Summary

Table of Content

Smart Lighting Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Smart Lighting Market Size

The global smart lighting market was estimated at USD 15.7 billion in 2024. The market is expected to grow from USD 18 billion in 2025 to USD 41.8 billion in 2030 and USD 88.4 billion by 2034, at a value CAGR of 19.3% during the forecast period of 2025–2034, according to Global Market Insights Inc.

To get key market trends

- Smart lighting is a key component of smart city projects as it provides many benefits in terms of energy efficiency, sustainable development and social improvement. The integration of smart lighting into urban infrastructure enable smart cities to achieve sustainability goals and contribute to global efforts to reduce carbon emissions. Nations around the globe are focusing on installing smart street lighting, driving market growth. For instance, in June 2024, an article published by Cities Today, states that, Switzerland’s Bellinzona city has installed more than 2,600 smart streetlights which resulted in 50% of reduced energy consumption.

- Smart lighting entails incorporation of the IoT in the lighting systems to incorporate more capabilities such as control, automation, and monitoring. Smart lighting is growing rapidly because standards in wireless communication such as Zigbee, Z-Wave and Bluetooth have advanced measurably, and smart home devices are becoming more popular. Integration and compatibility with other smart gadgets that control the lighting systems deliver more effective and easier to use smart solutions. Companies are continuously developing connected lighting products that leverage the latest advancements in IoT and connectivity technologies. For instance, in November 2023, Laser an Australian based tech firm has introduced its new range of AmbiColour fashionable Smart LED lighting solutions for home adornment. The smart lights, namely the AmbiColour is quite a creative and customizable concept, which, further, adds a colourful facet into the existing branding schemes and is affordable for brightening up spaces.

- The Asia-Pacific region dominated with over 34.3% market share in 2024, rapid growth is witnessed, propelled by increasing disposable income and the adoption of smart home technologies. Major countries such as Japan and China in the Asia-Pacific region are investing in smart city initiatives to improve urban infrastructure and services. Smart lighting is an integral part of these systems, helping to save energy, improve public safety and improve quality of life.

Smart Lighting Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 15.7 billion |

| Market Size in 2025 | USD 18 billion |

| Forecast Period 2025 - 2034 CAGR | 19.3% |

| Market Size in 2034 | USD 88.4 billion |

| Key Market Trends | |

| Drivers | Impact |

| Growing Focus on Energy Efficiency and Sustainability | Drives 25% of market growth as governments and businesses adopt energy-saving lighting solutions to reduce carbon emissions and meet regulatory standards. |

| Rapid Urbanization and Smart City Initiatives | Supports 22% growth by integrating connected lighting systems for traffic management, public safety, and efficient infrastructure in urban environments. |

| Advancements in IoT and Sensor Integration | Contributes 18% to growth as smart lighting systems incorporate occupancy sensors, daylight harvesting, and wireless controls for real-time adaptability. |

| Declining LED Costs and Widespread Adoption | Adds 20% growth as falling LED prices make smart lighting affordable for both residential and commercial applications, accelerating global penetration. |

| Rising Demand for Connected and Automated Homes | Accounts for 15% growth with increasing adoption of voice-controlled, app-based, and AI-driven lighting systems in the residential sector. |

| Pitfalls & Challenges | Impact |

| High Installation and Maintenance Costs | Restrains 18% of market growth as advanced smart lighting systems require significant upfront investment, complex wiring, and ongoing maintenance, limiting adoption in cost-sensitive regions. |

| Interoperability and Standardization Issues | Limits 15% of growth due to lack of universal protocols across devices and platforms, creating compatibility challenges that slow large-scale smart lighting deployments. |

| Opportunities: | Impact |

| Integration with Smart City Infrastructure | Smart lighting presents opportunities to become a backbone of smart cities, enabling adaptive street lighting, traffic management, and public safety enhancements through connected networks. |

| Adoption of AI and Predictive Analytics | AI-driven lighting systems can optimize energy use, predict maintenance needs, and personalize illumination, opening new service-based business models for providers. |

| Market Leaders (2024) | |

| Market Leaders |

Top 2 company accounts for 5.9% |

| Top Players |

Collective market share in 2024 is 27.5% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Asia Pacific |

| Emerging Countries | India, China, South Korea |

| Future outlook |

|

What are the growth opportunities in this market?

Smart Lighting Market Trends

- The rising trends towards advance homes is influencing the market. As more customers demand automated homes and connectivity, smart lightning is becoming an important part of smart living spaces. Smart lighting accounts for more than 15 - 20% of smart home appliances. As consumers invest in automated home solutions, the demand for smart lighting products are exponentially mounting.

- Smart lightning products are designed to configure with the vast smart home ecosystem. In context with the popular smart home platforms, voice assistants (such as Amazon Alexa, Google Assistant and Apple HomeKit) are influencing the adoptions of smart home systems. This ecosystems require other connected devices such as thermostats, security cameras, voice assistants and home entertainment systems. This integration enhances the overall smart home and encourages consumers to use more smart devices.

- Smart lighting allows homeowners to remotely control and manage their lighting systems, allowing users to adjust lighting on/off via mobile apps or voice commands. The intelligent lighting systems are customized.

- These smart systems can be customized according to the user's preference and needs. Users can create lighting maps based on specific preferences or activities. The feature to adapt lighting to different rooms and seasons enhances the overall environment of a smart home.

Smart Lighting Market Analysis

Learn more about the key segments shaping this market

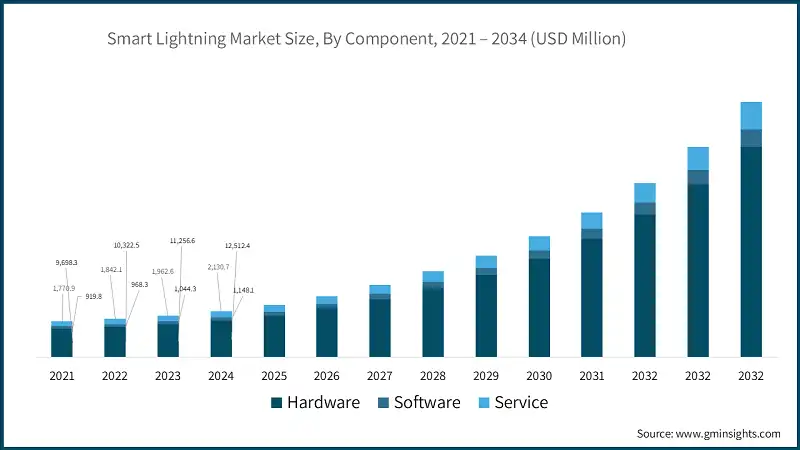

Based on component, the smart lighting market is divided into hardware, software, and services. The hardware segment is expected to register a CAGR of over 19.8% during the forecast period.

- The hardware segment was the largest market and was valued at USD 12.5 billion in 2024. The integration of smart lighting systems with the Internet of Things (IoT) is a key factor driving the hardware segment growth. Smart bulbs, luminaires, and light controls are equipped with connectivity features, enabling users to control & monitor lighting remotely through smartphones, tablets, or other IoT device.

- Manufacturers should focus on increasing levels of miniaturization (sensors, controllers, drivers) enhancing durability, lowering costs, and implementing enhanced technologies, like AI and IoT technologies, to best keep pace with the rapidly evolving smart lighting market.

- The software segment is the fastest growing and is anticipated to grow with a CAGR of 17.4% during the forecast period of 2025 – 2034. The smart lighting for software market will expand with the smart bulbs are becoming more technologically advanced, offering features such as color-changing capabilities, tunable white light, and compatibility with voice assistants & smart home ecosystems. These advancements make smart bulbs more appealing to consumers, contributing to increased sales and segment growth.

Learn more about the key segments shaping this market

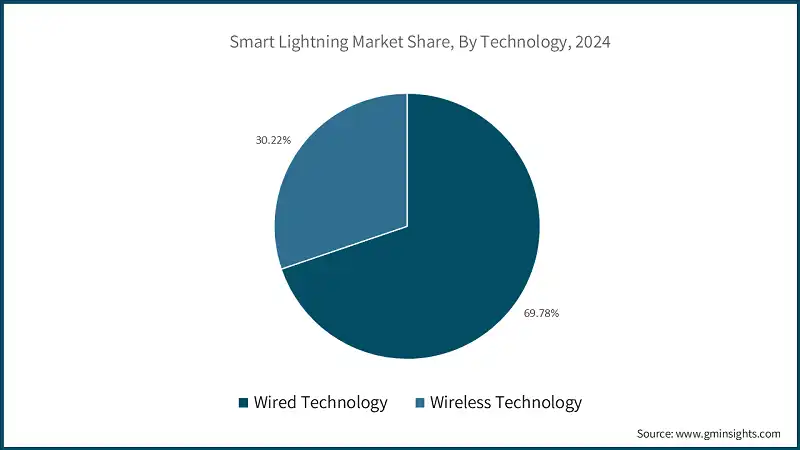

On the basis of technology, the smart lighting market is categorized into wired and wireless technology.

- The wired segment was the largest market and was valued at USD 11 billion in 2024. The smart lighting for wired segment market is driven by security advantages, long term cost efficiency, high data transmission capacity, suitability for large installations and regulatory & safety compliance.

- The wireless segment is anticipated to grow with a CAGR of 20.3% during the forecast period of 2025 – 2034, and is driven by ease of installation, low initial installation cost, remote & mobile control, IOT & smart home integration, flexibility and scalability and many other advantages.

On the basis of application, the smart lighting market is segmented into indoor and outdoor applications.

- The indoor segment was the largest market and was valued at USD 12 billion in 2024. The segment is well-established for residential homes & apartments, offices & workplaces, retail stores & shopping malls, hospitals & healthcare facilities, educational institutional, hospitality to name a few.

- The outdoor segment is the fastest growing market and is anticipated to grow with a CAGR of 20.6% during the forecast period of 2025 – 2034. This segment is in demand owing to increasing outdoor applications such as smart street lighting, parking lots & garages, sports arenas & stadiums, airports, ports & transport hubs and industrial complexes & logistics yards.

Looking for region specific data?

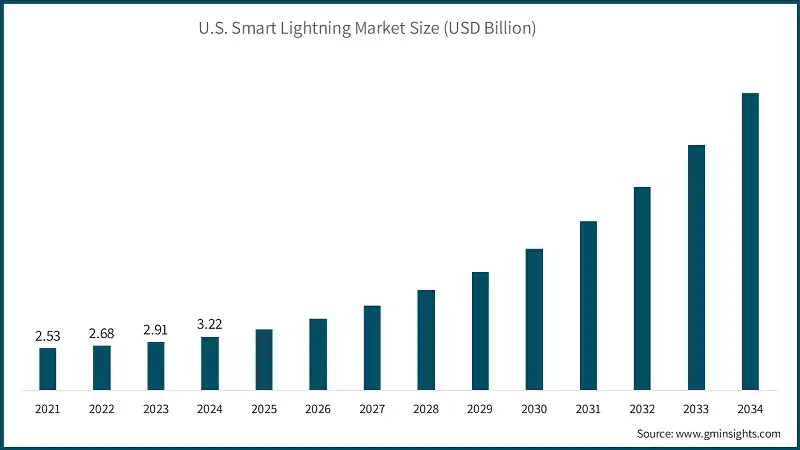

North America smart lighting market was valued at USD 3.9 billion in 2024 and is anticipated to grow with a CAGR of 19.8% during the forecast period of 2025 – 2034. Growth of the Smart Lighting commercial market is driven by increase in number of smart city projects, shifting customers towards energy-efficient lights and rise in demand for smart homes.

- U.S. dominated the market and was valued at USD 3.2 billion in the year 2024. The growth in the market is sustained by advancement in IOT and AI technologies, urbanisation and smart cities development, consumer demand for personalisation and integration with smart home ecosystems.

- Further, the smart lighting market in the U. S. is growing at significant rate, owing to innovation and an increased awareness of energy conservation. Owing to the rising popularity of smart home solutions and the incorporation of IoT into homes, consumers in the U. S. are taking up smart lighting systems for homes and offices amongst other things. For instance, in July 2023, Lumileds, a world leader in LED innovation and manufacturing, announced that it produces LUXEON Matrix products and custom-integrated LED solutions for the lighting industry in the U.S. This allows Lumileds to provide improved support for North American customers, reduce transportation costs, time & environmental impacts, eliminate tariffs, and simplify the entire supply chain. The market benefits from a supportive regulatory environment including government initiatives promoting energy conservation and sustainability

- The smart lighting market in Canada is anticipated to surpass USD 4.9 billion by 2034. Canada's Smart Lighting industry is benefitting from government incentives and sustainability policies, technological advancement and IOT integration, commercial sector adoption and smart city initiatives

The market in Europe is anticipated to grow with a CAGR of 18.3% during the forecast period of 2025 – 2034. Europe's Smart Lighting industry is growing due to strong support of government policies and sustainability initiatives, integration with smart city infrastructure and advancement in IOT and AI technologies

- Germany market was valued at USD 1.5 billion in the year 2024. Germany's industry growth is supported with government regulations, policies & incentives, smart city programs & urban infrastructure modernisations and supportive funding & business models

- UK market is anticipated to surpass USD 800 million by 2034. This growth is because of regulatory pressure & energy efficiency standards, urbanisation/ infrastructure modernization and government policies incentive programs

The smart lighting market in Asia Pacific was valued at 5.4 billion in 2024. Many cities in the Asia-Pacific region are investing in smart city initiatives to improve urban infrastructure and services. Smart lighting is an integral part of these systems, helping to save energy, improve public safety and improve quality of life.

- The market in China is developing at increasing rates fostered by urbanization processes, the introduction of advanced technologies and an increase in the number of smart homes. Smart lighting systems will benefit the Chinese government since efficiency is one of the objectives of its energy policy. For instance, in August 2023, Signify, a world leader in lighting, inaugurated its biggest LED lighting manufacturing site in the world in Jiujiang, Jiangxi Province, China. Large-scale smart city projects, coupled with the increasing demand for intelligent and connected living spaces, contribute to the flourishing smart lighting industry in China. Key players in the industry are actively innovating to cater to the diverse needs of the Chinese consumer base.

- The Japan smart lighting market is defined by technological and cultural characteristics which celebrates efficiency. Smart lighting that focuses on energy conservation and is eco-friendly is gaining popularity in both the residential uses and C&I customers. For instance, in January 2023, Nichia, a Japanese-based and world’s largest LED manufacturer & inventor of high-brightness blue and white LEDs, announced the addition of the NVSW719AC and NVSW219C-V2 to its industry-standard ceramic, high-power 3535 size portfolio of LEDs. Japan's technological leadership, coupled with a high standard of living, positions it as a key market for innovative smart lighting solution

The market in Latin America was valued at USD 300 million in 2024. The smart lighting market in Latin America is expected to witness growth as a result of rise of IOT, connected home, & automation trends, growing disposable incomes & consumers awareness, cost reductions & technological improvements, regulatory & incentives-based support throughout the region.

MEA market is projected to surpass USD 800 million by 2034. Growth is primarily driven by smart city initiatives & urban infrastructure, Public Infrastructure & Street Lighting Modernization, technological development & IOT penetrations to name a few

- South Africa smart lighting market was valued at USD 90 million in 2024. This growth is supported primarily due to IOT automation & smart homes, consumer demand for comfort & ambiences, government policies & energy efficiency regulations and smart cities & infrastructure projects.

- Saudi Arabia dominated the market and was valued at USD 300 million in the year 2024. The growth in the industry is sustained by urbanisation & infrastructure development, technology adoption (IoT, Wireless & Software Controls) and smart homes & commercial building adoptions

Smart Lighting Market Share

- The smart lighting industry is a highly competitive with many big and small companies within the market. Signify Holding, Acuity Brands, Legrand, Osram are the key players in the market. These companies collectively accounted for 50.96% of the total market share in 2024.

- Signify Holding and Acuity Brands Lighting Inc. hold a significant share of over 31.2% in the market. Major companies like Signify Holding, Acuity Brands Lighting Inc., OSRAM Licht Group, and Schneider Electric Software LLC dominate the market, due to their extensive product portfolios, strong brand recognition and global reach. These industry leaders leverage advanced R&D capabilities to introduce cutting-edge smart lighting solutions. They integrate IoT technologies energy-efficient systems and seamless connectivity. Strategic partnerships allow them to capture significant market share and maintain a competitive edge.

- Moreover, the smart lighting sector is witnessing substantial contributions from emerging companies and niche players focused on specialized solutions. These companies are driving innovation through unique product offerings. Examples include advanced lighting controls, personalized lighting environments and integrated smart home ecosystems. Competitive dynamics are further intensified by strategic mergers, acquisitions and collaborations, such strategies enable companies to expand their technological capabilities and market presence.

- Legrand secures the global market with 10.96% market share in 2024. Legrand has a significant presence in the smart lighting market, given its wide distribution network and partnerships, strong presence in residential, commercial and industrial sectors and sustainable & energy efficiency initiatives

- Osram held 9% of the global market in 2024. Osram leads the smart lighting industry based on its advanced R&D capabilities, broad adoption of IOT and AI integration, strategic partnerships and acquisitions, strong automotive smart lighting segment.

Smart Lighting Market Company

The top prominent companies operating in the smart lighting industry include:

- AAC Clyde Space

- CU Aerospace

- Dragonfly Aerospace

- EnduroSat

- EXOLAUNCH GmbH

- GomSpace

- ISISPACE GROUP

- Lockheed Martin

- Maverick Space Systems Inc.

- NanoAvionics

- Northrop Grumman

- Pumpkin Space Systems

- RTX Corporation

- Space Inventor A/S

- SpaceX

- Surrey Satellite Technology Ltd

- Tyvak International

Signify, Osram, Acuity Brands and Legrand are leaders in the smart lighting market due to their extensive smart lighting portfolios, strong global presence, and long-standing relationships with government, and commercial space programs. Their solutions cover smart lighting design, launch services, and broad adoption of IOT and AI integration. Continuous innovation, reliability, and ability to serve a wide range of smart lights for indoor and outdoor applications and commercial applications give them a significant competitive advantage in scale and credibility.

Eaton, Cree Lighting, Zumtobel Group are challengers and focus on niche Smart Lighting solutions, owing to technological differentiation, specialized service offerings, and strategic collaborations with launch providers and research institutions to expand their market share in specific geographic and application areas.

Syska, Xiaomi, TP link Systems serve as followers in the market. They are focused on niche offerings that include IOT components and launch integration, which will help promote broader Smart Lighting adoption. Their affordable, reliable solutions are aimed respectively, more to niche, specialized and commercial-research customer segments.

Hubbell Lighting and Havells & Wipro represent niche players. These companies develop specific smart lighting platforms, emphasizing modularity and reasonable cost. Collaborating often with residential developer projects, they succeed by offering tailored solutions for market.

Smart Lighting Industry News

- In April 2024, Govee announced the launch of two new smart floor lamps - the Floor Lamp 2 and Floor Lamp Pro. The Floor Lamp 2 offers brighter illumination, Matter compatibility, and customizable lighting effects. The Floor Lamp Pro features 324 color and white light beads for optimal illumination, a 300-degree rotatable light bar, and an integrated Bluetooth speaker.

- In October 2023, Signify acquired key assets from bankrupt lighting companies Universal Lighting Technologies (ULT) and Douglas Lighting Controls, including patents, product designs and trade names. This bolsters Signify's intellectual property portfolio, especially in LED drivers.

The smart lighting market research report includes in-depth coverage of the industry with estimates and forecasts in terms of revenue (USD Billion) from 2021 – 2034 for the following segments:

Market, By Component

- Hardware

- Smart bulb

- Luminaire

- Light Controls

- Software

- On premises

- Cloud

- Services

- Pre-Sales

- Post -Sales

Market, By Technology

- Wired Technology

- Power line communication

- Power over ethernet

- DALI

- Hybrid

- Wireless technology

- Bluetooth

- Zigbee

- Wi-FI

- Enocean

- LPWAN

- Hybrid

Market, By Application

- Indoor Lighting

- Residential

- Commercial

- Industrial

- Outdoor Lighting

- Highways & Roadways

- Public Places

- Bridges & Tunnel

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Spain

- Italy

- Netherlands

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- Saudi Arabia

- South Africa

- UAE

Frequently Asked Question(FAQ) :

Who are the key players in the smart lighting market?

Key players include Signify Holding, Acuity Brands, Legrand, Osram, Zumtobel Group, Cree Lighting, Hubbell Lighting, Eaton, Havells, Wipro, Syska, Xiaomi, and TP-Link.

What are the upcoming trends in the smart lighting industry?

Key trends include rising adoption of AI-driven lighting analytics, integration with smart city infrastructure, remote mobile control, and the growing demand for connected and automated homes.

What is the growth outlook for wireless technology from 2025 to 2034?

Wireless technology is projected to grow at a 20.3% CAGR till 2034.

Which region leads the smart lighting market?

The U.S. led the smart lighting industry at USD 3.2 billion in 2024. Growth is fueled by IoT and AI adoption, smart city development, and strong consumer demand for connected home solutions.

What was the valuation of the wired technology segment in 2024?

The wired technology segment was valued at USD 11 billion in 2024.

How much revenue did the hardware segment generate in 2024?

The hardware segment generated USD 12.5 billion in 2024.

What is the current smart lighting market size in 2025?

The market size is projected to reach USD 18 billion in 2025.

What is the projected value of the smart lighting market by 2034?

The market size for smart lighting is expected to reach USD 88.4 billion by 2034, fueled by smart city projects, IoT integration, and declining LED costs.

What is the market size of the smart lighting industry in 2024?

The market size was USD 15.7 billion in 2024, with a CAGR of 19.3% expected through 2034 driven by energy efficiency goals and sustainability initiatives.

Smart Lighting Market Scope

Related Reports