Summary

Table of Content

Smart Medical Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Medical Devices Market Size

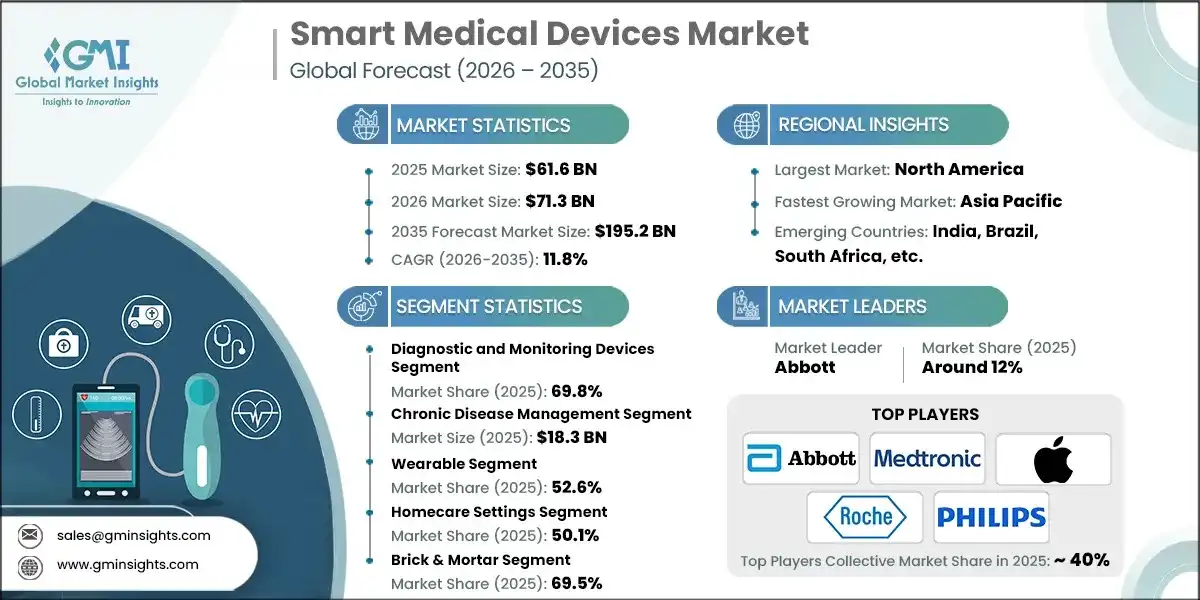

The global smart medical devices market was estimated at USD 61.6 billion in 2025. The market is expected to grow from USD 71.3 billion in 2026 to USD 195.2 billion in 2035, at a CAGR of 11.8% during the forecast period, according to the latest report published by Global Market Insights Inc.

To get key market trends

Rising health awareness and preventive care trends, miniaturization and wearable device innovations, and the rising trend of hospital-at-home and virtual care models are among the key factors propelling the industry demand. Abbott, Medtronic, Apple, Roche, and Philips are among the leading players operating in the market. These players mainly focus on geographic expansion, product innovation and affordability, integration of advanced technologies in devices, and collaboration with local or regional healthcare providers, among others.

The market is driven by numerous factors such as the increasing prevalence of diabetes, asthma, and other chronic diseases, growing demand for home healthcare solutions, expansion of telemedicine and digital health platforms, rising adoption of remote patient monitoring (RPM) devices, coupled with technological advancements in IoT, AI, and cloud integration, among other factors.

Patients need continuous monitoring and timely intervention, which is typically not possible through the traditional medical care approach. Smart medical devices such as continuous glucose monitors (CGMs), connected inhalers, and wearable sensors allow users to track their data in real-time and receive remote assistance if needed. Therefore, the use of smart medical devices decreases the need for hospital visits and improves patients’ overall quality of life.

In addition, the rising use of these devices is encouraging healthcare providers and patients to adopt technology-driven solutions to improve disease management, increase market growth, and accelerate innovation within the field of personalized medicine.

Additionally, due to the ease of access, lower cost, and greater comfort to patients, home healthcare is increasingly being recognized as the preferred method of delivering healthcare. Smart medical devices play a critical role in facilitating the transition from hospitals to the home, as they provide a means for monitoring patients remotely. Through the use of portable diagnostic devices, wearable sensors, and connected therapeutic devices, patients can continue to manage their chronic illnesses while staying connected with their healthcare providers from the comfort of their own homes. Hence, home healthcare is anticipated to continue to be a significant growth area for manufacturers of smart medical devices across the world.

Further, IoT-enabled devices with AI-powered insights and cloud storage are revolutionizing the medical device industry, creating a new ecosystem for connected health devices. This new ecosystem allows for seamless data collection, predictive insights, and the ability to provide access to healthcare providers and patients via the internet. AI provides predictive analysis of device usage and detects anomalies (such as incorrect doses) in real time. IoT is the backbone for real-time communication between medical devices and the healthcare system. Cloud technology enables secure data storage and seamless interoperability with other systems, allowing patient information to be accessed across multiple platforms. These factors are projected to collectively lead to increased adoption and expansion of smart medical devices worldwide.

Smart medical devices are technology-enabled healthcare tools that integrate sensors, connectivity, and data analytics to monitor, diagnose, or assist treatment, enabling real-time insights and remote patient management for improved outcomes.

Smart Medical Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2025 |

| Market Size in 2025 | USD 61.6 Billion |

| Market Size in 2026 | USD 71.3 Billion |

| Forecast Period 2026-2035 CAGR | 11.8% |

| Market Size in 2035 | USD 195.2 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Increasing prevalence of diabetes, asthma and other chronic diseases | The rising burden of chronic conditions is accelerating adoption of smart monitoring and therapeutic devices, making them essential for continuous and long-term care. |

| Technological advancements in IoT, AI, and cloud integration | Enhanced connectivity and analytics enable real-time health insights, improving device functionality and accelerating integration into clinical workflows. |

| Growing demand for home healthcare solutions | A strong preference for home-based care is increasing demand for portable and wearable smart devices that support remote monitoring and treatment. |

| Increasing adoption of remote patient monitoring (RPM) | Rapid expansion of RPM programs is making smart devices critical for continuous data collection and timely intervention in chronic disease management. |

| Expansion of telemedicine and digital health platforms | Growth in telehealth complements smart devices by enabling seamless data sharing and virtual consultations, improving patient engagement and care continuity. |

| Pitfalls & Challenges | Impact |

| High cost of smart medical devices | Premium pricing limits affordability, particularly in low-income regions, slowing adoption despite clear clinical advantages. |

| Data privacy and cybersecurity concerns | Security and compliance risks reduce trust and pose barriers to large-scale deployment of connected healthcare devices. |

| Connectivity issues in rural or low-infrastructure areas | Limited network coverage constrains device performance, reducing the effectiveness of remote monitoring in underserved regions. |

| Opportunities: | Impact |

| Growing demand for AI-driven predictive analytics in healthcare | AI integration can transform smart devices into proactive tools by enabling early disease detection and personalized treatment planning. |

| Innovations in biosensors and non-invasive monitoring | Advances in biosensor technologies are expanding device capabilities, allowing painless, continuous monitoring of multiple health parameters while improving patient comfort. |

| Market Leaders (2025) | |

| Market Leaders |

Around 12% |

| Top Players |

|

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, South Africa, etc. |

| Future Outlook |

|

What are the growth opportunities in this market?

Smart Medical Devices Market Trends

The rise of wearable health technology, the focus on non-invasive and connected solutions, the expansion of telehealth and remote monitoring, and the integration of AI and predictive analytics are among the key trends fueling the industry's growth.

- The healthcare technology landscape has significantly changed with wearable devices such as smartwatches, rings, or patches that enable health professionals to monitor patient’s vital signs, including heart rate, blood glucose levels, round the clock. Consumers are adopting these products because they are easy to use and sync with mobile applications, enabling remote healthcare delivery.

- Additionally, innovations in biosensors and the development of non-invasive monitoring technologies have resulted in patient-friendly smart devices that communicate with IoT systems. This allows healthcare providers and patients to access patient-generated data and improves the overall experience of the healthcare provider-patient interaction.

- Further, the rise of telemedicine has fueled the need for smart devices for remote patient monitoring. By enabling clinicians to monitor patient health from outside the hospital setting, these devices have the potential to lower hospital readmission rates and facilitate affordable home-based care environments.

- Moreover, AI is increasingly being utilized in smart medical devices to analyze real-time health status and predict potential complications associated with patients' illnesses. This capability facilitates earlier intervention, more individualized treatment plans, and improved clinical outcomes, making these devices even more beneficial for managing chronic diseases.

Smart Medical Devices Market Analysis

Learn more about the key segments shaping this market

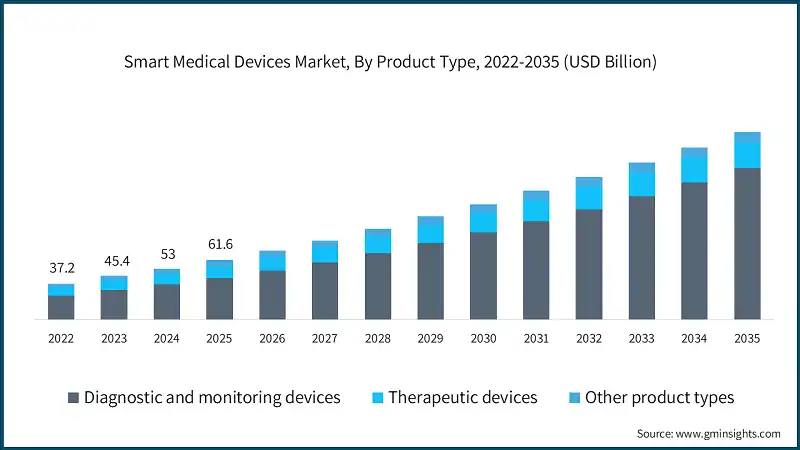

Based on product type, the global smart medical devices market is segmented into diagnostic and monitoring devices, therapeutic devices, and other product types. The diagnostic and monitoring devices segment accounted for a majority share of 69.8% in 2025 Partnerships between tech companies and healthcare providers are anticipated to fuel segmental growth. The segment is expected to reach USD 157.4 billion by 2035, growing at a CAGR of 13.5% during the forecast period.

- The smart medical diagnostic and monitoring category includes devices such as continuous glucose monitors (CGMs), wearable ECG patches, smart BP monitors, and pulse oximeters. These tools collect physiological data continuously in real-time and send that information to the connected platforms for processing and analysis.

- The primary function of these devices is to help detect health problems at an initial stage. This allows for improved care through the early detection of health problems and the continuous monitoring of chronic illnesses, allowing timely intervention.

- Additionally, by integrating with mobile applications and the cloud, patients and clinicians can view their data remotely and thus improve compliance and reduce hospital visits. The growth in this area is expected to be driven by the increased prevalence of chronic illnesses and a growing focus on preventive healthcare.

- The therapeutic devices segment was valued at USD 12.5 billion in 2025. Therapeutic smart devices assist in treating patients by providing connectivity for supervision and administration. Examples of these devices are smart pumps that dispense insulin, connected asthma inhalers, and neurostimulation devices for patients suffering from chronic pain and neurological disorders.

- Smart devices usually provide automation of dosage, track patients’ product usage, and send alerts to increase accuracy of treatment and patient compliance.

- Therefore, smart treatment devices continue to see demand, allowing for the management of chronic conditions in the comfort of the home, while at the same time enabling healthcare providers to tailor therapies to individual needs.

Based on application, the global smart medical devices market is segmented into chronic disease management, diabetes, cardiovascular disorders, respiratory disorders, and other applications. The chronic disease management segment accounted for a leading share and was valued at USD 18.3 billion in 2025.

- Smart devices are used in the field of chronic disease management (CDM) to facilitate ongoing and prolonged (multi-condition) treatment of individuals. These devices include platforms that comprise a combination of wearable sensors, home monitoring devices, and medication adherence systems to monitor vital signs, symptoms, and therapy utilization in real-time, which enables risk scoring of medical conditions for both patients and clinicians.

- CDM generally focuses on monitoring different chronic diseases such as diabetes, cardiovascular disease, respiratory conditions, and metabolic disorders (e.g., obesity).

- Additionally, the ability of different devices to communicate with electronic health records and telehealth workflows is critical for both implementing team-based care, developing personalized treatment plans, and monitoring long-term treatment results for large populations.

- The diabetes segment is anticipated to record the fastest growth with a CAGR of 12.6% over the forecast period. Smart diabetes solutions rely on continuous glucose monitoring (CGM), connected insulin pumps/pens, and decision-support applications as the core features. CGMs provide real-time data of glucose levels on patients’ phones or smartwatches, help observe patterns in glucose levels, and send alerts if levels are too low or too high.

- Automated insulin delivery combines CGM data with algorithms from insulin pump manufacturers to automatically change the insulin delivery rate and add correction doses to help patients stay within a steady range.

- Thus, the overall goal of smart diabetes technology is to avoid complications due to diabetes, personalize treatment plans, and alleviate the burden on both patients and providers by using data to make informed decisions and maintain a constant flow of information between patients and providers.

- The cardiovascular disorders segment held revenue of USD 10.2 billion in 2025, with projections indicating a steady expansion at 12% CAGR from 2026 to 2035. Cardiovascular tools include wearables such as ECG patches, smartwatches with ECG and heart rate features, connected daily blood pressure monitors, and rhythm analytics to help identify abnormal heart rhythms and early deterioration of overall health.

- Continuously or episodically recorded electrocardiograms (ECGs) are used to screen patients for atrial fibrillation (AF), assist in post-procedural follow-up, and, along with the use of artificial intelligence to prioritize patients' actionable risk-based events, help clinicians manage their patients.

- Moreover, the multi-parameter wearable devices monitor an individual's physical activity, sleep patterns, and ability to recover, all of which aid rehabilitation post-heart surgery.

Based on modality, the global smart medical devices market is segmented into wearable and non-wearable. The wearable segment accounted for a majority share of 52.6% in 2025.

- Consumer interest in wearable smart medical devices such as fitness trackers, ECG patches, and continuous glucose monitors is consistently growing. These smart devices offer continuous health monitoring by providing real-time information about the user's heart rate, glucose levels, and oxygen saturation.

- In addition, these devices connect easily to smartphones and cloud-based applications so that patients and healthcare providers can easily access the information remotely. The efficient and portable nature of wearable smart medical devices makes them convenient and effective for users, enabling them to manage both their lifestyle and medical concerns using the same solution.

- Further, the demand for wearable smart medical devices continues to grow due to the surging focus on preventive care and monitoring parameters of chronic illnesses.

- The non-wearable segment held revenue of USD 29.2 billion in 2025. Portable digital diagnostic tools and home healthcare equipment, such as spirometers and other devices, make up the majority of non-wearable smart medical devices. These products provide diagnostic assessment and therapy assistance for in-home and clinical settings and are equipped with Internet-of-Things (IoT) capabilities to allow for monitoring and communication between physicians and patients.

- Non-wearable smart medical devices are important for patients who require structured therapy or those who need to be closely monitored since these devices provide a high level of accuracy and reliability.

- Furthermore, the non-wearable smart medical device market is expected to grow in response to increasing consumer demand for home healthcare and telehealth platform integrations.

Based on end use, the global smart medical devices market is segmented into hospitals, homecare settings, and other end users. The homecare settings segment accounted for a majority share of 50.1% in 2025.

- Convenience, encouraging adherence, and proactive chronic illness management are among the major focuses of the homecare setting. Patients can track their vital signs and therapy usage from the comfort of their homes via connected inhalers, continuous glucose monitors (CGMs), smart blood pressure monitors, and portable respiratory devices.

- The data collected from these devices signify physical wellness. By syncing the collected information to either the patient's mobile device app or the clinician's portal, the data can be remotely analyzed and used to make timely interventions, thus supporting ongoing therapy.

- The use of automated reminders, trend insights, and risk flags helps to foster self-management of chronic illnesses in patients, thereby reducing emergency room visits.

- With the increase in the use of homecare for monitoring aging populations, post-discharge recovery, and hospital-at-home models, a shift toward increased decentralization of care delivery services and a reduction in costs has resulted in positive patient engagement and outcomes.

- The hospitals segment held a revenue of USD 23.9 billion in 2025. Smart medical devices are used in hospitals to improve all aspects of the patient's healthcare experience, from acute care to perioperative monitoring to chronic care pathways. Each of these connected devices, including bedside monitors, wearables, smart infusion pumps, and insulin systems, streams real-time data to clinical dashboards and electronic health records, supporting early warning alerts, workflow automation, and collaborative decision-making.

- Further, telemetry programs (or remote observation) reduce hospital stays and readmissions. Thus, by using AI-based analytics, hospitals can identify high-risk patients before they require a more complex workforce solution for triage and management.

Learn more about the key segments shaping this market

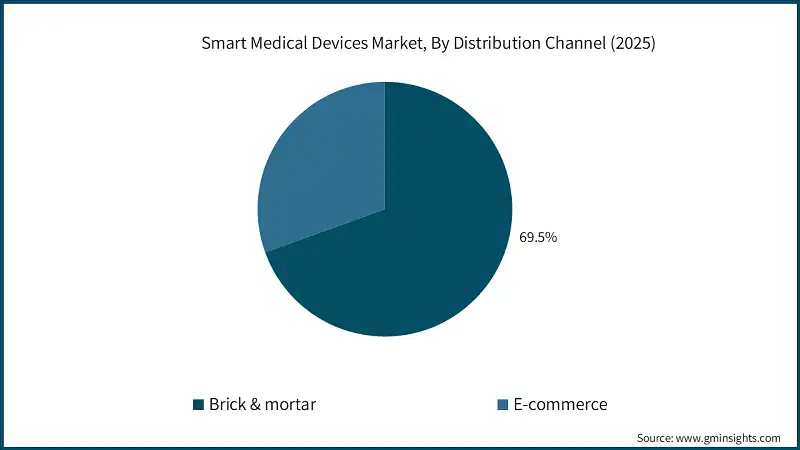

Based on distribution channel, the smart medical devices market is segmented into brick & mortar and e-commerce. The brick & mortar segment accounted for the leading market share of 69.5% in 2025.

- Brick-and-mortar channels, including pharmacies and medical equipment retailers, remain essential for clinical validation, device demonstration, and onboarding. They support prescription workflows, professional fitting (e.g., hearing aids, CGM sensors), and compliance documentation.

- In addition, face-to-face guidance improves adoption among older or complex-care patients, while service contracts cover calibration, maintenance, and training. Further, strengths of this mode include trusted relationships, immediate product availability, and post-sale support.

- Further, the e-commerce segment was valued at USD 18.8 billion in 2025. Through direct-to-consumer websites, marketplaces, or subscription models, e-commerce provides a way for consumers to quickly and easily access smart medical devices. Digital storefronts facilitate searching, comparing, and reordering consumable items via online channels, while telehealth integration supports electronic verification of prescriptions and virtual onboarding.

- Access to automated fulfillment, flexible financing options, and doorstep shipping helps users adhere to their prescribed treatment plans and makes it easier for patients with chronic conditions.

- In addition, by creating an integrated digital experience with user education, chat assistance, and app-based device management, these digital platforms also provide consumers with a more comprehensive way of interacting with their devices. Overall, e-commerce offers businesses an increased opportunity to expand into new markets and establish recurring revenue streams.

Looking for region specific data?

North America Smart Medical Devices Market

North America market accounted for majority share of 34.8% in 2025 in the market and is anticipated to show notable growth over the forecast period.

- North America holds the highest share in the global smart medical devices market. The primary attributes driving the regional growth include its well-established healthcare system, the high burden of chronic diseases, and the presence of a large number of digital health technology users.

- The availability of health insurance across the region and favorable reimbursement policies contribute to the significant adoption of the latest telehealth solutions.

- Further, the demand for remote patient monitoring and home healthcare continues to grow in the region, fueled by the rapid increase in the number of people using IoT-enabled devices and AI technology to help manage their health. The constant evolution of smart devices through R&D and increased consumer understanding of these technologies leads to increased adoption of wearable devices among consumers.

- Furthermore, regulatory clarity around smart medical devices also contributes to increasing investment in cybersecurity, thereby building confidence in the smart healthcare solutions market in North America.

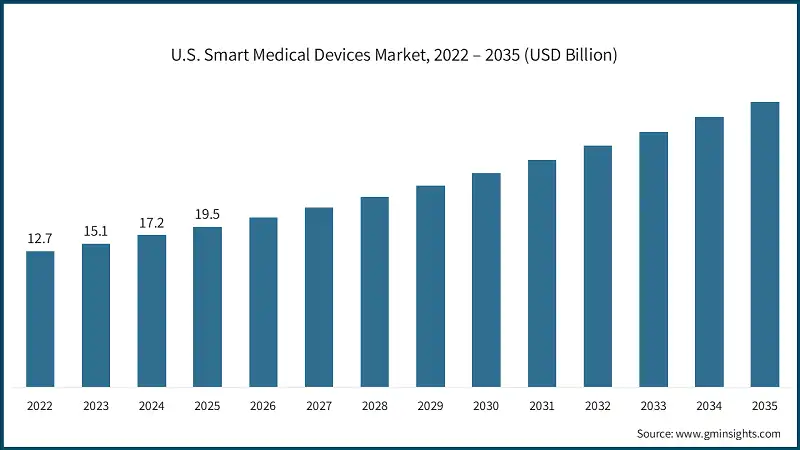

The U.S. smart medical devices market was valued at USD 12.7 billion and USD 15.1 billion in 2022 and 2023, respectively. In 2025 the market size was valued at USD 19.5 billion from USD 17.2 billion in 2024. Increasing adoption of remote patient monitoring (RPM) devices in the country is projected to fuel market growth.

- The U.S. is the global leader in the adoption of smart medical devices due to its extensive investment in healthcare and the significant pace of digital transformation.

- Chronic diseases such as diabetes and heart disease are anticipated to continue to increase the need for connected monitoring and therapeutic devices. For example, as per data reported by the New York State Department of Health, every year around 0.8 million people in the U.S. suffer heart attacks, and out of those, 0.6 million are the first-time heart attack cases. Such a high disease burden requires constant patient support to reduce disease-related mortality.

- The expansion of telemedicine and the growth of program-based care (hospital-at-home) are anticipated to increase demand for technologies that enable remote care solutions.

- In addition, technology companies and healthcare innovators are working together to develop ways that enhance patient access, engagement, and the efficiency of clinical services through the use of artificial intelligence, cloud platforms, and interoperability standards. Thus, the rising focus on consumer health and the growth of e-commerce enable increased sales of wearables and position the U.S. as the leader in the development of smart health solutions.

Europe Smart Medical Devices Market

Europe accounted for a significant share of the market and was valued at USD 18.2 billion in 2025.

- Smart medical devices are growing steadily throughout Europe due to a combination of universal healthcare systems and stringent digital health regulations. All member countries are placing a top priority on managing chronic diseases and providing preventive care, which is stimulating the introduction of connected monitoring systems.

- Additionally, initiatives by the governments to promote telehealth and encourage the interoperability of smart devices with clinical workflow processes are helping to boost this growth.

- The rise in the number of older citizens and demand for home healthcare services is anticipated to boost the adoption of wearable and portable smart devices. Compliance with sustainability and data privacy policies is a key area of focus that may impact how developers design and deploy these products.

- Furthermore, collaborative research and development programs, along with partnerships between public and private sectors, may further enhance Europe’s position as a key player in digital healthcare innovation.

UK held significant share of the European smart medical devices market, showcasing strong growth potential.

- In recent years, the expansion of digital health solutions in the UK has been fueled by the NHS Digital Health initiative, which is promoting Remote Patient Monitoring (RPM). There is an ever-increasing demand for smart devices to assist patients at home due to the rising prevalence of chronic diseases and the growing elderly population.

- The integration of electronic health records and teleconsultations with smart devices may improve clinical workflow for clinicians.

- In addition, consumers are increasingly using smart devices as preventative health and fitness tools because of increased awareness and the growing affordability of these devices, with a focus on improving data security and ensuring interoperability.

Asia Pacific Smart Medical Devices Market

The Asia Pacific market accounted for a substantial share of the market and was valued at USD 15.8 billion in 2025.

- A rise in healthcare investment, along with an increase in chronic disease burden and a growing middle-class population, is driving regional growth. Smart devices are being adopted in countries such as China, India, Japan, Australia, and South Korea rapidly as part of their homecare and telehealth services.

- Younger age groups have started to embrace wearable technology, while hospitals are implementing IoT-enabled devices to provide better patient monitoring and operational efficiency.

- Various national governments are strongly supporting digital health initiatives and updating current infrastructure to improve access to healthcare technology.

- However, while an overall increase in digital health activity presents a significant long-term opportunity for growth, challenges such as cost sensitivity and rural connectivity gaps limit growth.

China smart medical devices market is estimated to grow with a robust CAGR, in the Asia Pacific market.

- China’s market is growing rapidly due to factors such as government support for digital health technologies, a significantly growing consumer interest in wearable devices, a high penetration rate of smartphones, and the presence of advanced IoT (Internet of Things) infrastructure allowing for seamless remote monitoring access, among others.

- Additionally, increasing numbers of people living with chronic diseases and rising urbanization rates are also resulting in a greater need for homecare.

- Further, China's largest technology companies are partnering with healthcare organizations to create integrated AI-enabled platforms and ecosystems, fueling the industry's growth.

Latin America Smart Medical Devices Market

Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period.

- Brazil is emerging as a key market in Latin America, driven by the increasing prevalence of chronic diseases and growing telehealth adoption.

- Public and private healthcare providers are investing in smart monitoring devices to improve access and reduce hospital congestion. Wearable technology is gaining popularity among urban consumers for fitness and preventive care.

- In addition, government initiatives promoting digital health and expanding internet connectivity supports market penetration. Additionally, partnerships with global players and local manufacturing are supporting industry growth.

Middle East and Africa Smart Medical Devices Market

Saudi Arabia market to experience substantial growth in the Middle East and Africa market in 2025.

- Saudi Arabia’s market growth is supported by national healthcare digitization programs under Vision 2030. Investments in telemedicine and hospital modernization creating strong demand for smart devices in both clinical and homecare settings.

- Rising chronic disease prevalence and increasing health awareness drive the adoption of connected monitoring solutions. The government emphasizes interoperability and cybersecurity, ensuring compliance and trust in digital health systems.

- Moreover, wearable devices are gaining traction among younger populations, while hospitals integrate IoT-enabled platforms for predictive care.

Smart Medical Devices Market Share

The global smart medical device market is highly competitive due to the large number of global and local manufacturers offering a wide range of products. At the forefront of the competition are large, established companies in the healthcare sector, along with new technological innovators. Chronic disease management and smart therapy solutions are among the key focus areas of companies such as Abbott and Medtronic, both of which have a significant presence in the management of diabetes. For example, Abbott manufactures a broad spectrum of products for continuous glucose monitoring, while Medtronic produces connected insulin delivery and neurostimulation systems for the management of chronic diseases.

Apple, with its addition of state-of-the-art health monitoring features to consumer wearables, has created a hybrid product that combines health monitoring for both clinical purposes and lifestyle monitoring. Similarly, Roche has developed a key position in the market through their connected diagnostics and personalized healthcare solutions. Roche's data-driven approach creates a need for improved decision-making capabilities based on the information available from connected devices. In addition, for integrated care throughout the continuum of care (in and out of hospitals), Philips has combined Internet of Things (IoT)-enabled devices with telehealth and predictive analytics.

Intense innovation is being experienced within the medical market as various companies invest heavily in artificial intelligence (AI), the Internet of Things (IoT), and cloud connectivity, allowing for enhanced remote monitoring capabilities and predictive analytics. The establishment of strategic partnerships between technology companies and healthcare device manufacturers is expected to lead to faster and wider adoption of these products, while mergers and acquisitions may help expand product portfolios and geographical reach.

Furthermore, companies may continue to compete on data security, interoperability, and regulatory compliance as they develop solutions that enable seamless integration and patient focus through their products. In addition, new entrants into the market for wearables and biosensors have introduced an additional level of competitiveness to the market and are forcing existing participants to innovate continually in order to maintain their position as leaders in this emerging and rapidly growing market.

Smart Medical Devices Market Companies

Few of the prominent players operating in the global smart medical devices industry include:

- Abbott

- Apple

- Biobeat Medical

- Boston Scientific

- Dexcom

- Fitbit

- Masimo

- Medtronic

- NeuroMetrix

- Novo Nordisk

- OMRON Healthcare

- Philips

- Roche

- SAMSUNG

- Shenzhen Ztsense Hi Tech

- SmartCardia

- Vital Health Ring

- VitalConnect

- West Pharmaceutical Services

- WS Audiology

- Abbott

Abbott focuses on expanding its connected health ecosystem through continuous glucose monitoring (FreeStyle Libre), remote patient monitoring, and partnerships with digital health platforms. It invests in AI-driven analytics and wearable innovations to strengthen chronic disease management and global market penetration.

Apple leverages its consumer technology leadership to integrate advanced health monitoring features into Apple Watch, focusing on ECG, heart rate, and fitness tracking. Its strategy includes expanding health data interoperability, privacy-centric platforms, and collaborations with healthcare providers for preventive care.

Roche prioritizes digital diagnostics and connected solutions, integrating smart devices with its diagnostics portfolio. It invests in personalized healthcare, data-driven platforms, and partnerships to enable remote testing and chronic disease management, aiming to improve patient engagement and clinical decision-making.

Smart Medical Devices Industry News:

- In May 2025, electroCore, a medical technology company, announced the acquisition of neurotechnology solution provider NeuroMetrix. NeuroMetrix’s Quell platform is a cloud-enabled wearable neuromodulation solution intended to treat fibromyalgia symptoms. The acquisition enhances electroCore’s range of non-invasive bioelectronic therapies and broadens its commercial presence.

- In November 2024, SmartCardia announced that it had received FDA clearance for outpatient cardiac telemetry for its 7-Lead ECG Patch and Cloud Platform. The SmartCardia 7L Patch is a breakthrough 7/14-day patch that offers real-time 7-Lead ECG and vitals via SaaS. This development is expected to boost the company's presence in various healthcare settings and improve product sales.

- In February 2024, Widex, a WS Audiology company, announced the launch of the new Widex SmartRIC Hearing Aid. This new hearing aid aims to redefine device design for improved audiological performance. This development may enable the company to further improve its brand image and industry position in the coming years.

The global smart medical devices market research report includes in-depth coverage of the industry with estimates and forecasts in terms of revenue in (USD Million) from 2022 - 2035 for the following segments:

Market, By Product Type

- Diagnostic and monitoring devices

- Blood glucose monitors

- Heart rate monitors

- Pulse oximeters

- Blood pressure monitors

- Breathalyzers

- Other diagnostic products

- Therapeutic devices

- Portable oxygen concentrators and ventilators

- Insulin pumps

- Hearing aids

- Other therapeutic devices

- Other product types

Market, By Application

- Chronic disease management

- Diabetes

- Cardiovascular disorders

- Respiratory disorders

- Other applications

Market, By Modality

- Wearable

- Non-wearable

Market, By End Use

- Hospitals

- Homecare settings

- Other end use

Market, By Distribution Channel

- Brick & mortar

- E-commerce

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- MEA

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the global smart medical devices market?

Prominent players include Abbott, Apple, Biobeat Medical, Boston Scientific, Dexcom, Fitbit, Masimo, Medtronic, NeuroMetrix, Novo Nordisk, OMRON Healthcare, Philips, Roche, and SAMSUNG.

Which region led the global smart medical devices market in 2025?

North America held the largest share of 34.8% in 2025, driven by advanced healthcare infrastructure and high adoption of innovative medical technologies.

What are the key trends in the global smart medical devices market?

Key trends include the rise of wearable health technology, non-invasive monitoring solutions, telehealth expansion, remote monitoring, and the integration of AI and predictive analytics.

What was the market share of homecare settings in 2025?

Homecare settings held a majority share of 50.1% in 2025, reflecting the growing preference for remote healthcare delivery.

What was the market share of the brick & mortar distribution channel in 2025?

The brick & mortar segment led the market with a 69.5% share in 2025, highlighting its dominance in the distribution of smart medical devices.

What was the market share of wearable devices in 2025?

Wearable devices accounted for 52.6% of the market share in 2025, driven by consumer demand for user-friendly and connected health monitoring solutions.

What was the market size of the smart medical devices market in 2025?

The market size was USD 61.6 billion in 2025, with a CAGR of 11.8% expected through 2035, driven by advancements in wearable health technology, non-invasive solutions, and AI integration.

What was the valuation of the chronic disease management segment in 2025?

The chronic disease management segment was valued at USD 18.3 billion in 2025, leading the market among application segments.

What was the market share of diagnostic and monitoring devices in 2025?

Diagnostic and monitoring devices held a majority share of 69.8% in 2025 and are projected to reach USD 157.4 billion by 2035, growing at a CAGR of 13.5% during the forecast period.

What is the projected value of the global smart medical devices market by 2035?

The market is expected to reach USD 195.2 billion by 2035, fueled by the expansion of telehealth, remote monitoring, and connected healthcare solutions.

Smart Medical Devices Market Scope

Related Reports