Summary

Table of Content

Specialty Fuel Additives Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Specialty Fuel Additives Market Size

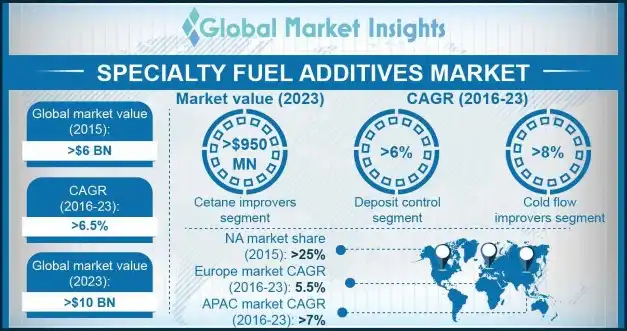

Specialty Fuel Additives Market size was recorded at over $6 billion in 2015, with an estimated growth rate of more than 6.5% from 2016 to 2023.

To get key market trends

Rise in high toxic emissions due to expansion in the manufacturing sector along with increased usage of vehicles has induced the law makers to make stringent regulations across the world, which is driving specialty fuel additives market. Upsurge in biofuel consumption across various industries will augment the global market. One of the widely used biofuels is ethanol, which acts as an additive to gasoline.

Increasing ethanol consumption is likely to provide a boost to the demand for specialty fuel additives. As per estimates, the global annual consumption of ethanol increased from 21.8 billion gallons in 2012 to 25.6 billion gallons in 2015, which is likely to drive the industry growth.

Specialty Fuel Additives Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 6 Billion (USD) |

| Forecast Period 2016 - 2023 CAGR | 6.5% |

| Market Size in 2023 | 10 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

The Environmental Protection Act of the U.S. has made it mandatory for heavy vehicles to use cleaner diesel with low sulfur content. Low sulfur content requires cold flow improvers which is a type of specialty fuel additive. This act is expected to positively influence the specialty fuel additives market. In the U.S., consumption of ultra-low sulfur diesel (ULSD) containing 0-15 ppm (parts per million) in 2012 was stated to be 1,255.5 million gallons.

Additionally, use of corrosion inhibitors (which is a type of specialty fuel additive) for protecting the fuel distribution and storage systems in automobiles will also drive the global specialty fuel additives market. Growing usage of alternative fuels like compressed natural gas (CNG) and liquid petroleum gas (LPG), may act as challenge for specialty fuel additive products.

Specialty Fuel Additives Market Analysis

Deposit control segment consumption is expected to surpass 3,800 kilo tons with CAGR exceeding 6% through 2023. They are used in gasoline and diesel to control and remove deposits such as soot and sludge which cause harm to the vehicle engine and reduce performance. Increasing global motor vehicle production (more than 90 million units in 2015 from 80 million units in 2011) will positively impact specialty fuel additives market share.

Cetane improvers are used in diesel to reduce ignition delays in the engine. They also improve cetane number leading to better performance of the vehicle. Increasing preference towards fuel economic measures is expected to drive this segment in the global market. The global cetane improvers segment will exceed $970 million by 2023 owing to increased ULSD consumption. Cold flow improvers segment is anticipated to witness gains over 8% with volume share of approximately 7.5% in 2023.

Learn more about the key segments shaping this market

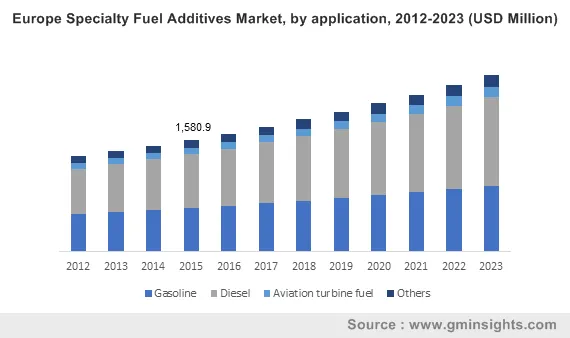

Gasoline application segment is expected to exceed 1,100 kilo tons in terms of volume consumption by 2023. Top Tier Detergent Gasoline (TTDG) formation in the United States is expected to drive the specialty fuel additives market growth. TTDG is performance specification designed, supported and followed by key automobile manufacturers. These additives contain more effective detergency, and free from deposit forming metallic additives.

Diesel application will be driven by the APAC region with estimated gains over 6.5% through 2023 owing to substantial usage of diesel in Asia, particularly India, China, Indonesia and Thailand. Diesel is a more polluting fuel as compared to gasoline, which makes additives critical to increase the economy of the vehicle.

North America will be driven by U.S. which is major market for gasoline and diesel. U.S consumption of gasoline and diesel was around 8,750 thousand barrels per day in 2010 and exceeded 8840 thousand barrels per day in 2013. Corresponding to the growing fuel consumption, by 2023, the U.S specialty fuel additives market will surpass $2.5 billion.

Europe led by UK and Germany was worth over USD 1.5 billion in 2015 and will witness 5.5% growth rate during forecast timeframe. Asia Pacific was driven by India and China, and together accounted for over 40% of total volume consumption in 2015. APAC is expected to grow at CAGR exceeding 6% during the next 8 years. This can mainly be attributed to growing demand for automobiles in India due to increase in disposable income.

Specialty Fuel Additives Market Share

Specialty fuel additives market analysis is partly consolidated and competitive, as the top industry participants accounted for below 50% industry revenue share in 2015.

Some of the major companies include

- Innospec Inc

- Chemtura

- Infineum

- Lubrizol corporation

- BASF SE

- Baker Hughes

In December 2015, Chemtura announced plans to expand its production capacity for antioxidants (ADPAs, a type of specialty fuel additive) in Italy. This expansion includes building a new manufacturing facility. In 2014 and late 2015, the company increased ADPA capacity at Elmira site in Ontario, Canada.

Industry Background

Global specialty fuel additives market value is anticipated to exceed $8 billion by 2023. Fuel additives increase the fuel efficiency of vehicle and lead to better performance. Global fuel additives demand is currently witnessing strong growth owing to increasing demand for ULSD. ULSD requires an extra dose of fuel additives for smooth performance of vehicle.

North America and Europe regions have implemented stringent carbon emission and environmental regulations. Hence, fuel additives which serve these purposes of fuel efficiency and low carbon emission are witnessing strong growth across these regions.

Specialty fuel additives market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue in USD billion from 2012 to 2023, for the following segments:

By Product

- Deposit Control Additives

- Cetane Improvers

- Antioxidants

- Corrosion Inhibitors

- Lubricity Improvers

- Cold Flow Improvers

- Others

By Application

- Gasoline

- Diesel

- Aviation Turbine Fuel

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- Europe

- Asia Pacific

- MEA

- Latin America

Frequently Asked Question(FAQ) :

How much is the specialty fuel additives industry worth?

The specialty fuel additives market size is expected to achieve $10 billion by 2023, registering with a CAGR of 6.5%.

Who are leading producers in the specialty fuel additives market?

Prominent participants in the specialty fuel additives industry comprise Innospec Inc, Chemtura, Infineum, Lubrizol corporation, BASF SE and Baker Hughes, and others.

What are the key factors driving the market?

Increasing demand for biofuels, strong ULSD (Ultra Low Sulfur Diesel) and stringent emission control regulatory standards are the key factors expected to drive the growth of global market.

How will the North America specialty fuel additives industry fare through 2023?

The North America specialty fuel additives market value will surpass USD 2.5 billion by 2023.

Specialty Fuel Additives Market Scope

Related Reports