Summary

Table of Content

Vehicle RFID Tags Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vehicle RFID Tags Market Size

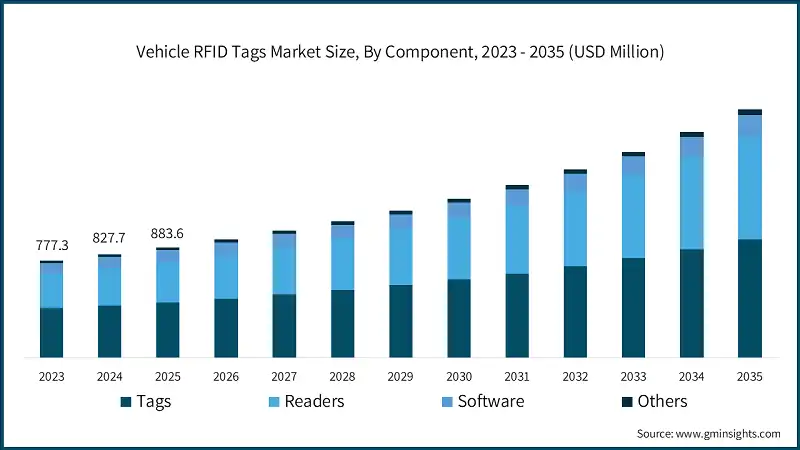

The global vehicle RFID tags market size was valued at USD 883.6 million in 2025. The market is expected to grow from USD 946.8 million in 2026 to USD 2 billion in 2035, at a CAGR of 8.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

The vehicle RFID tags market is projected to experience significant growth in the coming years, driven by the increasing adoption of smart transportation systems, rising demand for automated vehicle identification, and growing need for efficient fleet and asset management across industries. As governments, logistics providers, and enterprises prioritize accurate vehicle tracking, toll collection, and secure access control, advanced vehicle RFID tag solutions are becoming essential to ensure seamless, reliable, and traceable operations.

Technological advancements such as IoT-enabled real-time tracking, AI- and ML-powered route optimization, cloud-based logistics platforms, GPS and RFID monitoring, and automated fleet management systems are transforming traditional vehicle management practices. These innovations enable end-to-end visibility across transportation networks, from vehicle identification and tolling to fleet tracking and secure access, while enhancing operational efficiency, reducing errors, and improving compliance with regulatory requirements.

In 2024, leading vehicle RFID tag solution providers such as Avery Dennison, Impinj, Zebra Technologies, Alien Technology, NXP Semiconductors, HID Global, and Honeywell expanded their product portfolios. These companies invested heavily in UHF and passive RFID tag innovations, IoT-enabled monitoring platforms, cloud-based data analytics, and automated vehicle identification systems to enhance tracking accuracy, reduce operational downtime, optimize fleet utilization, and provide real-time visibility across regional and global deployments.

The vehicle RFID tags ecosystem continues to evolve as advanced analytics, automation, real-time monitoring, and integrated digital platforms reshape the market. Industry stakeholders are increasingly prioritizing end-to-end, technology-driven RFID solutions that provide holistic visibility into vehicle movement, enable faster toll collection, improve fleet efficiency, reduce human intervention, and support long-term operational growth. These advancements are redefining the Vehicle RFID Tags Market, enabling more efficient, reliable, and secure vehicle identification and tracking solutions across global transportation networks.

Vehicle RFID Tags Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 883.6 Million |

| Market Size in 2026 | USD 946.8 Million |

| Forecast Period 2026 - 2035 CAGR | 8.6% |

| Market Size in 2035 | USD 2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of Electronic Toll Collection (ETC) Systems | Governments and transportation authorities are increasingly adopting RFID-based tolling solutions to enable fast, automated, and contactless payment, reducing congestion and operational costs. |

| Rising Demand for Fleet & Asset Management | Businesses across logistics, transport, and public services are leveraging RFID tags for real-time vehicle tracking, route optimization, and efficient asset management. |

| Integration with Smart Transportation & IoT Ecosystems | The growing trend of connected vehicles and smart city initiatives is driving adoption of RFID tags for parking management, access control, and urban mobility solutions. |

| Regulatory Compliance and Security Requirements | Increasing government regulations for vehicle identification, secure transport of high-value assets, and anti-theft measures are pushing adoption of reliable RFID solutions. |

| Pitfalls & Challenges | Impact |

| Data Privacy and Security Risks | Vehicle RFID systems collect sensitive data; improper management may lead to data breaches, cyber threats, or misuse of tracking information. |

| Infrastructure Costs and Standardization Issues | High costs of deploying RFID infrastructure, lack of interoperability across regions, and varying global standards can limit market penetration, especially in developing economies. |

| Opportunities: | Impact |

| Adoption of Advanced Analytics, AI, and Cloud Platforms | Integrating RFID with AI/ML, cloud-based monitoring, and predictive analytics allows real-time fleet optimization, smarter toll management, and reduced operational errors. |

| Expansion in Emerging Markets | Rapid urbanization, increasing vehicle ownership, and improving logistics infrastructure in regions such as Asia-Pacific, Latin America, and MEA offer substantial growth potential. |

| Market Leaders (2025) | |

| Market Leaders |

8.8% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | Brazil, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Vehicle RFID Tags Market Trends

The demand for advanced vehicle RFID tags solutions is rapidly increasing, driven by growing collaboration among automotive OEMs, RFID technology vendors, system integrators, smart infrastructure providers, and government authorities. These partnerships aim to enhance vehicle identification, electronic toll collection, real-time tracking, access control, and fleet optimization, while improving operational efficiency and regulatory compliance. Stakeholders are jointly developing integrated and scalable RFID platforms incorporating UHF and passive RFID tags, IoT-enabled readers, cloud-based data platforms, AI-driven traffic analytics, and secure data management systems.

For instance, in 2024, leading companies such as Avery Dennison, Impinj, Zebra Technologies, Alien Technology, NXP Semiconductors, and HID Global expanded strategic collaborations with smart city developers, tolling authorities, logistics operators, and automotive manufacturers. These collaborations focused on deploying high-performance vehicle RFID tags, multi-lane free-flow tolling systems, real-time vehicle visibility dashboards, and automated vehicle authentication workflows, improving traffic flow, reducing congestion, enhancing data accuracy, and supporting large-scale transportation infrastructure modernization.

Regional customization of vehicle RFID tag solutions is emerging as a key trend across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Solution providers are developing region-specific frequency standards, compliance-ready tag designs, and localized deployment frameworks to support diverse regulatory requirements and infrastructure conditions. These tailored solutions address the needs of applications such as toll roads, smart parking, public transportation, logistics fleets, and government vehicle identification programs, ensuring interoperability and high performance across varied environments.

The rise of specialized RFID and IoT technology startups offering AI-powered traffic analytics, edge-based RFID readers, cloud-native fleet platforms, and predictive maintenance tools is reshaping the competitive landscape. Companies focusing on low-cost passive tags, durable automotive-grade RFID labels, and integrated vehicle identification platforms are enabling scalable, cost-effective, and highly reliable deployments. These innovations empower both established vendors and emerging players to enhance solution performance, accelerate adoption, and support the digital transformation of transportation ecosystems.

The development of standardized, modular, and interoperable vehicle RFID tag platforms is transforming the market. Leading players are deploying unified mobility and identification architectures that seamlessly integrate with transport management systems, ERP platforms, smart city infrastructure, parking management, and regulatory databases. These platforms support customizable workflows, real-time monitoring, cross-region scalability, and adherence to global RFID standards, enabling governments and enterprises to deploy secure, efficient, and future-ready Vehicle RFID Tags solutions across the entire transportation and mobility lifecycle.

Vehicle RFID Tags Market Analysis

Learn more about the key segments shaping this market

Based on component, the market is divided into tags, readers, software and others. The tags segment dominated the market, accounting for around 50% share in 2025 and is expected to grow at a CAGR of over 8% from 2026 to 2035.

- The tags segment dominates the vehicle RFID tags market due to its fundamental role in enabling vehicle identification, tracking, electronic toll collection, access control, and fleet management applications. Widespread adoption of passive and UHF RFID tags, driven by their cost-effectiveness, ease of deployment, and reliable performance, allows organizations to achieve accurate, contactless vehicle identification at scale. Advancements in tag durability, antenna design, and automotive-grade materials further enhanced read accuracy and operational reliability, making tags the core component across transportation, logistics, and smart mobility ecosystems.

- Readers, software, and other components play a critical role in supporting RFID-enabled vehicle systems by enabling data capture, analytics, and system integration. However, while these components are essential for system functionality, their adoption is directly dependent on the deployment of RFID tags. The continuous replacement cycle, high-volume usage, and widespread applicability of tags across tolling, tracking, and fleet operations give the tags segment a clear dominance. Ongoing innovations in low-cost passive tags, long-range UHF solutions, and secure authentication features further strengthen the leading position of the tags segment in the vehicle RFID tags market.

Learn more about the key segments shaping this market

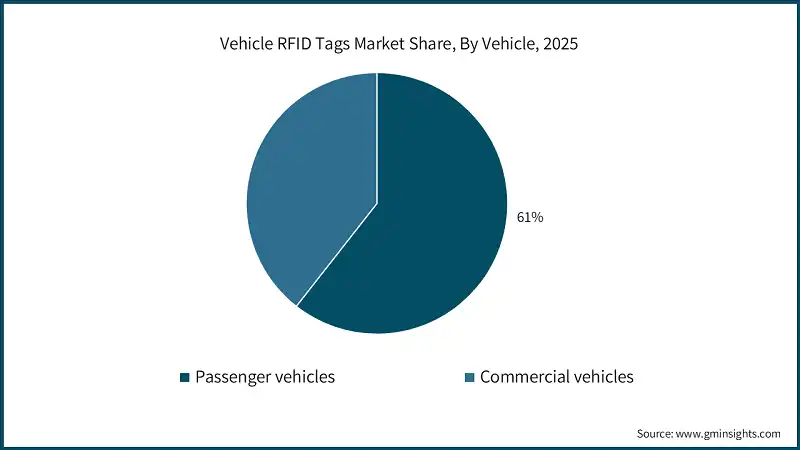

Based on vehicle, the vehicle RFID tags market is divided into passenger vehicles and commercial vehicles. The passenger vehicles segment dominates the market, accounting for around 61% share in 2025, and the segment is expected to grow at a CAGR of over 7.9% from 2026 to 2035.

- The passenger vehicles segment dominates the vehicle RFID tags market due to its widespread adoption across electronic toll collection systems, smart parking solutions, vehicle access control, and urban mobility applications. High passenger vehicle volumes, increasing penetration of RFID-enabled toll tags, and government-led smart transportation initiatives have driven large-scale deployment of RFID tags in this segment. Leveraging UHF and passive RFID tags, IoT-enabled readers, cloud-based mobility platforms, and real-time data analytics, passenger vehicle applications enable seamless identification, faster toll processing, reduced congestion, and improved traffic management across highways and urban road networks.

- The commercial vehicles segment plays a critical role in supporting fleet tracking, logistics optimization, freight movement, and regulatory compliance across domestic and cross-border supply chains. While commercial vehicles benefit from advanced RFID-based fleet management, long-range tracking, and asset utilization systems, the passenger vehicles segment maintains dominance due to higher unit volumes, frequent tag replacement cycles, and mass-scale tolling and parking deployments. Together, passenger and commercial vehicle applications form a comprehensive RFID-enabled transportation ecosystem, where passenger vehicles drive market volume and adoption, while commercial vehicles contribute higher value-added and specialized use cases globally.

Based on frequency, the market is divided into ultra-high-frequency, high-frequency, low-frequency and microwave. The ultra-high-frequency segment dominated the market and was valued at USD 436.3 million in 2025.

- The ultra-high-frequency (UHF) segment dominates the vehicle RFID tags market due to its critical role in enabling long-range vehicle identification, electronic toll collection, fleet tracking, and multi-lane free-flow traffic systems. UHF RFID technology supports fast read speeds, extended read ranges, and high tag density handling, making it ideal for high-volume vehicle environments such as highways, parking facilities, logistics hubs, and border checkpoints. The widespread deployment of UHF RFID tags across passenger and commercial vehicles, combined with strong regulatory support for automated tolling, positions this segment as the cornerstone of vehicle RFID deployments globally.

- The adoption of advanced UHF RFID technologies has further strengthened this segment’s market leadership. Improvements in antenna design, tag sensitivity, anti-collision protocols, and automotive-grade durability, along with integration of IoT-enabled readers, cloud-based data platforms, and AI-driven traffic analytics, have significantly enhanced system accuracy, throughput, and reliability. These technologies enable transportation authorities and fleet operators to reduce congestion, improve traffic flow, optimize toll operations, and maintain compliance with regional RFID frequency standards.

- Other frequency segments, including high-frequency (HF), low-frequency (LF), and microwave RFID, also contribute to the growth of the Vehicle RFID Tags Market, particularly in applications such as access control, short-range vehicle authentication, immobilizer systems, and specialized transportation use cases. These technologies are valued for specific security or proximity-based applications; however, the UHF segment continues to outperform due to its superior scalability, long-range performance, and suitability for high-speed, high-volume vehicle identification environments.

Based on application, the market is divided into tolls, tracking, fleet management, smart parking systems and keyless entry systems. The tolls segment dominated the market and was valued at USD 356.8 million in 2025.

- The tolls segment dominates the vehicle RFID tags market due to its critical role in enabling automated electronic toll collection (ETC), multi-lane free-flow tolling, and congestion-free highway transportation. RFID-based tolling systems support fast vehicle identification, contactless payments, and high transaction throughput, making them ideal for high-traffic environments such as expressways, urban highways, bridges, and border crossings. The widespread deployment of RFID toll tags across passenger and commercial vehicles, supported by government mandates and smart transportation initiatives, positions the tolls segment as the cornerstone application of vehicle RFID tag adoption globally.

- The adoption of advanced RFID-based tolling technologies has further strengthened this segment’s market leadership. Innovations in UHF RFID tags, high-speed readers, anti-collision algorithms, and AI-driven traffic analytics, along with integration of cloud-based toll management platforms and real-time monitoring systems, have significantly improved system accuracy, scalability, and operational efficiency. These technologies enable transportation authorities to reduce traffic congestion, improve toll plaza throughput, enhance revenue collection accuracy, and ensure compliance with regional transportation and billing regulations.

- Other application segments, including tracking, fleet management, smart parking systems, and keyless entry systems, also contribute significantly to the growth of the Vehicle RFID Tags Market, particularly across logistics, urban mobility, and enterprise fleet operations. These applications support vehicle visibility, access automation, and operational efficiency; however, the tolls segment continues to outperform due to its massive deployment scale, recurring transaction volumes, and essential role in national and regional transportation infrastructure.

Looking for region specific data?

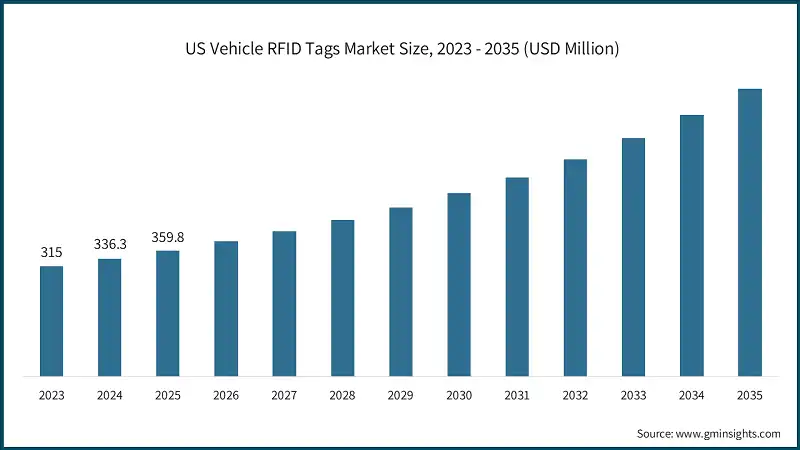

In 2025, US dominated the North America vehicle RFID tags market with around 78% market share and generated approximately USD 359.8 million in revenue.

- North America dominates the vehicle RFID tags market, supported by advanced transportation infrastructure, early adoption of smart mobility technologies, and strong integration of RFID systems across highways, urban road networks, and logistics corridors. The region benefits from widespread deployment of UHF RFID–based electronic toll collection systems, IoT-enabled vehicle tracking platforms, cloud-based data management solutions, and real-time monitoring tools, positioning North America as a leading market for automated vehicle identification and smart transportation solutions.

- Within North America, the United States accounts for the largest share, driven by high vehicle ownership, extensive highway networks, and strong regulatory and government support for intelligent transportation systems and automated tolling. Large-scale adoption of RFID-enabled toll tags, fleet tracking solutions, and smart parking systems—combined with high digital maturity and continued investment in smart city initiatives—continues to accelerate market growth across key states such as California, Texas, Florida, and New York.

- Key industry players operating in North America, including Avery Dennison, Impinj, Zebra Technologies, Alien Technology, NXP Semiconductors, and HID Global, are actively expanding their vehicle RFID tag portfolios and strengthening technological capabilities. Ongoing investments in long-range UHF RFID technology, cloud-native mobility platforms, AI-driven traffic analytics, and secure data ecosystems are further reinforcing North America’s dominant position in the market.

Germany holds share of 21% in Europe vehicle RFID tags market in 2025 and it will grow tremendously between 2026 and 2035.

- Europe accounted for a significant share of the market, supported by a mature enterprise ecosystem, advanced logistics infrastructure, and increasing adoption of technology-driven vehicle identification and tracking solutions. Organizations across the region are deploying AI- and IoT-enabled monitoring systems, predictive route optimization, fleet tracking, and cloud-based management platforms, while RFID solution providers focus on operational efficiency, regulatory compliance, and secure transportation of high-value assets. Strong IT infrastructure, established standards, and growing demand for secure mobility reinforce Europe’s position as a key regional market.

- Germany dominates the EU market, supported by its strong industrial base, advanced technology adoption, and stringent regulatory compliance standards. German enterprises and transportation authorities are leading large-scale deployments of UHF RFID-based tolling systems, fleet tracking solutions, real-time monitoring dashboards, and predictive risk analytics platforms. Investments in automated fleet management, centralized monitoring systems, and AI-driven traffic and asset analytics have strengthened operational efficiency, expanded service offerings, and accelerated regional market growth, positioning Germany as the European leader.

- Other major European countries, including France, the Netherlands, and the United Kingdom, are also contributing to regional expansion through adoption of vehicle RFID solutions for tolling, fleet management, and high-value asset tracking. France emphasizes specialized transport solutions for high-value goods, the Netherlands focuses on innovative monitoring and smart mobility platforms, and the UK prioritizes regulatory-compliant secure operations. Despite growth across these markets, Germany maintains its leading role in scale, technological innovation, and comprehensive deployment of Vehicle RFID Tags solutions across Europe.

China holds share of 23% in Asia Pacific vehicle RFID tags market in 2025 and it is expected to grow tremendously between 2026 and 2035.

- Asia-Pacific holds a major share of the market, supported by rapid digital transformation, increasing adoption of technology-driven RFID solutions, and growing demand for secure transport of vehicles, high-value goods, and sensitive materials. The region is witnessing steady growth as enterprises, logistics providers, and technology firms invest in AI- and IoT-enabled vehicle tracking systems, predictive route optimization, cloud-based fleet management, and real-time monitoring platforms. Strong IT infrastructure, large urban centers, and rising regulatory awareness continue to strengthen Asia-Pacific’s position in the vehicle RFID tags market.

- China dominates the APAC market, driven by widespread deployment of UHF RFID-based tolling, fleet tracking solutions, armored transport, and cash-in-transit services. Major metropolitan and financial hubs such as Beijing, Shanghai, Shenzhen, and Guangzhou are experiencing high demand for predictive route optimization, continuous vehicle monitoring, and secure transportation of high-value goods. Supportive regulations, technological maturity, and strong partnerships between enterprises, logistics providers, and technology vendors further accelerate the adoption of advanced Vehicle RFID Tags solutions across large enterprises, SMEs, and high-volume retail networks.

- Other Asia-Pacific markets, including India, Japan, and Singapore, are emerging as high-growth regions, supported by adoption of technology-enabled fleet tracking, real-time monitoring systems, and smart transportation platforms. India emphasizes cash management and armored transport services, Japan focuses on high-value goods and specialized RFID applications, and Singapore prioritizes regulatory compliance and integrated monitoring solutions. Despite rapid growth in these countries, China remains the dominant market in Asia-Pacific, driven by scale, technological innovation, and strong enterprise and regulatory support.

Vehicle RFID tags market in Brazil will experience significant growth between 2026 and 2035.

- Latin America holds a smaller share but is steadily expanding its presence in the market, driven by growing adoption of technology-enabled fleet tracking, digital logistics management, and secure transport solutions. Enterprises across the region are gradually deploying AI- and IoT-enabled vehicle monitoring systems, predictive route optimization, real-time tracking dashboards, and cloud-based logistics platforms. Strengthening enterprise networks, expanding operational coverage, and improving regional regulatory frameworks for asset security continue to support Latin America’s growing role in the global vehicle RFID tags market.

- Brazil dominates the LA market, supported by its large corporate ecosystem, high adoption of technology-driven secure transport solutions, and strong focus on operational efficiency and asset protection. Major urban hubs such as São Paulo, Rio de Janeiro, and Brasília host numerous enterprises, financial institutions, and retail chains implementing armored transport, cash-in-transit services, AI-powered risk analytics, and integrated vehicle monitoring platforms. Leading providers actively offer scalable, analytics-driven, and technology-enabled Vehicle RFID Tags solutions, reinforcing Brazil’s dominant position in the regional market.

- Mexico represents the second largest and rapidly growing market, driven by increasing adoption of secure transport solutions, hybrid operational models, and demand for reliable cash and high-value goods logistics. Key cities such as Mexico City, Monterrey, and Guadalajara are witnessing higher deployment of predictive risk analytics, armored fleet management, and real-time tracking systems, contributing to the overall modernization and expansion of Latin America’s market.

Vehicle RFID Tags market in UAE will experience significant growth between 2026 and 2035.

- MEA accounted for a modest share of the market in 2025, supported by gradual adoption of technology-driven vehicle RFID tag solutions, expansion of enterprise operations, and growing focus on secure transport and operational efficiency. Countries across the region are progressively implementing AI- and IoT-enabled vehicle tracking systems, predictive route optimization, real-time monitoring platforms, and cloud-based fleet management solutions. Expansion of enterprise networks, growth in high-value goods transport, and modernization of logistics infrastructure further support MEA’s integration into the market.

- Within MEA, the UAE dominates the regional vehicle RFID tags market, driven by advanced secure transport solutions among enterprises, financial institutions, and multinational corporations. Key hubs such as Dubai and Abu Dhabi host major corporate headquarters, regional offices, and logistics providers that implement armored transport, cash-in-transit services, AI-powered risk analytics, predictive route optimization, and integrated monitoring platforms to ensure operational efficiency, secure delivery, and compliance with regional regulations.

- Leading vehicle RFID tags providers, including Avery Dennison, Impinj, Zebra Technologies, Alien Technology, NXP Semiconductors, and HID Global, are actively deploying cloud-enabled, AI-driven, and real-time monitoring solutions to strengthen the UAE’s position as the regional leader in MEA. Adoption of advanced RFID technologies, centralized monitoring, and data-driven logistics practices in the UAE is expected to drive further growth and set benchmarks for neighboring MEA markets, supporting overall regional expansion in Vehicle RFID Tags services.

Vehicle RFID Tags Market Share

- The top 7 companies in the market are HID Global, Zebra Technologies, Alien Technology, Confidex, NXP Semiconductors, HARTING Technology and Impinj. These companies hold around 35% of the market share in 2025.

- HID Global is a leading provider of Vehicle RFID Tags, offering solutions for electronic toll collection, fleet management, smart parking systems, and vehicle access control. HID Global emphasizes secure RFID tags, IoT-enabled monitoring, cloud-based data platforms, and real-time analytics to enhance operational efficiency, accuracy, and compliance. Its strong global presence, technology leadership, and integration with enterprise and government systems reinforce its competitive market share.

- Zebra Technologies delivers comprehensive Vehicle RFID Tags solutions, focusing on long-range UHF RFID tags, readers, and integrated tracking platforms for fleet management, tolling, and logistics applications. Zebra leverages AI-driven analytics, cloud-based monitoring dashboards, and high-performance RFID hardware to improve operational reliability, scalability, and system interoperability, strengthening its global market presence.

- Alien Technology provides advanced UHF and passive RFID tags and inlays for vehicle identification, toll collection, fleet tracking, and asset monitoring. Alien Technology emphasizes high-sensitivity antenna designs, consistent read accuracy, and large-scale deployability, enabling enterprises to achieve reliable vehicle visibility and operational efficiency, enhancing its position in the Vehicle RFID Tags Market.

- Confidex offers specialized vehicle RFID tags and IoT-enabled identification solutions, with a focus on durable, long-range, and automotive-grade tags suitable for fleet management, tolling, and logistics tracking. Confidex integrates cloud-enabled tracking platforms and predictive analytics to optimize operations and ensure secure, compliant deployments, reinforcing its regional and global market share.

- NXP Semiconductors is a key technology provider in the Vehicle RFID Tags Market, supplying high-performance RFID ICs, NFC modules, and secure authentication solutions for electronic tolling, access control, and smart mobility systems. NXP leverages automotive-grade reliability, cryptographic security, and OEM partnerships to support large-scale deployments, strengthening its market presence worldwide.

- HARTING Technology delivers vehicle RFID tags and industrial connectivity solutions for fleet tracking, logistics, and smart infrastructure applications. HARTING emphasizes durable tags, integrated readers, IoT-enabled monitoring, and modular platforms to improve operational visibility, asset security, and system scalability, maintaining a competitive share in the vehicle RFID tags market.

- Impinj provides industry-leading RAIN RFID solutions for vehicle identification, fleet tracking, tolling, and logistics management. Impinj integrates high-performance RFID endpoints, reader ICs, cloud-enabled monitoring, and AI-powered analytics to deliver real-time visibility, reduce operational risks, and optimize fleet operations, reinforcing its strong position in both regional and international markets.

Vehicle RFID Tags Market Companies

Major players operating in the vehicle RFID tags industry include:

- Alien Technology

- Brink’s

- Confidex

- G4S

- GardaWorld

- HARTING Technology

- HID Global

- Impinj

- NXP Semiconductors

- Zebra Technologies

- The vehicle RFID tags market is highly competitive, with leading solution providers such as HID Global, Zebra Technologies, Alien Technology, Confidex, NXP Semiconductors, HARTING Technology, Impinj, Avery Dennison, Smartrac, and Confidex occupying key segments across vehicle identification, fleet tracking, electronic toll collection, smart parking systems, keyless entry, AI- and IoT-enabled monitoring, predictive analytics, and cloud-based RFID platforms.

- HID Global, Zebra Technologies, and Impinj lead the market with comprehensive, end-to-end Vehicle RFID Tags solutions, integrating UHF RFID tags, long-range readers, AI-driven traffic analytics, predictive route optimization, real-time vehicle monitoring, and cloud-enabled management platforms. These companies focus on enhancing operational efficiency, system reliability, regulatory compliance, and secure vehicle identification across smart cities, tolling authorities, logistics fleets, and urban mobility networks globally.

- Alien Technology, Confidex, NXP Semiconductors, HARTING Technology, Avery Dennison, Smartrac, and Impinj specialize in scalable, technology-driven RFID platforms, emphasizing durable tags, high-sensitivity readers, predictive analytics, workflow automation, mobile-accessible monitoring, and seamless integration with enterprise systems. Their solutions enable accurate vehicle identification, efficient fleet management, enhanced transport security, and data-driven decision-making across domestic, regional, and international transportation and mobility applications.

- Overall, the market is characterized by rapid technological adoption, with companies continuously developing AI and IoT enabled, cloud-integrated, mobile-accessible, and modular RFID platforms. Market players are focused on delivering reliable, scalable, and high-performance solutions, improving asset security, operational efficiency, and service quality for smart city initiatives, enterprises, fleet operators, and high-volume transport networks worldwide.

Vehicle RFID Tags Industry News

- In March 2025, HID Global launched an enhanced Vehicle RFID Tags solution featuring AI and IoT enabled fleet tracking, predictive route optimization, and cloud-integrated monitoring dashboards. The initiative aims to strengthen electronic tolling, smart parking systems, and fleet management operations, enhancing vehicle identification accuracy, operational efficiency, and regulatory compliance across smart cities and enterprise transport networks globally.

- In February 2025, Zebra Technologies Corp. introduced a next-generation long-range RFID reader and analytics platform, incorporating real-time vehicle tracking, AI-driven traffic analytics, and predictive maintenance tools. The rollout focuses on improving fleet visibility, automated toll processing, and operational reliability for urban mobility, logistics providers, and transportation authorities.

- In January 2025, Impinj, Inc. unveiled an AI-powered RAIN RFID platform for vehicle identification, integrating real-time asset tracking, automated reporting, and predictive risk analytics. The initiative targets high-volume fleet operations, cross-border logistics, and smart transportation networks, enabling faster decision-making, enhanced security, and improved operational efficiency.

- In December 2024, Alien Technology expanded its Vehicle RFID Tags portfolio with cloud-enabled monitoring platforms, high-sensitivity UHF tags, and automated vehicle identification systems. The deployment supports fleet management, electronic toll collection, and access control applications, providing enhanced operational transparency, reliability, and scalability for enterprises and urban infrastructure projects.

- In October 2024, Confidex, NXP Semiconductors, and HARTING Technology launched integrated RFID-enabled transport solutions, including predictive route analytics, IoT-enabled monitoring, automated reporting, and AI-driven decision support tools. The initiative emphasizes scalable, secure, and technology-driven operations for enterprise fleets, high-value asset transport, and smart mobility systems across regional and international markets.

The vehicle RFID tags market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Component

- Tags

- Passive

- Active

- Readers

- Software

- Others

Market, By Vehicle

- Passenger vehicles

- Hatchbacks

- Sedans

- SUV

- Commercial vehicles

- Light commercial vehicles (LCV)

- Medium commercial vehicles (MCV)

- Heavy commercial vehicles (HCV)

Market, By Frequency

- Ultra-High Frequency

- High-Frequency

- Low Frequency

- Microwave

Market, By Application

- Tolls

- Tracking

- Fleet management

- Smart parking systems

- Keyless entry systems

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the market share of the passenger vehicles segment in 2025?

The passenger vehicles segment accounted for around 61% of the market share in 2025 and is expected to grow at a CAGR of over 7.9% till 2035.

What is the growth outlook for the tags segment from 2026 to 2035?

The tags segment is set to expand at a CAGR of over 8% through 2035, propelled by the increasing adoption of RFID tags for vehicle identification and fleet management.

Which region leads the vehicle RFID tags sector?

North America leads the market, with the U.S. accounting for approximately 78% of the regional revenue in 2025, generating USD 359.8 million.

What are the upcoming trends in the vehicle RFID tags market?

Key trends include region-specific RFID solutions, AI-powered traffic analytics, IoT-enabled platforms, cloud-based data management, and modular, interoperable RFID architectures for smart cities.

Who are the key players in the vehicle RFID tags industry?

Key players include Alien Technology, Brink’s, Confidex, G4S, GardaWorld, HARTING Technology, HID Global, Impinj, NXP Semiconductors, and Zebra Technologies.

What is the expected size of the vehicle RFID tags industry in 2026?

The market size is projected to reach USD 946.8 million in 2026.

How much revenue did the tolls segment generate in 2025?

The tolls segment generated approximately USD 356.8 million in 2025, due to its critical role in enabling automated toll collection and congestion-free highway transportation.

What was the market size of the vehicle RFID tags in 2025?

The market size was valued at USD 883.6 million in 2025, with a CAGR of 8.6% expected through 2035. The growth is driven by the adoption of smart transportation systems, automated vehicle identification, and efficient fleet management solutions.

What is the projected value of the vehicle RFID tags market by 2035?

The market is poised to reach USD 2 billion by 2035, fueled by advancements in RFID technology, IoT-enabled platforms, and increasing demand for secure and efficient vehicle tracking systems.

Vehicle RFID Tags Market Scope

Related Reports