Summary

Table of Content

UV LED Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

UV LED Market Size

The global UV LED market was valued at USD 1.6 billion in 2025 with a volume of 173.8 thousand units. The market is expected to grow from USD 1.9 billion in 2026 to USD 4.6 billion by 2031 and USD 12.4 billion by 2035 with a volume of 1220.8 thousand units, growing at a value CAGR of 23.5% during the forecast period of 2026-2035.

To get key market trends

The UV LED market is experiencing rapid growth due to regulatory push from mercury and increasing inclination towards LED performance in controllability, energy savings, and system design flexibility. The market shows demand attributing to spanning disinfection, curing, and analytical use cases where LED’s instant switching and narrowband emission translate into tangible process.

Additionally the market is positively impacted by environmental and regulatory transitions resulting in increased adoption. For instance, in Europe, the EU revised its Mercury Regulation by prohibits manufacturing, importing, and exporting mercury?containing lamps from late 2026, implying the shift toward mercury?free alternatives. This compliance?aligned reasons to standardize LEDs across facilities makes the consumers to adopt UV LED.

The adoption of UV LED market is further increased by technology advancements in the UV?C LED wall?plug that increases the overall efficiency. Along with it, the packaging and thermal design advances such as three?pad flip?chip COB, are reducing junction temperatures in simulations, directly improving lifetime and stability that are essential for municipal and industrial duty cycles.

In 2025, North America accounted for 38.8% of the UV LED market. The growing healthcare and municipal adoption, EPA?aligned device frameworks, and ready integrator networks continue to spur rapid growth in the UV LED market in the North America.

UV LED Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.6 Billion |

| Market Size in 2026 | USD 1.9 Billion |

| Forecast Period 2026–2035 CAGR | 23.5% |

| Market Size in 2035 | USD 12.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Structural surge in disinfection demand | Supports 25% growth as disinfection demand elevates UV?C LED uptake across healthcare and water infrastructure. |

| Environmental and regulatory transition | Adds up to 22% growth as regulatory bans accelerate mercury?free procurement across regions. |

| Industrial efficiency and precision | Supports a 18% growth in the market, fueled by Process precision and energy savings anchor LED curing adoption. |

| Manufacturing ecosystem maturation | Adds 15% growth as advancements in chip design, packaging, and thermal management improve UV LED performance and reliability. |

| Expanding healthcare and life sciences applications | Expands the market by around 20%, as growing healthcare infrastructure, infection control requirements, and demand for compact, non-toxic light sources are strengthening UV LED penetration in clinical and research environments. |

| Pitfalls & Challenges | Impact |

| Cost-to-performance gap in high-power applications | Restrains market growth as UV LEDs compared to conventional mercury lamps systems demands greater initial costs due to more advanced thermal management, packaging, and power electronics, limiting adoption among small and mid-scale users. |

| Validation, standardization, and system integration hurdles | Limits growth as UV LED systems in water and healthcare applications must meet rigorous performance, safety, and regulatory requirements. Slow standardization, lengthy certifying, and complicated system integration limit UV LED systems in large-scale adoption and commercialization across industries. |

| Opportunities: | Impact |

| Integration of UV LEDs with smart and connected systems | Presents significant growth potential by combining UV LEDs in with IoT and control systems provide more efficient system operation, pathogen inactivation, and regulatory control. |

| Expansion of compact, portable, and consumer-grade UV LED devices | Offers opportunity for portable UV LED devices like handheld water purifier and sanitizers in the field of personal use, healthcare, travel. |

| Market Leaders (2025) | |

| Market Leaders |

12.9% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | North America |

| Emerging countries | US, China, India, Japan, Germany |

| Future outlook |

|

What are the growth opportunities in this market?

UV LED Market Trends

- UV?C LED platforms are now validated for municipal drinking water and wastewater resulting in increased adoption among municipal buyers between 2025 and 2032. It expands the market’s addressable base in regulated environments with recurring retrofit waves owing to have a mercury?free alternative that meets the highest bar for pathogen inactivation, including chlorine?resistant organisms.

- Regulations related to mercury replacement are gaining acceleration among the countries globally. The trend started gaining traction in 2022 and is expected to be implemented in full effect till 2030 as regulatory requirements require a gradual rollout. This will result in procurement policies being aligned to mercury?free defaults, and total cost of ownership (TCO) to tip further as it leads to energy and maintenance savings.

- Demand for UV-A LED curing in printing, coatings, and adhesives is expanding as manufacturers seek faster, lower-heat processing. This need is projected to strengthen through 2030, bolstering printing and electronics production efficiency, lowering operational costs, and capturing larger industrial market share as manufacturers shift toward mercury-free, compact LED systems.

UV LED Market Analysis

Learn more about the key segments shaping this market

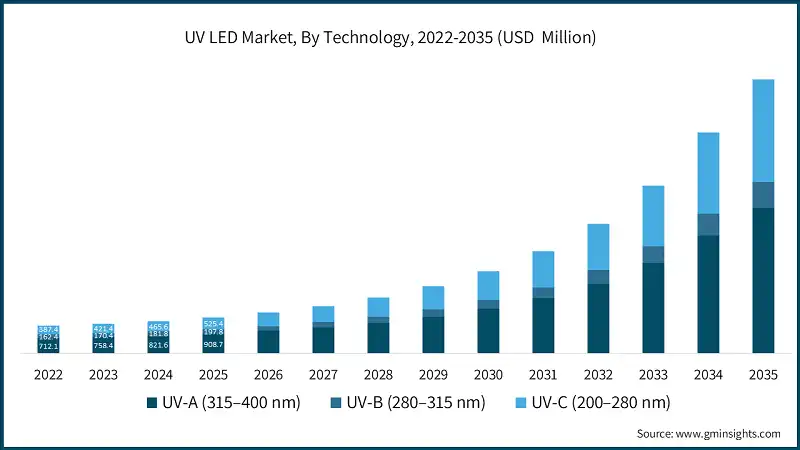

Based on technology, the market is segmented into UV-A (315–400 nm), UV-B (280–315 nm) and UV-C (200–280 nm).

- The UV-A (315–400 nm) segment accounted for 55.7% of the market in 2025 due to its extensive applications in curing made possible by the matured InGaN processes and narrowband emissions in the 365–405nm spectrum that promotes instantaneous polymerization and considerably lowers the thermal load in printing and electronics, coatings, and other industries. These factors make UV-A LEDs crucial in high-volume and continuous operations in various industries, both commercial and industrial.

- The UV-C (200–280 nm) segment is anticipated to grow at a CAGR of 25.3% over the forecast period. This growth is driven by the increasing demand for disinfection, EPA/NSF pathways, and packaging advances that raise output while maintaining reliability. Increasing hygiene awareness, regulatory support for mercury-free solutions, and advancements in UV-C efficiency are accelerating adoption, positioning UV-C LEDs as a key growth driver in the market.

Learn more about the key segments shaping this market

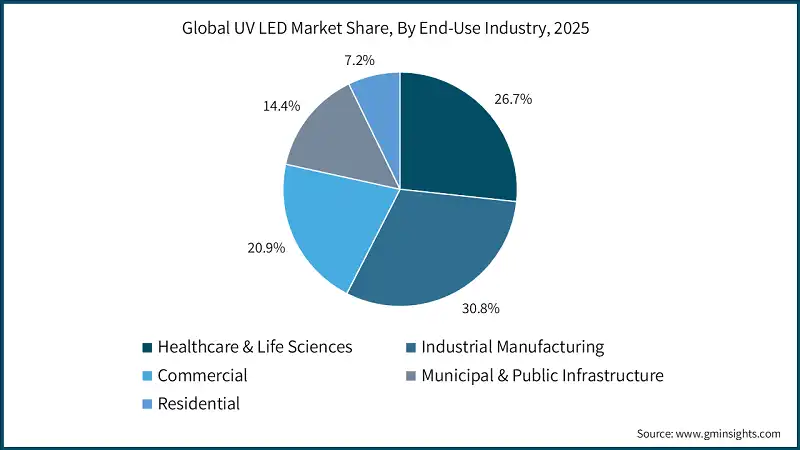

Based on end-use industry, the UV LED market is segmented into healthcare & life sciences, industrial manufacturing, commercial, municipal & public infrastructure and residential.

- The industrial manufacturing segment led the market in 2025 with the market share of 30.8% as UV LEDs offer curing solutions for inks, coatings, adhesive, surface treatments, and for quality inspections. This technology improves production rate, energy efficiency, and streamlining processes within the printed products, electronics, automotive, and packaged goods industries. With the ability to integrate into automated manufacturing processes, UV LEDs continue to achieve the greatest share in this segment.

- The healthcare & life sciences segment is expected to witness growth at a CAGR of 25.1% during the forecast period, attributed to UV LEDs for the treatment of water and other liquids, as well as disinfection and sanitation of medical devices, and in the field of phototherapy. The growth fueled within the healthcare infrastructure of the world, and the growing emphasis on healthcare especially on the management of communicable diseases, and the preference for compact sterilization devices with zero mercury are helping to create this segment in the market as a driving force.

Based on the application, the UV LED market is segmented into disinfection & sterilization, UV curing, medical & healthcare, analytical & detection and specialty applications.

- The disinfection & sterilization segment dominated the market in 2025 and was valued at USD 452.9 million, driven by its applications in the healthcare sector, surface, air, and water disinfection and purification. Increased awareness of hygiene and the adoption of regulatory frameworks, along with the need to find alternatives to toxic mercury, progressively substantiate the market. UV LEDs in disinfection provide real-time operation, low maintenance, and effective pathogen inactivation, making them ideal for applications that require consistent use.

- The UV curing segment is expected to witness growth at a CAGR of 24% during the forecast period, attributed to the increased use in the manufacturing of electronics, adhesives, coatings, and printing. The demand is driven by rapid curing, lower energy consumption, minimal heat production, and the ability to integrate with other automated production systems.

Looking for region specific data?

North America UV LED Market

North America held a market share of 38.8% of market in 2025.

- In North America, the market for UV LED is growing driven by stringent environmental regulations, advanced healthcare infrastructure, substantial industrial manufacturing base, and early technology adoption. The rise in adoption is further supported by EPA regulatory framework under FIFRA classifying UV lights as pesticide devices with clear compliance requirements.

- Municipal water treatment adoption shows growth in the region of UV LED market. Additionally, healthcare applications have most device registrations from Health Canada that allow for commercial deployment and third-party validation of efficacy claims. The region is expected to have the most UV curing adoption with healthcare & life sciences, and municipal & public infrastructure applications driving growth until 2035.

The U.S. UV LED market was valued at USD 419.7 million and USD 452.5 million in 2022 and 2023, respectively. The market size reached USD 555.6 million in 2025, growing from USD 496.3 million in 2024.

- The growth of the market in North America is particularly strong because of the increased funding in healthcare, water treatment, and industrial manufacturing, together with sustainability efforts. For instance, the U.S. EPA’s Clean Water State Revolving Fund (CWSRF) funded at about USD 2.5 billion in 2025 to promote advanced disinfection technologies and improve water quality infrastructure.

- In addition, the adoption of UV LEDs is fostered by the development of smart cities, the increasing number of more stringent environmental and public health laws, and the increasing need for systems that purify air and water. The combination of these factors, the technological development, and the early adoption of automation places North America on the top scale for the UV LEDs market, particularly in the disinfection, sterilization, and industrial curing segments.

Europe UV LED Market

Europe market accounted for USD 340.5 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe’s UV LED market is expanding steadily due to stringent environmental regulations, climate action policies, and a strong push toward sustainable and mercury-free technologies. The growing adoption of UV LEDs in the disinfection of water and air, healthcare applications, and industrial curing is influenced by EU directives concerning the energy efficiency and reduction of hazardous substances, and the smart city and public health initiatives throughout the region.

- Countries such as Germany, France, and the UK have committed to advanced sustainable manufacturing technologies, as well as sophisticated systems for the treatment of water and for the healthcare sector. Along with the pending regulatory framework and the innovations in UV LED efficiency, these investments will most likely ensure the ongoing adoption of UV LED technologies in the industry, in municipalities, and in healthcare across Europe.

Germany dominates the Europe UV LED market, showcasing strong growth potential.

- Germany leads Europe in UV LED adoption as the country has the most rigorous regulations in place for the disinfection and safety of industries and the energy efficiency of processes. Industrial curing, water and air treatment, and multiple healthcare applications are industries where UV LEDs have created opportunities, as they are efficient, do not contain mercury, and support automation. Along with increasing projects in municipal sanitation and smart infrastructure, the region is better positioned to serve its demand for reliable and scalable UV LED technologies.

- In Germany, UV LED market is growing in healthcare, industrial, and municipal systems owing to sustainability regulations and government support across the region. The incorporation of predictive maintenance monitoring systems and IoT with UV LED technologies has increased Germany's leadership position because of the refined regulations concerning water and air quality, industrial energy efficiency, and UV LEDs.

Asia Pacific UV LED Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 24.5% during the forecast period.

- The Asia Pacific UV LED market is growing rapidly because of rapid industrialization, urbanization, and increasing adoption of advanced disinfection and curing technologies. Rising demand across healthcare, water treatment, air purification, and electronics manufacturing is accelerating the adoption of the region's energy efficient, mercury free, UV LEDs.

- Countries such as China, India, Japan, and South Korea are making sizeable investments in smart city initiatives, public health infrastructure, and industrial automation. Adoption of such initiatives is spurred by government support, international investments, and the assimilation of monitoring and control automation technologies. These factors establish the Asia Pacific region as the world's most rapidly growing market.

India UV LED market is estimated to grow with a significant CAGR, in the Asia Pacific market.

- The rapid adoption of UV LEDs in India is due to a growing government focus on water treatment, air quality, and public health. Additionally, industrialization, urbanization and smart city initiatives are driving the need for energy efficient and mercury free technologies for disinfection and sterilization in the health, municipal and industrial sectors.

- Development of government programs such as the National Mission for Clean Ganga, Smart Cities Mission, and investments in wastewater treatment and industrial hygiene are driving rapid adoption of UV LEDs. Coupled with growing awareness surrounding sanitation, these initiatives are propelling India to become one of the most rapidly growing markets in the Asia Pacific.

Middle East and Africa UV LED Market

Saudi Arabia market to experience substantial growth in the Middle East and Africa market.

- Rapid adoption of UV LEDs in Saudi Arabia can be attributed to government programs around water treatment, air purification, and industrial sterilization. There is a growing use of UV LED technologies in the industry, healthcare, and municipal sectors for energy-efficient and mercury free disinfection, curing, and surface sterilization.

- Investments in smart cities, along with sustainability initiatives and Vision 2030 programs, are fostering the advancement of UV LEDs. Due to increasing industrialization, the urbanization of the public health sector, and increasing demand for water and sanitation solutions, Saudi Arabia is becoming the market leader in the MEA region.

UV LED Market Share

The market is led by players such as Seoul Viosys Co., Ltd., Nichia Corporation, ams OSRAM, Crystal IS, Inc., Everlight Electronics, Lumileds Holding B.V., and Lite-On Technology. These companies collectively account for a share of 52.4% in the global market in 2025. This market dominance is supported by advanced technology and varied products across the industrial, healthcare, water treatment, and consumer electronics markets.

These companies maintain a competitive edge through ongoing research and development expenditures, innovations involving high-efficiency UV-A and UV-C LEDs, advanced packaging, and mercury-free solutions aligned with global sustainability regulations. Improving the optical output, reliability, and integration of their products with disinfection, curing, and medical systems helps them address the growing demand in numerous markets and reinforces their dominant position as the adoption of UV LEDs accelerates globally.

UV LED Market Companies

Major players operating in the UV LED industry are:

- ams OSRAM

- Crystal IS (Asahi Kasei)

- DOWA Electronics Materials

- Everlight Electronics

- Lextar Electronics

- Lite-On Technology

- Lumileds Holding B.V.

- Luminus Devices, Inc.

- Nichia Corporation

- Nitride Semiconductors Co., Ltd.

- Seoul Viosys Co., Ltd.

- Violumas

- Seoul Viosys Co., Ltd.

Seoul Viosys develops UV-A, UV-B, and UV-C solutions for disinfection, curing, and medical applications and focuses on proprietary technologies like Violeds for mercury-free sterilization of air, water, and surfaces.

- Nichia Corporation

Nichia offers high-efficiency UV-A and UV-C LEDs used in industrial curing, and medical and sterilization applications. Nichia's commitment to research and development is directed to the manufacturing of high output, long lasting products to enable sustainable manufacturing advanced healthcare systems and cutting-edge disinfection technologies.

- ams OSRAM

ams OSRAM provides a variety of UV LEDs used in industrial curing and medical phototherapy and disinfection systems. Along with UV LEDs, the company provides optical components, integrated smart sensing, and other technologies to provide solutions that are reliable, energy efficient and tailored to the automotive, industrial, and precision healthcare sectors.

- Crystal IS, Inc.

Crystal IS manufactures high-performance UV-C solutions and high-reliability UV-C for mission-critical applications in the municipal, industrial, and defense markets. Applications include air disinfection, surface sterilization, and water purification, including AlN substrate deep UV-C LEDs.

- Everlight Electronics

Everlight Electronics specializes in UV LEDs for curing, counterfeit detection, medical diagnostics, and disinfection, among other applications. The company focuses on scalable manufacturing, reliable products, and cost efficiency resulting in the adoption of their products in consumer electronics, industrial devices, and healthcare.

- Lumileds Holding B.V.

Lumileds provides UV LED products for industrial curing, medical devices, and specialty lighting. Lumileds’ UV LEDs are known for their high optical output and durabilit to improve process efficiencies, lower energy use, and achieve a more sustainable, mercury-free lighting solution.

- Lite-On Technology

Lite-On Technology specializes in the design of compact and energy-efficient UV LED products that are easy to integrate into automated systems for smart manufacturing and healthcare.

UV LED Industry News

- In October 2025, Nichia Corporation introduced an innovative, highly efficient UV-C LED designed with a fusion of advanced chip technology and packaging with superior heat dissipation. The breakthrough technology, which doubles output density, improves thermal performance by 20%, accommodates miniaturization, and is compatible with subsequently mercury-free water sterilization systems with treatment capacities that are 2.5 times greater.

- In September 2025, AquiSense Technologies completed dual validation for its PearlAqua Kilo UV-C LED system after achieving US EPA UVDGM validation and NSF/ANSI/CAN 61-2024 certification. This ensures the reliable inactivation of chlorine-resistant pathogens which expand possible use with municipal and industrial drinking water.

- In August 2025, ams OSRAM announced a breakthrough UV-C LED with over 10% wall plug efficiency, validated by Germany’s PTB, that nearly doubled a previous performance. The technology delivers long lifetimes exceeding 20,000 hours and supports mercury-free disinfection of water, air, and surface applications.

The UV LED market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Million) and volume (Units) from 2022 to 2035, for the following segments:

Market, By Technology

- UV-A (315–400 nm)

- UV-A1 (340–400 nm)

- UV-A2 (315–340 nm)

- UV-B (280–315 nm)

- Broadband UV-B (280–315 nm)

- Narrowband UV-B (311–313 nm)

- UV-C (200–280 nm)

- Far UV-C (200–230 nm)

- Mid UV-C (230–260 nm)

- Near UV-C (260–280 nm)

Market, By Power Output

- Low Power

- Below 0.1W

- 0.1W – 0.5W

- 0.5W – 1W

- Medium Power

- 1W – 3W

- 3W – 5W

- 5W – 10W

- High Power

- 10W – 25W

- 25W – 50W

- Above 50W

Market, By Package Type

- Surface mount device (SMD)

- Through-hole

- Chip-on-board (COB)

- Flip-chip

- Module-level

Market, By Application

- Disinfection & Sterilization

- UV Curing

- Medical & Healthcare

- Analytical & Detection

- Specialty Applications

Market, By Sales Channel

- Direct Sales

- Distribution

- Online Sales

Market, By End-Use Industry

- Healthcare & Life Sciences

- Industrial Manufacturing

- Commercial

- Municipal & Public Infrastructure

- Residential

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- Uk

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabi

- South Africa

- UAE

Frequently Asked Question(FAQ) :

What is the projected value of the UV LED market by 2035?

The market is expected to reach USD 12.4 billion by 2035, with a volume of 1220.8 thousand units, growing at a value CAGR of 23.5% during the forecast period of 2026-2035.

What is the expected market size of the UV LED industry in 2026?

The UV LED market is projected to reach USD 1.9 billion in 2026.

What was the market share of the UV-A (315–400 nm) segment in 2025?

The UV-A segment accounted for 55.7% of the market in 2025, driven by its extensive applications in curing, enabled by advanced InGaN processes and narrowband emissions in the 365–405nm spectrum.

Which region led the UV LED market in 2025?

North America held a market share of 38.8% in 2025, driven by strong adoption across industries and advancements in UV LED technologies.

What are the key trends in the UV LED industry?

Key trends include the adoption of UV-C LED platforms for municipal water treatment, increasing regulations for mercury replacement, growing demand for UV-A LED curing in printing and coatings, and advancements in disinfection technologies for healthcare and industrial applications.

Who are the major players in the UV LED market?

Key players include ams OSRAM, Crystal IS (Asahi Kasei), DOWA Electronics Materials, Everlight Electronics, Lextar Electronics, Lite-On Technology, Lumileds Holding B.V., Luminus Devices, Inc., Nichia Corporation, and Nitride Semiconductors Co., Ltd.

How much revenue did the disinfection & sterilization segment generate in 2025?

The disinfection & sterilization segment was valued at USD 452.9 million in 2025, driven by applications in healthcare, surface, air, and water disinfection and purification.

What was the market size of the UV LED market in 2025?

The global market was valued at USD 1.6 billion in 2025, with a volume of 173.8 thousand units.

UV LED Market Scope

Related Reports