Summary

Table of Content

Soy Chemicals Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Soy Chemicals Market Size

Soy chemicals market size exceeded USD 25 billion in 2017, registering a CAGR of 7.7% through 2024 and expects consumption of above 6.5 million tons by 2024. Rising demand for biodegradable products along with supportive government initiatives owing to shifting consumer preference towards renewable chemical sources may fuel the market demand. Rapid urbanization along with booming food and agriculture industry mainly in China, Japan and India may further support product demand.

Global cosmetics products was valued at over USD 500 billion in 2017 on account of rising aging population & image consciousness along with changing lifestyle patterns and increasing trend of online purchasing. Soybeans comprises of high concentrations of phytosterols, minerals, vitamins, isoflavones, saponins and isoflavones. Soybean products are rich in protein, iron, calcium and zinc thereby providing several skin benefits such as wrinkle repair, hair growth, acne reduction along with boosting immunity and skin rejuvenation which may promote the soy chemicals market demand.

To get key market trends

Soy based chemicals incorporated in food & beverages are used as additives or ingredients as these products enhance the nutritional value of food items by boosting protein content. The global soybean industry stood at over USD 145 billion in 2017 and is expected to register maximum gains as these products are good sources of vitamins, minerals and insoluble fiber and helps in aiding diseases such as osteoporosis, breast cancer, Type 2 diabetes, fetal development along with lowering cholesterol level, improving energy and weight management thereby promoting the soy chemicals market growth.

Soy Chemicals Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2017 |

| Market Size in 2017 | 25 Billion (USD) |

| Forecast Period 2018 - 2024 CAGR | 7.7% |

| Market Size in 2024 | 44.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Rising demand for sustainable energy sources has led to increasing adoption of biodiesel majorly in North America which are produced from soy oil feedstock such as soybeans, animal fats and recycled edible oil. Bio diesel emits lower levels of particulate matter and carbon monoxide as compared to conventional petroleum bio-diesel. More than 50 percent of bio-diesel in the U.S. is manufactured using soy oil as it is renewable, less toxic, economic and provides GHG reductions. According to The United States Department of Energy, the usage of bio-diesel provides approximately 78% reduction in the CO2 emissions thereby promoting the soy based chemicals market demand.

Rising soybean allergies occurring from the consumption of various products such as soy milk, cheese, tofu, yoghurts and textured proteins may hamper the business growth. The allergy symptoms of consuming these products includes abdominal pain, skin redness, hivers and diarrhea. Additionally the U.S. food allergen labeling law requires all packaged food to state if the products contains top 8 allergen including soy which may cause hinderance for soy chemicals market growth.

Soy Chemicals Market Analysis

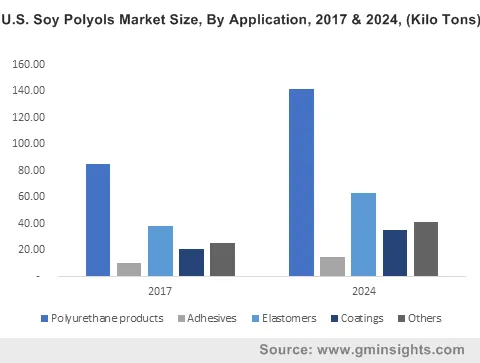

Soy polyols segment from polyurethane applications may surpass USD 1.9 billion by 2024. These products are highly used in mattresses, pillows, upholstered furniture and automotive cushions and seats. Soy polyols are majorly used as alternatives to petrochemical counterparts providing cost benefits, durability, light weight and sustainability. Rising government initiatives for reducing GHG emissions along with rapid production of vegetable oils in Indonesia, Malaysia and Thailand may fuel the soy chemicals market share.

Soy wax business from candle applications may register significant gains at over 4% by the end of forecasted timeframe. The product is a vegetable wax free from carcinogenic compounds & derived from soybean oil which is highly used in candle making. It is a natural and renewable resource and has lower melting point as compared to paraffin wax. Increasing awareness and benefits of vegetable wax may stimulate the soy chemicals market demand.

Soy isoflavones segment from nutraceutical applications was valued at over USD 5 billion in 2017. These products are known as phytoestrogens which are present in various dietary supplements and majorly used for used to improve metabolism of glucose, weight management, diabetes, osteoporosis and polycystic ovary syndrome (PCOS) in women.

North America soy chemicals market size led by the U.S., Canada and Mexico may register growth at over 5% by 2024. The region is a leading producer and exporter of soybeans ensuring abundant supply of raw materials for chemical production. According to The United States Department of Agriculture (USDA), more than100 million metric tons of soybeans were produced in the U.S. Moreover, increasing trend of bio-diesel adoption as compared to other counterparts may push soy chemicals regional growth.

Europe led by UK, France, and Germany may surpass USD 10 billion by 2024. Stringent government regulations regarding emission control and various favorable directives for reducing consumption of fossil fuels such as petroleum diesel contributing to GHG emissions may promote the regional soy chemicals market growth. Over 85% of reduction in carcinogenic emissions and 75% reduction in GHG emissions is obtained by the usage of soy based biodiesel which may further enhance soy based chemicals demand in the region.

Asia Pacific led by China, Japan, and India may expect growth at over 5.5% by the end of 2024. Rising demand of soybean based chemicals from various end-use industries such as healthcare & nutraceutical industries may boost the soy chemicals market growth. Asia Pacific nutraceuticals industry was valued at over 60 billion in 2017 owing to rising healthcare awareness and risk of chronic disease. Soy based isoflavones are available as medicines and dietary supplements for treating heart diseases, cholesterol, bone problems and hypertension.

Soy Chemicals Market Share

Soy chemicals industry share is partially competitive consisting of several key industry participants including :

- DowDuPont

- ADM

- Bunge limited

- Cargill

- Ag Processing Inc. (AGP)

Several manufacturers are engaged in forming strategic partnerships and collaborations to expand production and gain technical expertise. Additionally, the producers are highly focusing on enhancing their product portfolio and market reach.

Industry Background

Soy based chemicals are majorly extracts of soybean which are further processed into soy oil derivatives, natural extracts and refined industrial soybean oil. The oil is extracted from soybean seeds followed by refining, blending and hydrogenating processes. It is majorly used for cooking purposes and is a good source of vitamins and minerals providing major health benefits. The natural extracts of soybean oil are mainly isoflavones, lecithin and tocopherols.

The soy chemicals market report includes in-depth coverage of the industry, with estimates & forecast in terms of volume in tons and revenue in USD from 2013 to 2024, for the following segments:

By Product

- Soy oil derivatives

- By Product

- Soy polyols

- By Application

- Polyurethane products

- Adhesives

- Elastomers

- Coatings

- Others

- By Application

- Soy wax

- By Application

- Candles

- Cosmetics

- By Application

- Methyl soyate

- By Application

- Paints & coatings

- Industrial & domestic cleaning

- Printing inks

- Cosmetics & personal care

- Others

- By Application

- Epoxidized soybean oil

- By Application

- Paints & coatings

- Industrial & domestic cleaning

- Printing inks

- Cosmetics & personal care

- Others

- By Application

- Epoxidized soybean oil

- By Application

- Paints & coatings

- Industrial & domestic cleaning

- Printing inks

- Cosmetics & personal care

- Others

- By Application

- Soy polyols

- By Product

- Natural extracts

- By Product

- Soy isoflavones

- By Application

- Food & beverages

- Nutraceuticals

- Cosmetics

- Others

- By Application

- Vitamin E (Tocopherols)

- By Application

- Food & beverages

- Dietary supplements

- Animal feed

- Cosmetics

- Pharmaceuticals

- By Application

- Soy isoflavones

- By Application

- Food & beverages

- Animal feed

- Cosmetics

- Pharmaceuticals

- Industrial

- Others

- By Application

- Soy isoflavones

- By Product

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Poland

- Denmark

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Malaysia

- Thailand

- Latin America (LATAM)

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Frequently Asked Question(FAQ) :

What was the size of the global Soy Chemicals Market in 2017?

The Soy Chemicals Market in 2017 exhibited a revenue of 25 bn.

How is the Soy wax market expected to grow through 2024?

The soy wax market from candle applications is expected to register substantial gains at over 4% through 2024.

How is the global soy chemicals market anticipated to perform through 2024?

In 2017, the global soy chemicals market size exceeded USD 25 billion and expected to grow with a CAGR of 7.7% through 2024.

What factors will propel the growth of the global soy chemicals market size in the North American Region?

By 2024, the soy chemical market in North America is expected to witness a growth of over 5%. The rising trend of adopting biodiesel as compared to other counterparts will foster regional market growth.

Why will soy polyols as a product gain traction in the global soy chemicals market?

The soy polyols market segment is expected to grow over USD 1.9 billion by 2024. Their affordability, lightweight, durability, and sustainability will drive the growth of the global soy chemicals market size.

What will be the worth of the Soy Chemicals industry by the end of 2024?

The worth of Soy Chemicals Market is expected to reach a valuation of 44.5 bn by 2024.

Soy Chemicals Market Scope

Related Reports