Home > Aerospace & Defense > Defense and Safety > Vehicle Armor Market

Vehicle Armor Market Analysis

- Report ID: GMI7169

- Published Date: Oct 2020

- Report Format: PDF

Vehicle Armor Market Analysis

Metals material segment captured around 75% vehicle armor market share in 2019 and will continue to dominate the market over 2020-2026 driven by their versatility. Metals have been the traditional choice for armored vehicles since their inception. Steel is the most widely used metal for armor manufacturing, while aluminum, magnesium, and titanium are also used in some cases.

The two major types of steel armor are Rolled homogeneous armor (RHA) and cast homogeneous armor (CHA). Steel possesses good balance of toughness, hardness, and fatigue resistance. It can be easily cut, machined, welded & formed, and it is easily field repairable.

The armored fighting vehicles market is poised to witness more than 4.5% CAGR through 2026 propelled by rising procurement of armored personnel carriers (APC) and mine-resistant ambush protected (MRAP) vehicles. The strong growth of this segment is attributable to the increasing demand for agile, lighter, and flexible vehicles that can provide strategic advantage in battlefields.

Developments associated with ballistic protection, blast protection, and counter-IED will transform the armored fighting vehicles sector in coming few years. Technological progressions related to active protection systems, modular ballistic armor systems, information integration, and active mine protection systems will support vehicle armor market growth.

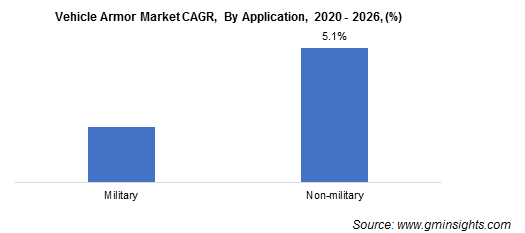

This non-military application is likely to grow at above 5% CAGR from 2020 to 2026. The armored vehicles are majorly used by government officials, diplomats, police forces, etc., for protection against various threats. Nowadays, the demand for armored vehicles is soaring amongst high net worth people, corporate tycoons, and celebrities for safety reasons. The armor reinforcement ranging from bulletproof glass to run-flat tires is being implemented within vehicles to safeguard passengers from all kinds of attacks.

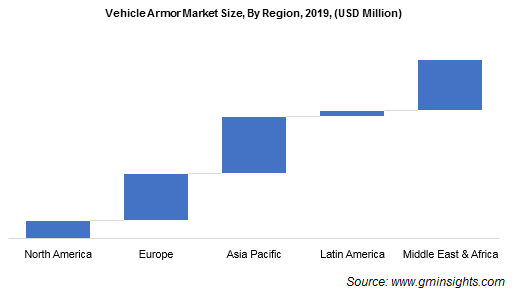

Asia Pacific held around 30% vehicle armor market share in 2019 on account of rising border disputes along with solidification of military capabilities of various countries. Japan’s Ministry of Defense provided a contract to BAE Systems for 30 new assault amphibious vehicles recently. In March 2017, the Royal Thai army ordered armed vehicles from China. In the same year, the Indonesian army procured five new armored personnel carriers from a Ukrainian manufacturer.