Summary

Table of Content

Suncare Products Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Suncare Products Market Size

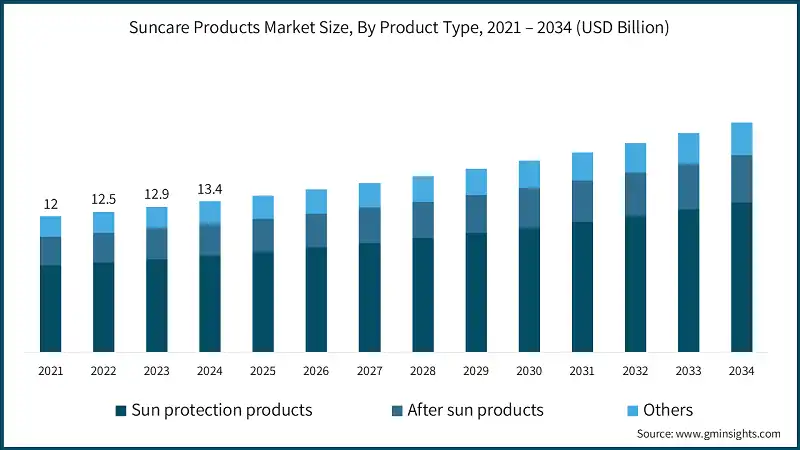

The global suncare products market size was estimated at USD 13.4 billion in 2024. The market is expected to grow from USD 13.9 billion in 2025 to USD 20.4 billion in 2034, at a CAGR of 4.3% according to latest report published by Global Market Insights Inc.

To get key market trends

The market for suncare products is growing rapidly, due to growing consumer awareness about the adverse effects of ultraviolet (UV) radiation on skin health. The Skin Cancer Foundation reports that annually, more than 5 million cases of skin cancer are diagnosed in the United States alone, with UV radiation being one of the major causes. Increasing incidents of skin like sunburn, premature aging, and skin cancer have fueled consumers to take proactive steps to save their skin. This increasing awareness is driving purchasing behavior, with more people adding sun protection to their everyday lives beyond the classical beach or holiday usage.

Educational initiatives, testimonials from dermatologists, and social media platform impacts are all contributing to disseminating information on the value of SPF, broad-spectrum protection, and frequent reapplication. Consequently, sun protection is becoming more accepted as a year-round rather than seasonal consideration.

The interest in natural and organic ingredients in suncare is a further strong market growth driver. Shoppers are getting increasingly picky, reading labels and looking for products that exclude nasty chemicals like oxybenzone, Octinoxate, and parabens. Almost 75% of sunscreens sold contain potentially toxic chemicals, according to the Environmental Working Group (EWG), which has fueled consumer demand for safer products. That trend is especially strong among eco- and health-oriented consumers who insist on mineral-based sunscreens with zinc oxide or titanium dioxide.

Manufacturers are in turn launching reef-safe, vegan, cruelty-free, and sustainably packaged products that are in line with clean beauty standards. Changes in regulation, like Hawaii's sunblock ban on oxybenzone and Octinoxate to shield coral reefs, are also accelerating innovation in green-friendly formulas. These trends are prompting companies to place bets on research and development to catch up with changing consumer attitudes and regulatory pressures.

Multifunctional suncare product innovation is also driving market growth. Today's consumers are looking for products that provide more than simple UV protection, and they are asking for extra benefits like hydration, anti-aging, skin color correction, and makeup coverage. This has developed the trend of hybrid products like SPF-enriched tinted moisturizers, sun protector serums, and sprays that integrate skin care and sun defense. As per a survey by the American Academy of Dermatology (AAD), 62% of consumers prefer multi-tasking skincare products, a trend toward greater convenience and efficiency.

Moreover, the rising popularity of outdoor recreation, wellness travel, and fitness lifestyle is fueling the demand for efficient, sweat-resistant, and travel-ready sun protection solutions. For example, the international well-being tourism industry, worth USD 817 billion as of 2022, is estimated to advance at a compound annual growth rate (CAGR) of 7.2% over the forecast period, further driving demand for innovative suncare products focused on active lifestyles.

Suncare Products Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 13.4 Billion |

| Market Size in 2025 | USD 13.9 Billion |

| Forecast Period 2025 - 2034 CAGR | 4.3% |

| Market Size in 2034 | USD 20.4 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Rising awareness of UV-related skin damage | Consumers are increasingly using SPF daily, driving demand for broad-spectrum and dermatologist-recommended products. This shift is expanding the market beyond seasonal use into year-round skincare routines. |

| Demand for natural and organic formulations | Eco-conscious buyers are pushing brands toward mineral-based, reef-safe, and clean-label sunscreens. This trend is opening new premium and niche segments focused on health and sustainability. |

| Multifunctional product innovation | Hybrid products combining sun protection with skincare and cosmetic benefits are boosting convenience and consumer loyalty. Formats like tinted SPF moisturizers and sunscreen serums are gaining popularity. |

| Growth in outdoor and wellness lifestyles | Active lifestyles and wellness tourism are increasing demand for high-performance, sweat-resistant, and portable sun protection. This is driving innovation in formats like sprays, sticks, and wipes. |

| Pitfalls & Challenges | Impact |

| Ingredient scrutiny and regulatory pressure | Increasing bans and restrictions on chemical UV filters are forcing brands to reformulate products, often at higher costs. This slows down product launches and demands greater investment in R&D and compliance. |

| High cost of raw materials | Rising prices of key ingredients like zinc oxide and titanium dioxide are inflating production costs. This affects profit margins and may lead to higher retail prices, impacting on affordability and competitiveness. |

| Opportunities: | Impact |

| Expansion in emerging markets | Rising skincare awareness and growing middle-class populations in regions like Asia, Africa, and Latin America present strong growth potential. |

| Digital and personalized skincare solutions | The rise of AI-powered skin analysis tools and personalized product recommendations via e-commerce platforms offers brands a chance to enhance consumer engagement. |

| Market Leaders (2024) | |

| Market Leaders |

Market share of ~5.5% |

| Top Players |

Collective market share in 2024 ~20% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Europe & Asia Pacific |

| Emerging Countries | U.S., Germany, UK, Brazil, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Suncare Products Market Trends

The suncare industry is witnessing a significant trend shift towards clean beauty as consumers show a strong preference for mineral-based, reef-safe, and paraben-free products.

- Regulatory measures, including the recent ban in Hawaii on chemical filters oxybenzone and Octinoxate, have propelled the move towards sustainable alternatives. The Environmental Working Group (EWG) states that more than 60% of consumers now proactively look for sunscreens with improved ingredients. In turn, manufacturers are coming with formulations that include zinc oxide or titanium dioxide, sometimes augmented with botanical extracts such as aloe vera and green tea for enhancing skin benefits.

- Sustainable packaging innovations like biodegradable tubes and refillable containers are also gaining appeal, in line with increasingly sought-after environmentally friendly products. This trend is especially strong among eco-conscious consumers and sensitive skin individuals, fueling innovation in green chemistry and responsible sourcing practices.

- Shoppers are increasingly looking for multipurpose suncare products that provide UV protection together with skincare benefits, including hydration, anti-aging benefits, and complexion improvement. This need is to give way to hybrid formats, such as colored sunscreens, SPF-enriched serums, and waterproof sprays, designed to address the demands of active lifestyles. As an example, a Skin Cancer Foundation report points out that 35% of consumers prefer a dual benefit product, such as sun protection and moisturizing. Conveniency and performance also call for new developments in application formats.

- Easy-to-use, portable alternatives such as powders, wipes, and sticks are becoming increasingly popular, with market leaders noting a 20% year-to-year sales growth for these formats. In addition, AI-driven e-commerce sites are transforming retail experience by providing consumers with personalized recommendations for SPF based on location, lifestyle, and skin type, driving consumer satisfaction and engagement sharply higher. These developments are likely to drive the suncare market in the forecast period, with a significant focus on innovation and sustainability.

Suncare Products Market Analysis

Learn more about the key segments shaping this market

Based on product type, the suncare products market can be segmented into sun protection products, after sun products, and others. The sun protection products accounted for revenue of around USD 8.6 billion in the year 2024 and is estimated to grow at a CAGR of 4.5% from 2025 to 2034.

- The growth is due to increasing consumer awareness towards the long-term effects of UV exposure and the importance of daily sun protection. As knowledge about skin health increases, especially regarding premature aging, hyperpigmentation, and skin cancer consumers are adopting SPF products as part of their everyday skincare routines, not just during vacations or summer months. This behavioral shift is further supported by dermatologists, influencers, and wellness campaigns that promote broad-spectrum protection.

- Additionally, innovations in formulation such as lightweight textures, invisible finishes, and skin-friendly ingredients have made sun protection more appealing and compatible with other skincare and makeup products. The rise of multifunctional products, such as moisturizers and foundations with SPF, has also contributed to increased usage across diverse demographics and geographies, fueling consistent market growth.

Learn more about the key segments shaping this market

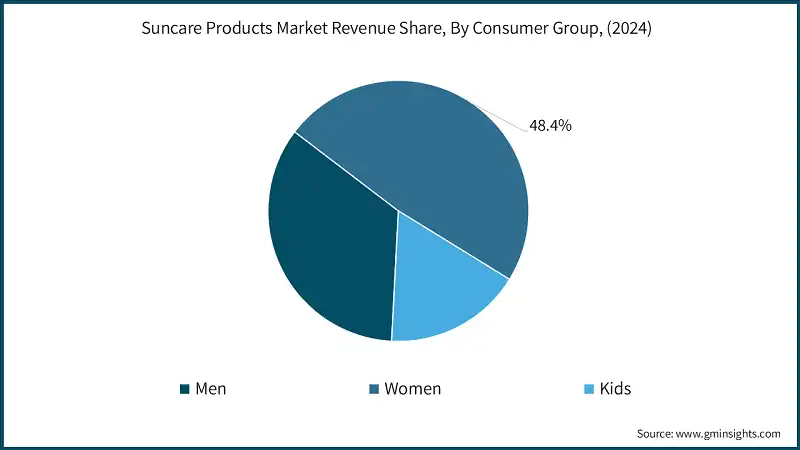

Based on consumer group, the suncare products market is segmented as men, women, and kids. The women held around 48.4% of the total market share in 2024 and is anticipated to grow at a CAGR of 4.5% during the forecast period.

- The growth is largely attributed to their higher engagement with skincare routines and greater awareness of sun-related skin concerns such as aging, pigmentation, and sensitivity. Women are more likely to incorporate SPF into their daily regimen, not only for protection but also for cosmetic benefits like even skin tone and anti-aging. This segment also drives demand for multifunctional products such as tinted sunscreens, SPF-infused moisturizers, and makeup with sun protection, making it a key target for innovation and premium offerings.

- Additionally, marketing campaigns and product development in the beauty and personal care industry often prioritize female consumers, further reinforcing their significant share and projected growth in the market.

Based on distribution channel, the suncare products market is segmented as online and offline. The offline distribution channel held around 65.3% of the total market share in 2024 and is anticipated to grow at a CAGR of 4.3% during the forecast period.

- Pharmacies, supermarkets, and specialty beauty stores offer trusted environments where consumers can physically evaluate texture, scent, and suitability, especially important for skincare products like sunscreens. Additionally, offline channels benefit from strong brand visibility, promotional campaigns, and dermatologist-backed recommendations, making them a reliable and convenient choice for many buyers, particularly in regions with limited digital access.

- Additionally, the offline channel benefits from strong brand visibility and impulse buying behavior, especially in high-traffic retail environments like supermarkets and pharmacies. Promotional displays, in-store sampling, and seasonal discounts often influence purchasing decisions, while trusted retail partnerships help reinforce product credibility. This physical presence continues to play a vital role in consumer engagement, particularly in regions where digital adoption is still growing.

Looking for region specific data?

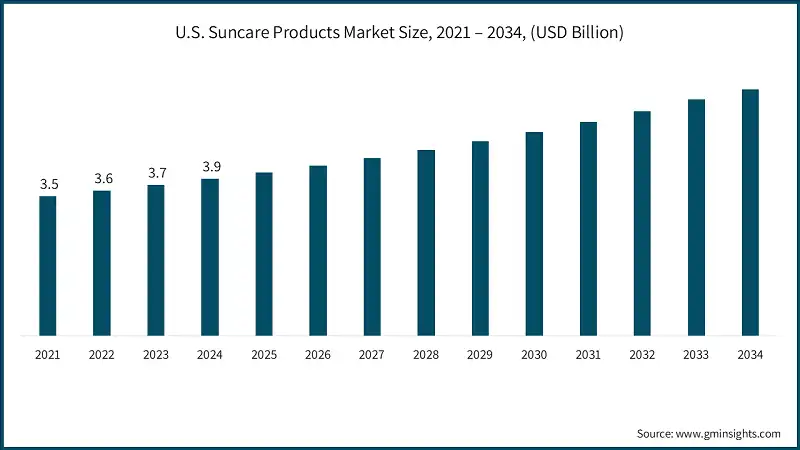

North America Suncare Products Market The U.S. dominates an overall North America market and valued at USD 3.9 billion in 2024 and is expected to grow at a CAGR of 4.7% during the forecast period from 2025 to 2034. The market in Europe, Germany is expected to experience significant and promising growth from 2025 to 2034. The Asia Pacific market, China held 33.2% market share in 2024 and is expected to grow at a CAGR of 4.4% during the forecast period from 2025 to 2034. In the Middle East and Africa market, Saudi Arabia held 22.2% market share in 2024 and is expected to grow at a CAGR of 3.6% during the forecast period from 2025 to 2034. Major players operating in the suncare products industry include: Shiseido drives its innovation strategy through its 2030 R&D Vision “We are the engine of BEAUTY INNOVATIONS.” The company operates under three core pillars: Skin Beauty Innovation, Sustainability Innovation, and Future Beauty Innovation. By integrating advanced dermatology, material science, and Kansei research, Shiseido develops cutting-edge sun care technologies such as SynchroShieldRepair, which enhances SPF performance under conditions of heat, water, and friction. The company also explores biotech-based UV filters derived from bacterial membranes and invests in inner beauty solutions and beauty devices. Shiseido's global R&D network fosters localized innovation, while its “De-Shiseido” culture promotes agility and collaboration across industries, positioning the company as a leader in the evolving suncare market. Johnson & Johnson sustains its competitive advantage by combining scientific innovation with consumer-centric marketing strategies. The company’s product approach emphasizes value-based pricing, multi-channel distribution, and emotionally engaging branding. With substantial investments in R&D, J&J has introduced groundbreaking products such as the Neutrogena Light Therapy Acne Mask and advanced SPF formulations. Leveraging data analytics and digital platforms, J&J personalizes consumer engagement and optimizes product reach.Europe Suncare Products Market

Asia Pacific Suncare Products Market

Middle East and Africa Suncare Products Market

Suncare Products Market Share

Suncare Products Market Companies

Suncare Products Market News

The suncare products market research report includes in-depth coverage of the industry, with estimates & forecasts in terms of revenue (USD Billion) and volume (Million Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Sun protection products

- After sun products

- Others

Market, By Product Formulation

- Chemical sunscreens

- Mineral sunscreens

Market, By Form

- Lotion

- Spray

- Gel

- Stick

- Others

Market, By Price

- Low

- Medium

- High

Market, By Consumer Group

- Men

- Women

- Kids

Market, By Distribution Channel

- Online

- E-commerce websites

- Company-owned websites

- Offline

- Supermarkets and hypermarkets

- Specialty stores

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What are the upcoming trends in the suncare products industry?

Key trends include the shift towards clean beauty, adoption of sustainable packaging such as biodegradable tubes and refillable containers, and the use of botanical extracts like aloe vera and green tea in formulations.

Which region leads the suncare products market?

The U.S. dominates the North American market, valued at USD 3.9 billion in 2024, and is expected to grow at a CAGR of 4.7% from 2025 to 2034, driven by strong consumer awareness and regulatory measures.

What was the market share of the women consumer group in 2024?

The women consumer group held around 48.4% of the total market share in 2024 and is anticipated to grow at a CAGR of 4.5% during the forecast period.

Who are the key players in the suncare products market?

Key players include Amorepacific, Avon, Bayer, Beiersdorf, Clarins, Coty, Edgewell, Johnson & Johnson, and Kao.

What is the projected size of the suncare products market in 2025?

The market is expected to reach USD 13.9 billion in 2025.

How much revenue did the sun protection products segment generate?

Sun protection products generated approximately USD 8.6 billion in 2024, leading the market and projected to grow at a CAGR of 4.5% from 2025 to 2034.

What is the projected value of the suncare products market by 2034?

The market is expected to reach USD 20.4 billion by 2034, fueled by consumer preferences for mineral-based, reef-safe, and paraben-free formulations.

What is the market size of the suncare products in 2024?

The market size was estimated at USD 13.4 billion in 2024, with a CAGR of 4.3% expected through 2034, driven by the rising demand for clean beauty products and sustainable packaging innovations.

Suncare Products Market Scope

Related Reports