Summary

Table of Content

Utility Scale Air Insulated Transformer Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Utility Scale Air Insulated Transformer Market Size

The global utility scale air insulated transformer market was estimated at USD 1.96 billion in 2024. The market is expected to grow from USD 2.07 billion in 2025 to USD 3.11 billion in 2034, at a CAGR of 4.6%. The global demand for electricity continues to grow due to urbanization, industrialization, and expanding economies, particularly in emerging markets. To meet this demand, there is a need for expanding and modernizing power transmission and distribution systems, driving the adoption of utility-scale AIS.

To get key market trends

Renewable energy projects prefer air-insulated transformers for their high voltage handling, reliability, and cost-effectiveness over alternatives like Gas Insulated Switchgear (GIS). For instance, according to the U.S. (DOE) Department of Energy, air-insulated transformers are widely used in renewable energy installations due to their ability to operate efficiently at voltages exceeding 69 kV, which is critical for large-scale wind and solar farms. Additionally, their lower initial costs make them a practical choice for developers aiming to optimize project budgets.

Utility Scale Air Insulated Transformer Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 1.96 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.6% |

| Market Size in 2034 | USD 3.11 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Governments worldwide are increasing investments in power grid infrastructure to ensure energy security, reduce transmission losses, and integrate renewable sources efficiently. For reference, the U.S. Department of Energy announced a SD 13 billion investment in 2023 to modernize and expand the nation's power grid under the Grid Resilience and Innovation Partnerships (GRIP) program.

Innovations in transformer design, insulation materials, and cooling techniques have improved the performance and durability of AIS units, leading to their increased adoption. For illustration, according to the U.S. Department of Energy, modern transformers with advanced insulation and cooling systems can achieve efficiency levels of over 99%, reducing energy losses and operational costs.

Utility Scale Air Insulated Transformer Market Trends

As green energy sources like wind and solar expands, the demand for utility-scale air-insulated transformers rises. These transformers play a vital role in adjusting voltage levels for the energy grid, especially as we integrate more renewable sources. As we incorporate an increasing amount of variable renewable energy into our grids, the need for stabilization and flexibility infrastructure intensifies. Consequently, these transformers are becoming essential in renewable energy projects, valued for their reliability and safety.

Rapid development has I creased the demand for compact and reliable electrical infrastructure surges. In urbanized areas, air-insulated transformers stand out as the preferred choice. Their smaller size and enhanced safety, in contrast to oil-insulated transformers, make them ideal for densely populated locales. With the rise of smart grids, air-insulated transformers are gaining prominence, seamlessly integrating with digital monitoring and control systems, thereby bolstering grid reliability and efficiency.

Outdated and inefficient equipment continues to affect many existing transmission grids. According to the U.S. Department of Energy, nearly 70% of the transformers in the United States are over 25 years old, leading to increased inefficiencies and reliability issues. The replacement of these aging transformers with more efficient and reliable AIS units is a significant growth driver, aligning with the global push for modernizing energy infrastructure.

Utility Scale Air Insulated Transformer Market Analysis

Learn more about the key segments shaping this market

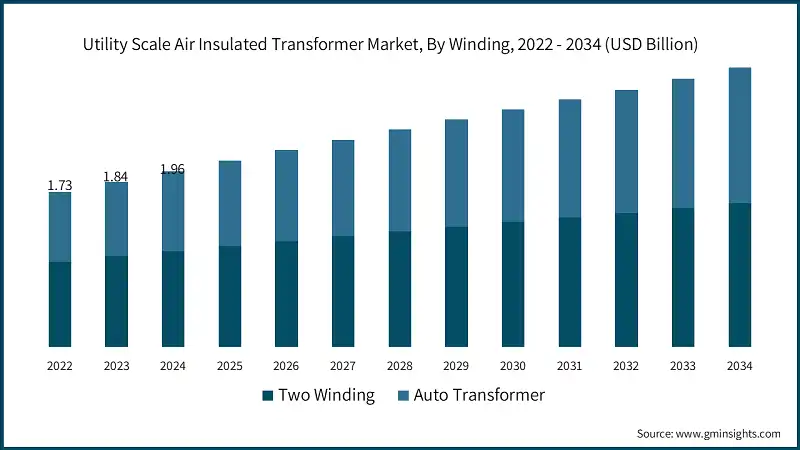

- The global utility scale air insulated transformer industry was valued at USD 1.73 billion, USD 1.84 billion, and USD 1.96 billion in 2022, 2023, and 2024, respectively. Based on winding, the industry can be categorized into two winding and auto transformer.

- Two winding segment is expected to dominate the market and exceed revenue of USD 1.6 billion by 2034. Two-winding transformers are commonly used in transmission systems where the primary requirement is to step up or step down the voltage levels for long-distance electricity transmission. Innovations in core and winding design, insulation materials, and cooling mechanisms have improved the performance and efficiency of two-winding transformers, reduced energy losses and enhancing operational life.

- Auto transformers are widely used in distribution systems where they provide voltage regulation in a cost-effective manner. They are particularly helpful in urban distribution systems that require frequent voltage adjustments to accommodate changing demand. With the ongoing trend of upgrading and expanding distribution networks, auto transformers are increasingly being used to help maintain voltage stability in areas with fluctuating loads.

Learn more about the key segments shaping this market

- Based on the rating, the utility scale air insulated transformer market is trifurcated into ≤ 10 MVA, > 10 MVA to ≤ 100 MVA, > 100 MVA to ≤ 600 MVA and > 600 MVA. The ≤ 10 MVA segment is set to lead the industry with major market share of over 51.4% in 2024 while growing at a positive CAGR through 2034. Large-scale power plants (coal, natural gas, hydro, and nuclear) that generate electricity at extremely high capacities require transformers in this range to handle the generated power and step it up or down for efficient transmission.

- These transformers ensure that electricity is delivered efficiently to distant cities and industrial centers without significant loss. Moreover, With growing investments in renewable energy infrastructure, transformers in the > 600 MVA range are essential for connecting major renewable generation projects to national grids.

- As developing nations continue their electrification efforts, particularly in rural or semi-urban areas, demand for smaller transformers (≤ 10 MVA) grows. These transformers are ideal for remote locations where large-scale infrastructure is not feasible.

- Large-scale industrial zones, such as petrochemical plants, steel mills, and heavy manufacturing industries, require transformers capable of handling heavy electrical loads. Transformers with ratings of 100 MVA to 600 MVA ensure that these industries can operate efficiently while maintaining grid stability.

- Many regions are modernizing their existing power grid infrastructure to support higher power demands and better load management. This often includes upgrading medium-voltage substations to accommodate transformers between 10 MVA and 100 MVA.

Looking for region specific data?

- The U.S. utility scale air insulated transformer market was valued at USD 415.99 million, USD 443.4 million, and USD 471.51 million in 2022, 2023, and 2024, respectively. With a strong push towards decarbonization under both federal and state-level policies (such as the Clean Power Plan and the Green New Deal), utilities are focusing on expanding renewable energy capacity. This shift necessitates the expansion of transmission networks and substations, including the deployment of AIS transformers to handle the increased load.

- In Asia Pacific, governments are providing significant support for energy infrastructure development through investments and incentives including China’s 13th Five-Year Plan for Energy and India's National Smart Grid Mission. These initiatives are boosting the deployment of utility-scale transformers for grid development. Asia-Pacific, particularly China, India, and Southeast Asia, is experiencing rapid urbanization and industrialization, leading to an increase in electricity demand.

- Europe is focused on modernizing and expanding its electricity grid to support the growing integration of decentralized energy sources. Additionally, there is a strong push for cross-border electricity grid interconnections between European countries. AIS transformers play a key role in these grid enhancements, ensuring efficient voltage regulation and power distribution.

- Governments in the Middle East are rolling out mega infrastructure projects such as NEOM in Saudi Arabia, which requires robust and scalable power transmission solutions. AIS transformers are seen as ideal for supporting these large-scale, high-voltage transmission systems.

- In Africa, significant portions of the population remain without reliable access to electricity. To meet electrification goals and improve access to power, many countries are deploying AIS transformers in rural areas, enabling both transmission and distribution of electricity in a cost-effective manner.

Utility Scale Air Insulated Transformer Market Share

Leading manufacturers including Schneider Electric, Siemens Energy, ABB, Eaton and Mitsubishi Electric holds over 55% of the market share. A significant market share allows companies to secure long-term contracts with utilities, governments, and large industrial clients, which provide a steady revenue stream and facilitate the scaling of operations to meet rising global electricity demands.

Large market share enables companies to expand into new geographic regions and access emerging markets. In addition, companies often build strong brand recognition and customer loyalty, which are crucial in the utility-scale market where long-term relationships and contracts are common.

Utility Scale Air Insulated Transformer Market Companies

- ABB is one of the most prominent players in the power and automation sector, offering air-insulated transformers for utility-scale applications. ABB has extensive experience in high-voltage transmission systems, renewable energy integration, and smart grid technologies. The company’s transformers are used in a wide range of energy projects, including power plants, grid upgrades, and industrial applications. The company’s overall revenue in 2024, surpassed USD 32.8 billion, observing an annual increase of about 2% from 2023.

- Siemens Energy, a leading player in the energy sector, has a large presence in the utility-scale transformer market, including AIS transformers. The company offers comprehensive transformer solutions with a focus on innovation, reliability, and digitalization. Siemens Energy’s portfolio includes air-insulated transformers, along with integrated grid solutions for power transmission and distribution.

- Schneider Electric is a leading company in the energy management and automation sector. It offers air-insulated transformers as part of its comprehensive product suite for energy distribution and smart grid applications. Schneider Electric’s focus on energy-efficient solutions aligns well with global trends toward sustainability and grid modernization. The company reported net income of USD 4.62 billion in 2024.

- GE Power is a significant player in the utility-scale transformer market, providing a range of high-voltage air-insulated transformers. GE’s transformers are known for their reliability, high capacity, and efficiency, which are crucial for large-scale power transmission and renewable energy integration.

- Mitsubishi Electric is a significant player in the transformer market, known for its reliable high-performance air-insulated transformers used in utility-scale applications. Mitsubishi Electric has a strong presence in Asia-Pacific, especially in Japan, China, and India, where utility-scale infrastructure development is booming. The company spent over USD 1.12 billion for research & development in the Q3, 2024.

Some of the key market players operating across the utility scale air insulated transformer industry are:

- ABB

- ARTECHE

- Celme

- CG Power & Industrial Solutions

- DAIHEN Corporation

- Eaton

- Elsewedy Electric

- General Electric

- Hyosung Heavy Industries

- IMEFY GROUP

- Kirloskar Electric Company

- Mitsubishi Electric Corporation

- Ormazabal

- Pfiffner Group

- Schneider Electric

- Siemens Energy

- Toshiba International Corporation

- Trench Group

Utility Scale Air Insulated Transformer Industry News

- In February 2024, ABB secured a USD 100 million contract with India’s National Thermal Power Corporation (NTPC) to supply utility-scale air-insulated transformers for several grid expansion projects across India. The AIS transformers will be used in new substations designed to support India's growing industrial demand and renewable energy integration. The project will enhance the company's presence in the rapidly growing Asia Pacific energy infrastructure market.

- In January 2024, Schneider Electric unveiled its new digital air-insulated transformer range designed for use in smart grid applications. These transformers incorporate advanced IoT sensors and cloud-based analytics to allow utilities to monitor transformer performance in real time, helping with fault detection, load balancing, and grid optimization. The company's investment in smart grid technology strengthens its position in the digital transformation of energy systems, tapping into the growing demand for automated and intelligent power distribution solutions worldwide.

- In December 2023, General Electric (GE) Power was selected to provide air-insulated transformers as part of the noor energy solar plant in the UAE, one of the largest concentrated solar power (CSP) plants in the world. GE will supply its latest generation of AIS transformers for power conversion and voltage regulation systems. The company’s involvement in the Middle East’s renewable energy projects strengthens its position as a key player in the global renewable energy transformation, especially in the solar power sector.

- In September 2023, Hitachi Energy has expanded its operations in Africa, securing a significant contract with the African Development Bank (AfDB) to supply air-insulated transformers for several rural electrification projects across East Africa. The transformers will play a key role in delivering reliable electricity to underserved areas, supporting both grid expansion and renewable energy integration. The company's focus on Africa highlights its commitment to sustainable development and improving access to electricity in underserved regions.

The utility scale air insulated transformer market research report includes in-depth coverage of the industry with estimates & forecast in terms of “’000 Units & USD Million” from 2021 to 2034 for the following segments:

Market, By Winding

- Two winding

- Auto transformer

Market, By Rating

- ≤ 10 MVA

- > 10 MVA to ≤ 100 MVA

- > 100 MVA to ≤ 600 MVA

- > 600 MVA

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- Russia

- UK

- Italy

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Latin America

- Brazil

- Argentina

Frequently Asked Question(FAQ) :

Who are the key players in the utility scale air insulated transformer industry?

Some of the major players in the industry include ABB, ARTECHE, Celme, CG Power & Industrial Solutions, DAIHEN Corporation, Eaton, Elsewedy Electric, General Electric, Hyosung Heavy Industries, IMEFY GROUP, and Kirloskar Electric Company.

What is the size of the two winding segment in the utility scale air insulated transformer industry?

The two winding segment is anticipated to dominate the market, exceeding revenue of USD 1.6 billion by 2034.

How much market value did the U.S. utility scale air insulated transformer market achieve in recent years?

The U.S. market was valued at USD 415.99 million in 2022, USD 443.4 million in 2023, and USD 471.51 million in 2024.

How big is the utility scale air insulated transformer market?

The market for utility scale air insulated transformers was valued at USD 1.96 billion in 2024 and is expected to reach around USD 3.11 billion by 2034, growing at a CAGR of 4.6% through 2034.

Utility Scale Air Insulated Transformer Market Scope

Related Reports