Summary

Table of Content

Sodium Lauryl Ether Sulfate (SLES) Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sodium Lauryl Ether Sulfate Market Size

Sodium Lauryl Ether Sulfate (SLES) Market size was recorded at over $1 billion in 2015 growing at a CAGR above 5% by 2024. Growing awareness regarding cleanliness and hygiene all over the world will likely bolster the global market during the forecast timespan.

To get key market trends

To get key market trends

Sodium lauryl ether sulfate (SLES), also known as sodium laureth sulfate, is an anionic surfactant popularly used in detergents. Several government initiatives to clean public infrastructures such as railway stations, airports, etc., and increasing household detergents usage owing to escalating number of residential projects all over the globe will also augment the global SLES market growth. Global demand for household detergents was beyond 30 million tons in 2015 and will accelerate at over 5% CAGR in the forecast spell.

Sodium lauryl ether sulfate is known to be a skin, eye, and lung irritant and may contain carcinogenic substances such as 1,4-dioxane due to the manufacturing process. Other harmful by-products of the manufacturing process may include ethylene oxide, which too is carcinogenic in nature, according to the International Agency for Research on Cancer. U.S. FDA and the EPA monitor the product usage in personal care products and cleaners respectively, and this may restrain the sodium lauryl ether sulfate market growth in the coming years.

Sodium Lauryl Ether Sulfate Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2015 |

| Market Size in 2015 | 1 Billion (USD) |

| Forecast Period 2016 - 2024 CAGR | 5% |

| Market Size in 2024 | 1.5 Billion (USD) |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Sodium Lauryl Ether Sulfate Market Analysis

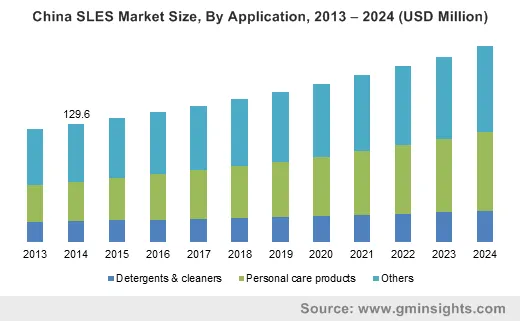

Based on applications, it is broadly categorized into detergents & cleaners, and personal care products apart from other uses such as medical, antimicrobial, and agricultural chemicals. Detergents & cleaners are the major application sector and generated more than $450 million for the overall sodium lauryl ether sulfate market share in 2015. Sodium laureth sulfate is an anionic surfactant with a strong amphiphilic base, making it compatible with both fat and water. The product is easily available and is a formidable stain remover, making it an accepted ingredient among detergent manufacturers.

Learn more about the key segments shaping this market

Personal care products application segment accounted for more than a quarter of the global SLES market and it includes consumer products such as creams, lotions, soaps, shampoos, body washes, facial cleansers, toothpastes, etc. Superior foaming and lathering properties of the product, due to which it wets the body surface, emulsifies the oil, and solubilizes soil, will have a positive influence on the global SLES market in the coming years. Malevolent impact of the product on human health may pose certain restraints on the sodium lauryl ether sulfate market.

In 2015, Europe sodium lauryl ether sulfate market was worth more than USD 250 million and it will likely flourish at more than 4.5% CAGR in the coming years. High living standards in the West European countries and consciousness about personal care and cleanliness will be the major drivers of the regional market. Personal care products in Europe generated over USD 100 million in 2015. The joining of the former communist nations in the European Union marked a significant industrial shift towards the eastern Europe, driving the demand for industrial detergents and cleaners in the region.

Asia Pacific accounted for over a third of the total market share in 2015 and is likely to register a CAGR of 5% through the forecast timeframe. Emerging economies of China, India, and Japan will catalyze the overall sodium lauryl ether sulfate market. Enhanced lifestyle and increasing purchase parity of the population along with increasing awareness about personal and institutional cleanliness will stimulate the overall sodium lauryl ether sulfate market in the coming years. Moreover, increasing urbanization and industrialization in the region will also augment the demand for detergents and cleaners.

Sodium Lauryl Ether Sulfate Market Share

Sodium lauryl ether sulfate market is fragmented with the presence of several multinational giants in the competitive landscape. Key product manufacturers include

- Croda International

- Evonik Industries

- Clariant Corporation

- Stepan Company

- BASF

- Huntsman Corporation

- Solvay

- The Dow Chemical Company

- Kao Corporation

- Galaxy Surfactants

- Godrej Industries

- Ho Tung Chemical

- Taiwan NJC Corporation

- Ultra Group

- Zhejiang Zanyu Technology

Sodium lauryl ether sulfate industry participants bank on extensive research & development programs and business partnerships to expand their product portfolio as well as to increase their production capacities in order to maintain their market positions. For instance, BASF opened a new R&D center in India and collaborated with several Asian universities to strengthen their focus on the emerging sodium lauryl ether sulfate market. Stepan Company, in March 2014, established a R&D center in Brazil to fortify their surfactants business.

Industry Background

The market is majorly driven by the increasing consumer awareness about personal hygiene and cleanliness. Growing commercialization of personal care products such as shampoos, soaps, body & face cleansers, etc., also has a positive impact on the global sodium lauryl ether sulfate market. Moreover, health benefits of residential as well as institutional cleanliness will also boost the market demand of the anionic surfactant in the coming years.

Health hazards associated with sodium lauryl ether sulfate may lead to product substitution by organic and bio-based ingredients in the developed nations, but its easy and economical availability and good foaming properties make it a lucrative additive for detergents and personal care products in the emerging regions.

Sodium Lauryl Ether Sulfate market research report includes in-depth coverage of the industry with estimates & forecast in terms of volume in kilo tons & revenue in USD million from 2013 to 2024, for the following segments:

By Application

- Detergents & cleaners

- Personal care products

- Others

The above information is provided on a regional and country basis for the following:

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Asia Pacific

- China

- India

- Japan

- Australia

- Indonesia

- Malaysia

- Latin America

- Brazil

- Mexico

- MEA

- South Africa

- GCC

Frequently Asked Question(FAQ) :

What are the key factors driving the market?

Increasing household detergents business and rising personal care products demand are major factors expected to drive the growth of global market.

Which are the top companies in the sodium lauryl ether sulfate industry?

Solvay S.A., Evonik Industries, Croda International, BASF SE, Huntsman Corporation, The Dow Chemical Company, Stepan Company, Clariant Corporation, Galaxy Surfactants Ltd., Kao Corporation, Godrej Industries, Ho Tung Chemical Corp., Taiwan NJC Corporation, Zhejiang Zanyu Technology Co. Ltd., Ultra Group are some of the top contributors in the industry.

Which application segment is expected to drive the market during the forecast period?

The detergents & cleaners application segment registered a major market value in 2015 and is projected to record a remarkable growth rate throughout the forecast period.

What will be the worth of global sodium lauryl ether sulfate market by the end of 2024?

According to the report published by Global Market Insights Inc., the SLES market is supposed to attain $1.5 billion by 2024.

What is the anticipated value of the Sodium Lauryl Ether Sulfate Market by the year 2020

Expected CAGR that Sodium Lauryl Ether Sulfate Market is estimated to register is 5.5% over 2020

What was the size of the global Sodium Lauryl Ether Sulfate industry in 2020

Sodium Lauryl Ether Sulfate Market was valued at USD 460 Million in 2020

Sodium Lauryl Ether Sulfate Market Scope

Related Reports