Summary

Table of Content

Vibration Monitoring Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vibration Monitoring Market Size

Vibration Monitoring Market size exceeded USD 1 billion in 2019 and is poised to grow at a CAGR of over 5% between 2020 and 2026.

To get key market trends

Proliferation of IoT technology has augmented the vibration monitoring market growth. It enables manufacturers to monitor the condition of process equipment and machines in real-time. Therefore, they can take predictive measures regarding the malfunction and schedule the service maintenance to avoid failure.

In process manufacturing, the sensors collect the vibration data and further transmit to cloud for analysis to identify equipment condition in potential critical state, driving the demand for IoT-based monitoring systems. Moreover, to cater to the high demand among competitors, companies are continuously involving in developing new components for Industrial IoT.

Vibration Monitoring Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | USD 1 billion |

| Forecast Period 2020 to 2026 CAGR | 5% |

| Market Size in 2026 | USD 2 billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

However, COVID-19 has affected the overall production capacity of various industries including automotive, chemicals, metals, food & beverages, etc. This is likely to restrain the demand for vibration monitoring market. Although, the major players are focusing to contribute in the current pandemic situation by substituting their production for the healthcare sector such as ventilators and healthcare devices.

Vibration Monitoring Market Analysis

The hardware segment held a market share of over 65% in 2019 and is estimated to witness around 6% growth till 2026. There are several hardware components used in the vibration monitoring system including sensors, transmitter, accelerometer, proximity probes, among others. The sensors enable to detect high level of vibration in the rotary machine and enhance the precision of monitoring system, driving the market demand.

Majority of the market leaders are focusing to deploy new sensing technologies in the vibration monitoring system owing to their cost-effective maintenance and high accuracy. For instance, in April 2019, Lord Solution has announced the launch of embedded wireless vibration solution. The G-link200 OEM sensor integrated into the system enables the user for cost-effective monitoring of machine and equipment used in aerospace and oil & gas industries.

Learn more about the key segments shaping this market

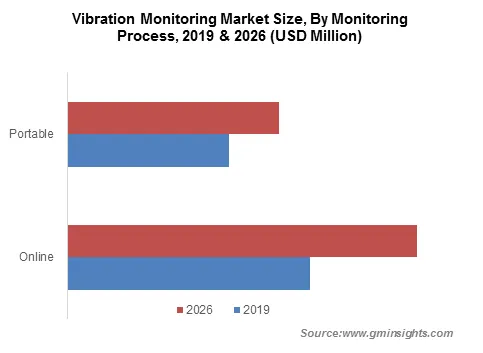

The online monitoring system accounted for 50% market share in 2019 and is expected to expand at over 7% through 2026. The growth is majorly attributed to its continuous monitoring capability, which determines when the process condition is harmful for the health of the equipment. Online monitoring system in pumps can deliver advanced predictive diagnostic, protection advisory for critical equipment, and integration for process control. This will increase their adoption in various industrial sectors and add a growth opportunity for the vibration monitoring market size.

These systems are widely integrated into critical equipment, such as steam turbine, whose failure may affect the entire process and plant shutdown Therefore, integrating online monitoring system along with process automation system in the plant empowers the decision makers to improve the machine reliability and health. It also helps to enhance real-time decision making and achieve early fault detection.

Embedded systems hold the majority of vibration monitoring market share and will grow at over 6% CAGR during the forecast period. These systems provide continuous & effective monitoring and are installed directly on the machine, offering a high market growth. Embedded systems are equipped with analysis, sensing, storage, and alarm capability that deliver quick notifications related to infrequent vibrations. This results in market opportunities of these systems in oil & gas, metal & mining, and energy & power industries, which require continuous monitoring in critical processes.

The growing market trend to integrate wireless technologies and software implication is creating high growth opportunities for players in the market. The embedded monitoring system integrated with wireless technology aids to deliver real-time assessment of machines Companies can track the machine condition through software installed on their smartphone, tablets, and computers, thereby reducing the cost indulged with downtime in production and machine failure.

Learn more about the key segments shaping this market

The oil & gas sector is showcasing a significant growth opportunity and holds a market share of 45%. The rising integration of wireless sensors throughout the plant on pump, motor, turbine, compressors, and coker units is adding an advantage for the vibration monitoring market growth. According to the survey of Accenture, in 2018, approximately 62% of the executives worldwide in the oil & gas sector are projected to increase investments in digital technology in the coming three to five years with majority of respondents in favor were from the U.S.

The embedded monitoring systems integrated in the refineries allow the engineers and operators to set appropriate parameters and acute information in real-time. The system helps to monitor the vibration data of pump and thereby alert the operator regarding the abnormal situation to reduce the downtime. According to Rockwell Automation, its vibration monitoring system though its flexible graphic user interface helps to reduce the operating training time and risk of downtime by 20%.

Looking for region specific data?

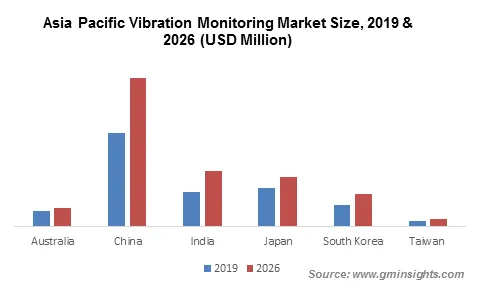

The Asia Pacific vibration monitoring market will register a growth rate of over 6% from 2020 to 2026 impelled by rising coal production in China. According to China National Energy Administration (NEA), around 141 million tons capacity was authorized for new coal production in January to June 2019 in comparison to 25 million tons in 2018. The country’s coal output increased by 2.6% in the first half of 2019 and has reached to 1.76 billion tones. This will increase the implementation of vibration monitoring for continuous monitoring of coal mines, influencing the market revenue.

Vibration Monitoring Market Share

Prominent vibration monitoring market players include

- Emerson Electric

- General Electric

- Honeywell International Inc

- National Instruments

- AB SKF

- Rockwell Automation, Inc

- Meggitt

- Analog Devices, Inc

The industry leaders are continuously focusing on the development of new and innovative technically advanced components to compete in the market.

For example, in April 2020, STMicroelectronics announced the development of its new vibration sensing solution that is integrated with IIoT multi-sensors evaluation kit. The vibration data can be analyzed locally or through cloud to help the owner to take strategic decision to maximize uptime and avoid unnecessary equipment repairs.

The vibration monitoring market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD from 2016 to 2026 for the following segments:

Market by Component

- Hardware

- Software

- Services

Market by Monitoring Process

- Online

- Portable

Market by System

- Embedded

- Vibration Analyzers

- Vibration Meter

Market by Application

- Oil & Gas

- Energy & Power

- Metal & Mining

- Chemical

- Automotive

- Food & Beverages

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Italy

- Norway

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- Kuwait

- UAE

Frequently Asked Question(FAQ) :

Why is embedded vibration monitoring system dominating the market landscape?

Embedded systems hold majority of the market share and will grow at over 6% CAGR till 2026 as these systems provide continuous & effective monitoring and are installed directly on the machine.

How much size did the global vibration monitoring market register in 2019?

The market size of vibration monitoring exceeded USD 1 billion in 2019.

How much will the vibration monitoring industry share grow during the forecast timeline?

The industry share of vibration monitoring is poised to grow at a CAGR of over 5% between 2020 and 2026.

How much will the online monitoring systems gain in the market during the forecast period?

The online monitoring system accounted for 50% market share in 2019 and is expected to expand at over 7% through 2026.

What are the growth forecasts for Asia Pacific vibration monitoring market?

The Asia Pacific market will register a growth rate of over 6% from 2020 to 2026 impelled by rising coal production in China.

Which are the major players operating in the vibration monitoring industry?

Prominent industry players include Emerson Electric, General Electric, Honeywell International Inc, National Instruments, AB SKF, Rockwell Automation, Inc, Meggitt, and Analog Devices, Inc.

Vibration Monitoring Market Scope

Related Reports