Summary

Table of Content

Transportation Management System Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Transportation Management System Market Size

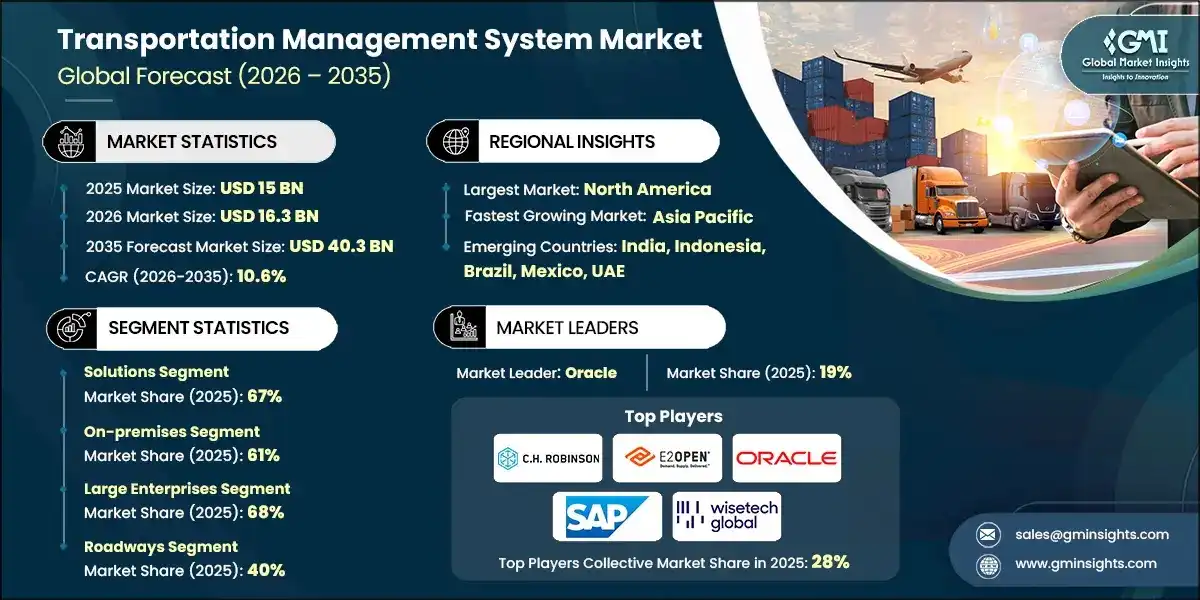

The global transportation management system market size was valued at USD 15 billion in 2025. The market is expected to grow from USD 16.3 billion in 2026 to USD 40.3 billion in 2035 at a CAGR of 10.6%, according to latest report published by Global Market Insights Inc.

To get key market trends

E commerce fulfilment is pushing parcel and LTL volumes higher while shrinking delivery windows, which raised the cost of manual routing and exception handling. Cloud-native deployments lowered entry barriers for small and mid sized organizations that previously found on premise implementations too slow or capital intensive. On the supply side, vendors have been refactoring platforms to microservices, exposing more APIs, and embedding AI for ETA prediction, dynamic pricing, and capacity matching. Because of this, the transportation management system market has become a clearer path to service reliability at scale rather than just a cheaper way to dispatch loads.

As companies continue to expand their operations across borders, Supply Chains continue to get longer, more complex and multimodal. As supply chains become more complex the need for a TMS solution that manages carrier coordination, automates documentation, optimizes international freight transportation, ensures compliance, and provides visibility across global routes is essential for companies to build resilient and cost-effective cross-border logistics networks.

There is a growing demand from both customers and businesses for an accurate and timely method of tracking their goods while in transit, and TMS platforms now provide Customers and Businesses with End-to-End Visibility by incorporating Telemetry, IoT Sensors, and GPS data integration. These solutions allow companies to make better decisions, mitigate risk from supply chain disruptions, reduce delays, and provide customers with a higher level of satisfaction.

The increasing cost of fuel, the decrease in available labor and the constantly changing nature of freight rates have created tremendous pressure on companies to better manage their logistics expenses. TMS platforms provide Companies with the ability to optimize their routes, automate carrier selection, conduct freight audit, consolidate loads and plan better, ultimately allowing companies to remain profitable through changing supply chain conditions.

Transportation Management System Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 15 Billion |

| Market Size in 2026 | USD 16.3 Billion |

| Forecast Period 2026-2035 CAGR | 10.6% |

| Market Size in 2035 | USD 40.3 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising e-commerce and online retail demand | Boosts TMS adoption to handle higher shipment volumes and faster delivery expectations. |

| Globalization of supply chains | Increases need for advanced TMS to coordinate cross-border, multimodal logistics. |

| Increases need for advanced TMS to coordinate cross-border, multimodal logistics. | Drives demand for connected, data-rich TMS platforms with tracking capabilities. |

| Increasing focus on cost optimization | Encourages enterprises to implement TMS for route efficiency and reduced freight spend. |

| Pitfalls & Challenges | Impact |

| High initial implementation cost | Slows adoption among cost-sensitive businesses. |

| Slows adoption among cost-sensitive businesses. | Data security and compliance challenges Limits cloud migration and increase vendor scrutiny. |

| Opportunities: | Impact |

| Expansion in emerging markets | Opens new revenue streams as logistics digitalization accelerates. |

| Growth in small and medium-sized enterprises (SMEs) | Increase demand for affordable, modular TMS solutions. |

| Increase demand for affordable, modular TMS solutions. | Increase demand for affordable, modular TMS solutions. |

| Partnerships with 3PL and logistics providers | Strengthens market penetration via integrated service offerings. |

| Market Leaders (2025) | |

| Market Leaders |

19% market share |

| Top Players |

Collective market share in 2025 is 28% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | India, Indonesia, Brazil, Mexico, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Transportation Management System Market Trends

Cloud based TMS adoption reaches a tipping point with buyers wanting faster time to value, elastic scale, and open pricing while avoiding upgrade projects and heavy IT overhead. That combination favours cloud native logistics platforms offering continuous updates, multi tenant data services, and broad API ecosystems. In the transportation management system market, AI becomes a differentiator only when paired with process change and clean integration expect RFPs to request model transparency and governance features.

Artificial Intelligence (AI) and Machine Learning (ML) are changing TMS, making it possible to make smarter, more data-driven decisions using logistics data. TMS and ML platforms can provide analyzed routing and scheduling automatically, based on predictive modelling, which includes traffic, weather, shipment history and capacity patterns. Predictive analytics capabilities are evolving, increasing the proactive capabilities of TMS, and therefore decreasing delays and costs, while greatly increasing efficiency within the supply chain.

Telematic equipment, connected vehicles, onboard diagnostic sensors, and other IoT-enabled tracking devices, provide real-time information on vehicle status (i.e. location, cargo temperature, vehicle condition, driver behavior). By using TMS with IoT-enabled devices, users will improve their approach to predictive maintenance, ship tracking, and overall risk management and increase visibility, SLA compliance, and support for automated processes in today’s more complicated logistics networks.

With today’s consumers in omnichannel commerce, retailers and logistics companies are forced to provide flexible, rapid delivery options through multiple shipping channels. TMS systems increasingly enable the last-mile optimization, micro-fulfilment, real-time routing and communication that retailers and logistics providers are beginning to seek in order to manage their differentiated delivery networks effectively and profitably.

Transportation Management System Market Analysis

Learn more about the key segments shaping this market

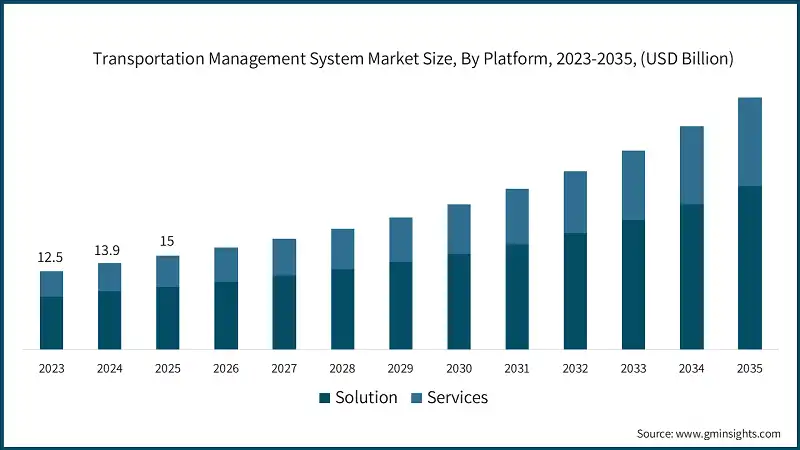

Based on platform, the transportation management system market is divided into solutions and services. The solutions segment dominated the market, accounting for 67% in 2025 and is expected to grow at a CAGR of over 10% through 2025 to 2035.

- The solutions segment is the main TMS platform for managing transportation planning, execution, routing, freight procurement, visibility, billing and analytics. This system of record for logistics operations has been the main driver of value through automation, optimization and real-time insights and has the largest share of the market and greatest upward trend in adoption.

- Growth will occur through an ever-increasing number of functional capabilities such as AI-based optimization, IoT-based visibility, advanced analytics and predictive capabilities. Modular architecture enables companies to start with a small solution but expand their use, Cloud-based models are driving adoption and demonstrating growth among small and mid-sized enterprises. The ability to expand and grow the use of TMS across modes, locations and globally creates upselling opportunities.

- The services segment consists of consulting, implementation, integration, training and managed services. The pace of growth for services is greater than that of the solutions segment, indicating an increase in the complexity of TMS deployment as well as greater integration needs and a greater reliance on the expertise of others. As organizations continue to modernize how they manage transportation processes, their need for services to support TMS rollout, adoption and optimization will continue to grow.

Learn more about the key segments shaping this market

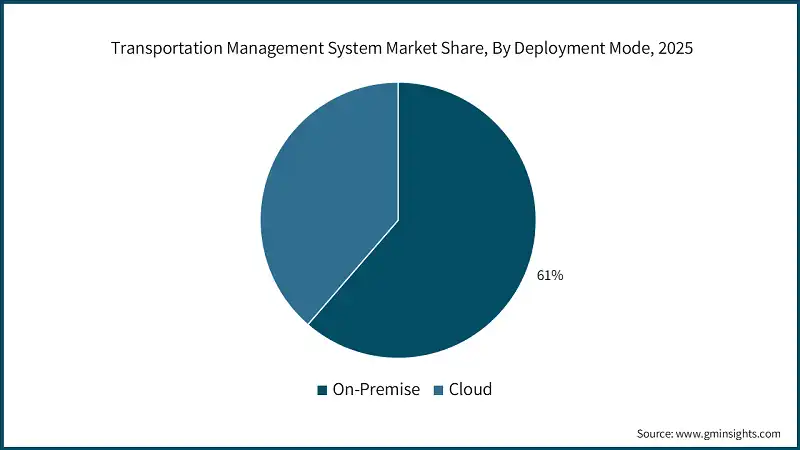

Based on deployment mode, the transportation management system market is segmented by on-premises and cloud. On-premises segment dominates the market with 61% share in 2025, and the segment is expected to grow at a CAGR of 9.2% from 2025 to 2035.

- On premise still accounts for the larger revenue base in 2025, but cloud deployments expand faster, benefiting SMEs and multi site rollouts that want 3–6-month implementations and continuous updates. The Transportation Management System market sees product differentiation shifting toward modular packaging, zero downtime release trains, and usage based pricing aligned to shipment volumes or locations. For regulated customized environments, on premise are favored due to sovereignty and control, yet even these buyers are adopting hybrid models for non sensitive workflows and analytics.

- Pricing dynamics show open friendly models winning in the mid market while enterprise deals bundle AI features (ETA prediction, dynamic tendering) and last mile modules. Also worth noting, partner ecosystems matter more: marketplaces that connect carriers, IoT devices, and analytics apps natively can simplify integrations and reduce services spend.

- Security and compliance have evolved from cloud adoption barriers to enablers, as leading cloud platforms offer security capabilities including encryption, access controls, threat detection, and compliance certifications (SOC 2, ISO 27001, GDPR) that exceed what most organizations can achieve with on-premise infrastructure. Data residency requirements in some jurisdictions (European Union, China, Russia) are addressed through regional cloud availability zones that maintain data within required geographic boundaries.

Based on enterprise size, the transportation management system market is segmented by large enterprises and SMEs. The large enterprises segment dominates the market with 68% share in 2025, and the segment is expected to grow at a CAGR of 8.9% from 2025 to 2035.

- The TMS market is driven primarily by large companies because they operate globally, are heavy shippers and have the financial means to invest in it. Due to their high volume of shipments, over 70% of these companies in North America and Europe have implemented TMS to improve the efficiency of their transportation networks with advanced technologies such as multi-modal optimization, deep analytics, and superior systems integration for the purpose of monitoring performance across all logistics modes (Road, Rail, Air, and Ocean).

- The capabilities that are most important to these companies include predictive analytics, Network Optimization, Cross-Border Compliance and Integration with ERP/WMS/Financial Solutions. Most of the companies operate hybrid networks with both owned and leased fleets, which necessitate the management of fleets. The growth of these companies comes primarily from geographic expansion, the addition of advanced modules to their existing TMS systems and replacing their legacy TMS with cloud-based TMS to reduce the complexity of the system and to allow for greater Scalability.

- The SMEs segment is growing the fastest because of the increased availability of cloud-based TMS platforms that offer SaaS pricing models with no upfront IT cost. Adoption is being accelerated due to the short deployment cycle of 3-6 months for many of the cloud-based TMS systems. Users also benefit from simplified user interfaces, pre-configured workflow templates and modular capabilities, making it possible for companies with limited technology budgets and small logistics staff to implement a TMS.

Based on transportation mode, the transportation management system market is segmented into roadways, railways, airways and waterways. The roadways segment is expected to dominate the market with a share of 40% in 2025, driven by high reach, accessibility, and extensive capabilities.

- The roadways segment dominates the TMS market, due to its crucial role for both first-mile and last-mile operations in the e-commerce industry and increasing demand for real-time routing and visibility of deliveries, growing (electric) delivery fleets, stringent regulatory compliance, cross-border trucking requirements, and other influencing factors are driving demand and scope of functionality, resulting in increased adoption rates and growth rates.

- Railways are the most fuel-efficient, with the lowest carbon emissions, and the best suited for high-volume long-distance freight transport and intermodal operations. Growth in this segment is primarily sourced from the demand for bulk commodities, the increased use of containerized transport, and sustainability initiatives that promote truck-to-rail conversions. The TMS railways require considerable integration with the existing rail systems and other applications, and to track equipment, real-time intermodal tracking and tracking by carbon-aware modes of transportation.

- The airways TMS segment is the fastest-growing component within the TMS market. The air segment enables the timely movement of goods between countries, particularly during seasons of increased e-commerce, and the parcel delivery market is also expanding. Within the airways TMS segment, the system integrates flight scheduling, consolidation, customs clearance, and real-time tracking, shipment and transportation delivery and tracking.

Looking for region specific data?

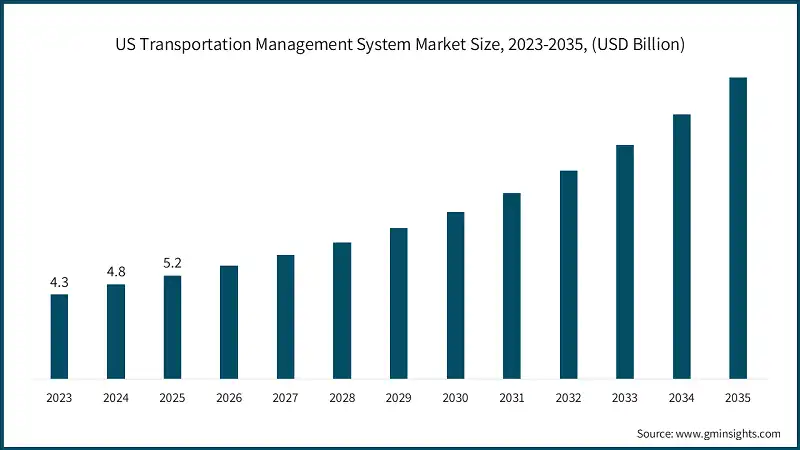

The US transportation management system market reached USD 5.2 billion in 2025, growing from USD 4.8 billion in 2024.

- The United States is leading in the adoption of AI-enabled Transport Management Systems (TMS) for both large shippers as well as very established 3PLs, along with the heavy investment in Cloud-based Logistics Systems. The complex nature of domestic transportation, combined with labor shortages and service level pressures, has led to an increased need for predictive analytics, automated planning and real-time visibility to improve the efficiency of levels of service across transportation networks, including Road, Parcel, Freight and Last-Mile.

- With the rapid growth of eCommerce, shipper requirements for TMS have changed from a static approach to using TMS for route optimization, real-time route planning and immediate same-day delivery. The growing use of application programming interfaces (APIs) among the parcel carriers, telematic technology throughout the shipping industry and the rise of micro-fulfilment centres have heightened the expectation of continuous tracking of parcel movements.

- To achieve better scalability and interoperability, The US Enterprises are aggressively transitioning away from using legacy on-premises software systems, of which there are many in most businesses, and are opting instead for Cloud-native TMS systems. Due to their size and numerous divisions, large retailers, manufacturers and 3PLs will be consolidating their various TMS vendors and systems into one larger "legacy" TMS system through a multi-year transformation effort.

North America dominated the transportation management system market with a market size of USD 5.9 billion in 2025.

- North American transportation management systems (TMS) are being adopted because of the need for customs integration, documentation accuracy and multimodal coordination for the movement of goods between the United States, Canada and Mexico. Increased demand for TMS platforms is also a result of the growth in nearshoring, the shift of automotive production to other regions, and the increasing demand for regionalized manufacturing on these three continents.

- With the emergence of digitized carrier networks in North America, TMS solutions have evolved to provide automated tendering and deeper TMS integration with carriers. There is a significant movement toward LTL optimization, dock scheduling, capacity matching, eBOL use and freight audit automation, which have contributed to strong TMS penetration by carriers and third-party logistics (3PLs).

- Due to the demands of cold chain and retail distribution operations, most fleet-heavy industries located in both Canada and Mexico are now utilizing integrated TMS and fleet management systems (FMS), which provide a seamless feed of telematics, driver safety monitoring and equipment tracking throughout the entire supply chain.

Europe transportation management system market accounted for a share of 26.5% and generated revenue of USD 4 billion in 2025.

- Europe leads in sustainability-driven TMS adoption due to strict emissions regulations, carbon reporting mandates, and low-emission zone compliance. Companies are now focusing their resources on implementing TMS systems with tools for measuring CO2 emissions, decarbonizing routes, finding optimized alternative methods of transport, and developing consolidated loads to reduce their impact on the environment and to fulfil their net zero commitments.

- The fragmented nature of Europe has led to increased requests for TMS due to the ability to move freight between different modes. The complexity of customs regulations after Brexit for freight moving within Europe, the need to create pan-European transport corridors, and an increase in the use of intermodal freight in the European market are driving the adoption of TMS systems that allow connection to carriers' marketplaces and enhanced routing capabilities or orchestration.

- The digitization of logistics in Europe will continue to grow due to the emergence of freight marketplace platforms. The vendors of TMS products are increasingly incorporating marketplace connectivity functionality in their products. This connectivity enables companies to quickly implement TMS systems using cloud technology and minimize the necessity for manual negotiation with carriers to find freight capacity based on pricing that they can compare across multiple carriers.

Germany dominates the transportation management system market, showcasing strong growth potential, with a CAGR of 8.9% from 2025 to 2035.

- Germany’s strong automotive, machinery and industrial sectors drive TMS demand for precision scheduling, inbound supplier coordination and multi-modal optimization. The complexity of shipments, the need for just-in-time delivery and the high number of suppliers are all factors leading to TMS being increasingly relied upon for reduced delays and the continuous flow of production.

- The integration of TMS into Industry 4.0 environments is well underway in Germany through the use of IoT/Telematics/Real-time Tracking for coordinating Plant-to-Plant Logistics Flows. The close connection between the TMS with ERP and MES systems drives the need for predictive planning for exceptions management through Automation.

- Germany has some of the strictest emissions regulations, which is driving the development of TMS for CO2 reporting, modal shift analysis and planning for electric vehicles and transit systems. The logistics zones and increased regulatory pressure from the government to optimize routes, consolidated product deliveries and monitor environmental performance are key factors driving enterprise adoption of TMS.

The Asia Pacific transportation management system market is anticipated to grow at the highest CAGR of 11.7% from 2025 to 2035 and generated revenue of USD 2.9 billion in 2025.

- Cloud-based Transport Management Systems (TMS) will increasingly provide solutions for last-mile orchestration, multi-carrier parcel management and real-time tracking in Asia Pacific, due to growth in online shopping and related delivery expectations, as well as a lack of proper logistics infrastructure in many areas of the region. As the availability of proper logistical infrastructure develops in emerging markets within the APAC region, the need for automated routing and real-time visibility into deliveries will increase.

- Infrastructure investments, such as improvement to ports and rail corridors and use of digital customs systems in India, Southeast Asia and Oceania, create a higher demand for TMS supporting multiple methods of transportation. These emerging economies are adopting TMS technology with hopes of decreasing distribution bottlenecks, increasing cross-border distribution efficiency as supply chains will diversify away from China.

- Cloud TMS is adopted by many SMEs from the APAC region due to TMS affordability, mobility accessibility, and limited IT resources. Many TMS vendors now provide a simple regionalized version of TMS, which includes localization of all languages and offices within the region, integration with major regional carriers, and compliance with regional customs laws.

China transportation management system market is estimated to grow with a CAGR of 12.1% from 2025 to 2035.

- The growing e-commerce market and delivery network in China is driving the adoption of TMS. Due to the high volume of deliveries, crowded delivery routes, and order fulfillment requirements being placed on businesses, companies utilize automated carrier routing, intelligent dispatch, and artificial intelligence for routing and dispatching to differentiate themselves from other companies by being able to efficiently and quickly deliver products to customers.

- China's Digital Logistics policies are focused on a government-supported plan to provide unified standards for TMS implementation, as well as requiring real-time tracking of all shipments and providing integrated customs platforms for customers. Transparency initiatives throughout the supply chain are accelerating the adoption of unified logistics systems in many industries including manufacturing, retail, and cold chains.

- The increased use of rail freight transportation to support cross-border e-commerce through the creation of the Belt and Road initiative, along with the continual development of smart port infrastructure are also driving the need for TMSs that can manage complex multimodal transportation movements. Companies are linking TMSs to warehouse automation systems, IoT tracking devices, and telematics systems to enhance domestic and international flow of goods.

Latin America transportation management system market shows lucrative growth over the forecast period.

- LATAM’s fragmented supply chain networks, combined with their inconsistent infrastructure, lead to lengthy customs delays; therefore, there is a demand for Transportation Management Systems (TMS), which help improve route planning, control costs, and provide visibility into shipments.

- Cloud-based TMS adoption has accelerated due to lower SaaS pricing and mobile-optimized interfaces, which remove many of the challenges associated with utilizing TMS for small to medium enterprises. Retail, food distribution, and e-commerce have adopted TMS to manage their delivery reliability, especially given the increasing expectations of consumers and the heightened competition within the industry.

- Complex taxation and documentation requirements, along with different regional trade agreements, are another factor that makes TMS systems necessary for companies operating in Latin America.

Brazil transportation management system market is estimated to grow with a CAGR of 6.7% from 2025 to 2035 and reach USD 510.8 million in 2035.

- Due to its extensive long-haul road transportation network, the Brazilian logistics sector has a high demand for TMS solutions. Due to the increase in logistics transportation costs, companies are investing in TMS that help improve route optimization, fuel efficiency and monitor driver performance.

- With growing e-commerce and omnichannel retail development in Brazil, TMS is likely to be adopted to help solve last-mile logistics challenges, orchestrate their parcel deliveries and provide visibility into those deliveries. Retailers and logistics service providers want to utilize TMS solutions that will allow them to manage increasing demands for last-mile delivery services in highly populated areas and meet the increasing demand for superior customer service.

- Brazil's complicated tax structure along with many in-country regulations regarding transportation, TMS allows companies to automate many related administrative documents and remain compliant with governmental regulations through the automatic generation of audit trails.

The Middle East and Africa transportation management system market accounted for USD 1.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Multimodal transportation is becoming increasingly important through investment in ports, free trade zones, and logistics centres in the Middle East & Africa, which has led to increasing demand for TMS to support multimodal transportation operations.

- Major retailers, FMCGs (fast-moving consumer goods), and third-party logistics providers have implemented TMS to better coordinate cross-border movement of goods and enhance their overall performance across fragmented networks of transportation.

- To stimulate the expansion of the digital logistics ecosystem, many governments in this region are implementing a range of policies, including e-invoicing requirements for customs documentation and promoting the use of paperless customs processes and new supply chain technology. Many companies are also implementing TMS to enhance their visibility into transportation operations and eliminate inefficiencies from their road-dominant networks.

UAE market is expected to experience substantial growth in the Middle East and Africa transportation management system market, with a CAGR of 7.2% from 2025 to 2035.

- In the Middle East and Africa (MEA), the UAE has emerged as a leader with its advanced logistics hubs technology-enabled free zones, and smart port facilities. UAE companies are implementing (TMS) to enable high-speed logistics and real-time shipment tracking, by providing for integrated multimodal movements by land, air, and sea.

- Companies throughout the UAE are using TMS technology as businesses rely seamlessly on cross-border routing between the Gulf Cooperation Council (GCC) nations. For documentation, customs processes and multimodal transportation corridors to be harmonized throughout the GCC, enterprises must implement advanced TMS solutions which provide for interoperability and facilitate real-time collaboration between shippers, carriers, and customs authorities.

- Additionally, the rapid growth of e-commerce in the UAE is encouraging wider use of TMS solutions to facilitate same-day order deliveries, automate shipping route selection, and leverage multiple carrier service options for parcel shipping. Retailers and 3PLs leverage TMS solutions to meet their customers' increasingly high service expectations, while maximizing the efficiency of their logistics operations from regional distribution centers.

Transportation Management System Market Share

- The top 7 companies in the transportation management system industry are Oracle, SAP, Manhattan Associates, CH Robinson, Trimble, Wise Tech Global, Descartes and E2open, contributing 29% of the market in 2025.

- Oracle Corporation dominates the Transportation Management System (TMS) market in 2025 with market share of 18.6% by offering Oracle Transportation Management (OTM). OTM services both external (Logistics Services Providers) and internal (Shippers) across multiple industries and regions. Oracle's dominance in the market stems from its multiple competitive advantages, a comprehensive functional set that supports multi-modal and multi-leg global shipments across road, ocean, air and rail channels.

- C.H. Robinson represents a unique position as a major Freight Broker/3PL with proprietary TMS capabilities that were developed for both internal operations and for the benefit of C.H. Robinson's external customers. Navisphere is C.H. Robinson's TMS platform that enables its customers to manage transportation using C.H. Robinson's own carrier network (over 37 million shipments annually and $23 billion freight managed) and logistics expertise.

- SAP Transportation Management integration with its supply chain and transport management solutions provides full visibility and automation of all modes of transportation from end-to-end and an integrated approach to predictive analytics, compliance and sustainability. Companies with a growing presence on the SAP TM cloud platform will have access to real-time visibility into their supply chains, reduced IT support overhead and AI-driven optimization of their global logistics operations.

- Manhattan Active Transportation Management provides continuous optimization of carrier selection, routing and load planning. It also leverages microservices architecture and provides the user with real-time visibility, predictive analytics and sustainability features. With its use by many leading global brands, the TMS by Manhattan has reduced transportation costs, improved service levels and can dynamically respond to complex supply chain challenges across multiple industries

- Trimble Transportation TMS suite of products is geared to support the carriers, brokers and shippers as they implement their supply chain management initiatives. The Trimble Transportation solutions will enable real-time visibility, route optimization and compliance across North America and Canada, and provide the ability to streamline business operations, reduce costs and increase productivity by integrating fleet management, freight procurement and asset maintenance into one cloud-based platform.

- WiseTech Global's CargoWise Platform supports freight forwarders and logistics providers by providing a Cloud-based Transportation Management Systems (TMS) solution that has a wide range of integrated TMS functionality that is both scalable and reliable. The CargoWise Platform allows for an extensive range of mode selections and analysis when creating a transport plan.

- Descartes provides a fully cloud-based TMS (Transportation Management System) that is integrated into their Global Logistics Network (GLN) and provides multimodal optimization, real-time visibility and dock scheduling tools. By utilizing Descartes’ TMS solutions shippers can save freight costs, elevate customer satisfaction and improve productivity by using automation and AI powered forecasting modalities.

- E2open is a Cloud-based Transportation Management System (TMS) solution that provides a unified platform for multimodal logistics planning, execution, and payment. The E2open transportation management system was recognized by Gartner Magic Quadrant as a leader in the transportation management software market. E2open provides real-time freight rating, Carrier Procurement and advanced analytical capabilities.

Transportation Management System Market Companies

Major players operating in the transportation management system industry are:

- Blue Yonder

- CH Robinson

- Descartes

- E2open

- Manhattan Associates

- MercuryGate International

- Oracle

- SAP

- Trimble

- Wise Tech Global

- Luminate Transportation Management System (TMS) by Blue Yonder uses artificial intelligence & machine learning to create predictive logistical plans for transportation via & to provide visibility across supply chains, as well as allow businesses to automate their operational execution. Navisphere TMS from C.H. Robinson provides global multi-modal logistics management with predictive analytics, automated workflows, & real-time ship tracking. Navisphere's design allows for scalability and supports cost-optimized and operational-agile businesses that mitigate risk.

- The TMS from Descartes is cloud-native and integrated into the global logistics network using multimodal optimization, dock scheduling and real-time visibility. Descartes is known for its global network connectivity as well as performance management within complex global supply chains, E2open utilizes an overall Multi-Modal Logistics Management TMS Platform to allow for Unified Planning, Execution, and Settlement of shipments, these platforms are built around the concept of an "open" architecture. E2open TMS allows for goods to be rated in real-time as shippers, payers, and other stakeholders make use of the service to settle for transport.

- Manhattan Active Transportation Management Solutions utilizes microservice-based architecture to continuously optimize routing, carrier and load planning. Provides visibility into the entire industry through real-time visibility, predictive analytics, and sustainability components. MercuryGate is an omni-modal TMS that supports all modes of Transportation under a single platform (Parcel, LTL, Truckload, Ocean, Air, and Rail). MercuryGate is known for its flexibility and automation, allowing users to Plan their freight with real-time visibility and make Use of its Freight Audit capabilities.

- Oracle Transportation Management is a cloud-based comprehensive solution designed specifically for global logistics. The Oracle TMS enables Multimodal Planning and Execution, optimized routes, and reduced freight costs. SAP Transportation Management is integrated into SAP's Supply Chain Suite. SAP TMS provides end-to-end visibility and automation for multimodal transportation, supports predictive analytics, compliance & sustainability initiatives. As SAP TM grows in adoption through cloud-based options, enterprises save IT costs, real-time track shipments, optimize globally with the use of AI.

- Trimble provides TMS solutions to carriers, brokers, and shippers to facilitate real time visibility, route optimization, and ensure compliance. Their cloud-based solution combines fleet management, freight procurement and asset maintenance allowing businesses to simplify operations and lower costs while improving efficiency across their entire North American and Global logistics networks. WiseTech Global has developed CargoWise as an integrated TMS platform for freight forwarding and logistics companies. They have positioned themselves as the Provider of choice with respect to scalability and reliability, while also offering multimodal planning, execution and analytics capabilities.

Transportation Management System Industry News

- In November 2025, C.H. Robinson's commitment to development within its supply network, as evidenced by having been awarded FreightTech 25 for innovative uses of Agency-based AI were further validated when the company received AI Excellence in Supply Chain award recognizing its deployment of over 30 skilled agents to facilitate quoting, appointments, and order conversion as well as other benefits associated with creating today's agent-based supply chain models.

- In October 2025, SAP announced SAP Logistics Management as a Next-Generation Cloud-native solution that connects the Transportation and Warehouse Management processes using embedded Artificial Intelligence through SAP Joule.

- In May 2025, Manhattan Associates added their growing line of Manhattan Active solutions to the Google Cloud Marketplace, making it easier for users to procure and more seamlessly integrate their solutions to Google's Cloud Services.

- In September 2025, C.H. Robinson again received AI Excellence in Supply Chain recognition for deploying their networks of agent-based AI to improve quoting, appointment scheduling, and LTL shipments.

The transportation management system market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue ($ Mn/Bn) from 2021 to 2034, for the following segments:

Market, By Platform

- Solutions

- Shipment planning

- Order management

- Audit & payments

- Analytics & reporting

- Routing & tracking

- Others

- Services

- Consulting

- Implementation & integration

- Support & maintenance

Market, By Transportation Mode

- Roadways

- Railways

- Airways

- Waterways

Market, By Deployment mode

- On-premises

- Cloud

Market, By Enterprise size

- Large enterprises

- SMEs

Market, By Industry vertical

- Retail & e-commerce

- Healthcare & pharmaceuticals

- Distribution & logistics

- Manufacturing

- Government

- Others

The above information is provided for the following regions and countries:

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Nordics

- Poland

- Romania

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

What are the upcoming trends in the transportation management system market?

Key trends include cloud-native platforms, AI/ML-based predictive analytics, IoT-enabled tracking, last-mile optimization, and micro-fulfillment for omnichannel demand.

What was the valuation of the on-premises segment in 2025?

The on-premises segment held a 61% market share in 2025 and is set to expand at a CAGR of 9.2% till 2035.

What is the growth outlook for the large enterprises segment from 2025 to 2035?

The large enterprises segment dominated the market with a 68% share in 2025 and is anticipated to observe around 8.9% CAGR up to 2035.

Which region leads the transportation management system sector?

The United States leads the market, reaching USD 5.2 billion in 2025. The region's in the adoption of AI-enabled TMS and cloud-based logistics systems, driven by domestic transportation complexities and labor shortages.

Who are the key players in the transportation management system industry?

Key players include Blue Yonder, CH Robinson, Descartes, E2open, Manhattan Associates, MercuryGate International, Oracle, SAP, Trimble, and Wise Tech Global.

How much revenue did the solutions segment generate in 2025?

The solutions segment accounted for 67% of the market in 2025 and is expected to grow at a CAGR of over 10% through 2035.

What is the projected value of the transportation management system market by 2035?

The market is poised to reach USD 40.3 billion by 2035, fueled by advancements in predictive analytics, Io over the years, and the adoption of cloud-based platforms and IoT-enabled devices.

What is the expected size of the transportation management system industry in 2026?

The market size is projected to reach USD 16.3 billion in 2026.

What was the market size of the transportation management system in 2025?

The market size was valued at USD 15 billion in 2025, with a CAGR of 10.6% expected through 2035. Growth is driven by e-commerce fulfillment, cloud-native deployments, and AI integration for enhanced logistics efficiency.

Transportation Management System Market Scope

Related Reports