Summary

Table of Content

Smart Sensor Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Sensor Market Size

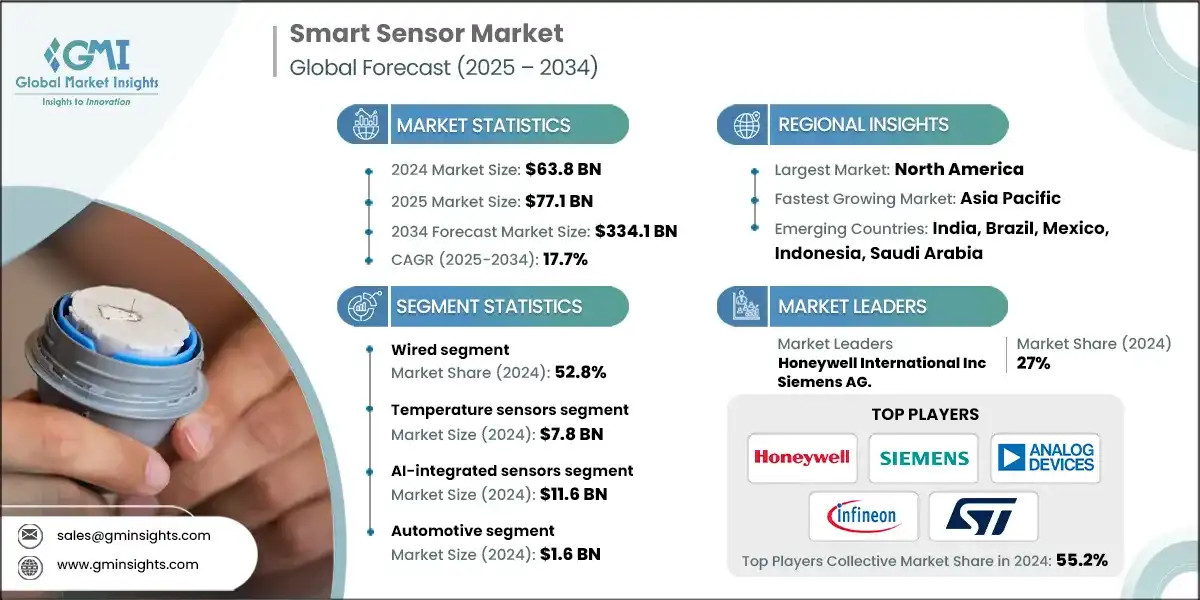

The global smart sensor market was valued at USD 63.8 billion in 2024. The market is expected to grow from USD 77.1 billion in 2025 to USD 172.6 billion in 2030 and USD 334.1 billion in 2034, growing at a CAGR of 17.7% during the forecast period of 2025-2034, according to Global Market Insights Inc.

To get key market trends

- The rapid proliferation of IoT-enabled architectural frameworks across industrial and commercial settings continues to serve as one of the principal engine-drivers for the expansion of the smart sensor market. Organizations are adopting predictive maintenance and persistent operational dashboards techniques whose success depends on advanced sensing technologies. To illustrate, Siemens has strengthened its condition-monitoring portfolio by integrating intelligent vibration and acoustic transducers into its industrial IoT platforms, enabling manufacturing sites to identify and address machine irregularities before they escalate. Similarly, Honeywell is refining its connected-building infrastructures by embedding temperature, humidity, and occupancy sensors into an integrated network, advancing the objective of superior energy efficiency. These patented frameworks are aligned with the smart-city initiatives being championed across North American and European jurisdictions.

- The automotive sector continues to function as a pivotal catalyst for systemic transformation, especially at the intersection of electrification and automated control. State-of-the-art intelligent transducer subsystems aligning multicores-layer LiDAR micro-hybrid guidance, MEMS diagnostic sensors imbued with robust command-and-control architectures, and hyper-sensitive nanoparticle pressure sensors have collectively redefined the boundaries of collision-avoidance redundancy, augmented energy harvesting through optimized regenerative braking, and programmed supervisory intelligence for context-specific operating envelopes.

- In disclosures published in 2024, Robert Bosch GmbH announced the forthcoming roll-out of a miniaturized, ultrahigh-precision MEMS inertial module that integrates three orthogonal axes of acceleration and gyroscope sensing, designed to sustain deterministic error margins at SAE automation levels 4 and 5, thereby reiterating a policy of intentional, capacity-constrained, high-rate manufacturing. Simultaneously, Tesla and a consortium of ten Tier 1 and prospective OEMs are intensifying the vertical integration of 3D and temperature LiDAR, MEMS gyroscope and capacometer stacks, and battery cell spectroscopy, all aimed at hierarchically minimizing incident energy and safety excursion energy. Industry-specific statutory frameworks are enforcing this technological cadence; the European Commission's (EC) General Safety Regulation, now ratified to phase in by 2025, requires adaptive cruise control, lane-keeping, and autonomous emergency braking, each predicated on multi-phenomena sensor fusion, thus catalyzing a concomitant surge in MEMS volume requirements and design tolerances.

- Life sciences and healthcare technology remain fundamental engines of long-term economic expansion, propelled in particular by the rapid uptake of wearable physiological analytics and intelligent diagnostic platforms. During 2023, Medtronic unveiled a suite of miniature, implantable biosensors designed for continuous, unrestricted monitoring of core vital-sign parameters. Concurrently, Abbott expanded its FreeStyle Libre portfolio by integrating advanced, Bluetooth-enabled glucose-sensing technology that pairs directly with smartphones, thereby offering enhanced, real-time analytics for precision diabetes management. Also, Asia-Pacific governments are supplementing public health strategy with substantial capital infusions aimed at modernizing their hospital infrastructures, funding the deployment of wireless sentinel biosensors paired with artificial-intelligence-enabled surveillance and alert-generating platforms. The COVID-19 pandemic had already entrenched a societal expert consensus on the strategic value of continuous, cloud-based diagnostics and diffused monitoring—this aggregation of demand and technical capacity has endured rather than dissipated.

- Moreover, public-sector capital flows into energy, transportation, and environmental surveillance suddenly widen the aperture for smart-sensing platforms. The U.S. Department of Energy, for instance, is anchoring smart-grid modernization pilots that hinge on networked flow and pressure sensors governing supply in real time. In parallel, Europe’s flagship renewable portfolios are embedding distributed fiber-optic sensors for continuous integrity checks on wind and solar structures. Across India and Latin America, smart-agriculture programs are rolling out in-situ soil-moisture and meteorological arrays to elevate crop performance. These intentional, policy-anchored expenditures are multiplying use-case boundaries and are simultaneously compelling providers to advance wireless protocols, energy harvesting modalities, and AI-enhanced sensing architectures.

- Based on technology, in 2024 the segment is divided into quantum sensors, AI-integrated sensors, advanced MEMS, photonic & optical advanced, bio-integrated sensors, edge computing integration, cybersecurity-hardened sensors and others. Advanced MEMS sector recorded revenues of USD 7.9 billion in 2024. Advanced MEMS (Micro-Electro-Mechanical Systems) sensors are witnessing strong growth as they enable high-precision, miniaturized sensing for applications in automotive safety systems, medical diagnostics, consumer electronics, and industrial automation. Their ability to integrate multiple functions such as motion, pressure, and pressure and mechanical sensing into compact low-power devices makes them essential for IoT and wearable technologies.

- In 2024, North America dominated the smart sensor market with a 34.2% share. In North America, growth in the market is driven by strong adoption in automotive ADAS, industrial automation, and healthcare wearables. The region benefits from early IoT deployment, advanced R&D ecosystems, and government support for smart infrastructure. Increasing investments in connected vehicles and smart cities further amplifies sensor demand.

Smart Sensor Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 63.8 Billion |

| Market Size in 2025 | USD 77.1 Billion |

| Forecast Period 2025 - 2034 CAGR | 17.7% |

| Market Size in 2034 | USD 334.1 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Automotive Sensor Adoption | Drives approximately 30% of smart sensor market demand, supported by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous vehicles, and electric vehicles requiring MEMS, LiDAR, and optical sensors. |

| Healthcare & Wearables | Contributes around 25% to market growth, fueled by remote patient monitoring, wearable devices, biosensors, and diagnostic applications responding to telemedicine and personalized healthcare needs. |

| Industrial Automation & Industry 4.0 | Expected to account for 18% of growth, enabled by smart manufacturing, predictive maintenance, AI-based condition monitoring, and IoT-enabled sensors integrated into industrial systems. |

| IoT & Smart Infrastructure | Projected to drive 12% of growth, supported by connected homes, smart cities, environmental monitoring, and energy management applications requiring wireless and multi-parameter sensors. |

| Advanced Technology Integration | Forecasted to contribute approximately 15%, driven by the adoption of AI-enabled sensors, edge computing, quantum sensors, and photonic/optical sensors for precision applications in automotive, industrial, and healthcare sectors. |

| Pitfalls & Challenges | Impact |

| High Implementation and Integration Costs | Deployment of advanced sensors, AI-enabled systems, and edge computing devices can be costly, limiting adoption in cost-sensitive regions or smaller enterprises. |

| Market Fragmentation & Interoperability | Multiple sensor types, communication protocols, and technology standards create integration challenges, hindering seamless adoption across platforms and industries. |

| Opportunities: | Impact |

| Expansion in Emerging Applications | Growing adoption in autonomous vehicles, smart factories, wearable healthcare devices, and precision agriculture opens high-value markets for specialized sensors. |

| AI & Edge Computing Integration | Advanced AI algorithms, edge analytics, and sensor fusion improve responsiveness, accuracy, and real-time decision-making, enabling next-generation industrial automation, healthcare monitoring, and smart infrastructure solutions. |

| Market Leaders (2024) | |

| Market Leaders |

Top two companies hold 27% market share |

| Top Players |

Collective market share in 2024 is 55.2% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, Brazil, Mexico, Indonesia, Saudi Arabia |

| Future outlook |

|

What are the growth opportunities in this market?

Smart Sensor Market Trends

- Smart sensors are steadily evolving into indispensable elements of industrial automation by offering not only high-resolution data acquisition but also embedded algorithmic processing and uniformly supported networking. These features enable continuous monitoring, predictive maintenance, and adaptive process control functions now regarded as essential rather than optional. Major automation suppliers such as ABB and Schneider Electric are integrating AI-empowered sensors within their control architectures to reduce unplanned downtime and enhance energy efficiency. The industry 4.0 agenda further accelerates this shift, encouraging manufacturing organizations worldwide to transition from reactive approaches to autonomous, data-driven operations.

- Current smart city programs are strategically widening the demand for networked sensing infrastructures by integrating such systems into the institutional architecture of urban governance. Use cases that optimize traffic dynamics, monitor ambient air quality, enhance energy consumption, and improve public safety response collectively demonstrate the pervasive relevance of sensing devices across civic functions. Joint initiatives involving Cisco, Honeywell, and multiple municipal authorities in Asia and the Middle East provide concrete examples of how smart technologies are being operationally embedded into municipal infrastructure at significant scale. Supporting these initiatives, the Horizon Europe framework is directing sizable resources toward urban sensor pilots, specifically to accelerate the commercial roll-out of connected devices designed to deliver energy savings, low maintenance, and longevity within the challenging urban context.

- Current frameworks for the design and deployment of sensor networks are systematically embedding sustainability metrics into the overarching strategic architecture. Manufacturers are now favoring topologies defined by extremely low power obligations, localized energy-harvesting capabilities, and an explicit commitment to substrates amenable to recyclability. Representative developments include Texas Instruments recently unveiled low-power sensor ensembles that substantially prolong operational lifetime and STMicroelectronics’s series of ultra-low-power MEMS sensors, tailored specifically for wearable and Internet of Things platforms. Concurrently, heightened regulatory frameworks in major global jurisdictions are mandating tighter environmental compliance, thus compelling firms to synchronize their engineering roadmaps with prevailing climate and sustainability imperatives.

Smart Sensor Market Analysis

Learn more about the key segments shaping this market

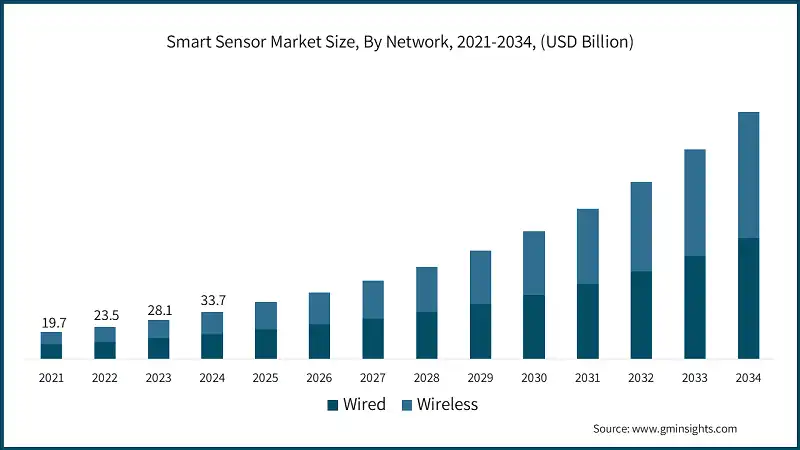

Based on network, the smart sensor market is divided into wired and wireless.

- In 2024, the wired segment commanded the largest share of 52.8% of the global smart-sensor market. Wired sensors dominate the network segment, driven by IoT proliferation and the growing need for remote monitoring and control across industries. These sensors offer installation flexibility, scalability, and enable data collection in hard-to-reach or distributed environments, making them ideal for smart cities, industrial IoT, and environmental monitoring.

- Manufacturers should invest in LPWAN- and 5G-enabled wireless sensors with low power consumption and robust security. Providing interoperable platforms that support multiple protocols will help capture diverse use cases. Additionally, offering sensor integration with cloud and edge computing platforms can increase appeal to enterprise and municipal customers.

- The wireless sensors segment will record a sharp increase in the compound annual growth rate (CAGR), estimated at 18.6% from 2025 to 2034. Wireless sensors integrated with edge computing capabilities are growing rapidly, as they allow on-device data processing, reduce latency, and support real-time analytics for industrial automation, autonomous vehicles, and smart infrastructure.

- Sensor developers should focus on embedding AI and edge computing capabilities within devices to offer actionable insights directly from the sensor. Collaborating with IoT and AI platform providers can enhance functionality, while designing scalable and secure edge-enabled solutions will meet increasing demand in high-speed, data-intensive applications.

Learn more about the key segments shaping this market

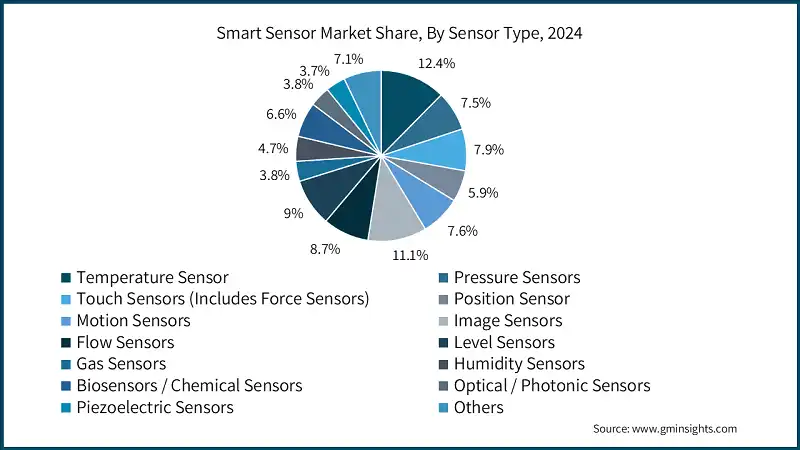

Based on sensor type, the smart sensor market is segmented temperature sensors, pressure sensors, touch sensors (includes force sensors), position sensors, motion sensors, image sensors, flow sensors, level sensors, gas sensors, humidity sensors, biosensors/chemical sensors, optical/photonic sensors, piezoelectric sensors and others.

- The temperature sensors sector recorded revenues of USD 7.8 billion in 2024. Their broad adoption across industrial automation, healthcare, and smart homes underscores their critical role in process monitoring, energy optimization, and safety systems. Companies and infrastructure projects continue to demand high-accuracy temperature sensing to ensure operational efficiency and reliability.

- Manufacturers should focus on improving sensor accuracy, reliability, and integration capabilities. Developing multi-parameter sensors that combine temperature with humidity or pressure monitoring can increase value for industrial and commercial clients. Additionally, providing solutions compatible with IoT platforms and wireless connectivity will enhance adoption in smart building and industrial automation projects.

- The smart sensor market from image sensors sector is expected to witness the communication technology segment expanding at a compound annual growth rate of 22% during the period 2025 to 2034. Image sensors, particularly CMOS-based, are the fastest-growing segment, driven by advancements in resolution, sensitivity, and low-light performance. In 2024, their adoption surged across applications such as smartphones, automotive cameras, industrial inspection, and IoT-based surveillance, highlighting their increasing importance in both consumer and industrial markets.

- Sensor manufacturers should prioritize high-resolution, low-power designs and explore integration with AI-based image processing to deliver more intelligent sensing solutions. Partnering with automotive, consumer electronics, and industrial OEMs can accelerate deployment, while modular solutions that combine image sensors with motion or thermal sensing will expand the potential market.

Based on technology, the smart sensor market is segmented into quantum sensors, AI-integrated sensors, advanced mems, photonic & optical advanced, bio-integrated sensors, edge computing integration, cybersecurity-hardened sensors, and others.

- The AI-integrated sensors segment dominated the market in 2024 with a valuation of USD 11.6 billion, driven by the increasing reliance on cloud-based platforms for processing and analyzing vast amounts of transportation data. AI-Integrated sensors are the largest segment within advanced technology, enabling real-time data processing, predictive analytics, and autonomous decision-making. They are widely used in industrial automation, healthcare diagnostics, and smart city applications, where on-device intelligence improves operational efficiency and responsiveness.

- Manufacturers should focus on embedding AI capabilities directly into sensor hardware to provide actionable insights at the edge. Developing modular solutions compatible with existing IoT platforms and collaborating with software providers will enhance adoption across industrial, healthcare, and infrastructure applications.

- The edge computing integration in smart sensor infrastructure is projected to grow at a robust CAGR of 20% over the forecast period. Sensors with integrated edge computing are experiencing the fastest growth. By processing data locally, they reduce latency, minimize bandwidth usage, and support time-critical applications such as autonomous vehicles, industrial robotics, and smart manufacturing.

- Manufacturers should prioritize low-latency, energy-efficient edge-enabled designs capable of performing complex computations on-device. Partnerships with AI and cloud platform providers can ensure seamless integration, and offering multi-parameter edge sensors will address high-performance industrial and automotive applications.

Based on end-use industry, the smart sensor market is segmented into commercial/industrial building, residential building/smart homes, consumer electronics, automotive, oil & gas, aerospace & defense and others.

- The automotive segment dominated the market, accounting for USD 1.6 billion in 2024. Automotive remains the largest end-use industry for smart sensors, driven by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous vehicles, and electric vehicles. Sensors such as LiDAR, CMOS image sensors, pressure sensors, and MEMS devices are critical for safety, navigation, battery monitoring, and vehicle performance optimization. Regulatory mandates on vehicle safety and emissions across North America, Europe, and Asia are further boosting sensor integration in modern vehicles.

- Manufacturers should focus on developing automotive-grade sensors with high reliability, durability, and real-time performance. Emphasizing multi-sensor integration, low-power designs, and seamless compatibility with ADAS and EV platforms will strengthen adoption. Collaboration with OEMs and Tier-1 suppliers can accelerate deployment and provide tailored solutions for evolving vehicle safety and electrification requirements.

- The healthcare segment is projected to grow at a strong CAGR of 15.1% during the forecast period. Healthcare is currently the fastest-growing end-use industry for sensors, particularly driven by wearable health devices, remote patient monitoring, and diagnostic systems. Continuous monitoring of vital signs, glucose levels, and other physiological parameters is creating strong demand for biosensors, optical sensors, and wireless connectivity solutions. The global shift toward telemedicine, personalized healthcare, and early disease detection is further accelerating sensor adoption in hospitals, clinics, and home care settings.

- Manufacturers should prioritize biocompatible, miniaturized, and wireless-enabled sensors suitable for wearable and implantable devices. Integrating AI-based analytics for predictive health insights can increase device value. Partnerships with healthcare providers, hospitals, and medical technology companies will help optimize sensor performance, compliance, and clinical validation, facilitating faster adoption in both consumer and professional healthcare markets.

Looking for region specific data?

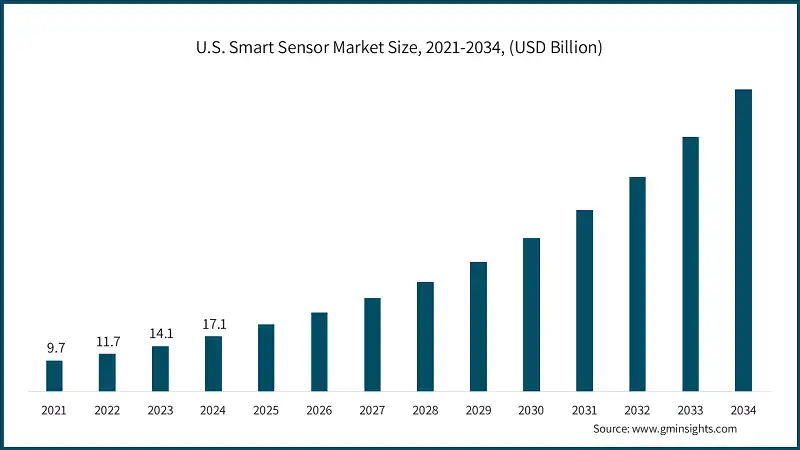

The North America smart sensor market accounted for USD 21.8 billion in 2024. North America is experiencing significant growth in the automotive sensor market, driven by the increasing adoption of advanced driver-assistance systems (ADAS), autonomous vehicles, and electric vehicles. Sensors are critical for vehicle safety, navigation, and battery management, while regulatory mandates on safety and emissions further support market expansion.

- In 2024, the U.S. smart sensor market reached a valuation of USD 17.2 billion. The U.S. sensor market is witnessing rapid growth in healthcare, particularly in wearable medical devices, remote patient monitoring, and diagnostic applications. The rise of chronic diseases and the shift towards telemedicine are major factors driving demand, with hospitals and clinics increasingly adopting sensor-enabled solutions.

- Manufacturers should focus on creating biocompatible, miniaturized sensors suitable for continuous health monitoring and diagnostic applications. Integrating AI-based analytics into these devices can improve patient care by providing actionable health insights in real-time.

- The Canada smart sensor market is projected to grow at a CAGR of 17.1% during the forecast period. Canada’s sensor market is expanding in industrial automation, driven by the adoption of smart manufacturing and Industry 4.0 initiatives. Sensors are vital for process optimization, predictive maintenance, and energy efficiency, enabling manufacturers to improve productivity and reduce operational costs.

- Manufacturers should focus on producing industrial sensors that are reliable, durable, and capable of operating in harsh environments. Real-time data collection and integration with factory automation platforms can enhance decision-making and predictive maintenance capabilities.

Europe smart sensor market is projected to grow at a CAGR of 17.2% during 2025–2034. The Europe sensor market is experiencing strong growth in automotive applications, with demand fueled by ADAS and autonomous vehicles. Stricter safety regulations and carbon emission reduction targets are driving the integration of advanced sensors into vehicles.

- The UK market is projected to reach USD 2.8 billion by 2024. The UK sensor market is growing in healthcare, particularly in remote patient monitoring and diagnostic applications. The NHS’s emphasis on digital health solutions and the increasing adoption of telemedicine are key growth drivers, creating demand for reliable, connected sensing devices.

- Manufacturers should develop sensor-based telehealth solutions that enable real-time monitoring and consultation, focusing on usability and patient comfort. Integrating AI analytics can provide early detection and predictive health insights, enhancing healthcare outcomes.

- The Germany smart sensor market accounted for USD 2.9 billion in 2024, Germany’s sensor market is expanding in the automotive sector, driven by demand for ADAS and autonomous vehicle features. The country’s automotive industry is a global leader, and innovation in sensor technology is critical to support vehicle safety and electrification initiatives.

- Manufacturers should invest in advanced R&D to develop high-precision, reliable sensors for autonomous driving, collision avoidance, and battery management. Collaborating with automotive OEMs ensures that sensors meet stringent German engineering standards and integrate seamlessly with vehicles.

Asia Pacific accounted for 19.6% of smart sensor market in 2024, Asia Pacific is experiencing rapid growth in automotive sensors, led by countries like China, Japan, and South Korea. The adoption of ADAS, autonomous vehicles, and electric vehicles is driving demand, supported by strong automotive manufacturing infrastructure and technology investment.

- The China smart sensor market is expected to grow at a CAGR of 20.8% during the forecast period 2025–2034. China’s healthcare sensor market is rapidly growing, driven by wearable devices and remote patient monitoring. Government initiatives to improve healthcare infrastructure, combined with high smartphone penetration, are accelerating adoption of connected medical sensors.

- Manufacturers should focus on creating affordable, scalable sensor solutions suitable for large populations and diverse healthcare needs. Collaborating with hospitals, clinics, and wearable device providers ensures products align with local healthcare requirements.

- Japan smart sensor market is expected to reach USD 11 billion by 2034, Japan’s sensor market is expanding in automotive applications, fueled by investments in ADAS and autonomous vehicles. Government support for self-driving technology and the presence of leading automotive OEMs drive demand for high-performance sensors.

- Manufacturers should invest in R&D to develop precise, durable sensors capable of supporting autonomous driving, battery management, and safety features. Collaborations with Japanese OEMs enable integration into advanced vehicle platforms.

The Latin America smart sensor market was valued at USD 4.7 billion in 2024. Latin America sensor market is growing in healthcare, driven by wearable medical devices and remote patient monitoring. Rising prevalence of chronic diseases and demand for accessible healthcare solutions are key growth drivers.

The Middle East & Africa (MEA) smart sensor market is anticipated to reach USD 22.7 billion by 2034. MEA’s sensor market is expanding in healthcare applications, including wearable devices and remote patient monitoring. Governments’ focus on digital health solutions and improving healthcare infrastructure drives demand.

- The UAE smart sensor market is projected to grow at a CAGR of 14.3% during the forecast period (2025–2034). The UAE’s healthcare sensor market is growing rapidly, fueled by digital health initiatives and adoption of wearable devices. Advanced healthcare infrastructure and government innovation programs support sensor deployment.

- Manufacturers should create state-of-the-art sensors that integrate seamlessly with UAE digital health platforms. Collaborating with healthcare providers and hospitals will enable effective deployment and utilization.

- The Saudi Arabia smart sensor market accounted for USD 2 billion in 2024. Saudi Arabia’s sensor market is expanding in healthcare, driven by remote patient monitoring, diagnostics, and the Vision 2030 initiative to modernize healthcare services. Increasing demand for digital healthcare solutions is supporting growth.

- Manufacturers should develop scalable sensor solutions suitable for deployment across healthcare facilities nationwide. Ensuring interoperability with existing healthcare systems will facilitate adoption.

Smart Sensor Market Share

- The global market in 2024 is notably concentrated among a handful of leading players, with Honeywell International Inc., Siemens AG, Analog Devices Inc., Infineon Technologies AG, and STMicroelectronics together accounting for nearly 55% of the market share. These companies drive growth through diverse portfolios spanning automotive, healthcare, industrial automation, consumer electronics, and IoT-based applications. Their leadership is underpinned by strong R&D pipelines, integration of AI and edge computing in sensors, and expansion into high-demand areas such as autonomous vehicles, Industry 4.0 systems, and wearable health monitoring. Continuous innovation in MEMS, photonic, and multi-parameter sensors remains a unifying growth driver for these leaders, enabling them to strengthen market positions while addressing emerging demands in connected infrastructure and digital transformation.

- Honeywell International Inc. held the largest share at 14.3% in 2024, supported by its strong presence in industrial automation, aerospace, and building automation systems. Its growth is fueled by demand for environmental, pressure, and occupancy sensors integrated into smart cities, predictive maintenance systems, and connected healthcare. Honeywell’s focus on IoT-enabled sensor platforms and cybersecurity-enhanced sensor solutions further strengthens its competitive advantage.

- Siemens AG captured 12.7% of the market in 2024, driven by its integration of smart sensors into industrial automation, energy management, and transportation systems. The company leverages its leadership in Industry 4.0 and digital twin solutions, where smart sensors enable predictive analytics and operational efficiency. Siemens’ expansion into smart grid and renewable energy applications has also been a catalyst for sustained smart sensor market growth.

- Analog Devices, Inc. accounted for 10.2% of the 2024 market, with a strong portfolio in MEMS sensors, signal processing, and automotive-grade solutions. ADI’s growth is underpinned by rising demand in autonomous driving, EV battery monitoring, and precision healthcare devices. Its expertise in sensor fusion and low-power ICs allows Analog Devices to cater to the growing need for high-performance, energy-efficient smart sensors.

- Infineon Technologies AG held a 9.2% share in 2024, supported by its dominance in automotive and industrial sensors, particularly radar, pressure, and MEMS microphones. Infineon has been a key beneficiary of the surge in ADAS, autonomous mobility, and electrification trends, while also targeting growth in IoT security-enabled sensors. Its acquisition-driven strategy has expanded its presence in connectivity and smart sensor ecosystems.

- STMicroelectronics secured an 8.8% market share in 2024, with its growth driven by consumer electronics, industrial automation, and healthcare applications. The company is a leader in MEMS accelerometers, gyroscopes, and environmental sensors, widely used in wearables, smartphones, and smart home devices. STMicroelectronics’ focus on miniaturization, low power consumption, and AI-embedded sensors positions it as a critical enabler of next-generation IoT and wearable ecosystems.

Smart Sensor Market Companies

The major companies operating in the smart sensor industry are:

- Global Players

- Honeywell International Inc.

- Siemens AG

- Analog Devices, Inc.

- Infineon Technologies AG

- STMicroelectronics

- Regional Market Champions

- DENSO CORPORATION

- Bosch Sensortec GmbH

- TE Connectivity

- NXP Semiconductors

- OmniVision Technologies, Inc.

- Emerging Technology Innovators

- PixArt Imaging Inc.

- Aeva Technologies

- Oura Health Ltd.

- Myriota

- LiXiA

- Specialized Solution Providers

- Advantech Co., Ltd.

- Raritan Inc.

- Alpha MOS

- Figaro Engineering Inc.

- BorgWarner Inc.

- Leading firms in the smart sensor market landscape comprise Honeywell International Inc., Siemens AG, Analog Devices, Inc., Infineon Technologies AG, and STMicroelectronics. Their command of the sector is sustained by extensive global reach, broad and complementary product families, and sustained investment in applied and product-oriented research. Present in the automotive, industrial automation, healthcare, and consumer electronics domains, they continue to roll out next-generation technologies including Micro-Electro-Mechanical Systems (MEMS), AI-augmented sensing nodes, and devices endowed with on-device computation and storage resources. Deep-embedded, long-standing customer relationships, coupled with robust collaborations with original equipment manufacturers and observance of global and sector-specific regulatory frameworks, afford these firms sustained stance and substantial global share.

- DENSO CORPORATION, Bosch Sensortec GmbH, TE Connectivity, NXP Semiconductors, and OmniVision Technologies, Inc. represent the immediately subsequent tier. Each maintains solid, if regionally concentrated, leverage yet registers marginally lower global share or breadth of offering. Their strategic briefing centres on automotive, industrial, and consumer markets; they typically proliferate the innovations pioneered by the tier-one incumbents, and they progressively introduce selective offerings to growth geographies. To widen geographic reach and erode incumbents' positions, these firms cultivate long-standing strategic alliances, rationalise and augment manufacturing capabilities, and fortify global distribution architectures.

- Among the newer entrant cohort, firms including PixArt Imaging Inc., Aeva Technologies, Oura Health Ltd., Myriota, and LiXiA have been designated challengers. These organizations leverage cutting-edge engineering, retain a lean operational structure, and channel resources into differentiated domains such as artificial intelligence-facilitated imaging, LiDAR, physiological wearables, and Internet-of-Things connectivity for remote diagnostics. Though current global shares remain limited, their projection trajectories indicate an ability to eclipse incumbent competitors by fielding precise, superior-engineered assets and by harnessing emerging technologies toward narrowly fortified, rapidly expanding smart sensor market subsectors.

- Alternatively, narrowly focused solution developers such as Advantech Co., Ltd., Raritan Inc., Alpha MOS, Figaro Engineering Inc., and BorgWarner Inc. confine activity to designated vertical markets. Each entity concentrates on bespoke use cases including industrial Internet, environmental surveillance, alimentary integrity measurement, gaseous species analysis, and vehicle emission control. Despite registering less extensive aggregate shares, cumulative specialization enables the layout, manufacture, and servicing of finely calibrated offerings that align with stringent enterprise specifications, frequently operating synergistically with broader distributive vendors and reinforcing their tier-one architectures without direct contention.

Smart Sensor Industry News

- In June 2023, Honeywell announced the DG Smart Sensor as a solution designed to enhance the efficiency and reliability of monitoring and controlling low-pressure combustion air and fuel gases. The product provided precise monitoring capabilities and aligned with digitalization trends under Industry 4.0, offering opportunities to improve combustion system performance and transform operational dynamics for OEMs, end users, and system integrators.

- In January 2025, At CES in Las Vegas, Bosch Sensortec showcased its AI-enabled sensors that combine MEMS, embedded microcontrollers, and AI to deliver smarter functionality. CEO Stefan Finkbeiner noted that these solutions supported applications in consumer health, smart homes, and smart cities, with AI and intelligent software as the core enablers.

- In October 2021, ABB launched its FusionAir Smart Sensor, a touch-free room sensor equipped with optional controls to monitor temperature, humidity, CO2, and VOCs, aimed at enhancing indoor air quality and reducing viral exposure risks.

This smart sensor market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) from 2021 to 2034, for the following segments:

Market, By Sensor Type

- Temperature Sensor

- Pressure Sensors

- Touch Sensors (Includes Force Sensors)

- Position Sensor

- Motion Sensors

- Image Sensors

- Flow Sensors

- Level Sensors

- Gas Sensors

- Humidity Sensors

- Biosensors / Chemical Sensors

- Optical / Photonic Sensors

- Piezoelectric Sensors

- Others

Market, By Network

- Wired

- Wireless

Market, By Technology

- Quantum Sensors

- AI-Integrated Sensors

- Advanced MEMS

- Photonic & Optical Advanced

- Bio-Integrated Sensors

- Edge Computing Integration

- Cybersecurity-Hardened Sensors

- Others

Market, By End Use

- Commercial/Industrial Building

- Residential Building/Smart Homes

- Consumer Electronics

- Automotive

- Oil & Gas

- Aerospace & Defense

- Others

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Which region leads the smart sensor market?

In 2024, the U.S. market reached USD 17.2 billion. Growth is fueled by rapid adoption in healthcare wearables, remote patient monitoring, and diagnostic applications, supported by rising telemedicine and chronic disease management initiatives.

What are the upcoming trends in the smart sensor market?

Key trends include AI and edge computing integration, proliferation of IoT-enabled sensor networks, sustainability-focused low-power designs, and growing adoption in autonomous vehicles, healthcare devices, and smart city projects.

Who are the key players in the smart sensor industry?

Leading players include Honeywell International Inc., Siemens AG, Analog Devices Inc., Infineon Technologies AG, and STMicroelectronics, along with Bosch Sensortec, NXP Semiconductors, TE Connectivity, and OmniVision Technologies.

What is the growth outlook for edge computing–integrated sensors from 2025 to 2034?

Edge-enabled sensors are projected to grow at a 20% CAGR through 2034.

What was the valuation of AI-integrated sensors in 2024?

AI-integrated sensors recorded USD 11.6 billion in 2024, leading the technology segment due to demand for real-time analytics and autonomous decision-making in industrial and healthcare sectors.

What is the projected value of the smart sensor market by 2034?

The smart sensor market is expected to reach USD 334.1 billion by 2034, supported by IoT proliferation, AI-integrated sensors, and rapid deployment of smart infrastructure.

How much revenue did the advanced MEMS technology segment generate in 2024?

Advanced MEMS sensors generated USD 7.9 billion in 2024, driven by their miniaturized precision sensing applications in automotive safety, medical diagnostics, and consumer electronics.

What is the current smart sensor market size in 2025?

The market size is projected to reach USD 77.1 billion in 2025.

What is the market size of the smart sensor industry in 2024?

The market size was USD 63.8 billion in 2024, with a CAGR of 17.7% projected through 2034, driven by adoption in automotive sensors, industrial automation, and healthcare wearables.

Smart Sensor Market Scope

Related Reports