Summary

Table of Content

Underwater Connectors Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Underwater Connectors Market Size

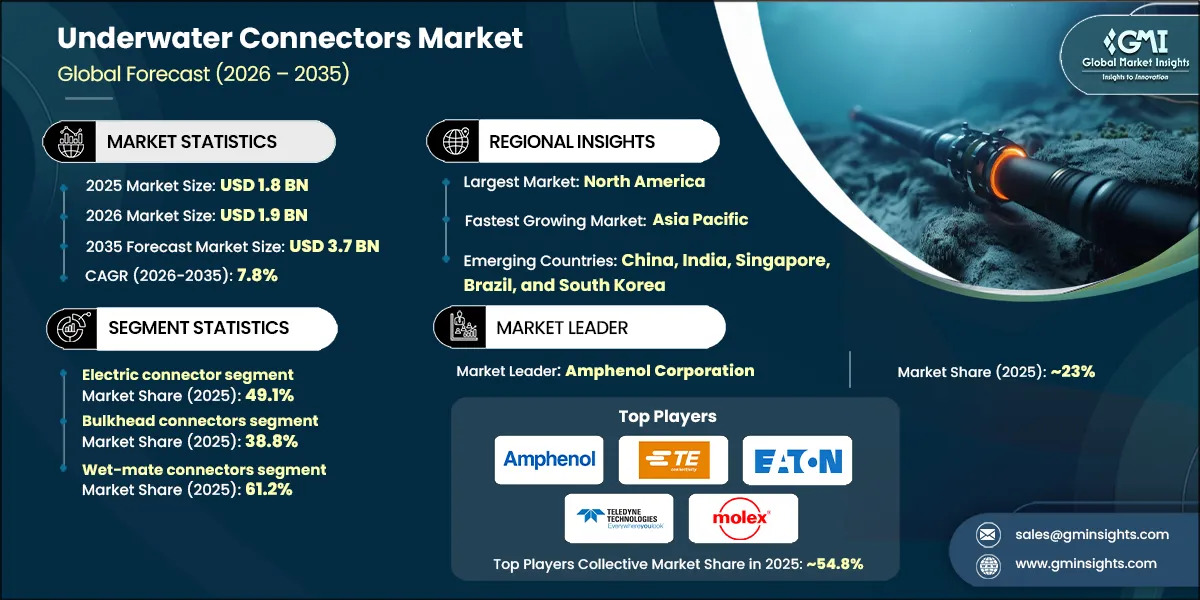

The global underwater connectors market was valued at USD 1.8 billion in 2025. The market is expected to grow from USD 1.9 billion in 2026 to USD 2.6 billion in 2031 and USD 3.7 billion in 2035, at a CAGR of 7.8% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

Several factors contribute to the growth of the underwater connectors industry, such as increasing exploration at offshore oil & gas sites, rising deployment of subsea communication and power transmission systems, and growing adoption of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs).

Furthermore, the broadening customer base, including energy operators, telecom consortia, defense programs, ocean science institutions, and new data-center operators, each bringing distinct voltage, depth, and reliability specifications. This creates a robust demand for both wet-mate and dry-mate connectors, especially in the water oil and gas developments, trans-ocean fiber routes, and high-voltage offshore wind interconnects, as per the Society for Underwater Technology (SUT). This factor plays a pivotal role in expanding the growth outlook of market across the world.

Underwater Connectors Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.8 Billion |

| Market Size in 2026 | USD 1.9 Billion |

| Forecast Period 2026 - 2035 CAGR | 7.8% |

| Market Size in 2035 | USD 3.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising offshore oil & gas deepwater operations | Drives 24% growth due to increased deepwater exploration and production activities requiring reliable high-pressure underwater connectors for power and data transmission. |

| Expansion in subsea telecommunications infrastructure | Contributes 20% growth driven by hyperscale data traffic, increasing submarine cable deployment and growing need for optical connectors at landing stations. |

| Growth in offshore renewable energy integration & grid | Fuels 22% growth as offshore wind and marine energy projects needed high voltage connectors for dynamic cables, modular subsea stations, and grid interconnections |

| Advancements in connector materials and sealing technologies | Account for 19% growth by enhancing connector durability and depth ratings, allowing longer lifespan and reduced maintenance in harsh subsea environments. |

| Pitfalls & Challenges | Impact |

| High development and manufacturing costs | Restrains 21% growth as premium materials, complex sealing/testing requirements and complex designs, keeping keep upfront costs elevated especially for high-voltage connectors |

| Complexities in sealing and high-voltage wet-mate connectors | Technical complexities in sealing and high-voltage wet-mate applications: TRL gaps above ~36 kV and installation/weather windows limit pace of rollout. |

| Opportunities: | Impact |

| Advancements in connector materials and sealing technologies | Account for 19% growth by enhancing connector durability and depth ratings, allowing longer lifespan and reduced maintenance in harsh subsea environments. |

| Increasing adoption of remotely operated vehicles (ROVs) | Contributes 16% growth due to the growing need for inspection, maintenance, and intervention under subsea communication and networking. |

| Market Leaders (2025) | |

| Market Leaders |

~23% market share in 2025 |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia-Pacific |

| Emerging countries | China, India, Singapore, Brazil, and South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

A significant increase in global investments in submarine cable infrastructure and offshore energy projects is likely to fuel the demand for market. According to the International Finance Corporation (IFC), the investment cycle in submarine cables is set to exceed USD 13 billion during 2025–2027, roughly double the prior three years, supporting the sustained demand for underwater connectors, especially the optical connectors, at cable landing stations and subsea repeaters. While the offshore energy targets are becoming well-defined, with the U.S. aiming to reach 30 GW offshore wind by 2030 and an EU ambition of 157 GW—pulling in high-voltage connector systems for dynamic cables, floating platforms, and modular subsea hubs, as referenced by Department of Energy (DoE). This ensures near-term growth from telecom and oil & gas, followed by an upturn in floating wind as high-voltage wet-mate offerings commercialize, thereby accelerating the market growth.

Between 2022 and 2024, the market witnessed considerable growth, increasing from USD 1.6 billion to USD 1.7 billion in 2024. The growth is primarily driven by the subsequent dependence on wet-mate connectors, which remain essential for subsea field intervention and network reconfiguration. Meanwhile, broader fiber-optic connector spending benefits from AI-era traffic growth and new private cables by hyperscale’s, even as subsea projects increasingly demand higher fiber counts and denser optical pass-throughs. This key factor further strengthens the demand for underwater connectors as subsea systems standardize around modular, serviceable interfaces.

Underwater Connectors Market Trends

- Commercial Carbon Capture and Storage (CCS) programs in the North Sea are transitioning from engineering into phased buildout, which raises the bar for high-pressure, corrosion-resistant connector systems. Industry field updates from SLB and OneSubsea describe active well construction and subsea power/control scope tied to UK and Norwegian clusters, while Enki AI’s project monitoring has tracked award momentum. As a result, the regulated decarbonization targets and operator commitments require offshore injection capacity, permanent subsea power and data links to wells and manifolds. Therefore, the steady electrical and optical demand for monitoring, safety, and control aligns with the long-term CCS infrastructure deployment.

- Connector-less subsea vehicles employing inductive charging and optical modems are gaining significant traction for inspection-class operations and persistent monitoring, reflected in product documentation from Advanced Navigation and Blueye Robotics and program announcements by Oceaneering International. In contrast to conventional top-side recovery cycles, resident systems can significantly reduce intervention costs materially and shrink downtime as per the NOAA Integrated Ecosystem Assessments (IEA). The adoption of underwater connector is likely to accelerate over time as docking infrastructure matures and interoperability improves. While this trend reduces the usage of standard wet-mate connector on the vehicle interface, it simultaneously escalates the demand for high-reliability docking connectors, bulkhead feedthroughs, and fixed subsea power and data interfaces.

- Research studies indicate that integrating marine hydrokinetic (MHK) kites with offshore wind turbines smooths output and enables shared cables and hubs, making subsea infrastructure more productive, as summarized in MIT Sea Grant publications. Also, the prominent region such as Gulf Stream’s and North Carolina’s coast, grid planners are exploring multi-resource nodes that maximize seabed rights and export capacity in support of decarbonization goals, pushing considerable interest in connector specifications toward improved reliability, corrosion resistance, and integrated monitoring capabilities.

Underwater Connectors Market Analysis

Learn more about the key segments shaping this market

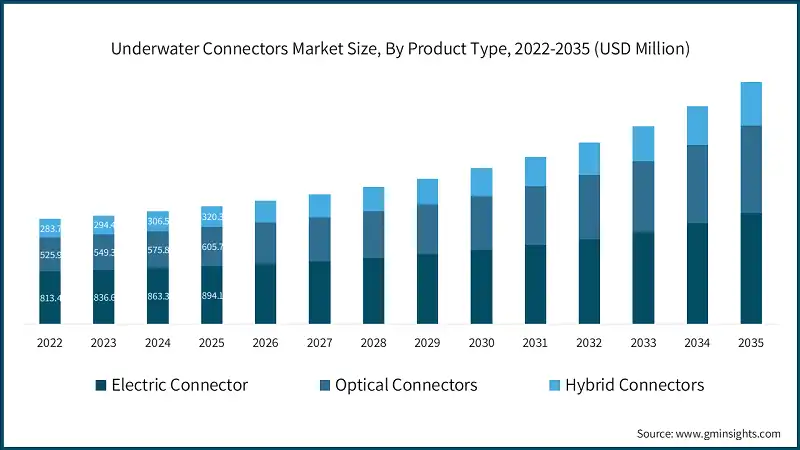

The global underwater connectors industry was valued at USD 1.6 billion and USD 1.7 billion in 2022 and 2023, respectively. The market size reached USD 1.8 billion in 2025, growing from USD 1.7 billion in 2023.

Based on the product type, the global market is divided into electric connectors, optical connectors, and hybrid connectors. The electric connector segment accounted for 49.1% of the market in 2025.

- Electric connectors continue to have a huge impact on this trend due to significant demand spanning across power distribution and subsea hubs. Also, the deepwater oil and gas systems, inspection-class robotics, and offshore wind exports all depend on ruggedized electrical interfaces, which further stimulates the adoption of electric connectors in subsea application. Furthermore, the robust U.S. rig activity and offshore production indicators, reinforcing capex in subsea power connectivity. As a result, electrical connection to retain leadership while higher-voltage, dry-mate assemblies expand in floating wind and grid-tie applications.

- The hybrid connectors segment was valued at USD 320.3 million in 2025 and is anticipated to grow at a CAGR of 8% over the forecast years. The hybrid connector segment has gained momentum due to the surging demand for integrated power and data transmission in compact subsea environment, especially in subsea processing and autonomous underwater applications.

- Manufacturers need to focus their efforts on developing high-voltage, high-bandwidth, and highly dependable connectors that enable simultaneous data transfer and facilitate modular subsea architecture.

Learn more about the key segments shaping this market

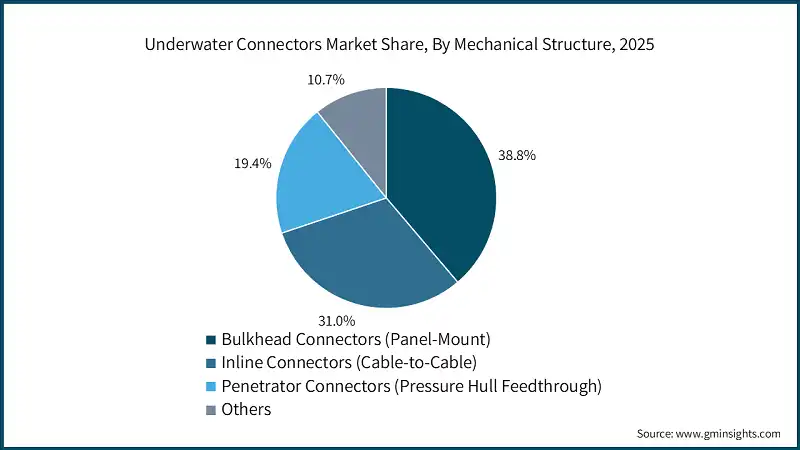

Based on mechanical structure, the underwater connectors market is classified into bulkhead connectors (panel-mount), inline connectors (cable-to-cable), penetrator connectors (pressure hull feedthrough), and others. The bulkhead connectors segment dominated the market in 2025 with a market share of 38.8%.

- The bulkhead connectors segment benefits from the need for reliable power and data feedthroughs across pressure boundaries in subsea housing and control modules, where signal and sealing integrity are utmost important to ensure performance and safety.

- Manufacturers should focus on developing high-performance, corrosion resistant bulkhead connector that support better sealing capabilities and support for higher power densities and data rates to meet evolving requirements in subsea systems.

- The inline connectors segment is expected to witness growth at a CAGR of 8.8% during the forecast period. The growing demand for rapid reconfiguration and accurate monitoring of underwater systems supports the demand for flexible, inline connectors.

- As such, manufacturers must make it a priority to create reliable inline connectors that support condition monitoring in dynamic offshore environments.

Based on mating method, the underwater connectors market is classified into wet-mate connectors and dry-mate connectors. The wet-mate connectors segment dominated the market in 2025 with a market share of 61.2%, and is expected to witness the fastest growth at a CAGR of 8.4%

- The wet-mate connectors segment benefits from escalating demand for subsea intervention, where dependable underwater connection/disconnection under pressure, robust sealing, and high signal integrity are important for field operations and network flexibility.

- Manufacturers should focus on developing high-performance wet-mate connectors that aid corrosion resistance, improved mateability, and greater depth ratings to meet evolving needs of subsea deployments.

Looking for region specific data?

North America Underwater Connectors Market

North America dominated the global market with a share of 38.6% in 2025.

- In the North American market, growing deployments for submarine cable, increasing activity in offshore wind projects, and growing investments in wind and defense programs are driving the growth of the market.

- In addition, the market growth is further due to technological innovation in subsea systems, along with regulatory backing for offshore energy development.

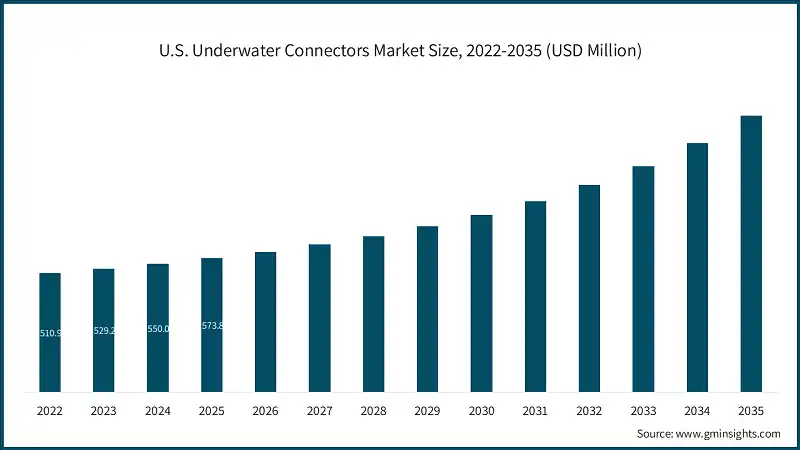

The U.S. underwater connectors industry was valued at USD 510.9 million and USD 529.2 million in 2022 and 2023, respectively. The market size reached USD 573.8 million in 2025, growing from USD 550.0 million in 2024.

- The growth of the market in the U.S. is being driven by increasing exploration in deepwater, especially in the Gulf of Mexico, along with increasing investments in subsea telecommunications infrastructure.

- Companies that are addressing these market conditions should focus on developing innovative, high-bandwidth connector solutions as well as advancements in sealing technologies to meet offshore and defense requirements.

Europe Underwater Connectors Market

Europe market accounted for USD 402.4 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- The European market is expected to grow due to the growing interconnections in subsea grid, large-scale offshore wind deployments, and increasing focus on oil & gas assets requiring reliable subsea power.

- In addition, robust decarbonization policies and considerable investments in subsea digitalization throughout Europe drive this market.

Germany dominates the Europe underwater connectors industry, showcasing robust growth potential.

- Germany's market is likely to driven by the offshore wind expansion in the North and Baltic Seas, cross-border power transmission projects, and subsea grid interconnections.

- Companies should focus on energy transition, offshore infrastructure modernization, and grid reliability supports demand for high-voltage and dry-mate connectors, thereby driving the market growth.

Asia Pacific Underwater Connectors Market

The Asia Pacific market is anticipated to grow at the highest CAGR of 8.7% during the analysis timeframe.

- The Asia Pacific market continues to see rapid growth from an expanding submarine cable network, along with the growing production capacity of offshore wind.

- Further, the market is driven by the continual investments in deepwater exploration, ocean monitoring programs, and marine robotics in China, Japan, and Southeast Asia.

China market is estimated to grow with a significant CAGR of 9.6% in the Asia-Pacific.

- China's market influenced by a range of factors, including the rising adoption of autonomous underwater vehicles (AUVs) and subsea monitoring systems, along with the increased investments in marine engineering and ocean technologies by regulatory bodies.

- Companies operating in the Chinese market prioritize the development of high-reliability underwater connector solutions to support expanding offshore wind projects and the increasing adoption of ocean monitoring systems and marine robotics.

Latin American Underwater Connectors Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil's market is being driven by growing developments in deepwater and ultra-deepwater oil & gas, especially in the pre-salt basins, needed advanced subsea production and control systems.

- Ensure that product development strategies support with Brazil’s expanding offshore oil & gas investments and subsea infrastructure required by offering cost-efficient, high-reliability underwater connector solutions well-suited for long-term offshore operations.

Middle East and Africa Underwater Connectors Market

South Africa market to experience substantial growth in the Middle East and Africa in 2025.

- In the Middle East & Africa Region, growing interest in offshore renewables, digital oilfield initiatives, and subsea surveillance facilitates the adoption of connectors in harsh marine environments is driving South Africa market growth.

- Ensure that companies developing products provide the necessary infrastructure to meet growing user demand and have affordable quality solutions that facilitate deployment across offshore hubs and coastal regions.

Underwater Connectors Market Share

Big players such as Amphenol Corporation, TE Connectivity, Molex, Eaton Corporation, and Teledyne control more than half of the underwater connectors industry, accounting for over 54.8% of total market share in 2025. These key contributors are innovating in the areas of subsea application, spanning across telecom infrastructure, research platforms, and underwater robotics. Leveraging advanced materials, system-level integration capabilities, and precision engineering, leading vendors are well positioned to provide reliable, high-speed solutions for harsh environments across industrial and transport adjacencies that aligns well with subsea environments.

Several small niche players entering the underwater connectors space. These companies support increased competition and ultimately drive technological advancements to provide specialized industry specific solutions to the emerging needs of the modular subsea systems, addressing specialized performance and environmental requirements across energy, telecom, and marine research sectors.

Underwater Connectors Market Companies

Prominent players operating in the underwater connectors industry are as mentioned below:

- Amphenol Corp.

- Baker Hughes (GE Company LLC)

- Eaton Corporation

- Fischer Connectors

- Glenair Inc.

- Hydro Group

- MacArtney

- Molex

- Smiths Group Plc

- TE Connectivity

- Teledyne

Amphenol Corporation maintains leadership with broad portfolios across electrical, optical, and hybrid connectors for offshore production, telecom landings, renewable arrays, and robotics—tailored to pressure, temperature, and corrosion demands common at depth.

TE Connectivity provides ruggedized, high-speed solutions end-to-end—from shallow-water instruments to deepwater systems beyond 3,000 meters—serving telecom, offshore wind, and production control.

Eaton Corporation

Eaton Corporation leverages power-management expertise for high-voltage distribution in offshore production systems and renewable exports, emphasizing reliability under harsh pressure/temperature profiles.

Teledyne integrates connectors with marine instrumentation and imaging, evidenced by optical connectors fielded for demanding expeditionary filming and research.

Molex brings cross-industry connector innovation to subsea, spanning telecom infrastructure, research platforms, and underwater robotics.

Underwater Connectors Industry News

- In January 2025, Teledyne Impulse-PDM, a major supplier of high-performance subsea interconnect solutions, delivered its advanced Omicron optical fiber connectors to BBC Studios for installation in an impending underwater natural history series scheduled to be released in 2026. The project implies custom-engineered camera systems designed to obtain high-resolution marine footage in extreme deep-water Arctic conditions.

- In April 2024, DWTEK Co., Ltd., a prominent provider of underwater connectivity solutions, has entered into a strategic partnership with Meiho Electronics Japan. Through this strategic collaboration, DWTEK targets to expand its business presence in Japan by providing its extensive portfolio of Taiwan-manufactured underwater connectors, including customized solutions based on local application requirements.

- In January 2024, MacArtney unveiled the Hybrid connector, an efficient addition to renowned TrustLinkTM Metal Shell series. Meeting consumer demands, the hybrid connectors seamlessly offer power, data, and communication simultaneously. The TrustLink Metal Shell (MS) design prioritizes better reliability in a high-density connector, addressing the challenges of harsh marine environments.

The underwater connectors market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

By Product Type

- Electrical Connectors

- Optical Connectors

- Hybrid Connectors

By Mechanical Structure

- Bulkhead Connectors (Panel-Mount)

- Inline Connectors (Cable-to-Cable)

- Penetrator Connectors (Pressure Hull Feedthrough)

- Others

- Dummy Connectors

- Protective Caps

By Mating Method

- Wet-Mate Connectors

- Dry-Mate Connectors

By Material Type

- Metal

- Stainless steel

- Titanium

- Composites

- Plastics & Polymers

- Rubber

By Connector Shape

- Circular Connectors

- Rectangular Connectors

- Others

- Oval

- D-type

- Custom

By Depth Rating

- Shallow Water (<200m)

- Medium Depth (200-1,000m)

- Deep Water (1,000-3,000m)

- Ultra-Deep Water (>3,000m / >10,000m)

By Voltage Rating

- Low Voltage (<1,000V)

- Medium Voltage (1,000V - 10kV)

- High Voltage (>10kV)

By Application

- Offshore Oil & Gas

- Subsea Telecommunications

- Defense & Naval

- Oceanographic Research

- Renewable Energy

- Others

- Subsea Mining

- Aquaculture

- ROVs

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which application segment drives demand in the underwater connectors market?

Offshore oil & gas remains a key application segment, supported by deepwater and ultra-deepwater developments that require high-reliability electrical and optical underwater connectors.

Who are the key players in the underwater connectors market?

Leading companies operating in the underwater connectors industry include Amphenol Corporation, TE Connectivity, Eaton Corporation, Teledyne, Molex, Fischer Connectors, Glenair, Hydro Group, MacArtney, and Smiths Group Plc.

What is the growth outlook for wet-mate connectors during the forecast period?

Wet-mate connectors dominated the market with a 61.2% share in 2025 and are expected to grow at a CAGR of 8.4% through 2035, driven by increasing subsea intervention, maintenance, and network reconfiguration activities.

Which region leads the underwater connectors market?

The U.S. market reached USD 573.8 million in 2025. Growth is driven by deepwater exploration in the Gulf of Mexico, expanding offshore wind projects, and rising investments in subsea telecommunications infrastructure.

What are the key trends shaping the underwater connectors industry?

Major trends include advancements in connector materials and sealing technologies, increasing adoption of high-voltage connectors for offshore wind, and growing use of connectors in ROVs and AUVs for subsea inspection and monitoring.

What was the valuation of the hybrid connectors segment in 2025?

The hybrid connectors segment was valued at USD 320.3 million in 2025, supported by growing adoption of integrated power and data transmission in compact subsea environments.

How much revenue did the electric connectors segment generate in 2025?

Electric connectors accounted for 49.1% of the underwater connectors industry in 2025, reflecting strong demand for reliable power transmission across subsea hubs, offshore wind exports, and deepwater oil & gas systems.

What is the market size of the underwater connectors industry in 2025?

The market size exceeded USD 1.8 billion in 2025, driven by rising offshore oil & gas deepwater operations and expanding subsea telecommunications infrastructure.

What is the projected value of the underwater connectors market by 2035?

The underwater connectors industry is expected to reach USD 3.7 billion by 2035, growing at a CAGR of 7.8% due to strong demand from offshore renewables, subsea telecom, and advanced marine robotics.

What is the current underwater connectors market size in 2026?

The market is projected to reach USD 1.9 billion in 2026 as investments increase in offshore energy, submarine cables, and subsea power transmission systems.