Summary

Table of Content

Vacuum Pump Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Vacuum Pump Market Size

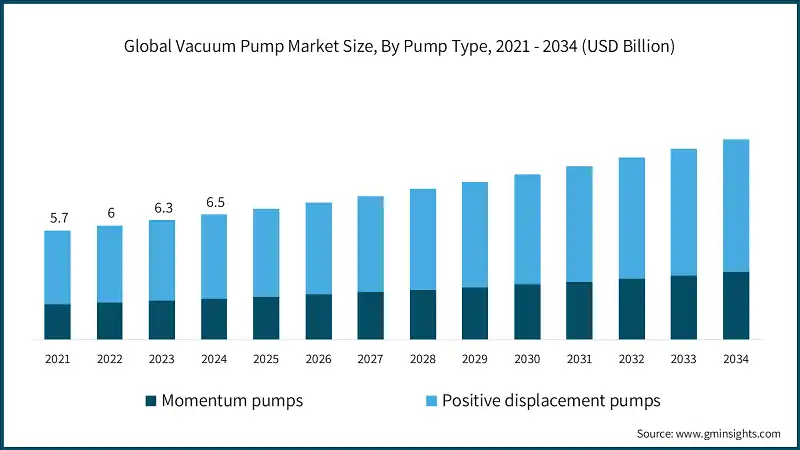

According to a recent study by Global Market Insights Inc., the global vacuum pump market was estimated at USD 6.5 billion in 2024. The market is expected to grow from USD 6.9 billion in 2025 to USD 10.5 billion in 2034, at a CAGR of 4.8%.

To get key market trends

- The vacuum pump market is growing with rising demand from industries such as manufacturing, healthcare, chemical processing, electronics and semiconductor industry. The growth of electronics and semiconductor industry is driving the demand for specialized vacuum solutions.

- Global sales in the semiconductor sector are expected to rise to USD 588.4 billion in 2024, as per the 2023 Semiconductor Industry Forecast report by the World Semiconductor Trade Statistics (WSTS). Besides that, it will witness a further push to USD 654.7 billion in 2025. Expansion in the semiconductor sector is the key driver behind the growth in the vacuum pump market.

- In 2023, United States semiconductor companies held 50.2% of semiconductor market share across all countries, the highest among all countries. The fables and traditional players invested a total of USD 107.5 billion in capital expenditures and research and development (R&D).

- This growth is naturally propelled by artificial intelligence, 5G infrastructure rollouts, and Internet of Things use cases that need leading-edge semiconductor manufacturing processes.

- The healthcare sector is one of the major end-users of vacuum pumps, especially in sterilization, medical suction units, and diagnostic purposes. The growth in health infrastructure investments and the rise in operations worldwide are the reasons why there has been a growing demand for vacuum pumps in this sector.

- The electronics sector is also witnessing strong growth, propel by increasing production of semiconductors and electronic components, which use vacuum pumps in operations such as coating, etching, and deposition.

- Asia-Pacific is expected to control the market for vacuum pumps throughout the forecast period due to intense industrialization, urbanization, and rising manufacturing plant growth in China, India, and Japan. The established strong presence in the automotive and electronics sectors across the region also stimulates market growth. North America and Europe are also expected to witness consistent growth, stimulated by technological advancements and rising applications of vacuum pumps.

- US tariffs are hastening China's localization drive, with 50–60% semiconductor independence in 2030 in a market that represents 42% of the world's equipment spend and 30% of the backend capacity.

- In 2024, China represented 42% of worldwide semiconductor equipment expenditure, a global peak, and grew 35% y/y, representing 30% of worldwide capacity in back-end assembly, packaging, and test. Drivers of structure like AI adoption, data localization, and cloud growth continue to underpin demand in the longer term.

- The market is confronted with high initial investment and maintenance costs in connection with vacuum pump systems. In spite of these challenges, continued research and development activities focused on further enhancing the efficacy and longevity of vacuum pumps are expected to be well-earning for the market participants.

Vacuum Pump Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 6.5 Billion |

| Market Size in 2025 | USD 6.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.8% |

| Market Size in 2034 | USD 10.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| The increasing adoption of vacuum pumps in industries | The increasing adoption of vacuum pumps in industries such as semiconductors, healthcare, and chemical processing is driving market growth |

| Advancements in technology | Advancements in technology are enabling the development of more efficient and durable vacuum pumps, enhancing their adoption across various applications. |

| Pitfalls & Challenges | Impact |

| High initial costs and maintenance expenses | High initial costs and maintenance expenses associated with vacuum pumps pose significant challenges to market growth. |

| Lack of skilled professionals | The lack of skilled professionals to operate and maintain advanced vacuum pump systems can hinder their adoption. |

| Opportunities: | Impact |

| Growing focus on renewable energy | The growing focus on renewable energy and the increasing use of vacuum pumps in solar panel manufacturing present lucrative opportunities for market players. |

| Expansion of industries in emerging economies | The expansion of industries in emerging economies and the rising demand for vacuum pumps in pharmaceutical and food processing sectors offer significant growth potential. |

| Market Leaders (2024) | |

| Market Leaders |

3.9% market share |

| Top Players |

Collective market share in 2024 is 11% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Germany, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Vacuum Pump Market Trends

- The vacuum pump sector has experienced a fundamental shift towards digitalization, with vendors increasingly integrating IoT connectivity, predictive maintenance capabilities, and AI-driven optimization platforms into their products. This is the notable change from classic hardware-driven business models to service-enhanced solutions with ongoing value to the customer.

- The development towards oil-free vacuum technology has changing at a fast pace with the stringent requirements against contamination in drug and semiconductor production. Busch TORRI BD series is a pointer to such technological advancement with power-saving operation that is specifically designed for clean room application.

- Sustainability requirements and environmental regulations have similarly prompted the adoption of oil-free technology, which is environmentally friendly with lower environmental footprint and no oil disposal issues.

- The transition to next-generation semiconductor process will put unprecedented technical demands on vacuum systems, ultra-high vacuum capability standard instead of upgrade features.

- GAA nodes logic/foundry budget spends should represent over 40% of all wafers fab equipment expenditure by 2027, so vacuum systems with tighter contamination control and process stability will be needed.

- Another prominent trend in the vacuum pump market is energy-efficient design. New-generation vacuum pumps are being formulated to provide comparable or superior performance at reduced energy consumption levels. This assists organizations in aiding environmental sustainability goals and saving significant costs in the long run.

- Levels of noise reduction being decreased is another major trend. Noiseless models are on the rise in sensitive sectors such as labs and food processing. Quiet vacuum pumps enhance employees' comfort in addition to enjoying optimal equipment lifespan through minimizing unnecessary noise and vibration on the manufacturing floor.

- Sustainability concepts range over a wide range of issues beyond simple energy saving, from product design during the manufacturing process through to maintenance regimes. Vacuum pumps are leading to the revolution. Future pumps, with style grabbing attention in carbon footprint reduction, with lower energy consumption, and longer lifespan, are a key component for green production objectives.

- Data analysis goes beyond being a failure prevention; it also facilitates process optimization. Management of real-time and past data simplifies the determination of the time when pumps are efficient or where they consume excess energy.

- This enables companies to decrease the consumption of energy while boosting overall efficiency. Vacuum pumps are no longer supporting equipment due to these Industry 4.0 benefits.

Vacuum Pump Market Analysis

Learn more about the key segments shaping this market

Based on the pump type, the market is divided into momentum pumps and positive displacement pumps. The positive displacement pumps dominated the market generating revenue of USD 4.4 billion in 2024 and is projected to grow at a CAGR of 4.7% during 2025 to 2034.

- Positive displacement pumps are widely used in different industries like oil and gas, food and beverages, and water treatment, where precise flow control and capacity to pump viscous liquids are required.

- The momentum pumps projected to witness about 5.1% CAGR during 2025 to 2034. Technological innovations, including the integration of smart monitoring systems and IoT, are increasing the reliability and efficiency of operation of these pumps further.

- Increased need for miniaturized electronics and growth in the semiconductor market is fueling the use of momentum pumps increasingly. Furthermore, the advancements in technology in pumps, including increased efficiency and reduced maintenance needs, are making them more appealing in different end-user markets.

Learn more about the key segments shaping this market

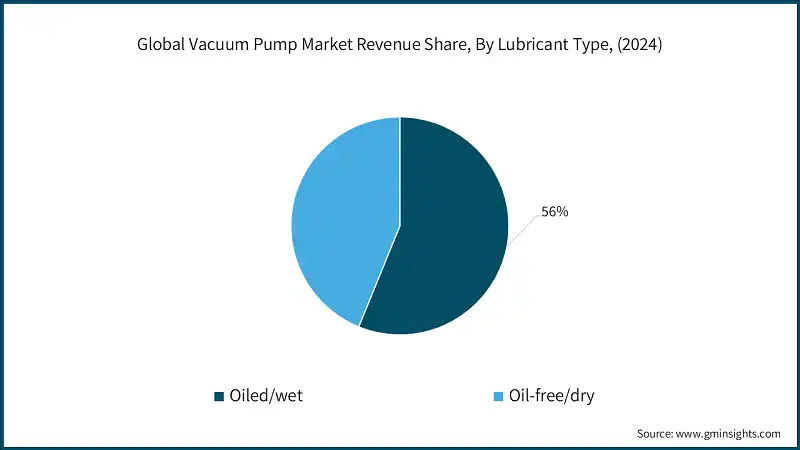

Based on lubricant type, the vacuum pump market is segmented into oiled/wet and oil-free/dry. The oiled/wet segment dominates the market with 56% market share and is expected to grow at a CAGR of 4.4% from 2025 to 2034.

- Oiled/wet vacuum pumps are favored because they allow for high-capacity operation and efficiency in the ability to sustain deeper vacuum levels than oil-free varieties. Environmentalism and disposal of oil and emissions regulations can be a growth restraint to the segment.

- The oil-free/dry projected to witness significant growth at a CAGR of 5.3% during the forecast period. The growth in dry/vacuum pump oil-free is due to the reason that industries such as food and beverages, drugs, and electronics manufacturing need extremely clean and contamination-free vacuum systems.

- Increased utilization of green technology and the quest for eco-friendly industrial processes continues to boost demand for oil-free vacuum pumps.

Based on end user industry, the vacuum pump market is segmented into electronics and semiconductor industry, pharmaceutical industry, chemical and petrochemical industry, oil and gas industry, food and beverages industry, others. In 2024, the electronics and semiconductor industry segment dominate the market and is expected to grow at a CAGR of 5.2% from 2025 to 2034.

- The most notable growth sector is the semiconductor and electronics industry, radically transformed by the USD 280 billion total investment under the CHIPS and Science Act, USD 52.7 billion of which is for direct semiconductor manufacturing.

- The European Chips Act, funded by USD 50 billion in public and private capital, will aim to double Europe's share of the world's production of semiconductors to 20% by 2030, creating enormous demand for advanced dry vacuum systems that will be required in manufacturing facilities.

- The pharmaceutical industry segment is witnessing tremendous growth all around the globe. India is generating humongous demand for sanitary equipment for manufacture, with the Indian nation's pharmaceutical industries catering to global markets through generic drug exports and API production necessitating colossal clean room space and vacuum systems free of contamination.

Looking for region specific data?

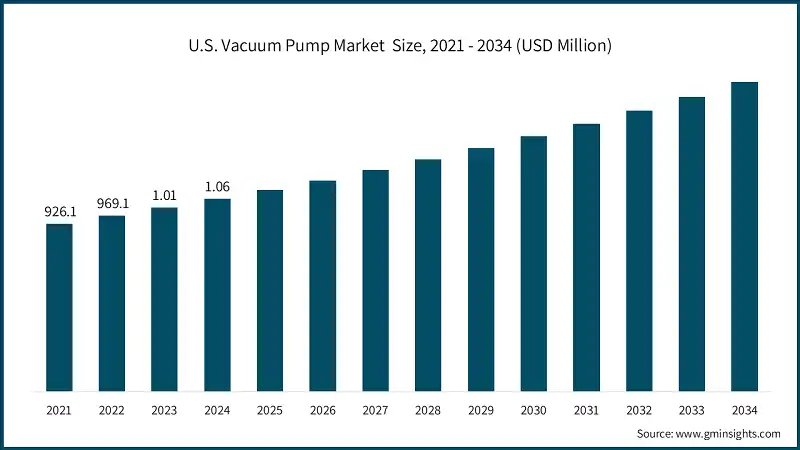

In terms of country, the United States led the 7% revenue share of the North American vacuum pump market with USD 1.06 billion revenue in 2024.

- The growth of the U.S. market is driven mainly by the largest semiconductor investment in U.S. history through the CHIPS Act and full-spectrum industrial policy support to key manufacturing sectors.

- The scale of economy benefits from the largest industry base in North America, which generates demand volumes that justify high investments in manufacturing and cutting-edge technology innovation.

The Europe vacuum pump market was valued at USD 1.6 billion in 2024 and is projected to grow at a CAGR of 4.3% between 2025 and 2034.

- Pharma is Europe's fastest and most reliable growth sector, fueled by the global lead of Europe in pharmaceutical research and manufacture.

- Europe's largest chemical sector, which is German, is being transformed with the need to become climate-neutral by 2050, which entails USD 51 billion worth of investment in high-end manufacturing equipment and vacuum systems.

The Asia Pacific vacuum pump market was valued at USD 2.8 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034.

- The electronics and semiconductor sectors are the fastest-growing sector in Asia-Pacific, fundamentally driven by the region's role as the electronics manufacturing and semiconductor manufacturing hub of the world.

- US tariffs are driving China's localization strategy, chip independence to reach 50–60% by 2030 in a market that represents 42% of worldwide equipment spending and 30% of backend capability.

- China spent 42% of worldwide semiconductor equipment spending in 2024, the world's highest, with 35% y/y growth, and also 30% of global capacity in back-end assembly, packaging, and testing. Structural drivers like AI adoption, data localization, and cloud growth continue to propel long-term demand.

The Middle East and Africa vacuum pump market was valued at USD 416.4 million in 2024 and is projected to grow at a CAGR of 4% between 2025 and 2034.

- Saudi Arabia boasts the largest Middle East & Africa vacuum pump market due to the vast oil and gas activities in the nation along with its vision of economic diversification under Vision 2030.

- The nation's petrochemical business dominated by SABIC generates further demand for vacuum systems across various petrochemical process applications.

Vacuum Pump Market Share

- The top 5 companies in the vacuum pump market are Atlas Copco, Becker Vacuum Pumps, Ebara Corporation, ULVAC, Busch Vacuum Solutions collectively hold a share of 11% in the market.

- These companies continue to acquire and merge with others, expand facilities, and make various collaborations to increase their product offerings, access customer bases, and secure their market positions.

- Atlas Copco is gaining market share through its global leadership and product diversity. Atlas Copco emphasizes ongoing innovation, providing energy-saving and sustainable vacuum pump solutions to every industry. Its strategic acquisitions and alliances further reinforce its market leadership.

- Becker Vacuum Pumps is increasing market share by focusing on high-quality, long-lasting, and customized vacuum pump solutions. The company competes in special applications in healthcare, packaging, and printing industries where precision and reliability are critical. Becker's customer-specific solution approach and capacity to accommodate unique operation requirements differentiate it from others.

- Ebara Corporation is expanding its market base by leveraging its deep experience in high-tech engineering and advanced manufacturing. The company provides an extensive portfolio of vacuum pumps suitable for high-performance industries such as electronics, chemicals, and semiconductors. Ebara's emphasis on precision engineering and technological advancements provides more quality and reliability products. The company also invests in creating its global presence through partnerships and local manufacturing plants.

Vacuum Pump Market Companies

Major players operating in the vacuum pump industry are:

- Aerzener

- Agilent

- Atlas Copco

- Becker Vacuum Pumps

- Busch Vacuum Solutions

- Circutec

- Ebara

- Elmo Rietschle

- Flowserve

- Ingersoll Rand

- Kashiyama

- Kirloskar Brothers

- Korting Hannover

- Schmalz Group

- ULVAC

To improve the product and market share key players are constantly investing in technological activities and are also entering into partnerships to provide improved and better solutions for the customers. These investments are benefiting both companies and customers as they help develop and offer solutions as per the changing technological trends and thus the customer requirements.

Atlas Copco, an industrial vacuum technology company, provides an integrated range of oil-free and energy-saving vacuum pumps. The product range of the company spans the technologies of claw, screw, and rotary vane and is used across multiple industries like electronics, food packaging, pharmaceuticals, plastics, and woodworking. The company is a key player in point-of-use as well as centralized vacuum systems, which are utilized to enhance process reliability, reduce noise levels, and enhance energy efficiency.

Flowserve is a multinational corporation that operates in the vacuum pump business. Flowserve, by its wholly owned subsidiary SIHI Group, delivers high-tech vacuum pumps to diverse industries. These are designed for clean, oil-free operation and deliver mission-critical industries like semiconductor manufacturing, pharmaceutical, and chemical processing.

Ingersoll Rand is an industrial technology global company providing vacuum pumps through its subsidiaries like Nash, Tuthill Pump Group and Ingersoll rand. They provide oil and oil-free vacuum solutions that can withstand the harsh conditions of industries like manufacturing, healthcare, food processing, and electronics. For its engineering prowess, Ingersoll Rand provides dry vacuum pumps that are dependable, energy-saving, and low-maintenance, making them well-suited for continuous operations.

Vacuum Pump Industry News

- In July 2025, Busch Vacuum Solutions has introduced the air-cooled version of its COBRA NC 2500 C dry screw vacuum pump, recognized as the largest dry and air-cooled vacuum pump globally. This new model includes a standard electric water pump across all COBRA NC 2500 C units and features an air/water radiator equipped with two high-efficiency electric fans.

- In January 2025, Agilent Technologies launched the Agilent IDP-35 and IDP-45 dry scroll pumps, designed to provide quiet, efficient, and oil-free vacuum solutions for applications requiring higher pumping capacity. Consistent with the high standards of Agilent's IDP scroll pump series, the IDP-35 and IDP-45 offer significant benefits, making them ideal for applications needing increased capacity without the limitations of oil-sealed pumps.

- In December 2024, in a significant development for the industrial vacuum solutions market, Ingersoll Rand acquired Toshniwal Vacuum, formerly the vacuum division of Toshniwal Instruments. This acquisition marks a transformative phase for Toshniwal Vacuum, particularly in the Indian and subcontinent markets.

- In August 2023, Flowserve Corporation announced the release of the SIHI Boost Ultra PLUS dry-running vacuum pump. This new unit is designed to reduce cycle times for batch processes by up to 50% or more. These improvements are achieved through enhanced cooling, upgraded materials to handle high-load scenarios, and an innovative gap distribution strategy.

The vacuum pump research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Pump Type

- Momentum pumps

- Radial vacuum pump

- Axial vacuum pump

- Mixed vacuum pump

- Others (regenerative blower vacuum pump etc.)

- Positive displacement pumps

- Liquid ring vacuum pump

- Gear vacuum pump

- Rotary vane vacuum pump

- Piston vacuum pump

- Diaphragm vacuum pump

- Others (plunger vacuum pump etc.)

Market, By Lubricant Types

- Oiled/wet

- Oil-free/dry

Market, By Configuration

- Single stage

- Multistage

Market, By Capacity

- Small capacity (below 500 m³/h)

- Medium capacity (500-1,000 m³/h)

- Large capacity (1,000-5,000 m³/h)

- Extra-large capacity (above 5,000 m³/h)

Market, By End Use Industry

- Electronics and semiconductor industry

- Pharmaceutical industry

- Chemical and petrochemical industry

- Oil and gas industry

- Food and beverages industry

- Others (power industry, aerospace etc.)

Market, By Distribution Channel

- Direct sales

- Indirect sales

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What was the market share of the oiled/wet lubricant segment in 2024?

The oiled/wet segment dominated with 56% market share and is expected to grow at a CAGR of 4.4% from 2025 to 2034.

How much revenue did the positive displacement pumps segment generate in 2024?

Positive displacement pumps generated USD 4.4 billion in 2024, dominating the market and projected to grow at a CAGR of 4.7% during 2025 to 2034.

What is the current vacuum pump market size in 2025?

The market size is projected to reach USD 6.9 billion in 2025.

What is the market size of the vacuum pump industry in 2024?

The market size was USD 6.5 billion in 2024, with a CAGR of 4.8% expected through 2034 driven by demand from manufacturing, healthcare, chemical, electronics, and semiconductor industries.

What is the projected value of the vacuum pump market by 2034?

The vacuum pump market is expected to reach USD 10.5 billion by 2034, propelled by semiconductor expansion, healthcare infrastructure investments, and technological advancements in vacuum solutions.

What is the growth outlook for oil-free/dry vacuum pumps from 2025 to 2034?

Oil-free/dry pumps are projected to grow at a 5.3% CAGR through 2034, due to demand from food and beverages, pharmaceuticals, and electronics requiring contamination-free vacuum systems.

Which region leads the vacuum pump market?

Asia Pacific held the largest market share with USD 2.8 billion in 2024 and is projected to grow at 5.4% CAGR through 2034, driven by intense industrialization and semiconductor manufacturing expansion.

What are the upcoming trends in the vacuum pump market?

Key trends include digitalization with IoT connectivity, shift toward oil-free technology, energy-efficient designs, noise reduction, sustainability focus, and Industry 4.0 integration for predictive maintenance.

Who are the key players in the vacuum pump market?

Key players include Atlas Copco, Becker Vacuum Pumps, Ebara Corporation, ULVAC, Busch Vacuum Solutions, Aerzener, Agilent, Circutec, Elmo Rietschle, Flowserve, Ingersoll Rand, Kashiyama, Kirloskar Brothers, Korting Hannover, and Schmalz Group.

Vacuum Pump Market Scope

Related Reports