Summary

Table of Content

Smart Pet Collar Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Pet Collar Market Size

Smart Pet Collar Market size was valued at USD 1.9 billion in 2023 and is estimated to register a CAGR of over 12% between 2024 and 2032, driven by increasing pet ownership worldwide.

To get key market trends

This rise in pet ownership is influenced by a combination of social, demographic, and economic factors, as well as advancements in pet care technology that cater to people's evolving lifestyles and preferences. In addition, other factors contributing to increasing pet ownership include enhancement of household security, companionship, emotional support, and social media led by pet influencers. According to the American Veterinary Medical Association (AVMA), in 2022, 44.6% of households in the U.S. owned at least one pet dog. This number has jumped drastically from the previous years, owing to rising pet ownership driven by pet influencers on social media. As a result of, rising pet ownership has contributed to an increased demand for smart pet collars to enhance their security and overall well-being.

Smart Pet Collar Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2023 |

| Market Size in 2023 | USD 1.9 Billion |

| Forecast Period 2024-2032 CAGR | 12% |

| Market Size in 2032 | USD 5.4 Billion |

| Key Market Trends | |

| Growth Drivers |

|

| Pitfalls & Challenges |

|

What are the growth opportunities in this market?

Further, urbanization trends and changing lifestyles, which often involve busy schedules and smaller living spaces, are driving the need for products that help monitor pets remotely and ensure their safety when outdoors. With the rise of smart home technology, pet owners are increasingly looking for integrated solutions that allow them to keep an eye on their pets through their smartphones. Additionally, the growing awareness of pet health and well-being is encouraging owners to invest in smart collars equipped with GPS tracking, activity monitoring, and health tracking features. These advancements provide peace of mind and make them more appealing to pet owners, thus contributing to the overall growth of the market.

Smart pet collars often come with advanced technology such as GPS tracking, health monitoring sensors, and communication features, which can make them expensive. high cost can limit their adoption among price-sensitive consumers. For instance, implementing GPS technology involves integrating sophisticated hardware components (GPS receiver, antennas) and software algorithms to process satellite signals and calculate location coordinates.

In addition, incorporating wireless communication technology requires additional hardware (such as transceivers), software development for data transmission protocols, and costs associated with data transmission and storage. Depending on the type of communication technology used (e.g., cellular data plans), there may also be recurring service fees. Thus, the cost of these components and the associated technology development adds to the overall cost of the smart collar which leads to higher retail costs which can further hinder the adoption of smart collars.

Smart Pet Collar Market Trends

There is an increasing demand for smart pet collars with advanced health monitoring capabilities beyond basic activity tracking. This includes real-time monitoring of vital signs such as heart rate, respiratory rate, and temperature. Additionally, the Integration of artificial intelligence and machine learning algorithms to analyze health data and provide actionable insights to pet owners and veterinarians has become more prevalent in the last few years. For instance, in June 2023, Whistle Labs introduced a new smart pet collar product SKU called Health 2.0 Smart Device, which aids in monitoring the weight of the pet. It also helps in spotting skin and allergy symptoms. The device also keeps the vet doctors informed about the overall well-being of the pet.

Moreover, features such as behavioral training aids (e.g., remote sound/vibration cues) are gaining popularity as pet owners seek ways to positively influence their pets' behavior through technology.

Smart Pet Collar Market Analysis

Learn more about the key segments shaping this market

Based on technology, the market is divided into RFID Devices, GPS, Sensors, and Bluetooth. In 2023, the GPS segment accounted for a market share of around 50%. This technology is dominant among all technologies in the market primarily, due to its unique capabilities and advantages for pet tracking and location monitoring. It provides highly accurate and precise location-tracking capabilities.

Further, this technology can pinpoint the exact geographic coordinates of a pet, typically within a few meters. The accuracy level is crucial for quickly locating pets in real-time, in case of being lost or wandering during emergencies. are lost, wandering, or in an emergency. As a result, many smart pets collar manufacturers are integrating GPS technology into their smart collars as a basic requirement in the product

For instance, in March 2022, Waldo Pet GPS Smart Collar announced that it is aiming to launch its advanced GPS-based smart pet collar in Q4 of 2024. This would come with extended battery life of up to 7 days, thus making it more appealing to the customers.

Learn more about the key segments shaping this market

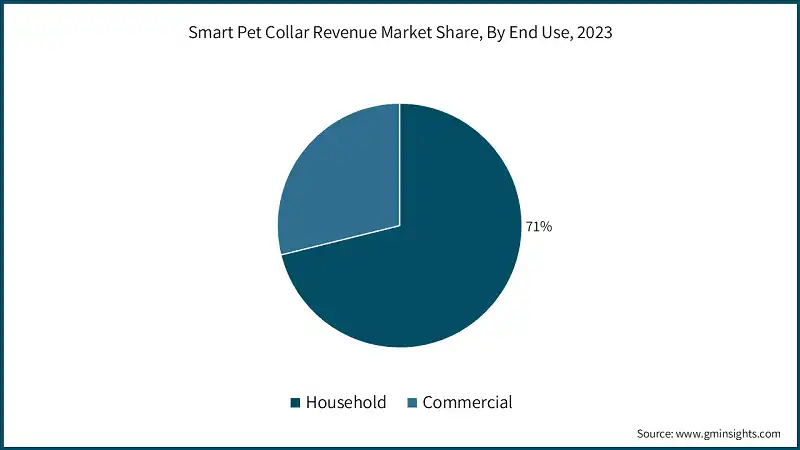

Based on end use, the smart pet collar market is categorized into household and commercial. In 2023, the household segment accounted for a market share of around 71% and is projected to grow by 2032. Household segments comprise of pet owners which account for the majority of demand for smart pet collars with the objective of location tracking and health monitoring. In addition, smart pet collars aid in training assistance that helps with household pets with behavioral correction.

Further, household pet spending has been increasing significantly which has resulted in traction and increasing sales of the market. For instance, according to the American Pet Products Association, in 2022, the U.S. households spent USD 136.8 billion on their pets, rising by nearly 11% from 2021. Thus, household segments are anticipated to occupy a larger market share in the coming years.

Looking for region specific data?

North America dominated the global smart pet collar market with a major share of over 50% in 2023, owing to several factors such as higher pet ownership rates, strong economic conditions, favorable consumer demographics, technological advancements, and the presence of effective distribution networks. According to APPA, nearly 66% of U.S. households i.e. 86.9 million homes own a pet which is up from 56% in 1988. Additionally, tech-savvy millennials are contributing to the sales of smart pet collars in North America owing to higher consumer and product awareness. Notably, as per the APPA data, Millennials make up the largest percentage of current pet owners (33%), followed by Gen X (25%) and baby boomers (24%).

The APPA data also reveals that between 2018 and 2022, the amount spent on pets in the U.S. increased by 51.16% from USD 90.5 billion in 2018 to USD 136.8 billion in 2022. Hence, due to factors such as higher disposable income, technology awareness, and increasing pet adoption, the demand for smart pet collars is higher in North America.

Smart Pet Collar Market Share

Whistle Labs, and Wagz Inc., hold a significant market share of over 2%, offering a wide range of smart pet collars. Whistle Lab is an established brand with a history of reliable products, which helps in gaining consumer trust easily, leading to higher adoption rates.

Wagz Inc.’s strategic marketing campaigns, strong online presence, and partnerships with pet care brands and retailers help these companies reach a wide audience. Additionally, providing excellent customer support and engaging with the pet owner community through social media and events builds loyalty and positive reputation for these companies.

Smart Pet Collar Market Companies

The major players operating in the smart pet collar industry are:

- FitBark

- Garmin Ltd.

- Link AKC

- Pawtrack

- PetPace

- PitPat

- Pod Trackers

- Tractive

- Wagz Inc.

- Whistle Labs

Smart Pet Collar Industry News

- In March 2024, PetPace launched PetPace 2.0, an AI-powered canine collar that offers continuous, real-time health monitoring and GPS tracking. It measures vital signs, including temperature, pulse, respiratory rate, and heart rate variability, using non-invasive sensors. The collar's advanced analytics provide early detection of health issues, supported by over a decade of research. Endorsed by leading universities, it aims to improve pet health and quality of life by alerting owners and vets to potential problems before they become serious.

- In May 2023, Datamars acquired Kippy S.r.l, the smart pet collar company with the objective of market expansion. The company will leverage the technology of Kippy into its existing product portfolio.

The smart pet collar market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue ($Mn) and shipment (Units) from 2021 to 2032 for the following segments:

By Technology, 2021 – 2032

- RFID devices

- GPS

- Sensors

- Bluetooth

- Others

By Pet type, 2021 – 2032

- Dog

- Cat

- Others

By Application, 2021-2032

- Tracking & Geofencing

- Health Monitoring

- Training

- Identification

By End use, 2021 – 2032

- Household

- Online

- Offline

- Commercial

- Online

- Offline

By Distribution Channel, 2021 – 2032

- Online

- Offline

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

Frequently Asked Question(FAQ) :

Who are the key players involved in the smart pet collar industry?

FitBark, Garmin Ltd., Link AKC, Pawtrack, PetPace, PitPat, Pod Trackers, Tractive, Wagz Inc., and Whistle Labs

How big is North America smart pet collar industry?

North America smart pet collar market held over 50% share in 2023, owing to higher pet ownership rates, and strong economic conditions.

What is the size of smart pet collar industry?

The smart pet collar market was valued at USD 1.9 billion in 2023 and is estimated to register over 12% CAGR between 2024 and 2032 driven by increasing pet ownership worldwide.

Why is the demand for smart pet collar GPS growing?

The GPS segment in market accounted for around 50% share in 2023 due to its unique capabilities and advantages for pet tracking and location monitoring.

Smart Pet Collar Market Scope

Related Reports