Summary

Table of Content

Synthetic Lubricants Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Synthetic Lubricants Market Size

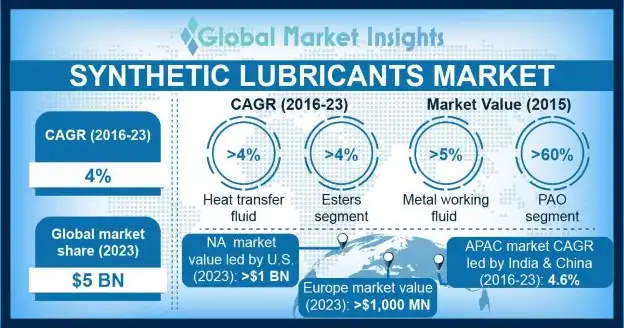

Synthetic Lubricants Market size is expected to reach over $5 billion by 2023 with an estimated growth rate of over 4% from 2016 to 2023. Increasing demand from industrial and automobile sectors in Asia Pacific subject to installation of new machines coupled with increased branded cars sales will drive the global market during forecast period.

To get key market trends

Growing adoption of new technologies, including fire resistant esters may favor the business growth in future. Major original equipment manufacturers have set NSF food lubrication standards for food application which will propel synthetic lubricants market share in coming years.

Synthetic oils are derived from ethylene oxides, which are procured through natural gas, tight oil, CBM, shale gas, and crude oil. Shell, Chevron, Total, Exxon Mobil and BP are integrated manufacturers, which ensures ethylene oxides supply to refining units for production PAG, ester-based and PAO synthetic lubricants.

Automotive applications may dominate the industry owing to increase in automobile sales mostly driven by the U.S., China, India, and Brazil, which will foster the synthetic lubricants market growth in future. China automobile sales increased from 9.3 million to 23 million units in 2014.

Synthetic Lubricants Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | |

| Forecast Period 2016 - 2023 CAGR | 4% |

| Market Size in 2023 | 5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Gulf Cooperation Council natural gas production reached 369.2 BCM in 2012 from 207.5 BCM in 2005. Growth in personal care, food & beverage, automotive, and construction sectors in emerging nations including UAE, Qatar and Saudi Arabia, has shifted political emphasis towards the development of natural gas which will positively influence the synthetic lubricants market value.

Synthetic Lubricants Market Analysis

Group IV was valued over 400 kilo tons in 2015 and is expected to witness growth rate over 4% from 2016 to 2023. Wide adoption of PAO in automotive engine with OEM recommendation in brands including Volkswagen and BMW will complement the synthetic lubricants market outlook.

Ester segment is set to exceed USD 1.7 billion by 2023. Increase in ester demand in reciprocating compressors will stimulate the business growth during forecast period.

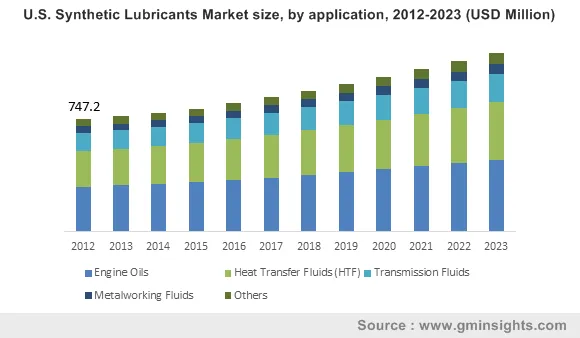

Engine oil contributed to 40% of global synthetic lubricants market share in 2015 and is expected to witness growth rate at over 4% by 2023. It offers excellent firm protection, high operating temperature range and increased drain interval.

Learn more about the key segments shaping this market

Synthetic lubricants market share demand from heat transfer fluids is expected to exceed USD 1.5 billion by 2023. These are primarily used for water removals in O&G and chemical plants. Automatic transmission fluids are used to execute various functions including torque conversion, valve operation, gear oiling and brake band friction and as hydraulic fluid in power steering.

Asia Pacific led by India and China is expected to reach over 200 kilo tons by 2023 with 4.6% CAGR anticipation from 2016 to 2023. Increasing automobile sales is predicted to stimulate the synthetic lubricants market statistics in future. It has wide applications in automobile industry subject to its superior properties with high performance when compared with mineral products.

Europe is set to surpass $1,000 million by 2023 subject to existence of major automotive engineering workshops including Mercedes, BMW, Rolls Royce, VW, Audi, and Airbus. Latin America and Middle East offers a high growth potential for industry players.

Synthetic Lubricants Market Share

Key industry players include:

- Shell

- Castrol

- ExxonMobil

- BP

- Fuchs

- Total

- Chevron

- Shell

- Castrol

ExxonMobil and BP accounted for 50% of synthetic lubricants industry revenue in 2015.

High fiber cost when compared with mineral oil and increasing demand for mineral oil from small scale manufactures mainly in Asia Pacific will hamper the synthetic lubricants market growth.

Industry Background

Synthetic lubricants are procured from pure chemicals rather than refined from crude oil. They can be used in both high and low temperatures. They improve oxidation resistance, thermal stability, low-temperature properties and reduce residue formation, flammability, and lower evaporation losses. They also help to reduce fiction and thus improve fuel efficiency and equipment life. Increasing demand for automobiles coupled with rising middle-class economy is expected to drive the synthetic lubricants business growth during forecast period.

Synthetic Lubricants market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume and revenue in Kilo Tons and USD Million from 2012 to 2023, for the following segments:

By Product

- Group IV (PAO)

- Group V (Esters)

- Group V (PAG)

By Application

- Engine Oils

- Heat Transfer Fluids (HTF)

- Transmission Fluids

- Metalworking Fluids

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- Italy

- Romania

- Netherlands

- Nordic Countries

- Spain

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Philippines

- Indonesia

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- UAE

- Saudi Arabia

- Turkey

- South Africa

Frequently Asked Question(FAQ) :

Which application segment is expected to drive the market during the forecast period?

The engine oil segment registered a highest market share in 2015 and is projected to record a remarkable growth rate throughout the forecast period.

What kind of growth will global Synthetic Lubricants Market size observes during the forecast timeframe?

According to report, Synthetic Lubricants Market size is estimated to be pegged at $5 billion by 2023.

Which are the top companies in the synthetic lubricants industry?

Exxon Mobil, Shell, British Petroleum, Total, Chevron, Fuchs Group, Pennzoil, Amsoil Inc., Kendall (Phillips), Valvoline, Castrol are some of the top contributors in the industry.

What are the key factors driving the market?

Positive automobile production outlook and abundant availability of natural gas in GCC are the major factors expected to drive the growth of global market.

What will be the worth of global synthetic lubricants market by the end of 2023?

According to the report published by Global Market Insights Inc., the synthetic lubricants business is supposed to attain $5 billion (USD) by 2023.

How much remuneration is the Synthetic Lubricants industry projected to register in 2016

Overall Synthetic Lubricants Market recorded a remuneration of $5 billion in 2016

Synthetic Lubricants Market Scope

Related Reports