Summary

Table of Content

Ultrasonic Sensors Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Ultrasonic Sensors Market Size

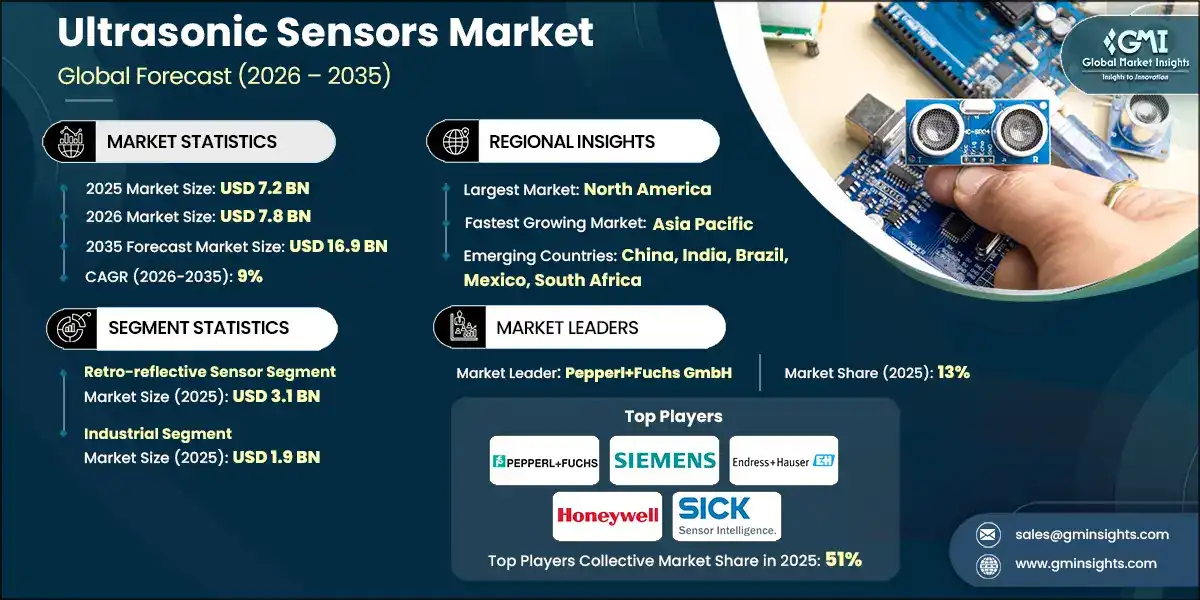

The global ultrasonic sensors market was valued at USD 7.2 billion in 2025. The market is expected to grow from USD 7.8 billion in 2026 to USD 16.9 billion in 2035, at a CAGR of 9% during the forecast period according to the latest report published by Global Market Insights Inc.

To get key market trends

As more automotive manufacturers integrate electronically controlled safety systems and Advanced Driver Assistance Solutions (ADAS) into their vehicles, the demand for ultrasonic sensors will continue to rise because of their ability to detect objects within a vehicle's immediate proximity and assist drivers while parking, blind-spot monitors will play an increasingly important role in fully autonomous or semi-autonomous vehicles.

In addition, as the emergence of Industry 4.0 continues to grow, the demand of ultrasonic sensors in industrial automation processes will also rise. Industrial-grade ultrasonic sensors provide reliable detection of materials and features, as well as highly consistent performance regardless of environmental conditions. Ifm electronic's ultrasonic sensor with IO-Link technology enables distance detection and robotic guidance in smart factories. As a result of both the emergence of connected production lines and automated material handling systems, there is a growing demand for the use of ultrasonic sensors in both newly purchased and retrofitted industrial systems.

Increasing use of ultrasonic sensors in healthcare and medical devices has contributed to increased market adoption. Non-invasive diagnostic methods such as ultrasonic sensing allow for patient monitoring & fluid/bubble detection, which improves equipment reliability & patient safety. Manufactures infusion pumps & dialysis machines with piezoceramic ultrasonic components built into them. As a result of incorporating ultrasonic sensors in medical practice, it has increased the capability of monitoring precision, compact designs, & regulatory compliance. These benefits have expanded the ultrasonic sensor market into a rapidly developing segment.

Between 2022 and 2024, the ultrasonic sensors market witnessed considerable growth, increasing from USD 5.4 billion in 2022 to USD 6.5 billion in 2024. Growth drivers also include advances in miniaturisation, performance, and smart integration in sensing technology. MEMS-based ultrasonic sensors provide improved detection ranges, high accuracy, low power consumption, and IoT/AI compatibility. For example, TDK offers the InvenSense SmartSonic ICU-20201 family of ultra-compact Time of Flight (ToF) ultrasonic sensors with integrated chip processing for use with connected devices and robotics. The use of these advanced types of ultrasonic sensors will further develop and expand the range of applications and increase adoption rates through the implementation of smaller battery-powered devices, consumer electronic products, and autonomous machinery.

New industries that are developing such as agriculture, new technology in smart homes and environmental monitoring are continuing to grow due to the contribution from ultrasonic sensors which are very robust and durable in adverse conditions. These sensors support the outdoor use of ultrasonic sensors in agriculture areas, providing the capability to control irrigation operations, and supports smart infrastructure and safety systems for humans and others.

The capability for ultrasonic sensors to operate in various industries beyond traditional Autonomy and industrial applications has created new revenue opportunities for the market. More revenue opportunities will open the addressable market for ultrasonic sensors and speed up the overall adoption of ultrasonic sensors in a variety of different regions and across many different industries.

Ultrasonic Sensors Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 7.2 Billion |

| Market Size in 2026 | USD 7.8 Billion |

| Forecast Period 2026 - 2035 CAGR | 9% |

| Market Size in 2035 | USD 16.9 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing Adoption of Automotive Safety and ADAS Technologies | Drives demand as ultrasonic sensors enable parking assist, blind-spot detection, and low-speed collision avoidance in ADAS-equipped vehicles. |

| Expansion of Industrial Automation and Industry 4.0 Applications | Fuels growth by supporting accurate object detection and robotic guidance in industrial automation and logistics. |

| Growing Utilization in Healthcare and Medical Devices | Supports expansion through non-invasive diagnostics, patient monitoring, and fluid detection in medical devices. |

| Advancements in Miniaturization and Smart Sensing Capabilities | Accelerates adoption with MEMS-based, energy-efficient sensors integrated with IoT and AI capabilities. |

| Penetration into Emerging Sectors such as Smart Homes and Agriculture | Expands market reach by enabling applications in smart infrastructure, agriculture, and environmental monitoring. |

| Pitfalls & Challenges | Impact |

| Limited Range and Environmental Sensitivity | Restrains growth as ultrasonic sensors have limited long-range accuracy and can be affected by harsh environmental conditions. |

| High Integration and Manufacturing Costs for Advanced Sensors | Hinders adoption as advanced, miniaturized ultrasonic sensors involve higher fabrication and integration costs. |

| Opportunities: | Impact |

| Integration with IoT and Smart Systems | Creates growth opportunities by enabling real-time monitoring, automation, and analytics in connected and IoT-enabled devices. |

| Expansion into Emerging Sectors such as Agriculture and Environmental Monitoring | Expands potential through applications in precision agriculture and smart cities, opening new revenue streams. |

| Market Leaders (2025) | |

| Market Leaders |

13% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Ultrasonic Sensors Market Trends

- The market is being influenced by a new trend involving increased use of sensors within advanced driver-assistance systems (ADAS) and autonomous vehicles. An increase in the number of ultrasonic sensors installed in cars for use with parking assistance systems, blind spot detection systems, forward collision avoidance systems and low speed object detection systems.

- Ultrasonic sensors have proven to be highly reliable in short-range sensing applications as well as being compatible with multiple sensor configurations in ADAS designs, therefore, they play an important role in providing and supporting safe driving and autonomous vehicle mobility solutions.

- In addition, industrial automation and industry 4.0 applications are driving the adoption of ultrasonic sensors within the manufacturing industry. Increased use of robotics, automated guided vehicles (AGVs), smart manufacturing lines etc, Having increased dependence on the ultrasonic sensor for unique object detection, Level Measurement Systems and process monitoring.

- Ifm electronic offers IO-Link enabled ultrasonic sensors that are being used for robotic guidance and tank level detection in smart factory settings, hence, the increasing use of connecting fully automated industrial systems.

- Another major trend being driven by the healthcare and medical device industry is the development of new products incorporating ultrasonic sensors. More manufacturers are using ultrasonic sensors in their products that help to provide non-invasive diagnostics, patient monitoring devices and fluid detection systems.

- The ability of ultrasonic sensors to provide accurate sensing without direct contact with the patient provides the potential for safer, more efficient and smaller healthcare solutions that comply with very strict regulatory standards.

- Miniaturization and smart sensing capabilities are rapidly advancing within the market. The adoption of MEMS-based ultrasonic sensors with integrated signal processing, IoT and AI connectivity, as well as low-power operation, has opened new opportunities for consumers to integrate ultrasonic sensing into multiple types of products, including consumer electronics, drones, robotics, and wearables.

- Many manufacturers can incorporate greater precision, improved detection range and reduced power consumption with these products and therefore continue to push the envelope with respect to how small and connected ultrasonics can be used.

Ultrasonic Sensors Market Analysis

Learn more about the key segments shaping this market

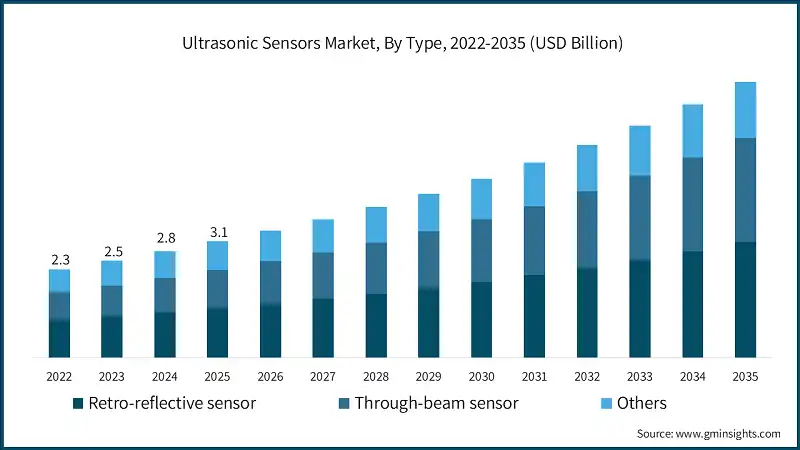

The market was valued at USD 5.4 billion and USD 5.9 billion in 2022 and 2023, respectively. The market size reached USD 7.2 billion in 2025, growing from USD 6.5 billion in 2024.

Based on type, the ultrasonic sensors market is divided into retro-reflective sensors, through-beam sensors, and others. The retro-reflective sensor segment dominated the market in 2025 with a revenue of USD 3.1 billion.

- The retro-reflective sensor segment has been growing due to the increased demand and necessity for reliable, long-range detection in several industries, including industrial automation, logistics and automotive applications. Retroreflective ultrasonic sensors utilize ultrasonic wave reflection from a target back to themselves, so they can produce a very accurate measurement of the surface of an object or a target regardless of the conditions around the sensor. These sensors can be used in many different types of applications such as automated material handling, parking assist systems, and vehicle detection systems.

- For instance, Pepperl+Fuchs offers retro-reflective ultrasonic sensors for distance measurement and object detection in factory automation, highlighting their widespread adoption in industrial settings.

- The through-beam sensor segment is anticipated to witness the growth at a CAGR of 10.5% over the forecast period.

- Through-beam ultrasonic sensors operate by aligning an emitter and a separate receiver, detecting any object that interrupts the sound beam. The precision of these sensors makes them quite useful in robotics and automation.

- Companies that specialize in through beam sensors must focus on the industrial automation, automotive safety, and robotics markets, where higher accuracy and longer ranges are required. Incorporating advanced signal processing, miniaturized transducers, and IoT-enabled connectivity can help expand applications into emerging smart manufacturing, autonomous vehicles, and precision agriculture, supporting accelerated market growth.

Learn more about the key segments shaping this market

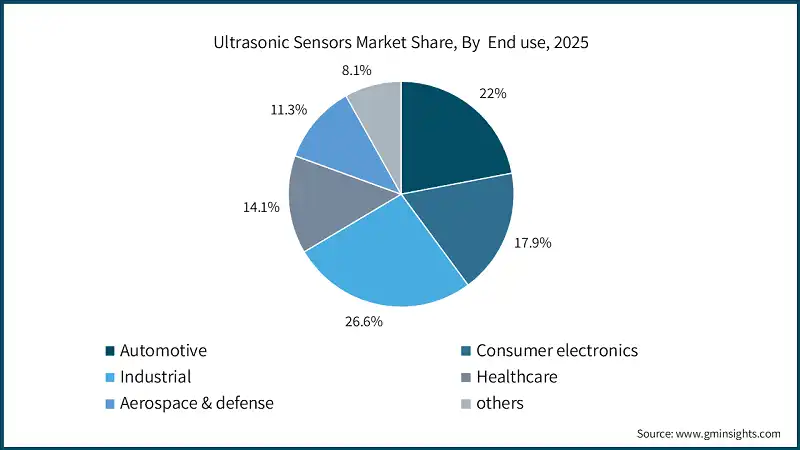

Based on end use, the ultrasonic sensors market is segmented into automotive, consumer electronics, industrial, healthcare, aerospace & defense, and others. The industrial segment dominated the market in 2025 with a revenue of USD 1.9 billion.

- The Industrial market is growing due to the widespread usage of ultrasonic sensors in the automation of processes, robots, material handling, and plant safety solutions.

- Industrial-grade ultrasonic sensors provide precise, contactless measuring and are able to detect in adverse conditions such as dust, moisture, and extreme temperatures.

- The Automotive sector is the fastest-growing end-use segment with CAGR of 11.7% during the forecast period. This growth in the automotive market is because ultrasonic sensors have been applied in the development of assistance systems such as ADAS, autonomous cars, parking assistants, and blind spot detection. Automotive-grade ultrasonic sensors offer short range and high precision detection.

Looking for region specific data?

The North America ultrasonic sensors market dominated the global market in 2025 with the market size of USD 3 billion, supported strong adoption across automotive, industrial automation, healthcare, and smart infrastructure applications, where high-precision, reliable, and cost-effective sensing solutions are increasingly critical.

- Stringent safety regulations, advanced manufacturing capabilities, and early adoption of Industry 4.0 initiatives are key enablers of market growth.

- North America’s increasing focus on automotive safety and ADAS technologies is intensifying demand for ultrasonic sensors in parking assistance, blind-spot detection, and collision avoidance systems.

- The proliferation of autonomous vehicle testing and connected vehicle initiatives in the U.S. and Canada further supports deployment, driving growth in short-range, high-accuracy sensing solutions across the automotive sector.

- In the industrial sector, the North American market remains on an upward trend when using ultrasonic sensors for process automation, robotics, material handling, and even factory safety systems. The integration of ultrasonic sensors into smart factories, predictive maintenance platforms, and AGVs has helped the industry increase the overall efficiency and has thus increased demand.

- Also, increasing adoption of ultrasonic sensors within the healthcare sector, consumer electronics, and smart homes is broadening their application area. Investment in research and development activities, especially for the miniaturization of sensors based on MEMS technology and compatibility with IoT and AI, is also propelling the region to become an innovation and sensing solution leader. Due to their relentless focus on automation, safety, and connected technology, the North American region will continue to have dominance over the global market.

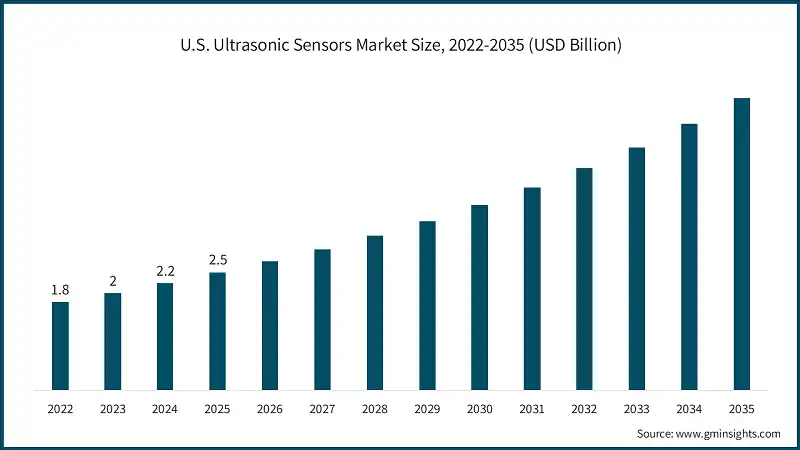

The U.S. ultrasonic sensors market was valued at approximately USD 2 billion and USD 2.2 billion in 2023 and 2024, respectively. The market size reached USD 2.5 billion in 2025, reflecting strong adoption across automotive, industrial, and healthcare applications.

- The U.S. dominates the ultrasonic sensors industry, driven by widespread integration in advanced driver-assistance systems (ADAS), industrial automation, and smart infrastructure projects.

- The presence of leading technology firms, robotics integrators, and car manufacturers, along with the well-established manufacturing infrastructure, facilitates the fast adoption of high-precision, short-range, and long-range ultrasonic sensors. The standards that support the safety of vehicles and the working place hasten the adoption.

- Industrial automation initiatives, particularly in smart factories and logistics operations, are fostering demand for ultrasonic sensors for material handling, object detection, and process monitoring.

- Increased investment in connected manufacturing and predictive maintenance systems encourages widespread sensor integration, helping industries improve efficiency, reduce downtime, and ensure personnel safety.

The Europe ultrasonic sensors market accounted for USD 1.3 billion in 2025 and is anticipated to witness strong growth over the forecast period, reflecting increasing adoption across automotive, industrial automation, healthcare, and environmental monitoring applications.

- The growth of the market in the European region is driven by the need for automotive safety and the implementation of ADAS technologies in new cars. Nations such as Germany, France, and Italy are emphasizing collision avoidance and parking-assist technologies, driving OEM adoption of ultrasonic sensors to meet safety standards and reduce road accidents.

- The industrial and manufacturing industries are adopting ultrasonic sensors for level measurement, leak detection, and robotic guidance. The factories of Europe, especially German and Dutch factories, are adopting ultrasonic sensors to improve the efficiency of their production processes as part of the intelligent factory concept to improve production efficiency and achieve preventive maintenance as a part of Industry 4.0.

Germany ultrasonic sensors market dominates the European market with an estimated 7.7% share in 2025, reflecting strong adoption across automotive, industrial automation, and smart infrastructure applications.

- Germany is a key market for ultrasonic sensors, driven by its robust automotive industry, advanced manufacturing sector, and growing focus on connected and automated systems.

- The presence of a strong ecosystem of automobile-original equipment manufacturers, industrial equipment manufacturers, and research bodies in the country is also propelling the adoption of ultrasonic sensors in parking assist systems, robotics guidance, level detection, and environment detection. Collaborations in sensor development by OEMs and technology providers make possible high-level multi-sensor systems, high-frequency sensing, and IoT-connected deployments, positioning Germany as a European hub for next-generation ultrasonic sensing technologies across the mobility, industrial, and smart infrastructure sectors.

The Asia-Pacific ultrasonic sensors market is anticipated to grow at the highest CAGR of 10.3% during the forecast period.

- As its automotive sector evolves, coupled with strong electronics manufacturing and government policies encouraging smart mobility and Industry 4.0, the Asia Pacific region is becoming the fastest growing region in the ultrasonic sensors industry. Countries such as China, Japan, South Korea, and Taiwan are investing heavily in ADAS integration, automated production lines, and IoT-enabled sensing solutions.

- The region’s leadership in manufacturing scale, R&D capabilities, and technology adoption enables cost-effective deployment of high-precision ultrasonic sensors across automotive, industrial, and consumer electronics sectors.

- Growing demands and requirements for reliable, contactless sensing in the areas of autonomous cars, robotics, and industrial automation, as well as environmental detection, are contributing to regional adoption. Collaborations between vendors of ultrasound sensors and firms that provide industrial and automotive technology are making way for frequent beams and IoT-enabled ultrasound technology.

The China ultrasonic sensors market is estimated to grow at a significant CAGR of 11.3% from 2026 to 2035.

- The market is seeing intense expansion from the Chinese government through their initiatives of smart mobility, Industry 4.0, and the Internet of Things for their Smart Infrastructure Plan. Initiatives like “Made in China 2025” and Smart Cities are encouraging the development of precise ultrasonic sensors in the country for the application of ADAS in automobiles, industries, and environment or weather measurement.

- Some of the most prominent technology firms such as BYD, Huawei, and SenseTime are incorporating ultrasonic sensors into autonomous vehicles, robotics, and smart factory solutions for improving safety, automation, and energy savings.

- Rising demand for reliable, non-contact sensing in electric vehicles, smart manufacturing, and IoT-enabled devices is driving regional adoption.

- With continued investment in auto electronics, smart manufacturing, and Internet of Things solutions for cities, China emerges as a major driver of the APAC ultrasonic sensor market and a global market growth contributor.

The Latin America ultrasonic sensors market, valued at approximately USD 111 million in 2025, is gaining momentum due to increasing adoption of automotive safety systems, industrial automation, and smart infrastructure solutions.

- Brazil leads the Latin American market, showing strong growth during the analysis period.

- Brazil is emerging as a key growth hub in the region, driven by expanding industrial automation, automotive production, and smart infrastructure development.

- Rising Urbanization as well as the growing requirement for automation and safety solutions is boosting the market for ultrasonic sensors.

- The encouraging government support initiatives in the field of industrial modernization, infrastructure development, and smart city development are giving a boost to the adoption of ultrasonic sensing technology.

The Middle East & Africa ultrasonic sensors market is projected to grow steadily at a CAGR of 5.5% over the forecast period, driven by the growing use of reliable, non-contact sensing solutions in automotive, industrial automation, and smart infrastructure. The use of ultrasonic sensors in autonomous vehicle testing, industrial robotics, and smart city initiatives by the UAE, Saudi Arabia, and South Africa, is geared to enhance and optimize safety, processes, and energy.

- South Africa is expected to witness substantial growth in the Middle East and Africa ultrasonic sensors industry during the forecast period.

- South Africa hosts several system integrators and is seeing rising adoption of ultrasonic sensors in mining, automotive, industrial safety, and smart building applications.

- The ongoing partnerships with global tech players, government-funded industrialization and infrastructure investments are likely to drive the rapid deployment of ultrasonic sensors and will address the continuous growth of the market in the region.

Ultrasonic Sensors Market Share

The market is witnessing robust growth, driven by rising demand for reliable, high-precision sensing solutions across automotive, industrial automation, healthcare, and smart infrastructure applications. Leading companies such as Pepperl+Fuchs GmbH, Siemens AG, Endress+Hauser Group Services AG, Honeywell International Inc., and SICK AG collectively account for over 51% of the global market. These players utilize strategic partnerships with automotive Original Equipment Manufacturers (OEMs), industrial automation integrators, medical device manufacturers, smart city builders, to promote the use of ultrasonic sensors for use in the automation and process monitoring in the critical safety systems. Emerging ultrasonic sensor developers are optimizing the operational reliability in various factors such as multi-beam, miniaturizing, and IoT enabling ultrasonics for extreme environmental deployment, energy efficiency, compactness and high reliability.

In addition, major ultrasonic sensor companies are driving market innovation through advances in miniaturization, MEMS-based sensing, wireless connectivity, and integrated signal processing for automotive ADAS, industrial robotics, and healthcare monitoring systems. These companies concentrate on advancing the detection range, precision, response time, and environmental resistance. These metrics enable faster and more dependable functions on both enterprise and consumer levels. Strategic partnerships with automotive, industrial automation, and IoT automation, partner ecosystems are fostering the use case in multiple industries. These partnerships are improving the systems' safety, operational efficiency, and scalability in support of more widespread ultrasonic sensors being used as critical components for advanced automotive, industrial, and smart infrastructure technologies.

Ultrasonic Sensors Market Companies

Some of the prominent market participants operating in the ultrasonic sensor market include:

- ABB Ltd.

- Banner Engineering Corp.

- Baumer Holding AG

- Continental AG

- Endress+Hauser Group Services AG

- Honeywell International Inc.

- ifm electronic GmbH

- Keyence Corporation

- Krohne Messtechnik GmbH

- MaxBotix Inc.

- Murata Manufacturing Co., Ltd.

- Omron Corporation

- Pepperl+Fuchs GmbH

- Robert Bosch GmbH

- Rockwell Automation, Inc. (Allen-Bradley)

- Senix Corporation

- Siemens AG

- SICK AG

- Texas Instruments Incorporated

- TURCK Inc.

- Pepperl+Fuchs GmbH (Germany)

Pepperl+Fuchs GmbH leads the global ultrasonic sensors market with a share of approximately 13%. The company specializes in industrial-grade ultrasonic sensors, including retro-reflective, through-beam, and time-of-flight solutions for automation, process control, and robotics applications. Its focus on high-precision, durable, and IoT-compatible sensors enables deployment in harsh environments, including chemical plants, logistics systems, and smart factories. Strategic collaborations with industrial integrators and system developers enhance integration of ultrasonic sensing solutions into automated production lines, ensuring accurate detection, level measurement, and proximity monitoring. The company’s extensive portfolio and technological reliability solidify its leadership position in the global market.

Siemens AG holds approximately 11.5% of the global ultrasonic sensors market. The company develops a wide range of sensors for industrial automation, smart manufacturing, and process optimization, including high-performance time-of-flight and Doppler ultrasonic sensors. Siemens emphasizes precision, energy efficiency, and integration with Industry 4.0 systems, enabling predictive maintenance, automated material handling, and real-time monitoring across factories and infrastructure projects. Partnerships with industrial automation providers and software integrators allow Siemens to deploy ultrasonic sensors across large-scale industrial environments, strengthening its market presence and supporting broader adoption of ultrasonic sensing technologies globally.

Endress+Hauser Group Services AG accounts for around 10% of the ultrasonic sensors market, focusing on process automation and measurement solutions for liquid and bulk material handling. The company’s portfolio includes ultrasonic level, flow, and distance measurement sensors designed for chemical, food & beverage, and water & wastewater industries. Its sensors are known for high accuracy, reliability under extreme conditions, and compatibility with digital monitoring systems. Endress+Hauser’s integration of advanced sensor technologies with process control platforms enables customers to optimize operational efficiency, reduce downtime, and enhance process safety, reinforcing its competitive position in the global ultrasonic sensing market.

Ultrasonic Sensors Industry News

- In May 2025, ABB and RMG announced a supply frame agreement to provide high-precision ultrasonic gas meters to the U.S. energy market. Through their agreement, RMG would supply its ultrasonic gas meters to ABB to supplement its instrumentation offering for custody-transfer and mid-stream measurement. The agreement was planned to improve the accuracy, availability, and low cost of measurement for oil and gas customers by leveraging the strengths of RMG and the automation and digitalization solutions provided by ABB.

- In September 2024, Baumer announced that its ultrasonic sensor UF401V was named a 2024 Top New Product by OEM Off-Highway magazine. Designed for mobile machines, including agricultural and construction equipment, the UF401V offers high reliability in harsh outdoor conditions, resisting dust, chemicals, extreme temperatures, and wet environments. The sensor provides precise distance, object, and presence monitoring, enhancing uptime and operational efficiency for OEMs worldwide.

The ultrasonic sensors market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion from 2022 – 2035 for the following segments:

Market, By Type

- Retro-reflective sensor

- Through-beam sensor

- Others

Market, By Operating Frequency

- Low Density STT-MRAM (≤16 Mb)

- Medium Density STT-MRAM (32 Mb - 256 Mb)

- High Density STT-MRAM (512 Mb - 1 Gb)

- Ultra-High Density STT-MRAM (>1 Gb)

Market, By Application

- Level Measurement

- Flow Measurement

- Distance/Proximity Detection

- Non-Destructive Testing (NDT)

- Medical Diagnostics

- Others

Market, By End Use

- Automotive

- Consumer electronics

- Industrial

- Healthcare

- Aerospace & defense

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the ultrasonic sensors market?

Key ultrasonic sensors industry trends include increased use in ADAS and autonomous vehicles, rising adoption in Industry 4.0 automation, and advancements in MEMS-based, IoT-connected sensing technologies.

What is the growth outlook for the automotive end-use segment from 2026 to 2035?

The automotive ultrasonic sensors segment is expected to grow at a CAGR of 11.7% through 2035, driven by increasing deployment in ADAS, parking assistance, and autonomous vehicle systems.

What was the valuation of the industrial end-use segment in 2025?

The industrial end-use segment generated USD 1.9 billion in 2025, supported by widespread use of ultrasonic sensors in robotics, material handling, and smart factory automation.

Who are the key players in the ultrasonic sensors industry?

Key market players include Pepperl+Fuchs GmbH, Siemens AG, Endress+Hauser Group Services AG, Honeywell International Inc., SICK AG, ABB Ltd., and Bosch.

Which region leads the ultrasonic sensors market?

North America dominated the market with a valuation of USD 3 billion in 2025.

What is the market size of the ultrasonic sensors industry in 2025?

The market size for ultrasonic sensors was USD 7.2 billion in 2025, growing steadily due to rising adoption across automotive safety systems, industrial automation, and healthcare sensing applications.

What is the current ultrasonic sensors market size in 2026?

The ultrasonic sensors industry is projected to reach USD 7.8 billion in 2026 as demand increases for non-contact, high-precision sensing solutions.

What is the projected value of the ultrasonic sensors market by 2035?

The market size for ultrasonic sensors is expected to reach USD 16.9 billion by 2035, growing at a CAGR of 9% from 2026 to 2035, driven by expanding ADAS integration, Industry 4.0 adoption, and increasing use in smart infrastructure applications.

How much revenue did the retro-reflective sensor segment generate in 2025?

The retro-reflective sensor segment generated USD 3.1 billion in 2025, leading the ultrasonic sensors market due to its reliability in industrial automation and automotive detection systems.

Ultrasonic Sensors Market Scope

Related Reports