Summary

Table of Content

Veterinary Autoimmune Disease Therapeutics Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Veterinary Autoimmune Disease Therapeutics Market Size

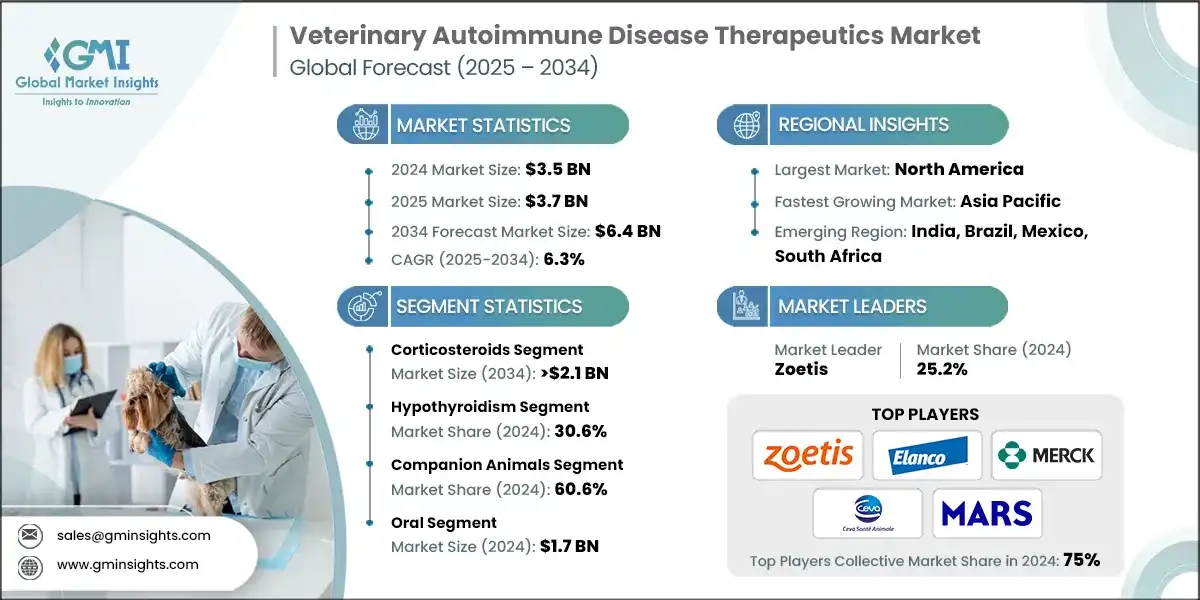

The global veterinary autoimmune disease therapeutics market was estimated at USD 3.5 billion in 2024. The market is expected to grow from USD 3.7 billion in 2025 to USD 6.4 billion in 2034, growing at a CAGR of 6.3%, according to the latest report published by Global Market Insights Inc. The increasing prevalence of autoimmune disorders in animals, coupled with rising adoption of companion animals, is expected to drive the growth in the market.

To get key market trends

The 2025 American Pet Products Association (APPA) National Pet Owner Survey indicates approximately 70% of households in the U.S. own a pet. Among these, 68 million households own a dog. This highlight growing demand for veterinary autoimmune disease treatments.

Veterinary autoimmune disease therapeutics are designed to treat conditions where an animal's immune system mistakenly attacks its own tissues. These treatments include immunosuppressants, corticosteroids, and biologics that manage diseases such as lupus, pemphigus, and immune-mediated anemia. The market is experiencing growth due to increased pet ownership, advancements in diagnostic technologies, and greater animal health awareness. Leading companies in this market, such as Zoetis, Elanco, Merck, and Ceva, are investing in innovative therapies to improve outcomes for affected animals.

Companies are focusing on geographic expansion to access new pet markets. Strategic partnerships between veterinary pharmaceutical firms and research institutions are boosting availability of advanced therapies. Research into targeted therapies and monoclonal antibodies is driving significant advancements. There is also a growing shift toward sustainable and eco-friendly therapeutics due to increasing demand for natural and organic formulations.

Technological advancements in drug delivery systems and personalized medicine are driving market growth. New treatment methods, including long-acting injectables, have improved patient compliance and treatment outcomes. Improved veterinary diagnostic capabilities now allow earlier detection of autoimmune conditions and timely therapeutic interventions. The market also benefits from stronger regulatory support and increased research funding, facilitating new product development. As pet owners demand more specialized care, the market is experiencing increased niche therapies tailored to specific breeds and conditions.

The veterinary autoimmune disease therapeutics market focuses on treatments for managing autoimmune conditions in animals. It includes biologics, small molecules, and advanced drug delivery systems that improve animal health, raise veterinary care standards, and enhance treatment outcomes for companion and livestock species.

Veterinary Autoimmune Disease Therapeutics Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 3.5 Billion |

| Market Size in 2025 | USD 3.7 Billion |

| Forecast Period 2025 - 2034 CAGR | 6.3% |

| Market Size in 2034 | USD 6.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing threat of transfer of zoonotic diseases among humans | Boosts demand for veterinary therapeutics to control animal diseases and prevent cross-species transmission to humans. |

| Rising incidence of auto-immune diseases in livestock animals | Drives innovation in livestock-targeted therapies, ensuring herd health and minimizing economic losses in agriculture. |

| Increasing awareness and diagnosis of autoimmune diseases | Improves early detection and treatment rates, expanding the market for specialized veterinary therapeutics. |

| Growing companion animal ownership | Raises demand for advanced pet healthcare solutions, including autoimmune disease management and preventive care. |

| Increasing expenditure on animal healthcare | Increases investment in premium therapeutics and diagnostics, accelerating market growth and product development. |

| Pitfalls & Challenges | Impact |

| High cost of veterinary autoimmune therapies | Limits accessibility for pet owners and farmers, potentially reducing treatment adoption and market penetration. |

| Increased risk of infection due to autoimmune drugs | Raises safety concerns, requiring careful monitoring and limiting long-term use of immunosuppressive treatments in animals. |

| Opportunities: | Impact |

| Rising demand for breed-specific and personalized treatments | Genomic tools and AI enable customized therapies for pets, improving autoimmune treatment precision, safety, and long-term health outcomes. |

| Growth in telemedicine and remote veterinary diagnostics | Wearables and AI-powered platforms support remote autoimmune monitoring, enabling early intervention, continuous care, and broader access to veterinary services. |

| Market Leaders (2024) | |

| Market Leaders |

25.2% market share. |

| Top Players |

Collective market share in 2024 is 75% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Veterinary Autoimmune Disease Therapeutics Market Trends

- As people care more about their pets' health, veterinary care is changing. Treatments for autoimmune diseases in animals are becoming more important due to new ideas and better ways to care for pets.

- There is increased demand for targeted therapies because of the rising incidence of autoimmune disorders such as pemphigus foliaceus, autoimmune hemolytic anemia, and discoid lupus erythematosus in companion animals. These conditions are particularly prevalent in dogs and cats, which make up a substantial portion of the global pet population.

- Moreover, increasing pet ownership plays an important role in driving demand for the veterinary autoimmune disease therapeutics market. For example, in 2025, according to the American Pet Products Association, 94 million U.S. households own a pet.

- Similarly, according to the European Pet Food Industry Federation (FEDIAF), cats remain Europe's most popular pets, with 127 million cats residing in 26% of homes, while 104 million dogs live in 25% of households. This growing pet population has increased demand for specialized veterinary care, particularly in autoimmune disease management.

- Veterinarians now use advanced diagnostic tools, including genetic and molecular testing, to detect autoimmune diseases earlier and with greater precision. The widespread use of immunomodulatory treatments, including cyclosporine, azathioprine, and corticosteroids, has become essential in managing chronic autoimmune conditions in pets, resulting in better symptom control and improved health outcomes.

- Further, modern veterinary practices incorporate technological advancements to enhance disease identification processes, helping veterinarians develop more effective treatment strategies. Research collaborations between veterinary pharmaceutical companies and academic institutions continue to strengthen the development of new treatments for pet autoimmune diseases.

- In parallel, collaborations between veterinary pharmaceutical companies and academic institutions are accelerating research into autoimmune disease treatments. These partnerships help create new and better medicines for animals.

- Also, educational campaigns by veterinary associations teach pet owners how to recognize early signs of autoimmune diseases. This helps pets get treated earlier and manage their illness better.

- Lastly, the expansion of veterinary infrastructure in emerging markets is improving access to specialized autoimmune treatments. This is making it easier for pet owners in those areas to get special treatments, helping the market grow globally.

Veterinary Autoimmune Disease Therapeutics Market Analysis

Learn more about the key segments shaping this market

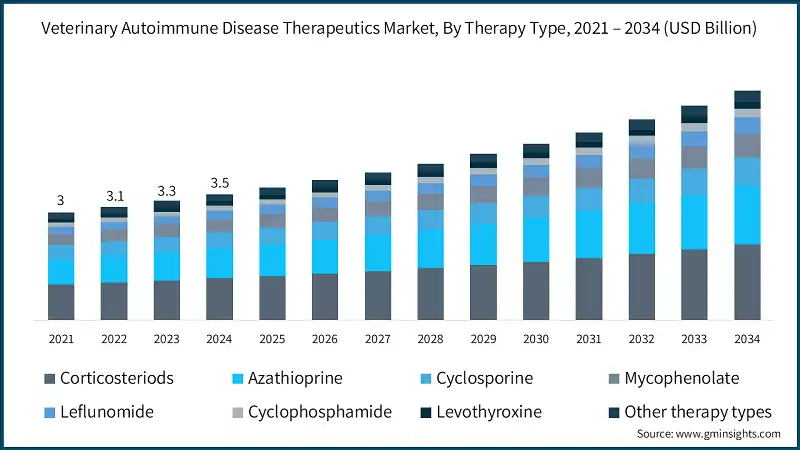

Based on therapy type, the global veterinary autoimmune disease therapeutics market is divided into corticosteroids, azathioprine, cyclosporine, mycophenolate, leflunomide, cyclophosphamide, levothyroxine, and other therapy types. The corticosteroids segment accounted for the highest market share and was valued at USD 1.2 billion in 2024 due to their rapid onset of action, easy affordability, and broad-spectrum efficacy. The segment is expected to exceed USD 2.1 billion by 2034, growing at a CAGR of 6.2% during the forecast period. As awareness of autoimmune diseases in animals grows, the demand for diversified and safer treatment options is expected to drive innovation across all therapeutic categories.

- Corticosteroids are one of the most widely used and essential drug classes in the treatment of autoimmune diseases in animals. Corticosteroids are commonly used to manage conditions such as autoimmune anemia, hypothyroidism, and immune-mediated arthritis. These drugs work by reducing inflammation and adjusting the immune system's response.

- Corticosteroid medications such as prednisone and dexamethasone are prescribed to treat symptoms of autoimmune diseases such as lupus, immune-mediated hemolytic anemia, and rheumatoid arthritis in pets and livestock. These medications work by preventing overactive immune response.

- Veterinarians often rely on corticosteroids because of their fast-acting nature. However, using them over a long period can lead to side effects such as weakened immunity, digestive issues, and weight gain.

- Additionally, the market is witnessing a gradual shift toward combination therapies, where corticosteroids are used alongside immunomodulators to enhance efficacy and minimize adverse effects. This approach is gaining traction in chronic autoimmune conditions that require long-term management.

- Moreover, ongoing research into novel delivery systems is expected to improve treatment compliance and reduce dosing frequency, further supporting market growth.

Based on disease, the global veterinary autoimmune disease therapeutics market is categorized into hypothyroidism, pemphigus disease, canine lupus, auto-immune hemolytic anemia, bullous pemphigoid, discoid lupus erythematosus (DLE), immune-related arthritis, and other diseases. The hypothyroidism segment dominated the market with 30.6% market share in 2024.

- Hypothyroidism is one of the most diagnosed autoimmune disorders in companion animals, especially in dogs. It occurs when the immune system mistakenly attacks the thyroid gland, leading to reduced hormone production and symptoms such as lethargy, weight gain, and skin issues.

- According to the National Institutes of Health (NIH), hypothyroidism is also one of the most diagnosed endocrine disorders in dogs, with primary hypothyroidism making up around 95% of all cases. Within these cases, lymphocytic thyroiditis and idiopathic follicular atrophy each account for about 50%.

- The high prevalence of this condition has resulted in the development of specialized treatments aimed at managing thyroid hormone deficiencies, helping to improve the quality of life for affected pets.

Based on animal type, the veterinary autoimmune disease therapeutics market is classified as companion animals, livestock animals, and other animals. The companion animals’ segment is further divided into dogs, cats, horses, and other companion animals. The livestock animals’ segment is further divided into cattle, swine, poultry, sheep and other livestock animals. The companion animals segment dominated the market in 2024 with a market share of 60.6%, anticipating its dominance with a CAGR of 6% during the forecast period.

- The companion animals’ segment in the veterinary autoimmune disease therapeutics market focuses on treating pets such as dogs, cats, and other small animals affected by autoimmune disorders.

- The growing number of pet owners and the increasing trend of pet humanization have led to a higher population of companion animals. As more pets become part of households, there is a rising demand for therapeutic options to treat autoimmune disorders in animals.

- More and more people are treating their pets as family members and want the best medical care possible for them. This has increased the need for modern treatments such as immunosuppressive drugs and biologics.

- Further, as more people want pets in their homes and become more aware of autoimmune conditions, this market continues to grow, improving both the health and well-being of companion animals.

- On the other hand, the livestock animals’ segment is growing significantly during the analysis period. This segment is being escalated by rising incidence of autoimmune conditions such as immune-mediated hemolytic anemia (IMHA) and pemphigus due to better awareness and improved diagnostic tools.

- Moreover, external stressors (e.g., environmental changes, intensive farming practices) and genetic predispositions are further contributing to the rise in these conditions, contributing to market growth.

Based on route of administration, the veterinary autoimmune disease therapeutics market is bifurcated into oral, injectable, and topical. The oral segment was anticipated to be worth USD 1.7 billion in 2024 and is expected to grow at 6.2% CAGR during the forecast period.

- The oral medications segment plays a vital role in managing autoimmune diseases in animals. Pet owners and veterinarians prefer oral medications for treating autoimmune diseases because they are easy to give at home, especially for long-term treatments.

- Additionally, the oral route offers higher compliance in animals, which ensures consistent intake of medications, leading to better treatment outcomes.

- The most prescribed oral medications include corticosteroids, immunosuppressants such as azathioprine and cyclosporine, and hormone replacements for thyroid conditions.

- Moreover, advancements in drug formulations have improved absorption and reduced side effects, contributing to the growth and expansion of this segment.

- On the other hand, the injectable segment is witnessing a rising trend in adoption, supported by rapid onset of action, which is crucial for managing acute autoimmune flare-ups.

- Also, in livestock, injectables are favored for ease of administration, controlled dosing, and reduced labor costs in herd health management. These factors contribute to market growth.

Learn more about the key segments shaping this market

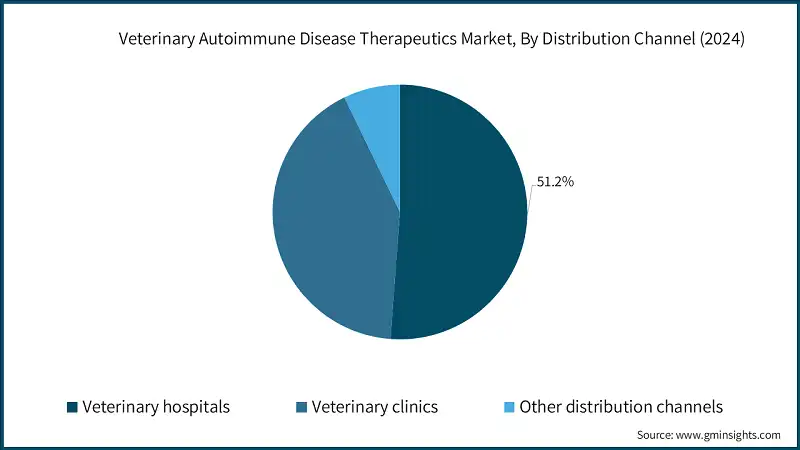

Based on distribution channel, the veterinary autoimmune disease therapeutics market is classified into veterinary hospitals, veterinary clinics, and other distribution channels. The veterinary hospitals segment dominated the market in 2024 and is expected to reach 3.2 billion within the forecast period.

- Veterinary hospitals play a major role in treating autoimmune diseases in animals. These hospitals offer advanced care, including accurate diagnosis, specialized treatments, and long-term disease management. Many pet owners prefer veterinary hospitals because they have trained staff, modern equipment, and access to a wide range of medicines.

- Autoimmune diseases often need regular check-ups and careful monitoring, which veterinary hospitals are well-equipped to provide. They also offer emergency care and support for serious cases, making them a trusted choice for pet owners.

- More people now treat their pets as family members and want the best medical care available for their pets. This change, along with better understanding of pet health needs, has made veterinary hospitals the main centers for treating animal autoimmune diseases.

- On the other hand, the veterinary clinics segment is growing with a CAGR of 6.6% during the analysis period. The market growth for this segment is driven by the rise in specialty veterinary clinics and advanced animal hospitals that have increased access to autoimmune disease treatments.

- Regulatory bodies are supporting the development and approval of autoimmune therapeutics, especially for use in clinical settings. Collaborations between pharmaceutical companies and veterinary institutions are accelerating innovation and clinic-level adoption.

Looking for region specific data?

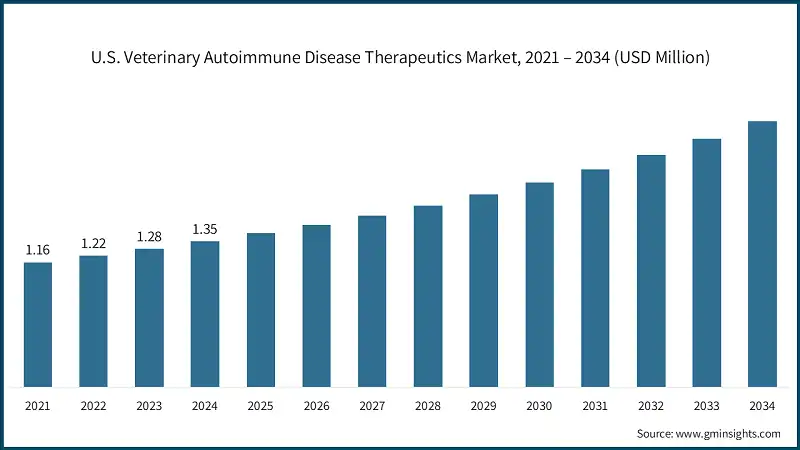

North America Veterinary Autoimmune Disease Therapeutics Market The North America market dominated the global market with a market share of 42.3% in 2024. The U.S. veterinary autoimmune disease therapeutics market was valued at USD 1.16 billion and USD 1.22 billion in 2021 and 2022, respectively. The market size reached USD 1.35 billion in 2024, growing from USD 1.28 billion in 2023. The Europe market accounted for USD 985.5 million in 2024 and is anticipated to show lucrative growth over the forecast period. Germany dominates the European veterinary autoimmune disease therapeutics market, showcasing strong growth potential. Asia Pacific Veterinary Autoimmune Disease Therapeutics Market The Asia Pacific veterinary autoimmune disease therapeutics market is anticipated to grow at the highest CAGR of 6.6% during the analysis timeframe. China veterinary autoimmune disease therapeutics market is estimated to grow with a significant CAGR in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. Middle East and Africa Veterinary Autoimmune Disease Therapeutics Market Saudi Arabia market is expected to experience substantial growth in the Middle East and Africa market in 2024. The market is characterized by diverse players competing in the industry. The top players such as Elanco, Vetoquinol, Ceva, Merck, Zoetis, and Virbac account for approximately 70% market share. These prominent players thrive through a combination of strategic initiatives, investing in research and development, meeting the specific needs of veterinary autoimmune drugs, geographical expansion, strategic approaches, and regulatory compliance. Leading players in the industry are leveraging a multi-pronged strategic approach including acquisitions, partnerships, R&D investments, and innovative product launches to reinforce their competitive positioning and respond to the rising demand for autoimmune disease therapeutics globally. The market is characterized by moderate consolidation, with major companies acquiring smaller players and diversifying into adjacent areas. Hence, leading players are constantly adopting key strategies for the growth of the market. In addition, companies are placing greater emphasis on improving efficiency and advancing product development through better use of data. Enhanced diagnostic tools in veterinary medicine are enabling earlier detection of autoimmune diseases, which allows for more effective treatment options. Further, the rise of telemedicine and remote monitoring tools is expanding access to veterinary care, especially in underserved regions. These technological advancements are not only improving treatment outcomes but also creating new revenue streams for market players. As competition intensifies, differentiation through innovation, sustainability, and customer-centric solutions will be key to long-term success in this evolving market. Prominent players operating in the veterinary autoimmune disease therapeutics industry are as mentioned below: Aratana specializes in innovative pet therapeutics, including Galliprant, a first-of-its-kind NSAID for canine osteoarthritis. Their focus on specialty conditions such as autoimmune-related pain and inflammation sets them apart in niche veterinary care. Zoetis leads the market with robust R&D and a diverse autoimmune therapeutics portfolio. Their biologics and immunomodulators, backed by strong clinical data, address conditions such as canine lupus and immune-mediated arthritis. Vetoquinol offers a broad portfolio of veterinary drugs, including immunosuppressants and anti-inflammatory agents. Their commitment to companion animal health includes therapies for autoimmune skin and joint diseases. Elanco combines deep expertise in livestock and companion animal health with a growing portfolio of autoimmune therapies. Their strategic acquisitions and investment in biologics enhance their ability to address immune-mediated diseases with targeted, effective solutions. Merck leverages advanced immunology research to develop therapies for autoimmune conditions in pets and livestock. Their biologic and vaccine-adjacent products support immune regulation, making them a strong player in chronic disease management and preventive care.Europe Veterinary Autoimmune Disease Therapeutics Market

Latin America Veterinary Autoimmune Disease Therapeutics Market

Veterinary Autoimmune Disease Therapeutics Market Share

Veterinary Autoimmune Disease Therapeutics Market Companies

Veterinary Autoimmune Disease Therapeutics Industry News

The veterinary autoimmune disease therapeutics market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2021 - 2034 for the following segments:

Market, By Therapy Type

- Corticosteroids

- Azathioprine

- Cyclosporine

- Mycophenolate

- Leflunomide

- Cyclophosphamide

- Levothyroxine

- Other therapy types

Market, By Disease

- Hypothyroidism

- Pemphigus disease

- Canine lupus

- Auto-immune hemolytic anemia

- Bullous pemphigoid

- Discoid lupus erythematosus (DLE)

- Immune-related arthritis

- Other diseases

Market, By Animal Type

- Companion animals

- Dogs

- Cats

- Horses

- Other companion animals

- Livestock animals

- Cattle

- Swine

- Poultry

- Sheep

- Other livestock animals

- Other animals

Market, By Route of Administration

- Oral

- Injectable

- Topical

Market, By Distribution Channel

- Veterinary hospitals

- Veterinary clinics

- Other distribution channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the oral segment?

The oral segment was valued at USD 1.7 billion in 2024 and is projected to grow at a CAGR of 6.2% during the forecast period.

Which region leads the veterinary autoimmune disease therapeutics market?

North America dominated the market with a 42.3% share in 2024, driven by high pet ownership rates and advanced veterinary healthcare infrastructure.

What are the upcoming trends in the veterinary autoimmune disease therapeutics market?

Key trends include the rising demand for targeted therapies, increasing pet ownership, and growing awareness of autoimmune diseases in animals, which are driving innovation in treatment options.

Who are the key players in the veterinary autoimmune disease therapeutics market?

Key players include Aratana Therapeutics, Ceva Santé Animale, Dechra Pharmaceuticals, Elanco, Heska, Mars Veterinary Health, Merck, Norbrook, Vetoquinol, Vet-Stem, and Virbac.

What is the projected size of the veterinary autoimmune disease therapeutics market in 2025?

The market is expected to reach USD 3.7 billion in 2025.

How much revenue did the corticosteroids segment generate?

The corticosteroids segment generated USD 1.2 billion in 2024, leading the market due to its rapid onset of action, affordability, and broad-spectrum efficacy.

What is the market size of the veterinary autoimmune disease therapeutics in 2024?

The market size was USD 3.5 billion in 2024, with a CAGR of 6.3% expected through 2034, driven by the increasing prevalence of autoimmune disorders in animals and the rising adoption of companion animals.

What is the projected value of the veterinary autoimmune disease therapeutics market by 2034?

The market is expected to reach USD 6.4 billion by 2034, fueled by growing awareness of autoimmune diseases in animals and demand for safer and diversified treatment options.

Veterinary Autoimmune Disease Therapeutics Market Scope

Related Reports