Summary

Table of Content

Vans Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vans Market Size

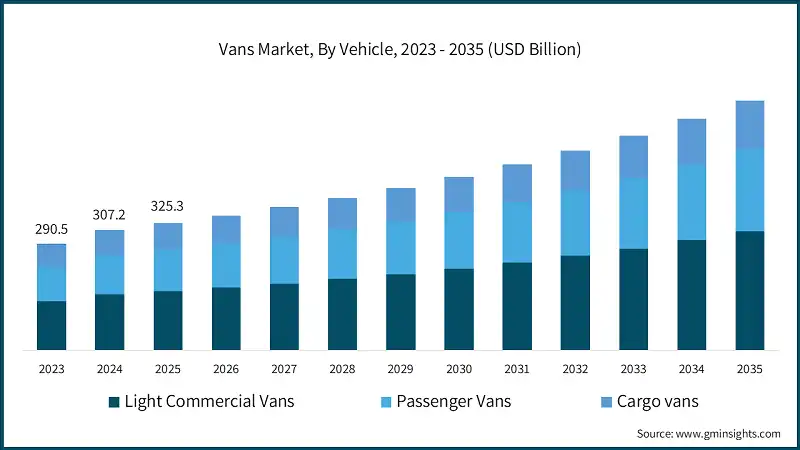

The global vans market size was estimated at USD 325.3 billion in 2025. The market is expected to grow from USD 345.2 billion in 2026 to USD 650.1 billion in 2035, at a CAGR of 7.3% according to latest report published by Global Market Insights Inc.

To get key market trends

The vans market encompasses light commercial vans, passenger vans, and cargo vans designed for diverse applications including logistics, e-commerce, public sector services, healthcare, and hospitality. These vehicles serve as essential transport solutions for businesses and organizations requiring flexible, efficient, and cost-effective mobility.

In 2023, global sales of electric light commercial vehicles (LCVs) surged by over 50%, with their sales share nearing 5% of all LCVs sold, as reported by international energy agency. This electrification momentum is especially evident in last-mile delivery, with industry giants like FedEx, Amazon, and Walmart pledging to shift their fleets to zero-emission vehicles.

Advanced telematics, fleet management software, and connected vehicle technologies are transforming operational efficiency in the van market. Research commissioned by Ford Pro and conducted by the Centre for Economics and Business Research reveals that 26.5% of commercial van operators use vehicle tracking technology. Notably, 40.5% of electric van drivers adopt these technologies, a stark contrast to the 22.6% adoption rate among diesel drivers.

Despite their higher upfront costs, electric vans are becoming the preferred choice for fleets, thanks to their lower operating and maintenance expenses. Research by Ford in five European markets reveals that over a three-year span, operating an electric fleet proves financially advantageous. A sole trader can expect average net savings of EUR 14,000, with figures peaking at EUR 19,000 in France and EUR 11,000 in Germany.

By 2025, vans, including minivans, cargo vans, and passenger vans, will represent 9% of the US vehicle market, with 298.7 million registered vehicles. Growth is driven by e-commerce expansion, fleet electrification mandates, and operational benefits for SMEs.

Vans Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 325.3 Billion |

| Market Size in 2026 | USD 345.2 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.3% |

| Market Size in 2035 | USD 650.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising e-commerce and last-mile delivery demand | Increase demand for cargo and light commercial vans to support fast and efficient urban deliveries. |

| Urbanization and improved infrastructure | Expands the use of vans for urban transport, logistics, and passenger mobility. |

| Shift towards electric and low-emission vans | Accelerates adoption of eco-friendly vans to comply with emission regulations and sustainability goals. |

| Growth of small and medium enterprises (SMEs) | Drives demand cost-effective and flexible vans for business and service operations. |

| Technological advancements in fleet management and safety | Improves operational efficiency, vehicle safety, and real-time monitoring of van fleets. |

| Pitfalls & Challenges | Impact |

| High upfront costs of electric and advanced vans | Increases financial burden on buyers and slows adoption, especially among small businesses and fleet operators. |

| Complex regulations across regions | Creates compliance challenges and delays market entry and cross-border expansion for manufacturers and fleet owners. |

| Opportunities: | Impact |

| Growth in electric van adoption | Increasing demand for sustainable transport solutions drives higher sales of electric vans and related infrastructure. |

| Rising demand from e-commerce deliveries | Expanding last-mile logistics significantly boosts demand for cargo and delivery vans. |

| Expansion in emerging markets | Rapid urban and industrial growth creates new demand opportunities for vans in developing regions. |

| Use of smart fleet management technologies | Real-time tracking, route optimization, and predictive maintenance improve fleet efficiency and operating cost savings. |

| Market Leaders (2025) | |

| Market Leaders |

8% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Europe |

| Emerging countries | India, China, Brazil, Vietnam |

| Future outlook |

|

What are the growth opportunities in this market?

Vans Market Trends

Technological innovations, evolving regulations, and shifts in consumer behavior are reshaping the market. Three key trends are altering the competitive landscape and guiding investment strategies a swift move towards electric propulsion systems, the adoption of advanced connectivity and autonomous driving technologies, and a reorganization of urban logistics networks to enhance last-mile delivery efficiency.

The vans market is rapidly shifting towards electrification, driven by government mandates, cost advantages, and sustainability goals. Major logistics players like FedEx, Amazon, UPS, and DHL are increasingly adopting zero-emission vehicles for their fleets.

International energy agency reports that in 2023, global sales of electric light commercial vehicles surged by over 50%. China led the charge, surpassing 240,000 units sold, while Europe saw a 60% uptick, nearing 150,000 units. Notably, in Korea, the adoption rate of electric LCVs outpaces that of electric passenger cars.

Major markets are ramping up electrification timelines, spurred by regulatory changes. In the UK, the 2023 Vehicle Emissions Trading Schemes Order stipulates that sales of zero-emission vans must surge from 22% in 2024 to a commanding 80% by 2030, as reported by international energy agency.

Advanced telematics, AI-driven route optimization, and connected vehicle technologies are revolutionizing van fleet operations. These innovations are enhancing operational efficiency, bolstering driver safety, and maximizing asset utilization. Today's fleet management systems harness real-time data analytics to refine routing, foresee maintenance needs, track driver behavior, and curtail fuel consumption.

Urban logistics networks have been fundamentally reshaped by the shift of retail towards e-commerce. Vans, now the primary vehicles for last-mile deliveries, navigate frequent stops, dense routes, and the challenges of congested urban centers.

Comprehensive fleet management platforms now integrate vehicle health monitoring, energy management for electric fleets, driver coaching, compliance management, and predictive analytics, as the digitalization trend expands beyond traditional telematics.

Autonomous driving technologies are advancing toward commercial use in controlled environments like warehouse campuses and delivery routes. While fully autonomous systems are years away, ADAS features such as collision warnings, automatic emergency breaking, and lane-keeping assistance are now standard.

Vans Market Analysis

Learn more about the key segments shaping this market

Based on vehicle, the vans market is segmented into light commercial vans, passenger vans, and cargo vans, each designed for specific operational requirements and serving distinct customer segments. The light commercial vans segment dominates the market with 47% share in 2025, and the segment is expected to grow at a CAGR of 7.6% from 2026 to 2035.

- Light commercial vans, with gross vehicle weight ratings ranging from 6,000 to 10,000 pounds, strike an ideal balance between payload capacity, fuel efficiency, and urban maneuverability.

- Major manufacturers, such as Ford with its E-Transit, Mercedes' eSprinter, GM's BrightDrop Zevo, and Rivian's EDV, are rolling out electric platforms tailored for last-mile delivery, signaling a robust electrification trend in the light commercial van segment.

- As reported by international energy agency, the average range of new light commercial vehicles surged by 55% from 2015 to 2023. Notably, 2023's favored models, like the Hyundai Porter and Ford E-Transit, showcased ranges of 210 to 260 kilometers, a significant leap from the roughly 170 kilometers seen in popular models from 2015.

- Vehicle technology innovations, such as Kia and Uber's partnership for last-mile delivery and the B-ON Pelkan electric van for niche commercial use, highlight modular designs with flexible interiors.

- Passenger vans, accounting for 33% of the market, are witnessing robust growth at a 7.4% CAGR from 2026 to 2035. Tailored primarily for human transport, these vans offer seating configurations that accommodate 8 to 15 passengers, contingent on their size classification.

- Passenger vans are used in hospitality (airport shuttles, hotel transport), healthcare (patient transport, medical mobility), public sector (fleet vehicles, public transit), and private applications (family transport, recreation).

- The segment is characterized by emphasis on passenger comfort, safety features, accessibility compliance, and reliability for high-mileage operations.

- Cargo vans segment, holding a 21% market share, are witnessing steady growth at a 6.5% CAGR from 2026 to 2035. Cargo vans are characterized by fully enclosed rear cargo areas prioritizing cargo space over passenger seating, typically featuring no rear windows and reinforced flooring for heavy-duty applications.

- Tradespeople like plumbers, electricians, and HVAC technicians, along with contractors and mobile service businesses, rely on these vehicles. They're also essential for transporting specialized cargo that needs weather protection and security.

- Cargo vans offer superior cargo protection compared to open-bed trucks, enhanced security for tools and equipment, and professional appearance for service businesses.

- Established operator preferences for proven diesel powertrains and a slower adoption of electrification among tradespeople and contractors contribute to the cargo van segment's relatively slower growth, especially when compared to light commercial and passenger vans.

Learn more about the key segments shaping this market

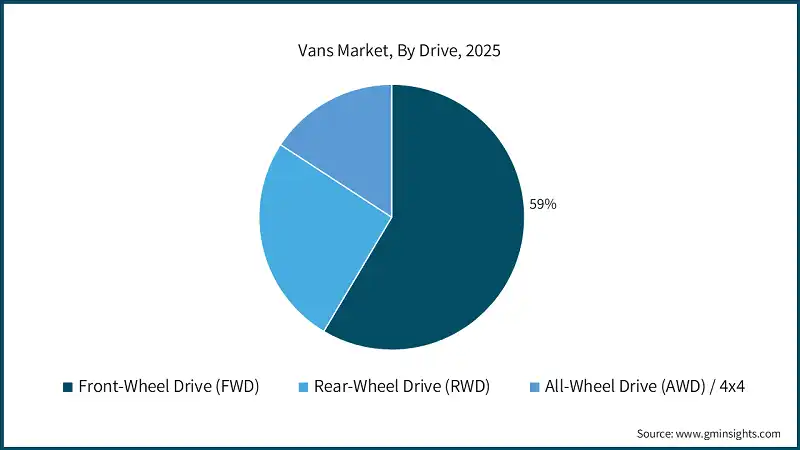

Based on drive, the vans market is divided into front-wheel drive (FWD), rear-wheel drive (RWD), and all-wheel drive (AWD)/4x4 configurations, each offering distinct performance characteristics, cost profiles, and application suitability. Front-wheel drive (FWD) segment dominates with 59% market share in 2025 and is growing at the fastest rate of 7.2% between 2026 and 2035.

- FWD configurations offer benefits such as improved fuel efficiency, lower manufacturing costs, enhanced urban traction, better interior space utilization, and reduced maintenance requirements.

- These attributes make FWD particularly attractive for urban delivery operations, service businesses, and applications prioritizing operational cost efficiency and cargo space maximization.

- FWD's prominence in the vans market underscores the typical operational backdrop for van usage as urban and suburban locales with paved roads, where the benefits of traction take precedence over the need for heavy-duty capabilities.

- Electric powertrains are driving the adoption of front-wheel drive (FWD) in electric vans, offering cost efficiency and better interior space. Manufacturers like Ford (E-Transit), Mercedes (eSprinter), and GM (BrightDrop) are leveraging these advantages.

- According to International energy agency, electric light commercial vehicle sales grew by more than 50% globally in 2023, with China exceeding 240,000 units and Europe reaching almost 150,000 units, predominantly featuring FWD configurations optimized for urban delivery operations.

- Rear-wheel drive vans represented 26% of the market at USD 83.4 billion in 2025, growing at 7.1% CAGR to reach USD 164.4 billion by 2035.

- Heavy-duty applications favor RWD configurations for their superior towing capacity, better payload distribution, enhanced handling under load, and durability in high-mileage commercial operations.

- RWD vans dominate full-size commercial applications including contractor service vans, heavy cargo transport, and applications requiring substantial towing capacity.

- RWD configurations maintain competitive advantages for specific applications despite higher fuel consumption and reduced cargo space compared to FWD alternatives.

- Tradespeople and contractors prefer RWD vans for durability, proven reliability in high-mileage applications, and superior performance when carrying heavy tool loads or towing trailers.

- All-wheel drive and 4x4 vans represented 16% of the market at USD 51.3 billion in 2025, demonstrating the fastest growth among drive type segments at 7.8% CAGR, expanding to USD 106.5 billion by 2035.

- AWD/4x4 configurations cater to specialized needs, offering improved traction in tough weather, off-road capabilities for remote services, winter operations, and a premium vehicle status.

Based on propulsion, the vans market is segmented into ICE, electric and hybrid. The ICE segment dominates with 79% market share in 2025.

- ICE vans dominate due to widespread refueling infrastructure, proven reliability, lower upfront costs, and operator familiarity, reducing training needs.

- Diesel engines dominate full-size and heavy-duty van sales due to their high torque, long range, and strong resale value.

- In 2024, diesel vans in the European Union totaled 1,340,003 units, capturing an 84.5% market share, as reported by ACEA. This strong showing comes even amidst mounting regulatory pressures, underscoring the persistent preference of operators for established diesel technology.

- Yet, the growth of the ICE van market faces hurdles, tightening emissions regulations, the spread of low-emission zones limiting diesel vehicle access in key cities, surging fuel costs affecting operational economics, and corporate pledges towards fleet electrification.

- Electric vans, despite representing only 13% of market value at USD 44.7 billion in 2025, are experiencing exceptional growth at 12.8% CAGR, expanding to USD 149.9 billion by 2035.

- Electric vans are increasingly adopted due to their lower total ownership costs, zero emissions enabling urban access, and reduced maintenance needs, while complying with zero-emission regulations.

- Hybrid powertrains combining internal combustion engines with electric motor assistance, reduce emissions, improve fuel efficiency in urban driving, and offer extended range with lower infrastructure dependency compared to plug-in electric vehicles.

- Hybrid-electric van sales in the EU dropped 4.3% in Q1-Q3 2024, comprising 2% of the market, as operators shift to battery-electric solutions or retain diesel powertrains due to infrastructure concerns.

Based on size, the vans market is divided into compact, mid-size and full-size. The full-size dominate with 57% market share in 2025, and with a CAGR of 6.3% during forecast period.

- Full-size vans offer over 15 cubic meters of cargo space, with gross vehicle weight ratings of 8,500–14,000 pounds and payload capacities up to 4,000 pounds, depending on configuration.

- These vehicles dominate contractor and tradesperson applications, heavy cargo transport, passenger shuttle services requiring 12-15 seat capacity, and mobile workshop configurations.

- The full-size van market, led by Ford, Mercedes, Ram, and Chevrolet, supports extensive upfitting options for applications like refrigerated cargo, wheelchair accessibility, and emergency response vehicles.

- Full-size vans face distinct hurdles in electrification, such as constraints on battery weight and packaging, range needs for regional distribution, and a scarcity of infrastructure for high-power rapid charging.

- For instance, Ford's E-Transit has emerged as the first mainstream full-size electric van in the market. Depending on the configuration, it boasts a cargo volume of up to 487.3 cubic feet, a payload capacity reaching 3,800 pounds, and offers driving ranges between 108 and 126 miles.

- Mid-size vans offer balanced capabilities combining substantial cargo capacity (typically 10-14 cubic meters), manageable dimensions for urban operations, and versatility across diverse applications.

- This segment targets small businesses needing moderate cargo capacity, service businesses balancing storage with maneuverability, and fleet operations seeking standardization.

- Popular mid-size van platforms including Ford Transit Connect, Mercedes Metris/Vito, Ram ProMaster City, and Nissan NV200 demonstrate strong market presence particularly in urban service and delivery applications.

- Electric mid-size vans, such as the Mercedes eVito, Nissan e-NV200, and the soon-to-be-launched Ford E-Transit Connect, are rapidly gaining traction, particularly for last-mile delivery and urban service needs.

- Compact vans serve urban delivery applications requiring exceptional maneuverability, courier and express package delivery, service businesses operating in congested urban centers, and small business transportation.

- These vehicles typically feature cargo volumes of 2-6 cubic meters, car-like driving dynamics, superior fuel efficiency, and parking advantages in dense urban environments.

- The growth of compact vans is driven by rising e-commerce demand for last-mile deliveries, urban congestion favoring smaller vehicles, low emission zones restricting larger vehicles, and cost advantages in fuel and maintenance.

Looking for region specific data?

Asia Pacific region dominated the vans market with a market share of 49% in 2025, which is anticipated to grow at a CAGR of 6.4% during the analysis timeframe. The region benefits from strong manufacturing capabilities in China, rising commercial vehicle demand in India, and expanding logistics and e-commerce activity across Southeast Asian countries.

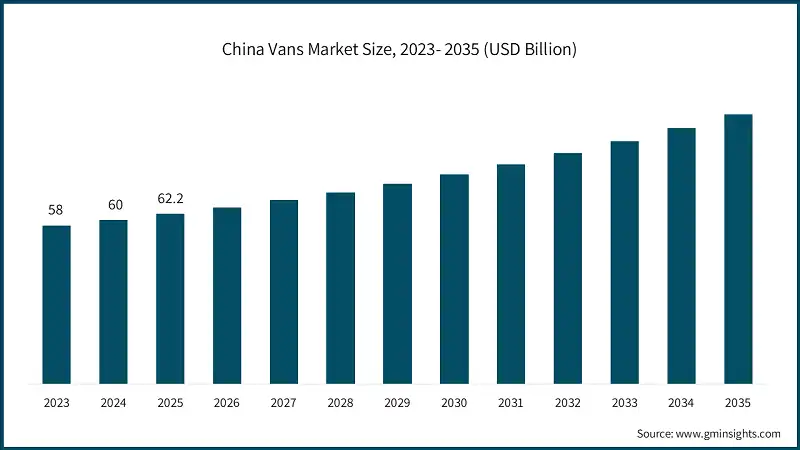

- China leads the Asia Pacific vans market, accounting for 39% of the regional market in 2025, driven by massive commercial vehicle fleet demand, strong domestic manufacturing capabilities, and rapid electrification of light commercial vehicles (LCVs).

- According to International energy agency, China’s electric LCV sales exceeded 450,000 units in 2024, representing over 40% year-over-year growth supported by government incentives and expanding charging infrastructure.

- India represents 31% share of the Asia Pacific vans market in 2025, making it the fastest-growing major market in the region with a projected 7.9% CAGR, reaching USD 105.9 billion by 2035.

- Japan's mature vans market in Asia Pacific relies on vehicle replacement over fleet expansion, with growth limited by aging demographics and stable freight activity.

- South Korea is rapidly emerging as a regional leader in the adoption of electric light commercial vehicles (eLCVs), thanks to a surge in domestic manufacturing and robust government incentive programs.

- Stable construction activities, a demand for mining-related logistics, and a gradual shift towards electrified commercial vehicle fleets bolster the steady growth of the market in Australia and New Zealand (ANZ).

The vans market in China is expected to experience significant and promising growth from 2026 to 2035.

- China's van market is growing rapidly, driven by strong demand in logistics, delivery, and service sectors. It offers diverse models for small businesses and large fleets.

- Government policies, such as incentives for electric commercial vehicles, investments in charging infrastructure, and stricter emission norms, are accelerating van electrification and encouraging businesses to transition their fleets toward low-emission vans.

- China's urban centers, industrial zones, and logistics hubs now boast a comprehensive and accessible charging infrastructure, streamlining operations for electric van fleets.

- Leading manufacturers are scaling production, leveraging domestic supply chains to cut costs, and deploying electric vans with smart fleet management and connectivity features to enhance efficiency.

- China leads the Asia Pacific market, supported by cohesive government policies, advanced infrastructure, and strong domestic manufacturing, making it the region’s largest and fastest-adopting market for electric and low-emission commercial vans.

Europe is the fastest growing region in vans market, which is anticipated to grow at a CAGR of 9.2% during the analysis timeframe.

- Europe's vans market is surging, propelled by strict emissions regulations, mandates for zero-emission vehicles, and robust commitments to corporate sustainability. Germany, the United Kingdom, France, Italy, and Spain stand out as pivotal markets.

- Germany leads the European market with its strong economy, advanced automotive manufacturing, robust logistics infrastructure, and government incentives, driving significant adoption of electric vans.

- With the backing of a growing charging infrastructure and government subsidies, countries like Italy, Spain, and France are rapidly adopting electric vans for urban logistics, deliveries, and commercial activities.

- Policies like the Vehicle Emissions Trading Scheme, which pushes for a swift uptick in zero-emission van sales, alongside bolstered investments in urban charging infrastructure, are fueling the UK's swift embrace of electric vans.

- Europe is witnessing a surge in electrification, with electric vans set to claim a notable market share by 2035, bolstered by regulatory mandates, incentives, and infrastructure advancements.

Germany dominates the Europe vans market, showcasing strong growth potential, with a CAGR of 7.7% from 2026 to 2035.

- Leading OEMs and commercial vehicle manufacturers, such as Mercedes-Benz, Volkswagen, MAN, and Ford, are at the forefront of Germany's van market, spearheading innovations in electric and low-emission vans tailored for urban logistics and commercial applications.

- Government subsidies, charging infrastructure investments, and stricter emission regulations are boosting the adoption of electric and hybrid vans in urban and suburban areas.

- German engineering firms are improving vehicle performance by focusing on battery efficiency, electric drivetrains, and smart fleet management, delivering cost-effective solutions for businesses and logistics operators.

- For instance, in 2024, Mercedes-Benz and Volkswagen collaborated on advanced electric van platforms, enhancing Germany's position as Europe's leading market for electric commercial vehicles.

North America vans market accounted for USD 60.5 billion in 2025 and is anticipated to show growth of 7.6% CAGR over the forecast period.

- Major US cities like New York, Los Angeles, and Washington D.C. are driving demand for electric vans, particularly for urban logistics and fleet operations. This positions North America as a key market for commercial electrification.

- City and federal policies are steering market growth. Incentives for fleet electrification, emission regulations, and infrastructure programs are propelling adoption. However, recent regulatory uncertainties pose short-term planning challenges for fleet operators.

- Leading US manufacturers like Ford, GM, and Rivian are advancing electric van production with a focus on battery technology, telematics, and fleet performance for commercial use.

- Investments in infrastructure and technology are driving the deployment of DC fast chargers, networked charging stations, and telematics systems, enabling real-time fleet monitoring and optimized route planning.

- Canada is emerging as a growth market, driven by zero-emission mandates, government incentives, and cold-weather vehicle technologies. Fleet electrification and alignment with US manufacturing further enhance its potential.

- North America's electric van market is driven by mature logistics networks, high vehicle ownership, and growing e-commerce demand, with electric vans expected to dominate commercial fleets in the next decade.

The US is fastest growing country in North America vans market growing with a CAGR of 7.8% from 2026 to 2035.

- The US leads the North American vans market, driven by rising demand for commercial and electric vans. Companies like FedEx, UPS, and Amazon are expanding electric van fleets in major cities.

- Advanced technologies like telematics, route optimization, and battery-electric drivetrains are being harnessed by US van manufacturers and fleet operators to boost efficiency and cut operational costs.

- Federal and state-level incentives, including electric vehicle tax credits, clean fleet grants, and infrastructure funding, are driving the adoption of electric and low-emission vans in commercial fleets.

- The US ecosystem integrates smart electric vans with software, connectivity, battery R&D, and telematics, while AI-driven tools enhance fleet efficiency.

- Commercial fleet operators are deploying electric vans to meet growing demand for sustainable urban logistics, driven by city-level zero-emission policies and infrastructure support.

Brazil leads the Latin American vans market, exhibiting remarkable growth of 5.2% during the forecast period of 2026 to 2035.

- In Brazil, urban logistics, delivery services, and passenger transport in cities such as São Paulo, Rio de Janeiro, and Brasília are fueling a steady growth in the demand for commercial and light vans.

- Governments are pushing for faster van electrification, rolling out purchase incentives, bolstering charging infrastructure, and championing the adoption of low-emission vehicles in key urban areas.

- Brazilian OEMs, fleet operators, and startups are collaborating with global manufacturers to develop cost-effective electric vans and solutions for last-mile delivery and urban logistics.

- Charging networks, battery support systems, and fleet management technologies are expanding, boosting the efficiency and practicality of electric and hybrid vans in commercial, service, and passenger sectors.

UAE to experience substantial growth in the Middle East and Africa vans market in 2025.

- Government initiatives, including Dubai's "Smart Mobility 2030" and Abu Dhabi's e-mobility strategies, are rapidly expanding the UAE's van market, particularly fueling the demand for electric and low-emission commercial vans.

- Urban logistics, delivery, and service operations are increasingly adopting electric vans, driven by government funding, smart city initiatives, and an expanding charging infrastructure.

- In Dubai and Abu Dhabi, electric vans are being deployed by global and regional OEMs, fleet operators, and startups, featuring advanced models designed specifically for commercial and last-mile transportation.

- Smart fleet management, telematics, and innovative charging solutions are boosting operational efficiency, positioning the UAE as the Middle East's premier hub for sustainable commercial vehicles.

- Supportive regulations, incentives, and urban planning initiatives across GCC countries are driving the adoption of zero-emission and sustainable vans for commercial and public transportation needs.

Vans Market Share

- The top 7 companies in the vans industry are Mercedes, Stellantis, Ford Motor, Toyota Motor, General Motors, Renault, and Nissan contributed around 46% of the market in 2025.

- Mercedes, leveraging its premium positioning strategy, underscores its commitment to build quality and advanced safety technologies. The brand also boasts a comprehensive service network and has established European market leadership, particularly with its Sprinter and Vito platforms.

- Stellantis, born from the merger of Fiat Chrysler Automobiles and PSA Group, is capitalizing on a diverse brand portfolio. This includes platforms like Ram ProMaster, Fiat Ducato, Peugeot Boxer, and Citroën Jumper, all of which share common architectures across various markets.

- Ford Motor dominates the global full-size commercial van segment with its Ford Transit platform, diverse configurations, and the market-leading E-Transit electric van, renowned for durability and cost efficiency among fleet operators.

- Toyota is expanding its commercial vehicle portfolio, offering light, medium, and heavy-duty options. Its HiAce dominates in Asia Pacific and emerging markets, while the ProAce, developed with Stellantis, serves Europe. Toyota also leverages its powertrain expertise for hybrid and electric models.

- General Motors dominates the North American full-size van segment with Chevrolet Express and GMC Savana, leveraging strong fleet customer ties and early entry into electric delivery vans with BrightDrop Zevo 600 and Zevo 400 for last-mile e-commerce deliveries.

- Renault targets the European market, using its Master, Trafic, and Kangoo platforms to cater to the full-size, mid-size, and compact van segments, respectively.

- Nissan maintains a strong global presence with the NV series in North America, the NV200 achieving fleet adoption, and the e-NV200 showcasing its focus on electrification. Its alliance with Renault supports platform sharing and cost efficiency.

Vans Market Companies

Major players operating in the vans industry are:

- Ford Motor

- General Motors

- Hyundai Motor

- Mercedes

- Nissan

- Renault

- SAIC Motor

- Stellantis

- Tata Motors

- Toyota Motor

- Ford's E-Transit and GM's BrightDrop EV600 are leading the charge in North America's electric van market. Both automakers harness cutting-edge battery technologies, fleet management solutions, and telematics to enhance urban logistics, streamline last-mile deliveries, and boost commercial operations.

- Hyundai Motor and Mercedes-Benz are prioritizing high-performance electric vans, such as the Hyundai Staria EV and the Mercedes eSprinter. These automakers are embedding smart connectivity, energy-efficient drivetrains, and fleet management solutions, all aimed at enhancing urban transportation and servicing fleets.

- With models like the e-NV200 and Kangoo Z.E., Nissan and Renault are broadening their range of electric light commercial vehicles. These models focus on compact cargo solutions, leverage IoT-enabled telematics, and prioritize efficient battery management, all tailored for last-mile logistics.

- Tata Motors and Toyota Motor are enhancing electric and hybrid van adoption in Asia and global markets through reliable, telematics-enabled fleets, efficient powertrains, and compact designs tailored for urban logistics and commercial applications.

Vans Industry News

- In January 2025, Mercedes-Benz unveiled the next-generation eSprinter electric van at CES, featuring a 280-mile range, 80% fast-charging in under 30 minutes, and advanced driver assistance systems. Targeting a late 2025 North American launch, it will compete with Ford E-Transit and GM BrightDrop for fleet electrification.

- In December 2024, Ford announced a USD 2 billion investment to expand E-Transit production, increasing capacity to 90,000 units annually by 2027. The E-Transit leads North America's electric commercial vehicle market with over 60% share.

- In October 2024, Walmart committed to deploying 5,000 Zevo 600 electric delivery vans from GM's BrightDrop by 2027, expanding BrightDrop's customer base. This supports Walmart's goal of achieving zero-emissions logistics globally by 2040.

- In August 2024, Mullen Automotive launched the bizEV lease program for its Mullen ONE, a Class 1 electric cargo van. This initiative aims to facilitate the transition to electric vehicles (EVs) for individuals, small businesses, and fleets by offering a flexible and affordable leasing option.

The vans market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Bn) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Vehicle

- Light commercial vans

- Passenger vans

- Cargo vans

Market, By Propulsion

- ICE

- Electric

- Hybrid

Market, By Size

- Compact

- Mid-size

- Full-size

Market, By Drive

- Front-wheel drive (FWD)

- Rear-wheel drive (RWD)

- All-wheel drive (AWD) / 4x4

Market, By End Use

- Logistics & transportation

- Ecommerce & retail

- Public sector

- Healthcare

- Hospitality

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Singapore

- Thailand

- Indonesia

- Vietnam

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the vans industry?

Key players include Ford Motor, General Motors, Hyundai Motor, Mercedes, Nissan, Renault, SAIC Motor, Stellantis, Tata Motors, and Toyota Motor.

What are the upcoming trends in the vans market?

Electric propulsion, AI-enabled fleet management, redesigned urban last-mile networks, and controlled-environment autonomous driving are key trends.

What is the growth outlook for the full-size vans segment?

The full-size vans segment held a 57% market share in 2025 and is anticipated to showcase around 6.3% CAGR till 2035.

Which region leads the vans sector?

The Asia Pacific region dominated the vans market with a 49% market share in 2025. The region is anticipated to grow at a CAGR of 6.4% during the analysis timeframe.

What was the valuation of the front-wheel drive (FWD) segment in 2025?

The front-wheel drive (FWD) segment accounted for 59% of the market share in 2025 and is set to expand at the fastest rate of 7.2% between 2026 and 2035.

What is the expected size of the vans industry in 2026?

The market size is projected to reach USD 345.2 billion in 2026.

What was the market share of the light commercial vans segment in 2025?

The light commercial vans segment held a 47% market share in 2025 and is expected to grow at a CAGR of 7.6% from 2026 to 2035.

What was the market size of the vans in 2025?

The market size was USD 325.3 billion in 2025, with a CAGR of 7.3% expected through 2035. The growth is driven by electrification, advanced connectivity technologies, and the expansion of urban logistics networks.

What is the projected value of the vans market by 2035?

The market is poised to reach USD 650.1 billion by 2035, fueled by the adoption of electric vehicles, AI-driven fleet management systems, and increasing e-commerce activities.

Vans Market Scope

Related Reports