Home > Industrial Machinery > Industrial Equipment > Monitoring and Control > Vibration Monitoring Market

Vibration Monitoring Market Analysis

- Report ID: GMI4647

- Published Date: Apr 2020

- Report Format: PDF

Vibration Monitoring Market Analysis

The hardware segment held a market share of over 65% in 2019 and is estimated to witness around 6% growth till 2026. There are several hardware components used in the vibration monitoring system including sensors, transmitter, accelerometer, proximity probes, among others. The sensors enable to detect high level of vibration in the rotary machine and enhance the precision of monitoring system, driving the market demand.

Majority of the market leaders are focusing to deploy new sensing technologies in the vibration monitoring system owing to their cost-effective maintenance and high accuracy. For instance, in April 2019, Lord Solution has announced the launch of embedded wireless vibration solution. The G-link200 OEM sensor integrated into the system enables the user for cost-effective monitoring of machine and equipment used in aerospace and oil & gas industries.

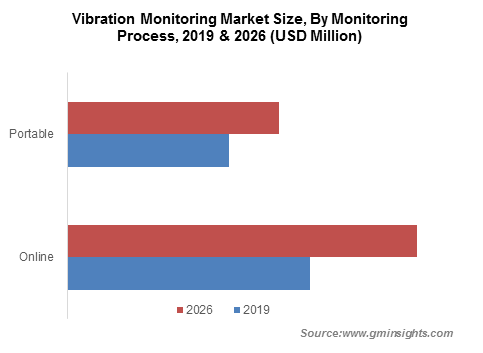

The online monitoring system accounted for 50% market share in 2019 and is expected to expand at over 7% through 2026. The growth is majorly attributed to its continuous monitoring capability, which determines when the process condition is harmful for the health of the equipment. Online monitoring system in pumps can deliver advanced predictive diagnostic, protection advisory for critical equipment, and integration for process control. This will increase their adoption in various industrial sectors and add a growth opportunity for the vibration monitoring market size.

These systems are widely integrated into critical equipment, such as steam turbine, whose failure may affect the entire process and plant shutdown Therefore, integrating online monitoring system along with process automation system in the plant empowers the decision makers to improve the machine reliability and health. It also helps to enhance real-time decision making and achieve early fault detection.

Embedded systems hold the majority of vibration monitoring market share and will grow at over 6% CAGR during the forecast period. These systems provide continuous & effective monitoring and are installed directly on the machine, offering a high market growth. Embedded systems are equipped with analysis, sensing, storage, and alarm capability that deliver quick notifications related to infrequent vibrations. This results in market opportunities of these systems in oil & gas, metal & mining, and energy & power industries, which require continuous monitoring in critical processes.

The growing market trend to integrate wireless technologies and software implication is creating high growth opportunities for players in the market. The embedded monitoring system integrated with wireless technology aids to deliver real-time assessment of machines Companies can track the machine condition through software installed on their smartphone, tablets, and computers, thereby reducing the cost indulged with downtime in production and machine failure.

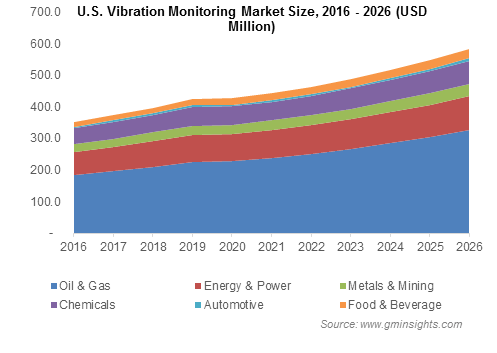

The oil & gas sector is showcasing a significant growth opportunity and holds a market share of 45%. The rising integration of wireless sensors throughout the plant on pump, motor, turbine, compressors, and coker units is adding an advantage for the vibration monitoring market growth. According to the survey of Accenture, in 2018, approximately 62% of the executives worldwide in the oil & gas sector are projected to increase investments in digital technology in the coming three to five years with majority of respondents in favor were from the U.S.

The embedded monitoring systems integrated in the refineries allow the engineers and operators to set appropriate parameters and acute information in real-time. The system helps to monitor the vibration data of pump and thereby alert the operator regarding the abnormal situation to reduce the downtime. According to Rockwell Automation, its vibration monitoring system though its flexible graphic user interface helps to reduce the operating training time and risk of downtime by 20%.

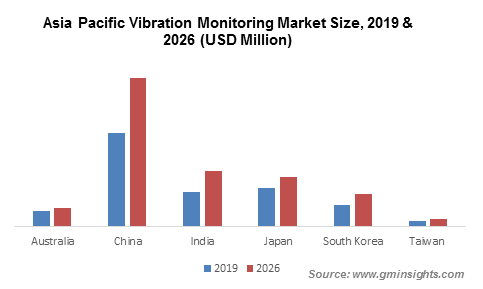

The Asia Pacific vibration monitoring market will register a growth rate of over 6% from 2020 to 2026 impelled by rising coal production in China. According to China National Energy Administration (NEA), around 141 million tons capacity was authorized for new coal production in January to June 2019 in comparison to 25 million tons in 2018. The country’s coal output increased by 2.6% in the first half of 2019 and has reached to 1.76 billion tones. This will increase the implementation of vibration monitoring for continuous monitoring of coal mines, influencing the market revenue.