Summary

Table of Content

Vehicle Tolling System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vehicle Tolling System Market Size

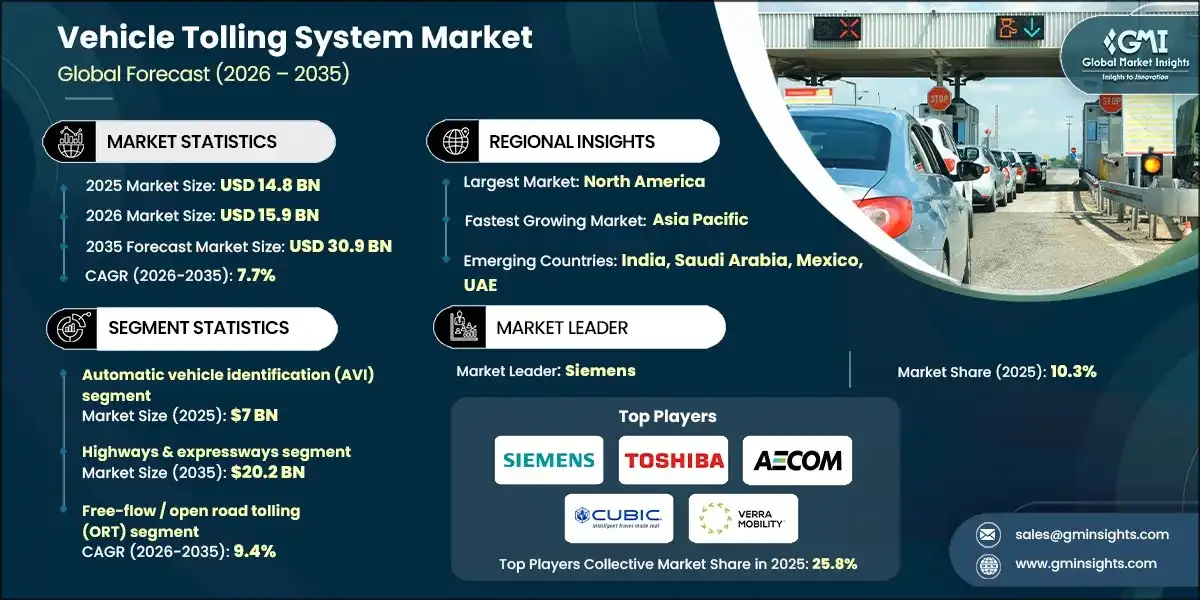

The global vehicle tolling system market size was valued at USD 14.8 billion in 2025. The market is expected to grow from USD 15.9 billion in 2026 to USD 30.9 billion in 2035 at a CAGR of 7.7%, according to latest report published by Global Market Insights Inc.

To get key market trends

Vehicle tolling systems around the world are moving to fully electronic and connected models, driven by government rules and infrastructure policies. In the U.S., many toll facilities now use Electronic Toll Collection (ETC) systems on highways and bridges to make collecting tolls easier and improve traffic flow.

These systems cover thousands of tolled miles, allowing cashless and automated tolling for both passenger and commercial vehicles. Federal programs under Title 23 are supporting efforts to manage traffic congestion and adopt digital payment systems.

According to the Federal Highway Administration (FHWA), the U.S. has a large network of toll facilities, including nearly 3,800 miles of interstate toll roads that now use electronic tolling instead of cash booths. Toll facilities in over 38 states collect fees on roads, bridges, and tunnels. This shows how public agencies are using tolling technology to fund infrastructure and manage traffic.

In the European Union, the European Electronic Toll Service (EETS), required by Directive (EU) 2019/520, ensures tolling systems work together. EETS allows drivers to use one subscription and onboard unit to pay tolls across multiple EU countries. This makes cross-border toll payments and enforcement easier.

Kapsch TrafficCom, a major tolling infrastructure provider, reported that tolling made up about 74% of its revenue in the 2024/25 financial year, with operations contributing around 60% of that. This shows how important tolling contracts and long-term operations are for suppliers, as demand for system installation, maintenance, and integration remains strong worldwide.

Recent company announcements highlight new developments in connected and advanced tolling systems. For example, Kapsch TrafficCom launched a connected vehicle tolling system on U.S. expressways. This system combines roadside infrastructure with data from connected vehicles, showing how tolling is changing to use vehicle connectivity for better pricing models and future mobility solutions.

Vehicle Tolling System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 14.8 Billion |

| Market Size in 2026 | USD 15.9 Billion |

| Forecast Period 2026-2035 CAGR | 7.7% |

| Market Size in 2035 | USD 30.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Adoption of Electronic Toll Collection (ETC) Systems | Accelerates traffic flow, reduces congestion and fuel wastage, improves toll collection efficiency, and supports seamless cashless mobility across highways and urban road networks. |

| Increasing Road Infrastructure Development and Highway Expansion | Expanding highway networks increases tollable road length, driving higher demand for scalable, automated tolling systems across national and regional transport corridors. |

| Growing Traffic Congestion and Need for Efficient Traffic Management | Rising congestion compels authorities to deploy advanced tolling solutions that optimize traffic distribution, minimize bottlenecks, and improve overall road utilization efficiency. |

| Integration of RFID, ANPR, and GNSS Technologies | Multi-technology integration enhances tolling accuracy, enables flexible pricing models and supports interoperable, future-ready intelligent transportation systems. |

| Pitfalls & Challenges | Impact |

| Interoperability Challenges Across Tolling Systems | Lack of standardization across regions limits seamless cross-border travel, increases integration costs, and restricts nationwide or international tolling system scalability. |

| Operational and Maintenance Complexity | Managing hardware, software, and backend systems increases operational costs, requiring skilled personnel and continuous upgrades to ensure system reliability and uptime. |

| Opportunities: | Impact |

| Expansion of Open Road Tolling and Barrier-Free Systems | Barrier-free tolling eliminates stoppages, improves driving experience, reduces emissions, and enables higher traffic throughput on busy highways and expressways. |

| Adoption of GNSS-Based and Distance-Based Tolling | Distance-based tolling supports fair usage pricing, urban congestion charging, and flexible tariff models aligned with evolving smart mobility policies. |

| Growth Opportunities in Emerging Economies | Rapid motorization, highway investments, and digital payment adoption in emerging markets create strong demand for modern, cost-effective tolling solutions. |

| Public–Private Partnerships (PPPs) in Toll Road Projects | PPPs enable faster deployment of advanced tolling infrastructure by combining public oversight with private-sector technology, funding, and operational expertise. |

| Market Leaders (2025) | |

| Market Leaders |

10.3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Enter metric name | North America |

| Enter metric name | Asia Pacific |

| Enter metric name | India, Saudi Arabia, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Vehicle Tolling System Market Trends

Transport authorities around the world are quickly switching from traditional toll booths to electronic toll collection (ETC) and multi-lane free flow (MLFF) systems. These systems let vehicles pass at highway speeds without stopping.

Governments in regions like Asia-Pacific, Europe, and North America are requiring interoperable tags to reduce delays and improve traffic flow. Studies show that about 78% of toll systems globally now process transactions electronically instead of using cash or manual methods.

Additionally, interoperable tolling systems allow one transponder or RFID tag to work across different regions and networks. Public agencies and infrastructure companies are working together to standardize tag technologies and back-office systems. This makes it easier for users and reduces the need for multiple toll accounts.

New technologies like AI-based number plate recognition (ANPR/ALPR) and computer vision are improving toll systems. These technologies help classify vehicles and enforce rules more accurately. Operators are using machine learning models that can recognize vehicles with over 95% accuracy, even in tough conditions. This improves enforcement and protects revenue.

Tolling systems are now using digital payment methods like mobile wallets, QR code payments, and RFID payments linked to user accounts. Tolling agencies are offering contactless payment options to support smart city goals and make payments easier and cashless.

Countries with large toll networks are switching to electronic systems and better traffic management. India's FASTag program uses RFID tolling on national highways to make collections faster and reduce traffic jams. Similarly, Hong Kong's HKeToll system replaces old toll booths with fast electronic systems. These projects show efforts to improve efficiency and cut travel times.

Vehicle Tolling System Market Analysis

Learn more about the key segments shaping this market

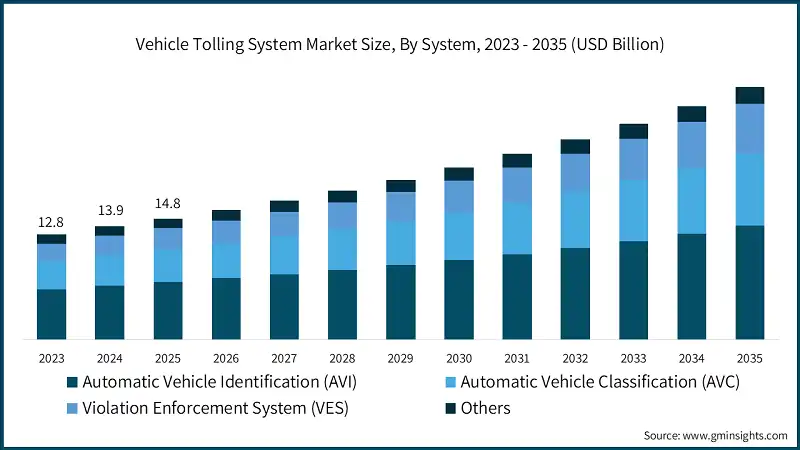

Based on system, the market is divided into automatic vehicle identification (AVI), automatic vehicle classification (AVC), violation enforcement system (VES) and others. The automatic vehicle identification (AVI) segment dominated the market and was valued at around USD 7 billion in 2025.

- The vehicle tolling system market saw the Automatic Vehicle Identification (AVI) segment become the most important one in 2025 as it brought the toll collection process to a new level of accuracy as well as efficiency. AVI technology uses transponders or RFID tags to automatically identify vehicles, reducing the need for manual toll collection and easing congestion at toll plazas.

- The increase of this segment can be attributed to three factors, including rapid and precise identification, seamless integration with various tolling systems, and a global upsurge in electronic toll collection (ETC) systems.

- For instance, in December 2025, TransCore launched express lane operations on an 18-mile stretch of Interstate 80 (I-80) in Fairfield and Vacaville. The system combined AVI and Automatic License Plate Recognition (ALPR) technologies to accurately identify and toll all Express Lane users, including carpools, buses, motorcycles, and solo drivers with FasTrak tags. This showed how effective and widely used AVI technology has become.

- The Violation Enforcement System (VES) segment is expected to grow the fastest, with a CAGR of 9.3% from 2026 to 2035. This growth is driven by stricter regulations and the need to stop toll evasion. Key factors include stronger enforcement of toll violations, better camera and sensor technologies, and integration with smart city systems.

Learn more about the key segments shaping this market

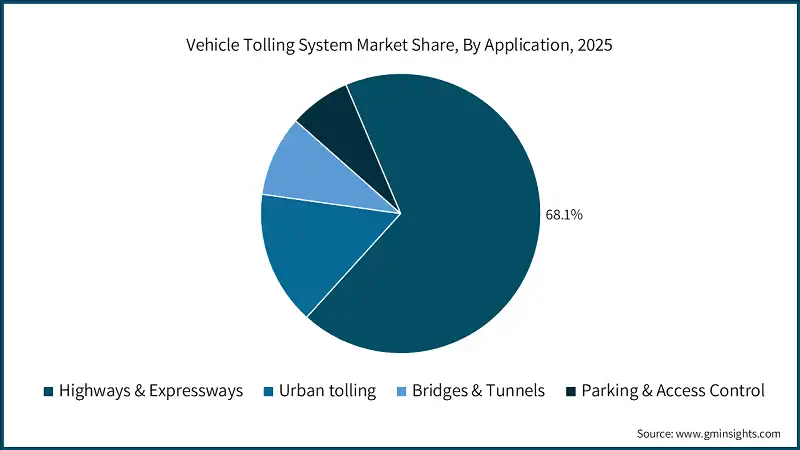

Based on application, the vehicle tolling system market is divided into highways & expressways, urban tolling, bridges & tunnels and parking & access control. The highways & expressways segment accounts for 68.1% in 2025 and is expected to reach USD 20.2 billion by 2035.

- The reason for the dominance of the highways and expressways segment is because they are important for intercity and interstate travel and have high traffic volumes. This segment leads the market for three main reasons, including heavy traffic, high revenue potential, and early use of advanced tolling technologies.

- For example, the U.S. is also planning a new toll route to improve freight movement near ports. Washington is about to open part of a toll route that will help truckers move freight faster.

- This is part of a project to bypass the busy Interstate 5 corridor and improve access to the ports of Seattle and Tacoma. The new toll road is the first mile of the four-lane state Route 509 Expressway, built by the Washington State Department of Transportation. This shows how highways and expressways play a key role in increasing the use of tolling systems.

- On the other hand, the urban tolling segment is expected to grow the fastest, with a CAGR of 9.7% from 2026 to 2035. Urban tolling systems help cities control vehicle entry into crowded areas, improve traffic flow, and lower emissions. As smart city projects grow worldwide, the urban tolling segment is expected to expand quickly, supporting its high growth rate.

Based on tolling method, the vehicle tolling system market is divided into automatic tolling / electronic toll collection (ETC), manual toll collection and free-flow / open road tolling (ORT). The free-flow / open road tolling (ORT) segment is expected to grow at the fastest CAGR of 9.4% between 2026 and 2035.

- ORT collects tolls without slowing vehicles down, making long-distance travel easier and helping to reduce traffic jams. This is becoming more important as highway congestion increases around the world.

- The automatic tolling/electronic toll collection (ETC) segment was the largest in the vehicle tolling system market, valued at USD 11.4 billion in 2025. ETC systems improve traffic flow by letting vehicles pass toll booths without stopping. They also reduce the cost of manual toll collection and make revenue tracking more accurate. Governments and private companies are increasingly using ETC systems as standard infrastructure, which is strengthening their role in the market.

- For example, in November 2025, the Netherlands introduced a new toll system with Tolltickets. This system is being approved to operate under the upcoming truck toll framework. Tolltickets also signed an agreement with RDW to become an official service provider under the European Electronic Toll Service (EETS) framework. Starting July 1, 2026, the system will require truck owners to pay for every kilometer driven on most motorways and some provincial and city roads.

Looking for region specific data?

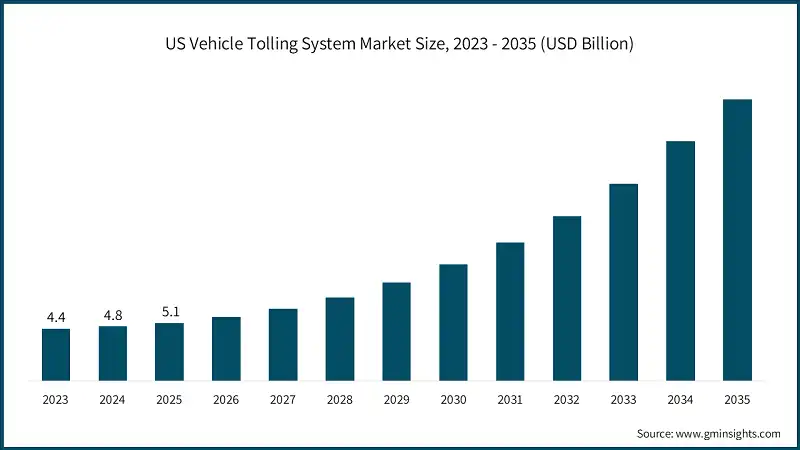

The US vehicle tolling system market reached USD 5.1 billion in 2025, growing from USD 4.8 billion in 2024.

- In the U.S., states are improving toll roads to make freight movement easier and connect regions better. They are building new toll roads to reduce traffic and improve logistics.

- For example, Washington will soon open the first mile of a toll road as part of the State Route 509 Expressway project. This will help truckers move goods faster around the busy Interstate 5 corridor to the ports of Seattle and Tacoma.

- Moreover, traditional cash toll booths are being replaced with systems that use transponders like E-ZPass or toll-by-plate billing. For example, the Atlantic City Expressway will fully switch to all-electronic tolling by January 2026. Cash payments will be replaced with toll-by-plate and E-ZPass billing, along with a standard toll increase for all drivers.

The North America region is estimated to reach USD 11.1 billion by 2035 by growing at the CAGR of 6.9% between 2026 and 2035.

- In the U.S. and Canada, toll authorities are replacing cash booths with systems that use transponders like E-ZPass or take pictures of license plates for billing. This change helps reduce traffic, improve safety, and lower costs. For example, the Atlantic City Expressway in New Jersey became fully cashless in January 2026.

- Tolls increased by about 3% for all vehicles, but drivers without E-ZPass now pay $13.60 through toll-by-plate, compared to $6.30 for E-ZPass users. This shows the shift to automated tolling and the use of higher toll rates to encourage electronic payments.

- Toll authorities are investing in RFID transponders, license-plate recognition, and overhead gantry systems. These systems let vehicles pass without stopping, making toll collection faster and easier. They also allow one toll tag to work in different states and facilities. Both Canada and the U.S. have widely adopted electronic tolling, with many toll points using these technologies and expanding on major highways and bridges.

The Europe region holds over 20% of the vehicle tolling system market, accounting for USD 3.1 billion in 2025.

- In Europe, toll policies are changing to support climate goals and reduce pollution, leading to new toll systems across member states. The European Commission is working on these changes through rules like the Eurovignette Directive, which adjust road charges based on how much vehicles pollute.

- One example of this change is the decision to make road tolls free for zero-emission heavy-duty vehicles until at least June 30, 2031. In June 2025, the European Commission suggested extending these toll exemptions to battery-electric and hydrogen trucks.

- The European Parliament supports this plan, and countries like Germany have already passed laws to keep electric heavy vehicles toll-free until mid-2031. These steps aim to help fleet operators buy cleaner trucks and move freight transport to low-carbon options.

- Green incentives support environmental goals but create problems for the traditional tolling market. When governments make zero-emission vehicles toll-free, fewer users pay for infrastructure. This makes it harder for toll operators to recover costs. As more heavy vehicles get reduced or waived tolls, it raises concerns about how toll systems will fund their operations and future projects.

Germany's vehicle tolling system market is growing quickly in Europe, with a strong CAGR of 6.5% between 2026 and 2035.

- Germany is planning to start charging tolls for passenger cars on its Autobahn network. So far, cars have used the Autobahns for free, with funding coming from general taxes, while trucks have been paying tolls for a long time.

- The government in Berlin is working on these toll plans to collect money for maintaining and improving the highways. This change shows a move toward having users pay directly as infrastructure needs increase.

- At the same time, Germany is updating its truck toll system (LKW-Maut) with new technology and environmental goals. Recent updates include charges based on CO2 emissions and easier toll payments through digital tools like smartphone apps. These changes aim to make the toll system better by focusing on raising funds, supporting environmental goals, and making it easier for users.

The Asia Pacific vehicle tolling system market is estimated to grow at fastest CAGR of 10.1% during the analysis timeframe.

- Governments, especially in India, are investing in electronic toll collection systems to manage traffic better. For example, toll collections through FASTag grew by nearly 20% in the first three months of FY2025-26, reaching about 21,000 crore. This is an 11% increase compared to 17,280 crore during the same period in FY2024-25, as reported by the National Electronic Toll Collection (NETC) system. This shows that more commuters and logistics operators are using contactless tolling systems.

- Fully automated tolling systems are becoming more popular, letting vehicles pass without stopping. In February 2025, the National Highways Authority of India (NHAI) introduced an automated toll system on the Urban Extension Road-2, linking Sonipat and Bawana.

- This system is expected to allow 20-minute travel time without delays. These projects aim to handle heavy traffic and make travel smoother.

- Technologies like RFID, ANPR (Automatic Number Plate Recognition), and mobile payment platforms are also changing tolling in the region. These technologies make payments faster and provide better data for managing traffic and planning infrastructure.

China is estimated to grow with a CAGR of 10.6% in the projected period between 2026 and 2035, in the Asia Pacific vehicle tolling system market.

- China boasts one of the world’s most extensive road networks, encompassing more than 5 million kilometers of various types of roads. This vast network plays a crucial role in the country’s economy and urbanization by linking cities, industrial areas, ports, and even the countryside. The expressway network, which is more than 160,000 kilometers in length, is the largest in the world and thus allows for quick and comfortable long-distance travels of both cargoes and passengers.

- The existence of such a big road network has caused the implementation of high-tech tolling systems such as Electronic Toll Collection (ETC) to be more common. The installed technology has allowed the toll and traffic management processes to be more automated and thus the movement of people and vehicles through the different provinces has become more manageable.

- The Chinese ETC system is now connected over the provinces through shared protocols, thus providing effortless travel from one end to the other free of toll-related problems. Additionally, tech firms are resorting to AI and IoT, among other things, in order to enhance the accuracy of tolling, manage their information better, and apply dynamic pricing.

Latin America vehicle tolling system market is estimated to reach USD 786.6 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Countries like Brazil, Chile, and Argentina are leading by using RFID-based and automatic license plate recognition (ALPR) systems on major toll roads. These systems let vehicles pass through toll points without stopping, cutting delays and pollution caused by idling vehicles. These advancements are encouraging nearby countries to consider similar upgrades, although the speed of adoption depends on local economic and regulatory conditions.

- Public-private partnerships and highway concessions are helping expand tolling systems, especially in big markets like Brazil and Mexico. Many concession agreements now include electronic toll collection systems because they improve revenue collection, reduce losses, and lower operating costs.

- For instance, in June 2025, Actis entered into an agreement to acquire a portfolio of operational toll roads in Colombia from Sacyr with a total transaction value of USD 1.6 billion. The investments will come from Actis’ Long Life Infrastructure Fund 2 (ALLIF2) and mark the launch of Actis’ first Latin American toll roads platform.

- In Brazil, the Sem Parar system now provides more than just toll payments. It also includes services like parking and fuel payments. This shift makes driving more convenient and increases the value of tolling technology.

Brazil is estimated to grow with a CAGR of 8.5% between 2026 and 2035, in the Latin America vehicle tolling system market.

- Brazil's vehicle tolling system is switching from cash-based toll booths to electronic systems, making traffic smoother and improving the experience for drivers. More toll payments are now electronic. Companies like Sem Parar, ConectCar, and Veloe are promoting RFID tags that let vehicles pass through toll plazas without stopping.

- Brazil is also using more "Free Flow" tolling, where vehicles do not need to stop at toll booths. Overhead systems automatically detect RFID tags or license plates and charge tolls electronically. This saves travel time and reduces emissions from idling vehicles.

- The Agência Nacional de Transportes Terrestres (ANTT) is working on policies to expand Free Flow tolling on federal highways, aiming to modernize toll systems and improve road efficiency.

- Another important trend in Brazil's toll market is connecting tolling with digital payment systems and mobility services. Starting in January 2025, transport operators must use digital toll voucher, which requires electronic tags. This will make payments faster and help logistics companies manage resources better. By focusing on digital systems, Brazil is creating a connected system that supports toll collection, fleet management, and other transportation needs.

The Middle East and Africa accounted for USD 456.9 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- In the region, countries like the United Arab Emirates and Saudi Arabia are investing in RFID-based tolling systems. These systems remove the need for cash payments and allow vehicles to pass toll points more easily. For example, Dubai's Salik system uses RFID technology to keep traffic moving without stopping. Governments are upgrading toll systems as part of their plans for smart infrastructure and urban mobility to reduce congestion and make travel faster on main roads.

- Also, these countries are testing IoT, GPS/GNSS, and satellite-based tolling systems. These systems do not need physical toll booths and can charge tolls based on distance or location. This approach creates flexible toll networks and reduces costs, especially in areas where building toll booths is difficult.

- Gulf countries are quickly building electronic toll networks as part of their smart city plans. On the other hand, some African countries are using modern toll systems only on major highways or through public-private partnerships. The region is also starting to explore by making toll systems work across borders.

UAE to experience substantial growth in the Middle East and Africa vehicle tolling system market in 2025.

- The market is growing as authorities and operators focus on digital technology and smart mobility. Dubai’s Salik toll network is leading this progress. In November 2024, Salik opened two new toll gates. The company is also improving its systems by upgrading its mobile app, adding features like an interactive WhatsApp service, and making its vehicle recognition systems more accurate.

- The market is expanding beyond regular toll collection to include more services. Salik has partnered with parking operators like Parkonic to expand its eWallet payment system to thousands of parking spaces across the UAE. This combines toll and parking payments on one platform.

Vehicle Tolling System Market Share

- The top 7 companies in the vehicle tolling system industry are Siemens, Toshiba, AECOM, Cubic, Verra Mobility, Conduent and Kapsch TrafficCom, contributing 30.5% of the market in 2025.

- Siemens provides vehicle tolling solutions as part of its intelligent transport systems. These include ANPR, DSRC, satellite, and multi-lane free-flow tolling technologies. Siemens also offers back-office software and roadside systems to support automated, congestion-based, and distance-based toll collection.

- Toshiba offers manual and electronic toll collection systems (ETC) and advanced tollgate management. Their systems allow speed-based, no-stop toll collection using roadside units and central servers. These solutions can work with different pricing structures and networks.

- AECOM provides consultancy, engineering, and system integration services for tolling infrastructure. They help transportation authorities plan, design, and set up tolling networks, transaction systems, and operations for electronic toll collection programs.

- Cubic Transportation Systems combines toll collection platforms with payment, traffic data, and operations software. Their solutions make vehicle tolling and transport management more efficient.

- Verra Mobility offers toll management solutions for fleets and drivers. Their products, such as TollLink and TollGuard, automate toll payments, combine billing, prevent violations, and improve compliance in electronic tolling systems.

- Conduent provides electronic toll collection systems, including ORT/AET roadside hardware, back-office processing, ANPR, and detection systems. They also offer software to improve toll operations and transaction accuracy.

- Kapsch TrafficCom delivers tolling technologies like GNSS-based satellite systems and Multi-Lane Free Flow (MLFF) systems. They also provide enforcement and back-office software to support scalable electronic tolling and road usage charging.

Vehicle Tolling System Market Companies

Major players operating in the vehicle tolling system industry are:

- Siemens

- Toshiba

- AECOM

- Cubic

- Verra Mobility

- Conduent

- Kapsch TrafficCom

- ST Engineering

- Mundys

- Thales

- Siemens combines tolling with wider transport infrastructure and smart city systems, offering scalable, interoperable solutions backed by global project experience in digital traffic management.

- Toshiba leverages its engineering and technology expertise to build reliable tolling hardware and software platforms, suited to varied toll environments and supporting integration with smart transport and infrastructure systems.

- AECOM’s edge lies in planning, engineering, and integrating tolling infrastructure at scale, helping authorities design and deploy systems within broader transportation projects and complex regulatory contexts.

- Cubic’s strength is in integrating tolling with payment and mobility systems, supporting different transaction models and data analytics that link tolling with broader transport operations.

- Verra Mobility focuses on toll management services for fleets and operators, with systems that simplify local authority integration, billing, and reporting across regions.

- Conduent’s competitive edge is in cloudbased tolling platforms, back office processing, and analytics that support large scale transaction processing and operational management.

- Kapsch excels in electronic toll collection technologies including open road and GNSS systems, with established deployments across multiple regions and strong integration capabilities.

Vehicle Tolling System Industry News

- In December 2025, TransCore started express lane operations on an 18-mile section of Interstate 80 (I-80) in Fairfield and Vacaville. The company installed a tolling system that uses Automatic Vehicle Identification (AVI) and Automatic License Plate Recognition (ALPR).

- In July 2025, Da Nang International Airport introduced an electronic toll collection (ETC) system. Drivers can pay electronically or use cash at the Nguyen Van Linh and Duy Tan toll booths.

- In July 2025, STAR Systems International launched its new tolling technology, which works with Gen2V3. This technology improves performance, speed, and reliability. Gen2V3 is an upgrade to the ISO/IEC 18000-63 protocol and offers better features than the older Gen2V2/6C standard.

- In June 2025, Actis agreed to buy operational toll roads in Colombia from Sacyr for USD 1.6 billion. The purchase is funded by Actis’ Long Life Infrastructure Fund 2 (ALLIF2) and is the company’s first toll road project in Latin America.

- In February 2025, NHAI announced an automated toll collection system for the Urban Extension Road-2's Sonipat spur. The system will use FASTags and advanced sensors to deduct toll charges automatically, so vehicles will not need to stop or slow down.

The vehicle tolling system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2022 to 2035, for the following segments:

Market, By Offering

- Hardware

- Roadside Equipment (RSE)

- On-Board Units (OBU)

- Central & Network Hardware

- Software

- Services

Market, By System

- Automatic Vehicle Identification (AVI)

- Automatic Vehicle Classification (AVC)

- Violation Enforcement System (VES)

- Others

Market, By Technology

- Radio-Frequency Identification (RFID)

- Dedicated Short-Range Communication (DSRC)

- Global Navigation Satellite System (GNSS)/GPS

- Video analytics/CCTV-based systems

- Others

Market, By Tolling Method

- Automatic Tolling / Electronic Toll Collection (ETC)

- Manual toll collection

- Free-Flow / Open Road Tolling (ORT)

Market, By Payment Method

- Prepaid

- Postpaid

- Pay-By-Plate

Market, By Vehicle

- Passenger cars

- Hatchback

- Sedan

- SUV

- Commercial vehicles

- LCV

- MCV

- HCV

Market, By Application

- Highways & Expressways

- Urban tolling

- Bridges & Tunnels

- Parking & Access Control

Market, By End Use

- Government / Public Sector

- Private Sector

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the valuation of the U.S. vehicle tolling system sector in 2025?

The U.S. market was valued at USD 5.1 billion in 2025, led by efforts to improve freight movement, reduce traffic, and enhance logistics.

What are the upcoming trends in the vehicle tolling system market?

AI-based ANPR/ALPR, ML vehicle classification, interoperable toll systems, digital payments (wallets/QR), and RFID tolling like FASTag and HKeToll.

What is the growth outlook for the free-flow/open road tolling (ORT) segment from 2026 to 2035?

The free-flow/open road tolling (ORT) segment is set to expand at a CAGR of 9.4% during the forecast period.

Who are the key players in the vehicle tolling system industry?

Key players include Siemens, Toshiba, AECOM, Cubic, Verra Mobility, Conduent, Kapsch TrafficCom, ST Engineering, Mundys, and Thales.

How much revenue did the automatic vehicle identification (AVI) segment generate in 2025?

The AVI segment generated approximately USD 7 billion in 2025, due to its ability to enhance toll collection accuracy and efficiency.

What was the market size of the vehicle tolling system in 2025?

The market size was valued at USD 14.8 billion in 2025, growing at a CAGR of 7.7% from 2026 to 2035. The market is driven by the global shift toward electronic and connected tolling systems.

What is the expected size of the vehicle tolling system industry in 2026?

The market size is expected to reach USD 15.9 billion in 2026.

What is the projected value of the vehicle tolling system market by 2035?

The market is poised to reach USD 30.9 billion by 2035, fueled by advancements in tolling technologies and government infrastructure policies.

Vehicle Tolling System Market Scope

Related Reports