Summary

Table of Content

Truck Platooning Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Truck Platooning Market Size

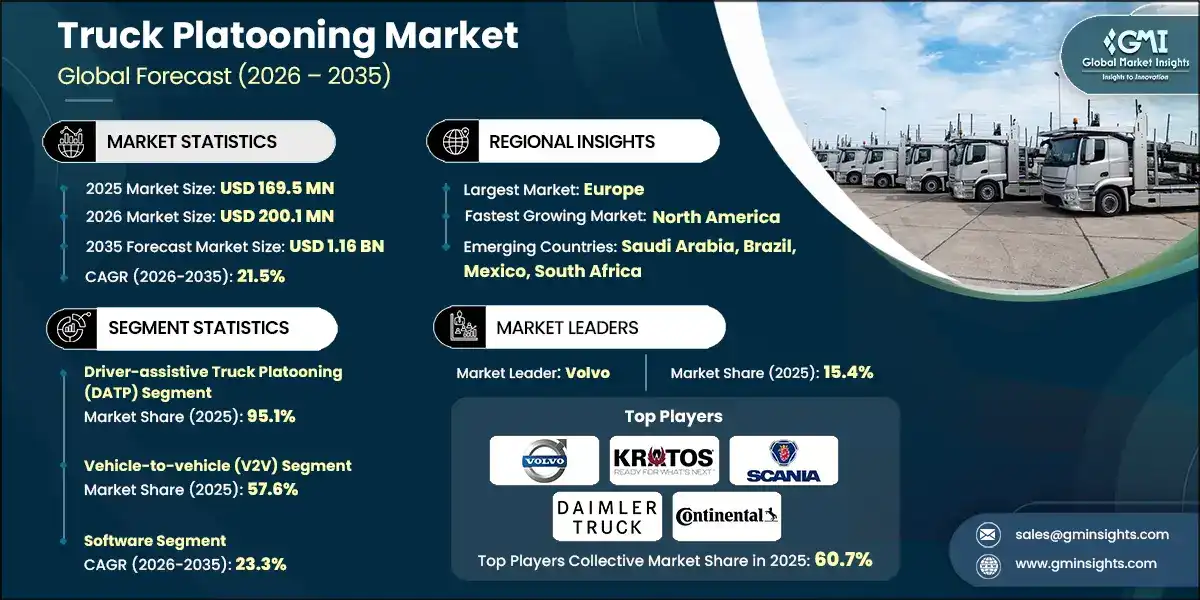

The global truck platooning market was valued at USD 169.5 million in 2025. The market is expected to grow from USD 200.1 million in 2026 to USD 1.16 billion in 2035 at a CAGR of 21.5%, according to latest report published by Global Market Insights Inc.

To get key market trends

Logistic and transportation industries are controlling the majority of the truck fleets with a share of over 70% of total truck applications. Innovation of truck platooning technology is grabbing the attention of fleet operators as well as government.

Since the inception of this technology, many governments and regulatory bodies, including the EU, the US Department of Energy and the US Department of Transport, have invested multi-millions of dollars. For instance, in April 2025, Ohio and Indiana deployed partially automated trucks on Interstate 70 between Columbus, Ohio, and Indianapolis, Indiana, delivering shipments for EASE Logistics.

This deployment is a collaboration between the Ohio Department of Transportation (ODOT)’s DriveOhio initiative and the Indiana Department of Transportation (INDOT) to advance the adoption of truck automation technologies in the logistics industry across the Midwest.

Additionally, the U.S. Government is actively funding autonomous vehicle R&D and investing in the development of technologies to enable and complement an efficient transition toward a transportation system in which AVs and conventional surface vehicles operate seamlessly and safely.

Geographically, Europe leads the market, as most of the truck platooning tests were completed in this region only. According to the European Automobile Manufacturers' Association (ACEA), road freight transport is the backbone of trade and commerce on the European continent. Trucks carry 75% of all freight transported over land in the European Union. Such huge truck deployments and better road infrastructure will continue to support the players to grow in the region.

Truck Platooning Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 169.5 Million |

| Market Size in 2026 | USD 200.1 Million |

| Forecast Period 2026 - 2035 CAGR | 21.5% |

| Market Size in 2035 | USD 1.16 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising Fuel Cost Reduction Imperative | Escalating diesel prices are pushing fleet operators to adopt platooning solutions that reduce aerodynamic drag and deliver measurable fuel savings. |

| Advancements in Vehicle-to-Vehicle (V2V) Communication | Improved V2V technologies enable real-time speed, braking, and distance coordination between trucks, enhancing platoon stability, safety, and operational efficiency. |

| Growing Adoption of Advanced Driver Assistance Systems (ADAS) | Wider deployment of ADAS features such as adaptive cruise control and lane keeping creates a technological foundation for scalable and safer truck platooning systems. |

| Government Support for Connected and Autonomous Mobility | Policy incentives, pilot programs, and funding for connected mobility accelerate testing, validation, and commercialization of truck platooning across major freight corridors. |

| Pitfalls & Challenges | Impact |

| Cybersecurity and Data Privacy Concerns | Increased vehicle connectivity exposes platooning systems to cyber threats, raising concerns over data breaches, system manipulation, and operational safety risks. |

| Limited Infrastructure Readiness in Emerging Economies | Inadequate road quality, inconsistent lane markings, and limited digital infrastructure restrict effective deployment of platooning technologies in developing regions. |

| Opportunities: | Impact |

| Integration with Level 2-4 Autonomous Trucking Solutions | Combining platooning with higher autonomy levels enhances fuel efficiency, safety, and scalability, supporting gradual transition toward fully autonomous long-haul trucking. |

| Deployment in Dedicated Freight Corridors | Platooning deployment in controlled, high-traffic freight corridors enables faster adoption by reducing regulatory complexity and improving operational reliability. |

| Partnerships Between OEMs, Fleet Operators, and Tech Providers | Collaborative ecosystems accelerate technology development, validation, and commercialization while reducing costs and risks associated with platooning deployment. |

| Adoption by Large Logistics and E-Commerce Fleets | High-volume logistics and e-commerce operators present strong demand for platooning due to scale-driven fuel savings, predictable routes, and cost optimization priorities. |

| Market Leaders (2025) | |

| Market Leaders |

15.4% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Europe |

| Fastest growing market | North America |

| Emerging countries | Saudi Arabia, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Truck Platooning Market Trends

From the testing phase to commercialization of truck platooning, it will go through various factors like road safety, road infrastructure, deployment cost and risk mitigation. Governments across the world are supporting the on-trial or testing of these technologies on the road by measuring each of these factors.

Growing logistics and transportation industries are showing their interest in such truck platooning technologies, as these industries are using the same route for day-to-day transportation. Logistics and e-commerce companies are following the same route each day for goods transportation.

For example, Amazon owns over 40,000 semi-trucks as part of its logistics fleet. Also in January 2025, it ordered more than 200 new ‘eActros 600’ vehicles from Mercedes-Benz Trucks, which will join Amazon’s existing eHGV transportation network later this year.

As soon as truck platooning technology gets advanced and commercialized e-commerce and logistics giants invest first to deploy this technology in their fleet operations. Countries with supportive government policies and a larger transportation base will grow much faster.

For instance, in January 2025, Pony AI received approval from the Chinese government for robotruck platooning tests on cross-provincial highways connecting Beijing, Tianjin, and Hebei Province. China’s dominance in robotaxis and autonomous vehicles is creating potential opportunities in the market.

Truck Platooning Market Analysis

Learn more about the key segments shaping this market

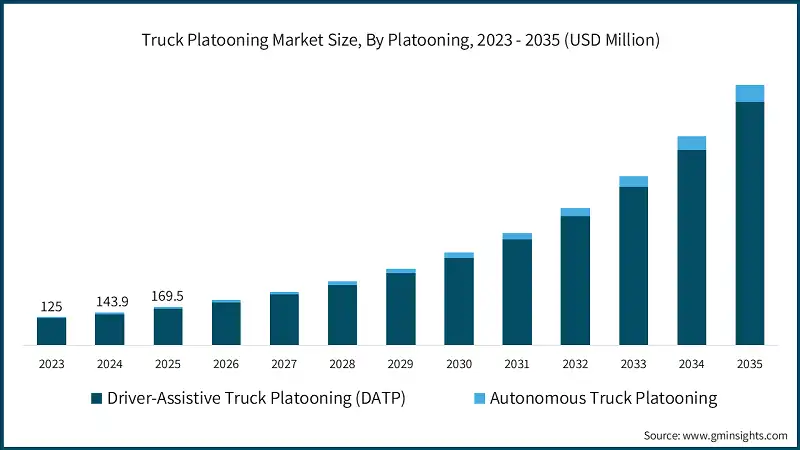

Based on platooning, the truck platooning market is divided into driver-assistive truck platooning (DATP) and autonomous truck platooning. The driver-assistive truck platooning (DATP) segment dominated the market with 95.1% share in 2025.

- Driver-assistive truck platooning requires at least a driver for leading the truck convoys. As road infrastructure and traffic are the bottleneck for deploying completed autonomous truck platooning, the dominance of the driver-assistive truck platooning (DATP) will continue in the coming years.

- In the year 2025, the driver-assistive truck platooning (DATP) segment reached USD 161.2 million. The driver-assisted truck convoy follows the first truck that is driven by a human using the vehicle-to-vehicle communication technologies.

- Due to poor road safety in many regions, this technology will experience slow adoption, mainly for autonomous truck platooning. However, in the projected period the segment is expected to grow at the fastest CAGR of 25.2% between 2026 and 2035. Countries with dedicated corridors or lanes for logistics and transportation will encourage fleet operators as well as governments to deploy truck platooning technology.

- For instance, countries like Japan and the UAE have already started separate lanes for motorcycles, pedestrians, buses and heavy commercial vehicles. Such initiatives will lead to early deployment of autonomous truck platooning on the road.

Learn more about the key segments shaping this market

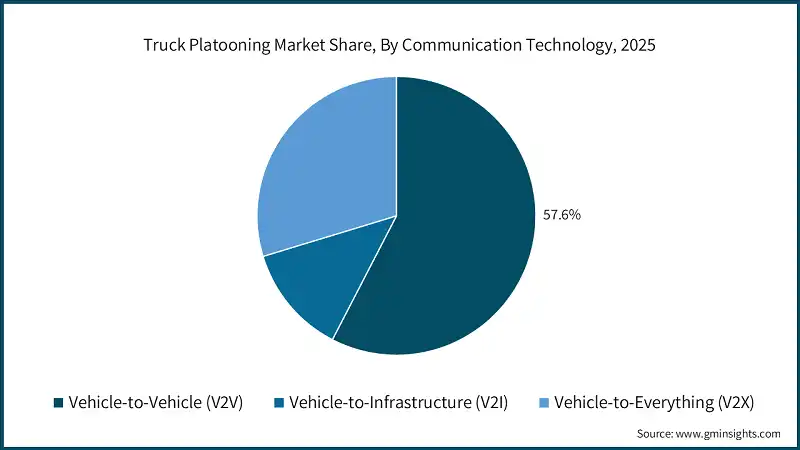

Based on communication technology, the truck platooning market is divided into vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I) and vehicle-to-everything (V2X). The vehicle-to-vehicle (V2V) segment accounts for 57.6% in 2025 and is expected to reach USD 658.1 million by 2035.

- The truck platooning technology uses vehicle-to-vehicle (V2V) communication to lead the convoy. The V2V communication concept enables a convoy to follow the same route by maintaining equal distance between two or more trucks.

- In the last five years, more than 8,100 new patents were filed for vehicle-to-vehicle (V2V) communication technology. The patent trends indicate how players in the V2V concept are focusing on this technology to secure early contracts, as approved patents bring consumer trust.

- On the other hand, vehicle-to-everything (V2X) is emerging as the fastest-growing communication technology within the truck platooning market. It is expected to grow at the CAGR of 23.1% between 2026 and 2035. The reason behind this is its feature to connect infrastructure, vehicles on roads, and driver assistance all in one technology. As soon as this technology gets advanced, other technologies like digital twin and autonomous technology will be added to support the segment’s future growth.

Based on component, the truck platooning market is divided into hardware, software and services. The software segment is expected to grow at the fastest CAGR of 23.3% between 2026 and 2035.

- During the forecast period, the software segment is expected to grow at the fastest rate because platooning now depends more on smart systems than just sensors. Software updates, often sent over-the-air, improve how vehicles coordinate with each other, manage speed, synchronize braking, and maintain safe distances.

- Fleet operators also need tools like analytics, AI-based decision-making, cybersecurity, and integration with fleet management systems. These software solutions are easy to use across multiple vehicles.

- On top of that, the hardware segment is the largest in the market because truck platooning needs physical sensors and control systems to work. Each truck in a platoon must have radar, LiDAR, cameras, control units, and communication modules, which adds high upfront costs.

- Hardware is more expensive per unit than software and is necessary for initial setups, especially in early-stage markets where pilot projects and OEM-installed systems are common. This makes hardware the biggest revenue contributor, even though its growth is slower over time.

Looking for region specific data?

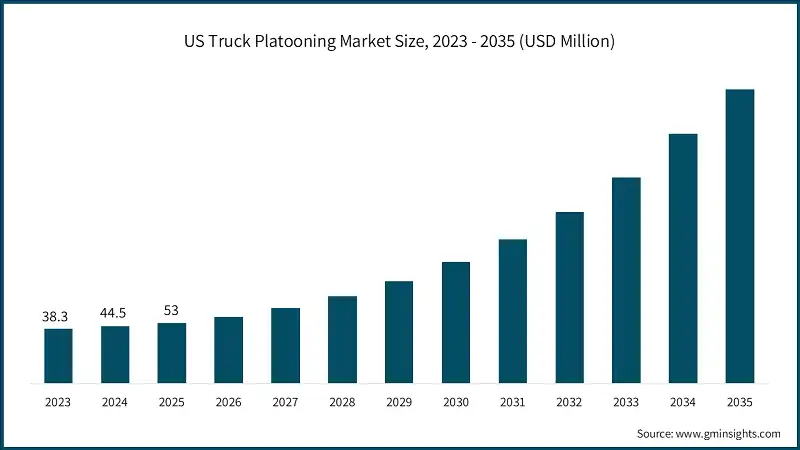

The US truck platooning market reached USD 53 million in 2025, growing from USD 44.5 million in 2024.

- The U.S. market is moving from testing programs to real-world freight operations on public highways. Instead of testing on closed tracks, truck platooning is now being used in actual freight deliveries, showing more trust in the technology. For example, in April 2025, partially automated trucks delivered goods on Interstate 70 between Columbus, Ohio, and Indianapolis, Indiana, for EASE Logistics.

- This project, led by the Ohio Department of Transportation’s DriveOhio program and the Indiana Department of Transportation, shows how state agencies are supporting the use of platooning systems to improve freight movement on major highways.

- Government support and rules are also helping truck platooning grow. The U.S. Department of Transportation (USDOT) has identified truck platooning as one of the first uses of automated vehicles in the freight industry. This support has encouraged state agencies to work together, like the Ohio–Indiana partnership, to align safety rules, prepare infrastructure, and create plans for operations. These efforts make it easier to use platooning technology and ensure it fits into current freight systems.

The North America truck platooning market is estimated to reach USD 449 million by 2035 by growing at a CAGR of 22.6% between 2026 and 2035.

- The North America region is promoting zero-emission commercial vehicles. For example, a total of 1,103 zero-emission heavy-duty trucks were registered in 2024, 34% more than in 2023.

- Such shifts towards electrification will create better opportunities for truck platooning, as such advanced systems are best suited for EVs for continuous power support.

- Also, government support in the U.S. and Canada for automated trucking will open new doors for players. As this technology directly supports fuel consumption, this will also attract fleet operators to deploy truck platooning technology in their current fleet. For instance, according to the Canadian Truck Alliance, two-truck platoons have the potential to reduce fuel consumption by about 4%.

- Also, government initiatives like the testing of partially automated trucks with platooning technology were deployed on Interstate 70 between Columbus, Ohio, and Indianapolis, Indiana, for EASE Logistics, enabled by Ohio’s DriveOhio initiative and the Indiana Department of Transportation, will continue to support the market players.

The Europe truck platooning market accounted for USD 82.4 million in 2025 and is anticipated to grow at the CAGR of 21.7% between 2026 and 2035.

- The European Union and national governments have supported projects like the European Truck Platooning Challenge. These projects bring major truck manufacturers together to test semi-automated truck platoons on public roads. Countries like Belgium, the Netherlands, Germany, and Sweden are working to make their systems compatible. These efforts aim to align rules and infrastructure to expand platooning and cut CO2 emissions.

- Companies such as Volvo Group, Scania, MAN (part of the TRATON Group), and Daimler Trucks have joined trials and research projects. They are working on technologies like vehicle-to-vehicle (V2V) communication, adaptive cruise control, and mixed-brand platoons on European highways.

- New companies and research groups are also developing autonomous driving and safety technologies to make platooning more useful for future freight systems.

- Partnerships between governments and private companies often link platooning with plans to reduce emissions, invest in smart infrastructure, and improve digital freight systems. This helps make platooning an important part of future transport plans.

Germany's truck platooning market is growing quickly in Europe, with a strong CAGR of 22.8% between 2026 and 2035.

- Germany is a hub for major market players. At present, major truck market players are based in the country or have a strong presence. This suggests their strong dominance in the local market. Also, strong government support and rules aimed at improving connected and automated freight transport will further support the market.

- The Federal Ministry of Transport and Digital Infrastructure has funded research and pilot programs. For example, early trials on the A9 digital testbed with MAN and DB Schenker showed that platooning improves safety and saves fuel. These trials also showed the government's support for adopting this technology.

- Truck makers and logistics companies in Germany and Europe are working faster to develop platooning. Companies like ZF Friedrichshafen and Bosch are teaming up to create advanced sensors and software for platooning. Daimler has also signed deals to use platooning-equipped trailers on real commercial routes, showing that manufacturers are moving toward practical solutions.

- European projects with multiple brands test cross-border platooning, focusing on making systems work together and moving beyond small pilot programs. These efforts show a shift from early trials to wider use of vehicle-to-vehicle (V2V) communication and advanced control systems, which are important for scaling up platooning.

The Asia Pacific truck platooning market is estimated to grow at the fastest CAGR of 19.2% during the analysis timeframe.

- Government support and improved infrastructure are helping truck platooning grow in the Asia Pacific region. For example, China has approved tests for autonomous truck platooning on major cross-provincial expressways. These tests allow "1+N" robotruck platoons, where only the lead truck needs a safety operator.

- This is a key step toward wider use. Along with these tests, national policies focused on intelligent connected vehicles and 5G infrastructure are supporting research, development, and pilot projects to connect logistics hubs. These efforts aim to modernize freight systems and reduce emissions.

- At the same time, companies and original equipment manufacturers (OEMs) are making progress in several Asian markets. In China, companies like Inceptio Technology and Pony.ai are adding autonomous trucks to long-haul logistics networks and getting permits for higher levels of autonomy on public roads.

- This shows that private companies are advancing alongside government regulations. In Japan, the government is working with partners like Toyota Tsusho to test and demonstrate platooning and truck connectivity on expressways.

China is estimated to grow with a CAGR of 19.8% in the projected period between 2026 and 2035, in the Asia Pacific truck platooning market.

- In January 2025, Pony AI became the first company in China to receive approval for robotruck platooning tests on cross-provincial highways connecting Beijing, Tianjin, and Hebei Province, marking a major milestone in the company’s pursuit of large-scale commercialization of autonomous trucking.

- In China, government support and improved infrastructure are helping truck platooning move from testing to real-world use. National and local authorities have introduced rules and testing areas for smart heavy trucks, especially in Beijing's smart vehicle zones.

- These rules allow "1+N" platoon setups, outline safety steps from having a driver to fully driverless follow trucks, and support testing on highways. This makes it easier for companies to test and improve their platooning systems in real logistics operations.

Latin America truck platooning market reached USD 3.8 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Brazil and Mexico are leading the adoption of advanced transport technologies in Latin America. In Brazil, the focus is on platooning to improve freight transport efficiency, especially on long-distance routes used for agriculture and exports. Companies and logistics operators in Brazil aim to reduce transport costs and driver fatigue.

- Governments and public programs are supporting the use of platooning and smart transport technologies. While Latin America does not yet have detailed policies for platooning, governments are supporting programs for connected trucks and digital infrastructure.

- Global companies like IVECO, Scania, and Volvo, which already serve fleets in Latin America, are improving connected vehicle technologies and safety systems to support platooning.

Brazil is estimated to grow with a CAGR of 13.4% between 2026 and 2035, in the Latin America truck platooning market.

- In 2025, the market reached 2.7 million in Brazil. It’s still in the early stages and is mostly linked to trends in freight automation and smart logistics rather than being widely used. Brazil’s large highway network and high demand for road freight make platooning a good option to save fuel and improve long-distance transport.

- The Brazilian government and public-private partnerships are working on modernizing transport and cutting emissions, which helps create the right conditions for platooning. For example, Brazil is part of the e-Dutra coalition, which aims to create zero-emission freight routes between major cities like São Paulo and Rio de Janeiro. This project, supported by global truck makers, logistics companies, and government partners, is helping prepare for future connected freight systems.

- In the industry, major truck makers and logistics companies in Brazil are investing in technologies that support platooning. Global companies like Volvo and Scania, which are active in Brazil’s commercial vehicle market, are adding telematics, advanced driver assistance, and connectivity features to their trucks.

The Middle East and Africa truck platooning market accounted for USD 5.2 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Countries like Saudi Arabia and the UAE are supporting platooning and vehicle-to-vehicle (V2V) technologies through smart transport plans and economic strategies. These include new rules and investments in smart infrastructure to improve safety, efficiency, and fuel use in freight transport.

- Trends in the market show that adopting new technology and forming partnerships are key factors. Across MEA, logistics companies and truck manufacturers are testing platooning through pilot projects and collaborations. They are adding platooning features to existing fleets and using adaptive cruise control and connectivity systems to improve long-distance operations.

- However, the speed of adoption is different across the region because of varying infrastructure and policies. Gulf Cooperation Council (GCC) countries are leading with smart mobility plans and supportive regulations, while other parts of Africa are still building the basic transport and digital infrastructure needed for platooning.

UAE to experience substantial growth in the Middle East and Africa truck platooning market in 2025.

- In Dubai, the Roads and Transport Authority (RTA) has approved a framework for autonomous heavy vehicles. This includes rules for licensing, safety, and testing driverless logistics, which is an important step toward expanding platooning on freight routes.

- In November 2025, Sharjah introduction of separate lanes for motorcycles, heavy vehicles, and buses, as part of a new road safety and traffic management campaign led by the Sharjah Police General Command in collaboration with the Sharjah Roads and Transport Authority (SRTA) will be beneficial for early market opportunities.

- These lanes keep smaller vehicles out, helping platooning trucks to maintain steady speeds and safe distances, which are important for their systems to work properly. Smart monitoring systems provide real-time traffic updates, helping trucks adjust and stay efficient.

Truck Platooning Market Share

- The top 7 companies in the truck platooning industry are Volvo, Kratos, Scania, Daimler Truck, Continental, MAN Truck & Bus and IVECO, contributing 76.3% of the market in 2025.

- Volvo truck platooning system uses vehicle-to-vehicle communication, adaptive cruise control, and automated braking to connect multiple trucks in a convoy. This setup reduces air resistance and increases safety with synchronized control at highway speeds.

- Kratos offers automated truck platooning systems that pair a human-driven lead truck with an autonomous follower. These systems use advanced V2V communication and control technologies to keep the trucks in formation, improve safety, and help solve driver shortages in commercial and defense logistics.

- Scania works on platooning by digitally linking trucks from the same or different brands into close convoys. They use IT-based steering and connectivity systems to lower fuel use and emissions while advancing automated driving research.

- Daimler Truck uses connected vehicle communication and semi-autonomous systems like Highway Pilot Connect for platooning. This technology links trucks electronically, allowing faster braking and acceleration, saving road space, and improving convoy efficiency.

- Continental develops platooning technologies like communication platforms, electronic "towbar" systems, and sensors. These tools wirelessly connect trucks, enabling closer spacing and synchronized braking to save fuel and improve convoy coordination.

- MAN Truck & Bus works on platooning by linking trucks digitally through vehicle-to-vehicle communication. This allows close convoys that save fuel and support automated transport research.

- IVECO's platooning system equips trucks with sensors, GPS, radar, cameras, adaptive cruise control, and automotive Wi-Fi. These features let trucks communicate and drive in tight convoys, reducing drag and showing efficiency in real-world tests.

Truck Platooning Market Companies

Major players operating in the truck platooning industry are:

- Volvo

- Kratos

- Scania

- Daimler Truck

- Continental

- MAN Truck & Bus

- IVECO

- Robert Bosch

- Knorr-Bremse

- DAF Trucks

- Volvo’s platooning edge lies in its deep integration of vehicle hardware, adaptive cruise, V2V communication, and fleet telematics, backed by extensive European pilot experience and partnerships. Its strong safety and sustainability focus supports real-world efficiency and emissions reduction efforts.

- Kratos stands out for leveraging military-grade autonomy and communications expertise, enabling safe leader-follower platoon configurations that address driver shortages and support both defense and commercial logistics with proven deployments in real highway environments.

- TRATON’s competitive edge comes from its combined MAN and Scania brands, pushing dual-brand platooning and digital convoy formation, extensive connected truck networks, and collaborative R&D that advances mixed-brand compatibility and automated transport innovation.

- Daimler leverages in-house autonomy research and its global commercial vehicle scale to integrate platooning with broader assisted driving roadmaps, supported by multi-region tests, strong engineering resources, and long-term safety and efficiency development efforts.

- Continental’s edge is in core platooning components and V2V communication systems, aiming for interoperable “electronic towbar” platforms that link trucks closely while enabling reliable data exchange, sensor fusion, and scalable safety-focused connectivity.

- MAN’s strengths in platooning stem from TRATON collaboration with Scania, extensive experience in connected truck ecosystems, and digital telematics, enabling efficient convoy control and real-world fuel and safety improvements built on rich operational data.

- IVECO benefits from participation in large European platooning initiatives and integration of advanced sensors, GPS, radar, and cooperative adaptive controls, supporting safe automated convoying and contributing to broader industry compatibility and sustainability goals.

Truck Platooning Industry News

- In November 2025, Sharjah announced new traffic lanes for motorcycles, heavy vehicles, and buses. This was part of a road safety and traffic management campaign led by the Sharjah Police General Command and the Sharjah Roads and Transport Authority (SRTA).

- In April 2025, Kratos Defense & Security Solutions expanded its automated truck platooning systems in Ohio and Indiana. This move shows Kratos’ plan to use technologies made for national security in affordable and useful ways for public and commercial infrastructure.

- In February 2025, Volvo Autonomous Solutions and Waabi partnered to combine the Volvo VNL Autonomous with the Waabi Driver for safer and more efficient autonomous freight transport.

- In January 2025, Pony AI became the first company in China to get approval for robotruck platooning tests on highways connecting Beijing, Tianjin, and Hebei Province. This was a big step toward making autonomous trucking widely available.

The truck platooning market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2022 to 2035, for the following segments:

Market, By Platooning

- Driver-Assistive Truck Platooning (DATP)

- Autonomous Truck Platooning

Market, By Component

- Hardware

- Radar

- Lidar

- Camera

- Other Hardware

- Software

- Services

Market, By Communication Technology

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Everything (V2X)

Market, By Vehicle

- Light Commercial Vehicle (LCV)

- Medium Commercial Vehicle (MCV)

- Heavy Commercial Vehicle (HCV)

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Benelux

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Singapore

- Malaysia

- Indonesia

- Vietnam

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What is the growth outlook for the software segment from 2026 to 2035?

The software segment is projected to grow at the fastest CAGR of 23.3% till 2035, as smart systems and over-the-air updates enhance vehicle coordination, speed management, and safety.

Which region leads the truck platooning market?

The United States leads the market, with the U.S. market valued at USD 53 million in 2025. The region is transitioning from testing programs to real-world freight operations on public highways.

What are the upcoming trends in the truck platooning market?

Commercialization of autonomous truck platooning, wider use of driver-assist systems, government approvals for cross-province testing, and improved vehicle-to-vehicle communication.

Who are the key players in the truck platooning industry?

Key players include Volvo, Kratos, Scania, Daimler Truck, Continental, MAN Truck & Bus, IVECO, Robert Bosch, Knorr-Bremse, and DAF Trucks.

What was the valuation of the vehicle-to-vehicle (V2V) segment in 2025?

The vehicle-to-vehicle (V2V) segment accounted for 57.6% of the market in 2025 and is expected to reach USD 658.1 million by 2035.

What was the market share of the driver-assistive truck platooning (DATP) segment in 2025?

The driver-assistive truck platooning (DATP) segment dominated the market with a 95.1% share in 2025, as it requires a driver to lead truck convoys, addressing current road infrastructure and traffic challenges.

What is the expected size of the truck platooning industry in 2026?

The market size is projected to reach USD 200.1 million in 2026.

What was the market size of the truck platooning in 2025?

The market size was valued at USD 169.5 million in 2025, with a CAGR of 21.5% expected through 2035. The growth is driven by advancements in autonomous technology and increasing investments from governments and private sectors.

What is the projected value of the truck platooning market by 2035?

The market is poised to reach USD 1.16 billion by 2035, fueled by the adoption of driver-assistive technologies, supportive government policies, and the expansion of logistics and transportation industries.

Truck Platooning Market Scope

Related Reports