Summary

Table of Content

Static Random-Access Memory (SRAM) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Static Random-Access Memory Market Size

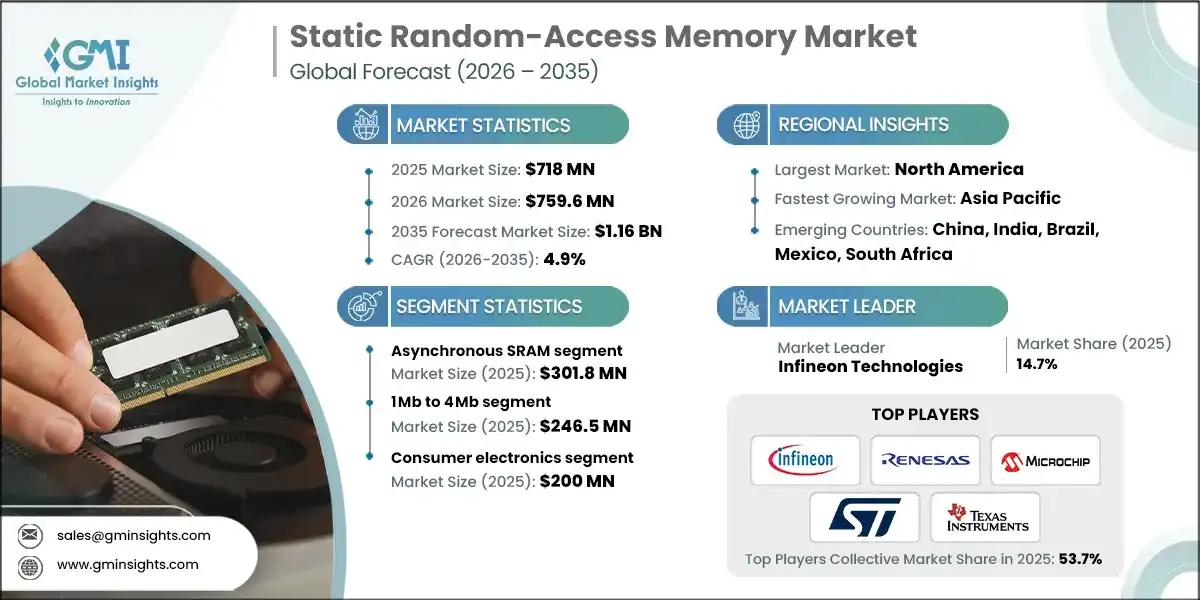

The global static random-access memory market was valued at USD 718 million in 2025. The market is expected to grow from USD 759.6 million in 2026 to USD 1.16 billion in 2035, at a CAGR of 4.9% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

The growth of the static random-access memory market can be attributed to factors such as the rising demand for high-speed and low-latency memory solutions, increasing adoption of SRAM in advanced semiconductor devices, expansion of applications across data centers, networking equipment, and automotive electronics, and continuous advancements in semiconductor manufacturing technologies. Additionally, growing investments in AI, IoT, and edge computing infrastructure are accelerating SRAM adoption across multiple end-use industries.

Also, the increase in the number of data-rich applications being used is helping to propel the growth of this market. The main uses for SRAM are in processor cache memory, network switch cache memory, and embedded system cache memory because SRAM provides very fast access and has a very high level of reliability. Applications that require very fast data processing (e.g., artificial intelligence, machine learning, and high-performance computing) will have an increased need for SRAM. As an example, Modern AI accelerators and CPUs will utilize large SRAM blocks as on-chip cache memory to decrease latency and increase system speed. Another reason for the growing demand for SRAM versus DRAM is that SRAM does not require periodic refreshing of its data, therefore, it will be able to operate more quickly and provides more efficient energy use than DRAM in applications where performance is critical. The trend toward increased demand for real-time processing and low-power electronics will result in additional growth in the adoption of SRAM, thus increasing the overall market base for SRAM.

Static Random Access Memory (SRAM) is a type of volatile semiconductor memory that uses bistable latching circuits to store data. SRAM will retain the contents of the memory while the supply of power remains, additionally, SRAM provides much faster access to data compared with DRAM. SRAM will be used mainly for applications requiring cache memory, register memory, and, in many cases, buffer memory in processors, Networking Devices, and Embedded Systems. Because of its high-speed operation and stability, SRAM is well-suited for applications that are sensitive to performance issues; however, due to its higher cost and lower memory density than other memory types, SRAM is not as widely used as DRAM.

Samsung Electronics, SK hynix, Micron Technology, NXP Semiconductors, and Infineon Technologies are the primary SRAM market participants. These businesses continually invest in R&D, improve process node technology, and develop SoC architecture to keep the SRAM market growing. The SRAM price and product innovation and the competitive positioning of the SRAM market depend on collaboration with SRAMS foundries, developments of OEMs, and expanding production capacity.

Between 2022 and 2024, the static random-access memory market will have steady growth at an estimated USD 609.8 million in 2022 growing to an estimated USD 680.3 million in 2024. During this time frame, one of the major SRAM trends will be the use of SRAM in automotive electronics, 5G network infrastructure, and edge devices with artificial intelligence. Increased complexity of SoCs, coupled with the need for additional SRAM cache memory per chip, resulted in a higher level of SRAM integration. In addition, this period represents a major capital outlay for semiconductor manufacturers to support the development of advanced-node SRAM products. Collectively, these developments have led to greater SRAM supply capacity, technological development, and ultimately increased growth potential for the SRAM market.

SRAM provides immediate access to stored data through the use of flip-flop circuits to store data rather than performing refresh cycles like dynamic random-access memory (DRAM). SRAM can be used in real-time processing applications because of the speed with which data can be retrieved, coupled with its low power consumption.

Static Random-Access Memory (SRAM) Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 718 Million |

| Market Size in 2026 | USD 759.6 Million |

| Forecast Period 2026-2035 CAGR | 4.9% |

| Market Size in 2035 | USD 1.16 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Expansion of AI and Machine Learning Applications | Drives SRAM market growth through rising demand for ultra-low-latency, high-speed cache memory in AI accelerators, GPUs, and neural processing units. |

| Proliferation of Edge Computing and IoT Devices | Supports market expansion as edge devices require fast, power-efficient SRAM for real-time data processing and localized decision-making. |

| Increasing Demand for High-Performance Cache Memory in Processors | Strengthen adoption as modern CPUs, SoCs, and microcontrollers integrate larger on-chip SRAM to enhance computing speed and system efficiency. |

| Advancements in Semiconductor Technology and Node Scaling | Contributes to market growth by enabling higher-density, lower-power SRAM integration in advanced-node semiconductor designs. |

| Growth in Automotive and 5G Infrastructure Electronics | Expands market scope with rising use of SRAM in ADAS, infotainment systems, base stations, and networking equipment requiring deterministic performance. |

| Pitfalls & Challenges | Impact |

| High Manufacturing Costs and Scaling Limitations | Restrains market growth as advanced-node SRAM fabrication requires complex processes, higher capital expenditure, and limits cost-effective scalability. |

| Volatility in Semiconductor Supply Chain and Raw Material Availability | Impacts market stability by causing production delays, price fluctuations, and supply constraints for SRAM manufacturers and OEMs. |

| Opportunities: | Impact |

| Rising Adoption of SRAM in AI Accelerators and High-Performance Computing | Creates growth opportunities by increasing demand for large on-chip SRAM blocks to enable low-latency data access and faster computation. |

| Growing Integration of Embedded SRAM in Advanced SoC Designs | Expanding market potential as consumer electronics, automotive, and industrial devices require efficient, high-speed memory within compact chip architectures |

| Market Leaders (2025) | |

| Market Leaders |

14.7% Market Share |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest growing market | Asia Pacific |

| Emerging countries | China, India, Brazil, Mexico, South Africa |

| Future outlook |

|

What are the growth opportunities in this market?

Static Random-Access Memory Market Trends

- SRAM's expansion and diversification of high-speed high-density SRAM products for embedded applications and AI accelerators, as well as data-intensive applications, is one of the primary drivers of the SRAM marketplace.

- For example, in March 2024, Microchip Technology expanded its serial SRAM product offerings with chips that contain 4Mb densities and utilize 143MHz SPI/SQI interfaces to provide customers with high-density, higher-speed SRAM devices for their embedded and data-intensive applications.

- Ultra-high performance SRAM products that satisfy next-generation computing and AI based systems are a second trend impacting the development of SRAM products, as they require low latency, energy-efficient, and high-density/high-volume memory for cloud and edge computing applications.

- An example of this is Marvell's announcement of the industry's first 2nm custom SRAM, which will deliver 6Gb high-speed SRAM with a reduction in standby power of up to 66% and will be developed for AI infrastructure and silicon designs for cloud data center storage.

- Automotive and industrial grade SRAM products are seeing a rise in acceptance, as more automobile and industrial automation systems are using smaller, lighter-weight and lower-power SRAM for their control electronics.

- Additionally, the growth of the SRAM market is aided by increased adoption in the automotive and industrial markets due to the growing need for small, efficient, and reliable low-power memory (SRAM) solutions for vehicle control and industrial automation equipment.

- Another major trend is that many manufacturers are incorporating SRAM within SoC designs to increase the amount of on-chip memory available and reduce their dependence on external memory for high-performance and low-latency applications.

- The growing emphasis on high-reliability/low-power SRAM will help meet the growing demand for devices used in embedded, IoT, and telecommunications applications to operate efficiently and reliably in mission-critical and energy-constrained environments.

Static Random-Access Memory Market Analysis

Learn more about the key segments shaping this market

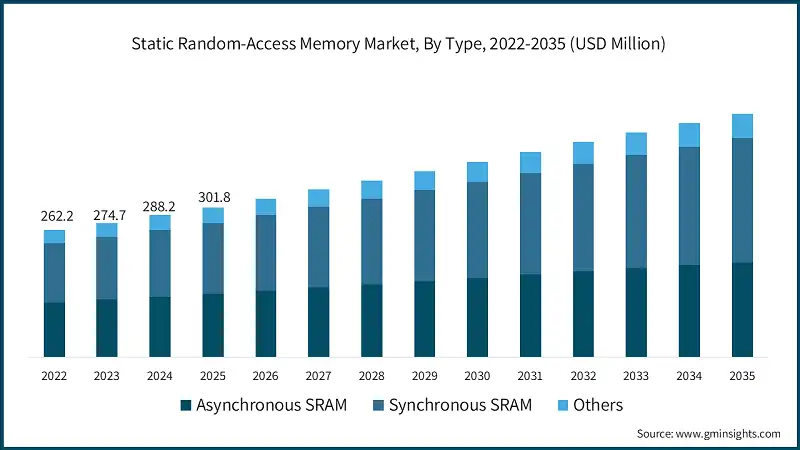

The global market was valued at USD 609.8 million and USD 643.6 million in 2022 and 2023, respectively. The market size reached USD 718 million in 2025, growing from USD 680.3 million in 2024.

Based on type, the global SRAM market is divided into asynchronous SRAM, synchronous SRAM, and others. The asynchronous SRAM segment accounted for the market size of USD 301.8 million in 2025.

- Asynchronous SRAM holds a significant market share in the SRAM market since it is widely used in cache memory, embedded systems, and networking devices due to its simple interface and reliable performance.

- Asynchronous SRAM is preferred for its stability and ease of integration, which is particularly important for industrial, automotive, and legacy electronic applications requiring deterministic performance.

- Additionally, the broad adoption of asynchronous SRAM is supported by well-established manufacturing processes and proven track record in microcontrollers, SoCs, and high-speed memory modules.

- While synchronous SRAM segment is anticipated to grow at a CAGR of 5.6% over the forecast years and is gaining popularity due to higher data throughput and compatibility with modern high-speed processors, asynchronous SRAM remains the dominant type, continuing to drive a large part of the market's adoption and revenue due to its reliability and lower cost.

- The synchronous SRAM segment is growing at a faster pace, driven by applications in AI accelerators, high-performance computing, 5G networking, and automotive electronics that demand low-latency, high-speed memory.

- Synchronous SRAM is increasingly preferred for its ability to operate at higher clock speeds and deliver faster data access, enabling improved system performance in modern, performance-critical electronics.

Based on memory size, the static random-access memory market is segmented into up to 1Mb, 1Mb to 4Mb, 4Mb to 16Mb, and above 16Mb. The 1Mb to 4Mb segment dominated the market in 2025 with a revenue of USD 246.5 million.

- The 1Mb to 4Mb SRAM segment holds the market due to its widespread use in microcontrollers, embedded systems, consumer electronics, and networking devices, where moderate on-chip memory meets performance and cost requirements.

- This segment’s growth is supported by established manufacturing processes, high reliability, and ease of integration in a variety of standard electronic applications.

- The 16Mb SRAM segment is anticipated to witness growth at a CAGR of 6.3% over the analysis period, reaching USD 194.7 million by 2035.

- The above 16Mb SRAM segment is experiencing rapid growth, driven by high-performance computing, AI accelerators, 5G networking equipment, and data center applications that demand large on-chip memory for low-latency, high-speed data access.

- Higher memory capacities allow SRAM to serve as high-speed cache or buffer memory, reducing dependency on external DRAM and improving overall system throughput.

- The trend toward larger memory sizes is also supported by advancements in semiconductor fabrication, enabling high-density SRAM with reduced power consumption and improved performance.

- As a result, the above 16Mb SRAM category is becoming increasingly critical in next-generation electronics, contributing substantially to overall market expansion.

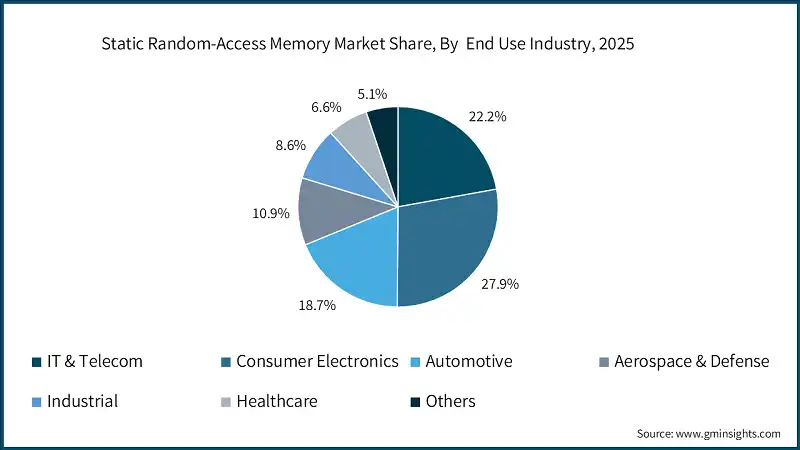

Learn more about the key segments shaping this market

Based on end use industry, the static random-access memory market is classified into IT & telecom, consumer electronics, automotive, aerospace & defense, industrial, healthcare, and others. The consumer electronics segment dominated the market in 2025 with a revenue of USD 200 million.

- The consumer electronics segment holds the largest market share due to the widespread integration of SRAM in smartphones, tablets, wearables, gaming consoles, and other connected devices requiring fast, low-latency memory.

- Consumer electronics applications benefit from SRAM’s high-speed performance, low power consumption, and reliability for cache memory, buffer memory, and embedded system designs.

- Many consumer electronics manufacturers are increasingly incorporating high-density and low-power SRAM solutions into their products to support AI functionalities, real-time processing, and seamless user experiences, further strengthening this segment’s dominance in the SRAM market.

- The automotive segment is experiencing the fastest growth with the CAGR of 6.4% during the forecast period, driven by the rising adoption of SRAM in ADAS, infotainment systems, electric vehicles, and autonomous driving solutions that demand high-speed, reliability, and energy-efficient memory.

- Automotive applications leverage SRAM for on-chip cache, buffering, and real-time data handling, enabling critical functionalities such as sensor fusion, navigation, and safety systems.

- As the automotive industry continues to evolve toward electric and autonomous vehicles, SRAM adoption is expected to accelerate, contributing substantially to overall market expansion in high-performance, safety-critical, and low-latency applications.

Looking for region specific data?

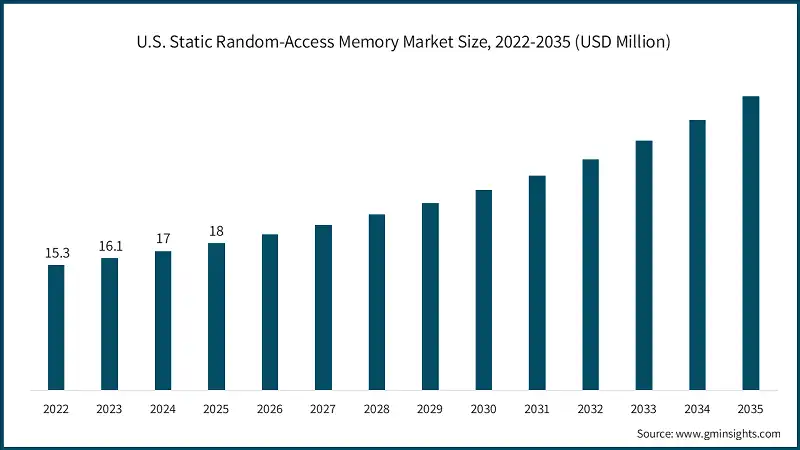

North America dominated the global static random-access memory market with a market share of 31.2% in 2025.

- A favorable industrial environment, strong investment in semiconductor manufacturing, advanced technological infrastructure, and a robust R&D ecosystem are key factors driving regional market growth.

- The U.S. has a well-established semiconductor and electronics R&D ecosystem. It hosts leading academic institutions, research centers, and SRAM manufacturers such as Microchip Technology, Infineon Technologies, and Renesas that actively contribute to advancements in high-speed, low-power, and high-density SRAM technologies. This ecosystem fosters innovation, attracts investment, and drives the development of next-generation memory solutions.

- Furthermore, growing demand from sectors such as consumer electronics, automotive electronics, AI accelerators, telecommunications, and industrial automation has created substantial need for advanced SRAM products.

- Additionally, supportive government policies, incentives for semiconductor fabrication, and initiatives to boost domestic chip manufacturing further fuel market growth in the region.

The U.S. static random-access memory market was valued at USD 159.5 million and USD 169.3 million in 2022 and 2023, respectively. The market size reached USD 190.9 million in 2025, growing from USD 179.9 million in 2024.

- The U.S. continues to lead the SRAM market, supported by its advanced semiconductor and electronics manufacturing ecosystem, strong R&D capabilities, and favorable industrial policies.

- The country hosts several leading SRAM and semiconductor manufacturers, including Microchip Technology, Infineon Technologies, and Renesas Electronics, and benefits from a robust pipeline of high-speed, low-power, and high-density SRAM solutions.

- Additionally, the presence of top-tier research institutions and extensive innovation in memory design, embedded systems, and AI/automotive applications further accelerates the development and adoption of advanced SRAM products.

The Europe static random-access memory market accounted for USD 156.3 million in 2025 and is expected to witness strong growth over the forecast period.

- Europe holds a significant share of the global SRAM market, supported by advanced semiconductor manufacturing infrastructure, increasing government initiatives, and rising investments in high-performance memory development.

- The region benefits from a collaborative ecosystem of academic institutions, research organizations, and SRAM manufacturers such as Infineon Technologies and Renesas Electronics, which accelerates innovation and adoption of advanced SRAM solutions.

Germany dominates the Europe static random-access memory market, showcasing strong growth potential.

- Within Europe, Germany holds a substantial share of the SRAM market, supported by its advanced semiconductor manufacturing infrastructure, strong industrial base, and favorable government initiatives.

- The country’s focus on high-performance automotive electronics, industrial automation, and AI-driven embedded systems has created a dynamic environment for SRAM development and commercialization.

- Furthermore, Germany’s robust industrial ecosystem and high technology adoption rates facilitate the deployment of high-speed, low-power, and high-density SRAM solutions across automotive, industrial, and consumer applications.

The Asia-Pacific static random-access memory market is expected to grow to the highest CAGR of 5.7% during the analysis period.

- The region is witnessing rapid SRAM market expansion, driven by increasing semiconductor and electronics manufacturing, rising demand from automotive, industrial, consumer electronics, and AI applications, and greater adoption of high-speed and low-power memory technologies.

- Governments in countries such as China, Japan, South Korea, and Taiwan are supporting high-tech electronics and industrial automation through infrastructure development, funding initiatives, and international collaborations.

- Furthermore, the large manufacturing base, growing technology adoption, and presence of local SRAM manufacturers are fueling demand for high-performance, high-density, and energy-efficient SRAM solutions across multiple applications.

China static random-access memory market is estimated to grow significantly within the Asia-Pacific market.

- China leads the Asia-Pacific SRAM market, driven by substantial investment in semiconductor and memory R&D, supportive industrial policies, and rapid expansion of high-performance memory manufacturing capabilities.

- The Chinese government prioritizes advanced electronics, AI, automotive systems, and industrial automation, providing funding and regulatory support to foster SRAM market growth.

- With strong production capacity, expanding semiconductor infrastructure, and rising domestic and export demand, China is at the forefront of SRAM adoption and development in the Asia-Pacific region.

Brazil leads the Latin American static random-access memory market, showing strong growth during the analysis period.

- Brazil is emerging as a key growth center in the region, driven by expanding semiconductor and electronics manufacturing, rising automotive production, and growing adoption of industrial automation and embedded systems.

- The country’s large industrial base and increasing use of high-speed, low-power, and high-density SRAM in automotive, consumer electronics, and industrial applications are generating strong demand.

- Additionally, supportive government policies and public-private initiatives are encouraging local semiconductor production and technology development, further boosting SRAM market growth.

South Africa static random-access memory market is expected to witness substantial growth in the Middle East and Africa market during the forecast period.

- The country shows significant potential, driven by expanding industrial automation, electronics manufacturing, and adoption of high-performance memory in smart technologies.

- South Africa hosts several prominent electronics and semiconductor companies and is seeing increasing demand for low-latency, energy-efficient, and high-density SRAM solutions.

- Government initiatives, infrastructure development, and collaborations with global SRAM technology providers are expected to further accelerate market growth in the region.

Static Random-Access Memory Market Share

The competitive landscape of the global SRAM market is characterized by intense competition, continuous technological innovation, and strategic collaborations among leading memory manufacturers. Top players such as Infineon Technologies, Renesas Electronics Corporation, Microchip Technology Inc., STMicroelectronics NV, and Texas Instruments hold a combined market share of approximately 53.7% in the global SRAM market. These companies invest heavily in R&D to enhance memory speed, density, and energy efficiency, while expanding applications in automotive electronics, industrial automation, AI accelerators, telecommunications, and consumer electronics.

The market also witnesses mergers, acquisitions, and strategic partnerships aimed at broadening geographic presence, improving manufacturing capabilities, and accelerating the adoption of advanced SRAM solutions. Smaller and specialized SRAM manufacturers contribute by focusing on niche applications such as ultra-low-power SRAM, high-density embedded SRAM, and automotive-grade memory, fostering innovation and differentiation.

Static Random-Access Memory Market Companies

Prominent players operating in the SRAM market are as mentioned below:

- Alliance Memory, Inc.

- Analog Devices, Inc.

- GSI Technology Inc.

- Infineon Technologies

- Integrated Silicon Solution Inc. (ISSI)

- Microchip Technology Inc.

- NXP Semiconductors

- ON Semiconductor

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- STMicroelectronics NV

- Texas Instruments

- Toshiba Corporation

- Winbond Electronics Corporation

Infineon Technologies is a leading player in the SRAM market with a market share of 14.7%. The company specializes in high-speed, low-power SRAM solutions for automotive, industrial, and consumer electronics applications. Its strong global manufacturing footprint and continuous investment in R&D for advanced embedded and automotive-grade SRAM reinforce its position as a front-runner in memory solutions.

Renesas Electronics Corporation

Renesas Electronics holds a market share of 12.8% in the global SRAM market. The company focuses on high-performance SRAM for automotive systems, industrial automation, and embedded electronics. Its competitive edge is supported by robust R&D capabilities, scalable production facilities, and strategic partnerships with global OEMs.

Microchip Technology commands a market share of 10.5% and is recognized for its wide portfolio of serial and parallel SRAM solutions for consumer electronics, automotive, and industrial applications. The company emphasizes innovative low-power, high-speed memory technologies, strong customer relationships, and a global distribution network, positioning it as a major player in the SRAM market.

Static Random-Access Memory Industry News

- In October 2025, NXP Semiconductors introduced smartphone mirroring capabilities for entry-level digital connected clusters in two-wheelers using its i.MX RT1170 microcontroller unit (MCU). The MCU enables seamless access to navigation, music, and calls directly on the dashboard, eliminating the need for extra hardware. With dual Arm Cortex cores, up to 2 MB on-chip SRAM, and integrated graphics, the solution enhances rider safety, connectivity, and user experience while maintaining cost efficiency.

- In June 2025, Infineon Technologies introduced a radiation-tolerant memory portfolio designed for low Earth orbit (LEO) missions, targeting the rapidly growing NewSpace market. The portfolio includes low-power F-RAMs, QSPI NOR flash memories (256/512 Mbit), and 256/512 Mbit pseudo-static RAM (pSRAM), offering high performance, reliability, and low size, weight, and power (SWaP-c). These products support harsh LEO conditions and complement Infineon’s radiation-tolerant power solutions for commercial satellite applications.

- In May 2023, at ChipEx2023, Samsung Foundry unveiled its 3nm Gate-All-Around (GAA) Multi-Bridge-Channel Field Effect Transistor (MBCFET) technology, highlighting enhanced SRAM design flexibility. The MBCFET structure allows independent tuning of transistor channel widths, optimizing performance, power, and area (PPA) while improving SRAM cell stability. Compared to FinFETs, GAA SRAM bitcells consume less power and provide superior design margins, enabling higher efficiency and reliability in analog and digital SRAM applications.

The static random-access memory market research report includes in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million from 2022 – 2035 for the following segments:

Market, By Type

- Asynchronous SRAM

- Synchronous SRAM

- Others

Market, By Memory Size

- Up to 1Mb

- 1Mb to 4Mb

- 4Mb to 16Mb

- Above 16 Mb

Market, By End Use Industry

- IT & telecom

- Consumer electronics

- Automotive

- Aerospace & defense

- Industrial

- Healthcare

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Which region leads the static random-access memory industry?

The U.S. market reached USD 190.9 million in 2025, making it the leading contributor within North America.

What are the upcoming trends in the static random-access memory market?

Key trends in the market include rising integration of embedded SRAM in advanced SoC designs, increased use in AI and machine learning workloads, and growing adoption across automotive, 5G, and edge computing applications.

Who are the key players in the static random-access memory industry?

Key players operating in the market include Infineon Technologies, Renesas Electronics Corporation, Microchip Technology Inc., STMicroelectronics NV, Texas Instruments, Samsung Electronics, NXP Semiconductors, and Winbond Electronics Corporation.

What is the growth outlook for the synchronous SRAM segment in the static random-access memory market through 2035?

The synchronous SRAM segment in the static random-access memory industry is projected to grow at a CAGR of 5.6% through 2035, supported by increasing deployment in AI accelerators, high-performance computing, 5G infrastructure, and automotive electronics.

What was the valuation of the 1 Mb to 4 Mb segment in the static random-access memory industry in 2025?

The 1 Mb to 4 Mb segment of the market generated USD 246.5 million in 2025, reflecting strong adoption in microcontrollers, consumer electronics, and embedded semiconductor designs.

What was the valuation of the 1 Mb to 4 Mb segment in the static random-access memory industry in 2025?

The 1 Mb to 4 Mb segment of the market generated USD 246.5 million in 2025, reflecting strong adoption in microcontrollers, consumer electronics, and embedded semiconductor designs.

How much revenue did the asynchronous SRAM segment generate in the static random-access memory market in 2025?

the asynchronous SRAM segment generated USD 301.8 million in 2025, leading due to its reliability and widespread use in cache memory, embedded systems, and networking devices.

What is the market size of the static random-access memory industry in 2025?

The market was valued at USD 718 million in 2025, supported by rising demand for high-speed and low-latency memory solutions across semiconductor and electronics applications.

What is the projected value of the static random-access memory market by 2035?

The market size for static random-access memory is expected to reach USD 1.16 billion by 2035, growing at a CAGR of 4.9% from 2026 to 2035, driven by rising adoption in AI accelerators, edge computing, automotive electronics, and high-performance cache memory applications.

What is the current static random-access memory market size in 2026?

The market is projected to reach USD 759.6 million in 2026 as adoption expands across AI computing, networking equipment, and embedded electronics.

Static Random-Access Memory (SRAM) Market Scope

Related Reports