibility, security, and scalability is increasing. The leading networking vendors are embracing rich VXLAN ecosystems packaged with load tyros, SDN controllers, network automation frameworks, and orchestration tools. For instance, both Cisco’s Application Centric Infrastructure (ACI) and VMware NSX utilize VXLAN overlays to effectively segment large networks and automate policy-based connectivity to workloads across hybrid and multi-cloud environments.

As data centers and hyperscale cloud providers become more prevalent, there is increasing demand and implementation to utilize VXLAN protocols to provide dynamic, programmable networking that can efficiently handle east-west traffic and the mobility of the virtual machines. VXLAN based overlays support networks that can connect geographically distributed facilities, supporting the elastically scalable and transparent migration of workloads which are both key capabilities for high-availability enterprise and cloud-native architecture.

The advancement of self-orchestration for networking technologies, open-source SDN templates, and intent-based networking management are also further driving the presence of VXLAN use cases outside conventional networking engineering teams. This democratization allows IT and DevOps teams to design virtual networks and manage them with automation, analytics and low-code policy tools to improve operational efficiency and minimize configuration workloads.

North America leads the virtual extensible LAN market due to the early adoption of software-defined networking (SDN), high cloud penetration and huge investments by technology vendors and hyperscale data centers. Asia Pacific region is fastest-growing region due to data center growth, telecom virtualization initiatives and the continuation of government-funded digital transformation agendas in countries such as China, India, Japan, and Singapore. Emerging regions are also showing high uptake in VXLAN use cases due to enterprise cloud migrations, increasing reliance on virtualized workloads, and the business demand for greater agility and scaling of networks.

Virtual Extensible LAN (VXLAN) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.88 Billion |

| Market Size in 2025 | USD 2.11 Billion |

| Forecast Period 2025 – 2034 CAGR | 16.9% |

| Market Size in 2034 | USD 8.58 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rapid cloud and data center expansion | Enhances interoperability and agility in large-scale virtualized environments. |

| Rising adoption of software-defined networking (SDN) | Improves operational efficiency and simplifies complex network management. |

| Growing need for network segmentation and security | Strengthens enterprise network security and compliance frameworks. |

| Increased virtual machine mobility | Facilitates workload flexibility and high-availability architecture. |

| Pitfalls & Challenges | Impact |

| Complex deployment and configuration | Slows adoption among enterprises with limited networking skills. |

| Interoperability challenges across vendors | Increases integration costs and operational risk. |

| Opportunities: | Impact |

| Edge and 5G network virtualization | Expands VXLAN use cases in telecom and low-latency applications. |

| AI-driven network automation | Reduces downtime and optimizes network performance. |

| Expansion in emerging data center markets | Increases global market penetration and revenue scalability. |

| Market Leaders (2024) | |

| Market Leaders |

8 % market share |

| Top Players |

Collective market share in 2024 is 42% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil |

| Future outlook |

|

What are the growth opportunities in this market?

Virtual Extensible LAN Market Trends

The integration of artificial intelligence and machine learning into VXLAN networks is changing how enterprises approach network visibility, anomaly detection, and traffic optimization. Network equipment suppliers are embedding AI-enabled analytics and automation to predict congestion, optimize routing, and optimize performance in overlay networks. Solutions like Cisco DNA Center and Juniper Mist incorporate AI to provide visibility and intent automation in VXLAN overlays. This shift is accelerating the evolution toward self-healing, adaptive network infrastructures that can more efficiently manage growing data traffic across hybrid- and multi-cloud landscapes.

As enterprises move into hybrid and multi-cloud environments, VXLAN is establishing itself as a foundational technology to provide unified connectivity across on-premises data facilities, private clouds, and public cloud infrastructures. Vendors like VMware, Arista Networks, and Dell Technologies are wrapping VXLAN overlays into software-defined networking (SDN) controllers and cloud orchestration frameworks to help to provide consistency of policy and workload portability. The effort is now accelerating demand for scalable overlay solutions that can help with seamless application migration and policy enforcement across cloud ecosystems.

VXLAN is used in conjunction with Ethernet VPN (EVPN), is emerging as the standard capability for scalable, standards-based network virtualization. This architecture provides efficient Layer 2 and Layer 3 connectivity with control-plane learning capabilities that improve operational stability and reduce broadcast traffic by building a more intelligent L3/Routing table inside the data center in a multi-tenant environment, blasting out unicast packets.

Network equipment manufacturers with established VXLAN with EVPN protocols include Cisco, Juniper, and Nokia.

These companies continue to innovate and push VXLAN-EVPN standards with new configurations and capabilities geared for high-performance and multi-tenant environments. As a result, both enterprises and service providers are moving towards predictable, high-performance, resilient virtualized networks to deploy the workloads of modern times.

The use of intent-based, centralized management frameworks is influencing how VXLAN overlays are deployed and controlled. With SDN controllers and network automation tools, enterprises can define intervention and policies that are automatically converted to VXLAN configurations. This is all part of a larger shift towards cloud-native, programmable, and software-defined infrastructure. This architectural shift will reduce human error, improve ease of operations, and reduce time-to-deploy of large-scale virtualized infrastructure.

Virtual Extensible LAN Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into hardware, software and services. The hardware segment dominated the market with 49% share, due to the growing demand for physical network devices such as switches, routers, and gateways that support VXLAN encapsulation and overlay networking.

- The hardware segment is leading the market by demand for high-performance, VXLAN-capable switches, routers, and NICs supporting low latency and high throughput. Enterprises and large data centers need hardware-accelerated VXLAN processing to handle internal (east-west) traffic, hybrid cloud setups, and multi-tenant networks. Growth in this area will be driven by advances in high-speed switching and better integration with SDN controllers.

- Developments in VXLAN software solutions alongside SDN controllers, network orchestration platforms and intent-based networking solutions are driving this segment. Enterprises are using software-based overlays to enable automated provisioning, dynamic segmentation, and centralized policy, while new integrations of AI/ML analytics and virtualization tools improve network visibility, security, and operational efficiency. Cloud-native and multi-cloud support are also driving software adaptation in enterprise networks and data centers.

- VXLAN services are expanding to include consulting, installation, integration, and managed service options. Vendors and service providers have stepped up to help enterprises optimize their overlay networks, ensure interoperability, and maintain compliance in hybrid and multi-cloud environments. Managed VXLAN services with monitoring, troubleshooting, and lifecycle management capabilities are also gaining traction, particularly among organizations without in-house expertise, as these services result in faster setup and operational efficiency, while still reducing network complexity, outages, and downtime.

- For instance, Cisco's NDFC offers complete lifecycle management for VXLAN EVPN fabrics, allowing companies to automate, monitoring, and troubleshooting of VXLAN overlays. NDFC offers a single management environment for both underlay and overlay networks and allows for greater integration of service devices such as firewalls and load balancers. This provides better operational efficiencies and compliance across multi-site deployments.

Learn more about the key segments shaping this market

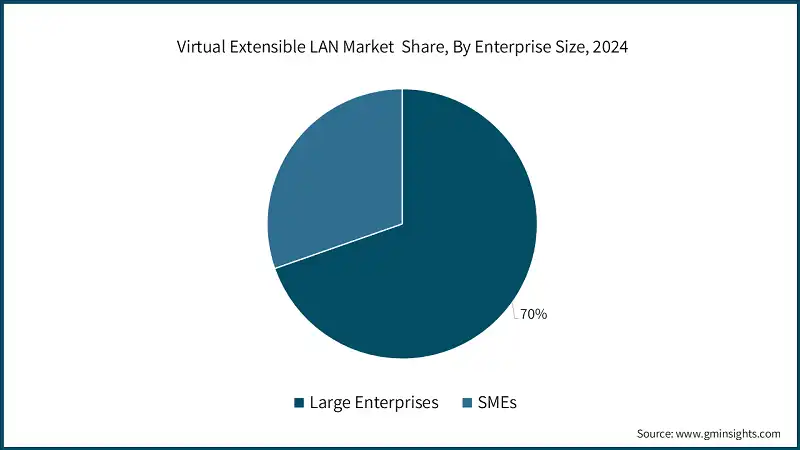

Based on enterprise size, the virtual extensible LAN market is segmented into large enterprises and SMEs. The large enterprises segment dominates the market with 70% share due to high adoption of cloud, SDN, and scalable network virtualization solutions.

- Large enterprises are increasingly deploying VXLAN overlays to consolidate connectivity across on-premises and multi-cloud services. This delivers a seamless way to migrate workloads, a consistent application of policy, and a common security posture across global data centers supporting agility and scale across complex, distributed enterprise architectures.

- Large enterprises are taking a step further in managing large and dynamic infrastructures utilizing AI-driven network automation incorporated with VXLAN overlays. These interfaces will enhance real-time visibility, predictive maintenance, and intent-based management which can reduce operational complexity and improve uptime across enterprise-grade data centers and campus environments.

- SMEs benefit from managed VXLAN and SDN-based networking services through cloud providers to lower infrastructure cost and support easier setup. Subscription-based offerings, provide enterprise grade virtualization and secure connectivity without a large monetary commitment to physical networking infrastructure.

- SMEs prefer VXLAN solutions that are integrated with low-code or GUI interface-based network orchestration tools. This is driven by the demand for easier configuration, scalability associated with both users and locations, and support for automation so smaller IT resources can efficiently support virtualized networks while supporting agility and data security.

Based on application, the virtual extensible LAN market is segmented into multi-tenancy, workload mobility, software-defined networking (SDN) overlays, network function virtualization (NFV), disaster recovery and others. The software-defined networking (SDN) overlay segment is expected to dominate the market due to its ability to deliver centralized control, network automation, and scalable virtualization across hybrid and multi-cloud infrastructures, enabling improved agility, security, and operational efficiency for modern data center and enterprise networks.

- The virtual extensible LAN market is experiencing increased multi-tenancy as enterprises or service providers want to host multiple customers or business units on a common shared infrastructure while ensuring isolation and security. VXLAN overlays can efficiently segment virtual networks enabling scalable, innovative, and cost-effective multi-tenant environments that can be deployed within data center, cloud, and enterprise campus environments.

- The mobility of workload is becoming increasingly important so enterprises can migrate applications and virtual machines from on-premises to private and public clouds. The use of VXLAN overlays can enable a seamless Layer 2 extension over Layer 3 networks while preserving application performance, providing dynamic allocation of resources, and offering efficiencies for disaster recovery. This further supports hybrid IT strategies that enable business continuity and dynamic scaling in distributed environments.

- SDN overlays are growing at a CAGR of 17.5% and are finding their way into VXLAN as part of a new generation technologies while providing centralized network control, automation of policy changes and the dynamic allocation of traffic. Enterprises are now able to take advantage of SDN-compatible VXLAN and its ability to simplify complex configurations, improve east-west traffic flows, and provide improved visibility across hybrid and multi-cloud networks. This has the potential to speed installation times, improve operational efficiency, and reduce facility down time in large infrastructure environments.

- NFV is accelerating VXLAN adoption by separating network services from proprietary hardware and integrating them into the network using virtualized functions built over VXLAN overlays. NFV with VXLAN supports multi-tenant environments, improves traffic management, and accelerates the rollout of advanced network services in virtualized data centers.

Based on deployment mode, the virtual extensible LAN market is segmented into on-premises, cloud-based and hybrid. The cloud-based segment is expected to dominate the market, due to its scalability, cost-efficiency, and ease of deployment, enabling enterprises to rapidly provision VXLAN overlays, support multi-cloud environments, and simplify network management without heavy upfront infrastructure investments.

- Cloud-based VXLAN adoption is rising as enterprises embrace multi-cloud and hybrid cloud strategies. Managed VXLAN services allow for virtualized network services at scale, remove the complexities of network connectivity, and enforce policies from a single pane of glass on distributed systems. This helps reduce capital expenditure, speeds up initial setup and provides on-demand network resources that offer flexibility to dynamic workloads.

- On-premises VXLAN continue to be favored by enterprises requiring complete control over their network infrastructure, data security, and compliance. Enterprises often deploy VXLAN overlays over local data centers or colocation centers, to optimize East-West traffic, add additional segmentation, and to support legacy workloads, while not sacrificing low-latency characteristics required for business-critical applications.

- A hybrid VXLAN encompasses the advantages of both on-premises and cloud environments by providing connectivity to easily migrate workloads and maintain policy enforcement. Enterprises will deploy VXLAN overlay networks to connect dedicated private enterprise data centers to public cloud environments to create high availability, disaster recovery, and elastic scaling while maintaining security and operational control of the hybrid network infrastructure.

- For instance, AWS or Microsoft Azure using VXLAN overlays, which allows for seamless migrations of virtual machines, consistent policy enforcement, and connectivity between private infrastructure and cloud resources, all while providing disaster recovery and scalability.

Looking for region specific data?

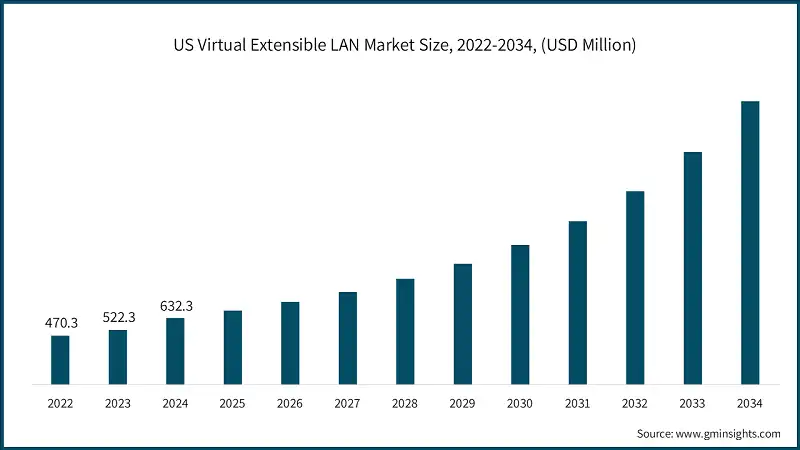

US dominates the North America virtual extensible LAN market and holds around 90.5% and revenue of USD 632.3 million in 2024.

- US market is growing due to the early-phase adoption of software-defined networking (SDN), cloud-based architecture and deployments from enterprise and hyperscale data centers at scale. Leading network solution vendors such as Cisco, VMware, Arista, and Juniper support strong implementations of VXLAN within enterprises and service providers.

- The US virtual extensible LAN market is the primary market due to its mature IT infrastructure, significant cloud penetration, extensive data center networks, and the strong integration of VXLAN with SDN, NFV, and multi-cloud orchestration platforms to enable enterprises to implement scaling, secure, and automated network virtualization.

- The US VXLAN market has considerable growth opportunities, as hybrid cloud adoption, edge computing, multi-tenant data centers, and increased demand for AI-driven network automation continues to expand. Enterprises are increasingly investing in VXLAN overlays to improve workload mobility, network segmentation, and operational efficiency, while reducing complexity and infrastructure costs.

The North America market dominated the virtual extensible LAN market with a market share of 37.1% in 2024.

- In North America, the growing interest in VXLAN solutions is linked to enterprises and service providers adopting multi-cloud, hybrid IT and virtualization in large-scale data centers. Companies are directing their investments into the increasingly scalable, secure and automated VXLAN overlays, specifically for multi-tenancy, workload mobility and software-defined networking.

- The Canada virtual extensible LAN market is fast-growing, with a projected CAGR of 13.6%, propelled by increasingly pervasive adoption of cloud-based services, the digital transformation journey of enterprises, and hybrid network deployments. The significant trends supporting modernization include AI-based network automation, simplified orchestration, edge connectivity and workforce enablement in network virtualization and overlay management.

- Beyond simple overlay and segmentation use cases, enterprises are beginning to deploy more advanced VXLAN capabilities by increasingly leveraging overlay networks to support multi-tenancy, workload mobility, next-gen intent-based networking, and SDN/NFV integration. VXLAN support operational efficiency, segmentation, and high availability while enabling enterprises and service providers to gain better management, visibility, and understanding of complex, distributed, and hybrid network infrastructure.

Europe virtual extensible LAN market accounted for USD 528.8 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- In 2024, Europe was ranked as the second largest global VXLAN market after North America, growing at a CAGR of 15.1%. The region's indirect growth will be driven by rapid cloud adoption, the expansion of hyperscale and colocation data centers, increased focus on SDN, and enterprise-wide digital transformation in sectors such as manufacturing, BFSI, and telecom.

- Germany, France, and the UK remain the biggest markets due to advanced IT infrastructure, strong network virtualization capabilities, and continued adoption of hybrid and multi-cloud. Germany has enterprise-driven data center modernization, UK has leadership in SDN integration and cloud connectivity, and France is enshrining secure network overlays and NFV for public and telecom sectors.

- Central and Eastern Europe, meanwhile, represent developing markets with strong market growth potential. Various countries, such as Poland, Hungary, and the Czech Republic, are investing in cloud data centers, enterprise connectivity, and SDN-enabled VXLAN. Central and Eastern Europe are undergoing a rapid digital transformation, with supportive government programs to back cloud infrastructure, alongside growing demand for scalable and cost-effective virtual networks.

Germany dominates the virtual extensible LAN market, showcasing strong growth potential, with a CAGR of 13.9%.

- Germany is positioned at the forefront of the VXLAN marketplace in Europe, owing to its advanced data center structure, strong enterprise networking ecosystem, and early adoption of software-defined networking (SDN) and network virtualization technologies. The demand for scalable, secure, and programmable network overlays continues to grow among use cases such as cloud data centers, financial services, and industrial automation.

- Enterprise users and service providers in Germany continue to invest in robust VXLAN platforms, automation frameworks, and intent-based networking services. These investments are being propagated through strict data governance policies, EU cybersecurity policies, and associated digital transformation initiatives that promote scalability, interoperability, and operational efficiencies across hybrid (hybrid cloud) and multi-cloud (multi-cloud) network architectures.

- Germany is promoting innovation and Industry 4.0 initiatives to support the VXLAN-enabled networks for smart manufacturing, logistics, and enterprise IT modernization. Leading vendors are bundling services that provide professional consulting services, SDN orchestration, and managed VXLAN deployments so that enterprises can improve network agility, performance, and multi-tenant connectivity across a variety of industrial and commercial sectors.

The Asia Pacific virtual extensible LAN market is anticipated to grow at the highest CAGR of 20.7% during the analysis timeframe.

- The Asia-Pacific region is the fastest growing of the global virtual extensible LAN (VXLAN) regions due to numerous factors such as increasing adoption of cloud, the expansion of hyperscale data centers, and accelerated digital transformation in telecom, BFSI, and enterprise. An increasing number of organizations are investing in VXLAN overlays to provide scalable, multi-tenant and automated network infrastructures that can provide flexibility for hybrid and multi-cloud environments.

- After China, the strongest market opportunity is represented by India and Japan, which are different in their growth characteristics. China leads the way with large-scale VXLAN deployments in hyperscale data centers, telecom virtualization and government-led cloud infrastructure programs. In India, the market is growing as SMEs and enterprises adopt affordable, cloud-enabled VXLAN solutions with software defined networking (SDN) and network function virtualization (NFV) to modernize IT networks.

- Many individual countries in the ASEAN bloc, led by Thailand, Indonesia, and Malaysia are experiencing strong regional growth as enterprise organizations upgrade existing network architectures and adapt them for hybrid connectivity, cloud migration and multi-tenant data center operations. The increasing use of SDN controllers, edge computing, and AI orchestration tools are improving capacity deployment, scalability and performance of VXLAN technology for a range of users and sectors including manufacturing, logistics and telecom.

China is estimated to grow with a CAGR of 21.2%, in the Asia Pacific virtual extensible LAN market.

- China leads the Asia-Pacific VXLAN market as it continuously grows its data center capacity, especially around 5G networks as well as cloud computing infrastructure. The presence of domestic technology companies and digital initiatives supported by government are working to increase VXLAN adoption in several sectors such as telecom, BFSI, and enterprise within an objective to improve scalability, automation and network efficiency.

- In China, enterprises and service providers are investing heavily into software-defined and cloud-native data center architectures that leverage VXLAN overlays for workload mobility, multi-tenancy and dynamic traffic management. These are primarily focused on high-performance networking, AI-driven orchestration, and integration with SDN controllers, all to deliver real-time visibility as well as policy consistency across hybrid networks.

- By the end of 2025, China is expected to strengthen its virtual extensible LAN market leadership through national strategies, particularly “New infrastructure” and “Digital China.” Large-scale VXLAN in China are also being driven by partnerships between local cloud providers (e.g., Alibaba Cloud, Tencent Cloud, Huawei Cloud) and global network vendors (Cisco, Juniper, Arista Networks, etc.) that provide secure, scalable, programmable virtual network environments nationally.

Latin America virtual extensible LAN market accounted for USD 144.2 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The Latin America market is expected to grow at a CAGR of 14.4% because of accelerated digital transformation efforts, increased cloud adoption including hybrid cloud, and deployment of software-defined networking (SDN) and network virtualization technologies across the region's sectors. Enterprises are increasingly using VXLAN to enable scalability, improve multi-tenancy management, and facilitate dynamic workload distribution in hybrid/multi-cloud environments.

- Mexico and Argentina will continue to play an important role in driving the growth of the regional market. Mexico has a robust industrial base, investment initiatives in data center infrastructure, and is increasingly adopting cloud-native and hybrid architectures. Argentina is modernizing its digital ecosystem by regulating its digital ecosystem for compliance with globally comparable standards while increasing investments in network automation, SDN orchestration, and virtualized connectivity frameworks.

- Emerging countries such as Chile, Colombia, and Peru show a high growth potential led by rapid urbanization and increased SME contributions to activity, along with significant digital government initiatives. Emerging enterprise IT networks, migrating to hybrid cloud, and using VXLAN based overlays to support distributed workloads are key to these areas' development.

- The regional VXLAN landscape is further strengthened by the growing availability of managed cloud services and partnerships between hyperscalers (e.g., AWS, Microsoft Azure, and Google Cloud) and telecom operators. These are providing enterprise customers with further chances to improve the performance of their networks, build security consistency across multi-cloud, and provide workload mobility and automation capabilities on a scale.

Brazil virtual extensible LAN market is estimated to grow with a CAGR of 12.2%, in the Latin America market.

- The market in Brazil is experiencing strong growth as companies continue to deploy hybrid and multi-cloud architecture to provide data security, regulatory compliance and scalable AI deployments. These architecture solutions allow for tighter integration of on-premises functions and cloud functions to provide real-time analytics, AI/ML capabilities and access to organizational data to accommodate many transportation functions, including automotive manufacturing, connected vehicle systems and industrial and operational workflows.

- Brazilian enterprises are leveraging lakehouse platforms as foundational infrastructure for AI-driven innovation. The increasing need for predictive analytics, customer personalization, and operational optimization are enabling the integration of AI processor capabilities into connected vehicle systems and production processes in automotive environments. Lakehouse architecture is important in other domains as well, including BFSI, manufacturing, and retail, which underline the usability of automotive transportation's financing and supply chains.

- The pace of VXLAN adoption is being driven by partnerships between IT service providers and automotive OEM partners with cloud hyperscaler organizations providing managed services and on-going AI deployment. These collaborative arrangements help organizations drive efficiencies to the infrastructure, increase the pace of AI adoption, and increase the value of existing data to enhance decision making timeframes, agility, and operational efficiencies.

The Middle East and Africa accounted for USD 65.8 million in 2024 and is anticipated to show lucrative growth over the forecast period.

- The MEA Virtual extensible LAN market represented around 3% of the global market in 2024, fueled by the rapid pace of digital transformation, the growing adoption of cloud, and the need for AI/ML-enabled analytics in a range of industries, including BFSI, telecom, manufacturing, and retail. The advancement of cloud native architectures drives adoption of next-gen network virtualization technologies to enable data-driven decision-making, operational intelligence, and predictive analytics.

- As organizations look to consolidate data silos, increase their analytics and AI readiness, and scale network operations, the modernization of legacy IT is also providing stimulus for regional growth in VXLAN. The deployment of hybrid and cloud-native architectures are used to ensure workload mobility, multi-tenancy management and network segmentation across enterprise and industrial networks.

- The UAE and Saudi Arabia represent the focus of the regional virtual extensible LAN market, benefitting from matured enterprise ecosystems, strong government backing for digitalization programs, and developed IT and cloud infrastructure. The UAE is focusing development on AI-driven analytics, autonomous mobility applications, and smart infrastructure while Saudi Arabia continues to emphasize multi-cloud deployment and AI enabled use cases in manufacturing, mobility, and governance, all as part of Vision 2030.

UAE to experience substantial growth in the Middle East and Africa virtual extensible LAN market in 2024.

- The VXLAN market in the UAE is experiencing significant development with a CAGR of 12.6% due to increased digital transformation initiatives across the country and a growing enterprise focus on AI-driven analytics. Government methods, such as the UAE National AI Strategy 2031, are driving sophisticated network virtualization and cloud adoption initiatives across automobile manufacturing, industrial, and transport business verticals.

- Organizations within the UAE are leveraging cloud-native and hybrid network architecture that helps to separate, or decouple, infrastructure allowing real-time analytics, enterprise AI and ML workloads and data-led decisions making. VXLAN overlays are allowing on-premises environments to integrate with and interact with public and private cloud environments, while also helping organizations to manage compliance, data sovereignty and optimizing network performance.

- The continued growth of this market is also supported by strategic partnerships with global cloud vendors, like AWS, Microsoft Azure, and Google Cloud, and regional system integrators that enable enterprise customers to leverage managed services, consulting and support deployment of VXLAN systems.

- These partnerships often speed up the enterprise adoption of network virtualization methodologies, drive efficiencies in operation, and enable organizations to rapidly build and deploy intelligent applications such as autonomous systems, connected platforms, and predictive analytics for a variety of industries.

Virtual Extensible LAN Market Share

The top 7 companies in the market are Cisco Systems, Arista Networks, Juniper Networks, Broadcom, Dell Technologies, Hewlett Packard Enterprise (HPE) / Aruba Networks and Huawei Technologies contributing 42% of the market in 2024.

- Cisco Systems utilizing its broad set of VXLAN-enabled switching platforms, software-defined networking, and professional services capabilities according to Cisco 2024 Global Networking Trends. Cisco's strength in market position is bolstered by its earlier entry into VXLAN development, which created significant adoption among its large partner ecosystem and integration capability with leading cloud platforms.

- Arista is a great option for organizations with large-scale VXLAN and it focuses on data center switching and high-performance cloud network. The Arista CloudVision platform allows centralized management and automation of VXLAN overlay networks and provides organizations with an operational approach to deploying complex network architecture.

- Juniper Networks leverages its enterprise and service provider networking capabilities to deliver a complete suite of VXLAN solutions. The Contrail platform provides software-defined networking with embedded VXLAN, allowing companies to deploy cloud-native networking architectures. Unrivaled in the industry are Juniper’s focus on AI-driven network operations and automated troubleshooting capabilities for their VXLAN solution and its promise to customers. In addition, Juniper’s platforms provide multi-cloud capabilities, automated and telemetry services, and a full support system.

- VMWare (Broadcom) continues to be a market leader with 7.7% market share with its NSX platform, which has a comprehensive set of network virtualization capabilities based on VXLAN technology. Broadcom's strengths relate to the integration with virtualization platforms and demonstrated consistency with networking policies in a hybrid cloud environment. Broadcom's recent acquisition expected to allow for greater integration with hardware platforms representing a larger addressable market with networking infrastructure.

- HPE with Aruba Networks, with its strengths in campus and data center networking is providing end-to-end VXLAN solutions based on its expertise. Their emphasis on AI powered network operations and edge computing capabilities, and HPE should be well situated to take advantage of future opportunities in the market. HPE's acquisition of Aruba Networks has strengthened their networking portfolio and service offerings in software defined networking and cloud managed platforms.

- Huawei Technologies is indicating its strong position in global markets and infrastructure networking portfolio. Huawei's focus on 5G integration and edge computing deliver differentiation in emerging markets. The company's CloudFabric offering differentiates itself with a suite of VXLAN capabilities, integrated AI-driven operations, and automated provisioning solutions.

- Dell Technologies with its full infrastructure portfolio includes PowerSwitch platforms that include VXLAN support and software-defined networking. The company takes a full infrastructure approach, which encompasses compute, storage, and networking features in integrated platforms. Dell works in partnerships and leverages a channel strategy to drive breadth in this market in multiple industries and geographic markets.

Virtual Extensible LAN Market Companies

Major players operating in the virtual extensible LAN industry are:

- Arista Networks

- Cisco Systems

- Cumulus Networks (NVIDIA Corporation)

- Dell Technologies

- Extreme Networks

- Hewlett Packard Enterprise (HPE) / Aruba Networks

- Huawei Technologies Co

- Juniper Networks

- VMware (Broadcom)

- Cisco Systems creates AI-optimized networking infrastructure which supports VXLAN-based overlays designed for cloud and data center virtualization. Their solutions integrate intelligent capabilities with AI-enabled visibility and analytics plus real-time telemetry data to create automatic and secure in-band/out-of-band network control.

- Arista Networks is focused on scalable cloud networking and utilizes AI-enabled monitoring and automation via its CloudVision platform to provide higher VXLAN efficiency, visibility, and resource management in large data operations. Both companies lead in VXLAN-enabled architecture through intelligent automation and software-defined network innovation.

- Juniper Networks emphasizes AI-enabled network orchestration and intent-based networking with its Mist AI platform to increase automation, validate performance, and engage in predictive management for VXLAN deployments. VMware (Broadcom) delivers VXLAN capabilities via its NSX Data Center platform by wrapping AI-enabled analytics, micro-segmentation, and software-defined networking capabilities to allow flexible, secure, and virtual multi-cloud infrastructures. Both organizations deliver intelligent VXLAN-enabled architectures that simplify operations and enhance performance of enterprise and cloud hosting service providers.

- Dell Technologies uses VXLAN capabilities in its PowerSwitch networking portfolio and SmartFabric OS, combining automation with AI-based optimization for data center and hybrid cloud environments. Hewlett Packard Enterprise (HPE) / Aruba Networks utilizes AI-driven insights through Aruba Central and its Edge Services Platform (ESP) to manage and configure VXLAN overlays, automate troubleshooting, and provide seamless scalability across distributed enterprise networks. Both companies add depth to VXLAN deployments with AI-driven intelligent edge-to-cloud connectivity, and automation.

- Huawei Technologies Co. uses VXLAN in its CloudEngine switches and its iMaster NCE platform, leveraging AI algorithms for traffic prediction, intent-based management, and virtualized cloud networking. Extreme Networks offers AI-powered network automation through its Fabric Connect solution to facilitate VXLAN configuration and deliver more advanced analytics and automated policy enforcement across data centers. Both companies function to use AI into SDN integration to streamline VXLAN-based enterprise and service provider networks.

- Cumulus Networks (NVIDIA Corporation) enables open networking solutions through VXLAN integration for scalable and automated data center solutions utilizing NVIDIA’s AI acceleration for real-time telemetry and intent-based fabric management. NVIDIA’s acquisition solidifies Cumulus’ ability to deliver AI-led VXLAN deployment through its Spectrum switches and Cumulus Linux platform, as both works together to unify AI compute and networking by integrating intelligent VXLAN fabrics optimized for modern AI workloads and virtualized infrastructure.

Virtual Extensible LAN Industry News

- In January 2025, Cisco Systems announced improved AI capabilities for the Application Centric Infrastructure (ACI) platform, adding predictive analytics to further optimize VXLAN overlay aspects, along with automated troubleshooting capabilities that Cisco Systems claim as reducing the complexity of network operations by as much as 40%, according to Cisco Systems press release.

- In December 2024, NVIDIA Corporation announced completion of the Cumulus Networks, integration of VXLAN capabilities with its AI computing platforms that allows customers to optimize their network fabrics for GPU clusters and distributed AI workloads with improved east-west traffic performance, per announcement by NVIDIA Corporation.

- In November 2024, Arista Networks announced the launch of the CloudVision 2025 platform, which has multi-cloud VXLAN management enhancements, supporting automated provisioning capabilities across AWS, Microsoft Azure, and Google Cloud Platform, and unified policy enforcement capability, according to Arista Networks press release.

- In October 2024, VMware (Broadcom) announced the NSX 5.0 version of its product, with new VXLAN security features that include integrated micro segmentation supporting Zero Trust architectures and automated threat response capabilities for overlay network environments, VMware press release stated.

- In September 2024, Juniper Networks announced the Mist AI-powered VXLAN module and associated analytics platform, providing predictive network optimization and offering automated policy recommendations based on machine learning analysis from traffic patterns and application requirements based on an announcement by Juniper Networks.

The virtual extensible LAN market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) and volume (Units)_ from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- Switches

- Routers

- Gateways

- Others

- Software

- VXLAN enabled network operating system

- Network virtualization software

- Network management and orchestration software

- Others

- Services

- Professional services

- Consulting

- Deployment & integration

- Support & maintenance

- Managed services

- Professional services

Market, By Enterprise size

- Large enterprises

- SMEs

Market, By Application

- Multi-tenancy

- Workload mobility

- Software-defined networking (SDN) overlays

- Network function virtualization (NFV)

- Disaster recovery

- Others

Market, By End Use

- Manufacturing

- Healthcare

- BFSI

- Retail

- Media & Entertainment

- Government

- IT & Telecommunications

- Others

Market, By Deployment Mode

- On-premises

- Cloud-based

- Hybrid

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Poland

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Vietnam

- Thailand

- Singapore

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the virtual extensible LAN (VXLAN) market?

Key players include Cisco Systems, Arista Networks, Juniper Networks, VMware (Broadcom), Dell Technologies, Hewlett Packard Enterprise (HPE), Huawei Technologies, and NVIDIA (Cumulus Networks).

What are the upcoming trends in the virtual extensible LAN industry?

Key trends include integration of AI and intent-based networking for self-healing networks, increased use of VXLAN-EVPN for scalable multi-tenant architectures, and expanding deployment across edge and 5G virtualized networks.

What is the projected value of the virtual extensible LAN market by 2034?

The VXLAN market is expected to reach USD 8.58 billion by 2034, propelled by large-scale data center virtualization and software-defined networking (SDN) adoption.

How much revenue did the hardware segment generate in 2024?

The hardware segment accounted for 49% of the VXLAN market in 2024, driven by demand for high-performance switches, routers, and gateways supporting VXLAN encapsulation in data centers.

Which region leads the virtual extensible LAN (VXLAN) market?

North America dominated the VXLAN market with a 37.1% share and revenue of USD 632.3 million in 2024. The region’s leadership is attributed to early adoption of SDN, mature cloud ecosystems, and strong presence of hyperscale data centers.

What was the valuation of the software-defined networking (SDN) overlay application segment in 2024?

The SDN overlay segment led the VXLAN industry, growing at a CAGR of 17.5%, fueled by centralized control, automation, and scalable network virtualization across hybrid and multi-cloud infrastructures.

What is the market size of the virtual extensible LAN (VXLAN) market in 2024?

The market size was USD 1.88 billion in 2024, with a CAGR of 16.9% projected from 2025 to 2034, driven by rapid cloud and data center expansion.

What is the current virtual extensible LAN market size in 2025?

The market size is projected to reach USD 2.11 billion in 2025.

Virtual Extensible LAN (VXLAN) Market Scope

Related Reports