Summary

Table of Content

Vehicle Armor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vehicle Armor Market Size

Vehicle Armor Market size valued at USD 6.7 billion in 2019 and will grow at a CAGR of 4.5% between 2020 and 2026. The rising government spending on the defense sector to strengthen armament power will propel the industry growth.

Rising military expenditures will accelerate the pace of procurement of armored vehicles in the upcoming years. The global military expenditure increased by over 7% during 2010 to 2019. Increasing conflicts and unstable political situations will change the course of combat operations. Global terrorism is another major threat faced by many countries, compelling them to strengthen their armaments. Additionally, growing concerns associated with small ballistic arms will generate the need for efficient vehicle armors by land armament sectors.

To get key market trends

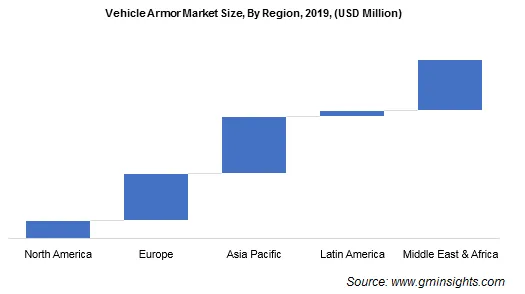

The emergence of political instability within the Middle East will support vehicle armor market demand. The civil war in Syria, violent conditions in Yemen, and surging terrorism activities are driving countries within this region to expand their military capabilities. The procurement of armored vehicles will see an upward growth trajectory backed by strong economic conditions and huge investments. This will help the countries to solidify the land arms sector to modernize inventories and reinforce military power.

Vehicle Armor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2019 |

| Market Size in 2019 | 6.7 Billion (USD) |

| Forecast Period 2020 to 2026 CAGR | 4.5% |

| Market Size in 2026 | 9.1 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The advent of technology will potentially generate many opportunities for the growth of vehicle armors through 2026. The integration of artificial intelligence, virtual training, sensor systems, active protection systems, and survivability equipment will aid in improving the capabilities of armor systems, thereby providing more safety to soldiers.

Moreover, companies are heavily investing in research & development activities to develop lightweight and efficient materials for the development of vehicle armor. This will help in reducing the vehicles’ weight and enhancing their mobility in combat situations.

Vehicle armor industry may face adversity due to limitations faced by vehicle armor manufacturers while entering into new and emerging markets. These manufacturers may find it difficult to get foothold of the market rapidly owing to stringent government regulations, inability to form strong relationship with suppliers, and budget constraints. Such trends may negatively influence the market growth.

Vehicle Armor Market Analysis

Metals material segment captured around 75% vehicle armor market share in 2019 and will continue to dominate the market over 2020-2026 driven by their versatility. Metals have been the traditional choice for armored vehicles since their inception. Steel is the most widely used metal for armor manufacturing, while aluminum, magnesium, and titanium are also used in some cases.

The two major types of steel armor are Rolled homogeneous armor (RHA) and cast homogeneous armor (CHA). Steel possesses good balance of toughness, hardness, and fatigue resistance. It can be easily cut, machined, welded & formed, and it is easily field repairable.

The armored fighting vehicles market is poised to witness more than 4.5% CAGR through 2026 propelled by rising procurement of armored personnel carriers (APC) and mine-resistant ambush protected (MRAP) vehicles. The strong growth of this segment is attributable to the increasing demand for agile, lighter, and flexible vehicles that can provide strategic advantage in battlefields.

Developments associated with ballistic protection, blast protection, and counter-IED will transform the armored fighting vehicles sector in coming few years. Technological progressions related to active protection systems, modular ballistic armor systems, information integration, and active mine protection systems will support vehicle armor market growth.

Learn more about the key segments shaping this market

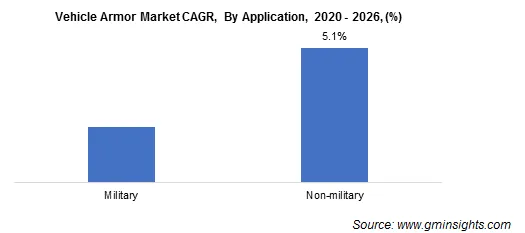

This non-military application is likely to grow at above 5% CAGR from 2020 to 2026. The armored vehicles are majorly used by government officials, diplomats, police forces, etc., for protection against various threats. Nowadays, the demand for armored vehicles is soaring amongst high net worth people, corporate tycoons, and celebrities for safety reasons. The armor reinforcement ranging from bulletproof glass to run-flat tires is being implemented within vehicles to safeguard passengers from all kinds of attacks.

Learn more about the key segments shaping this market

Asia Pacific held around 30% vehicle armor market share in 2019 on account of rising border disputes along with solidification of military capabilities of various countries. Japan’s Ministry of Defense provided a contract to BAE Systems for 30 new assault amphibious vehicles recently. In March 2017, the Royal Thai army ordered armed vehicles from China. In the same year, the Indonesian army procured five new armored personnel carriers from a Ukrainian manufacturer.

Vehicle Armor Market Share

The key vehicle armor industry participants are focusing on product differentiation & development by investing in research & development activities to improve the product capabilities. The manufacturers include

- Kaiser Aluminum

- CoorsTek

- Composhield A/S

- DuPont

- Armormax

- ATEK Defense Systems

- Garanti Kompozit

- Permali

- ASL GRP

- DEW Engineering and Development ULC

- SSAB

- MTL Advanced Ltd.

- Multotec Group

- Plasan Sasa Ltd.

- AMEFO

- MKU Limited

- Tenate Advanced Armor.

This market research report on vehicle armor includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD million from 2016 to 2026, for the following segments:

Market, By Material

Metals

- Ceramics

- Composites

- Others

Market, By Vehicle

Tanks

- Armored fighting vehicles

- Civilian & law enforcement vehicles

- Others

Market, By Application

Military

- Non-military

The above information is provided on a regional and country basis for the following:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Asia Pacific

- China

- India

- Japan

- Indonesia

- South Korea

- LATAM

- Brazil

- Mexico

- MEA

- Saudi Arabia

- Egypt

- Turkey

- South Africa

Frequently Asked Question(FAQ) :

How will metal as a material propel the vehicle armor market growth?

The metal vehicle armor industry accounted for a 75% share in 2019 and is expected to witness substantial growth through 2026.

What attributes will influence the growth of the global vehicle armor industry share from armored fighting vehicles?

The armored fighting vehicles market share is expected to witness 5% CAGR through 2026 due to rising procurement of mine-resistant ambush-protected (MRAP) vehicles and armored personnel carriers.

How is the global vehicle armor market size expected to perform in the Asia Pacific region?

The Asia Pacific vehicle armor industry helps around 30% share in 2019 and will continue to grow due to the rising border disputes and solidification of military capabilities of several countries.

What factors will drive the global vehicle armor market penetration?

The global vehicle armor industry size was valued at USD 6.7 billion in 2019. With increasing government spending on the defense sector to strengthen armament power, the market is expected to grow at 4.5% CAGR through 2026.

Vehicle Armor Market Scope

Related Reports