Summary

Table of Content

Titanium Dioxide Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Titanium Dioxide Market Size

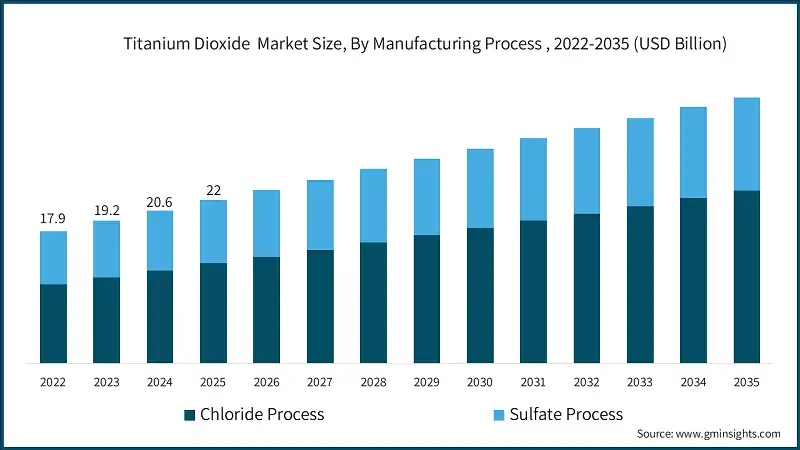

The global titanium dioxide market was valued at USD 22 billion in 2025. The market is expected to grow from USD 23.4 billion in 2026 to USD 35.8 billion in 2035, at a CAGR of 4.9% according to latest report published by Global Market Insights Inc.

To get key market trends

- Strategic product renovation of various industries has now majorly reshaped the titanium dioxide market towards the sustainability and performance. Recovery in demand, normalization in automotive production, and a move toward cosmetics and specialty applications have all helped counterbalance the effects of frictions in trade and the tightening of regulations on powders. Leading producers have focused on improving their product mix, balancing regions, and dealing in higher-value grades that could cushion them against volatility, yet remain competitive in the market.

- Such forecast from the industry is steady growth with matured regions emphasizing on demand for specialty applications while emerging economies will carry forward baseline consumption in construction, coatings, packaging, and consumer goods. Niche segments, such as nanoscale products and application-specific surface treatments gain traction, are expected to realize price increases and differentiation opportunities, causing value growth to outpace volume growth in some areas.

- The indications are that the industry is showing less boom-and-bust behavior than in previous cycles, as consolidation and rationalization take hold. New capacity additions will mainly keep pace with restricted supply strategies, while innovation in high-value grades and chloride process output will still shape the competitive landscape.

Titanium Dioxide Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 22 Billion |

| Market Size in 2026 | USD 23.4 Billion |

| Forecast Period 2026 - 2035 CAGR | 4.9% |

| Market Size in 2035 | USD 35.8 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Paints & coatings demand | Remains the anchor, underpinned by construction cycles, infrastructure outlays, and performance needs in exterior systems |

| Construction and infrastructure expansion | In Asia Pacific, Latin America, and the Middle East & Africa continues to widen the titanium dioxide market’s installed base and throughput |

| Automotive and lightweighting | Support premium rutile-grade adoption, including EV color/finish differentiation and higher-durability specs |

| Pitfalls & Challenges | Impact |

| Environmental compliance costs and emissions reporting | Stringent environmental regulations and compliance costs, including CO2 reporting for calcination, push operating expenses higher and favor best-in-class assets |

| EU food-grade TiO2 ban (E171) and global reformulations | Remove a small but permanent demand pool, inducing reformulations and supply-chain complexity for global brands |

| Opportunities: | Impact |

| Nanoscale UV & photocatalysis | Premium pricing, rapid adoption in cosmetics and environmental tech |

| Sustainability & circularity demand | Waste acid recycling, energy efficiency, and by‑product valorization reduce cost and risk |

| Market Leaders (2025) | |

| Market Leaders |

12% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Mexico, Argentina |

| Future outlook |

|

What are the growth opportunities in this market?

Titanium Dioxide Market Trends

- Accelerating transition to chloride process Producers continue to reweight toward chloride processing because it yields higher purity pigment, tighter particle size distributions, and lower environmental burden by avoiding acidic effluent. In North America and Europe, chloride already represents roughly 80–90% of capacity; China, historically sulfate heavy, is financing new chloride builds and technology upgrades at pace. Consider Lomon Billions’ plan for an overseas chloride facility in Saudi Arabia, this is a directional signal toward premium output and regional balance.

- Nanoscale TiO2 adoption and advanced functionalities Ultrafine particles (≤100 nm) are expanding much faster than the overall titanium dioxide market due to UV protection, photocatalysis, and emerging energy/electronics applications. Industry studies indicate the nanoscale segment could grow above 6.5% through 2035 as formulators leverage much higher surface areas and catalytic activity, particularly in anatase. In 2024, Tronox commissioned a 92,000 ton nanoparticle line for environmental coatings, a clear bet on long run demand for photocatalytic and self-cleaning systems.

- The incorporation of smart functionalities into sealant systems is yet another paradigm shift. Self-healing technologies and sensor enabled sealants are gathering momentum owing to the predictive maintenance capabilities they offer at extending service life. In conjunction with the digital performance management platforms of vessels, these create new value propositions for operators that seek efficiency and reliability in extremely harsh offshore environments.

- Consolidation, rationalization, and trade actions the titanium dioxide market remains moderately concentrated at the top while China’s producer base remains fragmented, creating periodic overcapacity and export surges.

- Sustainability and circularity as operating disciplines Compliance is now table stakes, but leaders are going further waste acid recycling, by product valorization, on site renewables, and energy intensity reductions are becoming differentiators. Chinese producers are scaling waste acid recovery and closed loop water systems, and selected producers are upgrading process controls to hit tighter particle specs (e.g., 98% uniformity targets) that reduce scrap and rework.

Titanium Dioxide Market Analysis

Learn more about the key segments shaping this market

Based on manufacturing process, the market is segmented into chloride process, sulfate process. Chloride process dominated the market with an approximate market share of 61.1% in 2025 and is expected to grow with a CAGR of 5.5% by 2035.

- The chloride process represents roughly 61.1% of global capacity today and dominates North America and Europe due to quality and compliance economics. It chlorinates high grade rutile or synthetic rutile to TiCl2 and oxidizes to pigment at high temperature, delivering rutile grades with refractive index around 2.71 and narrow particle distributions prized in exterior coatings. Capital intensity is high, but so is consistency, which keeps the market’s premium niches anchored to chloride.

- The sulfate process holds about 38.8% of capacity, particularly concentrated in China where ore flexibility and lower capex support scale-up. It digests ilmenite with sulfuric acid, hydrolyzes, and calcines to pigment (rutile or anatase), but generates acidic effluence and demands robust waste treatment.

Learn more about the key segments shaping this market

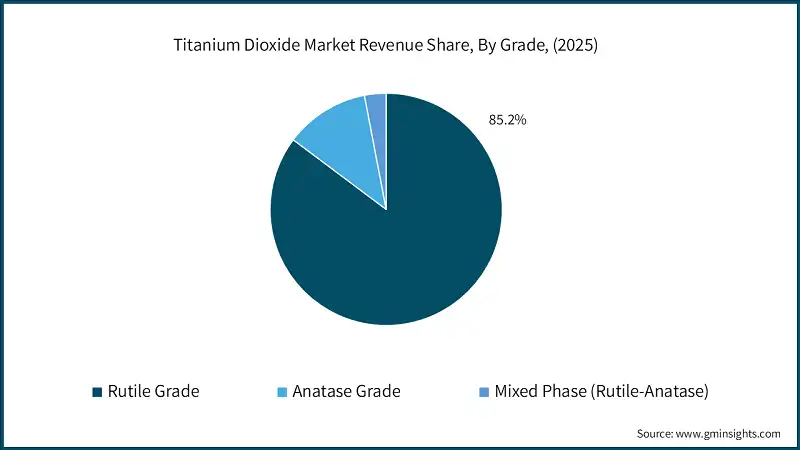

Based on grade, the titanium dioxide market is segmented into rutile grade, anatase grade, mixed phase (rutile-anatase). Rutile grade held the largest market share of 85.2% in 2025 and is expected to grow at a CAGR of 5% during 2026-2035.

- Rutile grade commands roughly 85.2% value share and remains the default for exterior durability, color stability, and hiding power across architectural and automotive systems. Its higher refractive index versus anatase translates into better scattering efficiency at typical pigment sizes, which is why the market’s largest segments won’t compromise on rutile.

- Anatase accounts for about 11.7% and is prized for photocatalytic performance, enabling self cleaning surfaces, air/water purification, and antimicrobial coatings. While mostly produced via sulfate routes, specialized chloride-route anatase is scaling to meet high-purity needs.

Based on particle size, the titanium dioxide market is segmented into pigmentary/conventional TiO2 (>100 nm), ultrafine/nanoscale TiO2 (≤100 nm), composite TiO2 products (<80% TiO2 Content). Pigmentary/conventional TiO2 (>100 nm) dominated the market with an approximate market share of 91.3% in 2025 and is expected to grow with the CAGR of 4.6% by 2035.

- Pigmentary or conventional Titanium Dioxide (>100 nm), that forms the basis of the industry. Opacity, brightness, and color stability are triad application needs. Such classes dominate architectural coatings, automotive finishes, and industrial paints, producing a coverage that can endure permanent deterioration under severe environmental conditions.

- Ultrafine or nanoscale Titanium Dioxide (<100 nm) is on its way to technology innovation. Its photocatalytic properties create breakthrough solutions for air and water purification systems that work toward a cleaner and healthier world. Nanoscale TiO2 also contributes to the renewable energy world through improved energy conversion efficiency in dye-sensitized and perovskite solar cells and sustainable development goals globally. It is also now commonly used in self-cleaning surfaces and antimicrobial coatings, where its capability to degrade organic pollutants under UV light adds substantial functional value cyclical loading.

Based on surface treatment & coating, the titanium dioxide market is segmented into uncoated/bare TiO2, inorganic coated TiO2, organic coated TiO2, Doped TiO2. Uncoated/bare TiO2 segment dominated the market with an approximate market share of 14.3% in 2025 and is expected to grow with the CAGR of 3% by 2035.

- Uncoated titanium dioxide is still widely used where basic pigment properties are perceived to be worthy: opacity, brightness, and whiteness. These grades are low-priced materials used in cheap coatings, plastic, and paper products with a strong covering and color performance. Since these are unmodified grades, they are more reactive and therefore less suitable in situations where extreme durability or chemical resistance is needed.

- Inorganic coatings consisting mainly of alumina or silica layers give excellent stability and help resist environmental stress to TiO2. In treated grades, these would be especially suitable for exterior coatings and automotive finishes requiring high weatherability, UV protection, and minimal photocatalytic activity.

Based on regulatory grade, the titanium dioxide market is segmented into industrial/technical grade, cosmetic grade, pharmaceutical/drug grade, medical device grade, food grade. Industrial/technical grade dominated the market with an approximate market share of 88.5% in 2025 and is expected to grow with the CAGR of 4.7% by 2035.

- Industrial or technical grade titanium dioxide forms the backbone of high-performance coatings and plastics and paper applications for durability, opacity, and UV resistance. Its applications extend to architectural coatings and automotive-grade coatings, industrial paints, and polymer formulations, providing shielding against severe conditions and aesthetic appeal.

- Cosmetic-grade TiO2 is manufactured with an emphasis on purity and safety, the strict criteria for skin-contact applications. It is a vital ingredient in sunscreen formulations, foundation, and other cosmetic products, in which its main function includes providing UV protection and finishing properties.

Based on application, the titanium dioxide market is segmented into paints & coatings, plastics & rubber, paper & pulp, printing inks, cosmetics & personal care, food products, textiles & fibers, photocatalytic applications, electronics & energy. Paints & coatings dominated the market with an approximate market share of 88.5% in 2025 and is expected to grow with the CAGR of 4.7% by 2035.

- Titanium Dioxide dominates the paint and coating industry where exceptional opacity, brightness, and UV resistance ensure long-lasting color stability and environmental stress protection. Its properties make it an absolute must in architectural, automotive, and industrial finishes, where durability and aesthetic appeal come into play. In plastics, rubber, and paper, TiO2 grants whiteness, opacity, and weather resistance to applications demanding visual quality and structural integrity under outdoor exposure.

- Most recent applications of titanium dioxide in photocatalytic technologies, electronics, and energy are far advanced. Ultrafine TiO2, by virtue of its photocatalytic activity, enables air and water purification, self-cleaning surfaces, and antimicrobial coatings. In renewable energy, it serves as a pivotal constituent of solar cells and energy storage systems, increasing efficiency and supporting sustainability objectives.

Looking for region specific data?

The North America titanium dioxide market is growing rapidly on the global level with a market share of 21.7% in 2025.

- North America has become an important region for titanium dioxide applications owing to its strong manufacturing capabilities and sound regulatory frameworks encouraging sustainability and safety. Those requirements generate high demand for TiO2-based solutions that ensure greater durability and opacity as well as protection against UV rays, which are essential in meeting changing standards in infrastructure and transport projects in construction, automotive, and industrial sectors.

U.S. dominates the North America titanium dioxide market, showcasing strong growth potential.

- U.S. is expected to emerge as the strongest among the regions, urged by policies championing modernization and application of cleaner, more efficient materials.

Europe titanium dioxide market leads the industry with revenue of USD 4.3 billion in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe takes a position as major source of innovation in titanium dioxide applications through strong sustainability regulations and high-quality material standards. The industries of this region are increasingly using Titanium Dioxide based solutions for coatings, plastics, and specialty applications for environmental compliance and superior performance.

Germany dominates the European titanium dioxide market, showcasing strong growth potential.

- Germany is leading country in European market, bolstered by its strong manufacturing base and its chief role in high-performance coatings and high engineered materials.

The Asia Pacific market is anticipated to grow at a CAGR of 5.2% during the analysis timeframe.

- Asia Pacific region is growing so quickly as the fastest growing hub of Titanium Dioxide, considering its solid industrial ecosystem and quickly incoming investments into advanced material technologies.

China titanium dioxide market is estimated to grow with a significant CAGR in the Asia Pacific region.

- The most prominent regional market is China, where vast domestic manufacturing facilities are coupled with innovation in coatings, plastics, and specialty materials. Demand for high-value TiO2 grades has risen owing to the recent push on energy efficiency and environmental compliance by governments.

Latin America Titanium Dioxide accounted for 8.2% market share in 2025 and is anticipated to show highest growth over the forecast period.

- Modernization of infrastructure and industrial evolution have promoted a steady build-up of the Titanium Dioxide growth area in Latin America. There is a strong demand for TiO2-based solutions, having improved properties of opacity/brightness/UV resistance targeted specifically to environmental-funded markets.

Brazil leads the Latin American titanium dioxide market, exhibiting remarkable growth during the analysis period.

- Brazil ranks as the most important market in the region benefiting from an already well-established industrial infrastructure, although it is pushing more on advanced material technology.

Middle East & Africa market accounted for 8% market share in 2025 and is anticipated to show lucrative growth over the forecast period.

- The Middle East and Africa are becoming the most essential developing regions for Titanium Dioxide, supported by the rapid development and modernization initiatives. Strong demands for TiO2 solutions in this region can be associated with expanding construction projects, infrastructure upgrades, and diversification in advanced manufacturing.

Saudi Arabia Titanium Dioxide industry to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia comes first in this regional phenomenal transformation as it pursues industrial modernization for integration of advanced materials in coatings, plastics, and specialty applications.

Titanium Dioxide Market Share

The top 5 companies in titanium dioxide industry include Chemours Company, Tronox Holdings plc, Lomon Billions Group, Kronos Worldwide Inc, Venator Materials PLC. These are prominent companies operating in their respective regions covering approximately 42% of the market share in 2025. These companies hold strong positions due to their extensive experience in market. Their diverse product portfolios, backed by robust production capabilities and distribution networks, enable them to meet the rising demand across various regions.

- Chemours Company is the global leader in chemical manufacturing, with specialization in titanium technologies, thermal and specialized solutions, and advanced performance materials. Its portfolio contains such prominent brands as refrigerants, fluoropolymers, and pigments.

- Tronox Holdings plc is a vertically integrated producer active in the manufacture of titanium dioxide pigments as well as of the minerals associated directly with titanium dioxide. It extends its mining production from processing to pigment manufacture, catering to industries such as coatings, plastics, and paper.

- Lomon Billions Group is one of the leading manufacturers of titanium dioxide pigments globally. It sells products through both sulfate and chloride processes and is in China. Lomon Billions serves coatings, plastics, and ink markets worldwide.

- Kronos Worldwide Inc is recognized as a leading source of titanium dioxide pigment products that cater for coatings, plastics, paper, and even specialty applications. It has a global reach, adjudged in providing related technical support services, and having its consistent quality and reliability in the supply on which the customers rely.

- Venator Materials PLC manufactures titanium dioxide pigments and performance additives, including iron oxides and specialized inorganic pigments. Its products are used in coatings, cosmetics, plastics, and certain industrial applications.

Titanium Dioxide Market Companies

Major players operating in the titanium dioxide industry include:

- Chemours Company

- Tronox Holdings plc

- Lomon Billions Group

- Kronos Worldwide Inc

- Venator Materials PLC

- CNNC Hua Yuan Titanium Dioxide Co Ltd

- Ishihara Sangyo Kaisha Ltd

- Tayca Corporation

- Grupa Azoty ZAK SA

- Kerala Minerals & Metals Limited (KMML)

- Cristal Pigment Australia Ltd

- Precheza AS

Titanium Dioxide Industry News

- In March 2025, Venator launched TME2free TMP TIOXIDE TR81 grade to meet tightening environmental and customer requirements.

- In February 2025, Chemours introduced Ti2Pure R2706 and Ti2Pure TS26706 for coatings, extending performance options in architectural and industrial systems.

- In December 2024, Chemours announced a DeLisle, Mississippi expansion via a chlor2alkali unit to secure chlorine for 340,000 t of additional TiO2 capacity: construction targeted for 2026

These titanium dioxide market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Kilo Tons) from 2022 to 2035, for the following segments:

Market, By Manufacturing Process

- Chloride process

- Sulfate process

Market, By Grade

- Rutile grade

- Anatase grade

- Mixed phase (rutile-anatase)

Market, By Particle Size

- Pigmentary/conventional TiO2 (>100 nm)

- Ultrafine/nanoscale TiO2 (≤100 nm)

- Composite TiO2 products (<80% TiO2 content)

Market, By Surface Treatment & Coating

- Uncoated/bare TiO2

- Inorganic coated TiO2

- Silica-coated TiO2

- Alumina-coated TiO2

- Zirconia-coated TiO2

- Mixed oxide coatings

- Organic coated TiO2

- Siloxane-treated TiO2

- Alkyl-silane-treated TiO2

- Polymer-coated TiO2

- Doped TiO2

Market, By Regulatory Grade

- Food grade (E171)

- Bakery products

- Confectionery

- Dairy products

- Beverages

- Pharmaceutical/drug grade

- Tablet coatings

- Capsule formulations

- Topical preparations

- Cosmetic grade

- Sunscreens & UV protection

- Color cosmetics

- Skincare products

- Medical device grade

- Contact lenses

- Intraocular lenses

- Medical device coatings

- Industrial/technical grade

Market, By Application

- Paints & coatings

- Architectural paints

- Industrial coatings

- Automotive coatings

- Marine coatings

- Powder coatings

- Wood coatings

- Plastics & rubber

- Polyolefins (pe, pp)

- Pvc

- Paper & pulp

- Coated paper

- Uncoated paper

- Specialty papers

- Printing inks

- Publication inks

- Packaging inks

- Commercial printing inks

- Cosmetics & personal care

- Sunscreens & uv blockers

- Color cosmetics

- Eye makeup

- Lip products

- Skincare products

- Food products

- Bakery items

- Confectionery

- Other food applications

- Textiles & fibers

- Delustering of synthetic fibers

- Textile coatings & finishes

- Photocatalytic applications

- Self-cleaning surfaces

- Air purification

- Water treatment

- Antimicrobial coatings

- Regional analysis

- Electronics & energy

- Solar cells (dye-sensitized)

- Sensors

- Capacitors

- Battery materials

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

Who are the key players in the titanium dioxide market?

Key players in the titanium dioxide industry include Chemours Company, Tronox Holdings plc, Lomon Billions Group, Kronos Worldwide Inc, and Venator Materials PLC. Together, these companies accounted for approximately 42% of the global market share in 2025.

Which application segment leads the titanium dioxide industry?

Paints & coatings dominated the industry with approximately 88.5% market share in 2025. Sustained construction activity and demand for long-lasting, high-performance coatings continue to anchor segment growth.

What are the key trends shaping the titanium dioxide market?

Key trends include accelerated transition to chloride processing, increasing adoption of nanoscale TiO₂, and heightened focus on sustainability and circular production practices. These trends are improving product performance while stabilizing long-term industry growth.

Which region leads the titanium dioxide market?

North America held a 21.7% market share in 2025, with the U.S. dominating regional demand. Growth is driven by strong manufacturing capabilities, sustainability-focused regulations, and rising use of premium TiO₂ grades in construction and automotive industries.

What is the growth outlook for nanoscale titanium dioxide through 2035?

Nanoscale titanium dioxide is expected to grow at a CAGR exceeding 6.5% through 2035. Growth is fueled by rising adoption in photocatalytic coatings, cosmetics, environmental purification, and advanced energy applications.

What was the market share of rutile grade titanium dioxide in 2025?

Rutile grade titanium dioxide held 85.2% of the market share in 2025. Its dominance is attributed to superior opacity, UV resistance, and durability across architectural, automotive, and industrial coating applications.

How much revenue did the chloride process segment generate in 2025?

The chloride process segment accounted for approximately 61.1% of the titanium dioxide market in 2025, Growth is driven by demand for high-purity rutile grades and stricter environmental compliance requirements.

What is the market size of the titanium dioxide industry in 2025?

The market was valued at USD 22 billion in 2025. Market expansion is supported by strong demand from paints & coatings, construction, plastics, and infrastructure-related applications.

What is the current titanium dioxide industry size in 2026?

The industry is projected to reach USD 23.4 billion in 2026, reflecting steady recovery in construction activity and normalization in automotive and industrial coatings demand.

What is the projected value of the titanium dioxide market by 2035?

The market is expected to reach USD 35.8 billion by 2035, growing at a CAGR of 4.9% from 2026 to 2035, driven by specialty-grade adoption, sustainability initiatives, and infrastructure expansion.

Titanium Dioxide Market Scope

Related Reports