Home > Healthcare > Medical Devices > Therapeutic Devices > Ventricular Assist Devices Market

Ventricular Assist Devices Market Analysis

- Report ID: GMI3014

- Published Date: Oct 2019

- Report Format: PDF

Ventricular Assist Devices Market Analysis

Bases on product, the ventricular assist device market is segmented as left ventricular assist devices (LVADs), right ventricular assist devices (RVADs), biventricular assist devices (BiVADs), percutaneous ventricular assist devices (PVADs) and total artificial heart (TAH). Left ventricular assist devices (LVADs) market accounted for significant revenue size of USD 910.9 million in the year 2018. The high market share is owing to rising number of implantations of left ventricular devices, growing incidence and prevalence rate of heart failure and cardiovascular diseases is rising at epidemic proportions. According to the American Heart Association, in 2018, around 92.1 million American adults suffered from some of the other form of cardiovascular disease or other effects of stoke. Furthermore, growing number of patients that have reached the end-stage heart failure need left ventricular assist devices has contributed in the segmental market growth.

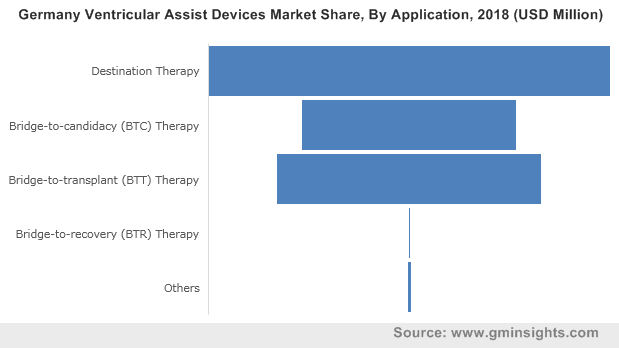

Bases on the application of ventricular assist devices, the market is segmented into destination therapy, bridge-to-candidacy (BTC) therapy, bridge-to-transplant (BTT) therapy, bridge-to-recovery (BTR) therapy and others. Destination therapy market is forecasted to grow at 6.9%% over the estimation period. Heart transplantation is considered as one of the gold standard treatments for patients with end-stage heart failure. However, due to decline in the number of donor heart organs, ventricular assist devices implantation for destination therapy witnessed significant growth. According to the National Centre for Biotechnology and Information, in 2014, around 46% destination therapy ventricular assist devices were implanted. Furthermore, in 2017 Medtronic announced that the FDA has approved its left ventricular assist device as a destination therapy for patients in use that cannot have heart transplants. Thus, destination therapy by left ventricular assist devices emerged as a new era for therapeutic strategy for heart failure, thereby, propelling the market growth positively in the upcoming years.

Based on the age group of patients, the ventricular assist devices market share is bifurcated as below 18 years, 19-39 years, 40-59 years, 60-79 years and above 80 years. The adoption of ventricular assist devices in below 18 years of age group is projected to expand at a CAGR of 5.6% over the forecast period. Continued clinical management and improvements in ventricular assist device (VAD) technology, have formed superior outcomes. For instance, the establishment of implantable continuous-flow devices such as the HeartWare and HVAD HeartMate II has led to physicians favouring VAD support over escalation of medical therapy among the below 18 years age groups.

As a result, VAD therapy is fast becoming the standard of care for intractable heart failure. Indeed, ventricular assist devices is expected to be an alternative to heart transplantation in the future thereby boosting the market growth and is expected to project a lucrative growth over the forecast period.

Based on type of flow, the market is segmented as pulsatile flow and continuous flow. The continuous flow segmented is further bifurcated as axial continuous flow and centrifugal continuous flow. The ventricular assist devices market with continuous flow was valued at around USD 2,113.1 million in 2018. In the last few years, the first-generation pulsatile volume displacement pumps have evolved to become continuous flow pumps. These pumps are a significant step towards the care of patients owing to reduced product weight and size, decrease in adverse events, improved survival, enhanced quality of life, and functional capacity. Hence, the above-mentioned factors have resulted in augmenting the demand and adoption rate of ventricular assist devices, boosting the industry growth in the future.

On the basis of design, the market is segmented as transcutaneous and implantable. The implantable ventricular assist devices industry is estimated to expand at a CAGR of around 11.0% over the forecast period. Increase in number of people suffering from heart failure and several other cardiovascular diseases has resulted in rise in ventricular assist devices implantation. The use of implantable devices for long-term treatment in patients that are not eligible for heart transplant will enhance the segment growth in the near future.

U.S. dominated the North America ventricular assist devices market and was valued at around USD 1,293.2 million in the year 2018. According to the Center for Disease Control and Prevention (CDC), around 610,000 people die of heart disease in the U.S. every year. Increase in number of people suffering from cardiovascular disease, recent technological advancements and favorable reimbursement policies in the country will boost the demand and adoption rate of ventricular assist devices, augmenting the market growth in the country.

India market is estimated to grow substantially at a CAGR of 15.2% during the projection period. Growing geriatric population in the country will result in high cardiovascular disease prevalence leading to high heart failure rates. Also, rise in awareness among the patients about the treatments related to cardiovascular diseases and heart failure will increase the demand for ventricular assist devices in the country.