Summary

Table of Content

Tempered Glass Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Tempered Glass Market Size

Tempered Glass Market size was over USD 24.5 billion in 2016 and the industry may expect consumption above 4.3 billion square meters by 2024. Increasing application scope in automotive and construction industries along with increasing consumer demand for improved infrastructure facilities should drive the product demand.

Increasing product demand in the automotive industry mainly in rear and side windows owing to its superior properties such as safety, durability, thermal shock resistance, reliability and tensile strength should stimulate tempered glass market growth. The products must be in compliance with OEM standards which are either sourced from suppliers or original equipment manufacturer. Global automotive industry may surpass USD 3 trillion by 2024. Europe’s motor vehicles production was over 18 million units in 2016.

To get key market trends

Technological advancement along with strict government norms regarding reducing carbon emission to enhance vehicle safety should drive the automobile business demand. Germany, France, UK, Spain, and Italy are the largest automobile market owing to increasing consumer demand for luxury & premium cars, easy car financing accompanied with government incentives and high economic conditions will have a positive influence in the tempered glass market trends.

Increase in infrastructure spending in China, India, Malaysia, Brazil, and Philippines along with rise in need for durable building materials should drive tempered glass market share. Global construction industry was valued at over USD 8 trillion in 2016 and is poised to surpass USD 10 trillion by 2024 owing to increasing government investments in infrastructure facilities.

Construction spending in Asia Pacific accounted for over 40% of the total demand in 2016. Rapid industrialization along with expanding foreign investment funding should drive regional industry growth. Rising architectural facilities towards and increasing application in building facades may fuel product demand.

Tempered Glass Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2016 |

| Market Size in 2016 | 24.5 Billion (USD) |

| Forecast Period 2017 - 2024 CAGR | 0% |

| Market Size in 2024 | 40 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Tempered glass is available as single, double and triple pane types. It has increasing application scope in greenhouse sector as it provides four to six times more shatter resistance than annealed types which should stimulate the tempered glass market demand. Increasing awareness regarding energy efficient and greener building will also help propel the industry growth.

Tempered glass is highly preferred for greenhouse construction to maximize heat-reflecting properties in hot climates, which provides an aid in blocking the heat more effectively. Moreover, these products prove to be an ideal choice for greenhouse construction due to its ability to withstand contraction and expansion during seasonal temperature changes.

Major raw materials used for manufacturing this product includes nickel-sulfide, calcium oxide, silicon dioxide, and sodium oxide. Volatility in raw material costs owing to increasing usage in construction and automotive industries may pose threat to industry profitability and affect the tempered glass market price.

Tempered Glass Market Analysis

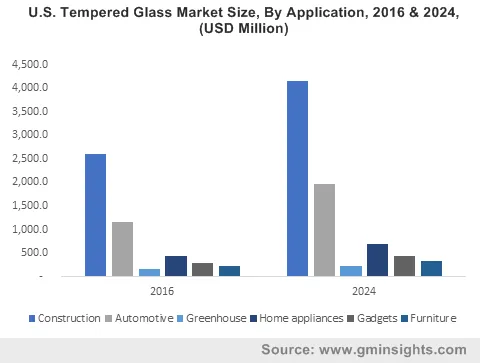

Construction applications may register gains close to 5.5% through the forecast period. It is used for building facades, glazed doors, partitions, shower enclosures, canopies, and wash basins. Increasing government spending and favorable schemes in construction sector coupled with stringent regulations related with the consumers safety should propel the tempered glass market sales.

Commercial construction should surpass USD 12.5 billion by 2024. It is widely used in various commercial buildings such as offices complexes and public buildings along with supportive regulations regarding product usage will stimulate the tempered glass market demand. Changing lifestyle patterns along with safety needs and demand for better infrastructure has led to growth of construction output in China, India and Brazil.

Tempered glass market size from home appliances may witness significant gains at over 5% through 2024. Positive application outlook in washing machines, refrigerators, cookware and microwave ovens will boost product demand, thereby providing safety, and anti-breakage properties.

Learn more about the key segments shaping this market

Gadgets applications segment should exceed USD 2.1 billion by 2024. These are widely used in smartphones, tablets and laptops or computers as screen protectors. Increase in smartphone penetration in South Korea, Poland, Brazil, Taiwan and Australia has led to adoption of toughened glass demand.

Increasing demand for furniture including tabletops, shelves and cabinets and other interior applications should stimulate tempered glass market. Furniture applications should witness significant gains up to 2024 owing to increasing demand for innovative furniture designs for interior applications accompanied with improving lifestyle patterns of consumers.

Europe driven by Germany, France, UK, and Russia should register growth at over 3.5% through 2024. Increase in smartphone penetration and presence of major automobile companies along with strong economic conditions is expected to propel regional tempered glass market growth.

China should exceed USD 4.5 billion by 2024 owing to its wide application scope in construction and automotive sectors. Increase in government spending for various green building facilities accompanied with growth towards central National New-Type Urbanization Plan and investment by foreign manufacturers in Chinese factories should favor the tempered glass market in the region.

Brazil should witness significant growth at over 5.6% through 2024. Increase in urban population along with improving economic conditions should drive industry growth. Increasing popularity of various home appliances including refrigerators, washing machines and microwave ovens is expected to propel the regional tempered glass market.

Tempered Glass Market Share

Global tempered glass industry share is moderately fragmented and competitive with some of industry participants include

- Saint-Gobain

- Asahi

- NSG

- Guardian Industries Corp

- Abrisa Technologies

- Fuso

- PPG

Industries catering to domestic and international market.

Manufacturing companies are focusing on strengthening regional presence and expanding business by developing strategies to size up production capability and enhancing product portfolio. Companies are also engaged in forming partnerships and acquisitions with regional & local companies to open new market opportunities, and further accelerate tempered glass market revenue.

Industry Background

Tempered glass, also known as toughened and safety glass is a product made from heat treatment or chemical processes to increase its strength. This product is first heated through chemical process which hardens it and rapidly cooled with the help of blowers. This product is approximately four times stronger than normal glass and majorly used for safety purposes as it breaks into small granular chunks rather than sharp edges thereby preventing damage and injuries. Strong application outlook in automotive, construction, furniture, and home appliances, along with its superior properties is expected to fuel the tempered glass market share.

Tempered glass market report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in Tons, Square Meters and revenue in USD from 2013 to 2024, for the following segments:

By Application

- Construction

- Residential

- Commercial

- Industrial

- Automotive

- Rear Windows

- Side Windows

- Greenhouse

- Home appliances

- Cookware

- Refrigerators

- Washing Machines

- Microwave Ovens

- Gadgets

- Smartphones

- Tablets

- Laptops/Computers

- Furniture

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Poland

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Thailand

- Malaysia

- LATAM

- Brazil

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

How is the gadgets applications segment expected to propel through 2024?

The gadget applications segment is expected to value over USD 2.1 billion through 2024.

What will foster the growth of the global tempered glass market in the European region?

The tempered glass market size in Europe, driven by Germany, France, UK, and Russia will witness a growth rate of over 3.5% through 2024 due to the rising smartphone penetration and existence of major automobile companies.

How will construction as an application segment propel the global tempered glass market growth?

Tempered glass industry size from construction applications is expected to register 5.5% CAGR through 2024 due to increasing government spending and advantageous schemes in the construction sector.

What will drive the growth of the global tempered glass market through 2024?

The tempered glass market valued over USD 24.5 billion in 2016 and the expected consumption is over 4.3 billion square meters through 2024 due to rising application scope in the construction and automotive industries.

What was the global tempered glass market share in 2016?

Tempered glass market recorded a valuation of 24.5 Billion (USD) in 2016.

What is the forecast remuneration of the tempered glass industry by 2024?

The tempered glass market is expected to witness a remuneration of 40 Billion in 2024.

Tempered Glass Market Scope

Related Reports