Summary

Table of Content

Textile Recycling Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Textile Recycling Market Size

The global textile recycling market was valued at USD 1.4 billion in 2025. The market is expected to grow from USD 1.7 billion in 2026 to USD 8.5 billion in 2035, at a CAGR of 19.3% according to the latest report published by Global Market Insights Inc.

To get key market trends

- Textile recycling is the process of collecting, sorting, and reprocessing used or waste textiles. For example, clothing, household fabrics, and industrial textile scraps into fibrous material and materials or products that can be reused. Its objectives are reducing amounts of textile waste sent to landfills and conserving natural resources while minimizing adverse environmental impacts associated with textile production.

- Recycling plays a vital role in sustainability in both the fashion and textile industries. The large volumes of textiles thrown away yearly that result from the fast fashion phenomenon, overconsumption, and the short life cycle of many products. Life of textile materials can be extended by converting them to second-hand garments, cleaning cloths, regenerated fibre. This helps in reducing the demand of virgin raw materials such as cotton and synthetic ones.

- Many obstacles such as fiber blends, contamination, and limited effective collection systems hinder textile recycling. Many textiles are composed of mix of fibers, like cotton and polyester. These types of fibers are rather difficult to separate with conventional recycling methods. Limited consumer awareness and poorly developed recycling infrastructures have also hampered developing large-scale initiatives. These challenges must be tackled through a collective initiative by the manufacturers, policymakers, and consumers.

- Latest technological advancements have transformed textile recycling, with inventions, such as chemical recycling automatic sorting via artificial intelligence, and fiber-to-fiber recycling technologies, enabling the separation of blended materials and the recovery of high-quality fibers for manufacturing new textiles. As these new technologies are maturing and up scaled, the potential of recycling rates increases and thus support circular economy in textiles.

Textile Recycling Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 1.4 Billion |

| Market Size in 2026 | USD 1.7 Billion |

| Forecast Period 2026 - 2035 CAGR | 19.3 % |

| Market Size in 2035 | USD 8.5 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Demand for recycled textile materials | Brands and manufacturers are increasingly incorporating recycled fibers to meet sustainability targets and consumer expectations. |

| Technological development in recycling | Advancements in sorting and recycling technologies are improving material recovery and enabling more efficient recycling processes. |

| Increase in textile waste generation | The rapid growth of apparel consumption and fast fashion has significantly increased post-consumer textile waste, creating demand for recycling solutions. |

| Pitfalls & Challenges | Impact |

| Complexity of textile materials | The presence of blended fibers, dyes, and finishes makes sorting and recycling difficult and reduces overall efficiency. |

| High cost of recycling processes | Textile recycling often involves higher operational costs compared to the production of virgin fibers. |

| Opportunities: | Impact |

| Fiber-to-fiber recycling technologies | Emerging recycling technologies allow used textiles to be converted into new fibers, supporting closed-loop production systems. |

| Digitalization and smart sorting systems | The use of digital tracking, labeling, and automated sorting technologies can improve traceability, efficiency, and material recovery in textile recycling. |

| Growth of secondary raw material markets | Increasing acceptance of recycled fibers as alternative raw materials creates stable demand and new revenue streams for recyclers. |

| Market Leaders (2025) | |

| Market Leaders |

8.3% market share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Middle East and Africa |

| Emerging country | Saudi Arabia, South Africa, UAE |

| Future outlook |

|

What are the growth opportunities in this market?

Textile Recycling Market Trends

- The fashion industry increasingly moves toward sustainability globally. This would lead brands from clothing, home textiles and industrial fabrics to start using recycled materials, eco-friendly materials, and both for their organizational, thus reducing carbon footprint.

- The demand for recycled fibers such as polyester-cotton blends will increase gradually since manufacturers comply with both regulatory and changed consumer demands. Companies have ambitious goals of including a higher percentage of recycled material in their products.

- The shift toward sustainable fashion has become important for brands to increasingly include recycled textiles in their collections. Consumers increasingly tend toward eco-friendly products. This trend in turn is affecting both the fast fashion and luxury fashion markets with increased sustainable sourcing and design innovations.

- Rise in the shift towards the adoption of a circular economy across textiles. Brands have set up take-back programs, resale platforms, and repair services to increase in the lifespan of textiles. Partnerships among manufacturers, recyclers, and governments are putting in place standardized systems to recover textiles. Consumers are engaging with these programs to provide more recyclable materials under the steady supply chain.

Textile Recycling Market Analysis

Learn more about the key segments shaping this market

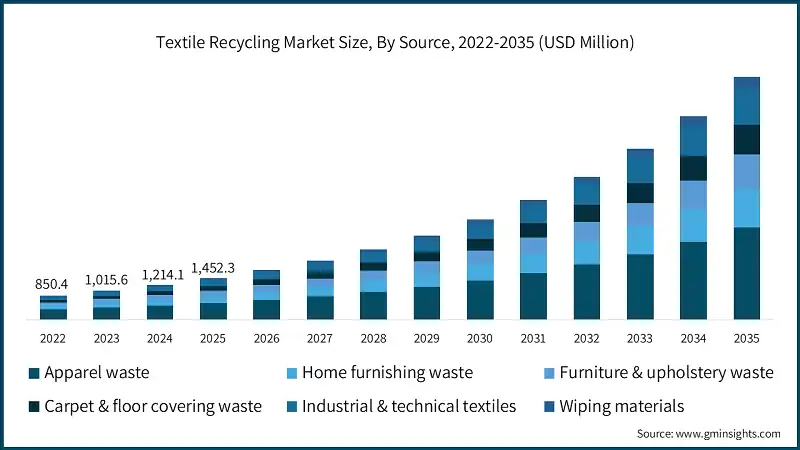

The textile recycling market by source is segmented into apparel waste, home furnishing waste, furniture & upholstery waste, carpet & floor covering waste, industrial & technical textiles, wiping materials. Apparel waste holds the largest market value of USD 580.1 million in 2025.

- Apparel waste appears as the clearly visible source since it is being consumed and disposed of at high rates. But, home furnishing, furniture, and carpet waste volumes remain bigger and heavier, posing longer replacement cycles. Controlled waste streams like industrial and technical textiles are mostly generated during manufacturing and commercial use. All these sources determine the overall availability of recyclable textile materials and the characteristics of every single material.

- In addition, all these resource types have different recycling requirements and value potential in a broader market perspective. Apparel waste fuels advances in sorting and separation of fibres since it mixes materials, while furnishing and carpets waste requires stronger processing due to high durability and coat. Industrial textiles add efficiencies because of material consistency, while wiping materials create easy access to lower-grade recycled fibers. As an overall final note, these sources support each other to ensure market stability and allow for diversified recycling schemes.

The textile recycling market by process is segmented into mechanical recycling, chemical recycling, biological & enzymatic recycling and thermal recycling. Mechanical recycling holds the largest market value of USD 1.19 billion in 2025.

- Mechanical recycling is growing as it is simple and economically viable for treating clean and single-material waste streams. It also benefits from existing infrastructure and regulatory support, which is widely used for most common plastics, paper, and metals. On the other hand, thermal recycling grows especially whenever material recovery is difficult, while energy recovery is needed from mixed or contaminated waste where landfilling is not an option.

- Chemical, biological, and enzymatic recycling grow faster mainly because they can handle complex mixtures and reduce downgrading of feedstocks from low-quality materials that cannot be easily processed by mechanical means. Chemical recycling growth is stimulated by the need for technologies and the demand for recycled feedstocks that are amenable to high-performance application. Biological and enzymatic recycling are at the early stages, however are drawing attention because of selective breakdown of specific materials, with reduced environmental impact, supported by advancements in biotechnology and sustainability-driven policies.

The textile recycling market by material type is segmented into polyester, cotton, nylon & polyamide, wool, viscose & rayon (cellulosic fibers), acrylic, blended textiles and other cellulosic fibers. Polyester holds the largest market value of USD 522.1 million in 2025.

- Polyester and cotton will keep growing because of the high usage in both apparel and home textiles and hence creates a steady supply of recyclable waste. Recycling polyester is supported by the compatibility of its recycling process, either mechanical or chemical, while increased importance on the natural and biodegradable fibers tends to boost cotton recycling. Moderate growth is also seen in using nylon, polyamide, and wool, as they are mainly used in performance textiles and premium apparel that seek to minimize dependency on virgin fibers through material recovery.

- Faster growth is seen in viscose and rayon and other cellulosic fibers. They also include blended textiles with innovation intensification aimed at recovery from complex and mixed materials. Among blended textiles, new technological advancements in recycling are easily separable. Acrylic is witnessing gradual growth, mainly through niche applications and advancement in handling synthetic fiber waste.

The textile recycling market by waste type is segmented into pre-consumer waste, post-consumer waste, post-industrial waste. Post-consumer waste holds the largest market value of USD 625 million in 2025.

- Pre-consumer and post-industrial waste resulting in tremendous as they are cleaner, have a more uniform composition, and are easier to collect and sort. These streams mainly comprise post-manufacturing offcuts or defective products and will be industrial scraps, which make them ideal candidates in the recycling process. These streams are also growth areas, supported by manufacturers striving to minimize production waste and to optimize material efficiency within supply chains.

- With growing awareness among consumers and policymakers about textile waste, post-consumer waste is being generated faster today in an improved collection system. Sorting technologies, take-back schemes, and advanced recycling investments make post-consumer textiles more recyclable-supporting its growing role in the international recycling scenario.

The textile recycling market by recycling type is segmented into closed-loop (fiber-to-fiber / textile-to-textile) and open-loop (textile-to-non-textile). Open-loop (textile-to-non-textile) holds the largest market value of USD 842.3 million in 2025.

- Closed-loop recycling is gaining growth as brands and manufacturers try to reuse fibers within the textile value chain. This takes support for circular production models and meeting sustainability targets, turning used textiles into new fabrics. Sorting and fiber separation and recycling technologies are improving with other closed-loop pathways with more applicability on various materials.

- Recycling in open loop is gaining strength by being flexible to use recycled textiles for non-textile applications like insulation, pads, and industrial materials. It doesn't return fibers back into apparel production but gives a useful outlet for textile waste that is lower in quality or mixed, thus helping divert materials from reaching the landfill and complementing other waste reduction efforts.

Learn more about the key segments shaping this market

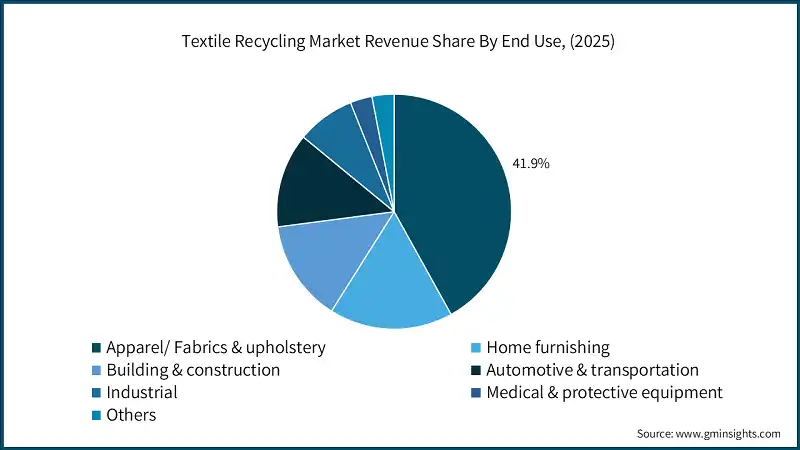

The textile recycling market by end use is segmented into apparel/ fabrics & upholstery, home furnishing, building & construction, automotive & transportation, industrial, medical & protective equipment and others. Apparel/ Fabrics & upholstery hold the largest market share of 41.9% in 2025.

- Apparel, fabrics & upholstery, and home furnishings consistently grow along the lines of their end use, as they are responsible for large volumes of recyclable textiles and are heavily correlated to sustainability projects implemented by the brands and retailers. The segments of clothing, carpets, and upholstery sustain and increase demand with the support of consumer awareness and regulatory pressure to reduce wastewater burden regarding textile materials, with a focus on higher recycled fiber content.

- Strongest growth is seen in automotive and transportation, building and construction, industrial, and applications where recycled textiles are having diverse application in insulation, composites, soundproofing, and reinforcement materials. Medical and protective equipment and other niche applications are growing more slowly through specific requirements for performance and safety but benefit from the continuing innovation in materials and the broader movement toward circular and resource-efficient use of materials.

Looking for region specific data?

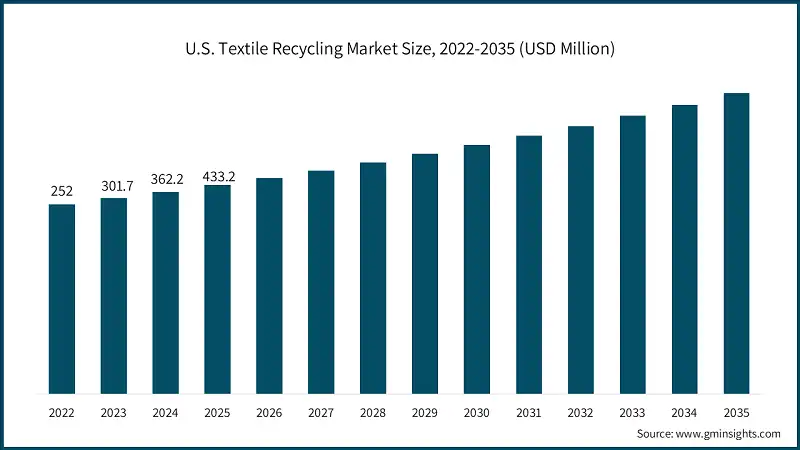

The North America textile recycling market is expected to experience significant and promising growth from USD 506.7 million in 2025 to USD 2.9 billion in 2035. The U.S. market accounted for USD 433.2 million in 2025.

- The North American market is seeing steady growth owing to increasing awareness about environment, waste management strict regulations, and circular economy practices. Advanced recycling as well as sorting technologies such as chemical and AI-enabled ones are to be applied in managing the increased volume of textile waste.

- US market is highly influenced by mass apparel consumption and the corporate sustainability initiatives. To meet the standards of their states and those of consumers, businesses are adopting the use of recycled fibers in their production process. At the federal level and state levels incentives are provided for recycling facilities.

The Europe textile recycling market is expected to experience significant and promising growth from USD 433.9 million in 2025 to USD 2.5 billion in 2035.

- Adoption of textile recycling in Europe is due to strict environmental regulations, heightened consumer awareness, and a strong government push toward the circular economy. Laws for extended producer responsibility (EPR), eco-labeling, and advanced recycling technologies caters the demand. Creation of standard processes between brands, recyclers, and policymakers is witnessing the growth in Europe regions.

- National waste segregation policies and the sustainability commitment of companies are driving factors of textile recycling in Germany. Brands and manufacturers are integrating recycled fibers into their products, thus minimizing the environmental impact. Systematic collection programs, take-back schemes and public awareness campaigns ensure continuous supply of textile waste for recycling thus helps in market growth. The area also emphasizes diverting waste from landfills and encouraging greener production in both apparel and industrial textiles.

The Asia Pacific textile recycling market is expected to experience increasing growth from USD 362.1 million in 2025 to USD 2.1 billion in 2035 with a CAGR of 19.3%.

- Due to high textile consumption, urbanization, and increasing post-consumer waste, Asia-Pacific market is rapidly growing. Governments are implementing laws aimed at reducing environmental impact and increasing recycling. Recycled fibers being adopted in the apparel and home textile sectors due to consumer awareness and industrialization.

- Government requirements with respect to waste management and environmental sustainability are driving recycling initiatives in China. In the post-consumer and industrial segments, textile waste is increasingly being recycled into new fibers and into nonwoven products. Leading manufacturers are working in the fiber-to-fiber direction to reduce their dependence on virgin resources. Urban collection systems and government incentives are entrenching China's position as a key player in the Asia-Pacific.

Middle East & Africa textile recycling market is expected to experience significant and promising growth from USD 72.8 million in 2025 to USD 418.3 million in 2035.

- The MEA textile recycling industry is set to grow owing to increasing urbanisation, population growth, and rising awareness of environmental sustainability. Governments have started to enact several policies for waste management and recycling, especially in urban centres. Creating this collection and recycling infrastructure has been on the initiative of private sector investments.

- Both the government's regulations and interests of the private sectors drives the market in South Africa. Such development includes organizing collection and sorting systems for recovering post-consumer textiles by companies and non-profit organizations. These recycled textiles are further processed into textiles for apparel, home, and industrial use. Awareness campaigns to encourage proper disposal or donation of unwanted clothing are also being carried out. South Africa now stands on the verge of becoming an important consumer market for the MEA textile recycling growth.

Latin America textile recycling market is expected to experience significant and increasing growth from USD 76.8 million in 2025 to USD 425.4 million in 2035.

- The Latin American market is gradually growing because of the awareness among people about environmental issues and huge volumes of textile waste. Countries are investing in recycling infrastructure and encouraging sustainable practices at the local level thus resulting in consumer awareness. Small and medium enterprises (SMEs) are starting the use of recycled fibers. Public and NGO-led campaigns have improved collection rates. Urbanization and growing consumption of apparel are expected to drive this market.

- Brazil is undergoing a process of textile recycling due to various government rules and corporate sustainability programs. Collection points and take-back practices for post-consumer textiles are being organized in major cities. Local manufacturers are looking at using recycled fiber in their products to some extent, motivated by the decreasing environmental impacts. Awareness campaigns are held in public for raising funds and developing awareness regarding donations plus proper disposal habits. Hence, these initiatives potentially position Brazil to be a leading market in terms of effective textile recycling in Latin America.

Textile Recycling Market Share

- The markets are moderately consolidated with players like Unifi Manufacturing, Inc. (REPREVE), Lenzing AG, Leigh Fibers, LLC, Textile Recycling International (TRI Group), Circ holding 25.2% market share and Unifi Manufacturing, Inc. (REPREVE) being the market leader holding the market share of 8.3% in 2025.

- The market depends mainly on continuous investments in advanced recycling technologies to maintain their position. Innovations in mechanical, chemical, or fiber-to-fiber recycling help companies improve material quality, processing efficiency, and scalability. By adopting emerging technologies, the major players can differentiate themselves and enter long-term contracts with apparel brands. Implementing the latest technologies presents an entry barrier for new competitors.

- Fashion companies do strategic partnerships with manufacturers as well as retailers. They collaborate with brands in take-back programs, recycled fiber supply agreements for such partnerships, and join sustainability initiatives with global brands. It creates an effective base for a consistent feedstock supply and steady demand for recycled materials. They are significant as they make long-term collaborations that improve credibility and visibility in the textile recycling market.

- An integrated supply chain and control over all stages of collection, sorting, and processing enable companies to retain cost efficiency as well as operational reliability. Companies utilizing vertical integration models can manage quality, minimize dependency on outside suppliers, and respond more quickly to market fluctuations. Efficient logistics and regional collection networks further strengthen competitive positioning.

- Most of the companies maintain their position by means of geographical expansion and diversifying end-use applications. Investment in new facilities, pilot projects, and regional partnerships helps firms gain access to markets. Diversification into apparel, home textile, automotive, and industrial applications brings down over-dependence on one segment.

Textile Recycling Market Companies

Major players operating in the textile recycling industry are:

- BLS Ecotech

- Circ

- Fibersort

- iinouiio Recycled Textiles

- Leigh Fibers, LLC

- Lenzing AG

- Martex Fiber / ReVive Fiber

- Patagonia, Inc. (Worn Wear Program)

- Refiberd

- Renewcell AB (Circulose)

- RE TEXTIL Deutschland

- Textile Recycling International (TRI Group)

- Unifi Manufacturing, Inc. (REPREVE)

- Worn Again Technologies Ltd

Unifi Manufacturing, Inc. (REPREVE) is a notable global innovator in synthetic and recycled performance fibers, especially recognized for its brand REPREVE, which converts waste into sustainable fibers for textiles and apparel. Unifi is committed to sustainability, along with circular economy practices, and supplies high-quality fibers to various global brands while developing environmentally friendly production processes.

Lenzing AG is a global leader and provider of high-quality specialty fibers from renewable wood sources including their also very well-known TENCEL brand. The company keeps high emphasis on sustainable practices in textile manufacturing thereby employing eco-friendly raw materials and processes to create biodegradable and compostable fibers to cater to fashion and hygiene industries.

Leigh Fibers, LLC, is a U.S.-based company focused on natural fiber yarns, including cotton and cotton-blend yarns. It is known for quality and innovation and it can provide textile manufacturers with sustainable yarn options to satisfy the rising need for Green products.

Textile Recycling International (TRI Group) is a global manufacturer and deals in textile recycling and sustainable material management. The firm provides solutions to keep textile waste away from landfills via collecting, sorting, and processing used textiles into recycled fibers. This aims at helping brands and manufacturers achieve sustainability objectives through circular material use.

Circ is a company that deals in providing innovating circular economy initiatives within the textile industry. It promotes recycling and reuse of materials and organizes innovative technologies and partnerships to mitigate textile waste while helping sustainable production cycles that minimize environmental damage.

Textile Recycling Industry News

- In October 2024, Circ U.S. textile recycling startup partnered with Birla Cellulose, the pulp and fibre arm of Aditya Birla Group, to expand the scale of their recycling operations. According to the terms of this agreement, Birla Cellulose will purchase up to 5,000 tonnes of Circ's pulp per year for the next five years, converting it into lyocell staple fibre for apparel production.

- In November 2024, Reju, a subsidiary of Technip Energies, partnered with Nouvelles Fibres Textiles (NFT) in France to boost textile waste recycling and create a circular textile ecosystem in France. NFT will supply secondary raw materials from end-of-life textiles while Reju brings into the program its expertise in industrial textile recycling. This will improve collection, sorting, and processing methods for textile waste and will help support.

The textile recycling market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Billion and volume in terms of kilo tons from 2022–2035 for the following segments:

Market, By Source

- Apparel waste

- Home furnishing waste

- Furniture & upholstery waste

- Carpet & floor covering waste

- Industrial & technical textiles

- Wiping materials

Market, By Process

- Mechanical recycling

- Chemical recycling

- Biological & enzymatic recycling

- Thermal recycling

Market, By Material Type

- Polyester

- Cotton

- Nylon & polyamide

- Wool

- Viscose & rayon (cellulosic fibers)

- Acrylic

- Blended textiles

- Other cellulosic fibers

Market, By Waste Type

- Pre-consumer waste

- Post-consumer waste

- Post-industrial waste

Market, By Recycling Type

- Closed-loop (fiber-to-fiber / textile-to-textile)

- Open-loop (textile-to-non-textile)

Market, By End Use

- Apparel/ Fabrics & upholstery

- Home furnishing

- Building & construction

- Automotive & transportation

- Industrial

- Medical & protective equipment

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Frequently Asked Question(FAQ) :

Which end-use segment leads the textile recycling market?

Apparel, fabrics & upholstery led the market with a 41.9% share in 2025, driven by brand sustainability targets and increasing use of recycled fibers in garment production.

Which region leads the textile recycling market and what is the U.S. market value?

The U.S. industry was valued at USD 433.2 million in 2025. Market growth is driven by high apparel consumption, corporate sustainability initiatives, and supportive federal and state-level recycling incentives.

What are the key trends in the textile recycling industry?

Major trends include fiber-to-fiber recycling adoption, AI-enabled automated sorting systems, and increasing use of recycled fibers by fashion and industrial textile manufacturers to meet circular economy goals.

Who are the key players in the textile recycling industry?

Key players in the market include Unifi Manufacturing, Inc. (REPREVE), Lenzing AG, Leigh Fibers, LLC & Textile Recycling International (TRI Group).

What was the valuation of the open-loop recycling segment in 2025?

Open-loop textile recycling generated USD 842.3 million in 2025, benefiting from its flexibility in converting low-grade textile waste into insulation, industrial, and non-woven applications.

How much revenue did post-consumer textile waste generate in 2025?

Post-consumer waste generated USD 625 million in 2025, driven by improved collection systems, take-back programs, and growing consumer awareness of textile waste reduction.

How much revenue did the apparel waste source segment generate in 2025?

The apparel waste segment generated USD 580.1 million in 2025, reflecting its dominant contribution to textile recycling feedstock availability due to high clothing consumption and disposal rates.

What was the valuation of the mechanical recycling process segment in 2025?

Mechanical recycling accounted for USD 1.19 billion in 2025, leading the textile recycling industry due to its cost efficiency and suitability for clean, single-material waste streams.

What is the market size of the polyester material segment in 2025?

The polyester segment was valued at USD 522.1 million in 2025, supported by high polyester usage in apparel and compatibility with both mechanical and chemical recycling technologies.

What is the market size of the textile recycling industry in 2025?

The market size was valued at USD 1.4 billion in 2025, supported by rising adoption of recycled textile materials and circular economy initiatives across the textile industry.

What is the current textile recycling market size in 2026?

The textile recycling industry is projected to reach USD 1.7 billion in 2026 as sustainability regulations and recycled fiber demand continue to expand.

What is the projected value of the textile recycling market by 2035?

The market is expected to reach USD 8.5 billion by 2035, growing at a CAGR of 19.3% driven by technological advancements in chemical and fiber-to-fiber recycling processes.

Textile Recycling Market Scope

Related Reports