Summary

Table of Content

Traffic Signal Controller Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Traffic Signal Controller Market Size

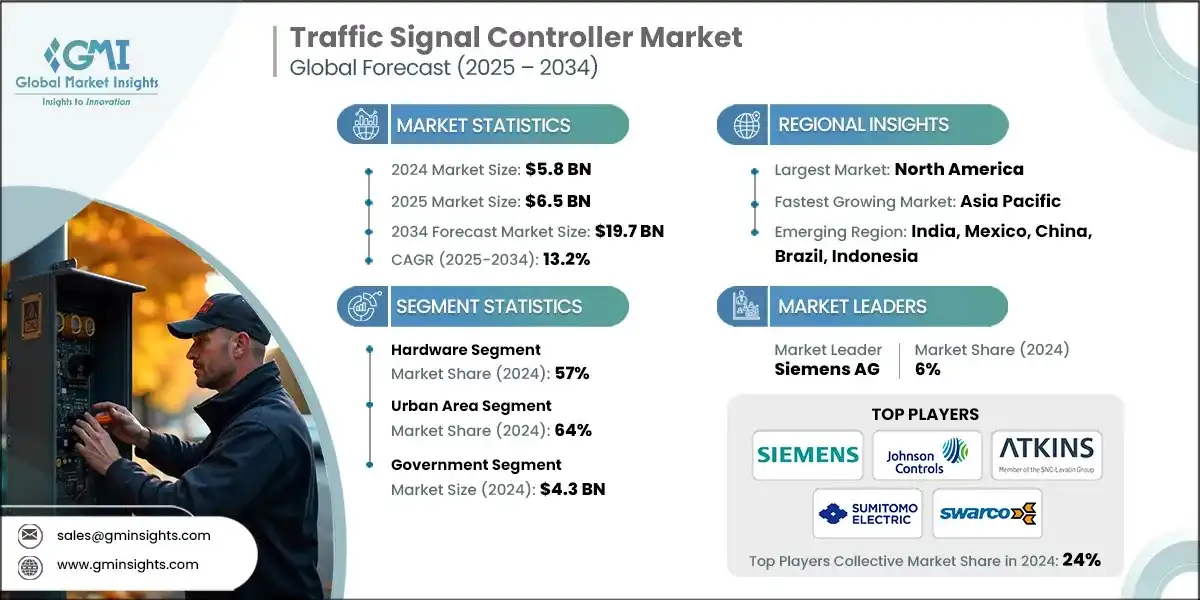

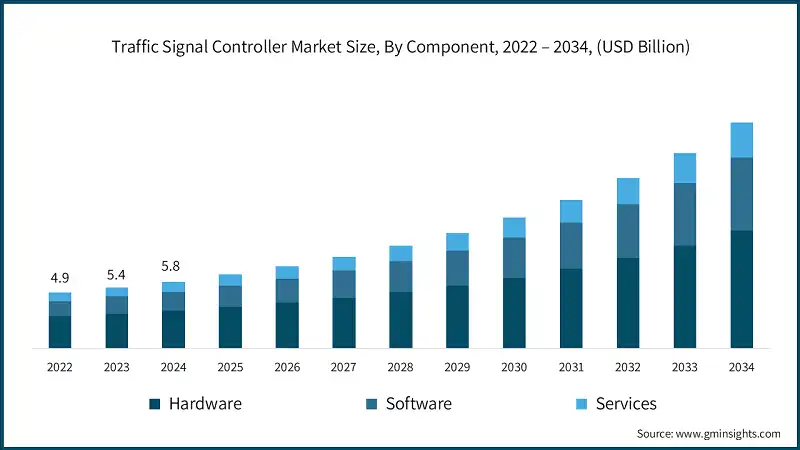

The global traffic signal controller market size was valued at USD 5.8 billion in 2024. The market is expected to grow from USD 6.5 billion in 2025 to USD 19.7 billion in 2034, at a CAGR of 13.2%, according to latest report published by Global Market Insights Inc.

To get key market trends

- With the increase in urbanization, eventually the number of cars on the road rises. Traffic signal controllers are a key instrument for regulating the increasing traffic flow. Traditional fixed-time signal controllers may be insufficient to manage the dynamic nature of urban traffic. This increases the demand for adaptive traffic management systems that employ real-time data such as traffic volume and pedestrian activity, to dynamically change signal timings. These adaptive systems use modern traffic signal controllers.

- For example, in January 2024, the UN Department of Economic and Social Affairs issued a report that stated urbanization is outpacing ruralization and projected that by 2050 two-thirds of the world will be urban. The report showed how quickly urban growth has taken place and its potential effects on social, economic, and environmental sustainability. This increasing urbanization is expected to lead to further growth in the traffic signal controller market.

- Before the COVID-19 pandemic, the global market for traffic signal controllers, and more generally the intelligent transportation systems markets, was growing steadily due to continued investment into urban mobility infrastructure and smart city projects; however, the industry faced a significant decline after the COVID-19 epidemic.

- The global market for intelligent transportation systems in 2021 declined to approximately USD 3 billion, according to Statista. This reflects the impacts of lockdowns, delayed projects, and appropriate funds. This immense decline in the global market was an exception; the adaptive traffic control systems segment saw a growth in market size between 2020 and 2021, and has continued to grow steadily, suggesting recovery and continued demand.

- The region of North America is experiencing rapid urbanization, resulting in increased traffic and congestion. This increase in congestion results in high demands for effective traffic management systems, with greater usage of modern traffic signal controllers. In addition, governments in the United States are focused on smart city initiatives, specifically transportation efficiency, and have increased their spending on these efforts.

- Asia-Pacific (APAC) is the fastest-growing region in the traffic signal controller market due to a powerful mix of rapid urbanization, strong smart-city initiatives, and technological innovations. With urban populations rising swiftly, expected to reach 60 percent by 2030 in Asia, cities are experiencing enormous pressure to manage congestion and mobility, which is fueling investment in modern traffic management infrastructure.

Traffic Signal Controller Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 5.8 Billion |

| Forecast Period 2025 - 2034 CAGR | 13.2% |

| Market Size in 2034 | USD 19.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing urbanization and traffic congestion in cities | Rapid growth of vehicles in urban areas forces governments to deploy advanced traffic signal controllers to reduce delays and optimize mobility. |

| Demand for improved safety and efficiency | Rising road accidents and bottlenecks push adoption of adaptive traffic control systems that enhance pedestrian safety and smooth vehicle flow. |

| Advancements in traffic control technology | Integration of AI, IoT, and cloud-based platforms enables real-time traffic management, accelerating market adoption of smart controllers. |

| Rise of smart city initiatives | Government-backed smart city projects create large-scale opportunities for deploying intelligent traffic infrastructure as a core component of urban modernization. |

| Pitfalls & Challenges | Impact |

| High Implementation and Maintenance Costs | Advanced traffic signal controllers require significant upfront investment and ongoing maintenance, which can limit adoption in cost-sensitive or developing regions. |

| Integration Challenges with Legacy Infrastructure | Many cities still operate outdated traffic systems, making it difficult and time-consuming to integrate modern intelligent controllers. |

| Opportunities: | Impact |

| Adoption of AI and IoT in Traffic Management | Increasing use of real-time data analytics, connected sensors, and adaptive algorithms offers strong potential for smarter, more efficient traffic flow solutions. |

| Government Support for Sustainable Urban Mobility | Funding and policies under smart city and green mobility programs open new growth avenues for traffic signal controller vendors. |

| Market Leaders (2024) | |

| Market Leaders |

6% market share |

| Top Players |

Collective market share in 2024 is 24% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Mexico, China, Brazil, Indonesia |

| Future Outlook |

|

What are the growth opportunities in this market?

Traffic Signal Controller Market Trends

- The emergence of smart cities is enabling more traffic signal controllers. Smart cities rely on a system of connected technologies to collect and evaluate data on a variety of urban life elements, such as traffic patterns. Advanced traffic signal controllers are expected to be able to interface with multiple smart city technology components, including sensors, cameras, and communications systems. This means that data is being shared in real time and provides traffic managing systems with a more integrated approach.

- Revenue from the entire smart cities market is projected to total approximately 54.24 billion U.S. dollars in 2025 in G20 countries, growing at an annual rate (CAGR) of over 9% through 2029, as reported by Statista. The United States is expected to hold the largest share in G20 countries accounting for an estimated 27.06 billion U.S. dollars in revenue in 2025.

- Smart cities also will require Intelligent Transportation Systems (ITS) to improve traffic flow and increase mobility. ITS requires enhanced traffic signal controllers with improved functionality to achieve this. Additionally, smart cities demand technology that will promote data-driven planning and decision-making. Advanced traffic controllers can collect relevant data about patterns, traffic congestion, and travel times.

- Additionally, establishing a traffic management system in the future may be complicated if new controllers do not interact with older controllers made by various suppliers appropriately. In addition, cities that are using various controlled technologies from multiple suppliers may be experiencing complications with maintaining and repairing their systems, which requires technicians to familiarize themselves with various systems, and it would be more difficult to account for spare parts inventory.

- Traffic controllers can use the data referenced earlier to further optimize appropriate traffic flow. These advancements in communication protocols enable traffic controllers to communicate easily with a variety of sensors and cameras and other equipment used for traffic management.

- This allows for real-time data interchange and better traffic management integration. For example, in October 2023, Kimley-Horn rolled out, Traction Priority, a cloud-based traffic signal software that uses artificial intelligence to achieve Signal Priority (TSP), Freight Signal Priority (FSP), and Emergency Vehicle Preemption (EVP) all in one software system.

- As an illustration, Kimley-Horn launched Traction Priority in October 2023, a cloud-based traffic signal software that utilizes Artificial Intelligence to provide Traffic Signal Priority (TSP), Freight Signal Priority (FSP), and Emergency Vehicle Preemption (EVP) in a single software package. Traction Priority can use existing equipment with real-time GPS feeds of buses, trucks, or any emergency vehicle, allowing municipalities and transit authorities to prioritize transportation modes, even emergency vehicles, and to create vehicle categories from air, to transit, to school bus or freight.

Traffic Signal Controller Market Analysis

Learn more about the key segments shaping this market

Based on components, the market is divided into hardware, software, and services. The hardware segment dominated the market accounting for around 57% in 2024 and is expected to grow at a CAGR of over 12.2% from 2025 to 2034.

- In the traffic signal controller market, the hardware segment is the largest due to intelligent, demonstration-grade solutions do not always hinge on hardware, but rather on the availability of hardware and the tenability and implement ability of the required software. Supporting analytics and integration with IoT, cameras, and sensor devices allows for more real-time predictive analysis that supports adaptive, data-driven real-time signal timing on the hardware.

- For example, TAPCO formed a relationship with SWARCO McCain in October 2023 to provide various advanced traffic signal cabinets and controllers. The partnership enabled TAPCO to develop its portfolio and add location and specifications of cabinets available with unique specifications.

- Software segment is increasingly gaining market share, due to modern traffic signal controllers, which advance depend more on, and co-create with, software for their main capabilities. The market to evolve traffic management systems, but a key factor is scalability and adaptability. Software is inherently more adaptable than hardware. Features & functionality change gradually and to real-time reactions to conditions and developments.

- The scalability and expandability of systems to support a dynamic, modern urban environment is critical for smart city evolutions. In July 2025, the North Carolina Department of Transportation implemented artificial intelligence traffic signal management software with over 2,500 intersections throughout the state that it hopes will modernize the state's overall traffic operations.

Learn more about the key segments shaping this market

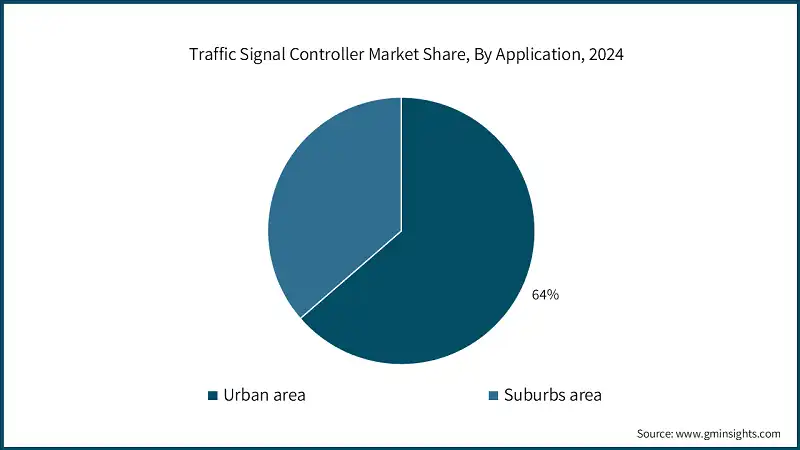

Based on applications, the traffic signal controller market is categorized into urban areas and suburban areas. Urban area segment dominates the market with 64% share in 2024, and the segment is expected to grow at a CAGR of 12.7% between 2025 & 2034.

- Urban regions have a substantially higher density of automobiles and people than the suburbs. This means more vehicles, and more people require effective management of traffic movement to reduce possible traffic congestion, accidents, and traffic jams. Traffic signal controllers play an important role in managing traffic flow in busy urban areas. In addition to being denser, urban areas have a more complex road & junction-layouts than suburbs. These complexities result in requiring much more sophisticated traffic management tools to aid optimal traffic movement around the city, hence again likely increasing the volume of traffic.

- For example, in June 2023, the Greater Hyderabad Municipal Corporation (GHMC) implemented Adaptive Traffic Signal Control (ATSC) systems and Pelican Signals to improve traffic management solutions for better commuter experiences in the city. In total, the GHMC installed 122 ATSC signals and a total of 94 Pelican Signals, as a part of this project. The GHMC also took over the contractual work and maintenance of the 213 traffic signals, as part of the Hyderabad Traffic Integrated Management System (HTRIMS).

- The suburban area segment in the traffic signal controller market is the fastest growing segment according to market forecasts, as suburban areas are rapidly expanding due to urban sprawl, new residential buildings mostly, and increased vehicles predominantly located outside urban city centers.

- Municipalities are making increased commitments toward investment for adaptive traffic signal solutions for more seamless commuting experiences for citizens traveling between the suburbs and urban cores. For instance, in February 2025, the Dallas–Fort Worth suburban corridor in the U.S. initiated the rollout of AI-enabled traffic signal controllers on expanding highways and residential junctions to address peak-hour congestion.

Based on end use, the market is divided into government and private contractors. The government segment dominates the market and was valued at USD 4.3 billion in 2024.

- The government sector is the largest end-use sector for traffic signal controller market because public authorities have the highest accountability for urban infrastructure development, road safety, and traffic management. Governments expend considerable budgets on smart city projects, sustaining mobility, and congestion reduction projects, thus being the largest purchasers of traffic control systems.

- By example, on March 8th, 2024, The Directorate General of Highways, has introduced aggressive programs to improve Türkiye's transportation infrastructure by providing smart technology plans, aimed at improving routes and efficiencies. Türkiye plans to implement 1,902 new apparatus on state and provincial roads, over about 900 kilometers by 2028.

- The commercial end-use segment is the fastest growing end-use segment in the traffic signal controller market, as governments are starting to release and contract their infrastructural development and maintenance programs using PPP (Public-Private Partnership) initiatives, leaving the contractors to take care of deploying, integrating, and maintaining the advanced traffic control solutions. This is especially true in areas of rapidly growing urbanization.

- For example, in May 2025, Smart mobility company Iteris, has been awarded a four-year task order based Indefinite Delivery Indefinite Quantity (IDIQ) contract from the Hillsborough County Board of County Commissioners for engineering service to support its Traffic Management Center (TMC) and other regional smart mobility projects.

Looking for region specific data?

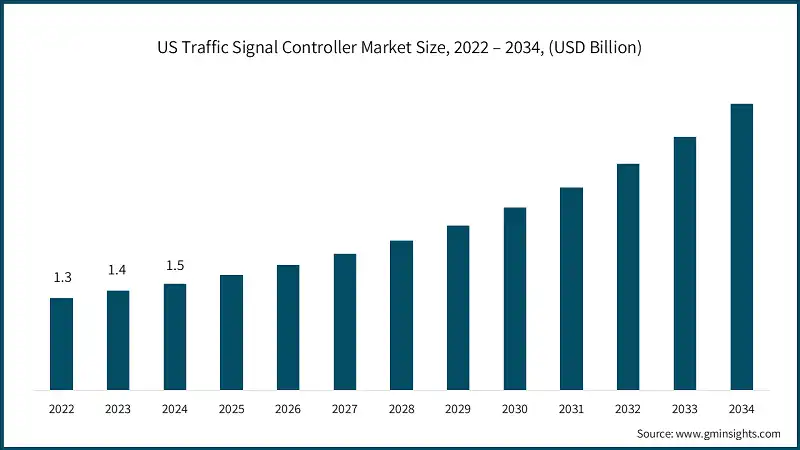

The US dominated the North America traffic signal controller market with around 76% market share and revenue of USD 1.5 billion in 2024.

- U.S. is a hub of technical innovation, which promotes the development of cutting-edge traffic controller technologies, such as adaptive traffic control systems and connected vehicle integration, boosting market growth. Similarly, U.S. governments are increasingly investing in smart city efforts, with a particular emphasis on improving transportation efficiency. In January 2025, Ouster announced that it was awarded a two-million-dollar contract to deploy its Ouster BlueCity traffic management solution in Chattanooga, Tennessee to improve roadway safety and reduce congestion. It is the Largest Lidar-Enabled Smart Traffic Solution in the United States.

- Canada is emerging as the fastest-growing country in North America in the traffic signal controller market, propelled by escalating investments in smart city infrastructure, expanding urbanization, and a concerted push toward congestion mitigation and road safety enhancements. Thes growth is further amplified by large-scale provincial and municipal deployments of intelligent traffic systems, including V2I-enabled intersections in Toronto and predictive AI-driven signal optimization initiatives in Montreal.

Germany traffic signal controller market will grow tremendously between 2025-2034

- Germany is the largest country market in Europe for traffic signal controllers, having a commanding share among worldwide manufacturers, driven in part by its thriving automotive industry and its continued commitment to sustainable urban mobility technologies and the technology surrounding urban mobility. This market share expansion is supported by government regulations which are both compelling emissions reductions of existing vehicles while also promoting smart signal systems and making large investments into intelligent traffic infrastructure projects.

- For example, in October 2024, Actelis announced that it has received a follow-on order for its hybrid-fiber networking technology from an important German municipality, deepening Germany's momentum in intelligent transportation systems (ITS) for smart traffic management applications.

- The United Kingdom is the fastest growing country in Europe's traffic signal controller market. Impacts of increased vehicle congestion in urban area, increased road safety regulations, and increased investments in smart-city technologies are fuelling growth which is rapidly accelerating the demand for best practice signal control solutions across UK municipalities. In May 2025, Indra has released in the UK is its next generation advanced In-Mova Traffic Platform to control traffic of the 1.4 kilometers of the newly opened Silvertown Tunnel in London, a key infrastructure for the city's urban mobility including the connections of the Greenwich Peninsula with the Silvertown district underneath the River Thames.

The traffic signal controller market in China will experience strong growth during 2025-2034.

- Asia Pacific contributes more than 25% of the traffic signal controller market, making it the fastest growth region with a projected CAGR of 15.7%. China is the largest country market for traffic signal controllers in the Asia-Pacific, driven by China's rapid urbanization, extensive road network development, and massive public investment into intelligent transportation infrastructure and smart city projects. In August 2023, Xiangyang, the first Chinese city to use artificial intelligence and internet of vehicles technologies for traffic management at a cost of CNY470 million (USD64.5 million), was announced in central Hubei province.

- India is the fastest growing country in the region's traffic signal controller market, expected to have a solid growth rate in the next few years. The current factors driving this accelerated growth include India's many developing urban centres, the high rate of vehicle ownership growth, and strong momentum around the Smart Cities Mission which is hastening the introduction of advanced AI/sensor based adaptive traffic signal control systems in cities across India. In June 2025, Dwarka Expressway will become India's first AI based traffic system that has the capacity to detect 14 kinds of traffic violations.

- Similarly, Southeast Asia is an emerging market in the traffic signal controller sector, because of fast modernization and smart mobility initiatives. Southeast Asia is ramping up investments in adaptive traffic management, as urbanization rates are creating uncontrollable congestion in urban centres, like Singapore, Malaysia and Thailand, where its Smart Nation plans are the working bench for experimenting with AI- and IoT-based traffic signals.

The traffic signal controller market in Brazil will experience significant growth between 2025 & 2034.

- Latin America holds a 8% share of the market in 2024 with a CAGR of 14.6%. Brazil holds the largest value share in the Latin American traffic signal controller market due to ongoing rapid urbanization in key metropolitan areas, significant government investment in smart infrastructure, and also dedication towards intelligent traffic management systems.

- Large urban areas, such as São Paulo, Ribeirão Preto and Rio de Janeiro are expanding their road networks and modernizing their traffic systems in a way to create greater operation efficiency and safety, which will create demand for advanced independent controllers and integrated platforms. As an example, in July of 2024, Ribeirão Preto is advancing its development as a Smart City through finalizing a plan for a cutting-edge Intelligent Transportation System (ITS) from Kapsch TrafficCom.

- Mexico is the fastest growing market in the region due to the country's focus on intelligent transportation systems and urban mobility modernization. There was a growing need to use smart technology to modernize road networks as municipalities are seeing congestion rise with changing infrastructure.

- Increasing push towards digital traffic management systems, due to local government initiatives, smart city pilot projects, and investment into road technology upgrades backed by the public sector. In August of 2025, Kapsch TrafficCom rolled out an advanced intelligent transportation system (ITS) along the Palmillas-Apaseo highway northwest of Mexico City as part of a plan to modernize their road infrastructure.

The traffic signal controller market in UAE is expected to experience high growth between 2025 & 2034.

- The UAE is the largest national market for traffic signal controllers in the Middle East and Africa. This growth is supported by significant investments in smart mobility infrastructure and modern traffic management systems. Cities such as Dubai are leading the way with AI-driven solutions like the UTC-UX Fusion system, which uses AI, predictive analytics, and digital twin technology to adjust signal timings in real time.

- Dubai's Roads and Transport Authority (RTA) has been studying and designing Phase II of its Intelligent Traffic Systems (ITS) Improvement and Expansion Project. The second phase of the project aims to increase coverage of the emirate's main road network from the current 60% to 100% by 2026.

- South Africa is the fastest-growing market for traffic signal controllers in the MEA region. This growth comes from efforts to modernize transportation infrastructure, improve road safety, and cut down urban congestion. Governments focusing on upgrades the traffic systems and increasing use of smart technologies in cities are driving this change. As a result, South Africa is becoming an emerging growth area in the region. The Road Traffic Management Corporation (RTMC) is the main road safety agency in South Africa. It focuses on improving road traffic management and safety throughout the country.

Traffic Signal Controller Market Share

The top 7 companies in the market are Atkins, Econolite, Johnson Controllers, PTV Group, Siemens, Sumitomo Electric, and SWARCO. These companies hold around 23% of the market share in 2024.

- Atkins is a recognized market player in the global traffic management market, especially in Europe, due to its expertise in designing and delivering intelligent transport systems (ITS). The company continues to supply advanced traffic signal control solutions and adaptive traffic management platforms to improve urban mobility and improve safety while decreasing congestion.

- Econolite is one of the leading traffic management solution providers in North America, and has a readily recognized footprint in the U.S., with its international presence growing. Its products include the flagship Cobalt traffic signal controller and the EOS advanced traffic control software, both of which have been widely deployed to manage intersections.

- Johnson Controls has built a market-leading positioning and capabilities in global building automation and smart infrastructure solutions and have transformed the offering into their intelligent traffic management systems portfolio which encompasses traffic signal control technologies with smart city platforms, combining IoT, AI, and cloud-based analytics functionality with traffic control systems to deliver energy efficient and scalable solutions.

- PTV Group is a well-known company for its traffic simulation and mobility management software solutions. The company's gaining sizeable market share across Europe and beyond. Its products, including PTV Vistro and PTV Optima, are aimed at modeling, optimizing, and managing real-time traffic flows.

Traffic Signal Controller Market Companies

Major players operating in the traffic signal controller industry include:

- Atkins

- Econolite

- Johnson Controllers

- PTV Group

- Siemens

- Sumitomo Electric

- SWARCO

- Temple

- Traffic Technologies

- Yunex Traffic

- These companies are leveraging acquisition strategies to extend their geographic reach and product breadth. For example Siemens Mobility is considered one of the main international players in traffic management systems and offers a wide-ranging global capability, portfolio of Sitraffic smart controllers and Sitraffic Concert as the central traffic management systems. Siemens Mobility operates a definitive solid footprint in Europe, Asia and America, while providing adaptive traffic control, V2X-ready solutions and an integrated ITS platform.

- Sumitomo Electric, a leading technology company based in Japan, has grown in importance across the Asia-Pacific region, while also making headway on the world stage. Sumitomo provides advanced traffic control systems that include adaptive signal controllers, communication networks and ITS solutions to ensure safe and effective traffic flow. Sumitomo Electric extends its capabilities of power, electronics, and fiber optics into its traffic signal control solutions and frequently participates in large, multimodal smart mobility and urban infrastructure projects in Japan and other parts of Asia.

- SWARCO is an important international player in traffic management with notable access to Europe, North America and Asia. Some of the products in SWARCO's traffic portfolio are SWARCO ITC-3 and ITC-4 traffic controllers, adaptive traffic management systems, and V2X ready solutions. The company is particularly strong in delivering complete smart mobility ecosystems, covering traffic signal controllers, LED traffic lights, road markings, and ITS software.

Traffic Signal Controller Industry News

- In August 2024, the Gurugram Metropolitan Development Authority (GMDA) developed smart traffic signal systems by including 32 junctions in the city. This second phase of the project will help meet the vehicle traffic management and pedestrian safety challenges across the city. The signalized junctions installed are smart signals with Adaptive Traffic Control Systems (ATCS) which provide timed traffic lights that adjust according to real-time traffic density and movement patterns.

- In July 2024, LEOTEK closed its acquisition of Dialight’s traffic business, a well-known global supplier of LED commercial and industrial luminaires. The acquisition provides LEOTEK with a much-needed leg up as a supplier/provider/manufacturer of traffic signals in the Americas. This acquisition will assist in LEOTEK reaching its strategic objectives of smart transportation and geographical expansion, giving the company the potential to provide more robustly tied together solutions regarding traffic management and helping the corporation gain against other competitors in the rapidly growing intelligent traffic controller space.

- In April 2024, PTV Group, Umovity, and Econolite partnered to an integrated prediction traffic monitoring and alarm solution leveraging an Advanced Transportation Management System (ATMS). This new predictive platform also accepted inputs from Econolite's Centracs Mobility software to optimize traffic flows, mitigate congestion, and improve safety using real-time data to respond to dynamic changes. This partnership illustrates the direction that software-enabled traffic management systems are heading in, further traditional traffic management systems and adaptive traffic signal controllers.

- In December 2023, Yunex Traffic also introduced a cloud-based Advanced Traffic Management System (ATMS) in the USA, product YutaTraffic Studio. Designed to create the most efficient traffic monitoring, planning, and operational solutions, YutaTraffic Studio utilizes many streams of real-time data collection - including inputs from connected vehicles! YutaTraffic Studio provides cities with adaptive, high-quality instructions for traffic control to address the current reality of traffic challenges and prepare for future transportation needs.

The traffic signal controller market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue and volume ($ Bn & Units) from 2021 to 2034, for the following segments:

Market, By Component

- Hardware

- Controller units

- Detectors

- Cabinets

- Others

- Software

- Central traffic management

- Edge/controller firmware

- Cybersecurity & device management

- Others

- Service

- Professional services

- Managed services

Market, By Control System

- Fixed time

- Actuated

- Adaptive

Market, By Application

- Urban area

- Suburbs area

Market, By Deployment

- New installations

- Retrofits/modernization

Market, By End Use

- Government

- Public transit agencies (TSP)

- Emergency services (EVP)

- City/municipal DOT

- Private contractors

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Belgium

- Netherlands

- Sweden

- Asia Pacific

- China

- India

- Japan

- Australia

- Singapore

- South Korea

- Vietnam

- Indonesia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the traffic signal controller industry?

Key players include Atkins, Econolite, Johnson Controllers, PTV Group, Siemens, Sumitomo Electric, SWARCO, Temple, Traffic Technologies, and Yunex Traffic.

Which region leads the traffic signal controller sector?

North America leads the market, with the U.S. accounting for 76% of the regional revenue, totaling USD 1.5 billion in 2024. This growth is supported by the U.S.'s position as a hub for technological innovation and the development of advanced traffic control systems.

What are the upcoming trends in the traffic signal controller market?

Trends include AI traffic systems, real-time data sharing, cloud signal software, and smart city connectivity.

What is the growth outlook for the government segment?

The government segment was valued at USD 4.3 billion in 2024, led by substantial investments in smart city projects and traffic management infrastructure.

What was the valuation of the urban area segment in 2024?

The urban area segment accounted for 64% of the market share in 2024 and is set to expand at a CAGR of 12.7% up to 2034.

What is the expected size of the traffic signal controller market in 2025?

The market size is projected to reach USD 6.5 billion in 2025.

How much revenue did the hardware segment generate in 2024?

The hardware segment generated approximately 57% of the market revenue in 2024 and is expected to witness over 12.2% CAGR till 2034.

What is the market size of the traffic signal controller in 2024?

The market size was valued at USD 5.8 billion in 2024, with a CAGR of 13.2% expected through 2034. The growth is driven by increasing urbanization and the rising need for adaptive traffic management systems.

What is the projected value of the traffic signal controller market by 2034?

The market is poised to reach USD 19.7 billion by 2034, fueled by advancements in smart city technologies and the adoption of intelligent transportation systems.

Traffic Signal Controller Market Scope

Related Reports