Home > Animal Health & Nutrition > Veterinary Services > Veterinary Hospital Market

Veterinary Hospital Market Analysis

- Report ID: GMI6569

- Published Date: Aug 2023

- Report Format: PDF

Veterinary Hospital Market Analysis

By animal type, the veterinary hospital market is segmented into companion animals and farm animals. The companion animal segments include dogs, cats. Horses and other companion animals. The companion animals segment dominated the market in 2022 with a business share of 65.4%. High growth can be attributed to the rising number of households adopting companion animals as beloved members of the family. For instance, according to the ASPCA and Humane Society, between 3.5 and 4.1 million dogs and cats are adopted annually in the U.S. This growing trend has significantly bolstered the demand for specialized healthcare services and facilities, propelling veterinary hospitals to expand their offerings and infrastructure. Also, pet owners are now more inclined than ever to invest in comprehensive medical care, preventive treatments, and wellness programs for their furry counterparts, leading to a surge in revenue within the market.

By services, the veterinary hospital market is segmented into general veterinary services, diagnostic services, surgical services, and other services. The general veterinary services segment held highest market share of 45.8% in 2022. High demand for general veterinary services can be attributed to increasing pet ownership, heightened awareness of animal health and welfare, and advancements in veterinary medical practices. Also, rising prevalence of veterinary diseases further increases the demand. This has prompted veterinary hospitals to diversify and enhance their general veterinary offerings, encompassing preventive care, routine check-ups, and vaccinations. Moreover, the integration of technology into veterinary practices has streamlined processes, enabled efficient medical diagnostics, and facilitated remote consultations, thereby further boosting the market expansion.

Based on ownership, the veterinary hospital market is segmented into private and public. Private segment was valued at USD 48.4 billion in 2022 and is anticipated to witness high growth at a CAGR of 7.2% between 2023 - 2032. In the past few years, the improvement in socio-economic factors and rising disposable income have led individuals to spend more on high-quality veterinary services offered in the private sector. In addition, the willingness of pet owners to provide premium services for their pets is further supporting segment growth. Growing number of mobile pet care hospitals further enhance the market growth. For instance, Premium Vet Care, Florida, U.S., is a mobile companion animal hospital that offers a wide range of services with the help of mobile veterinarians.

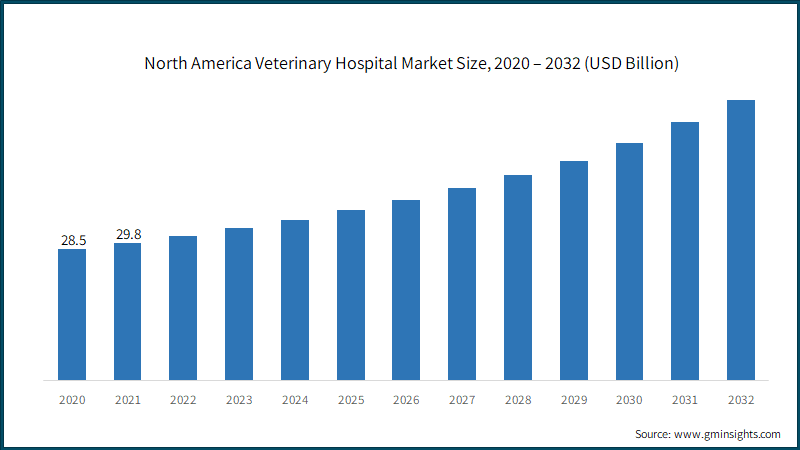

North America dominated the veterinary hospital market in 2022, with a revenue of USD 31.3 billion and is anticipated to grow at a CAGR of 7.0% between 2023 – 2032. High regional growth is fueled by factors such as heightened awareness of animal healthcare, increasing pet ownership in the region, and advancements in medical technology. The region's dedication to providing high-quality medical services for companion animals, coupled with the rising demand for specialized treatments, has led to a proliferation of state-of-the-art veterinary hospitals throughout the region. Also, with consistent expansion and commitment to animal well-being, the high growth of North America's veterinary hospitals market is expected to persist, setting new standards for excellence in veterinary care.