Summary

Table of Content

Sleep Tech Devices Market

Get a free sample of this report

Form submitted successfully!

Error submitting form. Please try again.

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Sleep Tech Devices Market Size

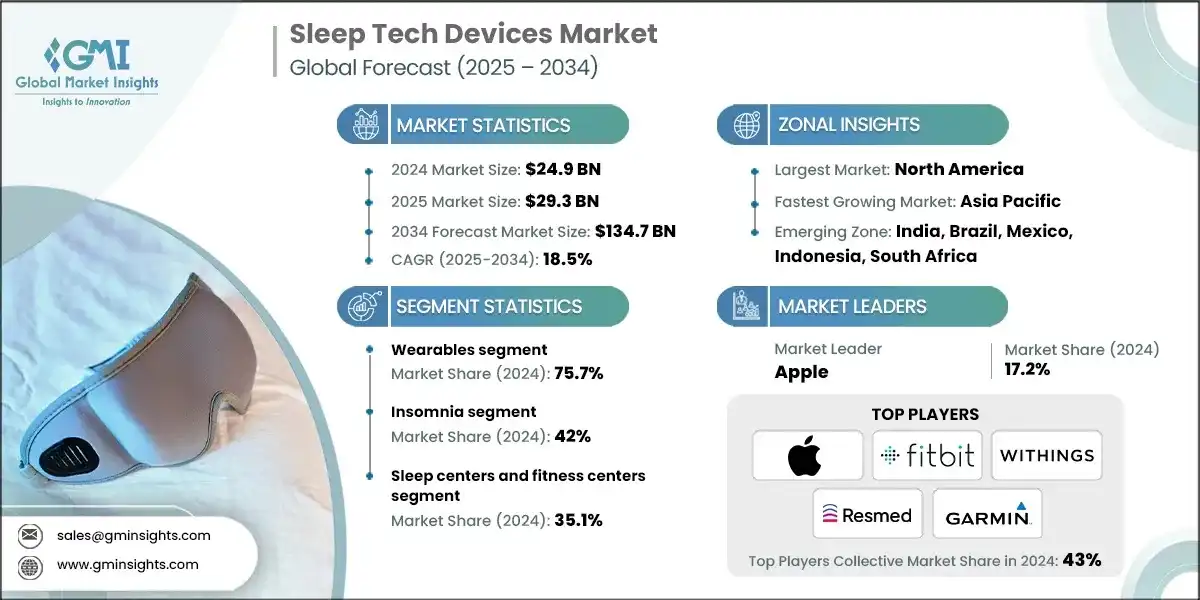

The global sleep tech devices market was valued at USD 24.9 billion in 2024. The market is expected to grow from USD 29.3 billion in 2025 to USD 134.7 billion in 2034, at a CAGR of 18.5% during the forecast period, according to the latest report published by Global Market Insights Inc. The market is driven by rising prevalence of sleep disorders such as insomnia and obstructive sleep apnea, growing consumer awareness of sleep health, and increasing adoption of smart wearables and connected non-wearable solutions for personalized sleep monitoring and management.

To get key market trends

Sleep tech devices are innovative solutions for the purpose of monitoring, improving, and even managing sleep health in both wearable and non-wearables forms. Apple including (Apple Watch -Sleep app and Stages), Balluga (Smart Interactive Bed), BedJet (BedJet 3 Climate Comfort), Emfit (QS under-mattress sensor), and Fisher & Paykel (F&P SleepStyle Auto CPAP) are significant players. The market continues to expand owing to the rising prevalence of sleep disorders such as insomnia and obstructive sleep apnea, increasing adoption of connected wearables and smart beds, and growing consumer focus on wellness and preventive healthcare.

The market reached from USD 15.2 billion in 2021 to USD 21.1 billion in 2023, registering a CAGR growth of 18.5% during this period. The global population is increasingly sleep-deprived, with insomnia affecting 10-30% of adults and obstructive sleep apnea (OSA) impacting about 425 million people worldwide. Market growth is fueled by unmet clinical needs and rising consumer interest in wellness-focused sleep solutions. Poor sleep is strongly linked to chronic diseases such as hypertension, obesity, diabetes, and depression, pushing individuals to adopt tools that track, analyze, and improve sleep.

Smart connected devices are at the core of this trend. Wearables like the Apple Watch with Sleep Stages, Fitbit Charge 6, Oura Ring Gen3, and Huawei Band 9 (TruSleep) provide continuous monitoring and insights. Non-wearables such as the Emfit QS under-mattress sensor, Eight Sleep Pod 3 smart mattress, and ResMed’s AirSense 11 AutoSet CPAP are also gaining traction for at-home management of sleep health and disorders. Smartphone penetration and the growth of the Internet of Things further accelerate adoption. Mobile apps like SleepScore deliver advanced sleep tracking, while solutions such as Smart Nora’s contact-free anti-snoring system integrate seamlessly with wearables and home devices to provide real-time feedback and personalized nudges.

The COVID-19 pandemic intensified health and wellness awareness, leading to a surge in investments in sleep-focused technology. For example, direct-to-consumer sales of smart mattresses jumped by 30% in 2022. Consumers increasingly prefer personalized, data-driven, and non-pharmacological approaches to address sleep issues and enhance daily performance. The convergence of rising sleep disorder prevalence, digital health adoption, and device innovation is expected to sustain robust market growth in the years ahead, making sleep tech a vital component of preventive healthcare.

Sleep tech devices are specialized wearables and non-wearables designed to monitor, analyze, and improve sleep quality. Using sensors, AI, and connectivity, they track patterns, detect disorders like insomnia and sleep apnea, and provide personalized interventions, enabling users to optimize rest, health, and overall well-being through technology-driven solutions.

Sleep Tech Devices Market Report Attributes

| Key Takeaway | Details |

|---|---|

| Market Size & Growth | |

| Base Year | 2024 |

| Market Size in 2024 | USD 24.9 Billion |

| Market Size in 2025 | USD 29.3 billion |

| Forecast Period 2025 - 2034 CAGR | 18.5% |

| Market Size in 2034 | USD 134.7 Billion |

| Key Market Trends | |

| Drivers | Impact |

| Technological advancements in sleep tech devices | Technological advancements improve accuracy, personalization, and efficiency of sleep tech devices, fueling adoption among consumers and healthcare providers. |

| Increasing awareness regarding availability of sleep tech devices | Rising awareness of sleep tech availability boosts adoption, supporting preventive care and broadening market reach across global demographics. |

| Rising geriatric population | Growing geriatric population drives demand for advanced sleep monitoring, addressing age-related disorders and ensuring improved quality of life. |

| Surging demand for portable, efficient and superior sleep tech devices | Demand for portable, efficient, superior sleep devices expands accessibility, driving adoption across diverse consumer groups and healthcare settings. |

| Product innovation and adoption of different strategies by key market participants | Product innovation and strategies by key players enhance competition, elevate user experience, and sustain long-term market expansion. |

| Pitfalls & Challenges | Impact |

| High cost of sleep tech devices | High device costs limit affordability, reducing adoption in price-sensitive markets and constraining overall growth potential. |

| Stringent regulatory framework | Stringent regulatory requirements delay approvals, hinder innovation, and create compliance challenges for sleep tech manufacturers. |

| Opportunities: | Impact |

| Integration with telehealth and remote patient monitoring | Telehealth and remote patient monitoring integration strengthens healthcare connectivity, opening growth avenues in personalized sleep management. |

| Expansion into mental health and wellness segments | Expansion into mental health and wellness fosters holistic care solutions, broadening use cases and unlocking multidimensional growth. |

| Market Leaders (2024) | |

| Market Leaders |

17.2% market share |

| Top Players |

Collective market share in 2024 is 43% |

| Competitive Edge |

|

| Regional Insights | |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Emerging Country | India, Brazil, Mexico, Indonesia, South Africa |

| Future Outlook |

|

What are the growth opportunities in this market?

Sleep Tech Devices Market Trends

The growth of the market is determined by a convergence of health needs, technological advancements, and shifting economic factors at both micro and macro levels. Increasing prevalence of sleep disorders remains a main driver, with studies guesstimating that 10-30% of adults experience insomnia globally, while obstructive sleep apnea (OSA) affects nearly 425 million people worldwide.

- These conditions not only impair quality of life, but they are also linked to chronic illnesses such as cardiovascular disease, diabetes, and obesity and this then prompts a greater demand for effective monitoring and intervention tools. Technological advancements are indeed transforming the landscape, so sleep devices are now more clever and non-intrusive and also user-friendly. Wearables today incorporate biosensors that track oxygen saturation plus sleep stages with accuracy that is always increasing. Among modern wearables are the Apple Watch, Fitbit Charge 6, Huawei Band, as well as Oura Ring.

- Non-wearables such as radar-based monitors, smart beds, and CPAP machines are also developing, with AI and machine learning incorporation enabling personalized insights and early detection of disorders.

- On the microeconomic front, rising disposable incomes, growing healthcare expenditure, and increased adoption of health insurance policies are encouraging consumers to invest in premium wellness technologies. At the macroeconomic level, urbanization, stressful work cultures, and the widespread use of digital devices contribute to poor sleep hygiene, further expanding the addressable market.

- Additionally, the rise of e-commerce platforms has enhanced accessibility, with global online sales of smart home and wellness devices registering double-digit growth in recent years.

- Moreover, integration of sleep tech with the broader digital health ecosystem-through IoT connectivity, smartphone apps, and telemedicine-has positioned these devices as key tools for preventive healthcare. As governments and employers increasingly recognize sleep health as integral to productivity and well-being, policy support and workplace wellness initiatives are further bolstering demand.

- Collectively, these medical, technological, and socio-economic drivers underscore the long-term growth potential of the sleep tech devices market, as consumers and healthcare systems like prioritize restorative sleep as a foundation for better health outcomes.

Sleep Tech Devices Market Analysis

Learn more about the key segments shaping this market

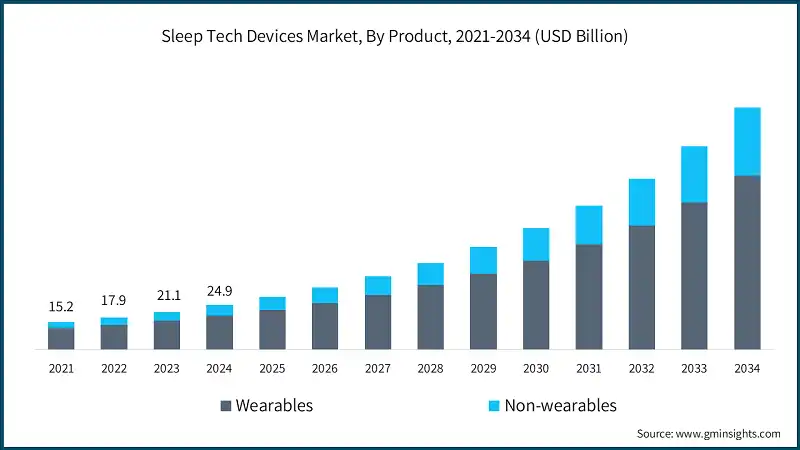

In 2021, the global market was valued at USD 15.2 billion. The following year, it saw a slight increase to USD 17.9 billion, and by 2023, the market further climbed to USD 21.1 billion.

Based on product, the global sleep tech devices market is bifurcated into wearables and non-wearables. The wearables segment is further divided into smart watches and bands, and others. The non-wearables segment is further divided into sleep monitors, and smart beds. The wearables segment accounted for 75.7% of the market in 2024 driven by growing consumer adoption of smartwatches and fitness bands with advanced sleep-tracking features, offering convenience, real-time insights, and integration with broader digital health ecosystems. The segment is expected to exceed USD 96.8 billion by 2034, growing at a CAGR of 17.9% during the forecast period. On the other hand, non-wearables segment is expected to grow with the fastest CAGR of 20.2%. The growth of this segment can be attributed to rising adoption of contactless, AI-powered sleep monitors and smart beds offering greater accuracy, comfort, and seamless integration into home and clinical sleep management.

- The wearables segment holds a dominant share as smartwatches along with fitness bands are being increasingly adopted with advanced sleep-tracking technologies. Wearables are in higher demand because consumers increasingly seek portable user-friendly solutions since these solutions provide real-time perceptions into sleep quality patterns and disturbances.

- These devices can integrate smoothly with broader digital health ecosystems, also including mobile applications along with telehealth platforms. By doing this, their value proposition is improved, and users can monitor overall wellness, track activity, and share data with healthcare providers. Furthermore, adoption is propelled further by raising health consciousness, increasing prevalence of sleep disorders, plus the growing focus on preventive healthcare.

- Continuous product innovations, such as AI-driven analytics, personalized sleep recommendations, and integration with IoT-enabled devices, also contribute to segment growth. Supported by affordability, stylish designs, and strong brand presence of major players like Apple, Fitbit, and Samsung, the wearables segment is expected to maintain robust growth.

- On the other hand, non-wearables segment is expected to grow with the fastest CAGR during the analysis period. The segment is driven by rising demand for advanced, contactless solutions such as AI-powered sleep monitors and smart beds. Unlike wearables, non-wearables offer greater comfort and long-term usability by eliminating the need for physical contact, making them ideal for both home and clinical settings.

- Their ability to deliver accurate, continuous sleep data with minimal disruption enhances user adoption. Furthermore, increasing integration of non-wearable devices with smart home ecosystems and healthcare platforms supports personalized sleep management, fueling strong growth and positioning the segment as a key market driver.

Based on the application, the sleep tech devices market is segmented into insomnia, obstructive sleep apnea, narcolepsy, and other applications. The insomnia segment accounted for the highest market share of 42% in 2024 driven by the rising prevalence of sleep disorders linked to stress, lifestyle changes, and growing demand for non-invasive digital sleep management solutions.

- The insomnia segment holds the largest share because of how sleep disorders are now increasingly popular worldwide. Rapid lifestyle changes occur, stress levels rise, and anxiety plus depression cases increase so these factors contribute much. Insomnia incidences are rising as a result of these contributions. Additionally, heightened awareness that poor sleep brings long-term health risks for example cardiovascular diseases, obesity, together with weakened immunity, increases demand for effective solutions.

- Because advanced, non-intrusive sleep tech devices are available for personalized monitoring, therapy, and real-time perceptions, they further drive adoption, making insomnia the most dominant application segment.

- The second-largest segment, obstructive sleep apnea, held a market share of 28.1% in 2024, driven by increasing awareness of OSA’s health risks such as cardiovascular diseases, obesity, and hypertension. Growing diagnosis rates, coupled with rising adoption of advanced sleep monitoring devices for early detection and management, are fueling demand. Additionally, integration of AI-powered technologies and home-based diagnostic tools is enhancing convenience and accuracy, further supporting segment growth.

- The narcolepsy segment, though smaller with a market share of 19.9%, is expected to grow at a CAGR of 18.9%, driven by increasing awareness and diagnosis of the condition, coupled with rising demand for technology-enabled solutions that improve sleep quality and manage excessive daytime sleepiness. The integration of smart wearables and AI-powered non-wearables is enabling better monitoring and personalized interventions, supporting early detection, improved patient outcomes, and wider adoption of sleep tech devices for narcolepsy management.

Learn more about the key segments shaping this market

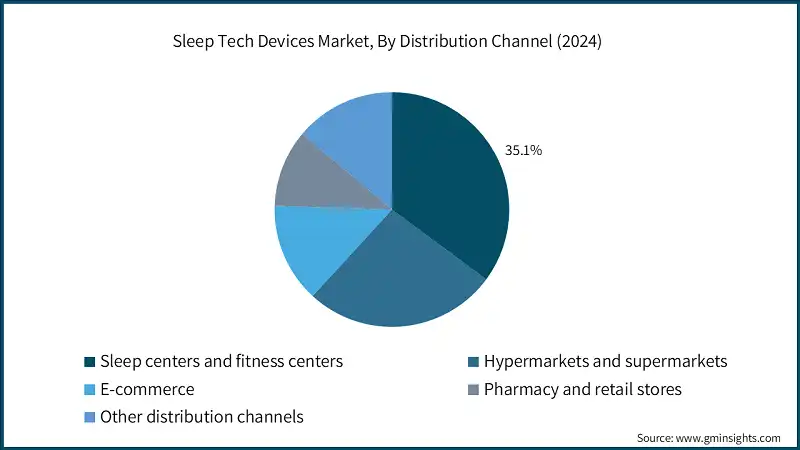

Based on the distribution channel, the sleep tech devices market is segmented into sleep centers and fitness centers, hypermarkets and supermarkets, e-commerce, pharmacy and retail stores, and other distribution channels. The sleep centers and fitness centers segment accounted for the highest market share of 35.1% in 2024 driven by rising consumer demand for professional, data-driven sleep analysis and wellness integration to address growing sleep-related health concerns.

- The top three end use segments represent 75.5% of total market value. The dominance of sleep centers alongside fitness centers in the market results from consumers demanding professional, data-driven solutions that address sleep disorders and overall wellness. More people suffer from insomnia, sleep apnea incidence grows, lives upset sleep, so people depend more on expert facilities using better sleep monitoring.

- Sleep tracking is integrated by fitness centers into holistic health and performance programs because of how quality rest is critical for productivity and for recovery. Consumer awareness is on the rise as well as the growing adoption of sleep tech devices in such settings. Furthermore, partnerships of healthcare providers with wellness centers are increasing as well.

- The hypermarkets and supermarkets segment, though smaller with a market share of 26.7%, is expected to grow at a CAGR of 18.1%, due to rising consumer preference for convenient, one-stop shopping experiences. These retail formats allow customers to physically evaluate products such as sleep monitors, smart beds, and wearables, enhancing trust and purchase intent.

- The increasing penetration of organized retail chains globally, coupled with strategic partnerships between sleep tech manufacturers and large retailers, ensures wider product availability and competitive pricing. Additionally, attractive in-store promotions, bundled offers, and live demonstrations are driving consumer adoption. This segment’s accessibility and mass reach significantly support its expansion within the sleep tech ecosystem.

- The e-commerce segment held a market share of 13.7% in 2024. The segment is driven by rising consumer preference for online shopping due to convenience, wider product availability, and competitive pricing. Growing digital health awareness, coupled with personalized product recommendations, subscription models, and easy doorstep delivery, further boosts adoption. Additionally, increasing internet penetration and integration of virtual consultations enhance consumer trust, making e-commerce a vital growth channel for sleep tech device distribution globally.

Looking for region specific data?

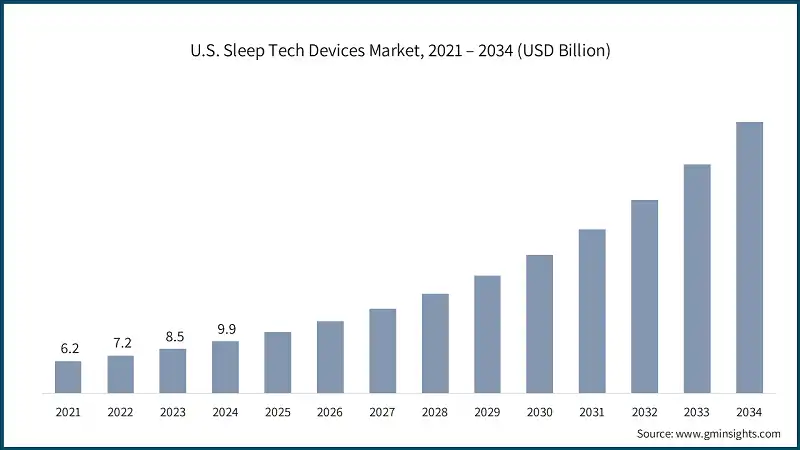

North America sleep tech devices market North America dominated the global market with the highest market share of 42.6% in 2024. The U.S. sleep tech devices market was valued at 6.2 billion and USD 7.2 billion in 2021 and 2022, respectively. In 2024 the market size reached USD 9.9 billion from USD 8.5 billion in 2023. Europe sleep tech devices accounted for USD 6.6 billion in 2024 and are anticipated to show lucrative growth over the forecast period. Germany dominates the European sleep tech devices market, showcasing strong growth potential. The Asia Pacific sleep tech devices is anticipated to grow at the highest CAGR of 19.1% during the analysis timeframe. China sleep tech devices are estimated to grow with a significant CAGR, in the Asia Pacific market. Brazil leads the Latin American market, exhibiting remarkable growth during the analysis period. Saudi Arabia market to experience substantial growth in the Middle East and Africa sleep tech devices industry in 2024. Leading companies like Fitbit (Google), Apple Inc., Withings, and ResMed together hold between 40% of the market share in the moderately consolidated global sleep tech devices industry. This consolidation reflects the dominance of a few well-established players that continue to set benchmarks in product innovation, user experience, and integration with broader digital health ecosystems. The global sleep tech devices market is characterized by a mix of established multinational corporations and emerging startups, creating a competitive yet innovation-driven environment. Large players leverage strong brand recognition, extensive research and development investment, and diversified product portfolios to secure substantial market share, while new entrants focus on niche solutions such as AI-driven sleep monitoring, contactless devices, or personalized sleep coaching to gain traction. E-commerce and digital health platforms are further reshaping competitive strategies by enabling direct-to-consumer distribution and subscription-based models, enhancing accessibility and user engagement. Moreover, partnerships between technology firms and healthcare providers are expanding the application of sleep tech devices from consumer wellness to clinical sleep disorder management. The market demonstrates a balance of consolidation among leaders and dynamism from innovative challengers, suggesting continued evolution toward more connected, data-driven, and medically validated sleep solutions. This blend of scale and agility defines the sector’s competitive landscape. Few of the prominent players operating in the sleep tech devices industry include: Apple leads the sleep tech devices market with a share of 17.2% in 2024. Apple dominates with its ecosystem-driven approach, integrating sleep tracking features into the Apple Watch and Health app. Its USP lies in combining premium hardware with advanced software analytics, offering holistic health monitoring. Apple’s seamless device interconnectivity, brand trust, and continuous innovation position it as a leader in consumer-driven sleep wellness solutions. Fitbit leverages Google’s advanced AI and cloud ecosystem to deliver accurate, real-time sleep tracking and health insights. Its user-friendly wearables integrate seamlessly with Google Fit, offering personalized recommendations. With a strong global presence and affordability compared to premium brands, Fitbit balances innovation, accessibility, and medical-grade data integration for broader adoption. Withings specializes in non-invasive, clinically validated sleep solutions, such as under-mattress sensors and smart devices. Its USP is medical-grade accuracy paired with a sleek, unobtrusive design, catering to users who prefer non-wearable options. The brand bridges consumer wellness and professional healthcare, appealing to both everyday users and clinical practitioners.Europe sleep tech devices market

Asia Pacific sleep tech devices market

Latin American sleep tech devices market

Middle East and Africa sleep tech devices market

Sleep Tech Devices Market Share

Sleep Tech Devices Market Companies

Sleep Tech Devices Industry News

The sleep tech devices market research report includes an in-depth coverage of the industry with estimates and forecast in terms of revenue in USD Million and from 2021 - 2034 for the following segments:

Market, By Product

- Wearables

- Smart watches and bands

- Other wearables

- Non-wearables

- Sleep monitors

- Smart beds

Market, By Application

- Obstructive sleep apnea

- Insomnia

- Narcolepsy

- Other applications

Market, By Distribution Channel

- Sleep centers and fitness centers

- Hypermarkets and supermarkets

- E-commerce

- Pharmacy and retail stores

- Other distribution channels

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Netherlands

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Frequently Asked Question(FAQ) :

How much revenue did the wearables segment generate in 2024?

Wearables accounted for 75.7% share of the market in 2024.

Which region leads the sleep tech devices market?

The U.S. market reached USD 9.9 billion in 2024, the largest globally. Growth is driven by high prevalence of sleep disorders, strong digital health adoption, and advanced healthcare infrastructure.

What are the upcoming trends in the sleep tech devices industry?

Key trends include integration of AI and biosensors, contactless sleep monitoring, telehealth-based remote management, and expansion into mental health and wellness segments.

Who are the key players in the sleep tech devices market?

Key players include Apple, Fitbit (Google), Withings, ResMed, Garmin, Philips, Ōura Health, Huawei, Eight Sleep, and Smart Nora

What is the growth outlook for the non-wearables segment from 2025 to 2034?

Non-wearables are projected to grow at a 20.2% CAGR till 2034.

What is the current sleep tech devices market size in 2025?

The market size is projected to reach USD 29.3 billion in 2025.

What is the projected value of the sleep tech devices market by 2034?

The sleep tech devices industry is expected to reach USD 134.7 billion by 2034, fueled by AI integration, telehealth connectivity, and consumer demand for personalized digital health solutions.

What is the market size of the sleep tech devices industry in 2024?

The market size was USD 24.9 billion in 2024, with a CAGR of 18.5% expected through 2034, driven by rising prevalence of sleep disorders, growing awareness of sleep health, and adoption of connected devices.

Sleep Tech Devices Market Scope

Related Reports