Summary

Table of Content

Threat Intelligence Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Threat Intelligence Market Size

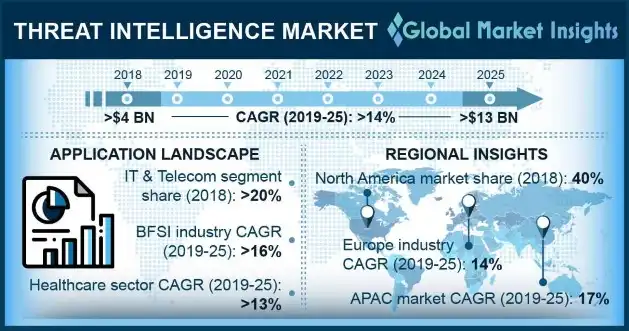

Threat Intelligence Market size surpassed USD 4 billion in 2018 and is anticipated to grow at a CAGR of over 14% between 2019 and 2025. The growing need among organizations to improve their security framework is fostering the market demand.

To get key market trends

As organizations are rapidly embracing cloud platforms, IoT, and other networking technologies, they are becoming increasingly exposed to various cybersecurity breaches. This is encouraging them to adopt threat intelligence platforms to strengthen their detection, protection, and response capabilities against the rapidly evolving cybercrime landscape.

Threat Intelligence Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2018 |

| Market Size in 2018 | 4 Billion (USD) |

| Forecast Period 2019 - 2025 CAGR | 14% |

| Market Size in 2025 | 13 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The increasing number of cyber vulnerabilities is also driving the growth of the threat Intelligence market. The rapid technological advancement has given rise to various forms of cybersecurity vulnerabilities such as phishing, zero-day attack, ransomware, and insider attacks. Due to this, there will be an increase in the number of security vulnerabilities, raising concerns among organizations to update their security infrastructure and to keep up with the changing threat scenario. The use of threat intelligence solutions among enterprises is to gain evidence-based insights regarding the existing or emerging threats to make informed decisions.

Threat Intelligence Market Analysis

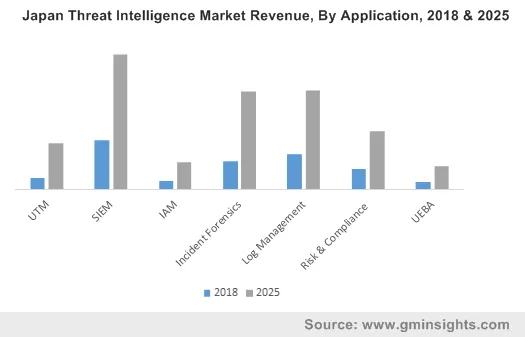

The UTM component segment is estimated to observe around 17% growth till 2025. The enterprises are adopting various trends such as Bring Your Own Device (BYOD), Choose Your Own Device (CYOS), and virtualization. With the incorporation of these trends, the enterprises need to prepare for the emerging internal and external security vulnerabilities in their networks. UTM safeguards the network against a wide range of internal & external threats.

The SIEM segment accounted for 30% of the market revenue in 2018. The increasing need to speed up the threat detection process is driving the use of SIEM solutions. The technology uses event discovery and correlation mechanisms to speed up the network event monitoring process by combining the error logs & alerts into a unified solution. This enables real-time threat monitoring across the entire network.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

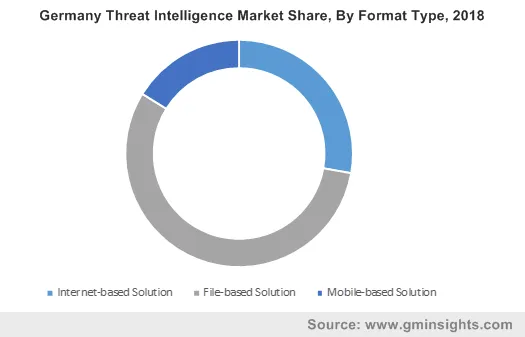

The internet-based solution segment is set to register over 14% gains in the threat intelligence market during the forecast period. This growth is credited to increasing proliferation of cloud technology.

Modern cyber-attacks such as WannaCry and NotPetya pandemic use disruptive and innovative security technology to circumvent the passive defense mechanism. To combat such advanced security threats, real-time defense mechanisms are required to forecast attack patterns. The cloud technology uses a collaborative approach to predict future attack locations by analyzing event streams of data.

The file-based solutions held more than 50% market share in 2018. The technological advancements in the connectivity infrastructure is a key factor influencing the market growth. The emergence of next-generation technologies such as 5G and 4G has enabled companies to download large files, thereby promoting the use of the file-based solutions.

In 2018, the on-premise deployment model dominated over 75% of the total stake in the threat Intelligence market. On-premise deployment solutions are widely used among large enterprises with high investments in their security infrastructure. It allows the companies to customize their security framework as per their requirements with minimal vendor involvement.

The cloud deployment segment is predicted to expand at 20% CAGR through 2025. The cloud-based solutions have experienced a very high adoption rate among SME due to its inexpensive nature. It saves substantial capital expenses through the reduction in spending on equipment, infrastructure, and software. It also enables companies to scale their operations without incurring any additional capital expenditure.

Learn more about the key segments shaping this market

Learn more about the key segments shaping this market

The IT & telecom applications accounted for over 20% of the global market revenue in 2018. This can be credited to rising number of cyber-attacks on IT & telecom providers. Telecom organizations attract sophisticated and complex cyber-attacks as they store sensitive customer information and provide critical unified communication services to organizations.

With the large section of their business operating online, the robust network security infrastructure has become an occupational necessity for the telecom industry. This is encouraging IT & telecom players to invest in threat intelligence solutions.

The BFSI sector is slated to witness growth of over 16% till 2025. The widespread digitalization of internet & online banking has a significant impact on the banking industry. Prior to the internet, financial establishments could easily secure the customers’ credentials; however, it was tough to reach their customers.

Currently, the ease-of-use has become a key competitive factor determining the success of financial organizations. This has encouraged companies to provide various online channels to improve their customer journeys. However, this has left financial establishments vulnerable to various cybersecurity attacks. The financial players are investing in advanced threat intelligence infrastructure to bolster their defenses against the latest cybercrime technologies.

North America dominated the global market with 40% share in 2018. The rise in number of connected devices along with increasing use of remote monitoring & tracking devices are encouraging companies to adopt advanced security solutions. The presence of several large threat intelligence vendors such as IBM, Symantec, and Palo Alto Networks and the widespread awareness regarding the security solutions will help in the market growth.

Europe threat intelligence market size will grow at more than 13% CAGR from 2019 to 2025 impelled by introduction of stringent compliance regulations mandating the companies to incorporate advanced security solutions into their network infrastructure. The early adoption of various next-generation technologies such as IoT and cloud computing across various businesses sectors has further added to the market demand.

Threat Intelligence Market Share

The threat Intelligence industry comprises various large players such as

- Symantec

- McAfee

- Kaspersky

- FireEye

- IBM

- Cisco

- Accenture

- Check Point Technologies

- Flashpoint

- Trend Micro

The large organizations are strategically acquiring various upcoming start-ups to expand their product line.

Some of the players in the market are

- Accenture

- Cisco Systems

- Crowdstrike

- Check Point Software

- Digital Shadows

- FireEye

- Flashpoint

- Group-IB

- Hold Security

- IBM

- IntSights

- Kaspersky Lab

- McAfee

- Oracle

- Palo Alto Networks

- Proofpoint

- Recorded Future

- Secureworks

- Sophos

- Symantec

- ThreatQuotient

- TrendMicro

The threat intelligence market research report includes an in-depth coverage of the industry with estimates & forecast in terms of revenue from 2014 to 2025, for the following segments:

By Component

- Platform

- Unified Threat Management (UTM)

- Security Information & Event Management {SIEM)

- Identity Access Management (IAM)

- Incident Forensics

- Log Management

- Risk & Compliance Management

- User and Entity Behavior Analytics (UEBA)

- Service

- Professional Services

- Managed Service

- Subscription Services

- Training & Consulting

By Format Type

- Internet-based Solution

- File-based Solution

- Mobile-based Solution

By Deployment Model

- On-Premise

- Cloud

By Application

- BFSI

- IT & Telecom

- Manufacturing

- Healthcare

- Energy & Utilities

- Government

- Others

The above information has been provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- Australia

- China

- India

- South Korea

- Japan

- Singapore

- Latin America

- Mexico

- Brazil

- Argentina

- MEA

- Israel

- UAE

- South Africa

- Saudi Arabia

Frequently Asked Question(FAQ) :

Why will internet-based solution segment gain traction in the market?

Internet-based solutions in the market will gain traction owing to growing proliferation of cloud technology and need for real time security solutions.

Which are the prominent companies operating in the threat intelligence landscape?

Some of the key players in the industry are Accenture, Cisco Systems, Crowdstrike, Check Point Software, Digital Shadows, FireEye, Flashpoint, Group-IB, Hold Security, IBM, IntSights, Kaspersky Lab, McAfee, Oracle, Palo Alto Networks, Proofpoint, Recorded Future, Secureworks, Sophos, Symantec, ThreatQuotient, and TrendMicro.

How much will the BFSI applications gain in the threat intelligence industry?

The BFSI sector is slated to witness growth of over 16% till 2025 due to online banking and widespread digitalization of internet has opened doors for potential cybersecurity threats.

What are the growth projections for Europe threat intelligence market?

The European market size will grow at more than 13% CAGR from 2019 to 2025 impelled by introduction of stringent compliance regulations directing the companies to implement advanced security solutions into the network infrastructure.

How much will the threat intelligence industry share grow during the forecast timeline?

The industry share of threat intelligence is anticipated to grow at a CAGR of over 14% between 2019 and 2025.

How much size did the global threat intelligence market register in 2018?

The market size of threat intelligence surpassed USD 4 billion in 2018.

Threat Intelligence Market Scope

Related Reports