Summary

Table of Content

U.S. OTC Hearing Aids Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

U.S. OTC Hearing Aids Market Size

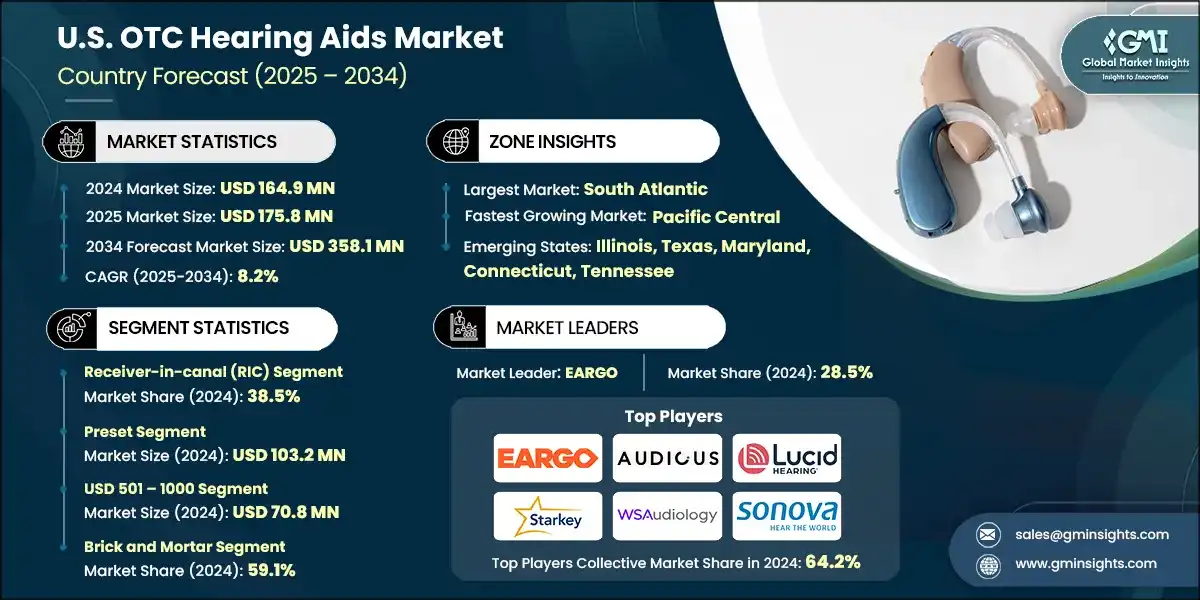

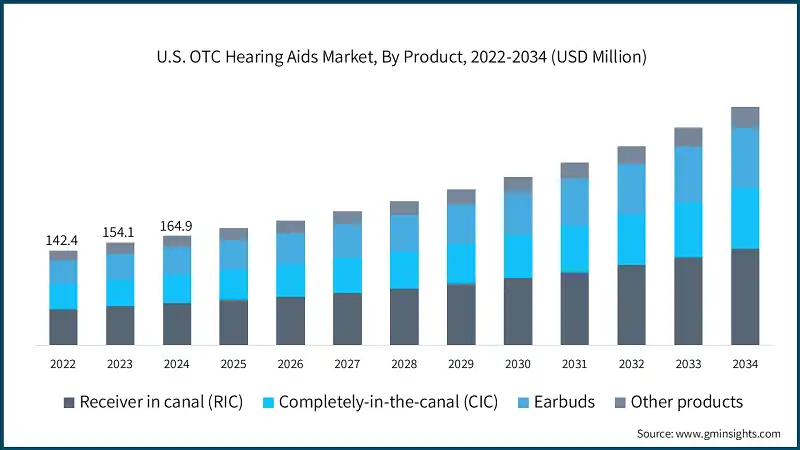

The U.S. OTC hearing aids market was valued at USD 164.9 million in 2024. The market is expected to reach from USD 175.8 million in 2025 to USD 358.1 million in 2034, growing at a CAGR of 8.2% during the forecast period, according to the latest report published by Global Market Insights Inc. The high market growth is attributed to the rising prevalence of hearing loss, ongoing advancements in technology and user-friendly features, regulatory changes supporting OTC devices, and growing awareness and acceptance among consumers, among other contributing factors.

To get key market trends

OTC are medical devices that can be purchased directly by adults with mild to moderate hearing loss without a prescription or professional fitting. These devices are made for the users to fit and adjust themselves, thereby providing them with ease and affordability of use. OTC hearing aids are intended to make hearing aid access easier and to lower the barriers that exist in comparison with the use of traditional prescription hearing aids.

Leading players in the U.S. OTC hearing aids market include EARGO, AUDICUS, Lucid HEARING, Starkey, WS Audiology, and Sonova. These corporations keep their edge over rivals by continually innovating their products, having a broad market presence around the world, and by making large investments in research and development.

The market has increased from USD 142.4 million in 2022 and reached USD 154.1 million in 2023, with the historic growth rate of 8.3%. This growth is attributed to the rising consumer awareness about mild to moderate hearing loss, increasing availability of affordable and user-friendly devices, and expanding distribution through retail and online channels.

The increasing prevalence of mild to moderate hearing loss among U.S. adults is driving demand for hearing solutions. For instance, according to the National Institute on Deafness and Other Communication Disorders (NIDCD), approximately 37.5 million American adults reported some degree of hearing difficulty in 2021. Over-the-counter (OTC) hearing aids offer a more accessible option for individuals who prefer to avoid prescription requirements.

Following the FDA’s landmark ruling in October 2022 that permitted the sale of OTC hearing aids, the market witnessed a 25% increase in hearing aid adoption rates by 2023. Further supporting this growth, Medicare expanded its coverage for hearing screening programs in 2024 to include annual hearing assessments for beneficiaries aged 65 and above.

Furthermore, the introduction of FDA regulations allowing over-the-counter hearing aids has created a new consumer segment. These regulatory changes reduce barriers to access, enabling more adults to purchase hearing aids directly from retail or online channels. This has expanded the market beyond traditional audiology clinics.

U.S. OTC Hearing Aids Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 164.9 Million |

| Market Size in 2025 | USD 175.8 Million |

| Forecast Period 2025 - 2034 CAGR | 8.2% |

| Market Size in 2034 | USD 358.1 Million |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of hearing loss | The growing number of individuals with mild to moderate hearing loss is fueling the demand for OTC hearing aids, as consumers seek convenient and affordable solutions without medical consultations. |

| Rising geriatric population base | The expanding elderly population, particularly those aged 65 and above, is significantly contributing to market growth due to a higher susceptibility to age-related hearing impairment. |

| Technological advancements | Innovations such as Bluetooth connectivity, smartphone compatibility, and self-fitting features are enhancing user experience and driving consumer adoption of OTC hearing aids. |

| Steadily surging awareness & penetration of hearing devices | Increasing public education campaigns and retail availability through pharmacies and online platforms are improving accessibility and boosting sales across the U.S. market. |

| Pitfalls & Challenges | Impact |

| Poor awareness and social stigma associated with wearing hearing aids | Persistent negative perceptions and lack of awareness about modern, discreet OTC models continue to hinder full market potential. |

| Concerns over device quality and efficacy | Inconsistent product performance among low-cost OTC brands and limited consumer confidence in their durability are restraining market expansion. |

| Opportunities: | Impact |

| Penetration in emerging markets | Expanding U.S. OTC hearing aid brands into emerging markets will open new revenue streams and enhance global brand visibility, supporting long-term growth and economies of scale. |

| Surging need for customized and user-friendly product innovations | Future advancements focusing on personalized fitting algorithms, ergonomic designs, and AI-driven sound adjustments will attract tech-savvy consumers and strengthen market competitiveness. |

| Market Leaders (2024) | |

| Market Leaders |

28.5% market share |

| Top Players |

Collective market share in 2024 is 64.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | South Atlantic |

| Fastest growing market | Pacific Central |

| Emerging states | Illinois, Texas, Maryland, Connecticut, Tennessee |

| Future outlook |

|

What are the growth opportunities in this market?

U.S. OTC Hearing Aids Market Trends

The U.S. OTC hearing aids industry is experiencing several notable trends that are shaping its growth and development. Factors such as growing shift towards lifestyle-oriented hearing solutions, integration of consumer electronics with hearing aid technology, and increased consumer awareness and acceptance, among other factors, collectively driving the industry growth.

- Tech giants like Apple are transforming everyday devices into hearing aids. For instance, a software update enables AirPods Pro 2 to function as OTC hearing aids for mild to moderate hearing loss. This trend combines convenience with advanced audio features, appealing to a tech-savvy audience, and is expected to drive mainstream adoption while redefining user expectations.

- OTC hearing aids are increasingly being viewed as lifestyle accessories rather than medical devices. Brands like Sony and Bose are entering the market with stylish and functional products. This shift reduces stigma and attracts younger consumers who prioritize aesthetics and ease of use, reflecting a broader trend of integrating health and wellness into consumer electronics.

- Furthermore, the Federal Communications Commission (FCC) mandates that all smartphones be hearing aid-compatible, ensuring universal connectivity. This includes establishing Bluetooth pairing requirements and new rules for volume control to minimize distortion. Such regulations enhance audio clarity and accessibility for users with hearing difficulties, supporting sustained long-term market growth.

U.S. OTC Hearing Aids Market Analysis

Learn more about the key segments shaping this market

Based on the product, the U.S. OTC hearing aids market is segmented into receiver-in-canal (RIC), completely-in-the-canal (CIC), earbuds, and other products. The receiver-in-canal (RIC) segment has asserted its dominance in the market by securing a significant market share of 38.5% in 2024 owing to the growing preference for discreet, comfortable, and technologically advanced hearing aids that offer enhanced sound quality and connectivity features. The segment is expected to exceed USD 145.2 million by 2034, growing at a CAGR of 8.8% during the forecast period.

On the other hand, the earbuds segment is expected to grow with a CAGR of 8.5%. The growth of this segment is driven by increasing adoption of multifunctional devices that combine hearing assistance with music streaming, voice assistants, and wireless connectivity, appealing to tech-savvy and lifestyle-conscious consumers.

- The receiver in canal (RIC) segment continues to dominate the market. RIC hearing aids improve sound clarity by putting the speaker right into the ear canal, thus reducing the distortion and allowing the user to have a more natural hearing experience. This method of production also reduces the occlusion effect; hence, the performance of speech understanding and satisfaction are increased. Due to these auditory advantages, RIC devices are very attractive to users with mild to moderate hearing loss.

- Contemporary RIC hearing aids include technological features such as Bluetooth connectivity, rechargeable batteries, and app-based controls, among others. These technological upgrades give more freedom to the user to adjust the setting, directly stream audio from devices, and easily control the hearing aids. The availability of such developments is aimed at the needs of the tech-savvy consumers, and it also contributes to the improvement of the overall user experience.

- The second-largest segment, completely-in-the-canal (CIC), held a market share of 26% in 2024, driven by its discreet design, which appeals to users seeking near-invisible hearing solutions. Its compact size offers personalized comfort and natural sound perception for mild to moderate hearing loss. Additionally, growing consumer preference for minimally noticeable devices is boosting adoption in the U.S. OTC market.

- The earbuds segment accounted for 25.1% of the market in 2024, driven by the integration of hearing aid functionality with everyday audio devices, offering convenience and multifunctionality. Advanced features like Bluetooth connectivity, noise reduction, and compatibility with smartphones enhance user experience. Rising popularity among tech-savvy and lifestyle-conscious consumers further fuels market adoption.

Based on type, the U.S. OTC hearing aids market is segmented into preset and self-fitting. The preset segment dominated the market in 2024, accounting for USD 103.2 million and is anticipated to grow at a CAGR of 8.4% during the forecast period.

- Preset hearing aids are equipped with a number of pre-programmed settings that accommodate different listening environments, for instance, a quiet room or a noisy street. Their plug-and-play feature makes it possible for a user to operate the device right away without any customization.

- Moreover, these hearing aids are particularly effective for individuals with mild to moderate hearing loss, as their preset programs are designed to amplify sounds appropriately for these levels of hearing impairment. This targeted functionality ensures that users receive adequate amplification without the need for professional tuning. Such simplicity reduces the barrier to entry for those new to hearing aids.

- The self-fitting segment accounted for significant revenue in 2024 and is anticipated to grow at a CAGR of 8% over the forecast period. The growth of the segment is due to the comfort of personalized, at-home adjustments without the need for an audiologist visit. The advanced mobile apps and AI-enabled algorithms give users the opportunity to set the sound as per their hearing requirements. This ease of use and autonomy is increasing adoption among consumers seeking affordable and flexible hearing solutions.

Based on price band, the U.S. OTC hearing aids market is segmented into upto USD 500, USD 501 – 1000, and over USD 1000. The USD 501 – 1000 segment dominated the market in 2024, accounting for USD 70.8 million and is anticipated to grow at a CAGR of 8.6% during the forecast period.

- Mid-range OTC hearing aids appeal to consumers seeking a balance between quality and affordability. Features like rechargeable batteries, better sound clarity, and limited customization options make this segment attractive. Growing preference for moderately priced devices with enhanced functionality supports steady market growth.

- On the other hand, the upto USD 500 segment is driven by the affordability factor, attracting price-sensitive consumers seeking basic OTC hearing solutions. Increasing awareness and availability of low-cost, entry-level devices through online and retail channels boosts adoption. The segment benefits from first-time users exploring hearing aids without high upfront costs.

- The over USD 1000 segment accounted for significant revenue in 2024 and is anticipated to grow at a CAGR of 7.7% over the forecast period. Owing to the advanced technology, including AI-driven sound adjustments, smartphone integration, and superior noise reduction. Consumers willing to invest in high-performance, feature-rich devices are fueling demand. This segment benefits from increasing adoption among tech-savvy and lifestyle-conscious users, prioritizing comfort and quality.

Learn more about the key segments shaping this market

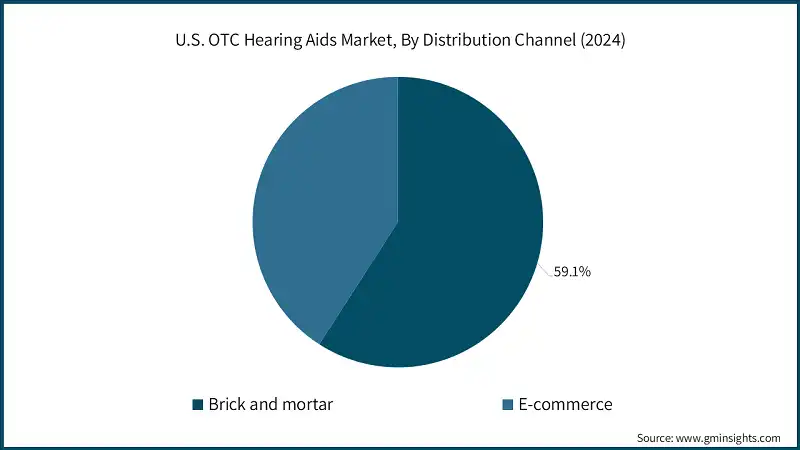

Based on distribution channel, the U.S. OTC hearing aids market is classified into brick and mortar and e-commerce. The brick and mortar segment dominated the market with a revenue share of 59.1% in 2024 and is expected to reach USD 205.8 million within the forecast period.

- Physical retail locations offer personalized consultations with trained staff, providing immediate answers to consumer questions and guidance on device selection. This hands-on support helps demystify the hearing aid purchasing process, especially for first-time buyers. Consumers value the ability to receive tailored recommendations and demonstrations in person.

- Brick-and-mortar stores allow consumers to purchase hearing aids and begin using them immediately, eliminating the wait time associated with online orders or shipping. This instant gratification appeals to individuals seeking prompt solutions for their hearing needs. Immediate availability ensures that users can start experiencing the benefits of their new devices without delay.

- The e-commerce segment held a revenue of USD 67.5 million in 2024, with projections indicating a steady expansion at 8.6% CAGR from 2025 to 2034. The segmental growth is driven by the convenience of online purchasing, allowing consumers to browse, compare, and buy OTC hearing aids from home. Competitive pricing, discounts, and subscription models offered online attract cost-conscious buyers. In addition, user-friendly platforms with virtual fitting tools and home delivery enhance accessibility and adoption across the U.S. market.

Looking for region specific data?

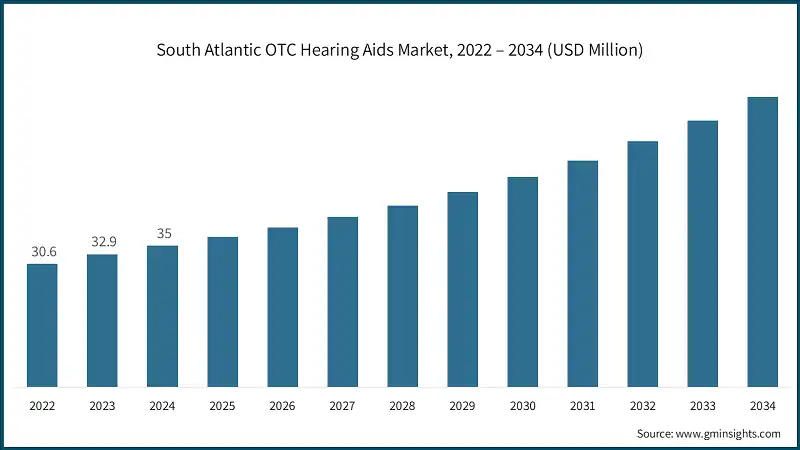

South Atlantic OTC Hearing Aids Market South Atlantic dominated the U.S. OTC hearing aids market with the highest market share of 21.2% in 2024. Northeast OTC hearing aids market accounted for USD 27.9 million in 2024 and is anticipated to show lucrative growth over the forecast period. The Pacific Central OTC hearing aids market is anticipated to grow at the highest CAGR of 9.7% during the analysis timeframe. The U.S. OTC hearing aids industry is highly competitive, characterized by the presence of both established hearing aid manufacturers and emerging direct-to-consumer brands. Companies are focusing on product innovation, user-friendly designs, and advanced technologies such as AI-driven sound adjustments, Bluetooth connectivity, and self-fitting features to differentiate themselves. Key players include EARGO, AUDICUS, Lucid HEARING, Starkey, WS Audiology, and Sonova, collectively accounting for 64.2% of the total market share. Market participants are also leveraging diverse distribution channels, including e-commerce platforms, retail chains, and tele-audiology services, to enhance accessibility and convenience for consumers. Strategic collaborations, mergers, and acquisitions are common as companies aim to expand their product portfolios and strengthen regional presence. Additionally, increasing investments in marketing and awareness campaigns are helping brands reduce social stigma associated with hearing aids and attract a broader, tech-savvy consumer base. Few of the prominent players operating in the U.S. OTC hearing aids industry include: Eargo, leading the U.S. OTC hearing aids market with a 28.5% share in 2024, and it differentiates itself with virtually invisible, rechargeable hearing aids that combine comfort and aesthetics. Its direct-to-consumer model and personalized online support enhance convenience and adoption among first-time users. WS Audiology leverages its strong global brands, including Signia and Widex, offering advanced acoustic technologies and customizable OTC solutions. Its extensive distribution network ensures wide market reach and reliable after-sales support. Sonova stands out with cutting-edge hearing aid innovations, including AI-powered sound optimization and sleek, discreet designs. The company emphasizes premium quality, professional fitting options, and integrated smartphone connectivity to enhance user experience.Northeast OTC Hearing Aids Market

Pacific Central OTC Hearing Aids Market

hearing intervention are encouraging adoption of OTC hearing aids.U.S. OTC Hearing Aids Market Share

U.S. OTC Hearing Aids Market Companies

U.S. OTC Hearing Aids Industry News:

The U.S. OTC hearing aids market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue (USD Million) and volume (Units) from 2022 – 2034 for the following segments:

Market, By Product

- Receiver in canal (RIC)

- Completely-in-the-canal (CIC)

- Earbuds

- True wireless stereo (TWS)

- Ear-hook

- Neckband

- Other products

Market, By Type

- Preset

- Self-fitting

Market, By Price Band

- Upto USD 500

- USD 501 - 1000

- Over USD 1000

Market, By Distribution Channel

- Brick and mortar

- E-commerce

The above information is provided for the following zones and states:

- East North Central

- Illinois

- Indiana

- Michigan

- Ohio

- Wisconsin

- West South Central

- Arkansas

- Louisiana

- Oklahoma

- Texas

- South Atlantic

- Delaware

- Florida

- Georgia

- Maryland

- North Carolina

- South Carolina

- Virginia

- West Virginia

- Washington, D.C.

- Northeast

- Connecticut

- Maine

- Massachusetts

- New Hampshire

- Rhode Island

- Vermont

- New Jersey

- New York

- Pennsylvania

- East South Central

- Alabama

- Kentucky

- Mississippi

- Tennessee

- West North Centra

- Iowa

- Kansas

- Minnesota

- Missouri

- Nebraska

- North Dakota

- South Dakota

- Pacific Central

- Alaska

- California

- Hawaii

- Oregon

- Washington

- Mountain States

- Arizona

- Colorado

- Utah

- Nevada

- New Mexico

- Idaho

- Montana

- Wyoming

Frequently Asked Question(FAQ) :

Who are the key players in the U.S. OTC hearing aids market?

Key players include AUDICUS, Audien Hearing, BOSE, EARGO, GN Store Nord, InnerScope Hearing Technologies, Lexie Hearing, Lucid HEARING, MD Hearing, and NUHEARA.

Which region dominated the U.S. OTC hearing aids market in 2024?

The South Atlantic region held the highest market share of 21.2% in 2024.

What are the upcoming trends in the U.S. OTC hearing aids market?

Key trends include the integration of hearing aid technology with consumer electronics, the perception of OTC hearing aids as lifestyle accessories, and the entry of tech giants like Apple, Sony, and Bose into the market.

What was the valuation of the USD 501 – 1000 price band segment in 2024?

The USD 501 – 1000 price band segment generated USD 70.8 million in 2024 and is anticipated to grow at a CAGR of 8.6% during the forecast period.

Which distribution channel led the U.S. OTC hearing aids market in 2024?

The brick and mortar segment led the market with a 59.1% revenue share in 2024 and is expected to reach USD 205.8 million during the forecast period.

What was the market size of the U.S. OTC hearing aids in 2024?

The market size was USD 164.9 million in 2024, with a CAGR of 8.2% expected through 2034, driven by rising hearing loss prevalence, technological advancements, and regulatory support for OTC devices.

What is the projected size of the U.S. OTC hearing aids market in 2025?

The market is expected to reach USD 175.8 million in 2025.

How much revenue did the preset segment generate in 2024?

The preset segment generated USD 103.2 million in 2024, dominating the market and projected to grow at a CAGR of 8.4% during the forecast period.

What is the projected value of the U.S. OTC hearing aids market by 2034?

The market is expected to reach USD 358.1 million by 2034, fueled by increased consumer awareness, lifestyle-oriented solutions, and integration with consumer electronics.

U.S. OTC Hearing Aids Market Scope

Related Reports