Summary

Table of Content

Thermal Transfer Ribbon Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Thermal Transfer Ribbon Market Size

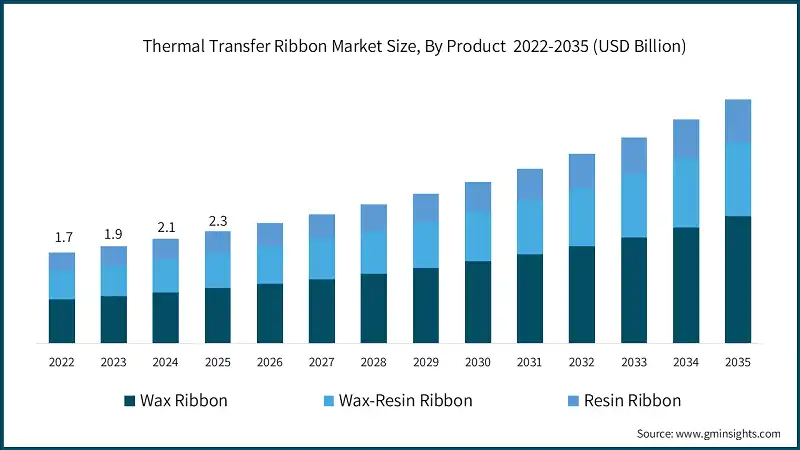

The global thermal transfer ribbon market was estimated at USD 2.3 billion in 2025. It is expected to grow from USD 2.4 billion in 2026 to USD 4 billion by 2035, at a CAGR of 5.9%, according to latest report published by Global Market Insights Inc.

To get key market trends

- Expansion of e-commerce and parcel logistics is firmly supporting the need of thermal transfer ribbons especially in shipping, sorting and last-mile delivery services. With parcel movements increasing by double digits in the national postal agencies and government trade bodies in the major economies, consumption of durable shipping labels is on the rise. This continued increase in fulfilment activity boosts directly the market of the wax-resin and resin ribbons.

- The use of TTR is gaining pace in industry as more firms in manufacturing and warehouses install automated label applicators and intelligent assembly lines. Increased use of high precision barcode and compliance labels are used in modern factories to facilitate throughput efficiency, reduction of errors and real time inventory visibility. This shift to more digitally organized operations increases the pressure on machine-compatible ribbon formulations with high performance.

- TTR utilization is growing through smart packaging projects as industries are changing their traceability and product-authentication methods. Pharmaceutical, food processors and chemical suppliers are adopting the use of sophisticated labeling tools to comply with highly vigilant safety, serialization and audit-trail standards. The movement to smart packaging processes demands high contrast and durable thermal prints all the time.

- The thermal transfer ribbon market growth is also being aided by the increased use of RFID and hybrid identification system with a number of sectors implementing RFID-enabled labels alongside traditional barcodes to enhance the tracking of assets. Defence, healthcare and controlled supply chains triplets have been compelled to switch to smarter identification technologies by governmental mandates. In mixed-technology environments, thermal transfer ribbons are also considered necessary in such applications as they provide readability, redundancy, and compliance.

- Government initiatives to digitize the supply chain, export transparency, and modernizing logistics are also driving the expansion of markets. Customs authorities, postal networks, and transportation regulators are still increasing the digitalization of their documentation and tracking systems, which add pressure on the need of standard barcode labels. The changes on a policy level support the topicality of thermal transfer ribbons in the global logistics infrastructure and trade.

Thermal Transfer Ribbon Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 2.3 Billion |

| Market Size in 2026 | USD 2.4 Billion |

| Forecast Period 2026 - 2035 CAGR | 5.9% |

| Market Size in 2035 | USD 4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| E-commerce & logistics expansion | Surge in demand for shipping and barcode labels, driving high-volume TTR consumption globally. |

| Industrial automation & smart packaging | Increased need for durable, machine-readable labels in automated production lines, boosting TTR adoption. |

| Increasing adoption of RFID | Integration of RFID with printed labels creates hybrid solutions, expanding TTR applications in asset tracking and smart inventory systems. |

| Pitfalls & Challenges | Impact |

| Increasing Competition from Alternative Printing Technologies | Market share erosion as direct thermal and digital printing gain traction, reducing TTR demand in cost-sensitive segments. |

| Compatibility Issues with Diverse Substrates | Higher production complexity and cost for specialized ribbons, limiting scalability and profitability. |

| Opportunities: | Impact |

| Growth in E-commerce and Logistics | Continuous rise in parcel volumes ensures sustained demand for durable TTR-based labels. |

| Rising Adoption in Healthcare and Pharmaceuticals | Regulatory compliance and traceability requirements create premium demand for high-quality TTR labels in medical and pharma sectors. |

| Market Leaders (2025) | |

| Market Leaders |

14.2% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest growing market | Latin America |

| Emerging countries | Brazil, Mexico, Argentina |

| Future outlook |

|

What are the growth opportunities in this market?

Thermal Transfer Ribbon Market Trends

- The rising popularity of high-speed, automated print-and-apply systems is creating a necessity in the faster-throughput ribbons with less downtime. As logistics centers and production facilities implement quicker conveyors and robotics of picking apparatus, ribbon output should improve to guarantee the print quality at enhanced rates of printing. This trend encourages the use of improved resin and hybrid formulations, which resist the resistance and mechanical forces.

- Ribbon innovation is also being affected by the movement towards linerless and sustainable forms of labels as companies look to cut down on waste in printing processes. Even though linerless labels are commonly used with direct thermal printing, the fact that they need durability only offered by TTR is pushing many businesses to find sustainable coating and ribbon materials that can be recycled. This shift would stimulate R&D spending and push suppliers to more environmentally friendly product lines.

- The increasing use of color-coded logistics and labeling of warehouses is on the increase to ensure companies can optimize inventory that may be flowing through and minimize scanning errors. Specialty inks and multi-color ribbons are becoming popular in cold-chain management, labeling of hazardous materials and priority freight classification. This trend is also connected with the automation of warehouses, where color segmentation enhances the vision of the machines and minimizes the operational bottlenecks.

- The emergence of cloud-based labeling systems is transforming the approach that businesses use to regulate print environments, ribbon consumption, and standardization of labels in various locations. The centralized control systems allow uniform label templates and diagnostics, shifting the demand towards ribbons that will perform similarly in the various geographies and printers. This trend enhances the relationships between the vendors, where buyers will tend more to choose those suppliers who have the global technical support.

Thermal Transfer Ribbon Market Analysis

Learn more about the key segments shaping this market

Based on product, the market is segmented into wax ribbon, wax-resin ribbon, and resin ribbon. Resin ribbon holds a significant share at a valuation of USD 1 billion in 2025.

- Thermal transfer ribbon resin ribbons have been incorporated to form the main revenue generating unit in the market of Thermal transfer ribbons as industries now seek labels that stand out in the harsh environment, chemical exposure, and long product life cycles. They are the preferred choice in industries that are increasingly demanding higher regulation compliance and durability thresholds, like the pharmaceutical, automotive, industrial equipment, and electronics industry due to their high grade of abrasion resistance and compatibility with high performance synthetic materials.

- Meanwhile, the use of wax and wax-resin ribbons still meets large and cost-effective printing requirements on retail, logistics, and warehousing in general, although its path of development is rather moderate in respect of performance. The progressive drift of the market to high-end substrates, custom industrial labeling and automation-driven traceability systems further reinforce the move to the resin-based solutions making them the product portfolio strategic anchor.

Based on substrate compatibility, the thermal transfer ribbon market is segmented into paper substrates, synthetic substrates, textile materials, and flexible packaging films. Paper substrates holds a significant share at a valuation of USD 1 billion in 2025.

- Paper substrates dominate the market since it provides the best combination of price, print quality, and versatility to the high-volume labeling environment. The necessity to provide fast, reliable, and low-cost barcode printing of shipping labels, shelf tags, and product identification encourages their high use in the retail sector, logistics, e-commerce fulfilment centers, and inventory-intensive markets. The emergence of omnichannel retailing and warehouse automation has added more weight to the supremacy of paper substrates as businesses focus on scalable labeling systems that enable rapid throughput and operational elasticity.

- Other categories of substrates as synthetic materials, textile labels, and flexible packaging films are increasing in volume but are more specialized since they are more expensive and require industry performance characteristics. They are focused on niche products such as pharmaceuticals, chemicals, industrial components and apparel, in which durability, heat resistance and chemical stability are essential. Nevertheless, due to their daily application to everyday labelling processes, the universal usage of paper substrates has remained at the top of the table which is backed by constant advancements in the coating technologies and their compatibility with high-speed printers.

Based on application, the thermal transfer ribbon market is segmented into barcode and product labeling, shipping and logistics labels, asset tracking and identification, flexible packaging, and healthcare and laboratory labels. Shipping and logistics labels hold a significant share at a valuation of USD 790.3 million in 2025.

- Shipping and logistics labels constitute the greatest portion of market because of the influx of e-commerce fulfilment, third-party logistics activities, and automated warehouse solutions that are dependent on high volumes and high precision barcode printing. The growing demand of scannable labels that are durable enough to withstand the changes in temperature, friction and long-distance transportation has compelled businesses to focus on the use of thermal transfer ribbons in shipping documentation as well as tracking the parcels.

- The other application divisions like barcode and product labeling, asset tracking, flexible packaging, and healthcare labels are also expanding albeit in a fairly limited scope based on the industry needs. Although other sectors, namely manufacturing, pharmaceuticals and retail are adopting sophisticated labeling as a requirement to ensure compliance and traceability, their quantities are still insignificant to the huge daily volumes produced within logistics hubs and distribution centers.

Learn more about the key segments shaping this market

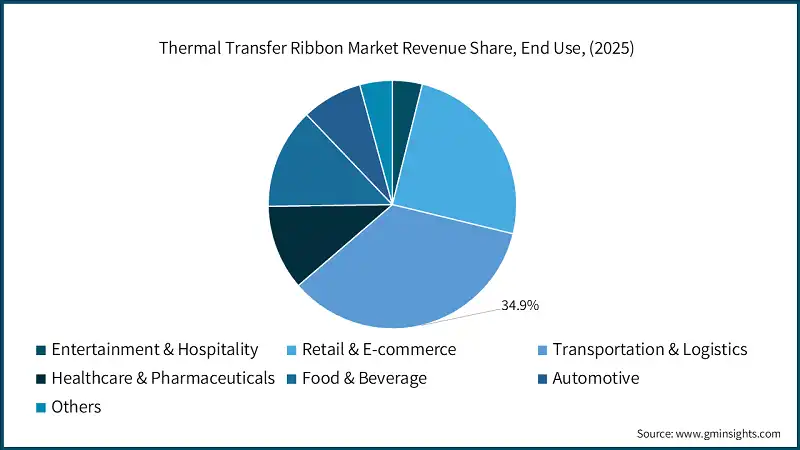

Based on end use, the thermal transfer ribbon market is segmented into entertainment and hospitality, retail and e-commerce, transportation and logistics, healthcare and pharmaceuticals, food and beverage, automotive, and others. Transportation and logistics is estimated to grasp a value of USD 787.3 million in 2025 and is expected to grow at 5.6% of CAGR during the forecast period.

- Transportation and logistics represent the biggest segment of the market as this industry heavily depends on high volume and high durability labeling to facilitate supply chain operations on a global scale. The requirements of thermal barcoding, tracking of shipments, pallet identification, pallet cross-docking, and documentation of final delivery motivates continuous utilization of thermal ribbons of transfer, particularly those of resin and wax-resin type that are resistant to abrasion, moisture, and unpredictable weather conditions.

- Other end user industries like the retail, healthcare, food and beverage, automotive and hospitality industries are increasing the use of thermal transfer printing in compliance labeling, inventory management and branding needs. Their print volumes and durability requirements, however, are relatively smaller when compared to transportation networks.

Looking for region specific data?

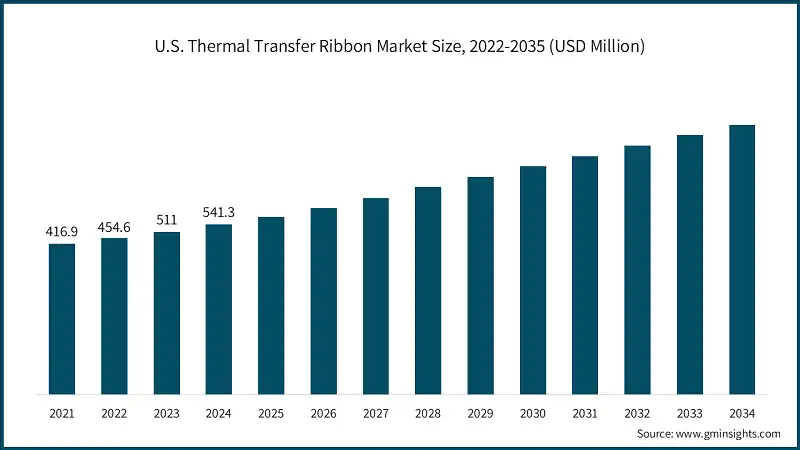

North America thermal transfer ribbon market accounted for USD 629.4 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- North America holds 27.9 % market share in 2025, with U.S. commanding the largest market share owing to its extensive logistical systems, and sophisticated retailing networks, and compliance-permitted labeling demands in food, pharmaceuticals, and chemicals. Due to the high rate of growth of e-commerce fulfilment centers and automated warehouses, ribbon consumption is on the rise alongside the fact that industrial and logistics real estate in the United States exceeded two billion square feet of operational active space by 2024 resulting in continued need of high-volume barcode and shipping label printers.

- The developed cold-chain ecosystem of the region, the growing activity of pharmaceutical distribution, and the strengthening traceability requirements of major industries also contribute to further growth. Canada also provides another impetus with active packaging, manufacturing and fresh produce export industries which all contribute to the strength of North America as one of the most label-intensive markets in the world.

Europe thermal transfer ribbon market accounted for USD 498.5 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- Europe accounts to 22.1% market share in 2025 with Germany having the highest country-level market share owing to the well-developed manufacturing base, robust automotive, and high-level compliance standards that regulate the identification of products and labeling of the industry. Regulatory policies like the REACH and food traceability legislations are so tough that the area is likely to grow faster in taking up long lasting, resistant to chemicals ribbon solutions in packaging, pharmaceutical sectors, and chemicals. The high rate of automation of the industrial sphere, the growing number of smart logistics hubs, and modernization of retail and warehouse activities in Western and Northern Europe all contribute to the growth of demand in the market.

Asia Pacific thermal transfer ribbon market accounted for USD 899.4 million in 2025 and is anticipated to show lucrative growth over the forecast period.

- In 2025, Asia Pacific holds market share of 39.8%, with China standing with the biggest market share owing to its massive manufacturing ecosystem, massive packaging activities, and control in the production of electronic, automotive components, and consumer goods. The speed of the development of the region is conditioned by the further increase of e-commerce penetration, multiplication of 3PL and express delivery chains, and high investment intentions in automating of the warehouses in China, India, and Southeast Asia. Durability in wax-resin and the resin ribbons to pharmaceutical and food processing is increasing as more markets like China and Japan continue with increased traceability and labeling requirements.

Latin America thermal transfer ribbon market accounted for 6% market share in 2025 and is anticipated to show steady growth over the forecast period.

- Latin America market is showing a stable, steady growth with the foundation of an increasing retail sector, food and beverage processing, and a slow-modernizing logistics network. Brazil is the largest shareholder in the region because it has a large consumer base, a robust manufacturing sector, and an ever-growing investment in warehousing and distribution systems.

- Incorporation of barcoding standards in industries like packaged food, pharmaceutical and industrial goods are on the increase and the e-commerce systems are gradually increasing operations and this creates a stable demand of labeling solutions. Despite the rate of automation is lower than in developed markets, continued improvement of supply-chain capacity and formalization of regional trade channels are driving long-term demand of dependable thermal transfer printing technologies.

Middle East and Africa thermal transfer ribbon market accounted for 4% market share in 2025 and is anticipated to show steady growth over the forecast period.

- The Middle East and Africa markets are also showing a consistent trend owing to the rising retail chains, growth in FMCG channels and the development of the pharmaceutical and healthcare provision channels. The regional demand is led by the United Arab Emirates and Saudi Arabia, which is backed by the rapid development of logistic hubs, free-trade zones, and temperature-controlled warehousing of imported food and medical supplies.

- The emergence of standardized labeling practices is slowly being enhanced through the industrial diversification schemes like continued growth in manufacturing in the Gulf region and construction of infrastructures in Africa. Although market maturity is not as high as in Europe or Asia, there is a steady investment in modernization of the supply-chain and improvements in regulations to promote a consistent and predictable increased usage of thermal transfer ribbon in major segments.

Thermal Transfer Ribbon Market Share

The market is moderately competitive, with the top five players of the market Armor-IIMAK, Ricoh Electronics, Dai Nippon printing, ITW ShineMark and Zebra Technologies having nearly 51.8% market share in 2025. The companies have advantageous global presence, diversified ribbon portfolio designs in wax, wax-resin and resin lines, and extensive integration into printing hardware systems. Existing distribution networks and long-term customer relationships also enhance their market domination, especially where the volume of sales is high like in the logistics, retail and industrial labeling markets.

The major manufacturers are also undertaking research and development to ensure high performing and specialty ribbons that have high durability, chemical resistance and compatibility with the substrate to stay competitive. Sustainability is also being prioritised in companies by recyclable cores, environmentally friendly coating, and use of solvents free production. The capacity expansion in the Asian-Pacific, vertical integration in the printing consumables and improvement of product compatibility with high-speed printers are emerging as critical strategic levers. Also, companies are enhancing supply-chain resilience, enhancing service capabilities and developing digital solutions to drive automation and smart-labeling trends in industries.

Thermal Transfer Ribbon Market Companies

Major players operating in thermal transfer ribbon industry are:

- Dai Nippon Printing

- Armor-IIMAK

- Ricoh Electronics, Inc

- ITW ShineMark

- Honeywell International

- Zebra Technologies

- TSC Auto ID

- Hangzhou Todaytec Digital Technology Co.

- Inkstar

- Dynic USA

- Avery Dennison

- SATO Holdings

- Brady Corporation

Armor-IIMAK is among the biggest world manufacturers of thermal transfer ribbons, which is created by the merger of ARMOR Group and IIMAK. The company supplies a complete variety of wax, wax-resin and resin ribbons which are used in retailing, logistics, industrial and packaging purposes. It has a reputation for robust R&D, uniform quality of prints and extensive distribution network around the world. Another area of concern is sustainability where the company manufactures products which have no solvents and recyclable parts.

Ricoh is a large manufacturer of high-quality thermal transfer ribbons, including wax, wax-resin, and resin types that are offered in durable and high-performance printing. Its ribbons are extensively applied in industrial industries where chemical, heat and abrasion resistance are crucial factors. The company uses the expertise of Ricoh in printing technology to ensure high levels of consistency of coating. Its product line serves both the flat-head and near-edge printers in the global thermal transfer ribbon market.

DNP is a global producer of thermal transfer ribbons, it is one of the oldest and the biggest manufacturers of the product producing wax, wax-resin and resin related ribbons. The company is also reputed in the manufacture of durable ribbons that are used in automobiles, electronic, medical and industrial purposes. It has a robust presence in the world market and provides high-quality TTR formulations, which have high resistance to chemicals and heat, as well as other adverse conditions. DNP enjoys a huge market share by being innovative in its products and maintaining a consistent level of quality.

ITW ShineMark is a division of Illinois Tool Works, which sells a wide range of wax, wax-resin and resin ribbons under its PrintheadSaver brand. The company concentrates on manufacturing ribbons with both high-quality sharp prints and long life of the printheads. The applications of its products include logistics, aerospace, chemicals, industrial packaging, and high-speed printing. ITW ShineMark will enjoy the advantage of global manufacturing and distribution capability of ITW.

Zebra Technologies is a major supplier of barcode and labeling applications, such as a full range of thermal transfer ribbons. Its wax, wax-resin and resin ribbons conform to Zebra printers and work well with the printers. The high level of TTR is influenced by the high level of logistics, retail, warehousing, and supply chain, which strategy Zebra has in place. The company is concerned with durability, reliability and volume printing efficiency.

Thermal Transfer Ribbon Industry News

- In November 2023, DNP launched Versatility Series, a simplified thermal transfer ribbon product line based on their current products. It makes it easy to pick four successful products and lower inventory and changeover expenses and always guarantee high-quality production.

- In January 2023, Domino launched the Vx-Series thermal transfer over printers in India to help improve efficiency in the flexible food packaging lines. The new TTO models will increase uptime of production and reduce the amount of ribbon used in either vertical or horizontal form-fill-seal processes.

The thermal transfer ribbon market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Million) & volume (Million Square Meters) from 2022 to 2035, for the following segments:

Market, By Product

- Wax ribbon

- Wax-resin ribbon

- Resin ribbon

Market, By Substrate Compatibility

- Paper Substrates

- Uncoated paper

- Coated paper (semi-gloss, matte)

- Synthetic Substrates

- Polypropylene (PP)

- Polyester (PET)

- Polyethylene (PE)

- Vinyl

- Textile Materials

- Flexible packaging films

Market, By Application

- Barcode & product labeling

- Standard barcode labels

- 2D barcode / Gr code labels

- Product identification labels

- Shipping & logistics labels

- Shipping labels

- Pallet labels

- Cold chain labels

- Asset tracking & identification

- Asset tags

- Equipment labels

- IT asset labels

- Flexible packaging

- Food packaging

- Beverage packaging

- Pharmaceutical packaging

- Healthcare & laboratory labels

- Laboratory specimen labels

- Patient wristbands

- Blood bag labels

- Cryogenic labels

Market, By End Use

- Retail & e-commerce

- Brick-and-mortar retail

- E-commerce fulfillment

- Grocery & supermarkets

- Transportation & logistics

- Freight & shipping

- Warehousing & distribution

- Cold chain logistics

- Healthcare & pharmaceuticals

- Hospitals & clinics

- Pharmaceutical manufacturing

- Laboratory & diagnostics

- Food & beverage

- Food processing

- Beverage production

- Food retail & service

- Automotive

- OEM parts labeling

- Aftermarket parts

- Vehicle identification

- Entertainment & hospitality

- Event ticketing

- Hotel operations

- Cruise & travel

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East and Africa

Frequently Asked Question(FAQ) :

What is the growth outlook for the transportation and logistics end-user segment through 2035?

The transportation and logistics segment is projected to grow at a CAGR of 5.6% through 2035, driven by global expansion in warehousing, freight operations, and automated distribution systems.

How much revenue did the resin ribbon segment generate in 2025?

The resin ribbon segment reached USD 1 billion in 2025, making it a major contributor to total market revenue.

What was the valuation of the shipping and logistics labels segment in 2025?

The shipping and logistics labels segment generated USD 790.3 million in 2025, representing the largest share among applications.

What is the projected value of the thermal transfer ribbon market by 2035?

The market size for thermal transfer ribbon is expected to reach USD 4 billion by 2035, growing at a CAGR of 5.9% from 2026–2035.

What is the market size of the thermal transfer ribbon industry in 2025?

The market size was USD 2.3 billion in 2025, reflecting strong demand across logistics, retail, and industrial labeling applications supported by e-commerce acceleration.

What is the current thermal transfer ribbon industry size in 2026?

The market size is projected to reach USD 2.4 billion in 2026, expanding steadily in line with growing labeling requirements in parcel logistics and manufacturing environments.

Which region leads the thermal transfer ribbon market?

The U.S. accounted for USD 629.4 million in 2025, making it the largest national market within North America and globally.

What are the upcoming trends in the thermal transfer ribbon industry?

Key trends include adoption of RFID-integrated labeling, growth of smart packaging, accelerated warehouse automation, and the rise of color-coded logistics.

Who are the key players in the thermal transfer ribbon market?

Key players include Armor-IIMAK, Ricoh Electronics, Dai Nippon Printing, ITW ShineMark, Honeywell International, Zebra Technologies, TSC Auto ID, Todaytec Digital Technology, Inkstar, Dynic USA, Avery Dennison, SATO Holdings, and Brady Corporation.

Thermal Transfer Ribbon Market Scope

Related Reports